Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards ›

- Amex Platinum Card

The Amex Platinum Card: How To Best Use Your $200 Airline Credit [Every Year]

Andrew Kunesh

Former Content Contributor

69 Published Articles

Countries Visited: 28 U.S. States Visited: 22

Keri Stooksbury

Editor-in-Chief

33 Published Articles 3134 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1172 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

![united travel bank amex platinum credit The Amex Platinum Card: How To Best Use Your $200 Airline Credit [Every Year]](https://upgradedpoints.com/wp-content/uploads/2022/09/Amex-Platinum-Upgraded-Points-LLC-06-Large.jpg?auto=webp&disable=upscale&width=1200)

Amex Platinum Card – Snapshot

Selecting an airline for your airline incidental credit, official ways to redeem the incidental fee credit, unofficial ways to redeem the incidental fee credit, purchases that do not trigger the airline incidental credit, what if my purchase isn’t automatically reimbursed, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

The Platinum Card ® from American Express is one of the top premium travel credit cards on the market, but also one of the most expensive.

The card’s annual fee is substantially higher than other cards. Still, it also comes with an extensive list of benefits like airport lounge access, Hilton Honors and Marriott Bonvoy hotel elite status, major bonus earnings on flights booked with airlines, and much more.

While the card’s fee may seem like a shocker at first, it’s not so bad when you take a look at the multiple statement credits offered, including an airline incidental credit of up to $200 (enrollment required).

Many travelers often aren’t sure how to take advantage of the airline incidental credit and what it can cover. After all, it doesn’t let you cover paid plane tickets but does let you cover other fees incurred from an airline — whether inflight or at the airport.

In this article, you’ll finally get clarity as to precisely what the Amex Platinum card’s airline incidental credit is and your best options for redeeming your card’s $200 annual credit. After all, what use is a benefit if you don’t know how to use it, right?

The Platinum Card ® from American Express

The Amex Platinum reigns supreme for luxury travel, offering the best airport lounge access plus generous statement credits, and complimentary elite status.

When it comes to cards that offer top-notch benefits, you’d be hard-pressed to find a better card out there than The Platinum Card ® from American Express.

Make no mistake — the Amex Platinum card is a premium card with a premium price tag. With amazing benefits like best-in-class airport lounge access , hotel elite status, and tremendous value in annual statement credits, it can easily prove to be one of the most lucrative cards in your wallet year after year.

- The best airport lounge access out of any card (by far) — enjoy access to over 1,400 worldwide lounges, including the luxurious Amex Centurion Lounges, Priority Pass lounges, Plaza Premium Lounges, and many more!

- 5x points per dollar spent on flights purchased directly with the airline or with AmexTravel.com (up to $500,000 per year)

- 5x points per dollar spent on prepaid hotels booked with AmexTravel.com

- Annual and monthly statement credits upon enrollment ( airline credit, Uber Cash credit, Saks Fifth Avenue credit, streaming credit, prepaid hotel credit on eligible stays, Walmart+ credit, CLEAR credit, and Equinox credit )

- TSA PreCheck or Global Entry credit

- Access to American Express Fine Hotels and Resorts

- Access to Amex International Airline Program

- No foreign transaction fees ( rates and fees )

- $695 annual fee ( rates and fees )

- Airline credit does not cover airfare (only incidentals like checked bags)

- Earn 80,000 Membership Rewards ® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card ® , Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

- Earn 5X Membership Rewards ® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year and earn 5X Membership Rewards ® Points on prepaid hotels booked with American Express Travel.

- $200 Hotel Credit: Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts ® or The Hotel Collection bookings with American Express Travel when you pay with your Platinum Card ® . The Hotel Collection requires a minimum two-night stay.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card ® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Cover the cost of a $12.95 monthly Walmart+ membership (subject to auto-renewal) with a statement credit after you pay for Walmart+ each month with your Platinum Card ® . Cost includes $12.95 plus applicable local sales tax. Plus Up Benefits are excluded.

- $200 Airline Fee Credit: Select one qualifying airline and then receive up to $200 in statement credits per calendar year when incidental fees are charged by the airline to your Platinum Card ® .

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- $300 Equinox Credit: Get up to $300 back in statement credits per calendar year on an Equinox membership, or an Equinox club membership (subject to auto-renewal) when you pay with your Platinum Card ® . Enrollment required. Visit https://platinum.equinox.com/ to enroll.

- $189 CLEAR ® Plus Credit: Breeze through security with CLEAR Plus at 100+ airports, stadiums, and entertainment venues nationwide and get up to $189 back per calendar year on your Membership (subject to auto-renewal) when you use your Platinum Card ® . Learn more.

- $100 Global Entry Credit: Receive either a $100 statement credit every 4 years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck ® (through a TSA official enrollment provider) application fee, when charged to your Platinum Card ® . Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost.

- Shop Saks with Platinum: Get up to $100 in statement credits annually for purchases in Saks Fifth Avenue stores or at saks.com on your Platinum Card ® . That's up to $50 in statement credits semi-annually. Enrollment required.

- $300 SoulCycle At-Home Bike Credit: Get a $300 statement credit for the purchase of a SoulCycle at-home bike with your Platinum Card ® . An Equinox+ subscription is required to purchase a SoulCycle at-home bike and access SoulCycle content. Must charge full price of bike in one transaction. Shipping available in the contiguous U.S. only. Enrollment Required.

- Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card ® to your Resy profile.

- $695 annual fee.

- Terms Apply.

Financial Snapshot

- APR: See Pay Over Time APR

- Foreign Transaction Fees: None

Card Categories

Credit Card Reviews

- Credit Cards

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

American Express Membership Rewards

- Amex Platinum 150k Welcome Bonus Offer

- Benefits of The Amex Platinum

- How to Use 100,000 Amex Platinum Points

- Amex Platinum Card Requirements

- American Express Platinum Military Benefits

- Amex Platinum and Business Platinum Lounge Access

- Amex Platinum Benefits for Authorized Users

- Amex Platinum vs Delta Platinum

- Amex Platinum vs Chase Sapphire Reserve

- Capital One Venture X vs Amex Platinum

- Amex Platinum vs Delta Reserve

Hot Tip: Check to see if you’re eligible for a welcome bonus offer of up to 125k (or 150k) points with the Amex Platinum. The current public offer is 80,000 points. (This targeted offer was independently researched and may not be available to all applicants.)

What Is the Amex Platinum Card’s Airline Incidental Credit?

Both the Amex Platinum card and The Business Platinum Card ® from American Express offer a $200 airline incidental fee credit upon enrollment.

According to American Express, this credit will be used to cover inflight expenses on your selected airline. Some of the items American Express lists as eligible for reimbursement include inflight refreshments and checked bag fees. Airline tickets, gift cards, and points or miles purchases aren’t eligible for reimbursement.

Here’s what the terms and conditions have to say:

“Incidental airline fees charged prior to selection of a qualifying airline are not eligible for statement credits. Airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award tickets are not deemed to be incidental fees. The airline must submit the charge under the appropriate merchant code, industry code, or required service or product identifier for the charge to be recognized as an incidental air travel fee.”

Once you’ve selected your airline, you can charge these expenses to your Amex Platinum card. You’ll automatically be reimbursed in the form of a statement credit within 6 to 8 weeks of the charge posting to your account.

If the statement credit has not posted after 8 weeks from the date of purchase, it is best to call the number on the back of the card.

Hot Tip: You receive the airline incidental once per calendar year. The credit is dispersed on January 1st each year and doesn’t roll over.

Unlike the Chase Sapphire Reserve ® ‘s $300 travel credit, you’re limited to using your Amex Platinum card’s incidental fee credit on a single airline. You can select your airline when you receive your card and change it once per year in January. However, we at Upgraded Points have had luck changing the airline more than once when chatting (nicely) with an American Express representative.

You can pick from the following airlines:

- Alaska Airlines

- American Airlines

- Delta Air Lines

- Hawaiian Airlines

- JetBlue Airways

- Spirit Airlines

- Southwest Airlines

- United Airlines

You must select an airline before you can use the airline incidental credit. Charges made to your account before choosing an airline are not eligible for reimbursement , so select your airline as soon as you receive your Amex Platinum card and have a trip booked.

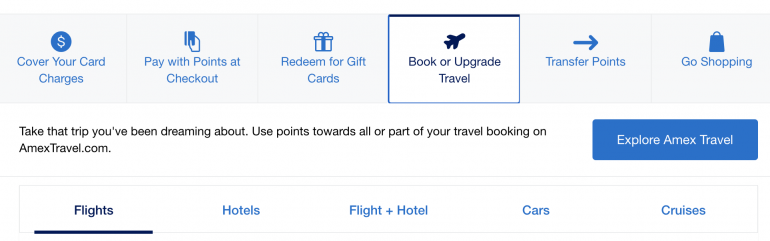

Thankfully, selecting your Amex Platinum card airline choice is easy. Just head over to the American Express website , log in, and select your Amex Platinum card (should you have more than 1 American Express card).

Click on the Rewards & Benefits tab on the bar at the top of the screen. And then click on the Benefits tab.

Here, you’ll see the balance of your Airline Fee Credit — how much you’ve used and how much you have left.

Scroll down the page for a list of benefits included with your Amex Platinum card . There will be an option labeled $200 Airline Fee Credit. Click on the Learn More button, and from there you can select your airline using the drop-down menu at the center of the screen.

The Best Ways To Use Your Airline Incidental Fee Credit

As mentioned earlier, the Amex Platinum card’s airline incidental fee credit cannot be used toward plane tickets, points purchases, or gift cards.

Frustrating, yes. But, thankfully, there are still plenty of great ways that you can spend the credit over the year.

Here are our favorite ways of utilizing the flight credit. We’ve split this section into 2 parts: official and unofficial ways to redeem the incidental fee credit.

Airport Lounge Day Passes and Annual Memberships

While the Amex Platinum card includes extensive lounge access , it doesn’t include access to all of the U.S. carrier’s lounges. You can use your Amex Platinum card’s credit to buy day passes to:

- Alaska Lounge

- American Airlines Admirals Club

- Delta Sky Club

- United Club

Just remember, you have to select the applicable airline for the lounge charge to be covered. So if you choose Delta as your preferred airline, your charges to the Admirals Club won’t be covered by your incidental fees.

United American and American Airlines both sell day passes, which could be an option if you don’t have access to a lounge on a long layover. You must be flying with the airline to have lounge access.

Hot Tip: If you purchase an annual lounge membership with your Amex Platinum card that costs more than $200, you’ll be credited the entirety of the incidental fee credit at once. So, in this case, you can think of it as a $200 discount on your lounge membership of choice.

Further, note that Amex Platinum cardmembers do not receive complimentary guest access at Delta Sky Clubs . However, guest access can be purchased for $50 for a standard day pass. If you purchase Delta Sky Club guest access and Delta is selected as your Amex Platinum card’s airline, you will be reimbursed for your entry fee.

Change Fees

Changing a trip’s date can be expensive, but your Amex Platinum card’s incidental fee credit covers the itinerary change fee. Note that the incidental fee will not likely cover the airfare difference as this is often charged like a plane ticket.

Hot Tip: Want more information on airline change fees? Learn how to avoid airline change fees in our dedicated article.

Checked Baggage Fees

So you planned on checking a bag, but it isn’t included with your ticket? Just charge it to your Amex Platinum card. This is especially helpful if you’ve selected a low-cost carrier, such as Spirit, as your airline, as these carriers generally charge more for baggage. Remember that the incidental fee credit only covers baggage fees on your selected airline.

Most airlines have a co-branded credit card that provides perks such as free checked baggage. If you carry an airline’s co-branded credit card , check if that card provides free checked baggage. This allows you to use your Amex airline incidental fee credit elsewhere.

Inflight Entertainment Fees

The incidental fee credit covers inflight entertainment fees including TV, movies, and tablet rentals charged directly by the airline. A good example of this is renting an Alaska Airlines entertainment tablet in flight. The airline charges a fee to rent these in economy class.

Unfortunately, this does not cover inflight internet, as a third party generally bills this . However, we have heard of United inflight entertainment being reimbursed, as it is usually charged by United directly. Proceed with caution, though, as there’s no guarantee it will be refunded.

Inflight Amenities

Most other inflight purchases are covered, too. Think amenities like headphones, blankets on budget carriers, food, and drink. The airline almost always charges for these directly, and you’re automatically reimbursed for them by your Amex Platinum card’s incidental fee credit.

Seat Selection Fees

Seat selection fees are another great way to redeem your airline incidental fee credit. You can use this when flying low-cost carriers or on a basic economy fare that doesn’t include free seat selection. Note that this does include things like Even More Space seating on JetBlue and Economy Plus on United Airlines.

Most airlines charge anywhere from $10 up to $50 for a seat assignment on domestic flights.

Pet Flight Fees

If you’re taking a furry companion with you , use your Amex Platinum card’s incidental credit to cover the pet fee. This can take out a nice chunk of your reimbursement, though — for example, JetBlue charges $125 per one-way flight.

Phone Booking Fees

You can usually avoid these by booking online, but there may be instances where you need to call to book an award ticket or a flight with special routing. If you can’t get the agent to waive this fee, your Amex Platinum card’s incidental fee credit should cover it.

Priority Boarding

Priority boarding purchases work on virtually all airlines. This can be especially valuable when flying Southwest Airlines, as it gives you first dibs on the best seats . Again, remember that the incidental fees only cover priority boarding fees on your selected airline.

The methods below are ways our team members have either tried or seen work for other travelers. Proceed with caution . There’s no guarantee that these will work for you, too. While we try to keep this section as up-to-date as possible, these things can change on a dime, and we can’t be held liable for a charge not being reimbursed.

Fill Your United TravelBank Account

This might be the easiest unofficial way to use your Amex incidental fee credit. United’s TravelBank allows you to fund the account with cash to use on future United flights. Any money you put in your TravelBank account does not expire for 5 years, provided there is account activity at least every 18 months.

You can fund your account in different increments up to $1,000. However, it is best to fund with how much you have available with your credit. You need to make sure United is selected as your preferred airline.

Admirals Club Food or Drink Purchases

A number of American Airlines Admirals Club locations have premium food and drink available for purchase. American Express has reimbursed these purchases, as they’re billed directly by American Airlines.

Unfortunately, we don’t have data for purchases at other lounges at this time. Again, proceed with caution.

Delta Airfare Purchased Partially With a Gift Card

There are reports of Delta tickets purchased partially with a gift card being reimbursed by American Express. This is because, when the purchase processes, it adds an “additional collection” to the transaction instead of listing an airline route, like most airfare purchases.

This means that American Express sees the transaction as if it were some sort of add-on or other inflight expense. However, this is not officially supported, and American Express may choose not to honor your incidental credit for this purchase.

Airfare of $99 or Below on Certain Airlines

We’ve seen reports of below-$99 fares on Delta, Southwest, and JetBlue being reimbursed by the incidental fee credit. But again, this is very much something you would try at your own risk, as the purchase will code as airfare.

Spirit Saver$ Club Memberships

Spirit Airlines has a members-only discount club called Spirit Saver$ Club. It provides access to discounted tickets and includes other perks but has an annual fee.

We’ve seen reports of Spirit Saver$ Club memberships being reimbursed by American Express. Definitely keep this in mind if you’re a frequent flyer on this ultra-low-cost carrier, as it can save you a nice sum of money as you travel throughout the year.

$5.60 TSA Passenger Security Fee on Award Tickets

Our team has had the $5.60 TSA passenger security fee reimbursed on multiple award tickets in the past.

Now that you have a full list of things that do (or might) trigger the airline incidental fee credit, here’s a quick look at the things that don’t trigger this credit.

Award Taxes and Fees

Aside from the $5.60 TSA security fee mentioned above, our team has not had luck having other award fees reimbursed. This is likely because these purchases code as airfare when posted to your American Express card.

Airline Gift Card Purchases

Airline gift card purchases were a longtime favorite for redeeming the airline incidental fee credit. However, as of this summer, our team has had no luck getting these reimbursed.

Class of Service Upgrades

Cabin upgrades are not eligible for reimbursement .

Inflight Wi-Fi

As mentioned, inflight Wi-Fi generally does not trigger the incidental fee credit, as a third party like Gogo or Panasonic usually bills it. However, we’ve seen reports of United Airlines Wi-Fi purchases being reimbursed because United does bill Wi-Fi purchases on its own or if you purchase the service through the airline before your flight.

While American Express states that it will reimburse eligible charges within 4 weeks, some charges don’t make it through the system. If you’re not reimbursed for an eligible charge, you can call the number on the back of your card or use the American Express live chat service to request reimbursement.

While the Amex Platinum card’s airline incidental fee credit is limited compared to travel credits offered by other premium credit cards, it still provides a ton of value. It has gotten hard to use the credits, but there are still ways to get the total value.

When you use the methods listed above, you’ll save money and have a better travel experience with extra checked bags, lounge access, and more. Better yet, the airline incidental credit can help offset the hefty annual fee of the Amex Platinum card.

For rates and fees of The Platinum Card ® from American Express, click here . For rates and fees of The Business Platinum Card ® from American Express, click here .

Frequently Asked Questions

What is the american express airline fee credit.

The American Express airline incidental fee credit allows you to receive up to $200 in statement credits per calendar year when incidental fees are charged to your account. You must select a qualifying airline before you can use the airline incidental credit.

Do authorized users get additional airline incidental fee credits?

No, the airline incidental fee credits are up to $200 per account per calendar year.

Can I use my airline incidental credit toward airfare?

Generally speaking, no. The terms and conditions prohibit this, and it has not worked in practice for a majority of Amex Platinum cardholders. However, there are reports of fares of $99 or below triggering the credit when you book on certain airlines.

Can I cash out my incidental fee credit if I don't use it?

No, you must use the entirety of the incidental fee credit before the end of a calendar year. Otherwise, the credit expires.

When does the airline incidental credit renew?

You receive $200 per year in incidental fee credit. The credit renews on January 1 of the new calendar year.

Will I earn points on purchases reimbursed by the incidental fee credit?

Yes, you will still earn points on reimbursed purchases.

Was this page helpful?

About Andrew Kunesh

Andrew was born and raised in the Chicago suburbs and now splits his time between Chicago and New York City.

He’s a lifelong traveler and took his first solo trip to San Francisco at the age of 16. Fast forward a few years, and Andrew now travels just over 100,000 miles a year, with over 25 countries, 10 business class products, and 2 airline statuses (United and Alaska) under his belt. Andrew formerly worked for The Points Guy and is now Senior Money Editor at CNN Underscored.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Top Credit Card Content

Buying Guides

- Best Credit Cards for High Limits

- Best Credit Cards for Young Adults

- Best Credit Card Combinations

- Best Credit Cards for Military

- Best Credit Card for Paying Monthly Bills

- American Express Platinum Card

- American Express Gold Card

- Chase Sapphire Preferred Card

- Chase Freedom Unlimited Card

- Capital One Venture X Card

Credit Card Comparisons

- Amex Gold vs Blue Cash Preferred

- Amex vs Chase Credit Cards

- Amex Platinum vs Capital one Venture X

- Amex Platinum vs Delta Platinum Card

- Chase Sapphire Reserve vs Amex Platinum Card

Recommended Reading

- How to Pay Your Credit Card Bill

- Credit Card Marketshare Statistics

- Debit Cards vs Credit Cards

- Hard vs Soft Credit Checks

- Credit Cards Minimum Spend Requirements

Related Posts

![united travel bank amex platinum credit The Amex EveryDay Credit Card — Full Review [2024]](https://upgradedpoints.com/wp-content/uploads/2016/10/The-Amex-Everyday-Credit-Card-from-American-Express.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Points of View: Which credit card should you use for United flights?

You're about to buy a flight and you have a credit card with that airline's name stamped on the front. That's the best card to use for this purchase, right? Or would you be better served if you used some other credit card?

You have options for earning extra points and miles when you pay. Conversely, there are options for enjoying additional perks during your flight. And some credit cards can give a mix of both.

Let's take a look at the best credit card to use for United flights so you can see your options.

Comparing credit cards for United Airlines flights

Aside from using a United Airlines credit card , you could also pay using an all-around travel rewards card that earns transferable points on travel purchases, including your next flight reservation with United Airlines . Here are some cards you might pay with and what you could get when using these cards:

* Bonus value is an estimated value calculated by TPG and not the card issuer.

The information for the American Express Green Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Which card should you use for United Airlines flights?

Typically, earning transferable points (which you can use in many ways, not just with United) is probably your best approach. And if you use a card that earns Ultimate Rewards points — such as the Chase Sapphire Reserve or the Chase Sapphire Preferred Card — you would be able to transfer these points to United Airlines later on if you want to make a redemption through the MileagePlus program .

But what if you need to check a bag? Do you get free checked luggage in some other way, due to flying in a premium cabin or having status with United? If not, paying with a United card might make sense.

Unlike holding a Delta Air Lines credit card — where the checked baggage benefit is attached to your loyalty program number — you must pay for your United flight with your United credit card to use the free checked baggage benefit. Simply having the United Club Infinite card or United Explorer card in your wallet doesn't confer this benefit.

There are other benefits that require paying with your United credit card. These include earning bonus PQPs through credit card spending, receiving 25% back (as a statement credit) for inflight purchases with United Airlines and getting up to $125 in statement credits each year for United purchases made with the Quest card .

Related: United Airlines baggage fees and how to avoid paying them

A credit card that has annual travel credits can also help to offset your checked bag fees. If you don't need to check a suitcase, consider whether you're losing out on other benefits. Have you used your Quest card's $125 in United credits so far this year, for example? If you aren't losing out on benefits like this, aim for the card that will give you the best return on your spending through miles and points.

If you choose to pay with your Amex Platinum Card to earn 5 Membership Rewards points for each dollar, you'll earn more value (in terms of rewards) on the money you spend but won't get free checked bags — even if you have a United credit card in your wallet.

Related: The ultimate guide to earning elite status with United cards

Some benefits exist regardless of which credit card you actually use to pay for your flights. These include eligible visits to the United Club lounges , priority boarding and priority check-in benefits, getting 5,000 miles back in your account if you make an eligible mileage award redemption while holding the Quest card, and gaining access to saver award bookings with a 10% discount thanks to the Club Infinite card.

Related: United changes how it shows saver awards online — how to tell if flights are bookable with a partner

Another benefit available to all cardholders — and also available to those with United Airlines elite status — is access to additional award space when redeeming miles for United flights . Plus, those who both have elite status with United and have a United credit card can receive complimentary upgrades to first class when using miles for award flights. That can make holding a United credit card worthwhile even if you also receive numerous benefits as an elite member.

Related: The single reason I'd open a MileagePlus credit card as a United elite

Bottom line

TPG values United miles at 1.45 cents apiece. Even the best-earning option for United credit cards yields just 5.8 cents in value for each dollar spent on United purchases, yet more general travel rewards credit cards can earn at a higher rate. But, you need to pay with your United credit card to take advantage of certain benefits, such as free checked bags and statement credits toward eligible purchases.

Related: The best credit cards for paying taxes and fees on award tickets

Evaluate whether you would be sacrificing benefits to earn more valuable rewards and how important this is to you. Earning fewer points but keeping more cash in your pocket will make sense for most people. For those who don't need to check a bag, you're probably free to use whichever credit card has the best earnings on your next United purchase.

And whenever the planned Star Alliance credit card is released, we'll see if that changes any of these considerations.

Also in this series:

- Points of View: What credit card should you use for IHG stays?

- Points of View: Which credit card should you use for Hyatt stays?

- Points of View: Which credit card should you use for Hilton stays?

- Points of View: Which credit card should you use for Marriott stays?

- Points of View: Can I cash out my points, and is it worth it?

- Points of View: Should my partner get their own card or be added as an authorized user?

- Points of View: Which card should I use for flights in case things go wrong?

- Points of View: Does paying the taxes and fees on award flights trigger trip protections?

For rates and fees of the Amex Platinum card, click here . For rates and fees of the Amex Green card, click here .

Additional reporting by Ryan Wilcox.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Maximize the AmEx Platinum Hotel Credit

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

As the COVID-19 pandemic rocked the world in 2020, many credit card issuers rolled out new temporary benefits to help boost value to cardholders.

American Express was no exception, and offered a particularly generous perk: a $200 hotel credit for some holders of The Platinum Card® from American Express . They also extended the amount of time that new cardholders had to meet the minimum spending requirements by three months, then went on to add a bevvy of new incentives , like limited-time bonus rewards, streaming credits, wireless credits and a host of juicy AmEx offers .

Since I’m a travel enthusiast and credit card junkie (admittedly), I found myself flush with newfound perks and growing balances of bonus points from everyday shopping. The problem was, like many people, I wasn’t really traveling.

Here’s how I was able to make use of — and maximize — the $200 travel credit.

» Learn more: How credit card issuers are responding to COVID-19

About the $200 American Express travel credit

Some cardholders of The Platinum Card® from American Express who renewed their card became eligible for a credit up to $200 for travel booked through American Express Travel. Terms apply.

I didn’t give the credit much thought at first. Due to COVID-19 considerations, I had canceled all of my travel for the foreseeable future. Even when I do travel frequently in “normal” times, I rarely book through American Express. I generally prefer to transfer my Membership Rewards points to travel partners to get outsize value.

Still, $200 is a generous credit that I didn’t want to waste. And when my family was starting to go stir-crazy after months of quasi-lockdown, I set out to plan a safe “staycation” using the bonus AmEx travel credit.

How the booking portal, American Express Travel, works

American Express Travel is a booking portal available to cardholders to book flights, hotels, cruises, tours and flight + hotel package deals. When you log into your AmEx account, just click into your Rewards page and you can find the AmEx Travel portal.

When you make a booking through American Express Travel, you can choose to pay with either your Membership Rewards points or with cash.

If you hold The Platinum Card® from American Express or The Business Platinum Card® from American Express , you’ll earn 5x points when you use your card to charge travel in the AmEx travel. All other Membership Rewards-earning cards will earn 2x points on AmEx travel bookings. Terms apply.

If you choose to pay with points, they’ll be worth 1 cent each. This isn’t a great redemption value, since you can easily get more value for your points by transferring to AmEx’s travel partners . But when you consider that you will earn airline miles (and sometimes hotel points) when you book your trip through AmEx travel, the value jumps up a bit. That’s because the airline or hotel sees this as a “cash” booking rather than an “award” booking, even when you’re using your Membership Rewards.

» Learn more: Best American Express credit cards

How I got out-sized value from my travel credit

Since my family was staying grounded during the pandemic, we decided to take a “staycation” in a nearby hotel. And since we had missed most of our planned travel in 2020, we decided to use the $200 credit toward a splurge for luxury.

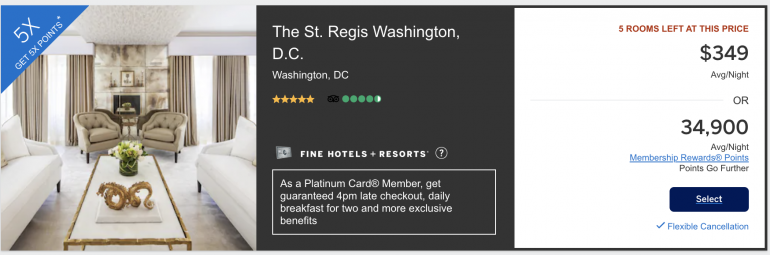

When I started hunting for hotel options in the American Express Travel portal, the first several hotels that appeared in my search were designated as being part of the Fine Hotels & Resorts program.

Available only to cardholders of The Platinum Card® from American Express , The Business Platinum Card® from American Express and the Centurion Card from American Express, the FHR program offers extra benefits, including:

Early check-in.

4 p.m. checkout.

Room upgrade (based on availability).

Daily breakfast for two.

$100 property credit (varies by hotel, but dining and spa credits are common).

Since my $200 AmEx credit would cover anything booked through AmEx Travel — including a hotel in the FHR program — I knew I could pack even more value when I combined the benefits.

We decided on a “staycation” night at the luxurious St. Regis close to where we live.

When booked through AmEx travel, the room was going for $349 a night. To be clear, booking a hotel through FHR doesn't always give you the lowest rate. If booked directly, a room at this same hotel could have cost $308 for that same night.

But the added benefits from booking through FHR can usually outweigh the added cost.

Here’s how my AmEx travel booking broke down. The room rate was $349, but by booking a FHR property through AmEx travel I got:

The Platinum Card® from American Express credit: $200.

Property credit: $100.

Breakfast credit: $60.

My family got the red-carpet treatment at the St. Regis. We were able to check in early at 11 a.m. to kick off our staycation, and we were upgraded to a larger room with a prime view.

The $100 property credit at this hotel was good for a food and beverage credit, so we used it to splurge on a fancy, socially-distanced tea party, to the sheer delight of our two young kids.

Photo courtesy of Erin Hurd

In the morning, we were informed that we would be given $60 in breakfast credits from our booking. Even at St. Regis prices, that credit was enough for all four of us to enjoy a light breakfast.

At checkout, we had a few incidental charges, including valet parking, that we needed to pay for out of pocket. Since St. Regis is a Marriott brand, I used my Marriott Bonvoy Brilliant® American Express® Card for those charges. The card comes with up to $300 in credits for eligible purchases at Marriott hotels. In September, the $300 Marriott credit will be replaced with a new benefit of up to $300 in statement credits per calendar year (up to $25 per month) for eligible purchases at restaurants worldwide. Terms apply.

The bottom line

This staycation was certainly not free, since I pay a hefty $695 annual fee to hold The Platinum Card® from American Express . But by booking a room through American Express’ Fine Hotels & Resorts program, I was able to get even more value from the extra $200 travel credit. Terms apply.

Though earning hotel points can sometimes be hit-or-miss with FHR bookings, I was pleasantly surprised a few days after checkout to see that I had earned Marriott Bonvoy points and an elite night credit on this booking.

If you have The Platinum Card® from American Express and are eligible, make sure you remember to use your extra $200 AmEx travel credit whenever you’re ready to travel again. The credit is good for travel through the end of 2021. Check your AmEx account to see if you have the offer, or contact customer service through online chat or over the phone to confirm your eligibility.

To view rates and fees of The Platinum Card® from American Express, see this page .

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

On a similar note...

Card Accounts

Business Accounts

Other Accounts and Payments

Tools and Support

Personal Cards

Business Credit Cards

Corporate Programs

Prepaid Cards

Personal Savings

Personal Checking and Loans

Business Banking

Book And Manage Travel

Travel Inspiration

Business Travel

Services and Support

Benefits and Offers

Manage Membership

Business Services

Checking & Payment Products

Funding Products

Merchant Services

Experience more with benefits and make your next trip one to remember

Travel your way..

See how Platinum Card® Members like you get the most from Platinum Card® benefits — and American Express Travel. Terms apply to all benefits listed below. Enrollment may be required.

PLANNING YOUR TRIP

Booking your vacation is easy.

You’re ready for a getaway, and Barcelona, Spain, looks like the perfect destination. Luckily, the International Airline Program gets you discounted prices on flights when you select First, Business, or Premium Economy class tickets on International itineraries. Tickets must be booked through American Express Travel with a maximum of eight tickets per booking, including the Card Member. Travel must originate in and return to the U.S.

Plus, get 5X points on flights for prepaid bookings through AmexTravel.com , on up to $500,000 on these purchases per calendar year.

Despite our best efforts, sometimes things happen that are out of our control. If you purchase a round trip entirely with your Eligible Card and a covered reason cancels or interrupts your trip, Trip Cancellation and Interruption Insurance can help reimburse your non-refundable expenses purchased with the same Eligible Card, up to $10,000 per trip and up to $20,000 per Eligible Card per 12 consecutive month period. Terms, conditions and limitations apply.*

*Coverage is provided by New Hampshire Insurance Company, an AIG Company.

Booking your hotel

Your summer escape is here.

You book a Fine Hotels + Resorts® property through AmexTravel.com — and you earn 5X Membership Rewards® points. You also save by receiving your $200 Hotel Credit (up to $200/year back) because you booked a prepaid Fine Hotels + Resorts® stay through AmexTravel.com using your Platinum Card®. The Hotel Collection requires a minimum two-night stay.

What a perfect start to your summer escape.

Getting to your destination

Travel day is here.

Now it's time to book an Uber to get to the airport using the $15 per month in Uber Cash (plus a bonus $20 Uber Cash in December) that you can receive as a benefit of your Card. Benefit renews annually.

You’ve made it to the airport with plenty of time to spare. You check your bags and take advantage of the $200 Airline Fee Credit benefit (up to $200/year back on incidental fees at your one selected, qualifying airline).

Then, you speed through security thanks to TSA PreCheck® or Global Entry – you can receive a statement credit for the application fee of either TSA PreCheck® or Global Entry as a benefit of your Platinum Card®.

Skip to the front of the line and enjoy a quick, easy screening process with your CLEAR® Plus Membership . CLEAR® is a digital identity verification company with unique screening attributes, such as eye or fingerprint verification. CLEAR® helps members move faster through security at select airports, stadiums, and entertainment venues nationwide. To be eligible for a statement credit of up to $189 per calendar year, the annual auto-renewing CLEAR® Plus Membership must be charged to your Platinum Card®. Excluding any applicable taxes. Subject to auto-renewal.

You have two hours before takeoff, so you use the American Express® App to search the Global Lounge Collection for the nearest lounge. You find a nearby lounge within the collection — a perfect spot to enjoy a light bite and a cocktail while you wait for your flight. All there is to do is check in to the lounge using the Amex® App.

Arriving at your destination

Enjoy your elevated hotel stay.

Hello Barcelona. Thanks to your Fine Hotels + Resorts® program benefits, you can check-in early and receive a complimentary Platinum Card® Member room upgrade upon arrival, if available*. Benefit is exclusively for bookings made through American Express Travel via an American Express Travel channel.

You settle into your spacious room and relax knowing you have guaranteed 4pm late check-out for when it’s time to leave.

After enjoying a delicious complimentary breakfast for two, you plan your day in beautiful Barcelona, starting with a visit to the famous Santa Caterina Market.

You end a day of exploring the city by using your unique $100 experience credit — use the up to $100 credit towards dining, spa treatments, and more. You choose to use your credit by indulging in a soothing personalized massage and aromatherapy treatment.

*Certain room categories are not eligible for upgrade.

Exploring the city

Take in new cultural experiences.

The hotel concierge recommends a few must-visit sites you plan to cross off your list — but first, you spend some quiet time shopping and strolling down the beautiful Barceloneta Beach.

Good news for your wallet. There are no foreign transaction fees from American Express when using your Platinum Card® for purchases outside the U.S.

Since you've planned ahead and made dinner reservations using the Resy app , you can go straight from exploring the city to savoring the best of Spanish cuisine.

What a wonderful day out in Barcelona.

Make your next trip one to remember

Enjoy a suite of benefits for streamlined travel, elevated hotel stays, premium flight benefits, and more.

International Airline Program benefits are valid only for eligible U.S. Consumer, Business, and Corporate Platinum Card ® and Centurion ® Members (Delta SkyMiles ® Platinum Card Members are not eligible), on international tickets booked through American Express Travel for select first class, business class, and premium economy tickets with participating airlines, subject to availability. Additional Platinum Cards on U.S. Consumer and Business Platinum Card Accounts and Additional Centurion and Additional Platinum Cards on U.S. Consumer and Business Centurion Accounts are also eligible to receive program benefits. Companion Card Members on Consumer Platinum and Centurion Card Accounts, Additional Business Gold and Business Expense Card Members on Business Platinum and Centurion Card Accounts are not eligible. Travel must originate in and return to U.S. gateway (may exclude certain overseas territories) and select Canadian gateways. One-way travel is permitted on some airlines where routing originates in U.S. or select Canadian gateways. An eligible Card Member can book for himself/herself and up to seven passengers traveling on the same itinerary as that Card Member. Bookings must be made using an eligible Card in the Card Member’s name. Discounts are applied to the base airfare. Discounts are not combinable with other offers unless indicated and may not apply to codeshare partners. Airline fare rules and restrictions apply and are subject to change at the discretion of the airline. Tickets are non-refundable unless otherwise indicated. Tickets are non-transferable; name changes are not permitted. Benefits, participating airlines, and ticket availability are subject to change.

Basic Card Members will get 1 Membership Rewards ® point for each dollar charged for eligible purchases on their Platinum Card ® or an Additional Card on their Account and 4 additional points (for a total of 5 points) for each dollar charged for eligible travel purchases on any Card on the Account (“Additional Points”), minus cancellations and credits. Eligible travel purchases are limited to: (i) purchases of air tickets on scheduled flights, of up to $500,000 in charges per calendar year, booked directly with passenger airlines or through American Express Travel (by calling 1-800-525-3355 or through AmexTravel.com ); (ii) purchases of prepaid hotel reservations booked through American Express Travel; and (iii) purchases of prepaid flight+hotel packages booked through AmexTravel.com . Eligible travel purchases do not include: charter flights, private jet flights, flights that are part of tours, cruises, or travel packages (other than prepaid flight+hotel packages booked through AmexTravel.com ), ticketing or similar service fees, ticket cancellation or change fees, property fees or similar fees, hotel group reservations or events, interest charges, or purchases of cash equivalents. Eligible prepaid hotel bookings or prepaid flight+hotel bookings that are modified directly with the hotel will not be eligible for Additional Points.

Bonuses that may be received with your Card on other purchase categories or in connection with promotions or offers from American Express cannot be combined with this benefit. Any portion of a charge that the Basic Card Member elects to cover through redemption of Membership Rewards points is not eligible to receive points. Additional terms and restrictions apply.

Merchants are assigned codes based on what they primarily sell. We group certain merchant codes into categories that are eligible for Additional Points. A purchase with a merchant will not earn Additional Points if the merchant’s code is not included in an Additional Points category. Basic Card Members may not receive Additional Points if we receive inaccurate information or are otherwise unable to identify your purchase as eligible for an Additional Points category. For example, you may not receive Additional Points when: a merchant uses a third-party to sell their products or services, a merchant uses a third-party to process or submit your transaction to us (e.g., using mobile or wireless card readers), or you choose to make a purchase using a third-party payment account or make a purchase using a mobile or digital wallet.

To be eligible for this benefit, the Card Account must not be cancelled. If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit in any way American Express may remove access to this benefit from the Account. For additional information, call the number on the back of your Card or visit americanexpress.com/rewards-info americanexpress.com/rewards-info for more information about rewards.

Coverage is provided by New Hampshire Insurance Company, an AIG Company, at no-additional-cost to the Card Member. Coverage is subject to certain terms, conditions and limitations, including limitations on the amount of coverage. This benefit provides secondary coverage. For more information about the coverage, please see the Guide to Benefits at americanexpress.com/TCITerms .

You can earn up to $200 in statement credits per calendar year when you use an eligible U.S. Consumer Basic Platinum or Additional Platinum Card to pay for eligible prepaid Fine Hotels + Resorts ® and The Hotel Collection bookings made through American Express Travel (meaning through amextravel.com, the Amex ® App, or by calling the phone number on the back of your eligible Card) or when you use an eligible Additional Gold Card on such Platinum Card Account to pay for eligible prepaid bookings for The Hotel Collection made through American Express Travel (meaning through amextravel.com, the Amex ® App, or by calling the phone number on the back of your eligible Card). Fine Hotels + Resorts ® program bookings may be made only by eligible U.S. Consumer Basic Platinum and Additional Platinum Card Members. The Hotel Collection bookings may be made by eligible U.S. Consumer Basic and Additional Platinum Card Members and Additional Gold Card Members on the Platinum Card Account. Delta SkyMiles ® Platinum Card Members are not eligible for the benefit. To receive the statement credits, an eligible Card Member must make a new booking using their eligible Card through American Express Travel on or after July 1st, 2021, that is prepaid (referred to as "Pay Now" on amextravel.com and the Amex App), for a qualifying stay at an available, participating Fine Hotels + Resorts or The Hotel Collection property. Bookings of The Hotel Collection require a minimum stay of two consecutive nights. Purchases by both the Basic Card Member and any Additional Card Members on the Card Account are eligible for statement credits. However, the total amount of statement credits for eligible purchases will not exceed $200 on the Card Account per calendar year. Eligible bookings must be processed before December 31st, 11:59PM Central Time, each calendar year to be eligible for statement credits within that year. American Express relies on the merchant to process transactions within the same calendar year that you made the prepaid booking in order to apply the statement credit in the calendar year that it was intended. For example, if you make an eligible prepaid booking on the last day of the year, but the merchant doesn't process that transaction until the next day, then the statement credit available in the next calendar year will be applied to the Card Account, if the purchase is eligible. Statement credits may not be received or may be reversed if the booking is cancelled or modified. Eligible bookings do not include interest charges, cancellation fees, property fees or other similar fees, or any charges by a property to you (whether for your booking, your stay or otherwise). Please allow up to 90 days after an eligible charge is posted to the Card Account for the applicable statement credits to be posted to the Card Account. Call the number on the back of your eligible Card if statement credits have not posted by that time. To be eligible for this benefit, your Card account must not be cancelled or past due at the time of statement credit fulfillment. If American Express does not receive information that identifies your transaction as eligible, you will not receive the statement credits. For example, your transaction will not be eligible if it is a booking: (i) made with a property not included in the Fine Hotels + Resorts or The Hotel Collection programs, (ii) not made through American Express Travel, or (iii) not made with an eligible Card. Participating properties and their availability are subject to change. If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit, American Express will not have an obligation to provide and may reverse any statement credits provided to you. Please refer to AmericanExpress.com/FHR and AmericanExpress.com/HC for more information about Fine Hotels + Resorts and The Hotel Collection, respectively.

Basic Card Members on a Consumer Platinum Card or Centurion account and Additional Centurion Card Members are eligible for Uber VIP and the monthly Amex Benefit (“Amex Benefit”). To receive this benefit, you must have downloaded the latest version of the Uber App and your eligible Platinum Card or Centurion Card must be a method of payment in your Uber account. The Amex Benefit may only be used in the United States.

To be eligible for the Amex Benefit, your Card Account must not be canceled or past due. American Express reserves the right to suspend your eligibility for the Amex Benefit if we suspect any violation or abuse. To continue to receive the Amex Benefit, the details for your eligible Card must be kept up to date in your Uber Account. Cards added to your Uber account through a third party such as Apple Pay or PayPal will not be eligible. An eligible Platinum Card or Centurion Card may receive the Amex Benefit on one Uber account. If the same Card is added to multiple Uber accounts, only the first Uber account to which the Card is added will receive the Amex Benefit. If your American Express Card details change, you will need to make required updates to your Card details in your Uber payment profile before the end of the current month to ensure you remain enrolled in the Amex Benefit. If you do not update your Card details prior to the first day of the following month, you may need to re-enroll to continue to receive your Amex benefit. It may take up to 48 hours for the Amex Benefit to become available in your Uber account after your eligible Card has been added to that account. Uber VIP is available in select cities and is governed by Uber’s terms and conditions.

The Amex Benefit is found within your Uber Cash balance. In order to use the Amex Benefit, Uber Cash must be turned on. If Uber Cash is turned on when you request a ride, Uber Cash will appear above the confirmation button. If Uber Cash does not appear above the confirmation button, tap on the current payment option and turn on Uber Cash. If you do not see the Amex Benefit in your Uber Cash balance within 48 hours from the time you enroll, call the number on the back of your Card for assistance.

The Amex Benefit may be applied to all vehicle types with Uber, orders on Uber Eats and to any other services to which Uber permits Uber Cash to be applied. If your Uber Cash balance does not satisfy the cost of your ride or order, the primary payment method on your Uber account will be charged for the difference.

The Amex Benefit will not apply to previous Uber transactions and cannot be used when paying with an UberFAMILY profile. New and existing Uber users are eligible. Uber will apply the Amex Benefit at the point of sale and it will be displayed on your emailed receipt. There is no limit to the number of transactions you may apply your Amex Benefit to each month, up to a total of $15 per month (up to a total of $35 in December).

Your monthly Amex Benefit expires at 11:59 PM Hawaii Standard Time on the last day of each calendar month. Unused balance in Uber Cash from your Amex Benefit will not carry over to the following month. Your Amex Benefit will be applied for the month in which the transaction is completed. If a transaction is eligible for another promotion that you have added to your Uber account, the promotion will be applied before your Amex Benefit. Certain other types of balances in Uber Cash may be applied to the cost of your ride or order prior to your Amex Benefit in Uber Cash. For purposes of fulfilling this benefit, American Express will share with Uber certain information about your Card, including the Card type, and updated Card information from time to time. If you do not wish to receive the Amex Benefit, please call the number on the back of your Card. If you do not see the Amex Benefit in your Uber Cash balance by 5:00 PM Hawaii Standard Time on the first day of each calendar month, call the number on the back of your Card for assistance.

Enrollment through American Express is required to receive the benefit. Basic Card Members on U.S. Consumer and Corporate Platinum Card Accounts can enroll in the benefit by making their airline selection in the Benefits section of their americanexpress.com online account or by calling us. Enrolled Basic Card Members on U.S. Consumer Platinum and U.S. Corporate Platinum Card Accounts are eligible to receive up to $200 in statement credits per calendar year for incidental airline fees charged by their one selected qualifying airline to the enrolled Card Account. Purchases by both the Basic Card Member and Additional Card Members on the enrolled Card Account are eligible for statement credits. However, the total amount of statement credits will not exceed $200 per calendar year, per Card Account. To receive statement credits, the Basic Card Member must select one qualifying airline through their American Express Online Account or the link for their Card below:

American Express Platinum Card ® : https://global.americanexpress.com/card-benefits/enroll/airline-fee-credit/platinum

Goldman Sachs Platinum Card ® : https://global.americanexpress.com/card-benefits/enroll/airline-fee-credit/goldman-platinum-card

Morgan Stanley Platinum Card ® : https://global.americanexpress.com/card-benefits/enroll/airline-fee-credit/morgan-stanley-platinum-card

The Platinum Card ® from American Express for Charles Schwab: https://global.americanexpress.com/card-benefits/enroll/airline-fee-credit/schwab-platinum-card

American Express Corporate Platinum Card ® : https://global.americanexpress.com/card-benefits/enroll/airline-fee-credit/corporate-platinum

Qualifying airlines include Alaska Airlines, American Airlines, Delta Airlines, Hawaiian Airlines, JetBlue Airways, Spirit Airlines, Southwest Airlines, and United Airlines, and are subject to change. Only the Basic Card Member or Authorized Account Manager(s) on the Card Account can select the qualifying airline. Card Members who have not chosen one qualifying airline will be able to do so at any time. Card Members who have already selected one qualifying airline will be able to change their choice one time each year in January through their American Express Online Account or by calling the number on the back of the Card. Card Members who do not change their airline selection will remain with their current airline. Incidental airline fees must be separate charges from airline ticket charges. Fees not charged by the Card Member’s selected airline (e.g. wireless internet and fees incurred with airline alliance partners) do not qualify for statement credits. Incidental airline fees charged prior to selection of a qualifying airline are not eligible for statement credits. Airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award tickets are not deemed to be incidental fees. The airline must submit the charge under the appropriate merchant code, industry code, or required service or product identifier for the charge to be recognized as an incidental air travel fee.

Please allow 6-8 weeks after the qualifying incidental air travel fee is charged to your Card Account for statement credit(s) to be posted to the Account. American Express relies on airlines to submit the correct information on airline transactions, so please call the number on the back of the Card if statement credits have not posted after 8 weeks from the date of purchase. Card Members remain responsible for timely payment of all charges. Statement credits may be reversed if an eligible purchase is returned/cancelled. To be eligible for this benefit, Card Account(s) must be not canceled and not past due at the time of statement credit fulfillment. If American Express, in its sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit, American Express will not have an obligation to provide statement credits and may reverse any statement credits provided to you. If a charge for an eligible purchase is included in a Pay Over Time feature balance on your Card Account, the statement credit associated with that charge may not be applied to that Pay Over Time feature balance. Instead, the statement credit may be applied to your Pay In Full balance. For additional information, call the number on the back of your Card.

The benefit is available to (i) Corporate Gold Card Members, (ii) Consumer Platinum Card ® Members, Corporate Platinum Card ® Members and Business Platinum Card ® Members, and (iii) Centurion ® Card Members. The benefit is also available to all Additional Card Members on Consumer and Business Platinum Accounts, and all Additional Card Members on Consumer and Business Centurion Accounts. To receive the Global Entry statement credit of $100 or the TSA PreCheck statement credit of up to $85, Basic or Additional Card Members on the eligible Card Account must pay for the respective application fee through a TSA PreCheck official enrollment provider with their eligible Card. Basic Card Members are eligible to receive a statement credit every 4.5 years for the TSA PreCheck ® application fee (when applying through a TSA official enrollment provider) and every 4 years for the Global Entry application fee, in each case when charged to the Basic Card or any eligible Additional Cards on the eligible Card Account. Basic Card Members will receive a statement credit for the first program (either Global Entry or TSA PreCheck) to which they or their eligible Additional Cards apply and pay for with their eligible Card regardless of whether they are approved for Global Entry or TSA PreCheck. However, eligible Card Members can earn no more than one credit for up to $85 for TSA PreCheck or $100 credit for Global Entry (but not both programs), depending upon the program the Card Member first applies for, for an application fee charged to an eligible Card. American Express has no control over the application and/or approval process for Global Entry or TSA PreCheck, and does not have access to any information provided to the government by the Card Member or by the government to the Card Member. American Express has no liability regarding the Global Entry or TSA PreCheck Programs. U.S. Customs and Border Protection (CBP) (for Global Entry) and U.S. Transportation Security Administration (TSA) (for TSA PreCheck) charge an application fee to process each respective application regardless of whether the Card Member’s application is approved. The Department of Homeland Security may suspend acceptance of applications on any basis at its discretion. American Express will provide a statement credit for the application fee regardless of the decision made by CBP (for Global Entry) or TSA (for TSA PreCheck) but will not provide a statement credit for subsequent application fees charged to the same eligible Card within 4 years (for Global Entry) or 4.5 years (for TSA PreCheck), even if the original application is rejected.

Membership for Global Entry or TSA PreCheck is per person, and a separate application must be completed for each individual. TSA PreCheck application must be processed through a TSA official enrollment provider. Global Entry membership also includes access to the TSA PreCheck program with no additional application or fee required. For additional information on the Global Entry or TSA PreCheck programs, including information regarding the application and/or approval process and for a list of participating airlines and airports, as well as the full terms and conditions of the programs, please go to www.cbp.gov/travel/trusted-traveler-programs/global-entry for Global Entry and www.tsa.gov for TSA PreCheck. The Global Entry or TSA PreCheck programs are subject to change, and American Express has no control over those changes.

The statement credit benefit applies to the Global Entry or TSA PreCheck programs only. Other program applications including, but not limited to, NEXUS, SENTRI, FAST, and Privium are not eligible for the statement credit benefit.

Please allow up to 8 weeks after the qualifying Global Entry or TSA PreCheck transaction is charged to the eligible Card account for the statement credit to be posted to the Card account. American Express relies on accurate transaction data to identify eligible Global Entry and TSA PreCheck purchases. If you do not see a credit for a qualifying purchase on your eligible Card after 8 weeks, simply call the number on the back of your Card. Card Members are responsible for payment of all application charges until the statement credit posts to the Card Account. Statement credits may be reversed if an eligible purchase is returned/cancelled.

To be eligible for this benefit, the Card Account must not be cancelled and not past due at the time of statement credits fulfillment. If American Express, in it’s sole discretion, determines that you have engaged in or intend to engage in any manner of abuse, misuse, or gaming in connection with this benefit, American Express will not have an obligation to provide statement credits and may reverse any statement credits provided to you. If a charge for an eligible purchase is included in a Pay Over Time feature balance on your Card Account, the statement credit associated with that charge may not be applied to that Pay Over Time feature balance. Instead, the statement credit may be applied to your Pay In Full balance. For additional information, call the number on the back of your Card.

Basic Card Members can earn up to $189 in statement credits per calendar year when the Platinum Card ® or Additional Cards on the Account are used to pay for an annual CLEAR Plus membership. Enrollment in CLEAR Plus is required and is subject to CLEAR’s terms and conditions. CLEAR Plus memberships automatically renew each year unless canceled and CLEAR will charge the applicable membership fee to the Card CLEAR has on file. American Express has no control over the application and/or approval process for CLEAR, and does not have access to any information provided to CLEAR by the Card Member or by CLEAR to the Card Member. American Express has no liability regarding the CLEAR program. If a Card Member's application is not approved by CLEAR, CLEAR will refund the charges. If the statement credit benefit has been applied before CLEAR refunds the charges, that statement credit will be reversed. Purchases by both the Basic Card Member and any Additional Card Members on the Card Account are eligible for statement credits. However, the total amount of statement credits for eligible purchases will not exceed $189 across all Cards on the Account per calendar year. For additional information on the CLEAR program, including information regarding membership, eligibility, and for a list of participating locations, as well as the full terms and conditions of the program, please go to www.clearme.com . The CLEAR program is subject to change, and American Express has no control over those changes. Please allow up to 6-8 weeks after a qualifying CLEAR transaction is charged to the Card Account for the statement credit to be posted to the Account. American Express relies on accurate transaction data to identify eligible CLEAR Plus purchases. If you do not see a credit for a qualifying purchase on your eligible Card after 8 weeks, please call the number on the back of your Card. Card Members remain responsible for timely payment of all CLEAR charges. If you are assigned a new Card number or have a Card number on file with CLEAR that is outdated (for example, if you replace your Card or if your Card has expired), you must update your Card information on file with CLEAR to help ensure that statement credits are received for eligible CLEAR Plus membership fees. To be eligible for this benefit, the Card Account must not be cancelled or past due at the time of statement credit fulfillment. If a charge for an eligible purchase is included in a Pay Over Time feature balance on your Card Account, the statement credit associated with that charge may not be applied to that Pay Over Time feature balance. Instead, the statement credit may be applied to your Pay In Full balance. For additional information, call the number on the back of your Card.

The American Express ® App and app features are available only for eligible accounts in the United States. American Express ® prepaid Cards and Cards issued by non-American Express issuers are not eligible. To log in, customers must have an American Express user ID and password or create one in the app.

The American Express Global Lounge Collection ® U.S Consumer and Business Platinum Card Members and any Additional Platinum Card Members on the Account are eligible for access to the participating lounges in the American Express Global Lounge Collection. Companion Platinum Cards on Consumer Platinum Accounts and Additional Gold and Additional Business Expense Cards on Business Platinum Accounts are not eligible for the Global Lounge Collection benefit. All lounge access is subject to space availability. Each lounge program within the Global Lounge Collection has its own policies and access to any of the participating lounges is subject to the applicable rules and policies. Participating lounges reserve the right to remove any person from the premises for inappropriate behavior or failure to adhere to rules, including, but not limited to, conduct that is disruptive, abusive, or violent. To be eligible for this benefit, Card Account must not be cancelled. Please refer to each program’s terms and conditions to learn more.

The Centurion ® Lounge U.S. Platinum Card Members have unlimited complimentary access to all locations of The Centurion Lounge. Companion Platinum Cards on Consumer Platinum Accounts and Additional Gold and Additional Business Expense Cards on Business Platinum Accounts are not eligible for access to The Centurion Lounge. All access to The Centurion Lounge is subject to space availability. To access The Centurion Lounge, Platinum Card Members must arrive within 3 hours of their departing flight and present The Centurion Lounge agent with the following upon each visit: their valid Card, a boarding pass showing a confirmed reservation for a departing flight on the same day on any carrier and a government-issued I.D. Note that select lounges allow access to Card Members with a confirmed reservation for any same-day travel (departure or arrival). Refer to the specific location’s access policy for more information. Failure to present this documentation may result in access being denied. Card Members must be at least 18 years of age to enter without a parent or legal guardian. All Centurion Lounge visitors must be of legal drinking age in the jurisdiction where the Lounge is located to consume alcoholic beverages. Please drink responsibly. American Express reserves the right to remove any person from the Lounge for inappropriate behavior or failure to adhere to rules, including, but not limited to, conduct that is disruptive, abusive or violent. Soliciting other Card Members for access into our Lounge is not permissible. Hours may vary by location and are subject to change. Amenities vary among The Centurion Lounge locations and are subject to change. Card Members will not be compensated for changes in locations, rates or policies. In addition to the complimentary services and amenities in the Lounge, certain services, products or amenities may be offered for sale. You are responsible for any purchases and/or servicing charges you make in The Centurion Lounge or authorize our Member Services Professionals to make on your behalf. Services available at the Member Services Desk are based on the type of American Express Card used to enter the Lounge. American Express will not be liable for any articles lost or stolen or damages suffered by visitors to The Centurion Lounge. If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with Lounge access in any way or that you intend to do so, we may remove access to The Centurion Lounge from the Platinum Account. Use of The Centurion Lounge is subject to all rules and conditions set by American Express. American Express reserves the right to revise the rules at any time without notice.

U.S. Platinum Card Members, U.S. Business Platinum Card Members and Additional U.S. Platinum Card Members on the Account will be charged a $50 fee for each guest (or $30 for children aged 2 through 17, with proof of age) unless they have qualified for Complimentary Guest Access. U.S. Platinum Card and U.S. Business Platinum Card Members may qualify for Complimentary Guest Access for up to two (2) guests per visit to locations of The Centurion Lounge in the U.S., Hong Kong International Airport and London Heathrow Airport (“Complimentary Guest Access”), after spending $75,000 or more on eligible purchases on the Platinum Account in a calendar year. Once effective, Complimentary Guest Access will be available for the remainder of the calendar year in which it became effective, the following calendar year, and until January 31 of the next calendar year (for example, if Complimentary Guest Access became effective on May 1, 2023, it would remain effective until January 31, 2025). Eligible purchases made by any Additional Card Members on the Platinum Account will contribute to the purchase requirement. Complimentary Guest Access is limited to two (2) guests per Card Member per visit, regardless of whether you are eligible for complimentary guest access through multiple Platinum Accounts or through other Amex Cards. Guest access policies may vary internationally by location and are subject to change.