Travel, Tourism & Hospitality

Tourism industry in the Philippines - statistics & facts

Domestic tourism leading the industry in times of uncertainty, outlook of the tourism industry, key insights.

Detailed statistics

Value of domestic tourism spending APAC 2022, by country

Value of international tourism spending APAC 2022, by country

Estimated online travel and tourism revenue Philippines 2023, by category

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Gross value added of the tourism industry Philippines 2019-2022, by type

Number of domestic tourism trips Philippines 2012-2021

Leisure Travel

International tourist arrivals Philippines 2012-2023

Related topics

Recommended.

- Coronavirus (COVID-19) pandemic in the Philippines

- Aviation industry in the Philippines

- Passenger transport in the Philippines

- Food service industry in the Philippines

Recommended statistics

- Premium Statistic International tourist arrivals worldwide 2019-2022, by subregion

- Basic Statistic Value of domestic tourism spending APAC 2022, by country

- Basic Statistic Value of international tourism spending APAC 2022, by country

- Basic Statistic Travel and tourism's direct contribution to employment APAC 2022, by country

- Premium Statistic Estimated online travel and tourism revenue Philippines 2023, by category

International tourist arrivals worldwide 2019-2022, by subregion

Number of international tourist arrivals worldwide from 2019 to 2022, by subregion (in millions)

Value of domestic tourism expenditure in the Asia-Pacific region in 2022, by country or territory (in billion U.S. dollars)

Value of international tourism expenditure in the Asia-Pacific region in 2022, by country or territory (in billion U.S. dollars)

Travel and tourism's direct contribution to employment APAC 2022, by country

Direct contribution of travel and tourism to employment in the Asia-Pacific region in 2022, by country or territory (in millions)

Estimated revenue on online travel and tourism services in the Philippines in 2023, by category (in million U.S. dollars)

Economic impact

- Premium Statistic Gross value added of the tourism industry Philippines 2019-2022, by type

- Premium Statistic Share of tourism GDP Philippines 2012-2022

- Premium Statistic Tourism industry growth rate Philippines 2018/19-2021/22, by sector

- Premium Statistic Tourism receipts Philippines 2019-2023

- Premium Statistic Tourism expenditures Philippines 2022, by travel type

- Premium Statistic Tourism sector employment figures Philippines 2012-2022

Gross value added generated from the tourism industry in the Philippines from 2019 to 2022, by type (in billion Philippine pesos)

Share of tourism GDP Philippines 2012-2022

Share of direct gross value added of the tourism industry to the GDP of the Philippines from 2012 to 2022

Tourism industry growth rate Philippines 2018/19-2021/22, by sector

Annual growth rate of the gross value added generated from the tourism industry (GVATI) in the Philippines from 2018/19 to 2021/22, by sector

Tourism receipts Philippines 2019-2023

Tourism receipts in the Philippines from 2019 to 2023 (in billion Philippine pesos)

Tourism expenditures Philippines 2022, by travel type

Total value of tourism expenditures in the Philippines in 2022, by type of travel (in billion Philippine pesos)

Tourism sector employment figures Philippines 2012-2022

Total number of people employed in the tourism industry in the Philippines from 2012 to 2022 (in millions)

Inbound tourism

- Basic Statistic International tourist arrivals Philippines 2012-2023

- Premium Statistic Tourist arrivals Philippines 2023, by country of residence

- Premium Statistic Expenditure value in inbound tourism Philippines 2021-2022, by type

- Premium Statistic Number of inbound overnight tourists Philippines 2012-2021

- Premium Statistic Average length of stay of inbound tourists Philippines 2012-2021

Total number of international tourist arrivals to the Philippines from 2012 to 2023 (in millions)

Tourist arrivals Philippines 2023, by country of residence

Leading source countries of foreign tourist arrivals in the Philippines in 2023 (in 1,000s)

Expenditure value in inbound tourism Philippines 2021-2022, by type

Total value of expenditure in inbound tourism in the Philippines in 2021 and 2022, by type (in billion Philippine pesos)

Number of inbound overnight tourists Philippines 2012-2021

Number of inbound overnight visitors in the Philippines from 2012 to 2021

Average length of stay of inbound tourists Philippines 2012-2021

Average length of stay of inbound tourists in the Philippines from 2012 to 2021 (in days)

Domestic tourism

- Premium Statistic Number of domestic tourism trips Philippines 2012-2021

- Premium Statistic Domestic passenger count Philippines 2023, by airline

- Premium Statistic Household expenditure share of domestic tourism spending Philippines 2012-2022

- Premium Statistic Domestic tourism expenditures Philippines 2012-2022

- Premium Statistic Domestic tourism expenditures Philippines 2020-2022, by product

Total number of domestic tourism trips in the Philippines from 2012 to 2021 (in 1,000s)

Domestic passenger count Philippines 2023, by airline

Number of domestic passengers in the Philippines in 2023, by airline (in 1,000s)

Household expenditure share of domestic tourism spending Philippines 2012-2022

Domestic tourism expenditure as a share of household final consumption expenditure in the Philippines from 2012 to 2022

Domestic tourism expenditures Philippines 2012-2022

Total value of domestic tourism expenditures in the Philippines from 2012 to 2022 (in billion Philippine pesos)

Domestic tourism expenditures Philippines 2020-2022, by product

Total value of expenditure in domestic tourism in the Philippines from 2020 to 2022, by product (in billion Philippine pesos)

Outbound tourism

- Premium Statistic Number of international tourist departures in the Philippines 2014-2029

- Premium Statistic Outbound tourism expenditures Philippines 2020-2022, by segment

- Premium Statistic Expenditures on accommodation services in outbound tourism Philippines 2012-2022

- Premium Statistic Expenditures on food and beverage services in outbound tourism Philippines 2012-2022

- Premium Statistic Expenditures on travel agency services in outbound tourism Philippines 2012-2022

Number of international tourist departures in the Philippines 2014-2029

Number of international tourist departures in the Philippines from 2014 to 2029 (in millions)

Outbound tourism expenditures Philippines 2020-2022, by segment

Total value of expenditure in outbound tourism in the Philippines from 2020 to 2022, by segment (in billion Philippine pesos)

Expenditures on accommodation services in outbound tourism Philippines 2012-2022

Value of expenditures on accommodation services for visitors in outbound tourism in the Philippines from 2012 to 2022 (in billion Philippine pesos)

Expenditures on food and beverage services in outbound tourism Philippines 2012-2022

Value of expenditures on food and beverage serving services in outbound tourism in the Philippines from 2012 to 2022 (in billion Philippine pesos)

Expenditures on travel agency services in outbound tourism Philippines 2012-2022

Value of expenditures on travel agencies and other reservation services in outbound tourism in the Philippines from 2012 to 2022 (in billion Philippine pesos)

Accommodation

- Premium Statistic Overnight travelers Philippines 2022, by type

- Premium Statistic Revenue of the hotels industry in the Philippines 2019-2028

- Premium Statistic Average hotel room rates Metro Manila Philippines 2021-2023, by star classification

- Premium Statistic Highest overnight room rates of hotels in Metro Manila, Philippines 2023, by city

- Premium Statistic Revenue of the vacation rentals industry in the Philippines 2019-2028

Overnight travelers Philippines 2022, by type

Number of overnight travelers in the Philippines in 2022, by type (in millions)

Revenue of the hotels industry in the Philippines 2019-2028

Revenue of the hotels market in the Philippines from 2019 to 2028 (in million U.S. dollars)

Average hotel room rates Metro Manila Philippines 2021-2023, by star classification

Average room rates of hotels in Metro Manila in the Philippines from 2021 to 2023, by star classification (in U.S. dollars)

Highest overnight room rates of hotels in Metro Manila, Philippines 2023, by city

Maximum overnight room rate of hotels in Metro Manila in the Philippines as of June 2023, by city (in Philippine pesos)

Revenue of the vacation rentals industry in the Philippines 2019-2028

Revenue of the vacation rentals market in the Philippines from 2019 to 2028 (in million U.S. dollars)

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- Press Releases

- Press Enquiries

- Travel Hub / Blog

- Brand Resources

- Newsletter Sign Up

- Global Summit

- Hosting a Summit

- Upcoming Events

- Previous Events

- Event Photography

- Event Enquiries

- Our Members

- Our Associates Community

- Membership Benefits

- Enquire About Membership

- Sponsors & Partners

- Insights & Publications

- WTTC Research Hub

- Economic Impact

- Knowledge Partners

- Data Enquiries

- Hotel Sustainability Basics

- Community Conscious Travel

- SafeTravels Stamp Application

- SafeTravels: Global Protocols & Stamp

- Security & Travel Facilitation

- Sustainable Growth

- Women Empowerment

- Destination Spotlight - SLO CAL

- Vision For Nature Positive Travel and Tourism

- Governments

- Consumer Travel Blog

- ONEin330Million Campaign

- Reunite Campaign

WTTC’s Latest Economic Impact Report Reveals Significant Recovery in the Philippines Travel & Tourism Sector in 2021

Travel & Tourism jobs in the Philippines increased by 20.5%

Fourth fastest Travel & Tourism GDP growth rate for any country in the world in 2021

MANILA, Philippines: The World Travel & Tourism Council’s latest Economic Impact Report revealed last year the Philippine’s Travel & Tourism contribution to the nation’s economy climbed 129.5.% year on year, to reach US$ 41 billion.

Following an 80% decline, this impressive rise saw it ranked as the world’s fourth fastest growing economy during 2021.

News of the sector’s growing revival from the pandemic was revealed today by Julia Simpson, President & CEO of the World Travel & Tourism Council ( WTTC ), which represents the global Travel & Tourism private sector, at its prestigious Global Summit in the Philippines.

It was delivered in the capital, Manila, before more than 1,000 delegates from across the global Travel & Tourism sector, including CEOs, business leaders, government ministers, travel experts and the international media.

WTTC’s Economic Impact Report (EIR) for the Philippines shows that in 2021, the sector supported 7.8 million jobs, representing a substantial 20.5% rise in 2020, compared with a global increase of 6.7%.

Before the pandemic, the Philippines Travel & Tourism sector’s contribution to GDP was 22.5% of the total economy (worth US$92.6 billion). However, due to damaging travel restrictions it then plunged by 80.7% to a mere US$ 17.8 billion, dropping to just a 4.8% share towards the country’s GDP.

But in 2021 this rose to US$ 41 billion, representing a 10.4% share of the nation’s total economy, which signals the recovery of the sector is well underway.

The latest EIR also takes a forward look at the sector with the global tourism body forecasting that the Philippines Travel & Tourism contribution to GDP will grow by 6.7% over the next decade, exceeding the expected country's overall economy average growth rate of just 5.6%.

Julia Simpson, WTTC President & CEO, said: “Our latest EIR for the Philippines signals the astonishing recovery of the country’s Travel & Tourism sector.

“Resulting in a massive employment boost for the sector, leading to the recovery of 1.3 million more jobs compared to the previous year. Our expert analysis shows that the economy has turned a corner and is firmly on the road to recovery.”

As a result, WTTC forecasts that the Philippines Travel & Tourism contribution to GDP could be worth in excess of US$ 155 billion in 2032, accounting for 21.4% of the whole economy.

With Travel & Tourism employment forecast to grow annually by an average of 3% over the next 10 years, nearly three million new jobs could be created, accounting for 21.5% of all jobs in the Philippines.

WTTC’s 2022 EIR marks a vast change in fortunes for the embattled Travel & Tourism sector in the country, which was left reeling by the impact of the pandemic but is now firmly on the road to recovery.

Download the press release .

China’s Travel & Tourism Sector Set to Recover by More Than 60% This Year, Reveals WTTC

Portugal’s Travel & Tourism Sector Faces Job Shortfall of 85,000 This Year, Says WTTC Report

UK Travel & Tourism Sector Sees a Massive Job Shortfall of More Than 200,000 This Year, Says WTTC Report

- Skip to main content

- Keyboard shortcuts for audio player

To Build Up Tourism, Philippines Loosens Pandemic Restrictions For Filipinos

Ashley Westerman

The tourism industry in the Philippines lost some $8 billion in 2020 because of the pandemic. Filipinos are being encouraged to travel domestically to try to restart a crucial sector of the economy.

Copyright © 2021 NPR. All rights reserved. Visit our website terms of use and permissions pages at www.npr.org for further information.

NPR transcripts are created on a rush deadline by an NPR contractor. This text may not be in its final form and may be updated or revised in the future. Accuracy and availability may vary. The authoritative record of NPR’s programming is the audio record.

Licence or Product Purchase Required

You have reached the limit of premium articles you can view for free.

Already have an account? Login here

Get expert, on-the-ground insights into the latest business and economic trends in more than 30 high-growth global markets. Produced by a dedicated team of in-country analysts, our research provides the in-depth business intelligence you need to evaluate, enter and excel in these exciting markets.

View licence options

Suitable for

- Executives and entrepreneurs

- Bankers and hedge fund managers

- Journalists and communications professionals

- Consultants and advisors of all kinds

- Academics and students

- Government and policy-research delegations

- Diplomats and expatriates

This article also features in The Report: Philippines 2021 . Read more about this report and view purchase options in our online store.

What the new normal means for the Philippines' tourism industry

The Philippines | Tourism

The global tourism industry has been hit hard by the Covid-19 pandemic, as border closures and travel restrictions prevented tourists from venturing overseas. In emerging markets such as the Philippines the slump in international tourism took a heavy toll on local communities that depend on the industry for their livelihoods, as well as starved these countries of a vital source of foreign exchange. Tourism generated P4.7trn ($93.5bn) for the Philippine economy in 2019 and supported nearly a quarter of all jobs in the country, either directly or indirectly.

After attracting a record of nearly 8.3m international tourists in 2019, the government was targeting 9.2m arrivals in 2020 before the pandemic hit. In the wake of a strict nationwide lockdown imposed in March, visitor numbers decreased by 62.2% in the first five months of the year compared to the same period in 2019. As of December 2020 the suspension of tourist visas was still in place, meaning full-year figures are likely to be considerably lower than previous years. Nevertheless, there is some hope that the reopening of domestic tourism could build the foundations for a recovery in 2021.

In consultation with key stakeholders, in April 2020 the Department of Tourism (DOT) launched the Tourism Response and Recovery Programme (TRRP). Together with two stimulus bills passed that year, the TRRP outlines both fiscal and non-fiscal support measures for tourism-related businesses to help them survive the difficult economic period and be ready to capitalise on new opportunities once the pandemic wanes. The DOT also announced that, in partnership with the Development Bank of the Philippines and the Land Bank of the Philippines, it would extend low-interest loans to tourism enterprises affected by the crisis. Moreover, the most recent of the stimulus bills – known as the Bayanihan to Recover as One Act, or Bayanihan 2 – earmarked P10bn ($198.9m) for tourism, including P6bn ($119.3m) for loans and subsidies for micro-, small and medium-sized enterprises (MSMEs).

Domestic Potential

Central to the recovery strategy is the initial resumption of domestic tourism as a prelude to the reopening to international tourists in 2021. Outbound Filipino tourists spent $616.9bn abroad in 2018, so it is hoped that at least some of this expenditure will be channelled into the domestic market. To help facilitate the safe resumption of domestic travel, the TRRP outlines stringent health protocols that operators and other sector players must follow in order to accept guests.

Starting in late October 2020 Filipinos were permitted to travel abroad for leisure purposes, but with most international borders still closed and the pandemic ongoing, few are likely to do so in the short term. This has created an opportunity for local destinations that are willing to accept an influx of visitors from other regions of the country.

Although destinations have been permitted to accept domestic tourists since June 1, 2020, many local government units (LGUs) were initially slow to reopen due to fears of imported Covid-19 cases despite the protocols outlined by the DOT. However, more destinations announced reopening plans as the year progressed. The island destination of Boracay reopened to domestic tourists on October 1, with hotels permitted to operate at 50% capacity and visitors required to pass a PCR test 72 hours before departure. Tourists are also required to register with the provincial government to obtain a QR code for contact tracing purposes.

El Nido in Palawan agreed to reopen to domestic tourists from October 30, but initially just nine hotels in the area were permitted to accept guests – with most of them high-end resorts that are out of the price range of most Filipinos. Elsewhere, Bohol, another popular island destination, reopened to domestic tourists on November 15 under similar conditions to Boracay. Visitors must choose from itineraries provided by the local authorities and cannot opt for independent tours. Meanwhile, the surfing capital of Siargao reopened on November 23, with flights resuming on December 1. Visitors to the island are required to show a negative PCR test taken 48 hours before arrival, and will be asked to take an antigen swab upon arrival if the PCR test was taken more than 48 hours before. In addition to these islands, tourist spots within driving distance of Manila began to open to visitors from beyond their immediate region in the second half of 2020, although the rules regarding tests and travel requirements were dependent on LGUs.

“The tourism industry is looking at a V-shaped rather than a U-shaped recovery due to growing, pent up demand for travel,” Aileen Clemente, chairman and president of Rajah Travel, told OBG. “The most significant barrier to overcome is the lack of harmonisation or implementation of safety and travel protocols across the different regions. This prevents seamless travel across different parts of the Philippines. The second biggest barrier is the requirement to quarantine in some regions instead of undertaking a pre-travel Covid-19 test.”

To better understand the sentiments of Filipinos towards domestic travel, stakeholders such as the DOT, Tajara Leisure and Hospitality Group and travel platform Experience Philippines conducted several surveys between March and May 2020. The main insights from their surveys include the fact that travellers are likely to opt for rural, secluded and natural areas as well as beaches over mainstream and urban centres; that they are likely to want customised experiences; and that health and safety protocols, as well as cost, will be key considerations.

Going Digital

Beyond the stimulation of domestic tourism, efforts have been made to digitalise the tourism industry. This is not only important for facilitating contactless transactions to limit exposure to Covid-19 and effective contact tracing programmes, it also helps to promote the Philippines to international travellers looking for post-pandemic options. Through social media, even MSMEs can reach and interact with potential travellers around the world, simultaneously promoting their business while showcasing various attractions and growing the country’s brand recognition.

Such individual efforts can complement government promotional activities. In 2020 official promotional videos encouraging tourists to “Stay at home, dream, and wake up in the Philippines” were released, featuring famous sceneries and activities throughout the country. The DOT’s Travel from Home initiative provided virtual backgrounds of famous Philippine destinations to be used on video conferencing platforms. Elsewhere, the administration of the Walled City of Intramuros partnered with Google Arts and Culture to create a website that allows users to virtually tour 17 museums.

Moreover, the DOT held webinars for stakeholders throughout the year to help them adapt to the new normal, with digitalisation a key theme. Operators can also make use of Rajah Travel’s Tourism Knowledge Centre, which features digital tools that can help manage visitor flows and facilitate contactless transactions. In the long run, digital transformation can enhance the competitiveness of the Philippine tourism sector. As travel resumes, online booking platforms and QR codes are likely to become increasingly common, which will ease the process for tourists and make operators more accessible to the international market.

Take Flight

Looking ahead, positive news around Covid-19 vaccine trials in late 2020 could bode well for the resumption of international travel in 2021. By the end of 2020 some destinations in the region had begun to cautiously open to international tourists. For example, Thailand began offering 60-day visas for foreign tourists in November, with applicants having to show a minimum bank balance, adequate medical insurance and be willing to quarantine for 14 days. Singapore and Hong Kong also agreed to open Asia’s first so-called travel bubble in November, allowing residents to travel freely between both destinations. However, in a sign of the ongoing challenges of the pandemic, the opening of the bubble was postponed for two weeks on November 21 amid a surge of Covid-19 cases in Hong Kong.

The Philippines has been cautious in opening to foreign arrivals and had yet to give official indication of when the issuance of tourist visas would resume as of late November 2020. Rajah Travel believes the short-haul market will be the first to recover once international tourism restarts, with the source markets of Japan, South Korea and Taiwan likely to lead the way. It is hoped that digitalisation, combined with the experience of providing a safe environment for domestic tourists, will allow operators to embrace more opportunities in the new normal.

Request Reuse or Reprint of Article

Read More from OBG

In Philippines

The Philippine roadmap for inclusive, balanced, long-term growth is aligned with environmental, social and governance (ESG) principles and the UN Sustainable Development Goals (SDGs).

Shifting dynamics: As governments look to boost arrivals, many strategies focus on sustainable solutions and support for small businesses As emerging markets develop new attractions and tap into new visitor source markets, they are leveraging technology and sustainable development in line with emissions targets. Following sharp declines in 2020, international tourism figures rebounded in 2021 to reach approximately 63% of pre-Covid-19 pandemic levels in 2022. Notably, in September of that year arrivals in the Middle East and the Caribbean surpassed 2019 levels by 3% and 1%, respectively. The recovery in travel demand is projected…

Ghana: Economic Snapshot 2024 Click here to read our Ghana Economic Report and Investment Analysis 2024 online …

Register for free Economic News Updates on Asia

“high-level discussions are under way to identify how we can restructure funding for health care services”, related content.

Featured Sectors in Philippines

- Asia Agriculture

- Asia Banking

- Asia Construction

- Asia Cybersecurity

- Asia Digital Economy

- Asia Economy

- Asia Education

- Asia Energy

- Asia Environment

- Asia Financial Services

- Asia Health

- Asia Industry

- Asia Insurance

- Asia Legal Framework

- Asia Logistics

- Asia Media & Advertising

- Asia Real Estate

- Asia Retail

- Asia Safety and Security

- Asia Saftey and ecurity

- Asia Tourism

- Asia Transport

Featured Countries in Tourism

- Indonesia Tourism

- Malaysia Tourism

- Myanmar Tourism

- Papua New Guinea Tourism

Popular Sectors in Philippines

- The Philippines Agriculture

- The Philippines Construction

- The Philippines Economy

- The Philippines Financial Services

- The Philippines ICT

- The Philippines Industry

Popular Countries in Tourism

- The Philippines Tourism

- Thailand Tourism

- Oman Tourism

Featured Reports in The Philippines

Recent Reports in The Philippines

- The Report: Philippines 2021

- The Report: Philippines 2019

- The Report: Philippines 2018

- The Report: The Philippines 2017

- The Report: The Philippines 2016

- The Report: The Philippines 2015

Privacy Overview

- Global Locations -

Headquarters

Future Market Insights, Inc.

Christiana Corporate, 200 Continental Drive, Suite 401, Newark, Delaware - 19713, United States

616 Corporate Way, Suite 2-9018, Valley Cottage, NY 10989, United States

Future Market Insights

1602-6 Jumeirah Bay X2 Tower, Plot No: JLT-PH2-X2A, Jumeirah Lakes Towers, Dubai, United Arab Emirates

3rd Floor, 207 Regent Street, W1B 3HH London United Kingdom

Asia Pacific

IndiaLand Global Tech Park, Unit UG-1, Behind Grand HighStreet, Phase 1, Hinjawadi, MH, Pune – 411057, India

- Consumer Product

- Food & Beverage

- Chemicals and Materials

- Travel & Tourism

- Process Automation

- Industrial Automation

- Services & Utilities

- Testing Equipment

- Thought Leadership

- Upcoming Reports

- Published Reports

- Contact FMI

Philippines Tourism Industry

Demand Forecast for Tourism in the Philippines by Medical Tourism and Sports Tourism for 2024 to 2034

Government-led Initiatives Propel Philippines to Tourism Excellence, Fostering Economic Growth and Cultural Exchange. Industry Outlook Available for 35+ Countries

- Report Preview

- Request Methodology

Analytical Study of Tourism in the Philippines from 2024 to 2034

The Philippines tourism industry is estimated to stand at US$ 12.30 billion in 2024. The industry is forecasted to exceed a valuation of US$ 34.47 billion by 2034. The industry is projected to experience impressive growth through 2034, recording a CAGR of 10.80%. Sales in the Philippines tourism are primarily driven by promotional efforts by tourism boards, travel agencies, and online platforms.

Don't pay for what you don't need

Customize your report by selecting specific countries or regions and save 30%!

Key Factors Influencing the Philippines Tourism Industry Growth

The Philippine economy relies a lot on tourism. Many people like to travel to the Philippines to enjoy its peaceful atmosphere and delicious food. Tourists especially love the Philippines because there are many tasty foods and beverages to choose from. Social media is making more people interested in culinary tourism in the Philippines .

In June 2023, the Philippines introduced its new tourism campaign called "Love the Philippines." It changed it from "It's More Fun in the Philippines" to focus more on real and deep experiences after the pandemic.

On Facebook, Twitter, and Instagram, travel influencers are showing off beautiful places and travel services online. Tourism companies are also putting ads there to reach more people. Consequently, there is likely to be around a 2.8X surge in the sales of tourism in the Philippines by 2034.

Hoteliers are using apps more to manage visitor services, giving them better control over the visitor experience. Also, services like digital check-in and contactless cards are getting popular, while facial and fingerprint verification help with payments and record keeping. This is boosting sales in the Philippines' hospitality industry.

In the Philippines, there are lots of different things to do for eco/sustainable tourism . People can join community activities in the Philippines, like fixing houses, planting mangroves, or helping with schools. They can also teach new skills or work on projects like building a visitor center or fixing up a forest.

Historical Industry Study on the Philippines Tourism alongside Future Projections

From 2019 to 2023, the Philippines tourism industry showed promising growth, boasting a 9.80% CAGR. Hotels in Metro Manila are getting better after the pandemic, with 4 million tourists visiting in the first nine months of 2023. That is almost twice as many as in 2022 and close to the year-end target set by the Department of Tourism. Tourists have already added US$ 5.7 billion to the economy.

Prices are still not as high as before the pandemic, and more places to stay are being made. If the government and cities with lots of future places to stay do well economically, more people might want to stay there, and the places might get fuller. More hotels are being built, with 6,400 new rooms expected by 2026, mostly in Quezon City and Pasay City. This trend is expected to contribute to the positive outlook of the Philippines tourism industry.

Social media is helping the tourism industry in the Philippines grow. Travel influencing is the new buzzword in the market. Travel influencers visit different places to promote tourism, and the Philippines is no exception. They now share the real footage of places and their experience on platforms like Facebook, Twitter, and Instagram, and tourism companies advertise there too. In the Philippines, there are 86.75 million active people using social media.

As social media platforms are proliferating more day by day, it is expected to help the industry develop more during the forecast period.

Principal Consultant

Talk to Analyst

Find your sweet spots for generating winning opportunities in this market.

Top Opportunities for the Philippines Tourism Industry Players

In October 2022, the Department of Tourism (DOT) in the Philippines changed the entry rule for travelers with the e-Arrival Card system. This system is easier because it does not need a mobile app and asks for less information. Also, by the end of 2024, the government plans to start a VAT Refund Program to give back VAT on things tourists take out of the country.

DOT started the "Tourism Champions Challenge" to help cities and towns with tourism, giving them $3.2 million. Overseas Filipino Workers (OFWs) who bring foreign tourists to the country can win prizes in a raffle called "Bisita, Be My Guest." Therefore, the future of the Philippines tourism and hotel market looks bright. Hotels in the Philippines are getting better, with more people coming, owing to promotions and help from the government.

Key Trends Shaping the Philippines Tourism Industry

- The Philippines travel industry is increasingly adopting sustainable practices. It aims to minimize environmental impact and promote responsible travel.

- Another evolving trend in the Philippines tourism industry is the increasing interest in medical and wellness tourism. The country is capitalizing on its natural resources to promote spa retreats and wellness-focused travel experiences.

- With the growth of remote work, more people are choosing to work while traveling. The Philippines has an affordable cost of living and reliable internet connectivity. This trend makes the Philippines an attractive destination to remote workers.

Get the data you need at a Fraction of the cost

Personalize your report by choosing insights you need and save 40%!

Comparative Analysis of the Adjacent Philippines Tourism Global Industry

A comparison of the tourism industry in the Philippines with that of South Korea and Malaysia has been conducted in the table below. Analysis of these industries from 2024 to 2034 suggests that their expected growth rates are going to be relatively similar, with minimal variations. This is because the entire Asia Pacific is witnessing a boom when it comes to tourism.

Philippines Tourism Industry:

South Korea Tourism Industry:

Malaysia Tourism Industry:

Tourism Industry Analysis in the Philippines by Segment

As far as the tourist type is concerned, the domestic segment is likely to perform better in 2024, holding 58.00% of the Philippines tourism industry share. Similarly, the 26 to 35 years segment is expected to generate significant turnover in terms of age group, possessing a 47.00% revenue share of the tourism industry in the Philippines in 2024.

Influence of Domestic Travelers is Very High in the Philippines Tourism Industry

The domestic traveler segment is likely to become the prime revenue generator within the industry. The main reason Philippine tourism is bouncing back is because more people are traveling within the country. In 2022, most overnight travelers were locals, with around 40 million visitors.

People prefer to visit their own country nowadays because they know about their own culture and interesting places there. Individuals also find domestic traveling cost-effective as it does not necessitate the huge amount of money required for trips abroad or getting visas. These travelers often know people and have friends in the places they visit, so they can do special things that they may not be able to do outside.

Tourism Emerged as the Go-to Choice for 26 to 35 Years Age Group

The 26 to 35 age group is the top segment in the industry. The main reason this segment is growing is because individuals belonging from this age group have enough money to travel. They are financially stable, so they can go wherever they want, whether it is within their own country or abroad.

People aged 26 to 35 like to travel because they want special and unforgettable experiences in each place they go. They really want to explore different tourist spots and are excited about seeing adventure sites. People in this group also enjoy adventurous activities like scuba diving and exploring different islands, which are easy to find in the Philippines.

Competitive Landscape

Tourism industry players in the Philippines employ miscellaneous strategies to get a competitive edge. Some players give high priority to enhancing infrastructure for smoother travel experiences. At the same time, many prioritize industry to showcase natural beauty and cultural richness. Some adopt sustainable practices to attract tourists who are extremely concerned about the environment. While others collaborate with the government to leverage policies for tourism promotion. Many make substantial investments in digital platforms for convenient traveler services.

Recent Developments

- In November 2023, the Department of Tourism and the Tourism Promotions Board Philippines launched the updated Travel Philippines app. This improved digital platform marks the start of the Philippine tourism industry's digital transformation. The aim is to offer travelers a more convenient way to explore the country.

- In October 2023, the Department of Tourism introduced its inaugural Tourist Assistance Call Center following the Philippines' achievement of over 4 million international arrivals. The call center is going to be available round-the-clock, connecting tourists with live agents who can offer information on various aspects. Some of these include addressing tourism complaints, responding to inquiries about the Philippine tourist destination policies, providing details on transportation options and accommodations, among others.

- In July 2023, the Department of Tourism launched the Philippines Hop-On-Hop-Off (HOHO) service in the capital city, debuting Manila's "Cultural Hub" tours. Secretary Frasco was accompanied by officials from the City Government of Manila, headed by Mayor Honey Lacuna, along with representatives from the tourism industry.

Key Philippines Tourism Industry Players

- Scorpio Travel and Tours Inc.

- Baron Travel

- Asiaventure Tours & Travel

- Vansol Travel & Tours

- Kapwa Travel

- Marsman Drysdale Travel Inc.

- Rajah Tours Philippines

- Atlas Tours and Travel Inc.

- Bridgeway Travel and Tours

- Haranah Tours Corporation

- Travel Related Incentive Programs and Services, Inc.

- Travbest Travel & Tours

- Rakso Air Travel & Tours Inc.

- GoldenSky Travel and Tours

- GrandHope Travel Tours

- Kesari Tours Pvt Ltd

- Tourismo-Filipino Inc.

Key Coverage in the Philippines Tourism Industry Research Report

- Factors Prompting the Philippines Culinary Tourism Market Size

- Philippines Tourism Market Outlook in Different Regions

- In-depth Analysis of Philippine Tourism Statistics

- Adjacent Study on the Philippines Vacation Market

- Emerging Trends in Philippine Hospitality Sector and Trends in Philippines Tourism Market

- Growth of the Philippine Travel Industry in Different Quarters

- Market Overview of Tourism Destinations in the Philippines

Key Segments Profiled in the Philippines Tourism Industry Survey

By tourism type:.

- Cultural & Heritage Tourism

- Medical Tourism

- Eco/Sustainable Tourism

- Sports Tourism

- Wellness Tourism

By Booking Channel:

- Phone Booking

- Online Booking

- In Person Booking

By Tourist Type:

- International

By Age Group:

- 15-25 Years

- 26-35 Years

- 36-45 Years

- 46-55 Years

- 66-75 Years

Frequently Asked Questions

How big is the tourism industry in the philippines.

The industry size for tourism in the Philippines is forecasted to be worth US$ 12.30 billion in 2024.

What is the Sales Forecast for Tourism in the Philippines?

The Philippines tourism market value is projected to surpass US$ 34.47 billion by 2034.

What is the Projected CAGR for the Philippines Tourism Industry?

The CAGR of the Philippines tourism industry is estimated to be around 10.80% through 2034.

What is the Market Trend in the Philippines for Tourism?

Ecotourism is a key industry trend where travelers indulge in protection and management of natural resources.

Which is the Leading Brand of Tourism in the Philippines?

Marsman Drysdale Travel Inc. and Rajah Tours Philippines are Philippines Tourism industry leaders.

Table of Content

List of tables, list of charts.

Recommendations

Travel and Tourism

Tourism Market

Published : November 2022

Philippines Culinary Tourism Market

Published : July 2022

Explore Travel and Tourism Insights

Talk To Analyst

Your personal details are safe with us. Privacy Policy*

- Talk To Analyst -

This report can be customized as per your unique requirement

- Get Free Brochure -

Request a free brochure packed with everything you need to know.

- Customize Now -

I need Country Specific Scope ( -30% )

I am searching for Specific Info.

- Download Report Brochure -

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

- March 16, 2023

Tourism in the Philippines: Exploring Opportunities and Overcoming Challenges

Introduction

Travel and tourism in the Philippines is a vibrant and growing sector. The country has many attractions, including beautiful beaches, impressive mountains, and a rich cultural heritage. Every year, millions of tourists flock to the islands of the Philippines to explore its breathtaking beauty and indulge in its offerings. In 2019, foreign arrivals peaked at 8.3 million , indicating the country’s popularity as a tourist destination.

However, the tourism industry in the country suffered significant losses in previous years because of the pandemic. Nevertheless, the country is optimistic and expecting a revival and revitalization of its tourism economy. Continue reading to explore the nation’s thriving sector, its obstacles, and the potential it provides.

Why do tourists love to visit the Philippines?

The Philippines, an archipelagic nation spanning over 7,000 islands, offers an unparalleled and distinctive experience for travellers. With a vibrant culture, delectable cuisine, welcoming locals, and breathtaking natural scenery, the country boasts a diverse range of offerings to cater to all interests. Here are just a few you won’t want to miss out on!

Stunning Beaches

The Philippines is home to some of the most beautiful beaches in the world. From laid-back, crystal-clear waters to vibrant nightlife scenes and everything in between, you’re sure to find something that will suit your tastes. Notable attractions are the stunningly beautiful islands of Siargao, Boracay, and Palawan, all of which were ranked first, second, and third, respectively, on Condé Nast Traveller’s list of Asia’s best islands in 2018 .

Adventure & Nature

The Philippines is a nature-lovers paradise, possessing a variety of breathtaking landscapes and diverse ecosystems. The country’s rainforests are home to some of the world’s most exotic plants and animals, while its mountains offer exciting trekking opportunities. Adventure seekers can also enjoy white-water rafting in the Cordilleras or explore some of the country’s many volcanoes including the perfectly cone-shaped Mayon Volcano in the region of Bicol, which is a UNESCO Biosphere Reserve.

Cultural Experiences

The Philippines is a melting pot of cultures, and its vibrant heritage can be experienced through its cuisine, music, art, and festivals. The country also features some of the most beautiful colonial architecture in the world, notably Vigan, a UNESCO World Heritage City and one of Asia’s best-preserved planned Spanish colonial towns. Additionally, the local people are warm and welcoming, and travellers often find themselves connecting with the locals for a truly authentic experience.

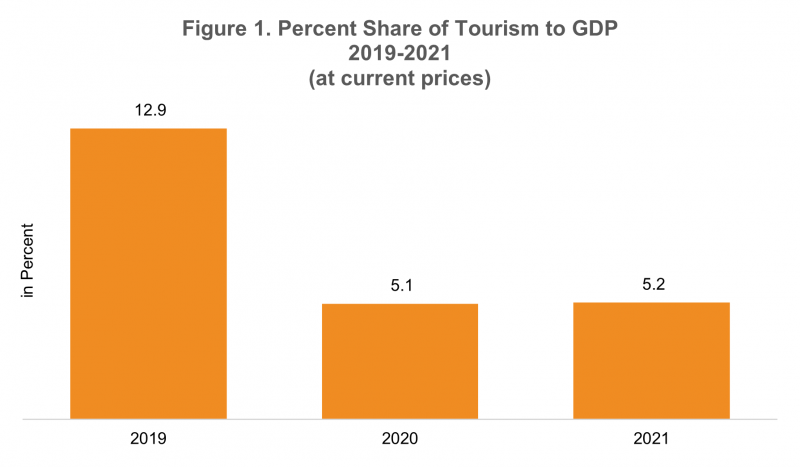

Tourism and the Philippine Economy

The travel and tourism industry is one of the major contributors to the Philippine economy. In 2019, the industry contributed a record 12.7% of the country’s GDP, amounting to PhP 2.48 trillion, a 10.8% increase over 2018. It is one of the largest service industries in the country in terms of gross revenue and foreign exchange earnings. It also employs millions of Filipinos, with an estimated 5.7 million people employed in the sector as of 2019. This makes it an incredibly important source of income for many local communities across the nation.

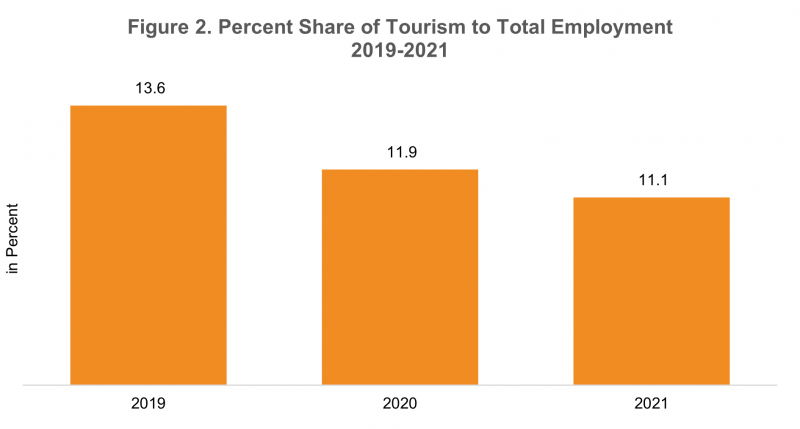

However, the COVID-19 pandemic has negatively impacted the industry in the past few years. Thousands of livelihoods were severely affected and many jobs were lost. In fact, in 2021, the sector was only able to contribute 5.2% to the country’s GDP. Tourism employment in 2021 also took a nosedive at an estimated 4.90 million, which, while higher than the 4.68 million recorded in 2020, is still significantly lower than pre-COVID numbers.

Challenges of the Philippine Tourism Sector

Covid-19 anxieties.

As mentioned, the recent pandemic has brought unprecedented challenges to the Philippine tourism sector. The industry has been one of the hardest-hit sectors, with a significant decline in international and domestic arrivals. As a result, businesses have suffered due to restrictions on travel, social distancing requirements, and a decrease in tourist spending.

In Standard Insights’ most recent Consumer Report Philippines 2023 , which surveyed over 1,000 Filipino respondents in November 2022, more than half of the population stated health & safety-related issues (53.6%) were their biggest worry about travelling in 2023.

Interestingly, most Filipinos, specifically 76.6%, feel safe and secure travelling abroad despite the ongoing COVID-19 situation. Merely a minority of 6.2% expressed feeling insecure about international travel this year.

Airline Woes & Airfare Costs

Another major challenge facing the Philippine tourism sector is the limited number of air links between domestic and international destinations. For many years, the country has relied heavily on its domestic airlines to provide service to both local and foreign passengers. However, with a limited number of flights available, it can be difficult for tourists to visit multiple destinations within the same trip. The lack of direct routes from other countries also proves to be an obstacle for those hoping to travel to the Philippines for a holiday or business trip.

Adding to this challenge is the high cost of airfare that affects the Philippine tourism sector. The cost of oil prices has been rising steadily over the past few years, and the cost of airfare is one of the most affected areas due to this trend. Moreover, airfares in the Philippines tend to be higher than in other Asian countries due to taxes imposed by both local and international airlines as well as fuel costs that are often not included in ticket prices. This makes it difficult for budget travellers and those who are looking to save money on their trips.

Infrastructure

Another challenge facing the Philippine tourism sector is inadequate infrastructure and services such as hotels, transportation networks, and attractions available at tourist destinations across the country. Inadequate infrastructure often leads to overcrowding at major tourist spots during peak season and prevents visitors from enjoying all that each destination has to offer. Additionally, poor public transportation options make it difficult for travellers to explore beyond just their immediate area without having access to private transport such as cars or taxis.

Government Tourism Revival Efforts

The Philippine government has undertaken various measures to revive the tourism sector. In 2021, it launched the Tourism Response and Recovery Plan (TRRP) to help mitigate the impacts of COVID-19 on the industry and protect jobs, visitors, and communities by providing financial assistance for businesses and individuals in need. This allows support for the recovery of tourism enterprises and helps to rebuild confidence and growing demand in domestic and foreign markets. The plan also included an incentive program for domestic tourists, which was implemented in late 2021 and aimed to help revive local tourism by offering discounts on accommodations, food, and activities.

Moreover, starting in 2024, foreigners will be allowed to get tax refunds for purchases made in the Philippines as part of the government’s aim to attract more visitors. Value-added tax (VAT) , which is presently charged at a rate of 12% on goods consumed domestically, will eventually be refunded to international visitors on items they take out of the country.

Finally, the Philippines can be hopeful about the future of its tourism industry. In the previous year, the country welcomed 2.6 million visitors , surpassing its 2022 goal of 1.7 million arrivals. This achievement has encouraged the Department of Tourism (DOT) to set a new target of attracting 5 million foreign visitors in 2023, double the number from last year.

In recent years, the Philippine tourism industry has encountered a multitude of obstacles, particularly with health and safety concerns. In the aftermath of the pandemic, these issues continue to linger, with over half of the population expressing apprehension about travelling in 2023 due to the ongoing impact of COVID-19. Despite the challenges, the industry remains resilient and adaptable, implementing measures to ensure the safety and well-being of tourists and locals alike.

The government has also responded by launching various initiatives such as the Tourism Response and Recovery Plan to help revive the industry and promote domestic and international travel. By continuing to focus on strengthening infrastructure, encouraging domestic tourism, and offering attractive packages for foreign visitors, the Philippines is taking steps toward restoring its tourism sector to its former glory.

Unlock reliable market research in the Philippines with real and authentic consumer insights. Know the needs and preferences of the Filipino population to help you make well-informed decisions in this dynamic market landscape.

Sign Up For More Like This.

Sign up now to receive a curated selection of our latest consumer insights, survey results, articles, reports and exclusive benefits.

- Consumer Insights

- | Industry Reports

- | News & Research

Social Media in Japan: Thriving Trends and Digital Dominance

Explore the dynamic world of social media in Japan, and uncover unique trends, preferences, and habits of Japanese social media users.

Unveiling the Impact of Surging Inflation in the United Kingdom

Uncover the impact of rising inflation in the UK. Explore insights revealing perceptions and buying behavior amid the economic challenges.

The Tech Landscape of California: Insights into Digital Preferences, Trends, and Influences

From Silicon Valley’s innovation hub to emerging startups, explore California’s dynamic tech and electronics scene in our latest article.

Make informed, data-driven decisions quickly with reliable consumer insights.

We’re dusting off the Market Research industry.

- Quantitative Research

- Qualitative Research

- Methodology

- Agency Benefits

- Respondents

- Case Studies

- Consumer Reports

- Consumer Choice

- Privacy Policy

- Terms and Conditions

Discover what consumers really think

Get notified of the insights in your country of interest

National Internal Revenue Code of 1997

Tax Code App

Tax Calendar and App

100 years of trusted service

Corporate Sustainability Report

Scholarships

Loading Results

No Match Found

Impact of COVID-19 on the Philippine Tourism industry

Introduction.

Without a doubt, the tourism industry is among the sectors that have been greatly affected by the COVID-19 pandemic. The closing of borders, airports, and hotels as well as restrictions on mass gatherings, land travel and related services across the world put around 100 to 120 million jobs at risk, as estimated by the World Tourism Organization.

In the first quarter of 2020, the period when the travel restrictions and lockdowns in most countries started, international tourist arrivals declined by 22% resulting in an estimated loss of US$80bn in global tourism receipts. In such period, 97 destinations have totally or partially closed their borders for tourists, 65 destinations have suspended international flights totally or partially, and 39 destinations were implementing the closing of borders (i.e., banning the arrivals from specific countries).

International tourist arrivals by region in Q1 2020

In the Philippines, the government closed the airports in Luzon on 20 March as part of the Enhanced Community Quarantine (ECQ) that started in the island on 16 March. The tourism sector has already felt the negative impact of the pandemic on its performance much earlier. In other countries, travel restrictions and measures have started as early as January of this year, and have impacted the Philippine international tourist arrivals. Domestic tourists, on the other hand, also limited their travel for fear of contracting COVID-19. The Department of Tourism reported that international tourist receipts in the first quarter of the year declined to PHP85bn, 36% lower than the revenues in the same period last year.

To understand the impact of COVID-19 on the Philippine tourism industry, PwC Philippines, together with the Department of Tourism, surveyed 247 decision makers across the different subsectors in May 2020.

Forty-four percent of the respondents are from the tourism services sector (i.e., travel agencies, bookings, tours, etc.), and 34% are from the accommodations sector. According to the survey, 97% say that COVID-19 has the potential for significant impact on their business operations, and is causing them great concern. Such finding is not surprising given that only businesses related to essential services and products were the only enterprises allowed to operate during the ECQ. Because of the low demand and restrictions, majority of the respondents say that they temporarily stopped offering a service/product, reduced their level of operations, and reduced the employee headcount.

Over 70% of the respondents belong to the tourism services and accommodations subsectors

Tourism-related businesses have opted to temporarily stop offering their products/services during the ecq, either due to restrictions or low demand, impact of covid-19 outbreak on the philippine tourism industry.

Given the travel restrictions and closure of businesses, 88% of the respondents expect losses of over 50% of their 2020 revenues. Sixty-three percent of the respondents also say that they expect their businesses to normalize within six months to over a year. Such findings are worrying because the tourism industry contributed 12.7% of the country’s GDP in 2019, and provided 5.71 million jobs in the same year.

Globally, the World Travel and Tourism council estimated that it could take up to ten months for the industry to recover.

Nine months since the virus was first detected in China, there is still no sign that the spread is slowing down. The road to recovery can take longer than initially anticipated. Fitch forecasts that tourist arrivals and tourism receipts will not go back to pre-COVID levels even five years hence.

The country had a stellar performance in 2019 with 8.3 million tourist arrivals and PHP550.2bn in international tourism receipts. Latest estimates show that 2020 tourist arrivals and international tourism receipts will go down to 3.9 million and PHP279.5bn, respectively.

Note: f - forecast Source: Fitch

Recovering from the pandemic

To help recover from the pandemic, 78% of the respondents say that they need up to PHP5m in additional funding to help normalize their operations. Majority say that they need such funds for working capital requirements, marketing fund to rebuild their brands, and refinancing.

With 91% of the respondents coming from the micro, small, and medium enterprises (MSMEs), it’s not surprising that 73% are planning to avail of government grants and subsidies to help revive their operations.

Many businesses are banking on government subsidies and grants as additional funding

Sources of funds to be obtained in the next 3 to 6 months, most businesses need funding to normalize their operations. it will be mainly used for working capital, and marketing and promotions. , around 78% need up to php5m in additional funding to normalize their operations after ecq, over 50% of the respondents plan to use their new funding to support working capital requirements, and rebuild their brand, mitigating the impact of covid-19.

To help businesses and individuals mitigate the impact of COVID-19, the country’s House of Representatives approved House Bill 6815 or the proposed Philippine Economic Stimulus Act (PESA) in June 2020. Once passed into law, an economic stimulus package amounting to PHP1.3 trillion will be provided in the next four years to fund the COVID-19 testing, wage subsidies, and assistance to MSMEs. Under the bill, PHP58bn will be appropriated to DOT-accredited tourism enterprises for the following programs:

- Interest-free loans or issuance of loan guarantees with terms of up to five (5) years for maintenance and operating expenses

- Credit facilities for upgrading, rehabilitation, or modernization of current establishments or facilities to be compliant with new health and safety standards

- Marketing and product development promotions and programs

- Grants for education training, and advising of tourism stakeholders for new normal alternative livelihood programs

- Utilization of information technology

- Other relevant programs, including infrastructure to mitigate the economic effects of COVID-19 on the tourism industry

Restarting the tourism sector

With the absence of revenues, majority of the respondents say that they can only sustain their operations for up to six months. Similarly, most of the respondents have a cash runway of up to six months.

How to restart the tourism sector after COVID-19 is one of the top questions leaders across the world are asking. In fact, 79% of the survey respondents say that they expect international tourist arrivals to decline by over 50% in 2020. A respondent shares, “I hope that the government and the Department of Tourism will be able to come up with a clear bounce back program immediately so the stakeholders may be able to make business decisions.”

Government assistance is needed to help businesses survive the impact of the pandemic

Many tourism-related businesses can sustain their operations and cash up to 6 months only., how the government can help tourism-related businesses.

While the government is currently reviewing the possible financial assistance that may be provided to the tourism players. According to our respondents, access to customers, reasonably-priced consultants, and suppliers as among their top needs to have sustainable businesses after the ECQ.

In other countries, some of the initiatives to help restart tourism are as follows:

- Funding to engage customers and maintain mindshare.

- The Singapore Tourism Board (STB) has launched a US$20m Marketing Partnership Programme.

- STB has also launched the SG Stories Content Fund of US$2m

- Online training to upskill workers

- Tools to accelerate digital transformation

- Go To Campaign - the government will subsidize half of domestic travel costs of up to ¥20,000 per night and issue coupons that can be used at souvenir shops and elsewhere

- Creating attractive stay content for diversifying customers, etc.

- For Japanese consumers who purchased domestic travel products during the period via travel agents etc., coupons equivalent to 1/2 of the price (including accommodation discounts, coupons, and usage coupons for local products, restaurants, facilities, etc.) are given

- Project to develop the capacity of entrepreneurs and personnel in tourism to improve the quality of service and build confidence for tourists

- CCTV installation in important tourist attractions to maintain the safety of tourists in Chiang Mai, Surat Thani, Krabi, Chonburi and Phuket provinces

- Project to promote and upgrade tourism operators to Thai tourism standards

- Project to promote the development of accommodation for tourism in the community

The industry expects a significant decline in international tourist arrivals, and almost all consider insuring their businesses for pandemics

International tourist arrivals are expected to dramatically decline in 2020., including pandemics as part of insurance coverage.

of respondents say pandemics should be included in the coverage

Insuring businesses for any eventualities/crisis that may arise

of respondents consider insuring their businesses for crises events such as COVID-19 pandemic

Getting back in flight

The Philippines has beautiful islands that will once again attract the tourists after the pandemic. Nevertheless, the country should take this opportunity to rebuild the sector by helping the players upskill and digitalize, rethink the way they do business, and ensure compliance with safety and health standards. Promoting medical tourism and agri-tourism may be among the programs that the country can prioritize to help restart the sector.

While the Philippines is experiencing difficulties at this time, Filipinos should remember that through combined efforts and hard work in the past, the country was able to grow the tourism sector, and made it one of the top GDP contributors. With the country’s renewed commitment, Filipinos can be confident that that the tourism industry will achieve better success after this pandemic.

While tax incentives and removing barriers to financing are relevant, access to customers is the top need of the industry players

Apart from financing, majority consider access to customers as a vital component in keeping a sustainable business after the ecq, top government interventions the businesses wish to receive.

- Tax incentivized business

- Removing barriers to accessing financial support

- Loan grants

- Generate a platform for the promotion of MSMEs

- Loan guarantee scheme that creates modest value

- Provide a program for entrepreneurs to take up service oriented activities

- Create a program for startups

- Capacity building seminar

Related content

Deals and corporate finance services, deals & corporate finance insights, our services, philippine gems.

Alexander B. Cabrera

Chairman Emeritus, PwC Philippines

Tel: +63 (2) 8845 2728

Mary Jade T. Roxas-Divinagracia, CFA, CVA

Deals and Corporate Finance Managing Partner, PwC Philippines

Karen Patricia Rogacion

Deals and Corporate Finance Partner, PwC Philippines

© 2010 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for details.

- Transparency notice

- Cookie information

- Legal disclaimer

- About site provider

By providing an email address. I agree to the Terms of Use and acknowledge that I have read the Privacy Policy .

Boosting tourism: Exploring the MICE sector in the Philippines

Clark is emerging as a robust hub for MICE-related tourism.

Renowned for its white sand beaches, vibrant coral reefs, and mountain ranges, the Philippines captivates travelers from around the world.

Yet amid its abundant natural beauty lies an often-overlooked asset: a promising meetings, incentives, conferences, and exhibitions (MICE) sector that offers a wealth of opportunities for business and leisure alike.

Pivotal aspect of tourism

The MICE sector represents a pivotal aspect of tourism, drawing focus toward business-oriented events like conferences, seminars, trade shows, and incentive travel programs. These gatherings serve as a hub for professionals across various industries, fostering collaboration, knowledge exchange, and lucrative business opportunities.

Unlike traditional tourism, MICE events can generate higher economic returns for host destinations. It holds potential to drive growth, bolster revenue streams, and enhance destination development efforts. But how can we harness and amplify this potential to elevate the performance of MICE in the Philippines?

With integrated resorts and various facilities being built within Clark Freeport Zone, it is also now becoming a preferred destination for MICE events.

Venue selection

Considering the demanding schedules of business professionals attending such events, organizers shoulder the responsibility of meticulous venue selection, balancing accessibility, convenience, and experiential aspects. This entails ensuring easy access to airports, transportation hubs, and a diverse range of accommodation options to cater to attendees’ varying needs.

The chosen venue must be equipped with state-of-the-art meeting rooms, conference halls, and exhibition spaces tailored to accommodate the event’s scale and format.

A robust technological infrastructure is thus essential—reliable high speed internet connectivity and audio visual equipment to facilitate smooth presentations and interactions.

Additionally, the destination should contribute to enhancing the overall experience. Optimal venues provide ample opportunities for networking, team-building activities, and cultural immersions during off-times, allowing attendees to foster connections and create lasting memories beyond the confines of the conference room.

Mactan offers an ideal ground for MICE attendees.

Tourist behavior

Based on Q3 2023 statistics from the Department of Tourism (DOT), the average daily tourist expenditure in the Philippines amounts to P11,100, across the following various categories: 26 percent on accommodation, 24 percent on food and beverage, 21 percent on transportation, 13 percent on shopping, 11 percent on entertainment and recreation, and 5 percent on other expenses.

With this data in mind, how can local tourism effectively cater to MICE attendees?

Given that MICE events typically unfold during weekdays and culminate on weekends, and with attendees often receiving daily allowances while having their major expenses such as accommodation and food covered by their companies, they possess additional spending power and the freedom to extend their stay at the destination. By cultivating a dynamic shopping scene and offering engaging activities, local tourism destinations can entice MICE attendees to prolong their visits, thereby generating increased revenue and potentially nurturing repeat patronage in the long run.

The surge in tourist activity not only boosts job creation but also amplifies business revenue, creating a ripple effect across various sectors, from food and beverage establishments to airport services.

MICE events can generate higher economic returns for host destinations. (HTTPS://WWW.MICECON.PH)

Accessibility from Clark and Mactan

With 10 and 12 direct international flights, Clark and Mactan are emerging as robust hubs for MICE-related tourism.

Planned expansions aim to accommodate this growth, ensuring that nearby hotels remain accessible and accommodating. These strategic investments also encourage airlines to expand their direct flight offerings, bolstering tourism in the region.

Given increasing accessibility and the abundance of nearby attractions such as the Clark Freeport Zone and the historic Mount Pinatubo in Clark, and the pristine beaches and Magellan’s Cross in Mactan, these locations serve as ideal gateways for travelers eager to explore the diverse offerings of the Philippines. Visitors from Clark have easy access to the stunning beaches of La Union, the mountains of Benguet, and Baler, the renowned birthplace of Philippine surfing.

Mactan, meanwhile, provides convenient ferry connections to Bohol, where travelers can indulge in the island’s turquoise waters and captivating natural wonders. Siquijor, another island paradise, is also within easy reach by ferry from Cebu.

Leechiu Property Consultants has noted a surge in inquiries from clients drawn to these destinations.

With its abundance of hotels, diverse tourist attractions, robust service industry, and solid infrastructure, the Philippines is primed to establish itself as a leading MICE destination in Southeast Asia.

By capitalizing on the unique strengths of Clark and Mactan gateways, by improving infrastructure, and by showcasing regional offerings, the Philippines can solidify its position as a coveted MICE destination.

The author is a manager for the Hotels, Tourism, and Leisure department of Leechiu Property Consultants Inc., the country’s premier real estate advisory firm. He holds licenses as a real estate appraiser and broker.

Subscribe to our daily newsletter

Curated business news

Disclaimer: Comments do not represent the views of INQUIRER.net. We reserve the right to exclude comments which are inconsistent with our editorial standards. FULL DISCLAIMER

© copyright 1997-2024 inquirer.net | all rights reserved.

We use cookies to ensure you get the best experience on our website. By continuing, you are agreeing to our use of cookies. To find out more, please click this link.

Share of Tourism to GDP is 5.2 Percent in 2021

In 2021, the contribution of Tourism Direct Gross Value Added (TDGVA) to the Philippine economy, as measured by the Gross Domestic Product (GDP), is estimated at 5.2 percent. (Table 10.1)

The TDGVA amounted to PhP 1,001.30 billion in 2021, higher by 9.2 percent compared with the PhP 917.20 billion in 2020. (Tables 6.1 and 6.2)

Among the forms of tourism expenditures, domestic tourism expenditure posted the highest growth in 2021 at 38.7 percent, followed by outbound tourism expenditure at 27.1 percent. On the other hand, inbound tourism expenditure recorded a decline of -79.2 percent. Internal tourism expenditure, comprising inbound and domestic tourism expenditure, grew by 16.3 percent. (Tables 1.2, 2.2, 3.2, and 4.2)

Inbound tourism expenditure, which refers to the expenditure of non-resident visitors (foreign visitors and Filipinos permanently residing abroad) within the Philippines, shared 0.6 percent to the country’s total exports in 2021. On the other hand, domestic tourism expenditure, which covers expenditures of resident visitors within the country either as domestic trip or part of an international trip, contributed 5.4 percent of the household final consumption expenditure. (Tables 10.2 and 10.3)

Employment in tourism characteristic industries improved in 2021

Employment in tourism characteristic industries was estimated at 4.90 million in 2021, higher by 4.6 percent compared with 4.68 million in 2020. Share of employment in tourism industries to total employment in the country was recorded at 11.1 percent. (Table 10.5)

The Philippine Tourism Satellite Accounts (PTSA) is compiled annually by the Philippine Statistics Authority (PSA).

DENNIS S. MAPA, Ph.D. Undersecretary National Statistician and Civil Registrar General

See more at the PTSA Main Page.

Related Contents

Psa conducts consultative and validation forum on subnational tourism satellite accounts for western visayas, psa and dot conduct online forum on tourism accounts and statistics.

- Secretary’s Corner

- GAD Activities

- GAD Issuances

- Mission and Vision

- Department Structure

- Key Officials

- Citizen’s Charter

- Attached Agencies

- General Info

- Culture & Arts

- People & Religion

- Tourism Industries Products

- Promotional Fair and Events

- Doing Business

- Philippines RIA Pilot Program

- Tourism Demand Statistics

- Standards Rules and Regulations

- Online Accreditation

- Accredited Establishments

- Learning Management System (LMS)

- News and Updates

- Announcements

- Publications

- Bids and Awards

DOT CHIEF: PHILIPPINES RECEIVES 2 MILLION INTERNATIONAL VISITORS; TOURISM RECEIPTS HIT PHP158 BILLION IN THE FIRST THREE MONTHS OF 2024

Manila, Philippines—The Philippines has already received over two million international visitors this month, the Department of Tourism (DOT) reported...

PH FORGES EXPANDED TOURISM TIES WITH QATAR

With the renewal of the Memorandum of Understanding (MOU) between The Philippines and State of Qatar, the two nations...

PBBM LAUDS WINNERS OF DOT’S TOURISM CHAMPIONS CHALLENGE; RAISES FUNDING FOR LGU INFRA PROPOSALS TO P255M

Manila, Philippines—President Ferdinand Marcos, Jr. lauds the Department of Tourism’s (DOT), flagship program, Tourism Champions Challenge, which encourages local...

Accreditations

Published Vacant Position – February 13, 2024

Published vacant position – january 29, 2024, published vacant position – november 3, 2023, published vacant position – august 24, 2023.

Balik Bayani sa Turismo: FAQs – March 2024 issue

Balik bayan sa turismo: briefer – march 2024 issue, on the dot: official dot newsletter – march 2023 issue, on the dot: official dot newsletter – february 2023 issue.

Tourism in the Philippines

Philippine tourism industries, explore by interest, tourism videos.

THE PHILIPPINES IN NUMBERS

100,972,303, 134,107,832, dot attached agencies.

- Open Data Portal

- Official Gazette

- Office of the President

- Sandiganbayan

- Senate of the Philippines

- House of Representatives

- Department of Health

- Department of Finance

- Supreme Court

- Court of Appeals

- Court of Tax Appeals

- Judicial Bar and Council

- Bureau of Internal Revenue

- Bureau of Customs

- Bureau of Treasury

- Bureau of Local Government Finance

- Top Stories

- Stock Market

- BUYING RATES

- FOREIGN INTEREST RATES

- Philippine Mutual Funds

- Leaders and Laggards

- Stock Quotes

- Stock Markets Summary

- Non-BSP Convertible Currencies

- BSP Convertible Currencies

- US Commodity futures

- Infographics

- B-Side Podcasts

- Agribusiness

- Arts & Leisure

- Special Features

- Special Reports

- BW Launchpad

- Editors' Picks

Philippines lags Southeast Asian neighbors in smart tourism index

By Beatriz Marie D. Cruz , Reporter

THE PHILIPPINES lags behind some of its Southeast Asian neighbors in terms of readiness in developing smart tourism ecosystems, hampered by high internet costs and accessibility issues in rural areas, the Asian Development Bank (ADB) said.

In a report entitled “Smart Tourism Ecosystem Development Readiness in Southeast Asia,” the Philippines received an average readiness score of 56. A score of 100 indicates a country’s ability to adopt an enabling environment for smart tourism.

Among six Association of Southeast Asian Nations (ASEAN) members in the index, the Philippines ranked fourth, behind Thailand (72), Vietnam (67) and Indonesia (66).

The Philippines was ahead of Laos (53) and Cambodia (50).

“Despite national tourism policies prioritizing digitalization backed by strong tourist and industry demand, smart tourism ecosystem development in Southeast Asia is constrained by insufficient finance and limited digital skills, urban-rural digital divides, and an evolving legal and digital policy environment,” the ADB said in the report.

Having an ecosystem that enables smart tourism boosts a country’s attractiveness as a tourist destination, the ADB said.

“The Philippines demonstrates strong gender equality, high average broadband internet and 4G coverage, and good transaction infrastructure supporting online access to finance. Additionally, the Philippines has high digital talent availability,” the ADB said in the report.

The index measured a country’s overall readiness based on two factors — enabling environment and technological readiness.

The Philippines received a score of 57 under enabling environment, which assesses a country’s tourism competitiveness and digital inclusiveness in the legal, financial, social, and geographic fronts.

The report noted Laos and the Philippines scored highest in terms of equality between men and women’s internet usage.

However, the Philippines scored the lowest among its regional neighbors in terms of the urban-rural digital divide. Digital gaps are “perpetuated by unreliable electricity and network coverage gaps, low literacy rates, unafforda-ble internet services, and language barriers,” ADB said.

The Philippines also scored below-average on tourism competitiveness, legal environment for businesses, and financing options for technological development.

The country also received a score of 55 in terms of technological readiness, second lowest among the six ASEAN members.

The Philippines received low scores in terms of average internet speed, percentage of rural households with internet access, percentage of households or businesses with a computer, mobile access affordability, and research and development for digital innovation.

Among ASEAN counterparts, the Philippines scored the lowest on broadband internet costs and availability of electronic visas (e-visa).

All six countries scored low on access to electronic payments, ADB added.

ADDRESSING ISSUES

The ADB said the Philippines needs to address the urban-rural digital divide, expand financing options, lower broadband costs, and launch an e-visa facility.

The ADB noted the Tourism department is working to close the urban-rural digital divide by allocating $2 million to local government units (LGUs) for smart tourism projects.