- Transportation & Roads

( Note from the marketing department : We could have used any image related to driving and vehicles here. But, honestly, we thought a picture of a dog with its head out the window might be more likely to bring a smile to your face.)

Oversight and Regulation

As you might imagine, ensuring the safety and maintenance of roads and transportation networks can be very complex. Issues such as taxation of vehicles, maintenance of roadways, commercial transportation, and the issuance of driver’s licenses require cooperation and coordination between many state and local entities. In Kansas, these entities currently share the primary responsibility for oversight and regulation:

- Kansas Department of Transportation

- Kansas Department of Revenue

- Kansas Highway Patrol

- Kansas Turnpike Authority

- Kansas Corporation Commission

- Kansas Insurance Commissioner

Each entity owns a unique piece of the puzzle and manages different aspects of licensure, compliance, regulation, planning, and oversight for their areas of specialization.

To make sure that people can get from place to place safely, Kansas requires that vehicles are registered and meet certain standards.

- Titles & Registration

- Automobile Tag Renewals

- Vehicle Liens

- Insurance Requirements

- Safety Inspections

- Disabled Parking Placards

Once you buy a vehicle, you’ll need to be sure that it is legally registered and properly insured. Whether your vehicle is new or used , you’ll need to visit your local county treasurer’s office to obtain tags and titles — this includes obtaining personalized or distinctive license plates. In addition to registering your vehicle, you will need to pay an annual renewal fee for your vehicle tags. Renewal notices are sent by your county treasurer’s office in the weeks preceding your renewal date. You can renew via paper or online through the iKan app .

Another requirement of a road-worthy vehicle is purchasing and maintaining automobile insurance. The Kansas Insurance Department provides drivers with information on the basic coverages required in Kansas, as well as an “Auto Shopper’s Guide” that can help give you the confidence you need to navigate the sometimes intimidating process of obtaining proper coverage.

For those who finance their vehicles, a lien will be placed on the vehicle title . The lien is filed by the Lienholder and acts as form of security until you pay off your loan in full. The Kansas Department of Revenue Division of Vehicles has provided answers to some of the most frequently asked questions related to liens.

Businesses with a need to verify titles, liens, and registrations of vehicles can take advantage of Kansas.gov’s Title, Lien, and Registration service.

For drivers who need to obtain a “Disabled Parking Placard/Plate/Decal,” you will need to:

- Print a copy of a TR159 form

- Have it certified by a health care professional who is licensed through the Kansas Board of Healing Arts

- Take the completed form to your local county treasurer’s motor vehicle office

Whether you drive for a living or live to drive, you need to have a valid license before you hit the road.

If you are an adult and have never been issued a Kansas license, you will need to prove your identity and residence , pass the necessary examinations (written, driving, and vision) and pay the applicable fees . KDOR publishes driver’s handbooks ( English and Spanish ) to help you study. There is also an Alexa skill that you can download to practice taking your test. There are special requirements for teen drivers who want to obtain a license.

Applying for your driver’s license must be done in person at a Driver’s License Exam Station. Several locations participate in the Q-Flow Wait Line Management System . This service allows you to reserve an appointment in advance and skip the line when you arrive. Be sure to review the checklist to make sure that you have brought all the necessary documentation with you when you arrive at your appointment.

Once you have your license, you will need to keep an eye on its expiration date. Your license is no longer valid once the date has passed, even if you have a good driving record. The good news is that many drivers are eligible to renew their licenses online .

The Kansas Department of Revenue may suspend a driver’s license for a variety of reasons, including failure to provide proof of insurance, driving under the influence, or accumulation of unpaid fines. If this happens to you, you will need to contact the Division of Vehicles – Driver Solutions office. Special action is required to apply for restricted driving privileges or to have your license reinstated .

Make an Appointment

Obtain your driver record, download the alexa skill, commercial driver's licenses.

There are certain careers that require a Commercial Driver’s License (CDL). Obtaining your CDL is much more rigorous than applying for a non-commercial driver’s license — think of it as akin to studying for a professional certification. CDL applicants must pass two exams to demonstrate their mastery of the state requirements:

- Written Exam: This knowledge test covers the information contained in the “ Kansas Commercial Driver’s License Manual “

- Skills Test: Applicants must pass this practical test of relevant skills before a CDL can be obtained. These tests are administered at designated CDL Skills Testing stations throughout the state

- Specialized Certification: As of July 1, 2018 all CDL holders and applicants are required to complete “ Truckers Against Traffickers ” training prior to being issued or renewing their CDL license

Commercial drivers and motor carriers are subject to a high level of oversight and regulation at both the state and federal level. Some of the programs with Kansas are:

K-TRIPS is the Kansas Truck Routing and Intelligent Permitting System . A cooperative effort among the Kansas Department of Transportation, Kansas Department of Revenue, Kansas Highway Patrol and the motor carrier industry, K-TRIPS provides internet-based permit application, payment and delivery. K-TRIPS will also include an interactive, map-based tool set to allow permit applicants to test routes with specific load configurations.

KCoVRS is the Kansas Commercial Vehicle Registration System . It is an online system that allows for the registration and renewal of commercial vehicles, as well as the payment of associated fees.

TruckingKS is a web portal which serves to provide consolidated regulatory requirements and information to motor carriers and drivers that travel on roadways in Kansas.

KTRAN is the Kansas Trucking Regulatory Assistance Network. It is a web-based system designed to help motor carriers meet regulatory requirements and successfully manage their businesses.

KTRAN is one-stop shop where users can apply and pay for authorities, waivers, renewals and Unified Carrier Registration (UCR) fees as well as receive important alerts and messages from the Kansas Corporation Commission.

Safety Resources

There are nearly 141,000 miles of roadway in Kansas. Staying safe and alert is the responsibility of every driver. In Kansas, the following safety-related resources are available to those who need them:

- Kansas Highway Patrol Online Accident Reports

- Kansas Highway Patrol Crash Logs

- School Bus Safety Requirements

- KanDrive (statewide road conditions)

- KCScout (KC-metro area road conditions)

- WICHWay (Wichita-metro area road conditions)

All Services

- Business & Industry

- Education & Training

- Jobs & Unemployment

- Kansas Tourism

- Natural Resources & Land

- Safety, Health, and Justice

- Taxes & Finance

- Transportation & Roads

- Voting & Civic Engagement

Connect With Us

534 S. Kansas Ave., Ste 925 Topeka, KS 66603

- Kansas Amber Alerts

- Subscriber Center

- Kansas Business Entity Search

- KHP Crash Logs

- Motor Vehicle Records

- Property Tax Payments

- Help Center

Useful Links

- Employee Service Center

- State Employment Center

- Online Communication Directory

- Ask a Librarian

- Weather Alerts

- Unemployment Claims

News & Updates

- Executive Orders

- Flag Honors

- Legislative News and Events

- Judicial Updates

- Kansas Public Square

- Social Media

Kansas.gov © 2023 Portal Policies All Rights Reserved

- Collections

- Recent Additions

- Public Access

- Submit Content

- home Rosa P

Understanding Oversize/Overweight Industry Freight Flow and Safety in Kansas Using the Kansas Truck Routing and Intelligent Permitting System (K-TRIPS) [Technical Summary]

Search our Collections & Repository

- Advanced Search

- Custom Query

All these words:

For very narrow results

This exact word or phrase:

When looking for a specific result

Any of these words:

Best used for discovery & interchangable words

None of these words:

Recommended to be used in conjunction with other fields

Publication Date Range:

Document Type:

Collection:

Query Builder

For additional assistance using the Custom Query please check out our Help Page

- By Morris, Blake ; Fitzsimmons, Eric J.

- Creators: Morris, Blake ; Fitzsimmons, Eric J. Morris, Blake ; Fitzsimmons, Eric J. Less -

- Corporate Creators: Kansas State University Transportation Center

- Corporate Contributors: Arkansas. Department of Transportation

- Subject/TRT Terms: [+] Oversize Loads Overweight Loads Permits Routes And Routing Truck Crashes Trucks

- Publication/ Report Number: K-TRAN: KSU-18-5

- Resource Type: Brief

- Geographical Coverage: Kansas ; United States Kansas ; United States Less -

- Edition: Technical Summary

- Corporate Publisher: Kansas. Dept. of Transportation. Bureau of Research

- Abstract: The Kansas Department of Transportation (KDOT) developed an automated permitting system called the Kansas Truck Routing and Intelligent Permitting System (K-TRIPS) to issue permits for all OSOW trucks. Using four years of data from K-TRIPS (2014‒2017), the research team developed a series of heat maps using ArcGIS to help visualize the routes OSOW trucks were using to travel through the state of Kansas. It was found that around 87 percent of the approximately 72,000 annual OSOW trips in Kansas were taken by five industries (general construction equipment, general freight, agriculture equipment/implements, wind energy, and oil and gas equipment), and that the majority of fluctuation in the consistency of routes travelled came from two industries (wind energy and oil and gas equipment). More ▼ -->

- Format: PDF

- Collection(s): US Transportation Collection

- Main Document Checksum: [+] urn:sha256:64e29a3af9bbec7b0726bf6a00ccabce3281ce00a9d1331663abdb7c935a804a

- Download URL: https://rosap.ntl.bts.gov/view/dot/68157/dot_68157_DS1.pdf

Supporting Files

You may also like.

Checkout today's featured content at rosap.ntl.bts.gov

Exit Notification/Disclaimer Policy

Thank you for visiting.

You are about to access a non-government link outside of the U.S. Department of Transportation's National Transportation Library.

Please note: While links to Web sites outside of DOT are offered for your convenience, when you exit DOT Web sites, Federal privacy policy and Section 508 of the Rehabilitation Act (accessibility requirements) no longer apply. In addition, DOT does not attest to the accuracy, relevance, timeliness or completeness of information provided by linked sites. Linking to a Web site does not constitute an endorsement by DOT of the sponsors of the site or the products presented on the site. For more information, please view DOT's Web site linking policy.

To get back to the page you were previously viewing, click your Cancel button.

U.S. DEPARTMENT OF TRANSPORTATION

Bureau of Transportation Statistics

1200 NEW JERSEY AVENUE, SE

WASHINGTON, DC 20590

800-853-1351

Subscribe to email updates

Trucking and Transportation Services

START A BUSINESS

Register a Business Determine Business Tax Requirements Hiring Employees Obtain Licenses and Permits Business Starter Kit Starting a Non-Profit Organization

The Trucking and Transportation Services Starter Kit provides information on operating a trucking or transportation company in Kansas. The kit is not intended to serve as legal or tax advice and should not be taken as such. If you have any legal or tax questions, please consult an attorney, accountant, or business counselor for additional guidance. In addition to the information provided below, review the steps necessary for Starting a Business in Kansas .

Register your commercial motor vehicle with the Kansas Department of Revenue.

Obtain a Kansas Commercial Driver’s License here.

The Federal Motor Carrier Safety Administration oversees safety requirements for commercial transportation nationwide. Information about both driver and vehicle safety can be found here .

Use K-TRIPS to plan routes and acquire permits for oversize loads. K‐TRIPS is used by Motor Carriers and Permit Services to create and maintain company accounts and to create permit applications for Oversize/Overweight (OS/OW) travel within the State of Kansas. It provides access to safe and legal routes based on the vehicle and load dimensions and weight for such travel.

Related Documents & Forms

The Kansas Department of Revenue has documents for Commercial Driver’s Licenses and Commercial Motor Vehicle Registration .

The Federal Motor Carrier Safety Administration provides documents and regulations to ensure safety when conducting commercial transportation.

Licenses and Permits

The Kansas Department of Revenue has information covering applying for a Commercial Driver’s License and Commercial Motor Vehicle Registration .

Use K-TRIPS to acquire permits for oversize loads.

- CUSTOMER SERVICE CENTER

Frequently Asked Questions About Motor Fuel

- IFTA/Interstate - $13 for a 24-hour motor fuel permit and $25 for a 72-hour motor fuel permit. Motor fuel permits may be purchased in multiples of three upon making proper application and payment of the required fees. The permits can be obtained at the ports of entry or by calling the Central Permit Office, 785-368-6501.

- LFCL - Licensed liquid fuel carriers can purchase a $5 trip permit for new vehicles or for an extra/substitute vehicle used temporarily or for emergency purposes. A non-licensed carrier may obtain a trip permit for vehicles that enter the state on an occasional trip or are in temporary service.

Distributor, Importer/Exporter, Manufacturer, Retailer and Liquefied Petroleum mileage basis licenses are free; no cost is associated with the application for these licenses. A Liquid Fuel Carrier's license is $10 for each vehicle. Liquefied Petroleum User Dealer licenses are $5. A Liquefied Petroleum Prepaid license is based on the vehicle weight and miles traveled. An IFTA license is $10 for the first truck and $1 for each additional truck.

A computer-generated tax return may be used in place of the standard tax return issued by the Revenue Department if the return includes all required information and is in a form that can be processed by the agency. The department must approve all computer-generated tax returns prior to filing. For further information, please call the Motor Fuel Tax Unit, Division of Taxation at 785-368-8222.

Fax documents are accepted. The FAX number is 785-296-2703.

- Distributors require a $1,000 minimum or three months average tax liability which ever is greater

- Importer or Exporters require a $5,000 minimum or three months average tax liability which ever is greater

- Manufacturers require a $5,000 minimum or three months average tax liability which ever is greater

Motor Fuel Tax

The completed distributor application (MF-42) must be accompanied by the bond in the statutory required amount and a Financial Statement (MF-43). If the ownership is an LLC the Articles of Organization or Articles of Incorporation must also be included. Also required is a list of owners/officers/managing members (parties responsible for the tax liabilities) and their personal information.

Motor fuel statutes apply to these agencies the same as any individual. There are no exemption provisions for any government agencies other than direct purchases made by the federal government and its agencies.

Police vehicles are not exempt from motor fuel tax on gasoline and diesel fuels. They are exempt from taxes on liquefied petroleum.

If a fire truck or ambulance is not licensed or does not require a license, dyed diesel fuel may be purchased with no tax. If a fire truck or ambulance is licensed, clear diesel fuel or gasoline must be purchased with the fuel tax included, however a refund of the tax may be obtained.

Yes, they are a federal agency.

The State of Kansas is not exempt from state motor fuel excise tax. See the Internal Revenue Service website for federal motor fuel excise tax exemptions.

Yes, they are an instrumentality of the federal government.

If the motor fuel excise tax is applicable, no sales tax is required. Fuel that is not subject to motor fuel excise tax becomes subject to sales tax. However, the fuel purchase may qualify for a sales tax exemption; refer to sales tax laws and regulations regarding exemptions.

A return must be filed even if there is no tax liability. If no return is filed, it is considered delinquent.

An operator of a gas well must obtain a manufacturer's license. A manufacturer is defined under K.S.A. 79-3401 as any person who or which produces, refines, prepares, blends, distills, manufactures or compounds motor vehicle fuels or special fuels in the state of Kansas for such person's own use therein, or for sale or delivery therein.

Kerosene is not subject to motor fuel tax unless it is blended with another fuel.

A delivery ticket must contain the same information that is on the bill of lading from the terminal. See K.S.A. 79-3415 and 55-511 for more information.

According to Kansas statute 79-3426, any distributor, importer, exporter or retailer that holds a valid license may receive a roster of all names and addresses of persons holding distributor, importer and exporter or retailer licenses. To request a complete list, contact the Motor Fuel Tax Unit, Division of Taxation at 785-368-8222.

Racing fuel would clearly fit within the definition of “special fuels,” set forth at K.S.A. 79-3401(s) and also appears to fit within the definition of “motor vehicle fuels,” set forth at K.S.A. 79-3401(l). Racing Fuel would be subject to the motor vehicle fuel tax imposed under K.S.A. 2000 Supp. 79-3408 et seq., to be paid by the supplier or the distributor.

In accordance with K.A.R. 92-3-20, the end-user or consumer (not the supplier or distributor) of the racing fuel may claim a refund from the Department of motor vehicle fuel tax on fuel properly documented and substantiated as consumed in non-highway use.

All retailers, and base exchanges and commissaries, must collect Kansas motor vehicle fuel taxes on fuel sales made on Federal areas located within Kansas.

Congress has waived the sovereign immunity of the United States in regard to collection of state motor vehicle fuel taxes on sales made on federal areas. The only exception is fuel sold to the federal government. The law requires the officer in charge of a military base to submit monthly reports showing the amount of taxable motor vehicle fuels sold on base.

Title 4 U.S.C.A., Section 104 states:

(a) All taxes levied by any State, Territory, or the District of Columbia upon, with respect to, or measured by, sales, purchases, storage, or use of gasoline or other motor vehicle fuels may be levied, in the same manner and to the same extent, with respect to such fuels when sold by or through post exchanges, ship stores, ship service stores, commissaries, filling stations, licensed traders, and other similar agencies, located on United States military or other reservations, when such fuels are not for the exclusive use of the United States. Such taxes, so levied, shall be paid to the proper taxing authorities of the State, Territory, or the District of Columbia, within whose borders the reservation affected may be located.

(b) The officer in charge of such reservation shall, on or before the fifteenth day of each month, submit a written statement to the proper taxing authorities of the State, Territory, or the District of Columbia within whose borders the reservation is located, showing the amount of such motor fuel with respect to which taxes are payable under subsection (a) for the preceding month. . . .

Motor Fuel Refund

Under present statutory provisions, the turnpike is considered as a part of the Kansas highway system. There is no refund provision on motor fuel taxes paid when such fuels are burned over the Kansas highways and therefore, no refunds can be obtained on motor fuels burned over the Kansas Turnpike.

School buses used for the transportation of pupils, or students to or from school or to or from school-related functions or activities are eligible for a refund of fuel tax paid.

If the fuel tank for the unit is separate from the fuel tank that powers the motor vehicle, dyed diesel fuel may be used. A refund may be obtained on the tax paid if clear diesel fuel is used.

If the rig does not require a license under the vehicle statutes, dyed diesel fuel may be used. If the rig requires a license, a refund of the tax may be obtained only with adequate records to substantiate the claim.

A refund may be obtained if fuel is purchased from a registered distributor or retailer in the last 12 months and the claim is for $25 or more.

The definition of public highways includes temporarily closed roads for the purpose of construction, reconstruction or repair; therefore, the motor fuel burned in motor vehicles subject to motor fuel tax during this time is not eligible for a refund of motor fuel taxes paid.

K.S.A. 79-3453 allows a refund to any person who uses any motor vehicle fuels on which the tax has been paid for any purpose other than operating a motor vehicle on the public highways.

K.S.A. 79-3453 provides that a claim for refund may be made for taxes paid on any motor fuel used for any purpose other than operation or propulsion of motor vehicles on the public highways. It is presumed that all fuel in a vehicle registered for use on the highways of the State of Kansas is used for operating or propelling such vehicle on the highways. The Department of Revenue will not trace which fuel was or is used. Therefore, the claimant must clearly and positively show that the fuel in question is used for only non-highway purposes.

Power Take-Off Information

A power take-off (PTO) generally is a splined shaft on a gearbox, separate from the propulsion or drive shaft that can be used to power attached auxiliary equipment or a separate machine. A power take-off provides a second power output from the engine that is not used to propel the motor vehicle. Auxiliary equipment operated by a motor vehicle's power take-off can be found on boom trucks, bulk-feed trucks, cement mixers, asphalt-distribution trucks, dump trucks, fire trucks, lime spreaders, aerial-lift trucks, milk-tank trucks, mobile cranes, refrigeration trucks, sanitation trucks, spray trucks, and wreckers, among others. Power take-offs are commonly found on farm tractors and on many lawn tractors.

In most cases, it will require a study. A claim cannot be submitted until a study has been received and approved by KDOR.

Currently, the following do not require a study: Garbage Trucks can get a flat rate of 35% Concrete/Mixer Trucks can get a flat rate of 25%

Engine-driven equipment that is used as an integral part of a vehicle's operation, including alternators, generators, air-conditioner compressors, hydraulic pumps for power steering and brakes, fuel-injection pumps, superchargers, and other similar equipment, is not considered to be auxiliary equipment for purposes of calculating power take-off fuel usage.

This is the fuel withdrawn from the propulsion tank of the motor vehicle that is used to operate auxiliary equipment via the power take-off. It is often stated as a percentage of the total amount of fuel that is withdrawn from the propulsion tank.

No. While some states impose motor fuel tax on fuel used to propel motor vehicles on state highways, Kansas imposes the tax on fuel used in motor vehicle operations on state highways. Fuel used to run a compressor that operates as part of an air conditioning or climate control system is fuel used in the motor vehicle's operations on Kansas highways within the meaning of the motor fuel imposition and refund statutes.

The Kansas motor fuel use tax is imposed on "motor fuel used in operations on highways within this state by such interstate motor fuel user." See K.S.A. 79-34,109(a). ;Safe highway operation requires alternators, generators, air-conditioner compressors, hydraulic pumps for power steering and brakes, fuel-injection pumps, and other similar equipment to be operated to defog windows, provide for driver and passenger comfort, allow for reasonable steering effort, provide for lights and braking, clear windshields, provide needed engine power, and so forth. The fuel use attributable to powering this equipment is "motor fuel used in operations on highways within this state" even though the fuel is not used to propel a vehicle down the road. None of the tax paid on fuel consumed to run this equipment is subject to refund as having been purchased for a purpose "other than operating motor vehicles on public highways." See K.S.A. 79-3453; Q & A on Motor Fuel User Idle Time Refunds.

Taxpayers may apply for a refund through the motor fuel refund section if records are included to support the amount of fuel being claimed for a refund.

A legitimate record is determined through a system that measures actual PTO usage including, but not limited to, a test period of operations to calculate the amount of fuel used by the PTO. Flat percentages may be allowed and reported when the adopted system is based on percentages arrived at during the test period. Once a system has been accepted, the carrier may claim credits for PTO usage from that time forward. Credits will not apply to previous periods.

Idle Time Information

No to both questions. Motor carriers pay fuel tax at the pump (or on the purchase of fuel in bulk), but they also pay fuel use tax to each state based on how much fuel they consume in their travels in the state. This is done through quarterly IFTA tax reports that detail the distance a carrier traveled in a state, the amount of fuel it purchased in the state tax-paid, and the overall miles-per-gallon of its fleet. From this the carrier calculates the fuel it used in the state and takes credit for any state fuel tax it paid on fuel purchases during the quarter. It then pays the state any additional tax owed or receives a credit if tax was overpaid. The fuel use tax is largely a mechanism for redistributing fuel tax to compensate for carriers' differential fueling among states, caused by patterns in freight movement, and for differences in state tax rates.

The amount of tax paid to Kansas on idle time fuel consumed in Kansas while stopped cannot be determined by using the mileage formula in K.S.A. 79-34,109(a) and the details on an IFTA quarterly report alone. This formula does not contemplate making any adjustments to the tax being reported because of idle time fuel consumption.

K.S.A. 79-34,109(a) codifies a mileage formula that determines the taxable "[n]umber of gallons used in the [interstate motor carrier's] operations … on highways within this state." Since the formula is a legal construct that establishes the taxable number of gallons used in a carrier's Kansas highway operations, none of the fuel use tax accounted for by a carrier can qualify for refund as having been paid for some purpose "other than operating motor vehicles on the public highways" under K.S.A. 79-3453.

Discussion: In 1994, Congress enacted legislation mandating that, after Sept. 30, 1996, states may enforce their motor fuel use reporting requirements only if those requirements conform to the International Fuel Tax Agreement [IFTA]. 49 USC Sec. 31705 (2000). The goal of IFTA is the uniform administration of motor fuel tax reporting by motor carriers that operate in the United States and Canada. See IFTA Article I(B). While IFTA's goal is uniform reporting, each member jurisdiction determines the rates, coverage, and exemptions for the tax on motor fuel use by interstate and international motor carriers. See IFTA Article IIIA. Kansas entered into the agreement in 1992. IFTA's uniform reporting requirements govern the reporting of Kansas motor fuel use by interstate motor carriers that operate in Kansas. See K.S.A. 79-34,165. This fuel use is taxed at K.S.A. 79-34,109(a): There is hereby imposed on each interstate motor fuel user a tax on motor fuel used in operations on highways within this state by such interstate motor fuel user. . . . The number of gallons of motor fuel used in the operations of any interstate motor fuel user on highways within this state shall be deemed to be such proportion of the total number of gallons of such motor fuel used in its entire operations within and without this state, as the number of miles traveled on highways within this state bears to the total number of miles traveled within and without this state. (Underlining provided.)

This statute codifies a formula that determines the taxable "number of gallons of motor fuel used in the operations of any interstate motor fuel user on highways within this state." Fuel consumed while a vehicle is stopped and idling does not affect the amount of fuel reported under the formula. This is because mileage determines the taxable gallons of fuel use. Mileage does not change when a vehicle is stopped and idling, wherever the idling occurs. Consequently, the taxable fuel use being reported does not change because of fuel consumed while idling.

Under the formula, any allowance for an interstate motor carrier's off highway use in Kansas must be based on the number of miles that the carrier travels off-highway in Kansas. When a carrier determines the ratio of Kansas highway miles to the total miles traveled within and without the state, the off-highway Kansas miles can be included as part of the ratio's denominator to reduce the number of taxable Kansas gallons being reported.

The mileage formula is a legal construct that provides interstate motor carriers with a uniform method for reporting their taxable fuel use. The construct establishes "[t]he number of gallons of motor fuel used in the operations of any interstate motor fuel user on highways within this state." Accordingly, any change to the taxable result must come from changes to the number of Kansas highway miles, the number of total miles, or the number of gallons that are entered in the formula. The formula's result is not changed by the fact that an interstate motor carrier may have consumed fuel while stopped and idling off-highway in Kansas. These gallons are already included in the formula as part of the "total number of gallons of … motor fuel used in [the interstate motor carrier's] entire operations within and without this state."

K.S.A. 79-3453 through K.S.A. 79-3464 deal with motor fuel refunds. K.S.A. 79-3453 extends the refund entitlement: Any person who uses any motor-vehicle fuels or special fuels on which the motor-fuel or special fuel tax has been paid . . . for any purpose other than operating motor vehicles on the public highways, such person shall be entitled to be refunded the tax paid upon complying with the requirements of this act . . . . (Underlining added). K.S.A. 79-3453.

K.S.A. 79-3454 requires that before a refund claim is made, each person who wants to be eligible for a refund must apply for a refund permit. The applicant is required to list "the uses to which the applicant intends to put such motor-vehicle fuel or special fuel upon which a refund will be claimed." If the fuel use is for farming, manufacturing, or industrial processing, the applicant must support the claim with additional information, such as the number of acres under cultivation, or the nature and kind of the manufacturing or industrial processing. Any incidental highway use of farm equipment and other motor vehicles that are "primarily designed or operated for non-highway use" is not taxed. K.S.A. 79-3463.

K.S.A. 79-3454 shows that taxes paid on fuel used in farming, manufacturing, and industrial processing qualify as having been paid for purposes "other than operating motor vehicles on the public highway." This is not the case with fuel that interstate motor carriers use for their carrier operations. K.S.A. 79-34,109(a) establishes the "[n]umber of gallons used in the [interstate motor carrier's] operations … on highways within this state." Thus, all of the fuel use tax that a carrier reports and pays under K.S.A. 79-34,109(a) is for the carrier's "operations … on highways within this state." None of this fuel use tax is subject to refund as having been paid for some purpose "other than operating motor vehicles on the public highways" under K.S.A. 79-3453.

Idling while stopped occurs both on highway as well as off highway. Idling on a highway occurs at stop lights, at interstate rest stops, at toll booths, while vehicles are stopped in traffic, along the side of the road, and at other similar locations. Idling off highway can occur at a warehouse, motel, restaurant, or similar location. The IFTA reporting formula is based on average miles per gallon, not on how much fuel use tax was remitted to the State of Kansas on fuel consumed during the time spent idling on-highway or off-highway.

Motor Fuel Retailer

A retailer license is not required for a bulk dealer that sells only to retail stations. If a bulk dealer sells to the end user, such as farmers and construction companies, then a retailer license is required.

If the person is only managing the station, a retailer license is not required. If the person owns the station and is only using the name, such as Amoco or Texaco, a retailer license is required in the owner's name.

A retailer license is required since you are selling to the end user.

The following office inspects pumps and investigates consumer complaints. Please contact: Department of Agriculture Division of Weights & Measures 1320 Research Park Drive Manhattan, KS 66502 785-564-6681

The following office registers and inspects the above and below ground storage tanks. Please contact: Department of Health & Environment Remediation Bureau 1000 Jackson St, Ste. 410 Topeka, KS 66612-1367 785-296-1678

International Fuel Tax Agreement (IFTA)

The purpose of this Agreement is to promote and encourage the fullest and most efficient possible use of the highway system by making uniform the administration of motor fuels use taxation laws with respect to motor vehicles operated in multiple member jurisdictions.

Enable participating jurisdictions to act cooperatively and provide mutual assistance in the administration and collection of motor fuels use taxes.

Establish and maintain the concept of one fuel use license and administering base jurisdiction for each licensee and to provide that a licensee's base jurisdiction will be the administrator of this Agreement and execute all its provisions with respect to such licensee.

States collect taxes on the motor fuel used within their borders to build and maintain the roads and highways that link their communities to each other and the rest of the nation. As an interstate motor carrier traveling in Kansas, you pay your share of these taxes according to the provisions of the International Fuel Tax Agreement (IFTA). This agreement, recognized by 58 states and provinces, simplifies the way you report and pay fuel taxes, reduces paperwork and minimizes compliance requirements.

Specifically, Kansas participation in IFTA means that:

- A single fuel tax license authorizes you to travel in all IFTA member jurisdictions;

- A single tax return fulfills your reporting requirements for all member jurisdictions;

- A single state usually performs your fuel tax audit.

The following jurisdictions are current IFTA members:

Any person based in a member jurisdiction operating a qualified motor vehicle(s) in two or more member jurisdictions.

Qualified Motor Vehicle means a motor vehicle used, designed, or maintained for transportation of persons or property and:

- Having two axles and a gross vehicle weight or registered gross vehicle weight exceeding 26,000 pounds or 11,797 kilograms; or

- Having three or more axles regardless of weight; or,

- Is used in combination, when the weight of such combination exceeds 26,000 pounds or 11,797 kilograms gross vehicle or registered gross vehicle weight. Qualified Motor Vehicle does not include recreational vehicles.

(Recreational vehicles such as motor homes, pickup trucks with attached campers, and buses when used exclusively for personal pleasure by an individual. In order to qualify as a recreational vehicle, the vehicle shall not be used in connection with any business endeavor.)

The member jurisdiction where the qualified motor vehicles are based for vehicle registration purposes and

- Where the operational control and operational records of the licensee’s qualified motor vehicles are maintained or can be made available; and

- Where some travel is accrued by qualified motor vehicles within the fleet.

The commissioners of two or more affected jurisdictions may allow a person to consolidate several fleets that would otherwise be based in two or more jurisdictions.

If you have fleets in more than one jurisdiction and want more information on consolidating your fleets under one base jurisdiction call the Kansas Department of Revenue IFTA section.

“Base Jurisdiction,” establishes the jurisdiction to which a carrier will make fuel tax payments. Your base jurisdiction will then distribute the appropriate amount of tax owed to each IFTA member jurisdiction for you.

Kansas will be your base jurisdiction if:

- You have IFTA qualified vehicle(s) registered in Kansas;

- Your vehicle(s) use is controlled from a physical location in Kansas;

- Your vehicle(s) records are maintained or can be made available at a physical location in Kansas; and

- At least one of your vehicles travels some miles within Kansas.

A license will not be issued if the applicant has been previously licensed under this Agreement and that license is still under revocation by any member jurisdiction or the application contains any misrepresentation, misstatement, or omission of information required in the application. All accounts using an FEIN, require a verification letter (SS-4 or 147C). Also, your USDOT must to be authorized and UCR fees must be paid for the current year.

In lieu of obtaining an IFTA license, you may satisfy motor fuels use tax obligations on a trip-by-trip basis in each jurisdiction you are traveling in. You can purchase a Kansas Trip Permit at K-Trips.com or through the Central Permit Office 785-368-6501.

Yes, you will be mailed a renewal application prior to the expiration of your current credentials. You can also renew online at www.ksrevenue.gov.

Order additional decals online at www.ksrevenue.gov. If you have a vehicle planning to leave the state within 10 days, you may issue yourself a 30 day temporary decal permit. A temporary decal permit will only be issued to a licensee in good standing. It will be vehicle specific, and you are only allowed one per vehicle. You will need to make sure you have a copy of your IFTA license in the vehicle along with this temporary decal permit.

The licensee shall file a calendar quarterly return with the base jurisdiction and shall pay all taxes due and included with the return. Tax returns are required even if no operations were conducted or no taxable fuel was used during the reporting period.

Tax Return, and full payment of taxes, shall be due on the last day of the month following the close of the reporting period for which the return is due. If the last day of the month falls on a Saturday, Sunday, or legal holiday, the next business day shall be considered the final filing date.

IFTA Return Due Dates

1st Quarter Jan . through March: April 30th

2nd Quarter April through June: July 31st

3rd Quarter July through Sept .: Oct . 31st

4th Quarter Oct . through Dec. : Jan . 31st

Penalty and interest will be assessed when failing to file a return, filing a late return, or underpaying taxes due.

You may request a refund of your credit balances of $10 or more by checking the box on the front of your IFTA return form 85. If the box is not marked, the credit balance will be applied to your next return. Credit balances cannot be carried for more than eight quarters (two years) from the date established.

Failure to file your quarterly fuel tax report will result in the Revocation of your carrier’s IFTA license. To reinstate the license, a bond must be posted in addition to paying delinquent taxes, penalties, and interest.

Your IFTA license may be revoked for any of the following reasons:

- Failure to file a quarterly IFTA report;

- Failure to pay tax due to all member jurisdictions;

- Failure to adhere to record-keeping requirements, and;

- Failure to pay or appeal an audit assessment within the established time period;

- Failure to post a bond when required; and

- Failure to remit payment to cover insufficient funds.

To reinstate your IFTA license after being revoked you must:

- Pay all taxes in full;

- File all required reports;

- Submit any records requested;

- File a new application;

- Pay registration fee ($10 for the 1st set of decals and $1 for each additional set); and

- Post a bond to cover 3 quarters tax liability but not less than $1,000.

Yes, you may cancel your IFTA license at any time, provided all reporting requirements and tax liabilities to all member jurisdictions have been satisfied. To surrender your license you need to sign and date the bottom of the license and mark the quarter you want the license surrendered. You must remove the IFTA decals from vehicles, and return the license, all unused decals, and any part of the decals that have been removed from the vehicles to the Kansas Department of Revenue IFTA office. A final audit may be conducted by any member jurisdiction upon cancellation. The records must be retained for four years after the due date of the final quarterly tax report.

If your license was misplaced or destroyed, you will need to submit a statement of what has happened to the license and decals. Include your name and phone number so the IFTA office may contact you if there is any additional information needed.

You will be subject to all appropriate penalties if you are found traveling on a surrendered/revoked license and or decals.

Yes, every licensee shall maintain detailed records to substantiate information reported on the quarterly tax returns. You must maintain your records for a period of 4 years. For details of record keeping refer to the IFTA Article of Agreement Manual at http://www.ksrevenue.gov/forms-mfifta.html .

Yes, the required elements include:

- START and END date of trip;

- Trip origin and destination;

When a trip includes more than one stop, (multiple destinations) the added stops should also be recorded;

- Route of travel;

- Beginning and ending odometer readings;

Total trip miles - IFTA and IRP require reporting all miles the unit travels;

- Total miles must include loaded and deadhead miles, and any local miles when the unit is taken for servicing.

- Miles in each jurisdiction;

- Unit number or vin;

- Fleet number;

- Registrant’s name.

In addition, IFTA specifies the records MUST include distance data on each vehicle for each trip and be included in monthly fleet summaries.

Regardless of the mileage documentation form used, it must include all of the elements listed above.

An acceptable receipt or invoice must include, but shall not be limited to the following:

- Date of purchase;

- Seller’s name and address;

- Number of gallons or liters purchased;

- Price per gallon or liter or total amount of sale;

- Unit numbers.

Purchaser’s name (in case of a lessee/lessor agreement, receipts will be accepted in either name, provided a legal connection can be made to the reporting party.)

See the following information from the IFTA Procedures Manual.

P610 OPTIONAL USE FOR FUEL TAX REPORTING On-board recording devices, vehicle tracking systems, or other electronic data recording systems may be used (at the option of the carrier) in lieu of or in addition to handwritten trip reports for tax reporting. Other equipment monitoring devices that transmit data or may be interrogated as to vehicle location or travel may be used to supplement or verify handwritten or electronically-generated trip reports.

Any device or electronic system used in conjunction with a device shall meet the requirements stated in this Section.

On-board recording or vehicle tracking devices may be used in conjunction with manual systems or in conjunction with computer systems.

P620 DEVICES USED WITH MANUAL SYSTEMS All recording devices must meet the requirements stated in IFTA Procedures Manual Section P640 and P660.

When the device is to be used alone, printed reports must be produced which replace handwritten trip reports. The printed trip reports shall be retained for audit. Vehicle and fleet summaries which show miles and kilometers by jurisdiction must then be prepared manually.

For further detailed requirements please reference the IFTA Procedures Manual located on the IFTA website www.iftach.org

Yes, to obtain credit for withdrawals from licensee-owned tax paid bulk storage, the following records must be maintained.

- Date of withdrawal;

- Number of gallons or liters;

- Unit number;

- Purchase and inventory records to substantiate that tax were paid on all bulk purchases.

Yes, all IFTA carriers based in Kansas are subject to audit. Kansas is required to audit 3 percent of their base jurisdictions licensee’s every year.

Licensees selected for an audit will be contacted in writing 30 days prior to the audit date. The auditor(s) will notify the licensee of the time period to be audited and the records to be reviewed.

After the audit, the licensee will be advised of the audit findings, including adjustments to fuel tax liabilities for affected jurisdictions, and suggestions for record-keeping improvements. The other member jurisdictions affected will be notified of the results. The licensee may be subject to a supplemental audit if any member jurisdiction disagrees with the audit results.

Yes, if you do not agree with your audit findings you may request an informal conference from the Secretary of Revenue. To request an informal conference, please send a written request, stating the reasons for your objections along with a copy of the audit notice. In order to preserve your appeal rights you must request a conference within 60 days of the date of the letter. Send your request to: Office of Administrative Appeals, PO Box 3506, 109 SW 9th St., Topeka, KS 66601-3506.

Once we review your request, we will contact you to schedule the informal conference. If possible, the conference will be held over the telephone to save you time and travel expense.

Liquid Fuel Carrier License

K.S.A. 55-507 states that no person shall transport any liquid fuels without having first a valid liquid fuel carrier's license. Pure alcohol meets the definition of a liquid fuel.

You will need a Liquid Fuel Carrier License if you wish to:

- Transport motor fuel, including aviation fuel, within the state of Kansas in quantities of 3,500 gallons or more;

- Transport across the state line in quantities of 120 gallons or more; or

- Pick up fuel from the refinery, pipeline, or place of manufacture, regardless of quantity.

Licensed liquid fuel carriers can purchase a $5 trip permit for new vehicles, substitute vehicles used temporarily, or emergency purposes. A non-licensed carrier may obtain a trip permit for vehicles entering the state on an occasional trip or vehicles in temporary service. Trip permits can be obtained by calling the Kansas Department of Revenue at 785-368-6501.

Liquefied Petroleum (LP)

You will find the "liquefied petroleum motor fuel tax law" under K.S.A. 79-3490 through K.S.A. 79-34,107, K.S.A. 79-34,141 and K.S.A. 79-34,142.

If you are an LP-gas dealer that is placing LP-gas in the fuel supply tank of a motor vehicle and/or your LP-gas delivery truck(s) run on LP-gas pulled from the cargo tank, you are required to have an LP-gas User-Dealer license as found in K.S.A. 79-3495.

If you own a vehicle licensed to be operated upon Kansas public highways and roads that burns LP-gas you may also apply for an LP-gas User-Dealer license, however you may opt to use the alternative method of calculating and paying the motor fuel tax. This option does not require a license but does require the vehicle to have a Special LP-gas permit user’s decal as found in K.S.A. 79-3492b.

Mileage Basis decals, are issued to licensed LP-gas users or dealers who consume LP-gas withdrawn from the cargo tank to power the truck they are delivering LP from while upon the public highways of the state or an individual that opts to pay the fuel tax monthly on the mileage traveled.

Special LP-gas permits also known as Pre-Paid Permits, are for those who own a vehicle powered by LP-gas and prepay the LP-gas tax annually, based on the miles operated and the weight class of the vehicle as found in K.S.A. 79-3492b. They only report miles actually traveled in Kansas. If a vehicle does not have an odometer, it can not be registered under the Special LP-gas permit.

Yes, renewals are mailed in November each year. The customer must provide all vehicle information; decals are issued and need to be placed on the vehicle no later than Feb 28.

The LP-gas User-Dealer license requires an application fee of $5.00 and a bond in the amount of 3 months tax liability but not less than $1,000.00.

Special LP-gas permits do not require a license fee or bond.

LP-gas User-Dealer (Mileage Basis) must file a Liquefied Petroleum Motor Fuel Tax Return (MF-202) monthly, which is due on the 25th of the following month that the fuel was used or sold.

Special LP-gas permits (Pre-paid) are filed annually when the decal is applied for or renewed (MF-10).

The CNG and LNG tax rates were changed during the 2014 Legislative Session. Previously all LP-gas was taxed at the rate of $0.23 per gallon. As of July 1, 2014 the CNG tax rate is $0.24 per gasoline gallon equivalent (GGE) and the LNG tax rate is $0.26 per diesel gallon equivalent (DGE). The Propane (LPG) tax rate is unchanged at $0.23 per gallon.

Yes, during the 2014 Legislative Session House Bill 2057 was passed changing the conversion formula of Compressed Natural Gas (CNG) from 120 cubic feet to 126.67 cubic feet or 5.66 pounds of compressed natural gas to equal one gasoline gallon equivalent. It also added a conversion formula for Liquefied Natural Gas (LNG) of 6.06 pounds to equal one diesel gallon.

If you have a Special Pre-paid decal that is renewed annually and you have paid tax at the time of purchase at an unmanned station, you will need to maintain records of those purchases. At the time of renewal you will take credit for tax paid at time of purchase and include copies of receipts showing Kansas motor fuel tax charged.

Mileage basis customers will need to take a credit for tax paid for those purchases at an unmanned station, on the monthly LP-gas return (MF-202). To claim the credit, copies of receipts showing Kansas motor fuel tax charged, need to be included with the return at time of filing.

Yes, you would be required to have an LP-gas User-Dealers license and collect the LP-gas motor fuel tax for fuel placed in the fuel supply tank of a motor vehicle that does not have either a Mileage Basis or Special LP-gas permit decal affixed to the windshield.

No, LP-gas is not a motor fuel taxable product until it is put into a supply tank of a motor vehicle.

No, equipment such as forklifts and tractors are not considered a motor vehicle. They do not operate on the highways and are not required to be tagged or registered as a motor vehicle so they are not subject to the liquefied petroleum motor fuel tax.

No, a Kansas Department of Revenue Motor Fuel LP-gas User-Dealer license is not required.

Petroleum Products Inspection and Environmental Assurance Fee

No. The State of Kansas does not exempt sales made to government agencies, including the U.S. Government from the Petroleum Products Inspection and Environmental Assurance Fees. See K.S.A. 55-426 and K.S.A. 65-34, 117 for statutory language.

The Oil Inspection Fee is a fee collected by the Kansas Department of Revenue from the supplier at the terminal or from the first importer of the fuel. You can locate prior rates on the web under Motor Fuel Tax Rates, Historical Petroleum Products Inspection Fee Rates from 1935 to Present. The fee is used for the inspection program overseen by the Department of Agriculture, Division of Weights and Measures.

The Environmental Assurance Fee is a fee collected by the Kansas Department of Revenue from the supplier at the terminal or from the first importer of the fuel. The fee is one cent per gallon. Environmental Assurance Fee effective dates can be found on the web under Fuel Tax Rates, Environmental Assurance Fee, Historical Environmental Assurance Fees. This fee is used for clean-up activities of underground and aboveground storage tank leakage and other fuel spills. The Department of Health and Environment oversees this fund.

The fees shall be paid by the manufacturer, importer, exporter or distributor first selling, offering for sale, using or delivering gasoline, diesel, or petroleum products including government sales. See K.S.A. 55-426 and K.S.A. 65-34, 117 for statutory language.

There is no exemption from Petroleum Products Inspection fee for export. The fee is owed on all gasoline and diesel sold in Kansas even if the destination is out of state. There is an exemption from Environmental Assurance Fee when directly exported from the terminal. If the fuel comes to rest in Kansas, there is no exemption for export.

No, the Petroleum Products Inspection & Environmental Assurance Fees are due from the first person offering for sell in the state or upon importation.

Yes, there is no exemption from the fees for dyed fuel.

Biodiesel is subject to the Environmental Assurance Fee. K.S.A. 65-34,102. Definitions. As used in the Kansas storage tank act: (l) "Petroleum" means petroleum, including crude oil or any fraction thereof, which is liquid at standard conditions of temperature and pressure, 60 degrees Fahrenheit and 14.7 pound per square inch absolute, including, but not limited to, gasoline, gasohol, diesel fuel, fuel oils, kerosene and biofuels.

B100 and B99 is not subject to Petroleum Products Inspection fee, however once it is blended further with diesel the total blended gallons are subject to the Petroleum Products Inspection fee.

- ABOUT K-TAG

PAY LOWEST TOLL WITH K-TAG

K-TAG is the Kansas Turnpike’s electronic toll collection program. Using a K-TAG gives you the lowest toll rate. How does K-TAG work?

- Sticker tags are FREE and there are no monthly administrative fees.

- You receive up to 35%* off the cash toll rate.

- With a valid payment method on file (credit, debit or bank account), you will be billed once a month for the tolls you accrue.**

- Your license plate information will serve as a backup in the rare event your valid K-TAG does not read. This will help prevent receiving a violation.

* 35% discount applies to vehicles with 2-4 axles. Vehicles with 5+ axles receives an 25% discount. **Your payment method will be charged when accrued tolls reach $10 or bi-annually based on account opening date. If you need a prepaid account, please contact customer service at 1-800-873-5824 or consider a BancPass.

WHAT ARE THE BENEFITS OF K-TAG?

There’s lots of great reasons to get a K-TAG!

- No stopping at a tollbooth, waiting in line, or digging for change.

- Pay the cheapest fare—even lower than the cash rate.

- K-TAG works on toll roads in Oklahoma, Texas and Florida.

HOW TO INSTALL YOUR K-TAG

An official State of Kansas government website. Here's how you know.

The .gov means it's official. A .gov website belongs to an official government organization in the United States.

The site is secure. The https:// or lock icon ensures you're safely connected to the website and any information you provide is encrypted.

Scott Schwab Kansas Secretary of State

Kansas administrative regulations.

- View proposed regulations currently open for comment.

- Subscribe to receive notifications of proposed permanent regulation changes.

- View adopted regulations with a future effective date.

- Learn more about finding regulations using the 2022 K.A.R. Volumes and the Kansas Register.

This website contains all of the currently effective permanent and temporary Kansas Administrative Regulations of Agencies 1 through 133 approved for publication pursuant to K.S.A. 77-415 et seq. For proposed or future effective regulations, use the links available in the menu.

Search for currently effective permanent and temporary Kansas Administrative Regulations below.

- You are here:

- Agencies/Main

View by Agency Number | Agency Name

Authentication: This certifies that the Secretary of State and Attorney General have examined each Kansas Administrative Regulation, and that this electronic publication contains all rules and regulations for state agencies and that it otherwise complies with K.S.A. 77-415 , et seq.

While every effort has been made to ensure the accuracy and reliability of the digitized version of the K.A.R., the Office of the Kansas Secretary of State makes no warranties, either express or implied, regarding the content therein or thereof.

- Kansas State University

Status of ITS resources

- K-State home

- » K-State News

- » Friends of Kansas State University Gardens bus trip May 17 to tour Johnson County Master Gardens

K-State News

- K-State Today

- Seek research magazine

- Graduation/honors lists

K-State News Kansas State University 128 Dole Hall 1525 Mid-Campus Dr North Manhattan, KS 66506

785-532-2535 [email protected]

Friends of the Kansas State University Gardens bus trip May 17 to tour Johnson County Master Gardens

Monday, April 15, 2024

MANHATTAN — The Friends of the Kansas State University Gardens organization has planned a public bus trip on Friday, May 17, to tour six homes on the 2024 Johnson County Master Gardeners Tour. The tour, organized by the Johnson County K-State Research and Extension Master Gardeners , gives guests the chance to explore and learn gardening design tips, such as which flowers to plant in the sun and which to plant in the shade, at six of the most beautiful private gardens in Kansas City. This all-day trip to six personal gardens and a buying spree at the six-acre Family Tree Nursery departs at 7 a.m. from the Manhattan Town Center southeast parking lot and returns at 8 p.m. Registration is $99 and includes round-trip coach travel, an admission ticket to the gardens, and a box lunch that includes three meat choices — plus vegetarian and gluten-free options — water, salad, chips and a brownie. Register to attend and select your lunch option by May 1. At each stop, tourgoers will have 35 minutes to walk around the home gardens. The final stop of the day will be a 90-minute visit to the nursery. Those interested in purchasing plants should bring a laundry basket lined with plastic to be stowed in the bus luggage compartment. Questions can be directed to Tim Lindemuth, chair of the Friends of the Gardens board education committee, at [email protected] .

Media contact

Division of Communications and Marketing 785-532-2535 [email protected]

Kansas State University Gardens

Tim Lindemuth [email protected]

- Statements and disclosures

- Accessibility

- Manhattan, KS 66506

- 785-532-6011

- © Kansas State University

- Updated: 4/15/24

Kansas State visit checks boxes for WR Braden Blueitt

K ansas State continues to have many unofficial visitors on hand for spring practice (which finished up on Saturday just ahead of the transfer portal opening). A new target to keep in mind is Colleyville, Texas wide receiver Braden Blueitt .

The Lone Star State native took his first visit to K-State April 9.

“It was just a quick trip,” Blueitt said. “I was in and out in a day, but I got to meet most of the coaches and see the facilities and how they run practice there.”

One moment in particular stood out to Blueitt.

“Getting to meet Coach [ Matthew ] Middleton for the first time in person,” he answered. “I had a nice one-on-one conversation with him where he went in-depth about what it would be like playing under him. Building that relationship with coaches is the first step in the process of recruiting.”

The Kansas State wide receivers coach left a strong first impression on the blossoming prospect wrapping up his junior year of high school.

“Middleton took the time to watch some film with me and give teaching points,” Blueitt noted. “He just pointed out some things in film like the coverages or route concepts that would be some of the first things I’d need to learn.”

Blueitt also learned a few things from watching K-State practice.

“I thought they were a very fast and explosive offense,” he opined. “There were multiple times throughout practice where someone would break away in team and make a big play. I was pretty impressed by this.”

Blueitt has taken visits to Tulsa, Northwestern and California in addition to Kansas State.

“I don’t think I’ve been to enough places to compare them all really yet,” he pointed out. “But I think it was evident of how big the football team is to K-State and Manhattan. I learned a lot about the team’s culture. K-State is all about winning football games and developing to NFL caliber players.”

The next step for Blueitt is to arrange his official visits. He does not have any planned just yet or a date in mind of when he would like to pick his future school. However, he does know what he is looking for in the one that receives his services.

“Have a good relationship with the coaches and players and fit into the family,” he stated. “I need to like the location because that’s where I’m going to be living for the next couple years. And be able to develop me into the best possible football player I can be so I can be the best at the highest level of football possible.”

The post Kansas State visit checks boxes for WR Braden Blueitt appeared first on On3 .

- TRAFFIC & TRAVELER INFO

- Kansas Travel and Tourism

- I-70 Association

- KDOT Safety Rest Areas

- Invasive Species Guidelines

- Western States – Call Before You Haul

- Kansas Byways

- ROAD WEATHER STATIONS

- Traffic Safety

- Safe Routes to School

- Driver Safety Brochures

- Bicycle Safety

- Railroad Safety

- Strategic Highway Safety

- Kansas City Metro Page

- Topeka/Lawrence Metro Page

- Wichita Metro Page

- BIDDING & LETTING

- COMMERCIAL VEHICLE INFORMATION

- DESIGN CONSULTANTS

- CADD SUPPORT

- HIGHWAY CONTRACTORS

- OFFICE OF CIVIL RIGHTS COMPLIANCE

- Request for Quotation

- Access Management

- State Sign Request Form

- DUI Memorial Marker

- Bureau of Local Projects

- Bridge Inspection Portal

- COUNTY PROGRAMS

- City Programs

- Resource Information

- Outdoor Advertising

- Salvage Yards

- Property For Sale

- ReConnect Program

- Cost Share Program

- Modern Tolling

- Discretionary Support

- For Employees

- DIVISIONS & BUREAUS

- ACCESS MANAGEMENT

- CONTRACT COMPLIANCE

- CONSTRUCTION & MATERIALS

- FISCAL SERVICES

- Inspector General

- LOCAL PROJECTS

- MAINTENANCE

- HUMAN RESOURCES

- RIGHT OF WAY

- COORDINATING SECTION

- STRUCTURES & GEOTECHNICAL SERVICES

- INTELLIGENT TRANSPORTATION SYSTEMS (ITS) UNIT

- TRANSPORTATION SAFETY

- TRANSPORTATION PLANNING

- PERFORMANCE MANAGEMENT

- Projects/STUDIES

- Transportation Planning

- PUBLICATIONS

- OPEN RECORDS

- Investor Relations

- Legislative Testimony

- Legislative Update

- Property Damage Claims

- KDOT – ADA Plan

- KSICS - 800 Radio

- Memorial Signs

- STORM WATER MANAGEMENT

- Protecting our Pollinators

- Rules and Regulations

- Adopt A Highway Program

- Drivers' Licenses

- Kansas Turnpike

- Transportation Sites

- Vehicle Registration

Work zone safety video blog series - click HERE

KDOT’s Go Orange webpage - click HERE

NATIONAL WORK ZONE AWARENESS WEEK

Work zone blog/video series, click HERE

For current road and weather information – www.KanDrive.gov

Make a difference and help keep Kansas moving! Click here for opportunities.

Before your vehicle moves, make sure everyone is buckled up.

LATEST NEWS

Kansas will “Go Orange” this week as buildings, bridges and fountains will be lit in orange and people will wear orange to help raise awareness of work zone safety. Read More...

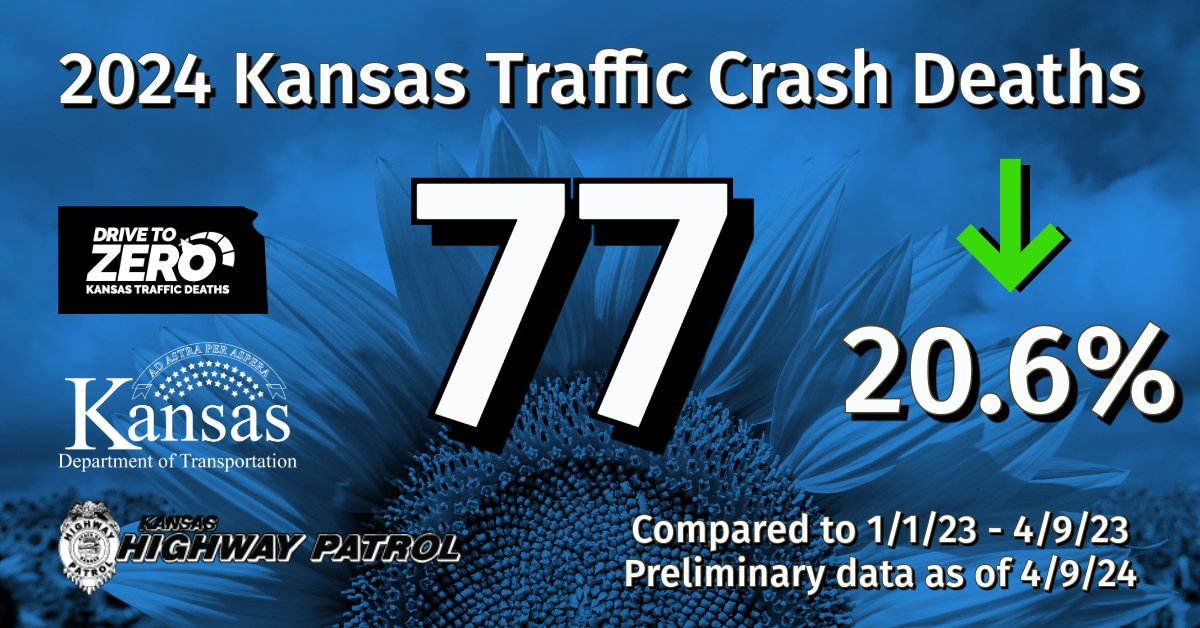

Driving high can be just as dangerous as drinking and driving. That’s the message KDOT and the Drive To Zero Coalition want toshare during the “If You Feel Different You Drive Different” safety campaign. Read More...

Communities in the beginning stages of creating more walk- and bike-friendly towns can greatly benefit from attending the Walk Bike Roll online webinar on April 24. Read More...

KDOT announces approved bids for state highway construction and maintenance projects. The letting took place March 20, 2024, in Topeka. Read More...

Your Kansas

Click the map to view information, news, and projects specific to your area.

- Kansas City Metro

- Topeka/Lawrence Metro |

- Wichita Metro |

LOCAL CONSULT MEETINGS

For dates, times, locations and more information on KDOT Local Consult meetings taking place across Kansas in October, click here.

Short Line Rail Improvement Fund

- Application

- Guidelines and Selection Criteria

- Current Openings

KDOT Project Information

- U.S. 24 Improvement Project in Topeka

- KDOT Long Range Transportation Plan

- Public hearing notice for K.A.R. 36-43-1

- Public Hearing on Proposed Permanent Regulation K A R 36 43 1 ‐ Train Crew Requirements

- Economic Impact Statement for K.A.R. 36-43-01

- Proposed regulation K.A.R. 36-43-01

- K.A.R. 36-43-1 – Received Testimony

- Follow-up written testimony must be submitted to [email protected] no later than 5:00 p.m. CST on August 2nd, 2023.

- Reimbursement request form

Rail Service Improvement Program

Innovative Technology Program

- Project Concept Form

Traveler information

- safety information

- tourist information

- Road Weather Stations

- Topeka/Lawrence Metro

- Wichita Metro

doing business

- bidding & letting

- commercial vehicles

- Design Consultants

- highway contractors

- local governments

- OFFICE OF CONTRACT COMPLIANCE

- Bridge Insp. Portal

- Local Projects

inside kdot

- performance management

projects/publications

- Projects/Studies

- publications

public information

- open records

- media contacts

connect with kdot

- Media Contacts

© Kansas Department of Transportation

To request an alternative accessible format of a KDOT publication, please contact Division of Communications : Eisenhower Building - 700 SW Harrison, 2nd Floor West, Topeka, KS, 66603-3745, or (785) 296-3585 (Voice)/Hearing Impaired - 711.

© Kansas Department of Transportation

To request an alternative accessible format of a KDOT publication, please contact Office of Public Affairs : Eisenhower Building - 700 SW Harrison, 2nd Floor West, Topeka, KS, 66603-3745, or (785) 296-3585 (Voice)/Hearing Impaired - 711.

IMAGES

VIDEO

COMMENTS

For additional assistance, please contact the Kansas Department of Transportation Central Permitting Office at 785-368-6501, and continue to to use the chat and call-back options if you need assistance after logging into your K-TRIPS account.

Hovering over the icon displays a brief explanation of the field; clicking on the icon will display a detailed help message. For additional assistance, please contact the Kansas Department of Transportation Central Permitting Office at 785-368-6501.

Using the K-TRIPS online service to obtain trucking permits for the State of Kansas.

Online Trucking Applications. Renew, add, delete, or transfer your KCC Authorities. Renew your IFTA License. Kansas Commercial Motor Vehicle Registration System (KCoVRS) Renew your KCC and Single State Authorities. Kansas Truck Routing and Intelligent Permitting System (K-TRIPS)

KTRAN. K-TRIPS is the Kansas Truck Routing and Intelligent Permitting System. A cooperative effort among the Kansas Department of Transportation, Kansas Department of Revenue, Kansas Highway Patrol and the motor carrier industry, K-TRIPS provides internet-based permit application, payment and delivery. K-TRIPS will also include an interactive ...

All permitting is done through the Kansas Truck Routing Intelligent Permitting System, known as K-Trips. Call (785) 368-6501 or visit

This video will show how to create a new account using the K-TRIPS permitting system.

The Kansas Department of Transportation (KDOT) developed an automated permitting system called the Kansas Truck Routing and Intelligent Permitting System (K-TRIPS) to issue permits for all OSOW trucks. Using four years of data from K-TRIPS (2014‒2017), the research team developed a series of heat maps using ArcGIS to help visualize the routes ...

Kansas Transportation Secretary Mike King. "Thanks to this customer-oriented permitting system, truckers carrying over-dimensional loads through Kansas can now move at the speed of business," K-TRIPS was developed by KDOT, the Kansas Department of Revenue and Kansas Highway Patrol, with support of the Kansas Motor Carrier Association. In

This video will show how to order a new permit using the K-TRIPS permitting system.

K‐TRIPS is used by Motor Carriers and Permit Services to create and maintain company accounts and to create permit applications for Oversize/Overweight (OS/OW) travel within the State of Kansas. It provides access to safe and legal routes based on the vehicle and load dimensions and weight for such travel.

Oversize/overweight vehicle operators can find routing permits on K-TRIPS, the Kansas Truck Routing and Intelligent Permitting System. Information about specific road construction, restrictions and general road conditions can be found on KanDrive. To speak to customer service about routing, call Central Permits at (785) 368-6501.

Commercial Vehicle Registration (KCoVRS) IFTA Additional Decals, License Renewal and Return Filing. Kansas Truck Routing and Intelligent Permitting System (K-TRIPS) KCC Authorities Renewal/Changes. Service Provider Information.

In lieu of obtaining an IFTA license, you may satisfy motor fuels use tax obligations on a trip-by-trip basis in each jurisdiction you are traveling in. You can purchase a Kansas Trip Permit at K-Trips.com or through the Central Permit Office 785-368-6501.

Information is available at www.k‐trips.com In Effect as of January 1, 2020 Definitions 36‐45‐1: Each of the following terms, as used in this article of the department's regulations, shall have the meaning specified in this regulation: (a) "Department" and "KDOT" mean the Kansas department of transportation.

WHAT ARE THE BENEFITS OF K-TAG? There's lots of great reasons to get a K-TAG! No stopping at a tollbooth, waiting in line, or digging for change. Pay the cheapest fare—even lower than the cash rate. K-TAG works on toll roads in Oklahoma, Texas and Florida. ORDER NOW.

A special annual permit exists for vehicles to only carry agricultural inputs, farm supplies, biofuels, feed, raw or processed agricultural commodities, livestock, raw meat products intended by the shipper for further processing or farm products.The maximum weight is 90,000 lbs., with a minimum of six axles, and cannot be operated on the ...

Kansas Travel and Tourism; I-70 Association; KDOT Safety Rest Areas; Aquatic Nuisance Species . Invasive Species Guidelines; Western States - Call Before You Haul; Kansas Byways; ... K-Trips. Kansas Online Trucking System. Federal Motor Carrier Safety Administration. Information for Vendors.

Authentication: This certifies that the Secretary of State and Attorney General have examined each Kansas Administrative Regulation, and that this electronic publication contains all rules and regulations for state agencies and that it otherwise complies with K.S.A. 77-415, et seq. While every effort has been made to ensure the accuracy and reliability of the digitized version of the K.A.R ...

Monday, April 15, 2024. MANHATTAN — The Friends of the Kansas State University Gardens organization has planned a public bus trip on Friday, May 17, to tour six homes on the 2024 Johnson County Master Gardeners Tour. The tour, organized by the Johnson County K-State Research and Extension Master Gardeners, gives guests the chance to explore ...

Kansas State continues to have many unofficial visitors on hand for spring practice (which finished up on Saturday just ahead of the transfer portal opening). A new target to keep in mind is ...

KDOT announces approved March bids. April 5, 2024. KDOT announces approved bids for state highway construction and maintenance projects. The letting took place March 20, 2024, in Topeka.

A target in the secondary for the Wildcats in 2025, Gunn recaps his experience in the Little Apple. Plus, a relatively new offer from nearby Oklahoma expresses increased interest from K-State's staff.