- February 25, 2024

Saudi Arabia has topped the United Nations Tourism ranking for 2023, achieving an impressive 56% increase in international tourist arrivals compared to 2019.

The World Tourism Barometer report also highlighted the Kingdom’s outstanding 156% tourism recovery rate in 2023, which positions it as a leader in Middle East and Global Tourism.

The No.1 Business Site in Saudi Arabia

Get The Latest Developments in The Growth of Saudi Arabia Straight to Your Inbox and Stay Ahead of The Curve

Saudi Arabia’s Remarkable Tourism Growth

In 2023, Saudi Arabia was recognized as the top country in terms of growth in international tourist arrivals among major tourist destinations, with a remarkable increase of 56% compared to 2019, according to the World Tourism Barometer Report, January 2024.

This growth was reflected in the SAR+100 billion spent by international tourists in the first three quarters of 2023. Saudi Arabia experienced a significant recovery of 156% in international tourist arrivals.

The remarkable surge in Saudi Arabia’s international tourist arrivals has set a new precedent for global tourism recovery. The Middle East region, with Saudi Arabia at its helm, is the only region worldwide to have surpassed pre-pandemic visitor numbers.

The Catalysts for the Kingdom’s Success

The significant increase in both domestic and international visitors in 2023 has played a pivotal role in Saudi Arabia’s successful tourism growth. The diversification of the Kingdom’s destinations has attracted many tourists, making Saudi Arabia a global tourist hotspot.

The UN Tourism congratulates Saudi Arabia as the destination among countries receiving over 5 million international tourists with the highest growth (+56%) in 2023 compared to 2019 (countries with data for 10 or more months). @Saudi_MT pic.twitter.com/EIMDto6oMz — UN Tourism (@UNWTO) February 16, 2024

The Impact of Tourism Growth

The exponential growth in Saudi Arabia’s tourism sector has positively impacted the Kingdom’s economy. It has contributed to the country’s GDP and created numerous job opportunities, thereby enhancing the livelihood of the Saudi population.

Saudi Arabia’s Commitment to Global Tourism

Saudi Arabia’s commitment to global tourism is evident in its proactive measures to enhance its tourism infrastructure and services.

The country has invested significantly in developing tourist destinations, accommodation facilities, and transportation services to ensure a comfortable and memorable tourist experience.

The Kingdom’s Vision for the Future

Saudi Arabia envisions becoming a leading global tourist destination by 2030. The country’s Vision 2030 plan outlines strategic objectives to enhance the tourism sector, including increasing the number of tourist arrivals and the contribution of tourism to the Kingdom’s GDP.

A Global Leader in Tourism Recovery

Saudi Arabia’s remarkable feat in the tourism sector is a testament to its commitment to enhancing its tourism infrastructure and services. The country’s impressive growth in tourist arrivals and tourism revenue has positioned it as a global leader in tourism recovery.

With its strategic vision for the future, Saudi Arabia is poised further to strengthen its position in the global tourism sector.

Upcoming Tourism Projects

Saudi Arabia’s NEOM , a visionary $500 Billion gigaproject, has recently revealed their latest project, Xaynor , a private members club situated on the picturesque Gulf of Aqaba coastline.

Featuring a magnificent architectural design and meticulously crafted interior, Xaynor is dedicated to providing guests with luxurious and discreet experiences.

Strategically positioned between the pristine coastline and the NEOM mountains, Xaynor offers a superb location for its exclusive members.

The NEOM giga project currently covers 11 distinct regions other than Xaynor, ranging from a 100-mile city called The Line to an all-year-round ski resort called Trojena:

Significant progress has been made in constructing new upcoming hotels in the prominent tourist spots of the NEOM gigaproject and The Red Sea Global , indicating a thriving hospitality sector in these areas.

Marriott International’s presence in Saudi Arabia is set to grow significantly, with plans for 40 new hotels and over 11,000 rooms. Additionally, the company will expand into luxury destinations like NEOM and The Red Sea Project .

The expansion includes luxury brands, including St. Regis , which is already open, Autograph Collection , The Ritz-Carlton Reserve, and several new hotel brands in the Holy Cities of Makkah and Madinah .

Marriott International has recently revealed its plans to build a new Ritz-Carlton hotel in Diriyah , with an expected opening date of 2026. This move represents the company’s commitment to providing high-end hospitality services.

The five-star hotel is to be located within the $63 Billion Diriyah Giga Project and is due to feature 195 guest rooms and 34 luxury suites.

Diriyah Company and Ritz-Carlton have also announced the launch of the first luxury-branded Ritz-Carlton Residences in the Kingdom.

Wadi Safar Project

The Diriyah Company has recently launched its newest luxurious development, known as Wadi Safar , referred to as the ‘Bel Air’ of Saudi Arabia, located within the massive Diriyah Giga project worth $63 billion.

This exclusive community is planned to offer residences starting at a minimum of $25 million, targeting individuals with significant wealth and already having a waitlist.

Located west of Diriyah, Wadi Safar is more than just a collection of luxury houses. In addition to lavish homes, the development will also offer a top-tier golf course, a prestigious equestrian center, and a polo club, enhancing the prestige of this high-end housing venture.

Jumeirah Jabal Omar Hotel

The Dubai’s Jumeirah Hotel group has officially revealed the launch of their inaugural hotel in Saudi Arabia, the Jumeirah Jabal Omar Hotel , located in the sacred city of Makkah .

Positioned in the center of Jabal Omar near the Grand Mosque, Al Masjid Al Haram , the hotel is in the second stage of the Jabal Omar development.

With more than 1000 rooms and suites, a significant number of which offer direct views of the haram, the hotel strives to offer unparalleled experiences for Hajj and Umrah pilgrims.

The Rise of Riyadh Air

The economy of Saudi Arabia is focused on diversification and has been making significant progress in the tourism industry. A major effort in this direction is the introduction of Riyadh Air , backed by the Public Investment Fund (PIF,) which is set to begin operations in 2025.

Riyadh Air plans to serve more than 100 destinations worldwide by 2030. The country’s determination to diversify its economy is evident in its ambitious plans for tourism and the substantial investments being made to achieve them.

Keep Reading: Visitors to Saudi Arabia Spent Over $26 Billion in First 9 Months of 2023

- TAGGED: Economy , Travel

Red Sea Global and Hyundai Partner To Bring Eco Friendly Vehicles Luxury Resorts

FlyDubai Launches First International Flights To Saudi Arabia’s Red Sea Airport

Royal Commission for AlUla Starts Construction of Sharaan Resort

Bookings Are Now Open For Nujuma, A Ritz-Carlton Reserve On The Saudi Red Sea

World’s First Dragon Ball Theme Park To Open In Saudi Arabia’s Qiddiya Entertainment City

HOSPITALITY

Red sea global, real estate, become smarter in just 5 minutes.

Get the latest developments on The Saudi Boom straight to your inbox and stay ahead of the curve for free

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

Travel Markets News & Offers

SAUDI ARABIA JUMPS 10 PLACES IN GLOBAL TOURISM RANKING

Riyadh, Travel & Markets , May 2022 – Saudi Arabia moved up 10 places to 33rd in the world overall, in the 2021 World Economic Forum (WEF) Travel and Tourism Development Index, which was released yesterday at Davos.

The independent index benchmarks 117 countries on 17 pillars crucial to the development and resilience of their travel and tourism industries. Saudi Arabia moved from 43rd in 2019 to 33rd in 2021, the second largest rise in rankings, as a result of improvements across almost all indicators. This is the first report to be produced since Saudi Arabia opened for international tourism in September 2019.

In 2019, Saudi Arabia launched the National Tourism Strategy, a clear plan to drive forward the aims of Vision 2030. These aims will increase the contribution of the tourism sector to 10% of GDP, create 1million new jobs, and attract 100 million local and international visits annually by 2030.

The World Economic Forum’s Travel and Tourism Development Index is a key indicator of Saudi Arabia’s extraordinary journey as a global tourism leader. Saudi Arabia’s leadership, resources and ambition are driving the monumental growth of the sector and delivering on Vision 2030 goals.

His Excellency Ahmed Al Khateeb, Minister of Tourism of Saudi Arabia said: “I am proud of the progress the Kingdom has made through our Vision 2030 reforms as we have opened to the world. Our success is demonstrated by our strong investment in the tourism sector – from creating jobs opportunities for citizens to working with global partners who are invested in our transformation.”

“Our ranking is proof that since 2019, despite the global pandemic, Saudi Arabia has demonstrated incredible global leadership as a new tourism destination. We have made it easier to invest and create tourism businesses in the Kingdom. Last year saw a record for domestic visits. And top global companies are recognising our commitment and are joining us.”

The WEF’s new Travel & Tourism Development Index measures against a set of factors that enable the sustainable and resilient development of the Travel and Tourism sector, which in turn contribute to national development.

The 2021 edition of the index highlights the vital need to invest in tourism, the impact of COVID-19 and how sector stakeholders can draw on development strategies to build back better. Amid current challenges, shifting demand and future risks, a more inclusive, sustainable and resilient sector must be created.

Saudi’s higher score was achieved by improvements across 12 out of 17 KPIs. Highlights include an improvement from 27th to 10th for business environment, an improvement from 47th to 40th for tourism services and a best in world ranking for managing demand pressure and impact.

This significant improvement in Saudi’s ranking reflects not only considerable investment into tourism but also its global leadership in future-proofing the sector. Focused on sustainable and resilient development, Saudi is bringing together key players in the sector to build a future for tourism that is better for all.

Related Posts

Department of Culture and Tourism – Abu Dhabi to deliver Tourism Strategy 2030 to ensure emirate’s sustainable growth as global tourism destination

3 simple tips for that seamless visa application journey

SAUDI ARABIA TO CELEBRATE 100 MILLION TOURISTS MILESTONE AT ITB BERLIN

Leave a reply.

You must be logged in to post a comment.

You May Have Missed

Sofitel Al Hamra Beach Resort welcomes Karim Abdelhamid as General Manager

Vibrant Eid Al Fitr Festivities Await at The Hotel Galleria Jeddah, Curio Collection by Hilton

Habtoor Grand Resort, Autograph Collection Introduces Special Spring Holiday Offer

JUMEIRAH GROUP OPENS ITS FIRST HOTEL IN THE KINGDOM OF SAUDI ARABIA

- LOGIN/REGISTER

Saudi Arabia rank 33rd in Global Tourism Ranking

Saudi Arabia moved up to 10 places (from 43rd to 33rd) in the world tourism ranking, in the 2021 World Economic Forum (WEF) Travel and Tourism Development Index. The WEF’s new Travel & Tourism Development Index measures against a set of factors that enable the sustainable and resilient development of the Travel and Tourism sector, which in turn contribute to national development.

In 2019, Saudi Arabia launched the National Tourism Strategy, a clear plan to drive forward the aims of Vision 2030 . These aims will increase the contribution of the tourism sector to 10% of GDP, create 1million new jobs, and attract 100 million local and international visits annually by 2030.

Saudi Arabia rank 33rd in Global tourism ranking

Saudi’s higher score was achieved by improvements across 12 out of 17 KPIs. Highlights include an improvement from 27th to 10th for business environment, an improvement from 47th to 40th for tourism services and a best in world ranking for managing demand pressure and impact.

This significant improvement in Saudi’s ranking reflects not only considerable investment into tourism but also its global leadership in future-proofing the sector. Focused on sustainable and resilient development, Saudi is bringing together key players in the sector to build a future for tourism that is better for all.

Related Articles

- Saudi Arabia Welcome Tourism From 1st August

- Saudi Arabia Launches One Of the World’s Biggest Investments In Next Generation of Tourism Professionals

- GCC citizens now can apply for an e-Visa of Saudi Arabia

HOW CAN WE HELP?

Your Full Name *

Your Email *

Your Phone Number *

Your Question *

NEED HELP 24/7

How it works ?

Apply with confidence.

- Safety, Fastest, Reliable, Save Time.

- Secure Online Payment.

- 3 Working Days Guarantee.

- No Hidden Fees and No Traps.

- Money Back Guarantee if Declined.

- Make a payment

- Coperate Account

- LOGIN / REGISTER

- Universal Terms Of Service

- Legal Agreements

- Privacy Policy

- Payment Guidelines

- Disclaimers

CHECK REQUIREMENTS

- Saudi Arabia visa for Cyprus

- Saudi Arabia visa for Dutch citizens

- Saudi Arabia visa for Malaysian

- Saudi Arabia visa for Singaporean

- Saudi Arabia visa for Swiss citizens

- Saudi Arabia visa for New Zealander citizens

EXTRA SERVICES

- Travel Insurance

USEFUL INFORMATION

- Check Requirements

- Make payment

- Check Status

- Government News

www.saudiarabiaimmigration.org is part of Saudi Arabia Immigration Services Group - the world leading in Online Travel & Related Services to travel to Saudi Arabia. 1997-2024. Saudi Arabia Immigration Services. All Rights Reserved.

This is a commercial/Private Website, NOT an official website of the government.

This is a commercial website to apply eVisa to Saudi Arabia through Saudi Arabia Government Website, you will be charged a fee. To book a landing visa under our process , we will charge a service fee for providing consultancy, submitting applications and informing the status and results.

Our fee will be higher than you apply directly on Saudi Arabia Government Website or at Saudi Arabia Embassies in your country.

- Environment

- Road to Net Zero

- Art & Design

- Film & TV

- Music & On-stage

- Pop Culture

- Fashion & Beauty

- Home & Garden

- Things to do

- Combat Sports

- Horse Racing

- Beyond the Headlines

- Trending Middle East

- Business Extra

- Culture Bites

- Year of Elections

- Pocketful of Dirhams

- Books of My Life

- Iraq: 20 Years On

Saudi tourism sector to be Mena's fastest-growing in next decade, WTTC says

Employment in travel industry set to double by 2032 and exceed pre-pandemic levels by next year.

An ancient Nabataean carved tomb at the archaeological site of Al Hijr (Hegra), one of Saudi Arabia's prime tourist attractions. AFP

Saudi Arabia's travel and tourism sector will grow an average 11 per cent annually over the next decade, making it the Middle East's fastest-growing market, the World Travel & Tourism Council ( WTTC ) has said.

Annual growth in the industry is set to bolster the overall economic recovery of the kingdom, the global tourism body said in a statement on Monday.

By 2032, the sector’s contribution to Saudi Arabia's gross domestic product could reach nearly 635 billion Saudi riyals ($169bn), representing 17.1 per cent of the kingdom's total economy, it said.

“Travel and tourism will become a driving force of the Saudi Arabian economy and will surpass the goals set out in its Vision 2030 blueprint," said Julia Simpson, WTTC president and chief executive.

Saudi Arabia had been developing its tourism industry before the Covid-19 outbreak, as part of its efforts to diversify the country's economy and steer away from dependence on oil. In May, the kingdom achieved the second biggest improvement in ranking among 117 countries featured in the World Economic Forum’s index on travel and tourism. From 2019 to 2021, Saudi Arabia moved up to 33rd position from 43rd, as its score rose by 2.3 per cent.

Employment in Saudi Arabia's travel and tourism sector could double over the next 10 years, creating more than 1.4 million jobs, to reach almost three million employed within the sector by 2032, the WTTC forecasts.

By 2023, Saudi Arabia’s travel and tourism sector contribution to the national economy could surpass pre-pandemic levels, when it is projected to rise 2 per cent above 2019 levels, to reach nearly 297bn riyals.

Employment in the sector could also exceed 2019 levels by 14.1 per cent by the end of next year, the tourism body said.

By the end of 2022, the sector’s contribution to the kingdom's GDP is expected to grow 15.2 per cent to nearly 223bn riyals, amounting to 7.2 per cent of the total economic output, while employment in the sector is set to grow by 16.1 per cent to reach more than 1.5 million jobs.

The kingdom is scheduled to host WTTC’s 22nd Global Summit in Riyadh in November this year.

“I am delighted the kingdom is hosting our 22nd Global Summit, where we will be able to continue our efforts of showcasing the importance of the travel and tourism sector and look ahead to the future of travel," Ms Simpson said.

Before the pandemic, Saudi Arabia’s travel and tourism sector's total contribution to GDP was 9.7 per cent (291.6bn riyals) in 2019, falling to only 6.6 per cent (190.6bn riyals) in 2020.

The sector also supported nearly 1.6 million jobs, before an almost complete halt to international travel, which resulted in a loss of 350,000 jobs (22.2 per cent), to reach slightly more than 1.2 million in 2020.

Checking In

Travel updates and inspiration from the past week

Our Vision: Bring Saudi Arabia to the world.

- Ahmed Saleh

- Oct 4, 2023

Saudi Arabia ranks second globally in tourist arrivals, achieving remarkable growth

Riyadh, October 03, 2023, Saudi Arabia has achieved a remarkable tourism milestone by ranking second globally in tourist arrivals during the first seven months of 2023. The Ministry of Tourism reported a staggering 58% growth in tourist numbers compared to the same period in 2019, based on data from the UNWTO World Tourism Barometer published by the United Nations World Tourism Organization (UNWTO) in September. This accomplishment further solidifies Saudi Arabia's position as a prominent player in the global tourism industry. The success can be attributed to the unwavering support of King Salman bin Abdulaziz Al Saud and Crown Prince HRH, as stated by Tourism Minister Ahmed Al-Khateeb. This surge in tourist arrivals underscores the Kingdom's appeal as a top international tourist destination, driven by its diverse and high-quality tourism offerings.

Recent Posts

Saudia's brand value surges by 58% in 2022: Brand Finance

Saudi Red Sea Authority (SRSA) advances maritime and tourism initiatives

GEA reveals Eid Al-Fitr Events 2024 Booklet with diverse activities nationwide

Do you want a KSA.com Email?

- Get your own KSA.com Email like [email protected]

- 50 GB webspace included

- complete privacy

- free newsletters

- Latest News

- Emergencies

- Ask the Law

- GN Fun Drive

- Visa+Immigration

- Phone+Internet

- Reader Queries

- Safety+Security

- Banking & Insurance

- Dubai Airshow

- Corporate Tax

- Top Destinations

- Corporate News

- Electronics

- Home and Kitchen

- Consumables

- Saving and Investment

- Budget Living

- Expert Columns

- Community Tips

- Cryptocurrency

- Cooking and Cuisines

- Guide to Cooking

- Art & People

- Friday Partner

- Daily Crossword

- Word Search

- Philippines

- Australia-New Zealand

- Corrections

- From the Editors

- Special Reports

- Pregnancy & Baby

- Learning & Play

- Child Health

- For Mums & Dads

- UAE Success Stories

- Live the Luxury

- Culture and History

- Staying Connected

- Entertainment

- Live Scores

- Point Table

- Top Scorers

- Photos & Videos

- Course Reviews

- Learn to Play

- South Indian

- Arab Celebs

- Health+Fitness

- Gitex Global 2023

- Best Of Bollywood

- Special Features

- Investing in the Future

- Know Plan Go

- Gratuity Calculator

- Notifications

- Prayer Times

Saudi Arabia ranked among global tourism destinations for the first time

Travel & Tourism

Riyadh: Saudi Arabia has been ranked in the worldwide tourism index for the first time, taking the 82nd spot among 130 countries.

The kingdom has been ranked ninth among Arab countries in the World Economic Forum's (WEF) report titled 'Balancing economic development and environmental sustainability'.

Oman was the other new entrant in the survey, which reported a fall in the tourism rankings of the UAE, Qatar, Bahrain and Kuwait.

The UAE, which ranked 18 among 124 countries surveyed in 2007, took the 40 spot this year.

The tourism index, known as the Travel and Tourism Competitiveness Index (TTCI), is based on 71 criteria and variables. Saudi Arabia ranked first as the most AIDS-free tourism destination in the world.

The kingdom took second position as the country with the lowest fuel charges, seventh in terms of taxes levied on tourists, and 15th regarding airport fees. The report ranks Saudi Arabia 15th in the availability of airline seats, and 39th in the number of airline services.

Switzerland retained its top position on the index, followed by Austria and Germany. The countries held on to their 2007 rankings. Australia, Spain, the UK, the US, Sweden, Canada and France completed the top ten, this year.

Qatar ranked first among Arab countries followed by Tunisia at 39th spot and UAE at 40.

The index showed Saudi Arabia received 8.62 million tourists, who spent $4.96 billion, in 2006.

The report that placed particular focus on the environment, said the volume of revenue from international tourism rose from $2.1 billion to $622.7 billion between 1950 and 2004.

More From Tourism

See: Sharjah luxury eco retreats complete expansion

Flying? Know the fire risks from batteries, power banks

Travel boom: Industry to top $11 trillion in 2024

Watch: Tales from the kitchens of Anatolia

650km-long Saudi-Kuwait railway to be completed by 2028

Riyadh airport gets newly revamped duty-free market

UAE remittance fee hike: Will residents go digital?

Emirates adds 19 extra flights ahead of Eid Al Fitr

Oil falls after report shows surge in us stocks.

Giga-project NEOM attracts expat property buyers

Uae stocks see dh6.5b inflow, gh and emaar lead, departing boeing ceo gets nearly $33m in 2023 payment, zuckerberg's wealth tops musk for first time since 2020, elon musk says tesla will unveil robotaxi in august, musk's tesla to unveil long-promised robotaxi in august.

Get Breaking News Alerts From Gulf News

We’ll send you latest news updates through the day. You can manage them any time by clicking on the notification icon.

Saudi Arabia’s Latest Tourism Count – What the Numbers Show

Josh Corder , Skift

February 12th, 2024 at 9:48 AM EST

Saudi Arabia has hit its tourism target seven years early, but there is still work to be done to be a global travel super power.

Josh Corder

Saudi Arabia’s tourism minister says the kingdom counted more than 100 million tourists in 2023 – the numbers show growth in visits from international travelers, but that it still has work to do to become a globally competitive destination.

Here’s the count shared by tourism minister Ahmed bin Aqeel Al Khateeb:

- Saudi saw 77 million domestic tourists and 27 million international ones, totaling 104 million visits.

- 77 million is the same number of domestic tourists Saudi had in 2022. The overall figure was boosted by a 11 million international visitors.

- Al Khateeb highlighted a new strategy set by crown prince Mohammed bin Salman to attract 150 million tourists by 2030, with 80 million domestic and 70 million international tourists.

- Total spending reached SAR100 billion ($26.67 billion) last year.

The Saudis don’t say exactly ‘how’ a domestic tourist can be measured. The ministry’s website defines a domestic tourist as: “The activities of a resident visitor within the country of reference, either as part of a domestic tourism trip or part of an outbound tourism trip.”

Saudi’s Leisure and Religious Travel Mix

Growing leisure tourism is a principal focus; diversifying the county from its historic religious tourism sector that benefits from hajj and umrah pilgrims.

For now, the leisure tourism sector Saudi is trying to build – whether it be through new hotels, festivals, sports events and giga-projects – has mostly pulled in locals.

For Saudi locals, leisure trips have significantly increased. 45% of all domestic trips by locals in the first half of 2023 were for leisure purposes, according to the ministry’s data. In 2022, it was 40% and in 2021 it was 36% of all trips.

For international visitors, 20% visited the kingdom for leisure, while visiting friends and relatives made up 23% and religious tourism accounted for 45%. In 2022, 15% of travelers visited for leisure, while in 2021, it was 9%.

The country’s wave of new developers are looking at ways to appeal to the massive base of religious travelers whose trips start and end in the holy cities.

John Pagano, CEO of Red Sea Global, sees an opportunity for his upcoming projects to extend the stays of these pilgrims.

“Think about the size of that market, one and a half billion Muslims in the world,” Pagano told Skift in an interview last December.

“So if we can tap into that market and have them make it a once-in-a-lifetime trip where they do the religious piece, which is hugely important and then tack on a family vacation at something that’s reasonably affordable, I think it’s a very deep market for us. (Religious travelers) tend to spend more middle and lower end of the (travel) market.”

Located nearer to Jeddah, one of Pagano’s new projects could seek to draw in the city’s many religious travelers. Jeddah is located approximately an hour from Makkah, one of the most important locations in all of Islam.

Spending Increases

Booking expenditures of local Saudi travelers went up by 10.8% last year, while most consumers (75%) chose to book local destinations with low-cost carriers, data from travel company Almosafer, part of Seera Group, showed.

“This indicates that domestic travelers are spending more on in-destination expenses, including accommodation and activities while saving on their journeys,” the travel firm said in a report.

The nation has relaxed its entry requirements by implementing the eVisa program, which now encompasses 63 countries and special administrative regions, along with the GCC residents visa. Additionally, there is a complimentary 96-hour stopover visa available, granting visitors a free one-night hotel stay if they book with the national carrier, Saudia. This stopover visa allows travelers to explore Saudi Arabia and undertake umrah.

Middle East Travel Roundup

Get the latest news from the Middle East in one easy-to-digest newsletter.

Have a confidential tip for Skift? Get in touch

Tags: saudi arabia , Saudi Tourism , Tourism news , travel news

Photo credit: AlUla, Saudi Arabia. Used for illustrative purposes. Seera Group

Tourism in Saudi Arabia

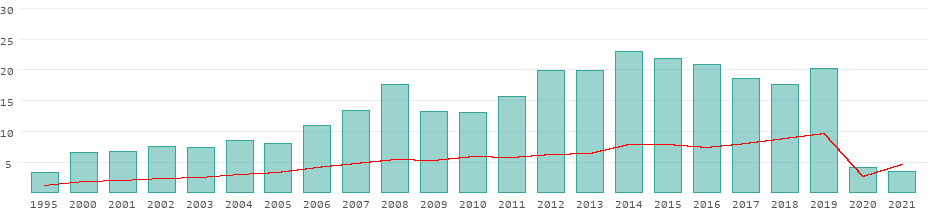

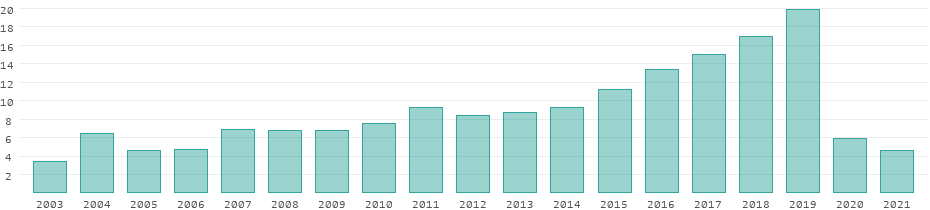

Development of the tourism sector in saudi arabia from 1995 to 2021.

Revenues from tourism

All data for Saudi Arabia in detail

- Switch skin

Saudi Arabia Tops UN Tourist Arrival Ranking for 2023

Saudi Arabia has topped the United Nations Tourism Ranking in terms of the growth of international tourist arrivals in 2023 compared to 2019 among the countries hosting major tourism destinations.

Saudi Arabia recorded an increase of 56 percent in the number of incoming tourists in 2023 compared to 2019, according to the World Tourism Barometer report issued by the United Nations Tourism Organisation in January.

The report also indicated that the Kingdom has achieved a remarkable tourism recovery rate of 156 percent in the number of tourist arrivals during the year 2023 compared to 2019.

The outstanding achievements in the tourism sector have contributed to positioning Saudi Arabia as a leader in the Middle East region’s global recovery in the field of tourism. The Mideast region is the only region that surpassed pre-COVID-19 growth levels with a 122 percent recovery rate in international tourist arrivals during the year 2023 compared to the year 2019.

According to the UN barometer report, several tourist destinations in the Kingdom witnessed a noticeable increase in the number of inbound and domestic visitors during the year 2023.

Saudi Arabia also achieved a new record in the spending of inbound tourists and visitors, reaching more than SR100 billion for the first three quarters of the year 2023, according to the balance of payments data issued by the Saudi Central Bank (SAMA).

These accomplishments reinforce the Kingdom’s position as a leading global tourist destination. The remarkable increase in the number of tourist arrivals reflects travellers’ confidence in the Kingdom’s attractive tourism options and their diversity, as the UN report pointed out.

Megha Nikesh

Pfizer’s own study confirms paxlovid sucks, “you try living with them” – botswana offers 20,000 elephants to germany, google eyes paid ai search features, explores subscription model; report, new england hospitals stop reporting newborns with drugs in system because it “disproportionately affects black individuals”, great, now band-aids pose cancer risk thanks to ‘forever chemicals’, the single wisest thing you can do with your money, eid al fitr 2024: sharjah plans 6330 trips between cities during holiday, bahrain: focus on marine pollution woes from giant oil tankers, california bill mandating “pregnancy dignity” for “birthing persons” passes health committee, the sad decline of america’s universities, lauryn hill electrifies bahrain national theatre in spring of culture’s 18th edition, renowned bahraini social figure passes away at 98, related articles.

Real Estate Scammer Jailed in Bahrain for Apartment Contract Forgery

2nd Saudi Cinema Nights Series of International Film Screening Begins This Month

648 People Detained for Unauthorized Passenger Pickup at Saudi Airports

Saudi Arabia Announces 50% Reduction on Accumulated Traffic Fines Before April 18, 2024

Saudi Arabia records highest ever inbound tourism spending of SR135 billion in 2023

Saudi Gazette Report

RIYADH — Saudi Arabia recorded the highest ever spending by inbound visitors during the year 2023, reaching SR135 billion, according to the Saudi Central Bank (SAMA).

The preliminary balance of payments data, released by SAMA, showed that this spending, the highest ever in the history of Saudi Arabia, represents a growth rate of 42.8 percent compared to the previous year of 2022 when the spending of inbound visitors reached SR94.5 billion. This record increase in spending by inbound tourists comes within a series of continuous successes achieved by the Kingdom’s thriving tourism sector.

It is noteworthy that Saudi Arabia topped the United Nations Tourism ranking in terms of the growth of international tourist arrivals in 2023 compared to 2019 from among the countries hosting major tourism destinations. The Kingdom recorded an increase of 56 percent in the number of incoming tourists in 2023 compared to 2019, according to the World Tourism Barometer report issued by the United Nations Tourism in January.

The report also indicated that the Kingdom has achieved a remarkable tourism recovery rate of 156 percent in the number of tourist arrivals during the year 2023 compared to 2019.

The outstanding achievements in the tourism sector have contributed to positioning Saudi Arabia as a leader in the Middle East region’s global recovery in the field of tourism. The Mideast region is the only region that surpassed pre-COVID-19 growth levels with a 122 percent recovery rate in the international tourist arrivals during the year 2023 compared to the year 2019.

According to the UN barometer report, several tourist destinations in the Kingdom had witnessed a noticeable increase in the number of inbound and domestic visitors during the year 2023. These accomplishments reinforced the Kingdom’s position as a leading global tourist destination. The remarkable increase in the number of tourist arrivals reflects travelers’ confidence in the Kingdom’s attractive tourism options and their diversity.

Earlier this month, the Ministry of Tourism celebrated a significant milestone, reaching 100 million tourists by the end of 2023, achieving this target seven years ahead of the timeline set by Saudi Vision 2030. The surge in tourism saw more than 106 million domestic and international visitors, marking a 56 percent increase from 2019 and a 12 percent rise from 2022.

The achievement has garnered international recognition, with accolades from UN Tourism and the World Travel and Tourism Council (WTTC), acknowledging Saudi Arabia's rapid development in the tourism sector. The international UN bodies also hailed the Kingdom for the government’s great efforts to tap the huge potential of the vital tourism sector.

Travel, Tourism & Hospitality

Tourism industry in Saudi Arabia - statistics & facts

Saudi arabia’s tourism revolution, entertainment and media fueling the tourism boom, key insights.

Detailed statistics

Total inbound tourist expenditure Saudi Arabia 2015-2022

Total inbound tourist expenditure Saudi Arabia 2021, by province

Share of tourist trips Saudi Arabia 2022, by purpose

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Number of Hajj pilgrims in Saudi Arabia 1999-2022

Share of travel and tourism contribution to GDP in Saudi Arabia 2015-2032

Leading inbound travel markets from Middle East Saudi Arabia 2022

Related topics

Recommended.

- Hotel industry in Saudi Arabia

- Hotel industry in GCC

- Tourism industry in UAE

- Tourism industry in Qatar

Recommended statistics

Regional overview.

- Basic Statistic Inbound visitor growth in the Middle East 2011-2025

- Basic Statistic Outbound visitor growth in the Middle East 2011-2025

- Premium Statistic Targets of international tourist arrivals GCC 2023, by country

- Premium Statistic Expected revenue of hospitality industry in the GCC 2026, by country

- Premium Statistic Expected revenue of hospitality industry in the GCC 2021-2026, by country

Inbound visitor growth in the Middle East 2011-2025

Inbound visitor growth in the Middle East from 2011 to 2025

Outbound visitor growth in the Middle East 2011-2025

Outbound visitor growth in the Middle East from 2011 to 2025

Targets of international tourist arrivals GCC 2023, by country

Targets for international tourist arrivals in the Gulf Cooperation Council as of 2023, by country

Expected revenue of hospitality industry in the GCC 2026, by country

Forecasted share of the hospitality revenue in the Gulf Cooperation Council in 2026, by country

Expected revenue of hospitality industry in the GCC 2021-2026, by country

Forecasted revenue of the hospitality industry in the Gulf Cooperation Council in 2021 and 2026, by country (in billion U.S. dollars)

Economic indicators

- Premium Statistic Share of the GDP of the tourism sector in Saudi Arabia 2013-2028

- Premium Statistic Total inbound tourist expenditure Saudi Arabia 2015-2022

- Premium Statistic Outbound tourism expenditures Saudi Arabia 2018-2022

- Premium Statistic Domestic tourist expenditure Saudi Arabia 2018-2022

- Premium Statistic Distribution of inbound tourist spending Saudi Arabia 2022, by purpose of visit

- Premium Statistic Outbound tourist spending Saudi Arabia 2022, by purpose of visit

Share of the GDP of the tourism sector in Saudi Arabia 2013-2028

Share of the GDP of the tourism sector in Saudi Arabia from 2013 to 2028

Total inbound tourist expenditure in Saudi Arabia from 2015 to 2022 (in billion Saudi riyals)

Outbound tourism expenditures Saudi Arabia 2018-2022

Outbound tourism expenditures in Saudi Arabia from 2018 to 2022 (in billion Saudi Riyals)

Domestic tourist expenditure Saudi Arabia 2018-2022

Domestic tourist expenditure in Saudi Arabia from 2018 to 2022 (in billion Saudi riyals)

Distribution of inbound tourist spending Saudi Arabia 2022, by purpose of visit

Distribution of inbound tourist expenditure in Saudi Arabia in 2022, by purpose of visit

Outbound tourist spending Saudi Arabia 2022, by purpose of visit

Expenditure of outbound tourists from Saudi Arabia in 2022, by purpose of visit (in billion Saudi riyals)

Types of tourism

- Premium Statistic Distribution of inbound tourist trips Saudi Arabia 2022, by purpose of visit

- Premium Statistic Total inbound tourist trips Saudi Arabia 2022, by purpose

- Premium Statistic Number of leisure inbound tourist trips Saudi Arabia 2015-2022

- Premium Statistic Total outbound tourist trips in 2022, by purpose and nationality

- Premium Statistic Number of outbound leisure tourist trips Saudi Arabia 2022, by country

- Premium Statistic Total domestic tourist trips Saudi Arabia 2022, by purpose

Distribution of inbound tourist trips Saudi Arabia 2022, by purpose of visit

Distribution of inbound tourist trips to Saudi Arabia in 2022, by purpose of visit

Total inbound tourist trips Saudi Arabia 2022, by purpose

Total inbound tourist trips in Saudi Arabia in 2022, by purpose (in millions)

Number of leisure inbound tourist trips Saudi Arabia 2015-2022

Number of leisure inbound tourist trips in Saudi Arabia from 2015 to 2022 (in 1,000s)

Total outbound tourist trips in 2022, by purpose and nationality

Number of Saudi and non-Saudi outbound tourist trips in Saudi Arabia in 2022, by purpose (in 1,000s)

Number of outbound leisure tourist trips Saudi Arabia 2022, by country

Number of outbound leisure tourist trips from Saudi Arabia in 2022, by destination country (in thousands)

Total domestic tourist trips Saudi Arabia 2022, by purpose

Total domestic tourist trips in Saudi Arabia in 2022, by purpose (in millions)

Inbound tourism

- Premium Statistic Number of inbound tourists Saudi Arabia 2018-2022

- Premium Statistic Total number of inbound tourists Saudi Arabia 2022, by region of origin

- Premium Statistic Number of inbound tourists Saudi Arabia 2022, by country of origin

- Premium Statistic Leading cities in inbound tourist arrivals Saudi Arabia 2022, by city

- Premium Statistic Share of inbound tourists Saudi Arabia 2022, by accommodation

- Premium Statistic Average length of stay of inbound tourists Saudi Arabia 2015-2022

Number of inbound tourists Saudi Arabia 2018-2022

Number of inbound tourists to Saudi Arabia from 2018 to 2022 (in millions)

Total number of inbound tourists Saudi Arabia 2022, by region of origin

Total number of inbound tourists in Saudi Arabia in 2022, by region of origin (in millions)

Number of inbound tourists Saudi Arabia 2022, by country of origin

Number of inbound tourists to Saudi Arabia in 2022, by country of origin (in millions)

Leading cities in inbound tourist arrivals Saudi Arabia 2022, by city

Number of inbound tourist arrivals to leading destinations in Saudi Arabia in 2022, by city (in millions)

Share of inbound tourists Saudi Arabia 2022, by accommodation

Share of inbound tourists in Saudi Arabia in 2022, by accommodation type

Average length of stay of inbound tourists Saudi Arabia 2015-2022

Average length of stay of inbound tourists in Saudi Arabia from 2015 to 2022 (in nights)

Outbound tourism

- Premium Statistic Number of outbound departures from Saudi Arabia 2015-2022

- Premium Statistic Total outbound tourist trips Saudi Arabia 2022, by region and nationality

- Premium Statistic Share of outbound Saudi tourist trips Saudi Arabia 2022, by destination country

- Premium Statistic Share of outbound non-Saudi tourist trips Saudi Arabia 2022, by destination

- Premium Statistic Share of Saudi outbound tourists Saudi Arabia 2022, by accommodation type

- Premium Statistic Share of non-Saudi outbound tourists Saudi Arabia 2022, by accommodation type

Number of outbound departures from Saudi Arabia 2015-2022

Number of outbound tourists from Saudi Arabia from 2015 to 2022 (in millions)

Total outbound tourist trips Saudi Arabia 2022, by region and nationality

Total outbound tourist trips in Saudi Arabia in 2022, by region and nationality (in millions)

Share of outbound Saudi tourist trips Saudi Arabia 2022, by destination country

Share of outbound trips of Saudi nationals in Saudi Arabia in 2022, by destination country

Share of outbound non-Saudi tourist trips Saudi Arabia 2022, by destination

Share of outbound trips of non-Saudi residents in Saudi Arabia in 2022, by destination country

Share of Saudi outbound tourists Saudi Arabia 2022, by accommodation type

Share of Saudi outbound tourists from Saudi Arabia in 2022, by accommodation type

Share of non-Saudi outbound tourists Saudi Arabia 2022, by accommodation type

Share of non-Saudi outbound tourists from Saudi Arabia in 2022, by accommodation type

Domestic tourism

- Premium Statistic Number of domestic tourists Saudi Arabia 2018-2022

- Premium Statistic Leading cities in domestic tourist trips Saudi Arabia 2022, by city

- Premium Statistic Number of domestic Hajj pilgrims in Saudi Arabia 1999-2022

- Premium Statistic Share of domestic tourists Saudi Arabia 2022, by accommodation

Number of domestic tourists Saudi Arabia 2018-2022

Number of domestic tourists in Saudi Arabia from 2018 to 2022 (in millions)

Leading cities in domestic tourist trips Saudi Arabia 2022, by city

Number of domestic tourist trips to leading destinations in Saudi Arabia in 2022, by city (in millions)

Number of domestic Hajj pilgrims in Saudi Arabia 1999-2022

Annual number of domestic Hajj pilgrims within Saudi Arabia from 1999 to 2022

Share of domestic tourists Saudi Arabia 2022, by accommodation

Share of domestic tourists in Saudi Arabia in 2022, by accommodation type

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

- Hotel industry worldwide

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Pipeline of Power: How the earnings of Saudi Aramco, the world’s most profitable company over the past decade, are helping the Saudi monarchy shake up the global economic order

For generations, the city of Cannes in the South of France has been famous for its glitzy film festival, where the world’s movie stars strut down the red carpet every spring amid adoring fans and clicking cameras. But in March, another group of A-listers arrived on the red carpet, this time not from Hollywood, but from a country that until recently was shrouded in insular secrecy: Saudi Arabia.

Instead of movies, these visitors came to exhibit massive building projects whose budgets would make any studio boss salivate. In razzle-dazzle exhibition spaces erected along the palm-lined Mediterranean, the power players were there to woo investors and suppliers at a sprawling real estate convention. They aired videos of futuristic cities, skyscrapers, resorts, and jagged mountains, images that floated across giant wraparound screens. Alongside them were scale models of projects ranging from practical to fanciful, from a vast expansion of Riyadh, the Saudi capital, to a planned city of 9 million rising from scratch along the Red Sea—at a projected cost of more than $500 billion.

“Almost all the countries in the world are already built,” Saud Alsulaimani, Saudi country head for Chicago-based real estate services company Jones Lang LaSalle , told a group of convention-goers who dropped in to ogle the 3D models. “There is nowhere else on the planet you will find $1.4 trillion worth of construction at the same time.”

Though he wasn’t physically present in Cannes, you didn’t have to look far to catch Saudi Arabia’s Crown Prince Mohammed bin Salman, whose face was projected on the walls of the pavilion of the huge Saudi state-run real estate company. Just 38, MBS, as the prince is commonly known, is seven years into what’s envisioned as his lifetime leadership of Saudi Arabia (his father, King Salman, the official head of state, is 88). Since 2022, MBS has also held the post of prime minister. The larger-than-life image of MBS conveyed a message: The young ruler is the ultimate patron behind these ambitious projects.

Not displayed, however, was an equally crucial player: Saudi Aramco , the most profitable company in the world over the past decade. The state-owned energy giant pumps out oil at a rate no other single company can match—at margins that are the envy of every competitor. Its revenues, which reached $440 billion in 2023, make up about 40% of Saudi Arabia’s GDP. Its enormous earnings finance hundreds of billions of dollars’ worth of Saudi investments, both internally—in the kingdom’s mammoth construction and tourism projects and its efforts to diversify its economy—and globally, through the intricate web of stakes that Saudi’s sovereign wealth fund, the Public Investment Fund (or PIF), has amassed in companies, sports franchises, and real estate worldwide.

While a tiny share of Aramco is publicly traded, the company is majority owned by the Saudi state, their agendas inexorably linked. Aramco in return provides the means for the crown prince’s overhaul of the Saudi economy, and his efforts to reshape the global economic order. That gives Saudi Arabia and its leader disproportionate clout beyond the kingdom, in the biggest geopolitical issues of our time—from prospects for peace in the Middle East to the global fight against climate change. And how MBS exerts that influence will hinge in part on how much money Aramco can make.

This rising global role of Saudi Arabia is an outrage to some, a cause for celebration to others. The crown prince rules with laser intent and no tolerance for dissent: A CIA investigation concluded that MBS assented to the 2018 murder of journalist Jamal Khashoggi (though the Saudi government strongly denies it), and since his father picked him to run the country in 2017, Saudi Arabia’s rate of executions has risen, while human-rights activists have been sentenced to long prison terms. At the same time, MBS has pushed through the most radical remake of the country since the Saud dynasty founded its absolute monarchy in the 1930s—including outward liberalization in what had long been one of the world’s most religiously conservative countries.

One key driver is Saudi demographics. Half the country is younger than 30, and a quarter is under age 15. Some of MBS’s reforms have resonated not only among the youth, but also in the West: He ended a longtime ban on movie theaters and live music—Alicia Keys and Pharrell Williams performed in Jeddah the weekend before Saudi execs arrived in Cannes—and scrapped laws forbidding women from driving cars or working most jobs. The billions the government has spent signing sports icons like soccer’s Cristiano Ronaldo and Neymar Jr. to local teams have brought young Saudis pouring into new stadiums.

“I never thought I’d be sitting in a stadium in Riyadh with women, their heads uncovered, screaming for Ronaldo,” says Helima Croft, head of global commodity strategy at RBC Capital Markets in New York, on her return from a recent trip to Saudi Arabia. “The mood was electric.”

If the absence of democracy is the price to pay for such pleasures, many Saudis appear to have decided it is worth the trade. The same goes for some giants of Western business—including BlackRock , Amazon , and Alphabet—which have welcomed Saudi capital and invested in the country. The kingdom is also a player in the AI race: IBM says it is investing $200 million in an AI software lab in Riyadh. And a $40 billion AI fund is being planned by the PIF and Silicon Valley’s top VC firm, Andreessen Horowitz—a deal that could make the kingdom the world’s biggest investor in AI.

No leader expressed surprise last year when MBS clinched hosting rights for the World Expo 2030—a six-month international extravaganza. “As a female, Saudi Arabia is now the best place to live in,” says Munira Aldayood, who helps organize conferences for Riyadh’s municipal authority, explaining why she moved back from Fairfax, Va., in 2020 after 23 years in the U.S. She says she found a thriving job market for women and a less stultifying lifestyle than the one from her youth: “It’s heaven.”

That paradise is largely paid for by Aramco. From fiscal 2016 through 2023, Aramco has posted an astonishing $722 billion in profits, more than any other company in the world over that span. ( Apple , famously a profit machine, lags far behind, at $558 billion.) Its $159 billion in profits in 2022 was the single most profitable year ever reported by any company.

But the Aramco cash machine is by no means guaranteed to last forever. In a world undergoing a complicated, urgent energy transition, Aramco’s continued health—and Saudi Arabia’s—will depend on how well the energy giant both shapes and adapts to the changes. For now, the billions from Aramco revenues flow to the PIF, which then spends lavishly on the kingdom’s new economy, including its investments in a green transition. “It’s a bit like taking from one pocket and putting it into another,” says Kate Dourian, Saudi oil expert at the Arab Gulf States Institute in Washington. Saudi Arabia’s massive building spree, and its huge investments, depend on Aramco finding top-dollar value for its hydrocarbons. “Without a certain oil price, they cannot do it,” says Dourian. Until the kingdom develops more diverse ways to keep its pockets full, Aramco will need to stay in good health.

“It’s a bit like taking from one pocket and putting it into another. Without a certain oil price, [Saudi Arabia] cannot do it.” Kate Dourian, Arab Gulf States Initiative

The Aramco juggernaut was originally funded with U.S. money. It began in the 1930s, when American wildcatters trekked into the desert with camels, hunting for prospects for Standard Oil, and hit it big, creating a booming industry. Saudi Arabia nationalized oil production in 1980, while keeping an American remnant: the “am” in Aramco. (The company was once known as the Arabian American Oil Co.) While many Western experts still work there, its management is thoroughly Saudi.

Today Saudi Arabia sits atop nearly one-fifth of the planet’s oil reserves. It pumps more than 9 million barrels a day—9% of global consumption—making it the world’s second-biggest producer after the U.S., which has leaped ahead this century. The Saudis can also ramp up output at short notice, to more than 12 million barrels a day, if the world needs it—something no other country can do.

If high volume means revenue, low costs mean mega-profits. Saudi reserves, in shallow sands, are so easily accessible that Aramco spends less than $10 to produce each barrel of oil. That’s a fraction, for example, of what it costs supermajors like Exxon Mobil and BP to drill in the Gulf of Mexico. “Aramco will make a profit at anything more than $10 a barrel,” says James Reeve, a Brit who serves as a senior director of investment strategy for the PIF in Riyadh; such cheap production is great news at a time when the global price exceeds $80 a barrel.

What’s more, Aramco also retains more of its revenues than its publicly traded competitors in the West. The state-owned company pumps oil in the vast Arabian desert, sends it through pipelines in which it has a majority stake, and exports it from state-owned terminals—meaning it controls more of its supply chain.

In March, Aramco reported year-on-year declines in both revenues and profits for 2023, as capital expenditure rose and global oil prices dropped. But it still notched net earnings of $121.3 billion—equal to more than $332 million in profit a day, or more than $13 million an hour.

Aramco’s intensive operations are highly mechanized; it employs only 70,000 people worldwide, including staff at various subsidiaries and joint ventures. It’s not generating nearly enough jobs for young, ambitious Saudis—which makes it all the more urgent that its profits help MBS diversify the Saudi economy.

In 2016, when the Saudi royals unveiled their master plan for the kingdom’s future, dubbed Vision 2030, it laid out one driving purpose: to lessen the country’s heavy dependence on hydrocarbons by opening new sectors like tourism (a key reason to allow women to drive and take jobs) and tech.

For now, though, the massive profits from those hydrocarbons are playing a dual role, laying a foundation for a modernized, multi-industry economy while putting MBS closer to the center of the world’s geopolitical web. MBS has proved skillful at using his immense riches to juggle alliances around the world. After the European Union banned Russian diesel in 2022, in punishment for Vladimir Putin’s war on Ukraine, MBS boosted oil exports to Europe, to make up for some of the shortfall—while at the same time importing Russian fuel to Saudi Arabia, to compensate Putin for his losses under sanctions.

No longer does U.S. President Biden vow to make Saudi Arabia a “pariah,” as he did as a candidate in 2019, or to halt arms sales to the country. U.S. Secretary of State Antony Blinken has flown to Saudi Arabia six times since October, seeking MBS’s help in ending the Israel-Hamas war. The U.S. has also been back-channeling to keep alive the possibility of normalizing Saudi relations with Israel—an effort that was making progress before Hamas’s murderous assault on Israel on Oct. 7, and that would uncork massive private investment if it came to fruition.

With the U.S. shale-oil boom this century, Americans, the biggest gas guzzlers in the world, are now its biggest oil producers, too, no longer in need of Saudi oil. Today, Aramco’s biggest customer is China—and not coincidentally MBS’s ties with China’s Xi Jinping have become quite warm. That also means that Aramco’s influence over global oil prices—and thus, the global economy—hasn’t waned.

As the dominant member of the OPEC group of oil-producing nations, Saudi Arabia has the loudest voice in whether those 13 countries cut or increase oil production—with marked effects on inflation, stock markets, and regular people. After OPEC cut its production quotas last summer, fearing sinking oil prices, the kingdom announced an additional million-barrel reduction, locking in higher profits. “They present themselves as the central bank to the oil world,” says Dourian, the Saudi oil expert. “And in many ways, they are.”

Those decisions are not made inside Aramco, however. Rather than focus purely on financial performance, as most energy companies do, Aramco’s key policies are set in Riyadh by top officials, right up to MBS. (Saudi energy minister Prince Abdulaziz bin Salman is MBS’s half-brother.) Aramco’s 2019 IPO was the biggest in history, raising nearly $30 billion, but the company floated only 1.7% of its shares.

In fact, it is almost impossible to untangle Aramco from the state. The sovereign wealth fund, the PIF, is run by Yasir Al-Rumayyan, who is chairman of Aramco’s board. The chairman of PIF’s board? That would be the crown prince. “[Aramco] is not always going to be making decisions that are about the bottom line,” says Croft, the RBC commodities strategist. “It’s basically in the national service.”

That service ethos was on full display this March. Aramco reported that revenues for 2023 were down 18% year over year—the kind of result that usually prompts companies to reduce their dividends. But Aramco subsequently transferred nearly $98 billion in dividends, 30% more than in 2022, to the Saudi government, which now owns 82.2% of Aramco. A week later, MBS announced that Aramco had transferred 8% of its total issued shares to the PIF—a stake worth nearly $164 billion.

Indeed, the PIF has become the primary vehicle through which Saudi Arabia and MBS convert Aramco’s earnings into influence and connections far beyond the kingdom. Flush with oil profits, PIF has about $925 billion in assets under management, according to estimates from Global SWF, a research organization tracking sovereign funds. Last year it spent $31.5 billion, and its portfolio includes a head-spinning array of companies, including stakes in Activision Blizzard , Uber , Electronic Arts , and Live Nation . The recently reported Andreessen Horowitz deal extends a long history of global tech investing by the PIF: It was, for a while, a large shareholder in Tesla , and it helped launch SoftBank’s huge (and often star-crossed) Vision Fund in 2017, with a $45 billion stake.

PIF chair Al-Rumayyan is the increasingly widely recognized face of the PIF. While human-rights groups accuse the PIF of being opaque and unaccountable, Al-Rumayyan remains welcome in global board rooms; he’s a director at SoftBank, India’s Reliance Industries , and Uber, among others. A keen golfer, he has pushed a multibillion-dollar deal with the PGA Tour, enraging many U.S. lawmakers. Since 2021, when the PIF purchased a majority stake in the U.K.’s Newcastle United Football Club and made Al-Rumayyan its chair, the PIF leader has been a regular at its stadium, sometimes appearing on the pitch in stylish team-themed clothing.

Days after the Saudi exhibitors descended on Cannes in March, Aramco CEO Amin Nasser flew to Houston to deliver a blunt message. Nasser’s speech at the oil industry’s premier global event, known as CERAWeek, might as well have been titled “Get Real.”

Nasser told the hundreds of oil executives, politicians, and investors in the audience that governments’ climate policies, aimed at phasing out fossil fuels, rested on misconceived ideas dreamed up in rich Western capitals. Environmentalists were ignoring the fact that millions in other regions had no electricity, while others could barely afford to turn the lights on at home, let alone buy electric cars. “We should abandon the fantasy of phasing out oil and gas, and instead invest in them adequately, reflecting realistic demand assumptions,” Nasser said. “The world has been trying to transition in fog, without a compass, on a road to nowhere.”

His words shook the audience, but Saudis have heard similar messages from their government for years; in an interview in his office in Riyadh in 2021, energy minister Prince Abdulaziz told me that those who envisioned the final demise of fossil fuels were “living in a fantasy land.”

And yet it is a fantasy for which Aramco has long been preparing, and for which there is even a national plan in Saudi Arabia.

Climate change is no mystery in the kingdom, where summer temperatures have been soaring to unlivable highs. Vision 2030 mandates that Saudi Arabia move half its grid to renewable sources—a marked change for a country that has long run on plentiful, cheap oil. The country aims to zero out its carbon emissions by 2060, while Aramco’s net-zero target date is 2050. (To the chagrin of environmentalists, neither target factors in “Scope 3” emissions, which would measure the impact of the end users of the kingdom’s oil.)

Aramco bases much of its net-zero strategy on what it calls the “circular carbon economy.” Its aim is to create new, better uses and processes for the hydrocarbons it produces, rather than cutting its production. That includes developing blue hydrogen, a fuel made from captured gas, and expanding the capture and storage of carbon and methane that is emitted while oil is drilled, rather than simply releasing the particles into the air. Researchers have reported promising progress with both those technologies, though neither is yet cost-effective or has much of a market.

“We should abandon the fantasy of phasing out oil and gas… The world has been trying to transition in fog, without a compass, on a road to nowhere.” Aramco CEO Amin Nasser, in a speech March 18

Nasser has also made clear that the company intends to invest heavily in liquefied natural gas, seizing on the booming demand in wealthier countries, which regard LNG as a cleaner way than coal or crude oil to generate power and manufacture plastics. Aramco plans to spend $110 billion doubling its domestic LNG production and to begin exporting it within a few years. In 2023, it invested $500 million into MidOcean Energy, a Washington, D.C., company, which is developing LNG projects in Australia. “They understand oil is not exactly the future of the global economy,” says Reeve of the PIF. “So they are hedging their bets by moving into gas.”

Other elements of a green-energy plan are slowly taking shape. Aramco’s power subsidiary has a 30% stake in a solar plant under construction on the Red Sea coast, which it has said will be the biggest in the world once it opens next year. And last year, Aramco announced it would develop the first test site for green hydrogen—a fuel made by using renewable energy to electrolyze water—in the PIF’s $500 billion futuristic city, Neom.

The strategy has environmental limitations, but in theory, it makes some financial sense: The less oil Saudis need for their own consumption, the more that can be exported on world markets, and sold for far higher prices. “The Saudis have finally started to invest in green energy, after making promise after promise after promise,” says Jim Krane, Gulf energy expert at Rice University in Houston. Until recently, he adds, “the Saudis made a bunch of grandiose goals, and didn’t come close to meeting 10% of them.”

Grandiosity was on vivid display in Cannes, at the recent real estate trade show. Laid out on room-size tables were models of entire new cities being built, including two new areas of Riyadh, whose master plan includes doubling its population by 2030, creating a metropolis of about 15 million people.

The exhibits were a kind of fun-house experiment in envisioning just what fantastical ideas a near-bottomless pit of money might enable. It included a downtown area in Riyadh, called New Murabba, which is being created from scratch. At its center will sit a gargantuan cube measuring a quarter-mile on each side—the biggest single building in the world by volume, “enough to fit 20 Empire State Buildings,” said the assistant offering me a VR headset to view the interior. It is scheduled to open in 2030 as a mix of office, hotel, and residential space. At the core of the building sits a hologram resembling the Sphere in Las Vegas—but about 20 times bigger.

The scale of the projects is hard to fathom. “We’re about to develop 400,000 houses by 2030,” Valentin Toubeau, strategy director for ROSHN, the PIF’s real estate wing, said in Cannes. He listed some of his needs: 4 million doors, and enough steel cable to circumnavigate the globe several times.

In another hall sat a model of PIF’s biggest project of all, Neom—a sci-fi-like outpost on the Red Sea, from which will rise, in theory, a new city of 9 million people. Improbably enough in the world’s biggest petrostate, it will prohibit all fossil-fuel transportation, including cars. It will house its residents in a string of connected skyscrapers along a narrow 110-mile strip called The Line, all built on virgin land. And amid the rugged desert landscape will be a full-service luxury ski resort called Trojena. “The main challenge is logistics,” Jean-Philippe Patesson, a Belgian engineer overseeing the ski area, told a group in Cannes. “There is no water, no roads, no transportation,“ he said. “When you finish a problem, 10 other problems come.”

“[Aramco leaders] understand oil is not exactly the future of the global economy. So they are hedging their bets by moving into gas.“ James Reeve, PIF

In interviews, those overseeing the projects say MBS scrutinizes their plans, demanding regular updates, and has little patience for delays. “He is involved in every detail, he approves every rendering,” says Jerry Inzerillo, chief executive of Diriyah, a $62.2 billion sports, retail, university, and office area being built in old adobe style on a historic royal site on the edge of Riyadh. Inzerillo, who moved to Riyadh from New York in 2018 to develop the project for PIF, said he had come to Cannes after an all-night meeting with MBS, in which the Saudi leader had discussed, sometime around 3 a.m., the placement of a large arch planned for Diriyah’s boulevard, whose dimensions are identical to Paris’s Champs-Elysées Avenue.

The crown prince and Al-Rumayyan face a more immediate problem than architectural details: how to pay for all these pricey projects. For years the kingdom has needed to sell its oil for $80 a barrel to balance its budget—one reason why MBS opted to cut Saudi oil output last year, rather than sell more barrels to help lower inflation.

In fact, oil analysts believe that fully funding Neom, Diriyah, and other splashy cities will require even higher oil prices—“probably a triple-digit price,” says Croft of RBC. Without the gigaprojects, the kingdom’s budget might show a slight surplus at today’s prices, by some estimations. But $100-per-barrel prices seem unlikely anytime soon, given weak global demand and a surge in oil supplies from the U.S. and Guyana. That leaves Saudi Arabia having to borrow on capital markets to fulfill its ambitions: Government debt has soared about 20-fold, to $253.6 billion, since 2014, according to research firm CEIC Data.

That’s a tradeoff that MBS is happy to accept in the short term. For one thing, the flashy buildings, parks, and entertainment venues help attract millions of visitors. The government says its tourism revenues were about $66 billion last year—a one-year rise of more than 50%, according to a February estimate by Riyadh financial firm Jadwa Investment.

Building the spectacular projects is becoming increasingly expensive, however. There is fierce competition for construction workers, many of whom come from India, where there are plenty of building projects underway. Materials like copper, rebar, and glass are also in high demand, driving up expenses. Says Jadwa: “Cost overruns are inevitable.”

The contractors, architects, and engineers in Cannes are keenly aware of the oil markets—and of Aramco’s year-by-year performance. “All we gigaprojects have a plan,” Inzerillo says. “If we’re at $80 [a barrel] and above, we can proceed. If oil prices drop, it becomes a phased project,” he says. “We all have plans to go to multiple phases.”

It is too early to know whether Inzerillo will be given funding for all Diriyah’s needs, or whether 9 million Saudis will ever zip around Neom on electric trains. But as long as Aramco is pumping oil, the financial and political clout that drives Saudi Arabia’s outsize ideas will be replenished far into the future.

This article appears in the April/May issue of Fortune with the headline, “Saudi Arabia’s power pipeline.”

Latest from the Magazine

- 0 minutes ago

The CEO leading ‘Korea’s Google’ in its battle against Big Tech

‘Gen Z doesn’t live to work. They work to live’: The paradox that defines the best companies to work for in 2024

Goodbye, tough guy. More men are rejecting the finance bro stereotype and going on retreats to learn empathy

How UBS, Deutsche Bank, and other giants tap their in-house art experts to appeal to ultrawealthy customers

As OpenAI targets Hollywood with Sora, Runway’s CEO is waiting for the $86 billion Goliath with a ‘sling and a stone’

Most popular.

California’s new $20-an-hour fast food minimum wage is so good that schools are worried they can’t compete for cafeteria workers

MacKenzie Scott’s game-changing philanthropy still mystifies nonprofits: ‘Her gifts are super generous, but unfortunately, they don’t provide long term sustainability’

Sam Bankman-Fried’s mom tried to explain her son to the judge: ‘He has never felt happiness or pleasure in his life and does not think he is capable of feeling it’

Nearly a quarter of baby boomer and late Gen X men are ‘unretiring’ or planning to because they can’t afford to kick up their feet in the current climate

The new retirement is no retirement: Baby boomers are keeping jobs well into their sixties and seventies because they ’like going to work’

‘A four-day workweek is coming,’ billionaire Mets owner Steve Cohen declares—and you can thank the rapid rise of AI

Global Finance Magazine

Global news and insight for corporate financial professionals

Home Economics, Policy & Regulation Saudi Arabia Hits Milestone In Shift Away From Oil Economy

Economics, Policy & Regulation

Saudi Arabia Hits Milestone In Shift Away From Oil Economy

April 2, 2024

Author: Luke Aplin

With Saudi Arabia’s non-oil sector reaching 50% of GDP for the first time last year, the Gulf nation marked a watershed in its diversification from fossil fuel dependency.

Government data released last month shows the real GDP growth rate for non-oil activities at about 4.4%, valuing the sector at about 1.7 trillion Saudi riyals (around $453 billion). This puts the kingdom on course to meet the objectives set out in Vision 2030, its broad program of policies and reforms, which holds economic diversification as one of its core objectives.

“The oil and gas sector is highly capital intensive and does not create the flow of job opportunities required to meet the supply of labor from a young and increasingly educated population,” says Nasser Saidi, an economist and Lebanon’s former minister of economy and trade, noting that around 30% of Saudi Arabia’s population is below age 30.

To meet the challenge, the government has introduced incentives aimed at growing both services and manufacturing. As a result, much of the non-oil sector’s growth last year was driven by private consumption in areas like entertainment, hospitality and tourism. Together, they accounted for 40% of economic activity last year.

The tourism sector, which has attracted $13 billion in private investments recently, has been a particularly strong point, Saidi notes, luring 27 million foreign visitors last year in addition to 77 million domestic travelers.

These achievements did not stop the kingdom from suffering a 4.3% year-on-year decline in real GDP in 2023, however. The principal culprit was a drop in oil sector activity caused by voluntary production cuts put in place by the OPEC countries amid market concerns and rising output outside the group. Moreover, the majority of Saudi wealth is still to be found below ground, even when oil production is not considered. Mining and quarrying accounted for one-third of total non-oil output last year. Outside of these sectors, manufacturing accounted for more than 15% of real GDP, while real estate and construction contributed 14%.

Related Content

IMAGES

VIDEO

COMMENTS

The Kingdom rose up from 29th in 2021 on the latest UN World Tourism Organization's ranking. According to the World Tourism Barometer, the Kingdom welcomed 16.6 million tourists in 2022 compared ...

27 May 2022. Saudi Arabia moved up 10 places to 33rd in the world overall, in the 2021 World Economic Forum (WEF) Travel and Tourism Development Index, which was released yesterday at Davos. The ...

Saudi Arabia has topped the United Nations Tourism ranking for 2023, achieving an impressive 56% increase in international tourist arrivals compared to 2019. The World Tourism Barometer report also highlighted the Kingdom's outstanding 156% tourism recovery rate in 2023, which positions it as a leader in Middle East and Global Tourism.

Saudi Arabia's tourism sector, leading the G20 in growth and ranking as the second fastest-growing tourist destination globally in the first three quarters of 2023, stands out significantly.

Riyadh, May 17, 2023, SPA -- The Kingdom of Saudi Arabia ranked 13th globally, advancing by 12 places on the World Tourism Organization (WTO) index, as one of the top countries receiving international tourists in 2022, compared to the 25th place in 2019. The number of international tourists who visited the Kingdom, for all travel purposes, hit 16.6 million in 2022, WTO reported.

Riyadh, Travel & Markets, May 2022 - Saudi Arabia moved up 10 places to 33rd in the world overall, in the 2021 World Economic Forum (WEF) Travel and Tourism Development Index, which was released yesterday at Davos. The independent index benchmarks 117 countries on 17 pillars crucial to the development and resilience of their travel and tourism industries. Saudi Arabia

Saudi Arabia was ranked second, globally, in terms of tourist arrivals during the first seven months of 2023, data from the United Nations World Tourism Organization (UNWTO) showed. According to ...

Saudi Arabia progresses 10 ranking places in the World Economic Forum's Travel and Tourism Development Index from 43rd in 2019 to 33rd in 2021 - the second highest climber globally. Riyadh:- Saudi Arabia moved up 10 places to 33rd in the world overall, in the 2021 World Economic Forum (WEF) Travel and Tourism Development Index, which was ...

Photo: RCU Commission. Saudi Arabia has achieved the second biggest improvement in ranking among 117 countries featured in the World Economic Forum's index on travel and tourism. The forum's Travel and Tourism Development Index 2021 benchmarks and measures factors and policies that enable sustainable and resilient development in the sector.

Saudi Arabia moved from 43rd in 2019 to 33rd in 2021, the second largest rise in rankings, as a result of improvements across almost all indicators. This is the first report to be produced since Saudi Arabia opened for international tourism in September 2019.

The UAE and Saudi Arabia ranked among the top 10 tourism destinations worldwide that have seen the strongest growth in international visitors this year compared with 2019, according to travel analysis company ForwardKeys.. The analysis of international tourist arrivals by destination countries in 2023, including forward bookings for the fourth quarter, reflected the continued recovery of the ...

Riyadh, October 03, 2023, SPA -- The Kingdom of Saudi Arabia has achieved a significant milestone in the tourism sector, ranking second globally in terms of tourist arrivals during the first seven months of 2023. According to the Ministry of Tourism, the Kingdom witnessed a remarkable 58% growth in tourist numbers during the first seven months of this year when compared to the same period in 2019.

Saudi Arabia moved up to 10 places (from 43rd to 33rd) in the world tourism ranking, in the 2021 World Economic Forum (WEF) Travel and Tourism Development Index. The WEF's new Travel & Tourism Development Index measures against a set of factors that enable the sustainable and resilient development of the Travel and Tourism sector, which in turn contribute to national development.

Saudi Arabia had been developing its tourism industry before the Covid-19 outbreak, as part of its efforts to diversify the country's economy and steer away from dependence on oil. In May, the kingdom achieved the second biggest improvement in ranking among 117 countries featured in the World Economic Forum's index on travel and tourism.

Riyadh, October 03, 2023, Saudi Arabia has achieved a remarkable tourism milestone by ranking second globally in tourist arrivals during the first seven months of 2023. The Ministry of Tourism reported a staggering 58% growth in tourist numbers compared to the same period in 2019, based on data from the UNWTO World Tourism Barometer published by the United Nations World Tourism Organization ...

Saudi Arabia's tourism aspirations revolve around its ambitious National Tourism Strategy, which outlines a set of targets to be achieved by 2030. These include attracting 100m overnight tourists annually, with a 45% domestic and 55% international split, boosting the contribution of tourism to 10% of GDP, a figure revised upwards to 15% in ...