COVID Information | Click here to learn more about our COVID Travel Insurance

Why should I purchase Travel Insurance?

Whether you're embarking on a weekend getaway or a month-long adventure, unexpected events can happen. An AXA protection plan can help ease your mind and help safeguard your trip, offer reimbursement for covered medical costs, and provide travelers with 24/7 access to assistance services, among other benefits.

Need to cancel your trip due to an unforeseen event?

Get coverage for your trip against illnesses, injuries, and natural disasters. Travel insurance can reimburse you for your prepaid, non-refundable trip costs.

Was your luggage lost or stolen?

Our travel plans can offer reimbursement for the value of your belongings, up to the policy limit. This includes coverage for lost or stolen passports, visas, or other important travel documents, as well as any necessary expenses related to replacing these items.

Stranded due to unexpected travel delays?

Whether it’s rebooking your flight, finding alternative transportation, or providing a place to stay, our 24/7 travel assistance team is here to help!

Is domestic and international medical coverage provided?

Our travel plans can provide up to $250,000 in medical coverage domestically and internationally for emergencies and accidents while traveling.

SILVER PLAN

Best for Domestic Travel

- 100% of Insured Trip Cost for Trip Cancellation

- $25,000 Emergency Accident & Sickness Medical

- $750 Baggage & Personal Effects

Best for Cruise

- $100,000 Emergency Accident & Sickness Medical

- $1,500 Baggage & Personal Effects

PLATINUM PLAN

Optional Cancel For Any Reason Coverage

- $250,000 Emergency Accident & Sickness Medical

- $3,000 Baggage & Personal Effects

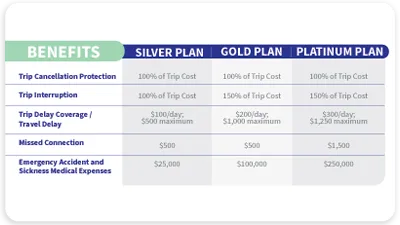

Compare Our Silver, Gold, Platinum Plans

Axa travel insurance benefits.

Medical Travel Benefit

AXA offers coverage for certain emergency medical expenses that result from an accidental injury or illness while traveling as well as emergency medical evacuation and repatriation. Learn more

Trip Cancellation

We can reimburse you up to the maximum benefit of your selected travel plan, that is due to an unforeseen event including illness and inclement weather and other covered reasons. Learn more

Emergency Evacuation

AXA Offers coverage for medically necessary evacuations and repatriation as directed by a physician to the nearest adequate medical facility or your home. Learn more

Baggage Loss

AXA offers reimbursement coverage in the event your baggage or personal effects are lost damaged or stolen during your trip. Learn more

Cancel For Any Reason

AXA offers coverage up to 75% of your prepaid nonrefundable trip costs if your trip is cancelled for any reason. Learn more

Trip Interruption

AXA offers coverage for your non-refundable trip costs in the event you cannot continue on your trip due to a covered reason. Learn more

MY TRIP COMPANION

Not just a travel app but a comprehensive travel assistant that enhances your travel experience.

Frequently asked questions about travel insurance, what is travel insurance, what does travel insurance cover on a cruise, why choose axa, how much does travel insurance cost, what is a pre-existing medical condition, does travel insurance have covid benefits.

Travel Assistance Wherever, Whenever

Speak with one of our licensed representatives or our 24/7 multilingual insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

Make the most out of your travels. Get AXA Travel Insurance and travel worry free!

Over 20 Years of Experience | Located in 30+ Countries | 24/7 Travel Assistance

Common concerns about travel insurance.

- It is a clever idea to purchase travel insurance If you are willing to protect your trip from variety of common travel-related incidents, including trip cancellations, flight delays or cancellations, lost or stolen baggage, and medical emergencies.

- Travel insurance provides coverage against medical expenses, reimbursement for lost or stolen luggage, compensation for expenses incurred due to travel delays and more while you are travelling.

- Travel insurance is to provide financial protection to travelers in case of unexpected events. Without adequate insurance coverage, travelers may face significant financial losses and hardships if they encounter any unforeseen circumstances while traveling in the Schengen Territory.

- A good option for travelers who are concerned about unforeseeable events or who want the freedom to cancel their trip for any reason. When you purchase CFAR coverage, you can cancel the trip without losing your entire prepaid, nonrefundable vacation expenses. Exclusive to Platinum Package holders.

Travel Insurance for Argentina: The Ultimate Guide

Written and researched by Michael Kays (Travel Insurance Expert) | Fact Checked by Danya Kristen (Insurance Agent).

Alright, so you’re all set to jet off to Argentina, a land of mouth-watering steaks, stunning landscapes, and the seductive tango.

But hold on! Before you pack your bags and start practicing your dance moves, let’s talk travel insurance.

It’s a must-have for any savvy traveler, and we’re here to make it less of a headache. Buckle up, and let’s dive into the ultimate guide to navigating travel insurance for Argentina.

Also read: Argentina Expatriate Health Insurance

In this article...

What to Look for in a Good Travel Insurance for Argentina

Navigating the world of travel insurance can be a bit daunting, but we’ve got your back.

Here are the essential features to look for in a good travel insurance policy for Argentina:

- Comprehensive medical coverage: Ensure your policy has adequate coverage for medical expenses, including hospitalization, doctor visits, and prescription medications.

- Emergency medical evacuation and repatriation: In case you need to be transported to another country for medical care or brought back home, this is a must-have feature.

- Trip cancellation and interruption protection: Plans can change, so make sure your policy covers non-refundable expenses if you have to cancel or cut your trip short.

- Baggage and personal belongings coverage: If your luggage gets lost, stolen, or damaged, you’ll want a policy that provides coverage for your belongings.

- 24/7 assistance: Choose a provider with round-the-clock customer service, so you have someone to call if you run into any issues during your trip.

- Customizable coverage: Each traveler has unique needs, so look for a policy that allows you to tailor coverage based on your specific requirements.

- Reputable provider: Go with a company with a solid reputation and good customer reviews to ensure a smooth claims process.

Recommended Plans

✅ Atlas America

Up to $2,000,000 of Overall Maximum Coverage, Emergency Medical Evacuation, Medical coverage for eligible expenses related to COVID-19, Trip Interruption & Travel Delay.

✅ Safe Travels Comprehensive

Coverage for in-patient and out-patient medical accidents up to $1 Million, Coverage of acute episodes of pre-existing conditions, Coverage from 5 days to 364 days (about 12 months).

✅ Patriot America Platinum

Up to $8,000,000 limits, Emergency Medical Evacuation, Coinsurance for treatment received in the U.S. (100% within PPO Network), Acute Onset of Pre-Existing Conditions covered.

Argentina: A Safe Bet or Risky Business?

- Generally safe : Argentina is usually a secure destination, but like any country, it’s essential to keep your wits about you.

- Petty crime : Beware of pickpockets and sneaky bag snatchers. They’re always on the lookout for unsuspecting tourists .

- Protests : Demonstrations can pop up unexpectedly, so keep your ear to the ground and stay away from large gatherings.

Also read: Travel insurance for Aruba

Do I Really Need Travel Insurance for Argentina?

- Entry requirements : Argentina doesn’t demand travel insurance, but trust us, it’s a smart move to have it.

- Visa requirements : Some visas might require insurance, so double-check before you submit that application.

Argentina Travel Medical Insurance: What’s the Deal?

- Medical emergencies : Healthcare ain’t cheap in Argentina, so insurance can be a lifesaver when it comes to medical expenses.

- Pre-existing conditions : Some policies cover them, while others don’t. Choose wisely based on your health history.

- Emergency evacuations : In a severe medical emergency, your policy should cover the cost of getting you to the nearest medical facility or back home.

- Repatriation : Nobody wants to think about it, but insurance can cover the cost of returning your remains to your home country.

The Best Travel Insurance for Argentina: How to Choose

Finding the perfect insurance policy is like finding a needle in a haystack, but we’ve got your back.

World Nomads, Allianz Travel, and IMG Global are some popular options. Compare coverage, limits, and exclusions to find your ideal policy.

Online or In Argentina: Where to Buy Travel Insurance

Do yourself a favor and buy your insurance online before you go. It’s more convenient, and you’ll have time to compare policies and make an informed decision.

Argentina’s Top Travel Insurance Companies: Who to Trust

Some of the top contenders for travel insurance in Argentina are:

- World Nomads

- Allianz Travel

Insider Tips for International Tourists Buying Travel Insurance

- Get familiar with local healthcare facilities : Know where to go when you need help.

- Understand policy exclusions : Some policies have limitations, so read the fine print.

- Check your existing coverage : You might already have some protection from your current insurance policies.

What’s Required for Argentina Travel Insurance?

No specific requirements, but here’s what to look for:

- Medical coverage : Make sure it’s enough for any potential emergencies.

- Trip cancellation and interruption coverage : Protect yourself from unexpected changes in plans.

- Baggage loss or theft protection : Don’t let a lost suitcase ruin your trip.

Is Travel Insurance Compulsory in Argentina?

It’s not mandatory , but trust us, it’s a smart move. Better safe than sorry!

Travel insurance might seem like a chore, but it’s the secret weapon of any wise traveler.

With this ultimate guide to Argentina travel insurance, you’ll be ready to tango through the streets with peace of mind.

Do your research, compare providers, and make sure you understand the fine print. Now go and enjoy all the incredible experiences Argentina has to offer!

Get Free Consultation

Safe Travels USA Cost Saver

January 24, 2020

Safe Travels USA Comprehensive

January 23, 2020

Patriot Platinum

Visitors Care

Patriot International

Patriot America

January 22, 2020

Patriot America Plus

January 21, 2020

Atlas America

January 16, 2020

Nationwide Prime Travel Insurance Review

September 21, 2023

Nationwide Luxury Cruise Travel Insurance Review

Nationwide choice cruise travel insurance review, nationwide universal cruise travel insurance plan review, nationwide essential travel insurance plan review, all clear travel insurance – all you need to know.

August 4, 2023

CoverMore Travel Insurance: Everything You Need to Know

Staysure travel insurance: everything you need to know, post office travel insurance – everything you need to know, argentina expatriate health insurance – ultimate guide.

August 2, 2023

Visitcover.com is a travel insurance review portal that will help you choose the right travel insurance plan for your next trip. By bringing you unbiased, fact-checked, verified information about travel insurance companies, plans, claim processes, and everything that's usually mentioned in the fine print. Make informed decisions, with us!

Opening hours

09.00 - 22.00

09.00 - 18.00

09.00 - 16.00

4422 Flamingo Villas, Ajman Media City, United Arab Emirates

Call Us: +1-972-985-4400

© 2023 VisitCover.com

Travel Insurance Plans

Choose the best travel protection plan for your trip.

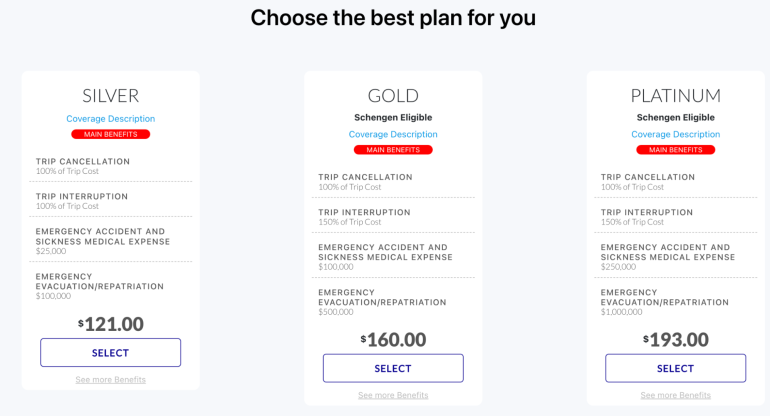

We offer three plans that will help protect you on your next trip. Whether traveling domestically or internationally, you want to plan for the unexpected. Our travel protection plans include many benefits such as Trip Cancellation, Trip Interruption, Emergency Medical Expense, Emergency Evacuation and Baggage Delay to help give you peace of mind before and during your trip. Optional travel insurance benefits are also available to enhance our travel plans and offer additional protection for your trip. In addition, our 24/7 emergency assistance and support services can help you deal with unforeseen circumstances during your trip.

SILVER PLAN

Best for Domestic Travel

- 100% of Insured Trip Cost for Trip Cancellation

- $25,000 Emergency Accident & Sickness Medical

- $750 Baggage & Personal Effects

Best for Cruise

- $100,000 Emergency Accident & Sickness Medical

- $1,500 Baggage & Personal Effects

PLATINUM PLAN

Optional Cancel For Any Reason Coverage

- $250,000 Emergency Accident & Sickness Medical

- $3,000 Baggage & Personal Effects

Silver Plan

Platinum plan.

Compare Travel Insurance Plans

Get covered against Trip Delays, Medical Emergencies, Lost Baggage, and more!

Do I need Travel Insurance?

Do these travel insurance plans cover pre-existing medical conditions.

Need Help Choosing a Plan?

Speak with one of our licensed representatives or our 24/7 multilingual Insurance advisors to find the coverage you need for your next trip. From Medical Coverage to Trip Cancellation Protection, our team of travel experts will help you choose the right coverage.

Travel Insurance for Argentina: What You Need to Know in 2024

Wondering about Argentina travel insurance and whether you need it?

The answer is YES!

When travelling overseas you should always, always get travel insurance. Hopefully, you’ll never need to make a claim but it’ll save you a lot of headaches (and money) if you do.

Every week I seem to read horror stories about people who didn’t get travel insurance and now need to set up GoFundMe accounts to pay their medical bills or repatriate home. It’s downright scary – and silly not to be covered for these types of things.

I’m a former Argentina expat with lots of experience with travel insurance. I lived in Argentina for two years, and I’ve also travelled to more than 40 countries (and purchased travel insurance plans every single time!).

I’m here to help you navigate the world of travel insurance for Argentina, so you can make the best decision for your travel plans.

This blog post may contain affiliate links, meaning if you book or buy something through one of these links, I may earn a small commission (at no extra cost to you).

What's in this article (Click to view)

Top 3 providers of travel insurance for Argentina

- Travel Insurance Master – Best website to compare Argentina travel insurance policies across multiple providers

- SafetyWing – Best insurance for long-term travellers and digital nomads in Argentina

- World Nomads – Best for simple and flexible travel insurance

Do I need travel insurance to travel to Argentina?

It’s not a legal requirement to have travel insurance when you visit Argentina. You don’t have to purchase general Argentina travel insurance or even medical travel insurance.

BUT it’s highly recommended.

I NEVER travel overseas without travel insurance. There are just too many things that can go wrong – and those things usually equal lots of money.

Just as you have insurance for your belongings, your car and your home – travel insurance is like insurance for yourself when travelling.

Why you should get travel insurance for Argentina

Already know that you should get travel insurance for Argentina? Skip to my recommended Argentina travel insurance providers .

But if you still need convincing, here are a few reasons why travel insurance is a must when travelling in Argentina.

1. Medical emergencies can be expensive

In the unfortunate event that you need medical treatment while in Argentina, it can get costly. Travel insurance can cover these expenses and save you from a huge financial burden.

It’s not just big accidents – imagine having the most painful tooth infection while you’re visiting Argentina ( this country loves its sweet foods !) and needing to see a dentist? Travel insurance can cover that.

2. Cancellations or delays

Flight cancellations and delays are quite common, especially during peak travel seasons. We’re seeing them every day as the aviation industry gets back to its former glory.

With travel insurance, you can get reimbursed for any non-refundable expenses that you need to pay because of a cancellation or delay.

3. Trip cancellation and interruptions

It’s not just flight cancellations that may be covered by travel insurance.

Imagine you’re planning an epi c trip to Argentina , only to find out that a close family member is very sick. Travel insurance may cover the cost of delaying your trip so you can stay home to be with them.

4. Lost or stolen baggage

Losing your bags while travelling is a nightmare. With travel insurance, you can claim compensation for lost or stolen baggage and not have to worry about replacing all your belongings.

5. Adventure activities

Argentina is famous for adventure sports like hiking , skiing and rock climbing. It’s what Argentina is known for . While they’re thrilling experiences, accidents can happen.

Travel insurance can cover any medical expenses or emergency evacuations that may arise from these activities.

6. Emergency evacuations

In case of a natural disaster or political unrest, travel insurance may cover the costs of emergency evacuation to a safe location. For Argentina, which has a history of political unrest, you want to make sure this is covered by your policy.

As you can see, there are so many reasons to get travel insurance for your trip to Argentina.

It’s always better to be safe than sorry, and having travel insurance can give you peace of mind during your Argentina itinerary .

While there are dozens and dozens of travel insurance providers out there, there are three travel insurance companies that will cover the vast majority of travellers to Argentina.

To figure out which insurance is best for you , consider the length of your trip, the activities you plan to do and any pre-existing medical conditions. Look at the total cost of the policy and the deductible amount, as well as the claims process. Read reviews about other travellers’ claims experiences.

Read the fine print and make sure the insurance covers everything you need it to before making a decision.

Make sure to also compare prices across different providers and consider any discounts or promotions they may be offering.

1. Travel Insurance Master

Love to compare policies across multiple providers? Travel Insurance Master is for you.

They’re a one-stop shop, aggregating dozens of travel insurance providers – the ones they consider the best – to present you with the policy and features that you need for your trip.

Simply answer a few questions online and voilà – you’ll be presented with a selection of travel insurance policies, including the policy that they recommend for you .

Their policy recommendation is designed to make it easy for you, so you don’t need to read through dozens of policies to understand what’s covered and what’s not. (Although do read the policy docs of the company that you end up choosing!)

You let them know which features you’re interested in – perhaps you want to go sky-diving or scuba diving – and they’ll filter out policies that don’t cover those activities.

The platform is really easy to use and you can filter out things you don’t need, as well as quickly read through the inclusions and exclusions of various policies by clicking on the details.

2. SafetyWing

SafetyWing is the ideal insurance for long-term travellers and Argentina digital nomads. Monthly travel policies start from only US$45.08 per month.

SafetyWing’s travel medical insurance includes access to hospitals and doctors for unexpected medical problems and accidents and includes coverage for emergency medical evacuation.

It also covers travel delays, lost checked luggage, emergency response and natural disasters and personal liability for travel in Argentina.

Covid-19 coverage is included.

Use the calculator below to calculate a plan for your trip to Argentina.

3. World Nomads

World Nomads travel insurance has been designed by travellers for travellers, with coverage for more than 150 activities as well as emergency medical, lost luggage, trip cancellation and more.

Love Argentina so much that you want to stay longer? If your policy runs out, you can buy or extend while on the road.

Because they believe in giving back to the places their customers travel to, World Nomads also enables you to make a difference with a micro-donation when you buy a policy.

And they’ll help you plan your trip with free downloadable guides, travel tips, responsible travel insights and recommendations from their global community.

TOP TIP: Wondering when you should buy travel insurance? I always buy mine when I’ve made my first big payment – for example, booking and paying for my flights.

Argentina travel insurance tips

I’ve said it already but I’ll say it again: read the fine print.

Don’t just purchase a travel insurance policy because the price is good. You NEED to understand what is covered and what’s not covered.

So many people have been caught out because they thought something was covered but it wasn’t. The number of people who go to Bali and then end up with big medical bills after scooter accidents is crazy. If they’d read their policy, they’d have found out that scooter accidents usually aren’t covered, unless you have a motorbike license.

Or did you know that most policies won’t cover an accident if your blood-alcohol level is higher than a certain limit?

Once you’ve got your policy, make sure you print or screen shot (or both!) the document details so you have them handy should you need them.

One last tip – always purchase travel insurance as soon as you book your trip , as some providers have time restrictions for when you can purchase coverage.

This will affect you if you need to make a claim for trip cancellation or interruption – ie. things that can go wrong before you’ve even stepped onto the plane.

Do you need car insurance for Argentina?

If you’re planning on renting a car in Argentina , then car insurance is wise.

Legally, Argentina car rental companies have to include third-party coverage – but that doesn’t often cover damage to the actual rental car.

If you rent a car through a company like DiscoverCars , there’s an option to add on full coverage for just a few dollars a day.

Otherwise, Travel Insurance Master’s platform allows you to filter policies that include rental car benefits.

Argentina travel safety tips

Argentina is safe to visit for tourists , but there are some ways to stay safe while travelling there:

- Be aware of your surroundings, especially in big cities like Buenos Aires

- Be cautious when travelling at night, and try to stick to well-lit areas

- Avoid carrying large amounts of cash (the complex money situation in Argentina does make it hard to avoid this!) or wearing expensive jewellery

- If you’re using public transport, keep an eye on your belongings and be wary of pickpockets

- Make copies of important documents (like your passport) and leave the originals in a safe place

- Research common scams in the area, and be wary of anyone trying to sell you something on the street or asking for money

- Invest in a money belt , passport scarf or secure bag to keep your valuables close to you while exploring

- If you’re planning on hiking or exploring more remote areas, make sure to do so with a guide or group

- Learn a few words of Spanish to communicate with locals and ask for help if needed

- Trust your instincts and use common sense – just like you would in any unfamiliar location!

- If you do find yourself in a robbery, don’t resist!

- Avoid protests and demonstrations, which can occur regularly in Argentina

- Keep an eye on your food and drink, and don’t accept drinks from strangers

Final thoughts: Getting travel insurance for Argentina

For me, getting travel insurance for Argentina – or any other country I visit – is a no-brainer.

It gives me peace of mind, knowing that I’m covered for any unexpected incidents or emergencies while travelling.

Plus, with the unpredictable political and economic situation in Argentina, having travel insurance can be a lifesaver if you encounter any disruptions to your trip.

When it comes to choosing the right travel insurance for your trip to Argentina, make sure to read the fine print and understand exactly what’s covered and what isn’t. Don’t get caught out!

I truly hope you’ll never need to make a claim, but travel insurance will help make your trip to Argentina a worry-free one.

Travel insurance for Argentina: FAQs

Where can i compare argentina travel insurance quotes.

Many online comparison sites allow you to compare quotes from different insurance providers. Try Travel Insurance Master , a site that aggregates policies across top providers.

What should I look for when choosing travel insurance for Argentina?

Make sure it covers medical emergencies, trip cancellation/interruption, lost/stolen luggage and any specific activities or adventures you plan on participating in. Also, check the coverage limits and any exclusions.

Are there any specific considerations for Argentina travel insurance?

Yes, make sure your policy covers political or economic disruptions that may occur in Argentina. You may also want to consider a policy that includes emergency evacuation coverage if you plan on visiting remote areas.

Do I need travel insurance if I already have health insurance that covers me internationally?

While your health insurance may provide some coverage while travelling abroad, it may not cover all medical expenses or emergency situations. Travel insurance can also provide coverage for trip cancellation and lost/stolen luggage, which your health insurance likely won’t cover.

Can’t I just rely on Argentina’s health system if I get sick while I’m there?

Argentina has a pretty decent standard of universal healthcare, and visitors can seek medical care in public hospitals at no cost. But by doing so, you’re putting a burden on Argentina’s public healthcare system. Travel insurance can help you with the best possible care in private facilities – as well as with other benefits like flight cancellations, medical evacuations and baggage loss.

What if I’m only going on a short trip to Argentina?

Even for short trips, travel insurance can provide valuable coverage in case of unexpected events. It’s always better to be safe than sorry!

Are there any age restrictions for purchasing travel insurance?

Most travel insurance policies have a minimum age requirement of 18 years old and some have a maximum age limit as well. However, there are some policies available for travellers of all ages, so research and compare different options before deciding.

Can I purchase travel insurance for Argentina after booking my trip?

Yes, you can typically purchase travel insurance at any point before your trip begins. However, keep in mind that there may be time-sensitive requirements, such as purchasing within a certain number of days after booking your trip or before a certain date. It’s best to purchase travel insurance as soon as you book your trip.

How much is travel insurance for Argentina?

The cost of travel insurance for Argentina will depend on various factors such as your age, length of trip, and the type of coverage you choose. On average, a basic policy for a one-week trip to Argentina can range from US$50-US$100. However, carefully review and compare different policies to find one that fits your specific needs and budget. You can get a free quote before you decide.

What isn’t covered by Argentina travel insurance policies?

Carefully review the specific terms and conditions of your travel insurance policy to understand what is and isn’t covered. Some common exclusions from Argentina travel insurance policies may include pre-existing medical conditions, risky activities such as extreme sports or trip cancellations due to events that were known before purchasing the insurance.

Is it safe to travel to Argentina right now?

Yes! Argentina is a safe country to visit . Of course, like any country there are instances of crime, so you will need to use common sense. But overall, Argentina is safe to visit. It’s a good idea to register with your home country’s embassy or consulate while travelling in case of an emergency.

What Covid-19 regulations are there for Argentina?

There are currently no Covid-19 regulations in place for people travelling to Argentina.

Do you need the Covid vaccine to visit Argentina?

Currently, Argentina doesn’t have a mandatory requirement for visitors to be fully vaccinated against Covid-19.

What vaccinations do I need for Argentina?

Before travelling to Argentina, make sure you’re up-to-date on routine vaccinations such as measles-mumps-rubella, chickenpox and the flu. Additionally, the CDC recommends getting vaccinated for Hepatitis A and typhoid.

Did you find this article helpful? Consider buying me a coffee as a way to say thanks!

Got any questions about travel insurance for Argentina? Drop them in the comments section below.

Related posts

Before you go… you might like these Argentina travel blogs:

- Is Argentina safe to visit?

- How to spend 2 weeks in Argentina

- The best things to do in Argentina

- The ultimate guide to visiting Iguazu Falls

- How to see the Ruta de los Siete Lagos – by car or bike!

ARGENTINA TRIP ESSENTIALS

- Book your flight to Argentina online with Skyscanner . I like how this site allows you to find the cheapest days.

- Find a great hotel in Argentina. Check prices on Booking.com and Expedia online.

- Check out the huge range of day tours throughout Argentina on GetYourGuide or Viator . There’s something for everyone.

- Keep those bottles of wine you’ll be buying safe in these wine bags .

- A copy of the Lonely Planet guide to Argentina will be handy. Also pick up a Spanish language guidebook to help you navigate your visit.

- One thing I always purchase is travel insurance ! Travel Insurance Master allows you to compare across multiple policy providers, while SafetyWing is great for long-term travellers and digital nomads.

PIN IT FOR LATER: ARGENTINA TRAVEL INSURANCE

Save this guide to travel insurance for Argentina to Pinterest for later.

About REBECCA

I'm a travel junkie who started dreaming about seeing the world from a very young age. I've visited more than 40 countries and have a Master of International Sustainable Tourism Management. A former expat, I've lived in Australia, Papua New Guinea, Argentina and the United States. I share travel resources, tips and stories based on my personal experiences, and my goal is to make travel planning just that bit easier.

Leave a Comment Cancel reply

MORE INFORMATION

ABOUT WORK WITH ME CONTACT PUBLISHED WORK

AFFILIATE DISCLOSURE

AS AN AMAZON ASSOCIATE I EARN FROM QUALIFYING PURCHASES

© 2024 REBECCA AND THE WORLD

Privacy Policy

I ACKNOWLEDGE THE WURUNDJERI AND BOON WURRUNG PEOPLE OF THE KULIN NATION AS THE TRADITIONAL OWNERS OF THE LANDS AND WATERWAYS OF THE AREA I LIVE ON. I PAY MY RESPECTS TO ELDERS PAST AND PRESENT AND CELEBRATE THE STORIES, CULTURE AND TRADITIONS OF ALL ABORIGINAL AND TORRES STRAIT ISLANDER PEOPLE ACROSS AUSTRALIA.

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

AXA Travel Insurance Review: Is it Worth The Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is AXA?

Axa travel insurance plans, which axa travel insurance plan is best for me, can you buy axa travel insurance online, is axa legit, what isn't covered by axa travel insurance, is axa travel insurance worth it.

- Lowest-cost plan includes some medical coverage.

- Pre-existing conditions waiver add-on available for higher-cost plans.

- No add ons are available for Silver-level policyholders.

- CFAR upgrade is only available for highest-cost plan.

In the era of staff shortages and extreme weather, your trip may not go exactly to plan. When that happens, travel insurance can be a big help. Although an insurance policy can’t prevent a delay or cancellation from happening, it can help relieve the financial burden if something unpredictable does occur on your trip.

But how do you know which insurance provider to go with? Here's a look at AXA travel insurance to help you determine if one of its plans is right for you.

AXA is a French insurance company that does business in over 200 countries. It offers many different types of insurance, including policies for travelers. These include coverage for baggage loss , trip cancellation and interruption, emergency evacuation and emergency medical costs. Cancel for any reason coverage is also offered.

AXA Assistance USA is part of the AXA Group.

» Learn more: How much is travel insurance?

AXA Assistance USA offers travelers three insurance plans: Silver, Gold and Platinum. The plans are underwritten by Nationwide Mutual Insurance Company and their affiliates in Columbus, Ohio. Here's the coverage you can expect from each policy.

Silver: This is the least expensive plan that offers 100% trip cancellation and trip interruption coverage, $25,000 in emergency accident and sickness medical coverage and $100,000 in emergency evacuation and repatriation coverage.

Gold: The mid-range Gold policy comes with 100% trip cancellation and 150% trip interruption coverage, $100,000 in emergency accident and sickness medical coverage and $500,000 in emergency evacuation and repatriation coverage.

Platinum: The AXA Platinum travel insurance plan includes 100% trip cancellation and 150% trip interruption coverage, $250,000 in emergency accident and sickness medical coverage and $1,000,000 in emergency evacuation and repatriation coverage.

If you want to add Cancel For Any Reason coverage, you’ll need to select the Platinum plan and purchase a policy within 14 days of paying the initial trip deposit. It’ll cover 75% of the prepaid nonrefundable expenses for your travel.

If you’d like coverage for pre-existing medical conditions , a waiver is available on the Gold and Platinum plans as long as you buy coverage within 14 days of your first trip payment.

» Learn more: How does travel insurance work?

Let’s compare AXA’s plans, the costs and coverage for a 19-day trip to Indonesia that costs $1,500 for a 36-year-old traveler who lives in Utah.

Coverage and limits for the Silver-level plan include:

Trip delay: $100 per day, with a $500 maximum.

Trip cancellation: 100% of the trip cost.

Trip interruption: 100% of the trip cost.

Baggage delay: $200.

Lost baggage: $750, up to $150 per article.

Missed connection: $500.

Emergency evacuation: $100,000.

Accidental death and dismemberment: $10,000 ($25,000 if on a common carrier).

Emergency accident and medical expense: $25,000.

The plan cost for our sample trip is $55.

For $79, the Gold-level tier offers the following coverage and limits:

Trip delay: $200 per day, with a $1,000 maximum.

Trip interruption: 150% of the trip cost.

Baggage delay: $300.

Lost baggage: $1,500, up to $250 per article.

Missed connection: $1,000.

Emergency evacuation: $500,000.

Accidental death and dismemberment: $25,000 ($50,000 if on a common carrier).

Emergency accident and medical expense: $100,000.

Collision damage waiver: $35,000.

Platinum is AXA’s highest tier level. This plan includes:

Trip delay: $300 per day, with a $1,250 maximum.

Baggage delay: $600.

Lost baggage: $3,000, up to $500 per article.

Missed connection: $1,500.

Emergency evacuation: $1,000,000.

Accidental death and dismemberment: $50,000 ($100,000 if on a common carrier).

Emergency accident and medical expense: $250,000.

Collision damage waiver: $50,000.

Lost golf rounds: $500.

Lost skier days: $25 per day.

Pet boarding fees: $25 per day (up to five days).

This level of coverage costs $95.

» Learn more: The best credit cards for travel insurance benefits

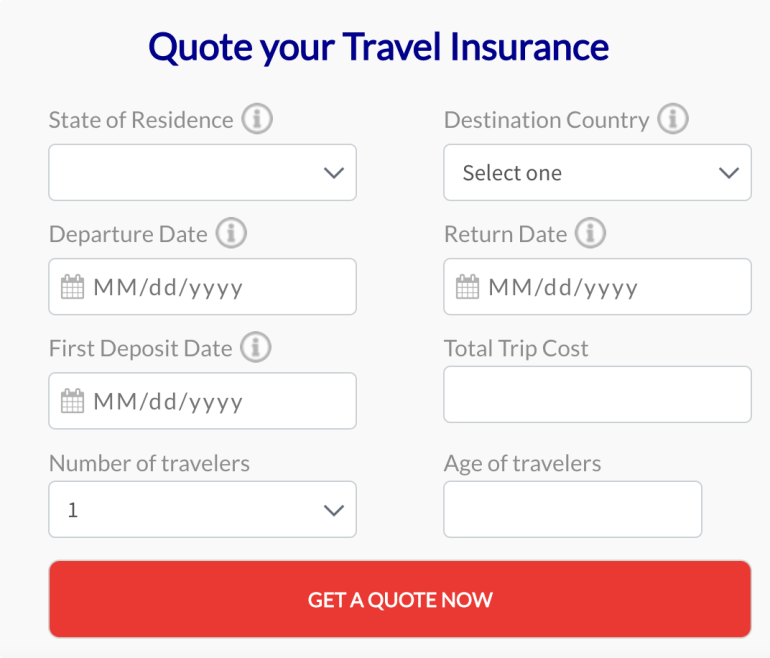

To get an AXA travel insurance quote, go to AXATravelInsurance.com and start by inputting your information in the quote box. Enter your state of residence, destination country, trip dates, date of first trip deposit, total trip cost, the number of travelers and their ages.

Once you’ve filled out the form, click on the “Get a quote now” button.

You’ll be presented with three quotes, one for each plan level. Make sure to click on the “See more benefits” link to get more information on each plan’s coverage limits. The plans with the highest coverage limits will be the most expensive.

If you need a pre-existing conditions waiver, select the Gold or Platinum plan. You’ll also have to purchase the plan within 14 days of making your initial trip deposit to be eligible.

The Gold and Platinum levels are also the two plans that offer Schengen zone coverage and a collision damage waiver . The Platinum plan is the only one that offers a Cancel For Any Reason add-on, so keep that in mind if you need more protection.

Overall, if you’re looking for emergency medical and emergency evacuation coverage specifically, the limits are good on all the plans, including the least expensive one.

To compare plans from multiple insurance providers at once, we recommend checking out Squaremouth, a travel insurance comparison site and a NerdWallet partner. The website helps you pick the right plan by displaying multiple quotes from many insurance providers, including AXA, in one spot.

AXA began in the early 19th century as a small insurance company specializing in property and casualty insurance.

Since then, the company has evolved, changing names and acquiring other insurance brands, until it became AXA in the 1980s. It is now one of the largest insurance companies in the world. In other words, yes, AXA is a legitimate travel insurance provider.

» Learn more: The best travel insurance companies

Every plan has different exclusions, so it's important to look at your coverage summary. Generally, pre-existing conditions without a previously purchased waiver are not covered.

Other limitations include:

Intentionally self-inflicted injuries.

Participation in bodily contact or extreme sports.

Traveling for the purpose of securing medial treatment.

Accidental injury or sickness when traveling against the advice of a physician.

Non-emergency treatment or surgery.

AXA handles more than 14 million cases each year, and every plan includes access to their 24/7 assistance hotline. The company is well established and has three plans for travelers to choose from.

AXA travel insurance covers several benefits including but not limited to 100% trip cancellation and trip interruption, medical emergencies, emergency evacuations, baggage delay or lost baggage, and accidental death and dismemberment. The Platinum plan also lets you add Cancel For Any Reason coverage.

AXA's least expensive plan, Silver, and its mid-range Gold policy do not have the option to add-on Cancel For Any Reason coverage. For travelers who opt to purchase the Platinum insurance plan, you can add Cancel For Any Reason coverage a la carte within 14 days of paying the initial trip deposit.

In the event that you need to make a claim, you can upload supporting documents online. If the claim is accepted, you will receive reimbursement within 30 days.

It's said that travel is the only thing you buy that makes you richer. But you don’t want to become poorer if something goes wrong before or during a trip. We don’t know what the universe has in store for us, so buying a travel insurance policy is one way we can protect our investment.

AXA offers budget, mid-range and premium policies that are easy to understand, provide adequate coverage and don’t cost a fortune.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

All About Travel Insurance in Argentina

The healthcare system in Argentina is notably one of the best in Latin America.

If you are concerned about what will happen if you get sick or injured here, don’t worry. You’ll be in great hands.

And I would know. I’ve spent five days in the hospital with pneumonia here, done fertility treatments, had a baby, endured a root canal and countless dental treatments, and basically used every ounce of care my local insurance plan provides.

I am a fan of healthcare here.

QUICK NOTE: This post contains affiliate links and Sol Salute may receive a commission for purchases made through these links, at no extra cost to you.

In this post:

Do you need travel insurance in Argentina?

If you’re wondering whether you need travel insurance in Argentina, the answer will strongly depend your specific plans.

Are you planning to move here and live as an expat? Then I recommend purchasing a private health insurance plan once you’re here. For more information read my living in Buenos Aires guide.

If you’ll be on vacation or passing through as a digital nomad then yes, travel insurance is always, always, always a good idea.

Argentina Travel Insurance Required: COVID Update 2022

Updated as of January 24, 2022

Currently, you are legally required to have travel health insurance that includes COVID coverage to enter Argentina.

Also, travelers must be fully vaccinated and the second dose has been given 14 days before arrival in Argentina., must provide a negative PCR taken within 72 hours of departure and fill out the declaracion jurada (sworn statement).

Health insurance that includes COVID coverage is a requirement. For that, I recommend SafetyWing’s Nomad plan .

A detailed list of requirements can be found on the US Embassy website

Why Get Travel Insurance for Argentina

Even though it’s an entry requirement at the moment, it’s always been a good idea to travel insured.

Anything can happen and even though we might disagree, we’re not invincible.

Besides covering emergencies like broken bones (it happens, my mother fell off a horse at an estancia and broke her arm!), unexpected illness, and even emergency evacuations, proper travel health insurance plans also cover things like lost luggage, trip delays, and theft.

So even if you don’t envision yourself falling down a mountain and requiring life flight, you may very well need help with a delayed flight or stolen phone.

Because theft in Argentina is a real concern you should take into account. I find it to be as safe as all major cities, but pickpockets and quick, petty theft are common.

Don’t leave your hotel with your passport, all your valuables, etc. And for those you do take, be insured.

Read More: Is Buenos Aires safe for tourists?

The Best Travel Insurance For Argentina

At the moment, the best Argentina travel insurance is SafetyWing .

Luckily, they are affordable at only $42/month, taking away any remaining excuses.

They include COVID i n their coverage which is a legal requirement to enter the country as a tourist at the moment.

Most notably, along with testing and medical expenses, SafetyWing covers up to $50 a day for quarantine expenses for up to 10 days. It may not sound like much but in Argentina, $50 can cover most Airbnbs.

Quarantine coverage is a benefit you won’t find in most plans (and with most cases these days being mild, it might be the biggest expense you encounter if you get COVID abroad).

The travel coverage is also excellent covering trip interruption, lost baggage, travel delays, and evacutions.

The only downside is the high deductible of U$250. That is a big number for Argentina but if you’re using travel medical insurance in an emergency, you may very well meet that number.

Use the calculator below to calculate a plan for your upcoming trip.

Argentina Travel Resources

- TRAVEL INSURANCE | It is always a good idea to travel insured. It protects you in so many cases, like lost luggage and trip cancellations, medical emergencies and evacuations. It’s very affordable with the potential to save you thousands in the case of an emergency. I recommend SafetyWing .

- PHONE PLAN | These days, traveling with data is essential. Especially in Argentina where everything is managed on Instagram and WhatsApp. I recommend this E-SIM card . It’s hassle-free and affordable, for more read how to get an Argentina sim card.

- ACCOMMODATION IN ARGENTINA | booking.com is the most common hotel site used in Argentina and it’s where you’ll find the most options.

- RENTAL CARS | I love to travel Argentina via road trip, I’ve always used rentalcars.com, now they are operating under the umbrella of B ooking.com’s car rental system.

- BUS TICKETS | Check Busbud for long distance bus routes and tickets.

- VPN | If you’ll be using a public WiFi connection and want to secure your data, I highly recommend using a VPN, I personally use and have had a good experience with ExpressVPN . I also use it to access Hulu and American Netflix from Argentina.

- FLIGHTS | Always check Google Flights and Skyscanner for flights to and within Argentina. Aerolineas Argentina is the local airline with the most routes. FlyBondi and Jetsmart are two budget airlines with dirt-cheap prices (but expect to pay for every add-on like luggage).

- BOOK A CONSULTATION | I offer one-on-one travel consultations to help you plan your trip to Argentina. Pick my brain to get a local’s insight. Click here for more information .

Leave a Comment

Save my name, email, and website in this browser for the next time I comment.

Hola, I'm Erin!

I'm a Texan expat based in Buenos Aires for over 13 years. I write about Argentina, Texas, and everywhere in between. My goal is to help you discover my favorite places like a local via my detailed guides and itineraries. Read more about me and my travels.

follow along with me

latest posts

- 10 Days in Argentina: 7 Sample Itineraries April 4, 2024

- Money in Argentina: Currency Exchange, the Blue Dollar, and Getting the Best Rate April 2, 2024

- The Best Wineries in Patagonia April 1, 2024

- A Traveler’s Guide to La Boca, Buenos Aires March 28, 2024

- Things to do in San Martin de los Andes, Argentina March 26, 2024

- Salta & Jujuy: A 9 Day Northwest Argentina Road Trip Itinerary March 26, 2024

Affiliate Disclosure

This website contains affiliate links and Sol Salute may receive a commission for purchases made through these links, at no extra cost to you. As an Amazon Associate, I earn from qualifying purchases. Read more.

About Me Work With Me Contact Me Privacy Policy

Argentina Travel Guide Buenos Aires Guide Patagonia Guide Food & Drink Culture

Travel Better

Travel Consultations Join the FB Group Travel Gear Live Abroad Yoga

Follow Along on Social Media

Copyright 2017-2024 Sol Salute. All Rights Reserved.

- Welcome to AXA Partners US

- AXA Travel Insurance

Travel Insurance

A partner you can trust.

Partnering with AXA to offer travel insurance means you and your clients benefit from the support of an industry leader with extensive experience and outstanding customer service. We will assist you in choosing the best plans to offer your customers, ensuring they are protected by the most suitable coverage for their trip, at the most cost-effective price, and with top-notch global emergency assistance services.

Vacation Package Protection

Boost your customers' confidence when booking vacation packages months in advance with our comprehensive Vacation Package plan. Our coverage safeguards their pre-paid, nonrefundable expenses, including airfare, hotel stays, and car rentals. It can also be tailored to protect against unforeseen events such as COVID illnesses, travel delays, and medical emergencies. Additionally, Cancel for Any Reason (CFAR) coverage can be made available for added flexibility.

- Cancel for Any Reason

- Interruption for Any Reason

- Sporting Equipment

- Inclement Weather

Silver-Gold-Platinum Product Suite

We understand that everyone has unique travel preferences. That's why we offer a range of options in our multi-level plan suite – Silver, Gold, Platinum. Your customers can choose the level of protection that best aligns with their travel style, providing coverage for unexpected events.

- Trip Cancellation

- Lost Skier Days

- Lost Golf Rounds

- Rental Car Collision Waiver

- Cancel for Any Reason

Airline Cancellation Protection

Increase your commission potential on airfare bookings by including travel insurance with every reservation. Our offerings include both domestic and international plans that safeguard non-refundable airfare for a wide range of covered reasons. This added flexibility can help transform potential buyers into confirmed bookings.

- Trip Interruption for Return Air

- Primary Medical

- Lost Baggage

Post Departure Protection

If cancellation protection isn't a priority for you, and you're seeking an affordable, all-encompassing coverage for your customers throughout their journey, our Post-Departure plan is the perfect choice. It empowers travel confidence from the moment they step out their front door until they return home, covering events like medical emergencies, baggage delay, and emergency evacuation.

- Trip Interruption for Return Air

- Lost Baggage Air

Let's partner together!

Interested in partnering with us to offer travel insurance? As a globally renowned and prominent brand, you can trust that your customers are protected by the top-notch solutions we offer. Together, let's discover the ideal product at the most cost-effective price to fulfill your specific business requirements. Become a partner NOW!

Top Travel Insurances for Argentina You Should Know in 2024

Byron Mühlberg

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

Argentina is famous for its tango, steak, and fine wine, as well as its natural wonders, such as the Iguazu Falls, the rolling Pampas, and the dramatic landscapes of Patagonia. Although travelling to Argentina can be an accessible holiday destination for many people, and although healthcare costs in the country aren't outrageously expensive, it's still a very good idea to arrive there with travel insurance anway, as you'll want the highest-quality healthcare you can find.

Luckily, online global insurances (known as 'insurtechs') specialize in cost-savvy travel insurance to Argentina and other countries worldwide. Our list below explores the four services we believe provide the best deals for young travellers, adventurers, everyday holidaymakers looking for comprehensive but affordable coverage, and longer-term expats.

Argentina Insurance Profile

Here are a few of the many factors influencing the scope and cost of travel insurances for Argentina:

Best Travel Insurances for Argentina

- 01. Should I get travel insurance for Argentina? scroll down

- 02. Best medical coverage: VisitorsCoverage scroll down

- 03. Best trip insurance: Insured Nomads scroll down

- 04. Best mix for youth and digitial nomads: SafetyWing scroll down

- 05. FAQ about travel insurance to Argentina scroll down

Heading to Argentina soon? Don't forget to check the following list before you travel:

- 💳 Eager to dodge high FX fees? See our picks for the best travel cards in 2024.

- 🛂 Need a visa? Let iVisa take care of it for you.

- ✈ Looking for flights? Compare on Skyscanner !

- 💬 Want to learn the local language? Babbel and italki are two excellent apps to think about.

- 💻 Want a VPN? ExpressVPN is the market leader for anonymous and secure browsing.

Do I Need Travel Insurance for Argentina?

Yes, travel insurance is mandatory for travel to Argentina. This means that as a traveller to Argentina, you must provide valid travel insurance coverage for the entire duration of your stay. If you don't arrive with travel insurance, you risk being denied entry into Argentina, or even deported in certain cases.

However, regardless of whether or not it's legally required, it's always a good idea to take our health insurance before you travel — whether to Argentina or anywhere else. For what's usually an affordable cost , taking out travel insurance will mitigate most or all of the risk of financial damage if you run into any unexpected troubles during your trip abroad. Take a look at the top five reasons to get travel insurance to learn more.

With that said, here are the top three travel insurances for Argentina:

VisitorsCoverage: Best Medical Coverage

Among the internet's best-known insurance platforms, VisitorsCoverage is a pioneering Silicon Valley insurtech company that offers comprehensive medical coverage for travellers going abroad to Argentina. It lets you choose between various plans tailored to meet the specific needs of your trip to Argentina, including coverage for medical emergencies, trip cancellations, and travel disruptions. With its easy online purchase process and 24/7 live chat support, VisitorsCoverage is a reliable and convenient option if you want good value and peace of mind while travelling abroad.

- Coverage 9.0

- Quality of Service 9.0

- Pricing 7.6

- Credibility 9.5

VisitorsCoverage offers a large variety of policies and depending on your needs and preferences, you'll need to compare and explore their full catalogue of plans for yourself. However, we've chosen a few highlights for their travel insurance for Argentina:

- Policy names: Varies

- Medical coverage: Very good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, mental health-related conditions, and many others.

- Trip coverage: Excellent - but only available for US residents.

- Customer support: FAQ, live chat and phone support

- Pricing range: USD 25 to USD 150 /traveller /month

- Insurance underwriter: Lloyd's, Petersen, and others

- Best for: Value for money and overall medical coverage

Insured Nomads: Best Trip Coverage

Insured Nomads is another very good travel insurance option, especially if you're adventurous or frequently on the go and are looking for solid trip insurance with some coverage for medical incidents too. With Insured Nomads, you can choose the level of protection that best suits your needs and enjoy a wide range of benefits, including 24/7 assistance, coverage for risky activities and adventure sports, and the ability to add or remove coverage as needed. In addition, Insured Nomads has a reputation for providing fast and efficient claims service, making it an excellent choice if you want peace of mind while exploring the world.

- Coverage 7.8

- Quality of Service 8.5

- Pricing 7.4

- Credibility 8.8

Insured Nomads offers three travel insurance policies depending on your needs and preferences. We go through them below:

- Policy names: World Explorer, World Explorer Multi, World Explorer Guardian

- Medical coverage: Good. Includes coverage for doctor and hospital visits, pre-existing conditions, repatriation, and many others.

- Trip coverage: Good. Includes coverage for trip cancellation and interruption, lost or stolen luggage (with limits), adventure and sports activities, and many others.

- Customer support: FAQ, live chat, phone support

- Pricing range: USD 80 to USD 420 /traveller /month

- Insurance underwriter: David Shield Insurance Company Ltd.

- Best for: Adventure seekers wanting comprehensive trip insurance

SafetyWing: Best Combination For Youth

SafetyWing is a good insurance option for younger travellers or digital nomads because it offers flexible but comprehensive coverage at a famously affordable price. With SafetyWing, you can enjoy peace of mind knowing you're covered for unexpected medical expenses, trip cancellations, lost or stolen luggage, and more. In addition, SafetyWing's user-friendly website lets you manage your policy, file a claim, and access 24/7 assistance from anywhere in the world, and, unlike VisitorsCoverage, you can even purchase a policy retroactively (e.g. during a holiday)!

- Coverage 7.0

- Quality of Service 8.0

- Pricing 6.3

- Credibility 7.3

SafetyWing offers two travel insurance policies depending on your needs and preferences, which we've highlighted below:

- Policy names: Nomad Insurance, Remote Health

- Medical coverage: Decent. Includes coverage for doctor and hospital visits, repatriation, and many others.

- Trip coverage: Decent. Includes attractive coverage for lost or stolen belongings, adventure and sports activities, transport cancellation, and many others.

- Pricing range: USD 45 to USD 160 /traveller /month

- Insurance underwriter: Tokyo Marine HCC

- Best for: Digital nomads, youth, long-term travellers

How Do They Compare?

Interested to see how VisitorsCoverage, SafetyWing, and Insured Nomads compare as travel insurances to Argentina? Take a look at the side-by-side chart below:

Data correct as of 4/1/2024

FAQ About Travel Insurance to Argentina

Travel insurance typically covers trip cancellation, trip interruption, lost or stolen luggage, travel delay, and emergency evacuation. Some travel insurance packages also cover medical-related incidents too. However, remember that the exact coverage depends on the insurance policy.

Yes, medical travel insurance is almost always worth it, and we recommend taking out travel insurance whenever visiting a foreign country. Taking out travel insurance will mitigate some or all of the risk of covering those costs yourself in case you need medical attention during your stay. In general, we recommend VisitorsCoverage to travellers worldwide because it offers excellent value for money and well-rounded travel and medical benefits in its large catalogue of plans.

Health insurance doesn't cover normal holiday expenses, such as coverage for missed flights and hotels, but in case you run into medical trouble while abroad, it may cover some or all of your doctor or hospital expenses while overseas. However, not all health insurance providers and plans offer coverage to customers while abroad, and that's why it's generally best to take out travel insurance whenever you travel.

Although there's overlap, health and travel insurance are not exactly the same. Health insurance covers some or all of the cost of medical expenses (e.g. emergency treatment, doctor's visits, etc.) while travel insurance covers non-medical costs that are commonly associated with travelling (e.g. coverage for missed flights, stolen or lost personal belongings, etc.).

The cost of travel insurance depends on several factors, such as the length of the trip, the destination, the age of the traveller, and the level of coverage desired. On average, travel insurance can cost anywhere between 3% and 10% of the total cost of the trip.

A single-trip travel insurance policy covers a specific trip, while an annual one covers multiple trips taken within a one-year period. An annual policy may be more cost-effective for frequent travellers.

Yes, you can sometimes purchase travel insurance after starting your trip, but it is best to buy it before the trip begins to ensure maximum coverage. If you do need to buy insurance after you've started your trip, we recommend VisitorsCoverage , which offers a wide catalogue of online trip and medical insurance policies, most of which can be booked with immediate effect. Check out our guide to buying travel insurance late to learn more.

Yes, you can most certainly purchase travel insurance for a trip that has already been booked, although we recommend purchasing insurance as soon as possible aftwerwards to ensure all coverage is in place before your journey begins. Check out our guide to buying travel insurance late to learn more.

See Our Other Travel Insurance Guides

Looking for Travel Insurance to Another Country?

See our recommendations for travel insurance to other countries worldwide:

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

Coronavirus (COVID-19) Travel Disruption Advice

Updated 7th August 2020

Everything about affected countries

The Covid-19 situation is constantly evolving. Please check individual Government websites and the World Health Organization (‘WHO’) to access the latest information about the situation: https://www.who.int/emergencies/diseases/novel-coronavirus-2019 Please specify the country you would like to check.

Everything about cancellation benefit

Transport providers have an obligation to refund the customer if they have cancelled the booking. In addition to this many accommodation providers are offering refunds, date changes at no cost and credit notes. EU Air Passenger Rights: • If your flight is within the EU and is operated either by an EU or a non-EU airline • If your flight arrives in the EU from outside the EU and is operated by an EU airline • If your flight departs from the EU to a non-EU country operated by an EU or a non-EU airline Link for EU Air Passenger Rights - Coronavirus: https://europa.eu/youreurope/citizens/travel/passenger-rights/air/index_en.htm. They should provide a voucher or refund.

In the first instance you should contact the property owner or booking agent. They will normally be responsible for refunding all or part of your accommodation costs. For bookings made in the UK, or with a UK agency, you may follow CMA guidelines and make a complaint with them. If your booking is with a oversees agent, you may submit a claim and we will be able to give further guidance. Your insurance will only consider costs which are both explicitly excluded in your booking agreement and which are covered in your policy.

Airlines/package holiday providers may offer you reimbursement through either a voucher or monetary refund. Customers are being encouraged to accept voucher refunds by airlines/package holiday providers which will allow them to rebook their trip for a later date. The intention is that these vouchers will have ABTA financial protection which means if the tour operators cease trading the customer would be able to seek a refund through ABTA.

If you are dissatisfied with the voucher they have been offered, you are entitled to refuse this with the airline and/or tour operators obtain a monetary refund.

If you accept the vouchers but do not them use them in the period for which they are valid, then you cannot claim this cost from the insurance policy.

ABTA - https://www.abta.com/tips-and-advice/is-my-holiday-protected/new-package-travel-regulations EU Air Passenger Rights - Coronavirus: https://europa.eu/youreurope/citizens/travel/passenger-rights/air/index_en.htm Package Regulations: https://www.abta.com/tips-and-advice/is-my-holiday-protected/new-package-travel-regulations

There is no coverage for this scenario as we do not consider claims because of loss of enjoyment. We would only consider this claim if the relevant authorities advise against travel to the destination in question.

Please open a case with the Claims Team. You will have provide us with medical information confirming your condition so that we can consider your claim.

If you hold a package holiday, you can pursue a refund with your tour operator under package regulations. If you have independent bookings, your flight would be claimable with the airline under the Denial of boarding regulation. For independently booked accommodation, you should contact your accommodation provider directly. If they refuse to refund, we will require your full booking terms and conditions, including a letter from them confirming why they will not refund. Bookings made within the UK will fall under UK CMA guidelines of and you can make a complaint with the CMA against your provider. If you made your booking directly with the accommodation provider abroad, please open a case with the Claims Team. You will have to share documentation showing your travel booking date, itinerary and trip dates along with a brief explanation of why you could not travel (Official Government Travel Advice…) and we will be able guide you further.

Please contact our claims team. You will have to provide the reason for your claim and further supporting documents so that we can assist you further. You can make a claim online or via email as follows: - Visit our online claims page https://claimsform.axa-travel-insurance.com/ or send an email to [email protected].

You should contact your airline or travel provider to seek refund or postpone your trip. They should provide you with a full refund or travel credit. Where the Government in your country of Residence, Destination or any countries you pass through advise against travel due to Covid 19, you will not be covered to travel whilst advice is in place.

All claims will be assessed individually in accordance with your terms and conditions. There are specific perils listed in your policy for coverage and we would recommend you check this to see if your claim falls within those perils. If unsure, you can register a case with us and we will assess your reasons for cancellation in line with terms and conditions

There is no cover to cancel a trip due to the event which you were due to attend is no longer going ahead. If the event was cancelled due to Covid you should pursue refund from the provider directly.

If your trip and policy were purchased prior to 11th March 2020 and you are not travelling against advice from your Country of Residence, Destination or any countries you pass through, then we would consider a claim for an early return and any necessary accommodation costs up to the limit shown in your policy. If your trip and/or policy was booked after 11th March, you will not be covered

If your trip and policy were purchased prior to any non-travel advice in your Country of Residence, then we would consider a claim up to the limit shown in your policy if your policy supports trips within your home country. Please refer to your policy terms and conditions. - this needs to go back in to the package and independent booking advice

We will consider your claim on a case-by-case basis irrespective of any connection to Covid 19. Some policies provide cover where a close family member (as defined in your policy) suffers serious illness or death - provided you were not aware of the seriousness of their condition prior to starting your trip. For full details, please refer to your policy wording.

Providng you haven't travelled against regulatory advice, you are covered to stay abroad for the duration of your trip - unless you are requested to return home by the local Government or the Government of your Country of Residence. The duration of cover will be extended if we/you are unable to secure new flights home, despite your/our best endeavours to do so. Any decision on your part to remain beyond your original travel plan, or the earliest flight offered to you to come home will result in your cover being ceased. If you require any assistance whilst abroad you should call the Emergency Assistance line in your policy document.

Please contact your holiday provider in this instance, as your contract of payment is with them. They will advise you. Please be aware that any potential refund may be dependent on full payment of the trip prior to travel.

As the travel operator has issued you a cash alternative for your holiday, there is no claim to make under your policy. If you prefer a cash refund instead of the voucher you will need to speak to the Travel Operator or Booking Agent.

Please contact our Claims department and we will consider your claim. You should seek a refund from the tour operator, travel and accomodation provider in the first instance and provide details of their response as part of your claim. If the accommodation is booked in the UK, please contact the accomodation provider for a refund.

Unfortunately, as the Travel provider has settled the contract with you, there is no further payment due. You will need to contact the Travel provider again to discuss the voucher expiry.

Unfortunately, your policy does not cover disinclination to travel. If the trip is going ahead as planned we would suggest you talk to your tour operator or travel provider directly.

We are not recommending our customers cancel their trips as it may affect your rights or ease in obtaining a refund - its best wait to see if what FCO or local Government advice is in place within 28 days of your trip. If you have cancelled your trip, please speak to your Tour Operator or Travel operator regarding a refund.

Please contact our Claims team to discuss the cancellation of your trip. Visit our online claims page or send an email to [email protected].

Please contact our Claims team to discuss the cancellation of your trip. Visit our online claims page or send an email to [email protected]. We will need you to provide evidence of the track and trace notification and advice.

If you bought your policy prior to 11th March 2020, we can consider your claim.Please contact our Claims team to discuss the cancellation of your trip. Visit our online claims page or send an email to [email protected].

Your tour operator will arrange your return if a full ban is implemented and you are required to come home immediately. If the FCO or other government agency have advised against all but essential travel, but have also said domiciled residents aren't required to come home immediately, you can continue your trip as planned, your policy will remain in force. If you wish to come home early, please tell us why so that we can consider if your claim.

Everything about curtailment benefit

We can only consider your claim where there is government advice asking you to return to your home area as soon as possible.

If you bought your policy prior to 11th March 2020, we can consider your claim. Please contact our Claims team to discuss the cancellation of your trip. Visit our online claims page or send an email to [email protected].

Everything about customer service

Please call on the Claims number mentioned in your Policy Wording. This will be found under the section, Making a Claim.

Everything about expenses

If your trip and policy were purchased prior to 11th March 2020, providing you haven't travelled against regulatory advice, if you are quarantined abroad due to Medical or Government advice beyond your Return Date you will be covered for accommodation costs up to the limit shown in your policy. Any pre-paid excursions or activities purchased prior to your quarantine and which you are unable to undertake will be consider as per the policy limits. Please refer to your Terms & Conditions for your policy limit. If you are still abroad, please contact your 24-hour medical assistance team for guidance by calling the number on the back of your card. If your trip was booked after 11th March, please check your Terms & Conditions.

Everything about medical assistance

We will continue to cover all valid medical claims caused by coronavirus if you're travelling to an area where no regulatory advice against travel is in place. Please however note that policies sold after 11th March do not hold cover for cancellation or curtailment/cutting short your trip due to Corona Virus/Covid 19.

If you are still abroad you should call the Emergency Assistance line in your policy document.

Everything about missed departure

If your trip and policy were booked before 11th March, if your airline or travel provider cannot book you on a later flight, we may be able cover an alternative flight under the Terms and Conditions. If your trip and/or policy was booked after 11th March, you will not be covered.

Everything about making a claim

You can make a claim online or via email as follows: - Visit our online claims page or send an email to [email protected].

IMAGES

VIDEO

COMMENTS