- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Capital One Venture vs. Chase Sapphire Preferred 2024: Sapphire Shines a Bit Brighter

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The Chase Sapphire Preferred® Card and the Capital One Venture Rewards Credit Card don’t provide the multitude of perks you’d find with ultra-premium travel cards, but they both offer quite a bit of value thanks to generous sign-up bonuses and comparatively modest annual fees.

The Capital One Venture Rewards Credit Card stands out for how simple it is to use, but the Chase Sapphire Preferred® Card comes out slightly ahead because the points it earns are worth 25% more when you redeem them for travel through Chase. If you carry other cards that earn Chase Ultimate Rewards® points, like the Chase Freedom Flex℠ or Chase Freedom Unlimited® , you can transfer points to your Chase Sapphire Preferred® Card to redeem for that higher rate.

Here’s how to decide which is right for you.

» MORE: NerdWallet’s best travel credit cards

At a glance

on Chase's website

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

5 points per $1 spent on all travel booked through Chase.

3 points per $1 spent on dining (including eligible delivery services and takeout).

3 points per $1 spent on select streaming services.

3 points per $1 spent on online grocery purchases (not including Target, Walmart and wholesale clubs).

2 points per $1 spent on travel not booked through Chase.

1 point per $1 spent on other purchases.

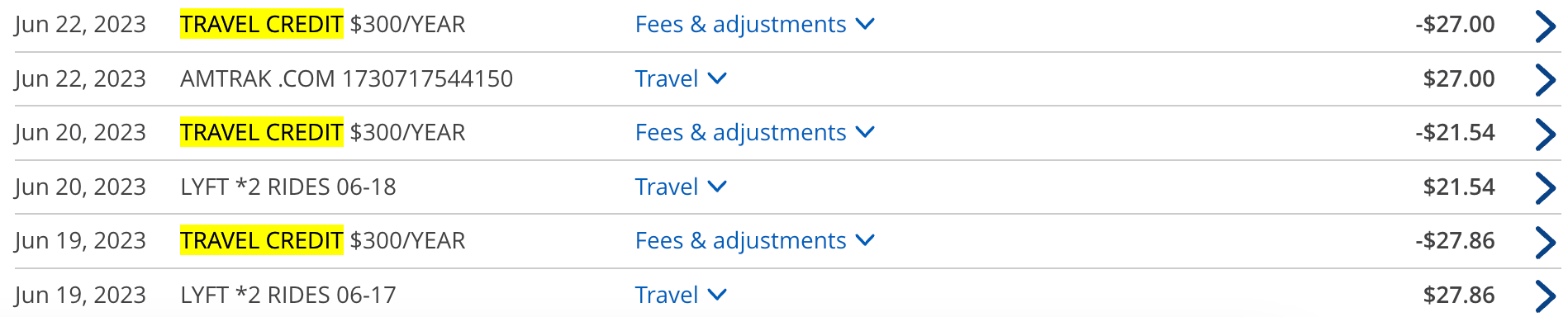

Through March 2025: 5 points per $1 spent on Lyft.

Points are worth 1.25 cents apiece when redeemed for travel through Chase.

5 miles per $1 spent on hotels and rental cars booked through Capital One Travel.

2 miles per $1 spent on all other purchases.

Transfer points to airline and hotel partners.

Travel protections including rental car insurance, trip cancellation, interruption or delay coverage, and baggage delay coverage.

Up to $100 credit to cover Global Entry or TSA Precheck.

Rental car and travel accident insurance.

Two complimentary visits per year to Capital One Lounges or to 100+ Plaza Premium Lounges.

Why the Chase Sapphire Preferred® Card is better for most people

The Chase Sapphire Preferred® Card boasts higher point-earning opportunities, depending on your spending. In general, Chase Ultimate Rewards® points are worth 1 cent each. But if you redeem them for travel booked through Chase, their value rises to 1.25 cents apiece. That effectively makes your rewards rate 2.5% on travel and dining and 1.25% on everything else. It's also the choice if you're the type who strives to squeeze maximum value out of your rewards, especially since you can transfer points earned on certain other Chase cards to the Chase Sapphire Preferred® Card , supersizing your stash of rewards.

Chase boasts some big-name transfer partners, too, including JetBlue, Southwest, United and Marriott Bonvoy.

And if you’ve ever experienced travel plans completely falling apart, you’ll appreciate the card’s built-in travel protections:

Trip cancellation and interruption insurance: Get reimbursed for up to $10,000 per person and $20,000 per trip if you must cancel or go home early due to a covered reason like illness or severe weather.

Rental car coverage: Primary collision and theft insurance.

Baggage delay insurance: Get up to $100 a day for five days to buy clothing and toiletries if your baggage is delayed.

Trip delay reimbursement: If you’re delayed for more than 12 hours or must stay overnight, you’re covered for up to $500 per ticket on your reservation for meals and lodging.

Emergency assistance: This is helpful if you experience an emergency while traveling. You will be responsible for the cost of any services you opt into.

The Capital One Venture Rewards Credit Card offers rental car coverage and travel accident insurance, which is helpful, but doesn’t go above and beyond.

» MORE: 11 benefits of the Capital One Venture Rewards Credit Card

Who might prefer the Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card is a remarkably easy card to use. Not only do you earn 2 miles per $1 on all purchases, so there’s no need to keep track of spending categories, but redeeming for travel is as simple as requesting a statement credit. Capital One considers purchases from the following merchants to count as travel: airlines, hotels, rail lines, car rental agencies, limousine services, bus lines, cruise lines, taxi cabs, travel agents and timeshares. Miles are worth one cent each when redeemed for travel.

You can also transfer miles to more than a dozen airline and hotel loyalty programs, but Capital One doesn't have any domestic airlines as travel partners.

You can transfer Capital One miles to other Capital One cards that earn miles, including the Capital One VentureOne Rewards Credit Card and Capital One Spark Miles for Business , which is a definite advantage. You can also transfer cash rewards to the Capital One cards that earn miles.

» MORE: Capital One Miles: How the program works

Which card should you get?

Both cards have their upsides, but the Chase Sapphire Preferred® Card comes out slightly ahead because of its higher point redemption rate, robust list of transfer partners and comprehensive travel protections.

» Learn more: Is the Chase Sapphire Preferred® Card worth its annual fee?

If you’d simply prefer the flexibility to book however you want and pay with rewards later, the Capital One Venture Rewards Credit Card is probably more your speed.

» MORE: How to choose a travel credit card

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

1%-10% Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases. Earn 8% cash back on Capital One Entertainment purchases. Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024. Terms apply.

$200 Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening.

2x-10x Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel, Earn unlimited 2X miles on all other purchases.

75,000 Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Chase Sapphire Preferred vs. Capital One Venture

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Building credit

- • Credit card debt

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- The Chase Sapphire Preferred® Card and Capital One Venture Rewards Credit Card both have an annual fee of $95, but their similarities end there.

- These two popular travel rewards credit cards have fairly different rewards structures, meaning that choosing between them will likely come down to your spending habits and the ways you like to travel.

- For those who like maximizing their rewards through category spending, the Sapphire Preferred will likely be a better pick, while those looking for a travel card with a strong flat-rate rewards rate will likely prefer the Venture.

The Chase Sapphire Preferred® Card and Capital One Venture Rewards Credit Card are two of the most flexible travel credit cards on the market today, but they vary dramatically in terms of how you can redeem your rewards. Both cards let you exchange points or miles for travel directly or transfer them to airline and hotel partners, but they do so at very different values and with a different set of partners.

The way you earn points or miles with each card also varies, with the Venture Rewards card, commonly called the Venture, offering a flat 2X miles on all purchases and the Sapphire Preferred giving cardholders a higher rate in select categories.

With both of these travel credit cards offering generous sign-up bonuses right now, you may be wondering which one would leave you better off. Bankrate’s expert analysis below will help you determine the value of each offer and which card might work better for your needs.

Main details

Chase sapphire preferred vs. capital one venture highlights.

At first glance, these cards seem somewhat similar in terms of their rewards structures and bonuses. However, they earn different types of rewards, which are not valued the same. We go over the most popular categories each card stands out in below.

Why they tied

At first glance, it may seem like the Capital One Venture Rewards, which is offering a welcome bonus of 75,000 miles once you spend $4,000 on purchases within three months from account opening, has the better offer. The welcome bonus , also called a sign-up bonus, from Chase Sapphire Preferred lets new cardholders earn 60,000 points when they spend $4,000 on their card within three months of account opening, which is 15,000 points less than the Venture.

But because of how much these points are worth, the result is a tie. Each welcome bonus offer is worth up to $750 when redeemed through each issuer’s respective travel portal.

However, it’s good to keep in mind that there are other ways to redeem your points, meaning that 15,000 more of them from the Venture might work out better for you. Also, Capital One miles are worth up to 1.7 cents and Chase Ultimate Rewards points are worth up to 2.0 cents each with the right high-value transfer partner, based on Bankrate’s points and miles valuations . So if you want to transfer your points to a high-value partner, you’d likely get more worth out of the Sapphire Preferred.

Chase Sapphire Preferred

Chase Ultimate Rewards points are worth more in general, and because the Chase Sapphire Preferred offers boosted rewards in a variety of spending categories, it pulls ahead of the Capital One Venture. With the Chase Sapphire Preferred, you can get:

- 5X points on travel purchased through Chase Ultimate Rewards

- 3X points on dining (including eligible delivery services, takeout and dining out)

- 3X points on select streaming services

- 3X points on online grocery purchases (excluding Walmart, Target and wholesale clubs)

- 2X points on other travel purchases

- 1X points on everything else

The card also currently has a promotion with Lyft to provide 5X points total — 2X points from the general travel category plus 3X points as a bonus.

The Venture, on the other hand, offers a flat 2X miles for each dollar you spend, which will likely help you rack up more miles on all your regular spending and bills over time. On top of that, you’ll still get boosted rewards of 5X miles for hotels and rental cars booked through the Capital One Travel portal.

Because the Sapphire Preferred gives you more chances to earn higher boosted rewards, particularly in popular spending categories, it wins when it comes to rewards rates. However, the real winning card depends on how you like to spend. A cardholder who puts all their purchases on one card will likely come out ahead with the Venture’s flat rate of 2X miles for all other purchases when compared to the Sapphire Preferred’s rate of 1X points.

You should do the math on your own budget to see which works better for your individual needs (check out how to calculate this in our spending example below).

Both of these cards charge the same $95 annual fee , which is very reasonable considering the rewards proposition each card offers. The fact you can earn such a big bonus the first year with both cards also makes the fee a good value for the first year especially.

Neither card charges foreign transaction fees on purchases you make outside of the United States. That means both are a good value and a good option if you travel abroad often or purchase online from foreign websites.

Which card earns the most?

With the Capital One Venture letting cardholders earn 2X miles for every dollar they spend, this card can easily help you rack up a higher number of miles over time. But with the value of Chase Ultimate Rewards points being higher in general, the Chase Sapphire Preferred can still help you earn a similar amount of value in rewards.

Let’s do the math.

Chase Sapphire Preferred vs. Capital One Venture spending example

Imagine you’re someone who spends a lot on travel and dining each month, but that you also use your credit card to pay for regular spending and bills. In that case, your monthly spending might look something like this:

- $200 per month spent on dining

- $100 per month spent on general travel

- $200 per month spent on eligible travel through the travel portals

- $300 per month spent on groceries

- $1,200 spent on other purchases

With the Chase Sapphire Preferred, you’d earn 3,900 points per month, which would be 46,800 points per year. With the welcome bonus, that comes out to 106,800 for the first year.

With the Capital One Venture, you’d get 4,600 miles per month, equating to 55,200 miles per year. Add the welcome bonus you earned to that number, and your first year’s total would be 130,200 miles. That’s a difference of 23,400 miles in the first year and a difference of 8,400 miles per year after that.

However, due to the valuations of these rewards points when redeemed in their respective travel portal, 55,200 Capital One miles are worth $552, but 46,800 Chase Ultimate Rewards points are worth $585. So, while you may earn more miles with the Capital One Venture, the Chase Sapphire Preferred’s Ultimate Rewards points will give you more bang for your buck.

This is all from one specific spending example, however, and it comes with some caveats. For example, while both cards earn 5X the points or miles on travel booked through their respective travel portals, the Capital One Venture only includes hotels and rental cars in that category, so you wouldn’t earn 5X the points on flights the way you could with the Chase Sapphire Preferred. But the Sapphire Preferred also requires cardholders to track their spending more closely to make sure they’re maxing out their rewards categories. If you don’t buy your groceries online, for example, you wouldn’t be able to take advantage of the Sapphire Preferred’s boosted rewards on grocery purchases.

Money tip: If you'd prefer not to worry much about bonus categories or find yourself spending more in miscellaneous purchases, then earning the flat 2X miles with the Capital One Venture is going to be the better choice. If you spend a lot in certain categories and like how much value you get from Ultimate Rewards points, then the Sapphire Preferred would likely be better for you.

Why should you get the Chase Sapphire Preferred?

With so many bonus categories, the Chase Sapphire Preferred is a good rewards card whether you travel often or not. Plus, when it comes to using your rewards, you can cash them in for a lot more than travel.

Here are some additional reasons to consider signing up:

Additional benefits

Sapphire Preferred cardholders also get a 10 percent anniversary point bonus each account anniversary. That means if you earned 50,000 points in a year, you’d receive 5,000 additional bonus points.

The Chase Sapphire Preferred also gives cardholders perks like trip cancellation and interruption insurance worth up to $10,000 per person and $20,000 per trip. You also qualify for benefits such as:

- Primary auto rental coverage

- Baggage delay insurance

- Lost luggage reimbursement

- Trip delay reimbursement

- Travel and emergency assistance services

- Travel accident insurance

- Purchase protection

- Extended warranties

Redemption options

The Chase Sapphire Preferred really stands out in terms of its rewards program. Chase Ultimate Rewards points can be redeemed for options like statement credits, cash back, gift cards and merchandise. However, you can also redeem points for travel through the Chase Travel portal and get 25 percent more value when you do.

The Chase Ultimate Rewards program also offers a robust transfer program that lets you move your points to airline and hotel partners like Marriott Bonvoy, Southwest Rapid Rewards, World of Hyatt and United MileagePlus. With high-value transfer partners, each point can be worth up to 2 cents each.

Recommended credit score

To successfully apply for a Chase Sapphire Preferred, you typically need at least a FICO credit score of 670 or better.

Why should you get the Capital One Venture?

The Capital One Venture lets you earn a flat 2X miles for each dollar you spend, which can be a better deal if you don’t like to keep track of bonus category spending. Here are some additional reasons you might prefer the Venture over the Sapphire Preferred:

The Capital One Venture stands out due to the fact you get up to a $100 credit toward Global Entry or TSA PreCheck membership as a cardholder perk. This credit can be used for the primary cardholder or someone else. You also get free cardholder benefits such as:

- An auto rental collision damage waiver

- 24-hour travel assistance

Learn more: The Capital One Venture Rewards benefits guide

When you earn miles with this card, you can redeem them to cover travel purchases at a rate of 1 cent per point or cash them in for purchases made on Amazon.com. You can also transfer your miles to airline and hotel partners like Aeromexico, Aeroplan, Flying Blue / Air France, Accor and more.

Just remember that Capital One miles do not transfer at the same favorable ratio as Chase Ultimate Rewards. Using a high-value transfer partner will mean that your miles are worth up to 1.7 cents each, but in other scenarios, your points might lose value. Some Capital One mile transfer partners let you convert miles at a ratio of 2:1.5. Others, like Accor, Emirates and Singapore Airlines, let you transfer at an even worse ratio of 2:1.

To get approved for the Capital One Venture, you typically need at least a FICO credit score of 670 or better.

The bottom line

Both of these rewards credit cards offer generous welcome bonuses with the same annual fee of $95, and they both let you redeem your points for travel or for additional options for more flexibility.

However, each card has a different type of rewards structure and a different set of transfer partners that may work better for you depending on your spending and travel habits. If you prefer to charge everything to one card and tend to spend a lot in miscellaneous categories, then the Capital One Venture might be your best bet. If you want to maximize your rewards in certain categories, want more travel protections and prefer the value that comes with earning Chase Ultimate Rewards, then you’d be better off with the Chase Sapphire Preferred.

If you can’t decide between these Chase and Capital One credit cards , consider checking out other travel rewards credit cards before applying. You can use Bankrate’s card comparison tool to help you find out which one is right for you.

Related Articles

Premium credit card comparison: Chase Sapphire Reserve vs. Capital One Venture X vs. Amex Platinum

Southwest Rapid Rewards Plus vs. Capital One Venture Rewards

Capital One Venture X vs. Chase Sapphire Reserve

Southwest Rapid Rewards Plus Credit Card vs. Chase Sapphire Preferred

Chase Sapphire Preferred vs Capital One Venture: Card comparison

- How to use Chase Ultimate Rewards points

How to use Capital One Venture miles

- Benefits comparison

- Which card should you choose?

Chase Sapphire Preferred vs Capital One Venture: How to decide which travel rewards credit card is best for you

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The Chase Sapphire Preferred has long been a favorite among travelers with its useful spending categories and top-notch travel and purchase protections. But it faces stiff competition from the Capital One Venture Rewards Credit Card , which comes with a fantastic intro offer of its own.

While both of these travel credit cards are a terrific choice for beginners and experts alike, each offers a unique set of rewards, benefits, and costs. Depending on where you spend most and how you like to travel, one may make more sense for your needs than the other (though it's certainly possible to have both).

Here's a head-to-head face-off between these cards to help you decide which best fits your situation.

The Chase Sapphire Preferred and Capital One Venture Rewards Credit Card are both travel rewards credit cards with similar annual fees. The way you earn and redeem rewards with each card is different, so it's important to look at what sets them apart to decide which could be best for your needs.

The Chase Sapphire Preferred offers:

- 5 points per dollar on Lyft rides through March 2025

- 5 points per dollar on all travel purchased through Chase Travel

- 3 points per dollar on dining, select streaming services, and online grocery purchases (excluding Target, Walmart, and wholesale clubs)

- 2 points per dollar on other travel

- 1 point per dollar on everything else

That's comparatively many bonus categories when compared to the Capital One Venture Rewards Credit Card, which earns 5 miles per dollar on hotels and car rentals booked through Capital One and an unlimited flat 2 miles per dollar on all other purchases. This card trades bonus categories for a substantial return on all spending.

Chase Ultimate Rewards points and Capital One miles work differently, and each may appeal to a different type of traveler. In general, the Chase Sapphire Preferred is better for those who want to squeeze out more value per point and are willing to put in a little time to figure out the best way to redeem points with the Chase Ultimate Rewards® program's airline and hotel transfer partners.

The Capital One Venture Rewards Credit Card is better for those looking for really easy and flexible redemptions. To understand why, let's dive into the details of each program and how the redemption options work.

How to use Chase Ultimate Rewards points from the Chase Sapphire Preferred

Earn 5x on travel purchased through Chase Travel℠. Earn 3x on dining, select streaming services and online groceries. Earn 2x on all other travel purchases. Earn 1x on all other purchases.

21.49% - 28.49% Variable

Earn 60,000 bonus points

Good to Excellent

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. High intro bonus offer starts you off with lots of points

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Strong travel coverage

- con icon Two crossed lines that form an 'X'. Doesn't offer a Global Entry/TSA PreCheck application fee credit

If you're new to travel rewards credit cards or just don't want to pay hundreds in annual fees, the Chase Sapphire Preferred® Card is a smart choice. It earns bonus points on a wide variety of travel and dining purchases and offers strong travel and purchase coverage, including primary car rental insurance.

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

Chase points are worth 1.25 cents apiece toward travel reservations booked through the Chase Travel Portal℠ when you hold the Chase Sapphire Preferred.

Points can be worth a lot more, however, when you transfer to partner airlines. You can also transfer to hotel partners, but airlines tend to offer the best value. For example, I got a huge value when I took my dad to Israel in business class with Chase points transferred to my United account .

All Chase Ultimate Rewards® transfers are at a 1:1 ratio, meaning 1 Chase point = 1 airline mile or 1 hotel point.

The Sapphire Preferred card lived in my wallet for a very long time until I decided to upgrade it to the ultra-premium Chase Sapphire Reserve . But I still think the Sapphire Preferred is the best card for people new to travel rewards. It gives you a ton of value and a lot of protections. If you ever have any trouble, Chase customer support for these cards is very good.

Don't overlook the value of the Sapphire Preferred's other benefits, too. Chase helped my sister get her money back after a bad experience with an African tour guide operator. But that's a story for another day.

The card charges a $95 annual fee and currently has an intro bonus offer of 60,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. That can get you $1,080 in travel (based on Insider's valuations) when you transfer points to airline and hotel partners.

The easiest way to use Capital One miles is to redeem them to cover travel charges from your Venture card statement posted within the past 90 days. All you need to do is open your online account, find the charge in your transaction history, and erase it with miles at a rate of 1 cent per mile.

If you're willing to get a bit more complicated, Capital One now offers 18 airline and hotel partners with which you can receive outsized redemption value.

The list offers a wide array of international airlines, including some of the most aspirational in the world — Singapore, Emirates, and Etihad often battle for the title of the world's most luxurious airline.

Because flights sometimes go on sale, you might get the best value by redeeming right through the Capital One portal. Similar to Chase, you can always run the numbers for a specific flight to compare.

The card charges a $95 annual fee ( rates and fees ) and currently offers a substantial bonus: 75,000 miles after spending $4,000 on purchases within three months from account opening.

Chase Sapphire Preferred and Capital One Venture benefits comparison

Both the Chase Sapphire Preferred and Capital One Venture Rewards Credit Card waive foreign transaction fees and a wide range of travel and purchase coverage.

The Chase Sapphire Preferred includes trip cancellation insurance, primary car rental insurance, baggage delay insurance, trip delay insurance, and travel emergency assistance. At the checkout counter, it offers purchase protection and extended warranty on eligible items. It also offers up to $50 in credit each year toward hotels booked through the Chase Travel Portal℠.

The Capital One Venture Rewards Credit Card comes with travel assistance service***, secondary car rental insurance***, travel emergency assistance***, and extended warranty on eligible purchases***. One big benefit you don't get with the competitor, in this case, is up to $100 credit for TSA's Global Entry or PreCheck programs when you pay with the Capital One Venture Rewards Credit Card.

For benefits, Capital One's card is a little lighter than what you get from Chase. Depending on how much you travel and the anticipated costs along the way, those insurance and protection benefits can be very valuable.

Should you choose the Chase Sapphire Preferred or Capital One Venture?

If I had to pick a winner, it would be the Chase Sapphire Preferred.

While the Capital One Venture Rewards Credit Card gives you more miles per dollar across the board and offers more transfer partners, its airline partners won't be as useful to many US travelers, so it's harder to get outsized value.

Advanced travelers and those who are willing to research award availability on major US travel partners can get the best results from Chase Sapphire Preferred. Those who just want to keep things easy and flexible will enjoy the Capital One Venture Rewards Credit Card's structure a little more.

The Chase Sapphire Preferred also has the edge when it comes to travel protections like primary car rental insurance and trip delay insurance — hopefully, you don't have to put these benefits to use, but if you do they can save you some serious cash. You've also got plenty of non-travel redemption options with the Chase Sapphire Preferred if you're not ready to stray too far from home just yet.

Either way, regular travelers looking to get a travel rewards card with an annual fee of around $100 will do very well with one of these cards.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

***Terms, conditions, and exclusions apply. Refer to your Guide to Benefits for more details. Travel Accident Insurance is not guaranteed, it depends on the level of benefits you get at application.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

- Main content

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Best of Wellness Awards 2024

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

Chase sapphire preferred card vs. capital one venture x rewards card: which card is better for travel, the capital one venture x rewards card comes with a higher annual fee but more travel perks..

The Chase Sapphire Preferred® Card and the Capital One Venture X Rewards Credit Card are two popular credit cards designed for rewarding those who love to spend on travel. They do have big differences in the annual fees they charge — the Chase Sapphire Preferred card has a $95 annual fee while the Venture X card has a $395 annual fee (see rates and fees ). But their rewards programs and perks should be enough to offset each respective fee. The two cards are consistently solid contenders for those who want to upgrade to a card that gives them more bang for their buck, especially when booking flights and hotels.

Below, CNBC Select compares both cards to help you figure out which one works best with your lifestyle and spending needs.

Chase Sapphire Preferred Card vs. Capital One Venture X Rewards Card

Card rewards, redemption options, the welcome bonus, additional perks, bottom line, chase sapphire preferred® card.

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Welcome bonus

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Regular APR

21.49% - 28.49% variable on purchases and balance transfers

Balance transfer fee

Either $5 or 5% of the amount of each transfer, whichever is greater

Foreign transaction fee

Credit needed.

Excellent/Good

Terms apply.

Read our Chase Sapphire Preferred® Card review .

- Points are worth 25% more when redeemed for travel via Chase Travel℠

- Transfer points to leading frequent travel programs at a 1:1 rate, including: IHG® Rewards Club, Marriott Bonvoy™ and World of Hyatt®

- Travel protections include: auto rental collision damage waiver, baggage delay insurance and trip delay reimbursement

- No fee charged on purchases made outside the U.S.

- $95 annual fee

- No introductory 0% APR

Capital One Venture X Rewards Credit Card

Unlimited 2X miles on all eligible purchases, and 5 Miles per dollar on flights and 10 Miles per dollar on hotels and rental cars when booked via Capital One Travel portal

Earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

19.99% - 29.99% (Variable)

$0 at the Transfer APR, 4% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you

Foreign transaction fees

See rates and fees , terms apply.

Read our Capital One Venture X Rewards Credit Card review.

- Large welcome bonus

- No foreign transaction fees

- Up to $100 statement credits for either Global Entry or TSA PreCheck®

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- High annual fee

- No introductory 0% APR period

The Chase Sapphire Preferred Card and the Capital One Venture X Rewards Card sit at opposite ends of the annual fee spectrum. The Sapphire Preferred card has a $95 annual fee , which makes it among the most affordable. The Venture X card, on the other hand, charges a hefty $395 annual fee (see rates and fees ).

Granted, the annual fee on the Venture X Card still isn't as high as the Chase Sapphire Reserve® $550 annual fee , or The Platinum Card® from American Express $695 fee (see rates and fees ), but it's still a considerable expense. Terms apply.

Of course, both cards have perks and benefits that can offset the cost of that fee, so make sure you determine whether or not you can truly make that fee worthwhile.

WINNER: The Chase Sapphire Preferred card's annual fee costs $300 less than the Venture X card's. This already makes it appealing to those who want to upgrade to a card with more perks but don't quite have the appetite for a higher annual fee. Again, both cards offer benefits that can offset the costs of those annual fees.

Both credit cards are well known for their earnings for booking travel, but there are many key differences in the way you rack up rewards.

Chase Sapphire Preferred Card: Cardholders can earn 5X points on travel purchased through Chase Travel℠, 3X points on dining, 3X points on select streaming services and online grocery purchases (excluding Target, Walmart and wholesale clubs), 2X points on all other travel purchases, and 1X points on all other purchases.

Capital One Venture X Card: Earn unlimited 2X miles on all eligible purchases, and 5 miles per dollar on flights and 10 miles per dollar on hotels and rental cars when booked via Capital One Travel portal.

At first glance, you'll notice that the Chase Sapphire Preferred Card lets you earn points while the Venture X Card lets you earn miles. However, the miles you earn on the Venture X card actually function similarly to transferable points programs since they can be redeemed for more than just travel (below, we break down the different ways cardholders can redeem their rewards for both cards).

The Chase Sapphire Preferred impressive offer of 5X points on travel purchases through Chase Travel℠ appears similar to the Venture X Card's offer of 5 miles per dollar on flights. However, the Venture X Card also offers an impressive 10 miles per dollar on hotels and rental cars that get booked through their travel portal.

However, the point and mile values can be very different when redeeming them for rewards through each card provider's respective travel portals. For instance, 75,000 miles from the Venture X Card's welcome bonus is worth around $750 , while you only need 60,000 bonus points earned through the Chase Sapphire Preferred Card's welcome bonus to achieve the same cash value of $750.

Rewards experts like The Points Guy take into account the different transfer options when valuing points. Because of this, they value the points at 1.25 cents per point for the Chase Sapphire Preferred card, making the value of the bonus work out to $1,200. They also value the miles for the Venture X card at 1.85 cents per point (when again, taking into account the various transfer options), making the full value of the bonus work out to be $1,387.50 toward travel.

Aside from travel rewards, the Chase Sapphire Preferred Card gives a generous 3X earnings for money spent on dining, streaming services and grocery store purchases, whereas the Venture X Card lets users earn 2X on other eligible purchases.

WINNER: The Capital One Venture X Rewards Card comes out on top since the full value of its welcome bonus works out to be higher than that of the Chase Sapphire Preferred Card. On top of that, at the very least, you'll earn 2X miles on other eligible purchases with the Venture X card while the Chase Sapphire Preferred card only lets you earn 1X points on other eligible purchases. So even if you don't spend a ton on travel or dining, you'll still earn more for other types of purchases with the Venture X card.

There are a variety of ways to redeem your rewards for both credit cards.

Chase Sapphire Preferred Card:

Cardholders can redeem points for cash back or gift cards at a rate of 1 cent per point.

If redeeming through Chase Travel℠, though, you'll increase the value of your points to 1.25 cents apiece. If you use this redemption option, the 60,000-point welcome bonus is worth $750.

The most valuable option is generally to transfer your points to one of Chase's hotel and airline partners. Transferring your points to partners typically yields a much higher value, especially if you want to redeem them for luxury travel.

Chase's 14 transfer partners include:

- Aer Lingus AerClub

- Air Canada Aeroplan

- British Airways Executive Club

- Emirates Skywards

- Flying Blue (KLM and Air France)

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

- IHG One Rewards

- Marriott Bonvoy

- World of Hyatt

Capital One Venture X Rewards Card:

Capital One miles can be redeemed in several ways, including:

- Booking travel directly through Capital One Travel

- Transferring them to 17 different airline and hotel partners (like Air France-KLM Flying Blue and Air Canada Aeroplan)

- Using them for recent travel purchases on your credit card statement

- Redeeming them for gift cards

- Redeeming them for cash back (note: similar to the CSP card, this is the least valuable option)

The most valuable way to redeem Capital One miles is to transfer them to the various travel partners and book business or first-class award flights.

Capital One's 17 transfer partners include:

- Air France-KLM

- ALL Accor Live Limitless

- British Airways

- Cathay Pacific

- Choice Privileges

- Singapore Airlines

- TAP Air Portugal

- Turkish Airlines

- Wyndham Hotels

Both credit cards come with ambitious welcome bonuses.

Chase Sapphire Preferred Card: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Capital One Venture X Card: Earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening.

Both credit cards have a fairly short time horizon for earning the welcome bonus ; new cardholders will have to spend $4,000 within the first 3 months after opening an account. While it may appear that you earn a larger bonus for spending the same amount on the Venture X card, when you calculate the value of the miles when redeemed for travel through each card's respective rewards portal, it comes out to $750 for both credit cards.

Again, though, when you take into consideration the value of rewards when redeeming through transfer partners, the Venture X card comes out on top since the welcome bonus is valued at $1,387.50 toward travel and the Chase Sapphire Preferred bonus is valued at $1,200.

WINNER: If you plan to redeem the welcome bonus through each card's respective rewards portal, it's a tie since the value of the welcome bonus works out to be the same. However, if you're redeeming the bonus through transfer partners, the Venture X card provides the best value.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

Both cards come with an appealing array of perks that are meant to satisfy different lifestyle needs.

Chase Sapphire Preferred cardholders can enjoy these additional perks:

- Exclusive shopping discounts at select retailers

- Up to $50 Annual Chase Travel Hotel Credit

- Trip cancellation and interruption insurance

- Primary rental car insurance

- Baggage delay insurance

- Trip delay reimbursement

- Each account anniversary, you'll earn bonus points equal to 10% of your total purchases made the previous year. For instance, if you spend $25,000 on purchases, you'll receive 2,500 bonus points

- Cardholders can get complimentary access to DashPass, which is a membership that can be used for DoorDash and Caviar. You'll pay $0 delivery fees and lower service fees on eligible orders for a minimum of one year when you activate this perk by December 31, 2024

- 6 months of complimentary Instacart+ membership if activated by July 31, 2024 (membership auto-renews). Instacart+ members can also earn up to $15 in statement credits quarterly through July 2024

Capital One Venture X cardholders can enjoy these additional perks:

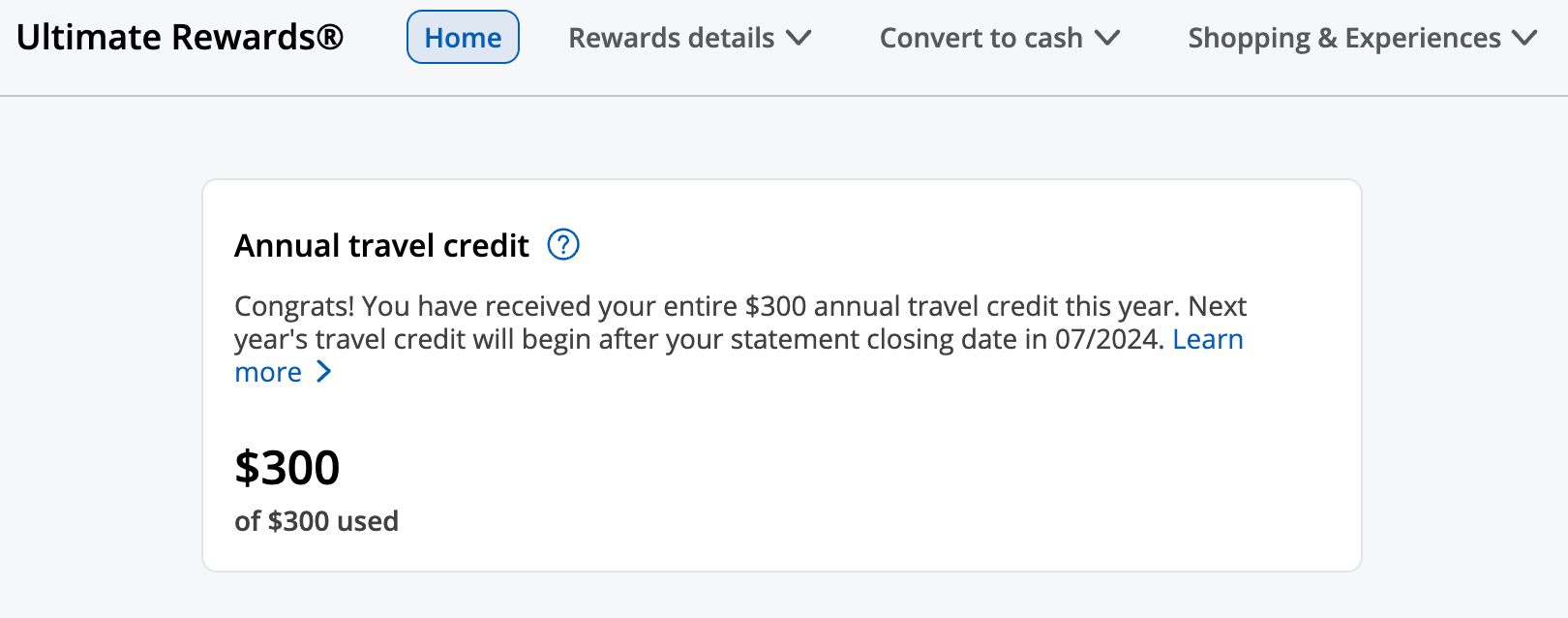

- Up to $300 in annual statement credits each year for bookings made through Capital One Travel

- A 10,000-mile bonus on each account anniversary, starting on your first card anniversary

- Up to $100 statement credit for either Global Entry or TSA PreCheck®

- Access to over 1,300 Priority Pass lounges, as well as Capital One Lounges. Free entry for up to two guests per visit ($45 per visit for additional guests)

- *Complimentary cell phone insurance (terms and conditions apply)

- *Baggage delay reimbursement

- *Trip delay reimbursement

WINNER: As far as travel credit cards go, the Capital One Venture X card comes out on top for its more robust set of travel perks. The Sapphire Preferred card does offer some lifestyle benefits, like the complimentary DashPass and Instacart+ membership, but those perks may not be most valuable to those who are just looking for a travel credit card that'll give them more bang for their buck.

Both the Chase Sapphire Preferred Card and the Capital One Venture X card are such strong travel credit cards that it can be genuinely difficult to go with one over the other.

The Venture X card comes with a hefty annual fee of $395 (see rates and fees ), though, perks like the $300 annual travel credit and airport lounge access make up for that cost. The Sapphire Preferred $95 annual fee may feel a bit more manageable to more people but still offers valuable benefits like trip delay insurance and monthly credits for popular delivery services.

Overall, the Chase Sapphire Preferred card may be best suited for those who value the best of both travel and dining perks.

The Capital One Venture X card is best for those serious travelers who want elite perks without elite airline status.

Both cards offer a ton of value if used correctly. However, if you still want some to earn towards travel without paying high annual fees, you might consider opting for a low or no-cost credit card like the Capital One VentureOne Rewards Credit Card (see rates and fees ).

Capital One VentureOne Rewards Credit Card

5 Miles per dollar on hotel and rental cars booked through Capital One Travel, 1.25X miles per dollar on every purchase

Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

0% intro APR on purchases and balance transfers for 15 months

19.99% - 29.99% variable

3% for the first 15 months; 4% at a promotional APR that Capital One may offer you at any other time

See rates and fees . Terms apply.

Read our Capital One VentureOne Rewards Credit Card review.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

For rates and fees of The Platinum Card® from American Express, click here .

*For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

- How can I get homeowners insurance after nonrenewal? Liz Knueven

- How a CLUE report affects your insurance rates Ryley Amond

- What to do if your homeowners insurance claim is denied Liz Knueven

Chase Sapphire Preferred vs. Capital One Venture: Which $95 Annual Fee Card Should You Pick?

March 7, 2024

Going has partnered with CardRatings for our coverage of credit card products. Going and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses, and recommendations are the author's alone, and have not been reviewed, endorsed, or approved by any of these entities. Some of all of the card offers that appear on this page are from advertisers; compensation may affect how and where the cards appear on the site; and Going does not include all card companies are all available card offers.

In life, we’re constantly asked to choose between two options, and that’s true when it comes to travel credit cards.

The Chase Sapphire Preferred® Card and Capital One Venture Rewards Card are two entry-level travel cards that are great for folks who want to start earning points and miles. How do you choose which one is right for you?

Chase Sapphire Preferred vs. Capital One Venture Rewards Card

Let’s start with how the Chase Sapphire Preferred Card and Capital One Venture Rewards Card similar.

Let’s start with how the card_name and card_name are similiar.

Each card carries an annual fee of annual_fees , which means the barrier to entry is relatively low.

In addition, both cards come with a foreign_transaction_fee foreign transaction fee, which means that you will not pay extra pesky fees when you use your card internationally. Instead, your credit card issuer converts the purchase into US dollars based on the exchange rate on the date of the transacation.

Both beginner cards earn points that transfer to a handful of airline and hotel partners. They also both come with nice welcome offers that can get you at least a head start toward a free flight.

Since the cost of holding the cards is equal, how do they compare? Which one is right for you?

Earning points

I say this often but pay close attention to your card’s earning rates. While a welcome offer is exciting, the bonus points your card earns on your daily purchases will matter in the long term.

The card_name and card_name differ most when it comes to earning bonus points.

Capital One Venture Rewards Card

The card_name is quite simple: you’ll earn 2X points per dollar spent on all eligible purchases.

That’s it. Nothing else to think about.

Going to a football game? Buying tickets to a concert? This card will earn you 2X points on every purchase.

Chase Sapphire Preferred® Card

The card_name earns bonus points in several spending categories. The card’s sweet spots are in experiences like travel, food, and streaming services.

More specifically, you’ll earn:

- 2X points per dollar on travel purchases: This is a pretty capacious category and includes things like public transit and Amtrak trains, as well as airfare.

- 5X points per dollar on purchases through the bank’s travel portal: If you book your flight through Chase Travel(SM), the bank’s travel portal, you’ll earn at this higher rate. Just do your homework first and compare the price if you bought directly from the airline.

- 3X points per dollar on dining at restaurants takeout, and eligible delivery services: Who doesn’t like to eat?

- 3X points per dollar on online grocery stores (excluding Target, Wal-Mart and wholesale clubs): This could be a great card to use if you ever order groceries online through services like Instacart or FreshDIrect.

- 3X points per dollar on streaming services: This could be a great card to put your monthly Netflix or Disney+ subscription on.

- 1X points per dollar on all other purchases.

Plus, on each card anniversary, the Chase Sapphire Preferred card awards you extra bonus points. You’ll receive an anniversary bonus equal to 10% of the total amount you spent last year. So, if you spent $10,000 on purchases, you’d get 1,000-anniversary bonus points.

Welcome offers

Both cards come with welcome offers granting you thousands of flexible travel points after spending a certain amount. Their offers are:

bonus_miles_full

Chase Sapphire Preferred Card

In sheer raw numbers, the welcome offer on the Capital One Venture Rewards card is higher.

But, I’d argue that the welcome offer on the Chase Sapphire Preferred card is more valuable because of where you can transfer its points. I’ll explain more below.

Transfer partners

The best way to maximize the value of your credit card points is to transfer them to the bank's airline and hotel partners . Called “transfer partners” or “travel partners,” you convert your hard-earned credit card points into miles with a specific airline.

Both the card_name and the card_name transfer to a lot of the same international airlines. Common transfer partners with each include:

The Capital One Venture Rewards card also has Avianca LifeMiles and Turkish Miles&Smiles among its transfer partners . We have sent several Going with Points deals making use of these airline partners.

However, I think it is Chase Sapphire Preferred’s travel partners where the card really shines. In addition to the partners listed above, the Chase Sapphire Preferred card has several US domestic airlines as partners including, United MileagePlus, Southwest Airlines, and JetBlue.

In addition, Iberia airlines is another airline partner, which can be a great way to fly business class to Europe for a reasonable amount of miles. The Chase Sapphire Preferred card also transfers to Hyatt hotels, which is a favorite of point and miles enthusiasts.

To be perfectly honest with you, the breadth of transfer partners for a relatively low annual fee is why the Chase Sapphire Preferred card is my favorite card in my wallet.

Extra card perks and protections

One of the great things about the Capital One Venture Rewards card is that it offers a statement credit for an application fee for Global Entry or TSA PreCheck .

You can use this application credit once every four years. And, if you already have it you could use this card’s credit for a loved one’s application.

The Chase Sapphire Preferred card doesn’t have the Global Entry/TSA PreCheck credit, but it is one of our top picks for credit cards with rental car insurance because it comes with Auto Rental Collision Damage Waiver.

While many travel credit cards offer secondary rental car insurance coverage, this card provides primary coverage on car rentals, which means you would not need to file a claim with your personal auto insurance. So, if you used this card to pay for your rental car, you could potentially decline the rental company’s collision insurance and save on your costs.

This is the full list of travel protections that the Chase Sapphire Preferred Card offers:

- Trip Cancellation/Interruption Insurance: Up to $10,000 reimbursed per person if your trip is cancelled or cut short by sickness, severe weather or other covered situations.

- Auto rental collision damage waiver: Primary coverage

- Baggage delay insurance: Reimburses baggage delays over 6 hours up to $100 a day for five days.

- Trip delay insurance: Up to $500 per ticket when your carrier is delayed more than 12 hours or requires an overnight stay. Can include meal and lodging expenses.

Should you get the Chase Sapphire Preferred or Capital One Venture Rewards Card?

For most people, the card_name is the better option, simply because Chase points are more valuable than Capital One Miles (their term for points). While the Global Entry/TSA PreCheck credit is tempting, I think most casual travelers are better off with the travel protections that the Chase Sapphire Preferred provides. You could always get Global Entry or TSA PreCheck through another card that compliments its bonus categories.

Still, if you’d rather not track categories, and just want to earn a flat 2X points per dollar, then the card_name might be the better option for you.

Of course, there’s no reason why you can’t have both. They complement each other and allow you to earn more points together.

Still need to think about it? Read our reviews of each card to help you decide.

- Review: Chase Sapphire Preferred Card

- Review: Capital One Venture Rewards Card

Published March 7, 2024

Last updated March 28, 2024

Articles you might like

Best Credit Cards for Points and Miles Beginners

Mar 28, 2024

Capital One Transfer Partners: How to Transfer Miles

Mar 11, 2024

Chase Transfer Partners Guide

Mar 14, 2024

Treat your travel to cheap flights

Most deals are 40-90% off normal prices with great itineraries from the best airlines. If it's not an amazing deal, we won't send it. Sign up for free to start getting flight alerts.

- Best Travel Insurance 2024

- Cheapest Travel Insurance

- Trip Cancellation Insurance

- Cancel for Any Reason Insurance

- Seniors' Travel Insurance

- Annual Travel Insurance

- Cruise Insurance

- COVID-19 Travel Insurance

- Travel Medical Insurance

- Medical Evacuation Insurance

- Pregnancy Travel Insurance

- Pre-existing Conditions Insurance

- Mexico Travel Insurance

- Italy Travel Insurance

- France Travel Insurance

- Spain Travel Insurance

- Canada Travel Insurance

- UK Travel Insurance

- Germany Travel Insurance

- Bahamas Travel Insurance

- Costa Rica Travel Insurance

- Disney Travel Insurance

- Schengen Travel Insurance

- Is travel insurance worth it?

- Average cost of travel insurance

- Is airline flight insurance worth it?

- Places to travel without a passport

- All travel insurance guides

- Best Pet Insurance 2024

- Cheap Pet Insurance

- Cat Insurance

- Pet Dental Insurance

- Pet Insurance That Pays Vets Directly

- Pet Insurance For Pre-Existing Conditions

- Pet Insurance with No Waiting Period

- Paw Protect Review

- Spot Pet Insurance Review

- Embrace Pet Insurance Review

- Healthy Paws Pet Insurance Review

- Pets Best Insurance Review

- Lemonade Pet Insurance Review

- Pumpkin Pet Insurance Review

- Fetch Pet Insurance Review

- Figo Pet Insurance Review

- CarePlus by Chewy Review

- MetLife Pet Insurance Review

- Average cost of pet insurance

- What does pet insurance cover?

- Is pet insurance worth it?

- How much do cat vaccinations cost?

- How much do dog vaccinations cost?

- All pet insurance guides

- Best Business Insurance 2024

- Business Owner Policy (BOP)

- General Liability Insurance

- E&O Professional Liability Insurance

- Workers' Compensation Insurance

- Commercial Property Insurance

- Cyber Liability Insurance

- Inland Marine Insurance

- Commercial Auto Insurance

- Product Liability Insurance

- Commercial Umbrella Insurance

- Fidelity Bond Insurance

- Business Personal Property Insurance

- Medical Malpractice insurance

- California Workers' Compensation Insurance

- Contractor's Insurance

- Home-Based Business Insurance

- Sole Proprietor's Insurance

- Handyman's Insurance

- Photographer's Insurance

- Esthetician's Insurance

- Salon Insurance

- Personal Trainer's Insurance

- Electrician's Insurance

- E-commerce Business Insurance

- Landscaper's Insurance

- Best Credit Cards 2024

- Best Sign-Up Bonuses

- Instant Approval Cards

- Best Cash Back Credit Cards

- Best Rewards Credit Cards

- Credit Cards for Bad Credit

- Balance Transfer Credit Cards

- Student Credit Cards

- 0% Interest Credit Cards

- Credit Cards for No Credit History

- Credit Cards with No Annual Fee

- Best Travel Credit Cards

- Best Airline Credit Cards

- Best Hotel Credit Cards

- Best Gas Credit Cards

- Best Business Credit Cards

- Best Secured Credit Cards

- Best American Express Cards

- American Express Delta Cards

- American Express Business Cards

- Best Capital One Cards

- Capital One Business Cards

- Best Chase Cards

- Chase Business Cards

- Best Citi Credit Cards

- Best U.S. Bank Cards

- Best Discover Cards

- Amex Platinum Card Review

- Amex Gold Card Review

- Amex Blue Cash Preferred Review

- Amex Blue Cash Everyday Review

- Capital One Venture Card Review

- Capital One Venture X Card Review

- Capital One SavorOne Card Review

- Capital One Quicksilver Card Review

- Chase Sapphire Reserve Review

- Chase Sapphire Preferred Review

- United Explorer Review

- United Club Infinite Review

- Milestone Mastercard Review

- Destiny Mastercard Review

- OpenSky Credit Card Review

- Self Credit Builder Review

- Chime Credit Builder Review

- Aspire Card Review

- Amex Gold vs Platinum

- Amex Platinum vs Chase Sapphire Reserve

- Capital One Venture vs Venture X

- Capital One SavorOne vs Quicksilver

- How to get Amex pre-approval

- Amex travel insurance explained

- Chase Sapphire travel insurance guide

- Chase Pay Yourself Back

- CLEAR vs. TSA PreCheck

- All credit card guides

- Citibank Savings Account Interest Rate

- Capital One Savings Account Interest Rate

- American Express Savings Account Interest Rate

- Western Alliance Savings Account Interest Rate

- Barclays Savings Account Interest Rate

- Discover Savings Account Interest Rate

- Chase Savings Account Interest Rate

- U.S. Bank Savings Account Interest Rate

- Marcus Savings Account Interest Rate

- Synchrony Bank Savings Account Interest Rate

- Ally Savings Account Interest Rate

- Bank of America Savings Account Interest Rate

- Wells Fargo Savings Account Interest Rates

- SoFi Savings Account Interest Rate

- Best Savings Accounts & Interest Rates

- Best High Yield Savings Accounts

- Best 7% Interest Savings Accounts

- Best 5% Interest Savings Accounts

- Savings Interest Calculator

- Emergency Fund Calculator

- Pros and Cons of High-Yield Savings Accounts

- Types of Savings Accounts

- Checking vs Savings Accounts

- Average Savings by Age

- How Much Should I Have in Savings?

- How to Make Money

- How to Save Money

- Compare Best Checking Accounts

- Compare Online Checking Accounts

- Best Business Checking Accounts

- Compare Best Teen Checking Accounts

- Best Student Checking Accounts

- Best Joint Checking Accounts

- Best Second Chance Checking Accounts

- Chase Checking Account Review

- Bluevine Business Checking Review

- Amex Rewards Checking Account Review

- E&O Professional Liability Insurance

- Best Savings Accounts & Interest Rates

- Best Credit Cards

- Chase Credit Cards

- Chase Sapphire Preferred vs Capital One Venture

On This Page

- Key takeaways

- Chase Sapphire Preferred vs. Capital One Venture Which card is better?

- Chase Sapphire Preferred vs. Capital One Venture Welcome bonus

- Chase Sapphire Preferred vs. Capital One Venture Rewards

- Chase Sapphire Preferred vs. Capital One Venture Travel Perks

- Chase Sapphire Preferred vs. Capital One Venture Other card benefits

- Chase Sapphire Preferred vs. Capital One Venture Rates and fees

- Chase Sapphire Preferred vs. Capital One Venture Eligibility

Should I get the Chase Sapphire Preferred Card or the Capital One Venture Rewards Credit Card?

Faq: chase sapphire preferred vs. capital one venture.

Chase Sapphire Preferred vs. Capital One Venture: Which Is Best?

- The Chase Sapphire Preferred® Card is slightly better overall than the Capital One Venture Rewards Credit Card .

- The Chase Sapphire card reigns supreme in terms of rewards, travel perks and other card benefits.

- The Capital One Venture card has a better welcome offer.

- Chase’s travel perks are a major benefit for cardholders who love to travel.

- Both cards have a $95 annual fee and similar variable APR rates.

In the battle between credit cards, the Chase Sapphire Preferred® Card and the Capital One Venture Rewards Credit Card go head-to-head.

The Chase Sapphire Preferred boasts a strong reputation and diverse benefits, while the Capital One Venture offers simplicity and rewards tailored to travelers and everyday spenders.

This comparison breaks down rewards, bonuses and travel perks to help you choose the best fit for your needs.

Chase Sapphire Preferred vs. Capital One Venture: Which card is better?

The Chase Sapphire Preferred® Card is a mighty contender thanks to big-time name recognition and the promise of ample rewards, but the Capital One Venture Rewards Credit Card is heady competition with its own cache of rewards and perks.

In the case of Chase Sapphire Preferred vs. Capital One Venture, Chase Sapphire Preferred has the edge in several categories. An attractive list of rewards, useful travel perks and a regularly updated slate of other card benefits all help nudge Chase into the winner’s circle.

But depending on how you plan to use your credit cards, you may find Capital One Venture to be better for your specific needs.

To help you learn what each of these rewards cards has to offer and see how signing up for a Chase or Capital One card could shape your finances, we’ll take a look at each category or perk on a granular level.

Why should I get the Chase Sapphire Preferred Card?

For starters, the Chase Sapphire Preferred Card has a higher point redemption rate, including higher rates for things like online grocery shopping, dining out and some streaming services. There are also many rewards partners if you want to shift your points. You can take advantage of some 14 airline loyalty programs and three hotel loyalty programs, giving you access to upgrades, lounges and other benefits the world over.

The final feather in Chase’s cap is the card’s robust list of travel protections. If you often find yourself exploring the planet, you’ll likely rest easier knowing you have backup if weather delays your flight or there’s a problem and you need to get home.

Why should I get the Capital One Venture Rewards Credit Card?

The Capital One Venture card is a solid choice for people who are most interested in earning rewards for travel and everyday spending. This card gives you 2 miles per dollar for purchases outside travel and 5 miles per dollar for travel. You won’t get the same higher rates for dining and other lifestyle purchases like Chase offers, but depending on how you spend, that might not matter.

Also take a look at Capital One’s partner list. If there are airlines or hotels listed that you favor over Chase’s partners, that’s an additional reason to go for the Venture card over the Sapphire Preferred.

Chase Sapphire Preferred vs. Capital One Venture: Welcome bonus

Winner of this category: Capital One Venture Rewards

The Chase Sapphire Preferred card has a welcome bonus of 60,000 points. This reward is only available once you spend a minimum of $4,000 on purchases within three months of opening your account.

The Capital One Venture card seems to come out ahead here because the welcome bonus is 75,000 miles. It’s also only available when you spend $4,000 on purchases within three months of opening your account.

However, in both cases, the points or miles you get once you achieve the bonus threshold are redeemable for up to $750 of free travel. This assumes a $1.25 and $1 redemption rate for Chase and Capital One, respectively, as discussed in more detail below.

Chase Sapphire Preferred vs. Capital One Venture: Rewards

Winner of this category: Chase Sapphire Preferred

Rewards are the cornerstone of both cards, but how you earn those rewards differs significantly.

With Chase Sapphire Preferred, you can earn the following amounts in these ways:

- 5 points per dollar spent on travel purchases using Chase Travel℠

- 3 points per dollar spent on dining, eligible delivery services, select streaming services and online grocery purchases (Walmart, Target and wholesale club purchases excluded)

- 2 points per dollar spent on travel purchased without using Chase Travel℠

- 1 point per dollar spent on anything not covered above

There are sometimes limited-time-only offers as well, such as the current promotion (as of January 2024) of 5 points per dollar spent with Lyft through March 2025.

The Capital One Venture Rewards Credit Card has a simpler but less exciting rewards scheme:

- 5 miles per dollar spent on rental cars and hotels only when booked through Capital One Travel

- 2 miles per dollar spent on anything else

Which is better for earning rewards?

The Chase Sapphire Preferred Card offers far more ways to earn rewards. While the emphasis is on Chase Rewards travel, you can still rack up a decent number of points just for grocery shopping, going to lunch or streaming your favorite shows.

Capital One Venture Rewards only wins out if you use the card for Capital One Travel purchases, as those are the only ones eligible for top-level 5 miles per dollar rewards. The 2 miles per dollar you get for “other purchases” with Capital One beats Chase’s 1 point per dollar rate, but that only helps you come out ahead if you aren’t spending much on dining, streaming, online grocery purchases and other travel.