Philippine Consulate General

The Republic of the Philippines

PHILIPPINE CONSULATE GENERAL

New york, usa.

travel tax exemption

The travel tax is a levy imposed by the philippine government on individuals who are leaving the country irrespective of the place where the air ticket is issued and the form or place of payment, as provided for by presidential decree (pd) 1183, as amended..

The following individuals are REQUIRED by the Philippine government to pay the Travel Tax every time they leave the country irrespective of the place where the air ticket is issued and the form or place of payment, as provided for by Presidential Decree (PD) 1183, as amended:

- Filipino citizens

- Sec. 13 Quota or Preference Immigrant Visa

- Sec. 13 A Visa issued to an Alien Spouse of Philippine Citizen

- Sec. 13 B Child born outside the Philippines by a 13A Mother

- Sec. 13 C Child born in the Philippines by a 13A Mother

- Sec. 13 D Loss of Citizenship by a Filipino Woman by her Marriage to an Alien

- Sec. 13 E Returning Resident

- Sec. 13 G Former Natural-born Citizen of the Philippines who was Naturalized by a Foreign Country

- TRV Temporary Residence Visa

- RA 7919 Alien Social Integration Act of 1995

- RC /RFC Recognition as Filipino Citizen

- RA 7837 Permanent Resident

The following Filipino citizens are EXEMPTED from the payment of travel tax pursuant to Sec. 2 of PD 1183, as amended:

- Overseas Filipino workers

- Filipino permanent residents abroad whose stay in the Philippines is less than one year

- Infants (2 years and below)

- Other individuals qualified to avail of exemption. Please see complete list below, including the requirements to avail of the exemption.

Note: In all cases, the passenger will be required to bring and present his/her original passport.

The Tourism Infrastructure and Enterprise Zone Authority (TIEZA) is now accepting online application for Travel Tax Exemption Certificate (TEC). Click here to apply.

For more information, please visit TIEZA’s website here.

- The Philippines

- The President

- The Government

- The Department of Foreign Affairs

- The Secretary of Foreign Affairs

- The Consul General

- The Consulate

- History of the Consulate General

- Consulate Directory

- Non-Working Holidays

- Consulate Finder

- Announcements and Advisories

- Press and Photo Releases

- Cultural & Community Events

- Consular Outreach

- Online Appointment

- Assistance-to-Nationals

- Civil Registration

- Dual Citizenship (RA 9225)

- Notarial Services

- Overseas Voting

- Travel Document

- Passport Tracker

- Schedule of Fees

- Citizen’s Charter

- Adopt a Child from the Philippines

- Foreign Donations to the Philippines

- Foreign Medical Missions to the Philippines

- GSIS Pensioners Abroad

- Importation of Motor Vehicles to the Philippines

- Importation of Personal Effects to the Philippines

- Importation of Pets and Plants to the Philippines

- J1 Visa Waiver

- National Bureau of Investigation (NBI) Clearance

- Philippine Centenarians

- Philippine Driver’s License Renewal

- PRC Registration of New Professionals

- Renunciation of Philippine Citizenship

- Restrictions in Bringing Medicine & Other Regulated Products to the Philippines

- Shipment of Human Remains to the Philippines

- Social Security System (SSS)

- Travel Tax Exemption

- Videoconference Hearing

- Sentro Rizal

- Promoting Philippine Culture

- Doing Business & Investing in the Philippines

- Traveling to the Philippines

- Fil-Am Community Directory

- Filipino Businesses

- Filipino International Students

- Request Message of the Consul General

- Procurements

Philippine Consulate General Los Angeles California

Travel tax exemption and duty free privileges.

Travel Tax Exemption

The following individuals are required by the Philippine Government to pay the Travel Tax every time they depart the country for an overseas destination:

(a) Filipino citizens

(b) Permanent resident aliens

(c) Permanent resident aliens

The following Filipino citizens are exempted from the payment of Travel Tax pursuant to Sec. 2 of PD 1183, as amended:

(a) Filipino overseas contract workers.

(b) Filipino permanent residents abroad whose stay or visit in the Philippines is less than one year.

(c) Infants (2 years and below).

Also exempted are foreign diplomatic representatives in the Philippines, United Nations employees, US military personnel, international carrier crew, Philippine foreign service personnel (i.e., officials and employees of the Philippine Government who are assigned in Philippine foreign service posts and who are returning to their country of assignment), Philippine government employees (who are on official travel), bona fide students on scholarships and personnel of multinational companies.

Non-immigrant aliens, who have not stayed in the Philippines for more than a year, is exempted from the Travel Tax.

For more information on travel tax exemption, read this or contact the Philippines’ Tourism Infrastructure and Enterprise Zone Authority (TIEZA) here

Duty and Tax Free Privileges

Section 105 of the Tariff and Customs Code of the Philippines (TCCP) as amended by Executive Order No. 206 provides duty and tax free privileges to the following individuals, the extent of which depends on their particular status:

(1) Returning Resident. A Returning Resident is a Filipino national who had gone abroad and is now returning. Only those Returning Residents who have uninterrupted stay abroad of at least six (6) months prior to their return to the Philippines are entitled to duty and tax-free privileges.

(2) Overseas Contract Workers (OCW). An OCW is a Filipino national who is working in a foreign country under an employment contract. Only OCWs who have uninterrupted stay abroad for at least six (6) months are entitled to duty and tax-free privileges.

(3) Former Filipino. A former Filipino national is one who has acquired foreign citizens abroad and is now returning. Only former Filipinos who are coming to settle permanently in the Philippines and have stayed abroad for six (6) months are entitled to the duty and tax exemption privileges.

What is the extent of duty and tax-free privileges of returning Filipinos or Balikbayans?

The extent varies as follows:

(1) Returning Resident – Personal effects and household goods used by him and abroad for at least six (6) months and the dutiable value of which is not more than Ten Thousand Pesos (PhP10,000.00) are exempt from duties and taxes. Any amount in excess of PhP10,000.00 is subject to fifty percent (50%) duty for the first PhP10,000.00 exemption across the board as provided for under Section 105 (F) of the Tariff and Customs Code of the Philippines.

(2) Overseas Contract Worker (OCW) – in addition to the privileges granted to Returning Residents as described above, an OCW may be allowed to bring in, duty and tax free Ten Thousand Pesos (PhP10,000.00) worth of used home appliances provided:

- The quantity is limited to one of each kind.

- The privilege has not been enjoyed previously during the calendar year which must be declared under oath by the owner.

- The owner’s passport is presented at the port/airport of entry.

- Any amount in excess of PhP10,000.00 will be subject to taxes and duties.

Are family members of returning residents, OCW and former Filipinos also entitled to certain privileges?

Yes, provided they themselves satisfy the specifications outlined in Section 105 of TCCP.

What are the conditions and limitations attached to tax exemption privileges?

The following are the conditions imposed in availing of the duty and tax privileges:

(1) The Bureau of Customs must be presented with a written endorsement from the relevant government agency (2) The goods extended duty and tax-free privileges are not to be sold, bartered nor traded (3) The quantity is not commercial.

(4) The goods are not prohibited importations. Goods that are restricted or prohibited require endorsement from the proper regulatory agency.

For more information on duty and tax free privileges, contact the Philippines’ Bureau of Customs

WWW.EDC.NET.PH

Trailblazing. Collaborative. Resolute.

TIEZA promotes the online release of the Travel Tax Exemption Certificate

The Tourism Infrastructure and Enterprise Zone Authority (TIEZA) promotes the online release of the Travel Tax Exemption Certificate (TEC). This initiative makes it easier for the traveling exporter to get their TEC online.

Once TIEZA approves the online application, exporters can print the TEC at the convenience of their home or office. The following requirements are to be observed by exporters in applying for the online release of TEC:

1. 2×2 ID Picture (taken within the last six months in JPEG format) 2. Passport Identification and Signature page 3. Airline Ticket or Confirmed Flight Booking 4. Endorsement from the EDC (Approved travel tax exemption application form)

In applying for the online release of travel tax exemption certificate, TIEZA reminds of the following: (a) All applications submitted for the online release of TEC are processed within three (3) working days from the date of complete submission of requirements. (b) The flight date must be at least three (3) days before the date of your application for the online release of TEC. Otherwise, applications shall be processed ONSITE through any TIEZA’s Travel Tax Offices or Airport Counters. (c) All applications for the online release of TEC are processed and evaluated from Monday to Friday, and (d) Submissions beyond 5 pm or weekends are considered the next working day application.

Exporters must first verify with the EDC Secretariat if the application for travel tax exemption was already endorsed to TIEZA before filing an application for the online TEC release. To access the TIEZA application form, please click the link .

All Filipino exporters traveling to attend and participate in international events like trade fairs, outbound business matching and selling missions, trade negotiations, promotions, seminars, and international conferences organized or endorsed by the recommending agencies under E.O. 589 are qualified to avail of this exemption and online TEC release.

For further inquiries on the online TEC release, exporters may call TIEZA at 02 8249-5900 to 79 Local 641, 643, 646 or email at [email protected]. MGL

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Airport Transfer

Things to Do

Traveloka PH

14 Apr 2022 - 5 min read

Travel Tax in the Philippines: Everything a Traveler Needs to Know

Paying the travel tax is one of the steps a traveler must do before flying out for an international trip. Here's a guide on what you need to know about this tax.

What is Travel Tax?

The Philippine travel tax is an additional fee you need to pay every time you go abroad.

You can read up on it in greater detail under Presidential Decree 1183 , but all you need to know about it is that you are required to pay this fee no matter which country you are headed to.

Who is required to pay the travel tax?

If you fall under any of the following demographic, you are required to pay the travel tax:

Who is exempted from paying the travel tax?

Manila to singapore flight.

Jetstar Asia Airways

Start from ₱ 2,849.85

Manila (MNL) to Singapore (SIN)

Sat, 4 May 2024

Cebu Pacific

Start from ₱ 3,082.00

Tue, 7 May 2024

AirAsia Berhad (Malaysia)

Start from ₱ 3,750.03

Tue, 14 May 2024

There are also other individuals who are exempted from paying the travel tax:

I fall under the travel tax exemption. What do I need to avail of it?

Depending on your case, you will need:

1. Original documents required by your embassy or agency , which can include but are not limited to:

2. Travel to the nearest TIEZA Travel Tax Field Office in the Philippines , either in the airports or in the provincial field offices.

Show your original documents, as well as photocopies.

3. Pay a PHP 200 processing fee.

Wait for your Travel Tax Exemption Certificate to be released, and present this to the authorities at the airport.

How much do I have to pay?

Depending on your ticket, your travel tax will vary. See the table below:

Where do I pay the Philippine travel tax?

You can pay your travel tax in advance in several malls. Check out these mall counters that accept travel tax payments:

You can also pay your travel tax on the day of your flight in the airport counters. You need to show your ticket and passport.

Meanwhile, there are also provincial offices and other government offices where you can pay the travel tax:

You can also pay online. Here's how:

Where does that money go.

As per Section 73 of the Republic Act No. 9593 , the money earned from the travel tax is divided accordingly:

How do I get a refund?

You qualify for a refund if you fall under one of the following conditions:

What do you need to present to get a refund?

Depending on your case, prepare the following:

Now you know your travel tax basics. Make sure you keep them in mind when you plan and book your trips with Traveloka!

Payment Partners

About Traveloka

- How to Book

- Help Center

Follow us on

- Traveloka Affiliate

- Privacy Notice

- Terms & Conditions

- Register Your Accommodation

- Register Your Experience Business

- Traveloka Press Room

Download Traveloka App

- Articles >

The Moscow Metro Museum of Art: 10 Must-See Stations

There are few times one can claim having been on the subway all afternoon and loving it, but the Moscow Metro provides just that opportunity. While many cities boast famous public transport systems—New York’s subway, London’s underground, San Salvador’s chicken buses—few warrant hours of exploration. Moscow is different: Take one ride on the Metro, and you’ll find out that this network of railways can be so much more than point A to B drudgery.

The Metro began operating in 1935 with just thirteen stations, covering less than seven miles, but it has since grown into the world’s third busiest transit system ( Tokyo is first ), spanning about 200 miles and offering over 180 stops along the way. The construction of the Metro began under Joseph Stalin’s command, and being one of the USSR’s most ambitious building projects, the iron-fisted leader instructed designers to create a place full of svet (radiance) and svetloe budushchee (a radiant future), a palace for the people and a tribute to the Mother nation.

Consequently, the Metro is among the most memorable attractions in Moscow. The stations provide a unique collection of public art, comparable to anything the city’s galleries have to offer and providing a sense of the Soviet era, which is absent from the State National History Museum. Even better, touring the Metro delivers palpable, experiential moments, which many of us don’t get standing in front of painting or a case of coins.

Though tours are available , discovering the Moscow Metro on your own provides a much more comprehensive, truer experience, something much less sterile than following a guide. What better place is there to see the “real” Moscow than on mass transit: A few hours will expose you to characters and caricatures you’ll be hard-pressed to find dining near the Bolshoi Theater. You become part of the attraction, hear it in the screech of the train, feel it as hurried commuters brush by: The Metro sucks you beneath the city and churns you into the mix.

With the recommendations of our born-and-bred Muscovite students, my wife Emma and I have just taken a self-guided tour of what some locals consider the top ten stations of the Moscow Metro. What most satisfied me about our Metro tour was the sense of adventure . I loved following our route on the maps of the wagon walls as we circled the city, plotting out the course to the subsequent stops; having the weird sensation of being underground for nearly four hours; and discovering the next cavern of treasures, playing Indiana Jones for the afternoon, piecing together fragments of Russia’s mysterious history. It’s the ultimate interactive museum.

Top Ten Stations (In order of appearance)

Kievskaya station.

Kievskaya Station went public in March of 1937, the rails between it and Park Kultury Station being the first to cross the Moscow River. Kievskaya is full of mosaics depicting aristocratic scenes of Russian life, with great cameo appearances by Lenin, Trotsky, and Stalin. Each work has a Cyrillic title/explanation etched in the marble beneath it; however, if your Russian is rusty, you can just appreciate seeing familiar revolutionary dates like 1905 ( the Russian Revolution ) and 1917 ( the October Revolution ).

Mayakovskaya Station

Mayakovskaya Station ranks in my top three most notable Metro stations. Mayakovskaya just feels right, done Art Deco but no sense of gaudiness or pretention. The arches are adorned with rounded chrome piping and create feeling of being in a jukebox, but the roof’s expansive mosaics of the sky are the real showstopper. Subjects cleverly range from looking up at a high jumper, workers atop a building, spires of Orthodox cathedrals, to nimble aircraft humming by, a fleet of prop planes spelling out CCCP in the bluest of skies.

Novoslobodskaya Station

Novoslobodskaya is the Metro’s unique stained glass station. Each column has its own distinctive panels of colorful glass, most of them with a floral theme, some of them capturing the odd sailor, musician, artist, gardener, or stenographer in action. The glass is framed in Art Deco metalwork, and there is the lovely aspect of discovering panels in the less frequented haunches of the hall (on the trackside, between the incoming staircases). Novosblod is, I’ve been told, the favorite amongst out-of-town visitors.

Komsomolskaya Station

Komsomolskaya Station is one of palatial grandeur. It seems both magnificent and obligatory, like the presidential palace of a colonial city. The yellow ceiling has leafy, white concrete garland and a series of golden military mosaics accenting the tile mosaics of glorified Russian life. Switching lines here, the hallway has an Alice-in-Wonderland feel, impossibly long with decorative tile walls, culminating in a very old station left in a remarkable state of disrepair, offering a really tangible glimpse behind the palace walls.

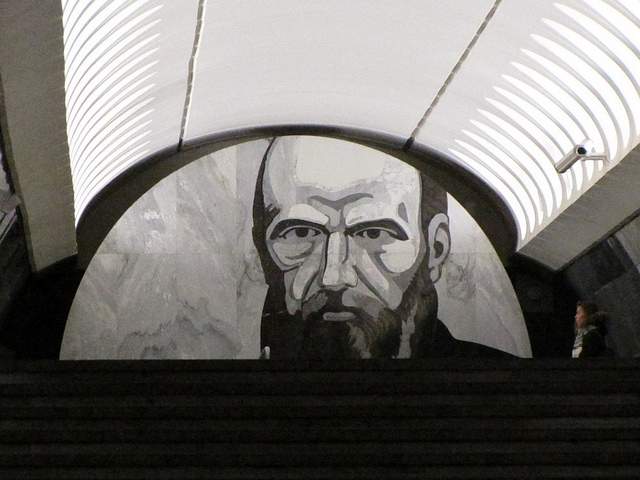

Dostoevskaya Station

Dostoevskaya is a tribute to the late, great hero of Russian literature . The station at first glance seems bare and unimpressive, a stark marble platform without a whiff of reassembled chips of tile. However, two columns have eerie stone inlay collages of scenes from Dostoevsky’s work, including The Idiot , The Brothers Karamazov , and Crime and Punishment. Then, standing at the center of the platform, the marble creates a kaleidoscope of reflections. At the entrance, there is a large, inlay portrait of the author.

Chkalovskaya Station

Chkalovskaya does space Art Deco style (yet again). Chrome borders all. Passageways with curvy overhangs create the illusion of walking through the belly of a chic, new-age spacecraft. There are two (kos)mosaics, one at each end, with planetary subjects. Transferring here brings you above ground, where some rather elaborate metalwork is on display. By name similarity only, I’d expected Komsolskaya Station to deliver some kosmonaut décor; instead, it was Chkalovskaya that took us up to the space station.

Elektrozavodskaya Station

Elektrozavodskaya is full of marble reliefs of workers, men and women, laboring through the different stages of industry. The superhuman figures are round with muscles, Hollywood fit, and seemingly undeterred by each Herculean task they respectively perform. The station is chocked with brass, from hammer and sickle light fixtures to beautiful, angular framework up the innards of the columns. The station’s art pieces are less clever or extravagant than others, but identifying the different stages of industry is entertaining.

Baumanskaya Statio

Baumanskaya Station is the only stop that wasn’t suggested by the students. Pulling in, the network of statues was just too enticing: Out of half-circle depressions in the platform’s columns, the USSR’s proud and powerful labor force again flaunts its success. Pilots, blacksmiths, politicians, and artists have all congregated, posing amongst more Art Deco framing. At the far end, a massive Soviet flag dons the face of Lenin and banners for ’05, ’17, and ‘45. Standing in front of the flag, you can play with the echoing roof.

Ploshchad Revolutsii Station

Novokuznetskaya Station

Novokuznetskaya Station finishes off this tour, more or less, where it started: beautiful mosaics. This station recalls the skyward-facing pieces from Mayakovskaya (Station #2), only with a little larger pictures in a more cramped, very trafficked area. Due to a line of street lamps in the center of the platform, it has the atmosphere of a bustling market. The more inventive sky scenes include a man on a ladder, women picking fruit, and a tank-dozer being craned in. The station’s also has a handsome black-and-white stone mural.

Here is a map and a brief description of our route:

Start at (1)Kievskaya on the “ring line” (look for the squares at the bottom of the platform signs to help you navigate—the ring line is #5, brown line) and go north to Belorusskaya, make a quick switch to the Dark Green/#2 line, and go south one stop to (2)Mayakovskaya. Backtrack to the ring line—Brown/#5—and continue north, getting off at (3)Novosblodskaya and (4)Komsolskaya. At Komsolskaya Station, transfer to the Red/#1 line, go south for two stops to Chistye Prudy, and get on the Light Green/#10 line going north. Take a look at (5)Dostoevskaya Station on the northern segment of Light Green/#10 line then change directions and head south to (6)Chkalovskaya, which offers a transfer to the Dark Blue/#3 line, going west, away from the city center. Have a look (7)Elektroskaya Station before backtracking into the center of Moscow, stopping off at (8)Baumskaya, getting off the Dark Blue/#3 line at (9)Ploschad Revolyutsii. Change to the Dark Green/#2 line and go south one stop to see (10)Novokuznetskaya Station.

Check out our new Moscow Indie Travel Guide , book a flight to Moscow and read 10 Bars with Views Worth Blowing the Budget For

Jonathon Engels, formerly a patron saint of misadventure, has been stumbling his way across cultural borders since 2005 and is currently volunteering in the mountains outside of Antigua, Guatemala. For more of his work, visit his website and blog .

Photo credits: SergeyRod , all others courtesy of the author and may not be used without permission

IMAGES

VIDEO

COMMENTS

Learn how to apply for travel tax exemption online through TIEZA, a GOCC attached to the Department of Tourism. Find out who are exempted, what documents to prepare, and how long it takes to process your application.

travel tax exemption. The travel tax is a levy imposed by the Philippine government on individuals who are leaving the country irrespective of the place where the air ticket is issued and the form or place of payment, as provided for by Presidential Decree (PD) 1183, as amended. The following individuals are REQUIRED by the Philippine ...

Welcome to the TIEZA Online Travel Tax Payment System (OTTPS) The OTTPS is used to process your travel tax payments online. Full Travel Tax Rates FIRST CLASS ₱ 2,700.00. ECONOMY/BUSINESS CLASS ₱ 1,620.00

The refund claimant must immediately contact the TIEZA Travel Tax Department and provide the necessary information and supporting documents for processing of their refund. The TIEZA Travel Tax Department may be reached through the following: Tel. No.: (02) 8249-5987 Email Address: [email protected] I have read and accept the Terms and ...

For more information on travel tax exemption, read this or contact the Philippines' Tourism Infrastructure and Enterprise Zone Authority (TIEZA) here Duty and Tax Free Privileges. Section 105 of the Tariff and Customs Code of the Philippines (TCCP) as amended by Executive Order No. 206 provides duty and tax free privileges to the following ...

As a requirement, the applicant shall attach the approved tax exemption application form signed by the EDC to the TIEZA online platform through this link. TIEZA gives three (3) working days to process the said application. The applicant will receive an email notification about their online TEC application status.

Learn how to apply for the online release of TEC for Filipino exporters traveling abroad for international events. Find out the requirements, processing time, and contact details of TIEZA.

Travel Tax Exemption/Reduced Travel Tax Certificate can only be issued by the TIEZA Travel Tax Office. Certificate must be valid and original copy. Tickets which will be issued outside Philippines, submit the Travel Tax Exemption/Reduced Travel Tax Certificate/Official Receipt of Travel Tax payment to the airline check in counter personnel at ...

Learn who is exempted from paying travel tax, how much to pay, and where to pay it. Find out how to get a travel tax exemption certificate and refund if applicable.

The TIEZA travel tax only applies to international travellers. Filipino citizens, taxable foreign passport holders, and non-immigrant foreign passport holders who have stayed in the Philippines for more than one year and wish to travel abroad will need to pay the levy. As mentioned above, travel taxes can be settled at the airport while waiting ...

Have a hassle-free and more enjoyable out-of-the-country travel when you settle and pay your travel taxes online made possible by TIEZA in partnership with MYEG PH. Transact with government agencies, financial services ranging from online savings, insurance,and lending online, from the comfort of your home. ...

Welcome to the TIEZA Online Travel Tax Payment System (OTTPS) The OTTPS is used to process your travel tax payments online. Full Travel Tax Rates FIRST CLASS ₱ 2,700.00. ECONOMY/BUSINESS CLASS ₱ 1,620.00

Online Travel Tax Processing System. Please enter your user information. Remember Me. Forgot Password? Register. Sign me in. Trouble logging in? Please contact [email protected].

TIEZA's main tasks include building tourism infrastructure, designation, regulation and supervision of Tourism Enterprise Zones (TEZs), operation and management of TIEZA Assets , and the collection of the Philippine Travel Tax.

Europe's visa waiver program is being postponed until 2025. From ETIAS to accommodation taxes in Europe, including charges for cruise passengers and Venice's entry fee, here are the expenses ...

Have a look (7)Elektroskaya Station before backtracking into the center of Moscow, stopping off at (8)Baumskaya, getting off the Dark Blue/#3 line at (9)Ploschad Revolyutsii. Change to the Dark Green/#2 line and go south one stop to see (10)Novokuznetskaya Station. Check out our new Moscow Indie Travel Guide, book a flight to Moscow and read 10 ...

Central PPK operates a train from Ploschad Tryokh Vokzalov to Fryazevo 4 times a day. Tickets cost RUB 120 - RUB 170 and the journey takes 44 min. Train operators. Central PPK. Other operators. BlaBlaCar. Taxi from Moscow Central Bus Station to Elektrostal.

Find the travel option that best suits you. The cheapest way to get from Elektrostal to Moscow Domodedovo Airport (DME) costs only RUB 735, and the quickest way takes just 1¼ hours. Rome2Rio uses cookies to help personalize content and show you personalised ads.

Rome2Rio is a door-to-door travel information and booking engine, helping you get to and from any location in the world. Find all the transport options for your trip from Elektrostal to Moscow right here. Rome2Rio displays up to date schedules, route maps, journey times and estimated fares from relevant transport operators, ensuring you can ...