The bank card made for travel

🙌 Pay anywhere, in any currency, fee-free

💸 Split costs with pals in seconds

🌎 Get worldwide travel insurance and more with Monzo Premium

UK residents. Ts&Cs apply.

Your bank account for going abroad

Spend abroad with no fees.

Pay anywhere, in any currency, with no foreign transaction fees using your debit or credit card. We pass Mastercard's exchange rate directly onto you, without sneaky fees or extra charges.

Make fee-free cash withdrawals

If Monzo is your main bank account, make unlimited fee-free cash withdrawals abroad in the European Economic Area (EEA), and up to £200 every 30 days for free outside the EEA. After that, we’ll charge 3%.

Grow your holiday money

false Your interest is paid monthly and you can take out your money any time.

Split costs with pals in seconds

Track how much everyone owes and settle up whenever you like with a Shared Tab. You focus on the good times, we’ll do the maths.

Travel often? Upgrade to Monzo Premium

Sort travel insurance instantly.

Beat travel stress with multi-trip insurance for you and your family if they’re travelling with you. So you can focus on having fun while you’re away. £50 excess • Exclusions apply

Take out more cash abroad

Withdraw unlimited cash for free in the European Economic Area (EEA), and up to £600 every 30 days for free outside the EEA. After that, we’ll charge 3%.

Protect your phone, anywhere

Enjoy peace of mind with worldwide phone insurance for phones up to £2,000 (including VAT), so you feel comfortable bringing your phone with you wherever you go. £75 excess • Exclusions apply

Enjoy airport lounge discounts

Get discounted access to over 1,100 airport lounges worldwide for you and your friends and family when they are travelling with you.

Monzo Premium is £15 per month • 6 month minimum Must be aged 18-69 • Ts&Cs apply

Get more time to pay for travel with the Flex credit card

A credit card with some monzo magic.

Enjoy 0% time and time again when you pay in full or in 3 monthly payments, or 29% APR representative (variable) if you pay in 6 or 12 monthly payments. You'll need to select a monthly payment plan within a day of making a purchase. If you choose not to, we'll set it to the minimum monthly payment at your personalised rate.

Save money by paying anywhere in any currency with no foreign transaction fees. We pass Mastercard’s exchange rate directly onto you, without sneaky fees or extra charges.

Protect big purchases like flights and hotels

You could get your money back if things don’t go to plan, with Section 75 Protection on eligible purchases made with your Flex credit card.

No waiting around

If approved, you can start your holiday spending straight away with a limit up to £3,000.

Representative example: 29% APR representative (variable), with an assumed credit limit of £1,200 and an annual interest rate of 29% (variable).

Eligibility criteria and Ts&Cs apply. 18+ year olds only. Missed payments can negatively impact credit scores and you may lose the interest-free rate on existing plans.

Frequently asked questions

Are there any fees associated with using monzo abroad.

You can pay anywhere in any currency using your Monzo card, fee-free. We pass Mastercard’s exchange rate directly onto you, without sneaky fees or extra charges. You can also make fee-free cash withdrawals up to a certain limit (see below).

What is the Monzo cash withdrawal limit when using my card abroad?

Depending on how you use Monzo, you can make fee-free cash withdrawals up to a certain limit. Any fees you may have to pay are partly based on whether you’re in the European Economic Area (EEA) or not. The EEA includes EU countries and also Iceland, Liechtenstein and Norway.

Here is a breakdown of any fees you might need to pay.

The 30-day period for allowances resets exactly 30 days after your first withdrawal, rather than at the start of a new month. Your allowances are shared across any accounts you have. So if you have a joint account, your allowance is split across that account and your personal account. For example, if you take out £150 on the 2nd of the month and £50 on the 5th, your allowance would reset on the 2nd and 5th day of the next month. If you made a third withdrawal before those dates, then we'd charge the withdrawal fee.

Just be aware that some ATMs will charge you a fee for taking out cash (which we don’t receive), so we recommend using a free machine whenever you can.

What is the European Economic Area?

The European Economic Area (EEA) includes EU countries and also Iceland, Liechtenstein and Norway.

How do I know if Monzo is my main bank?

If you have a free account and meet any of the below criteria, then we consider Monzo to be your main bank:

At least £500 was paid into a Monzo account in your name over the last rolling 35-day period, and you have at least one active Direct Debit on the same account in the same period.

You’ve received a Department for Work and Pensions or a Department for Communities payment into a Monzo account in your name over the last rolling 35-day period.

You’ve received a student loan payment into a Monzo account in your name over the last rolling 8-month period.

You’re sharing a Monzo Joint Account with someone who has done at least one of the above.

Remember that if you use Monzo as your main bank, you can enjoy unlimited fee-free cash withdrawals in the European Economic Area (EEA).

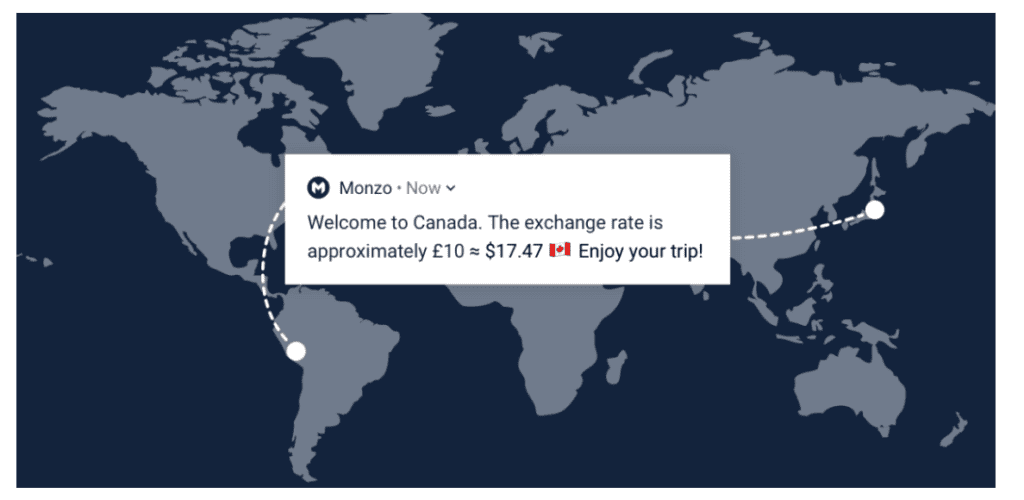

Do I need to let Monzo know when I’m travelling abroad?

You don’t need to tell us when you’re travelling. You can use your Monzo card abroad just like you would in the UK. We won’t block your card if we see you using it in a different country. Instead, we'll tell you the local exchange rate when you make your first payment in the local currency.

What should I do if my Monzo card is lost or stolen while I am travelling?

If your Monzo card is lost or stolen while travelling, immediately freeze your card and contact our customer support team for assistance (you can do both through the Monzo app).

Will I be covered by the Monzo Premium travel insurance?

The worldwide family travel insurance available in Monzo Premium is provided by Zurich, powered by Qover. If eligible, the travel insurance helps you enjoy stress-free travel with insurance that includes multi-trip cover applied to you and your family when you are travelling together anywhere in the world, including the US. By “family”, Zurich means spouse or legal partner (a couple in a common law relationship living permanently at the same address) and unmarried, legally and financially dependent children up to 19 years old (or 21 if in full time education) living in the country of residence. Additionally, this covers cancellation up to £5,000, medical bills up to £10m, lost valuables up to £750, winter sports and more. Exclusions apply, please read the Ts&Cs. Learn more about our travel insurance or see the full Zurich terms and conditions, including general and coronavirus exclusions. There's a £50 excess for every successful claim. Monzo Premium is £15 per month • 6 months minimum • Must be aged 18-69 to apply • Ts&Cs apply

Apply for a Monzo account in under 15 minutes

And join more than 9 million people who’ve already changed the way they bank.

Existing customers can get help via the app

Monzo Bank Limited is a company registered in England and Wales (No.09446231). Monzo Bank Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Our financial Services Register number is 730427. Our address is Broadwalk House, 5 Appold St, London EC2A 2AG.

What Is The Monzo Card & Should You Get One?

If you’re new to my blog and can’t tell from my blog name, I love to travel and seek out adventures wherever I can. Gone are the days of carrying bundles of cash when you travel abroad, as we now live in quite a cashless world. Before my first trip of the year, I was researching travel cards beforehand, I’d used a Post Office card before but wanted something different, then I came across Monzo. Read on for my Monzo review !

What Is Monzo?

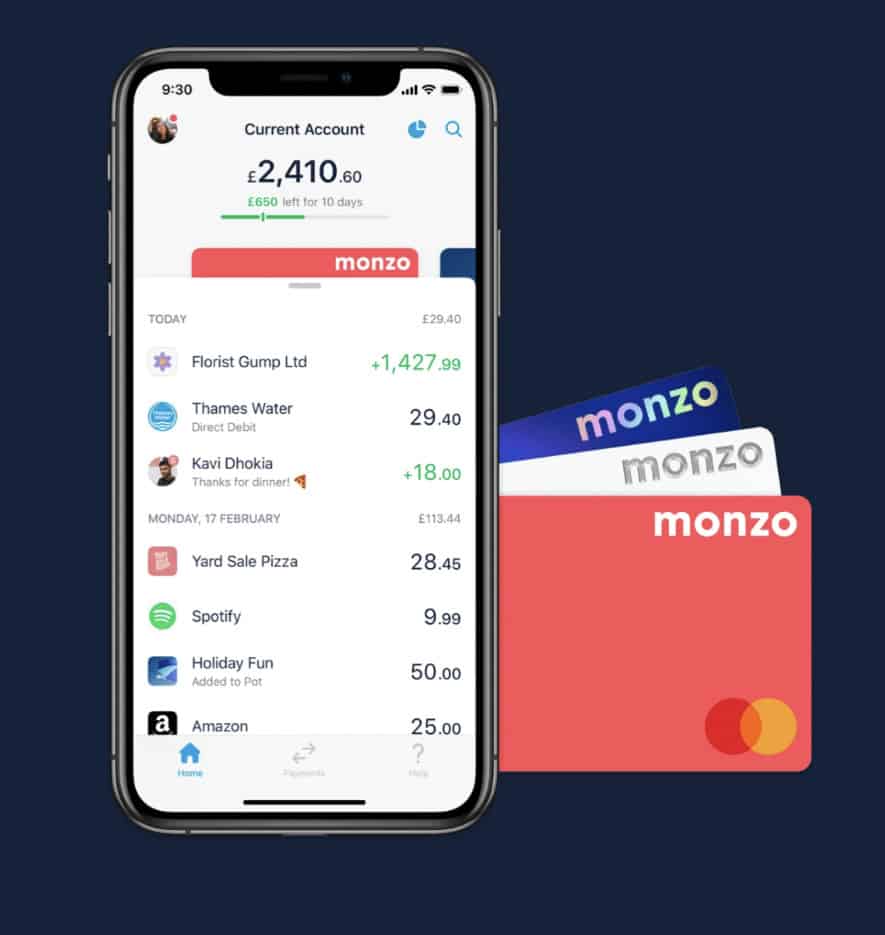

Founded in 2015, Monzo is an app-based bank which has no physical store. It’s grown incredibly over the past four years, with over 2.5 million people having accounts. The one thing that attracted me to getting a Monzo card was that you could use it abroad, with no added fees and you’re able to withdraw up to £200 a month wherever you are in the world.

How Does It Work?

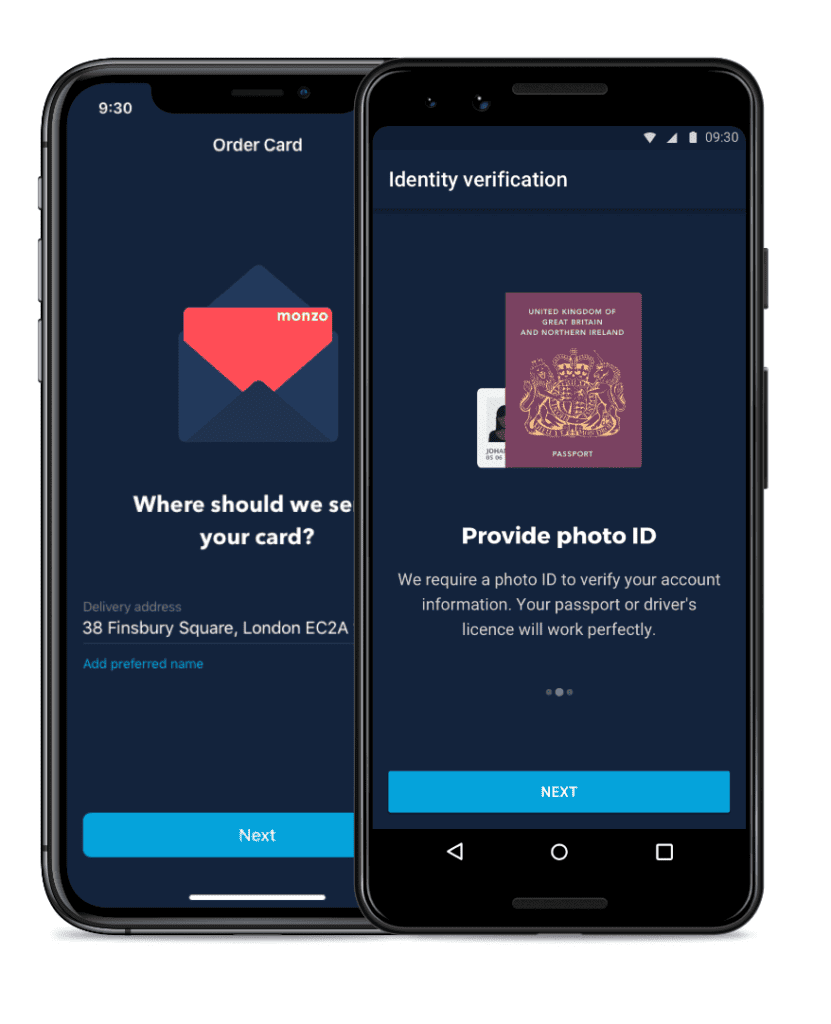

To apply for a Monzo card you do it through the app, you’re asked for your details and have to record a message to verify you’re an actual person. The whole process of applying took no longer than five minutes and within a few days, my coral card arrived through the door. You set your pin number on the app, I’d recommend going into the settings and adding a passcode to the app, as it doesn’t automatically do this and if someone gets hold of your phone, they’d be able to access.

The app is really easy to use, you can set budgets, sort all your transactions out into categories and even freeze your card (if like me you sometimes go overboard on clothes shopping!). I transfer money over from my normal bank account to use while I’m away.

Should I Get One?

I only use Monzo as a travel card, I’ve still got my normal bank account which I use daily. But I like to keep things separate, plus my bank doesn’t waive travel fees when using your card abroad. I would consider switching to Monzo fulltime as so far, I’ve found it pretty seamless.

Monzo has transformed the way I travel. If you run out of money while abroad, not to panic, it’s super easy to transfer yourself over money and you’ll even be notified once the money has reached your account.

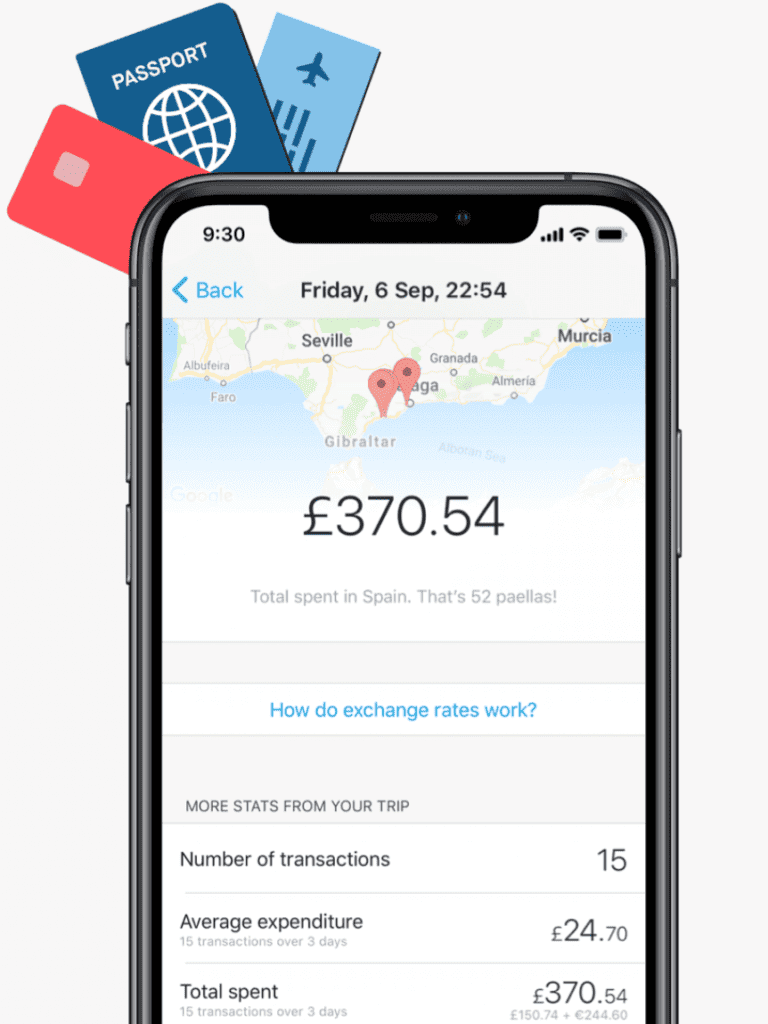

Personally, the best thing I like about Monzo is that is breaks down your spending, notifies you of every transaction and totals up your spending as the day goes on. Once you arrive in the country you’re travelling to and use your card for the first time you’ll be notified with a ‘Welcome to xxx’. Travelling is a great experience and if like me when you’re on holiday you get into the spirit and treat yourself a few more times than you think, it can be easy to go overbudget. With each transaction it will total up how much you’ve spent on that day, giving you an easy way to stay keep on track with your budget.

Once you arrive home, you’ll also be notified. Detailing how much you’ve spent over how many days:

You’ll also find all the details of your trip within the app; how many transactions you’ve made, how much you’ve spent and an even a little map of where each transaction took place:

I’ve found it incredibly useful! Having some leftover money, I’ve also made a few UK transactions. I purchased something from Pretty Little Thing, and decided to return the item, and as soon as I got the refund, I got notified! It’s great for keeping on top of your spending, so yes, I would recommend getting a Monzo card, for either your travels or for everyday use.

Hopefully, this blog has helped you understand Monzo a bit more! I think a lot of people can be apprehensive when it comes to banks, especially when it comes to an app-based one! But I’ve found it really useful, I’ve also read that the customer service is top-notch too! Have you used a Monzo card or something similar? Let me know in the comments!

I joined the Monzo family last year and so far my experience has been positive. I like the ethos and philosophy of the brand. It’s a refreshing change from the traditional banks. It should get better with the passage of time. Kudos to Monzo.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Sign me up for the newsletter!

Join The London Crew: Grab this checklist with 110 things to do in london from a local.

Hues Of Delahaye

Monzo Travel Card Review – The Best Card To Use Abroad

This post details my review of the Monzo travel card, which I have used while travelling throughout Europe.

This Monzo card abroad review guide should let you know if the Monzo travel card is for you.

If you travel a lot like me, then the last thing you want to see when you get home from travelling is huge foreign exchange fees all over your bank statement. These huge added fees were happening every time I would travel with my standard debit card.

I would come home to see my bank statement sprinkled with foreign transaction fees for that month. Though these fees might seem small as one-offs here and there, they add up over a few weeks or months.

After a few statements like this, I was determined to find a travel card with a 0% foreign exchange fee. So, I could continue to travel without the bank taking half my money in costs and using that money to explore even more.

For scenarios like this, the Monzo travel card comes in – a bright coral coloured card that I’ve been using over the last year.

I’ve taken my Monzo card abroad with me to Prague, Rotterdam , Cologne and Amsterdam , and I can’t tell you how good it feels to know that there wouldn’t be any pesky 3% foreign exchange fees to pay. This Monzo card is also great if you’re travelling in London .

Because I’ve used this card so much and love it, I wanted to put together a little Monzo travel card review together to help you. In case you are looking for a travel card to use while abroad.

I can honestly say that my Monzo travel card is one of the best prepaid travel cards I’veI’ve used so far. I use my Monzo card for travel more than my standard bank card.

Who or What is this Monzo travel card you ask?

Monzo is an app-only bank. They were initially only used as prepaid travel cards or prepaid travel money cards, which you could top up via an app (the Monzo app).

The Monzo card prepaid travel card has now switched to the Monzo current account.

Monzo bank is currently only available to UK residents, but they hope to expand to other countries eventually.

How to apply for a Monzo Bank Card?

UK residents aged 16 or over can apply for a Monzo account through the app, which is available to download at the Apple App Store and Google Play Store.

To register for a Monzo account, you download the app, scan your ID, and make a little introduction video. It takes only a few minutes. Then all you do is wait for your account to be approved.

Once activated, you’ll receive a lovely bright coral bank card. Monzo also created the app with the customer in mind. It had a beautiful, simple, user-friendly interface with well thought out functionality.

My account took less than a week to activate, and I received the card shortly after. I did all this in the comfort of my own home in my bathrobe! This is genuinely the bank of the future. I now always use my Monzo for travelling. I recommended it to my brother, and now he’s a proud owner of a Monzo card himself.

Monzo prepaid travel cards are great if you want to keep tabs on how much you spend while travelling.

Can I use my Monzo card abroad?

Yes, you can use your Monzo abroad, and I have listed some of the benefits that come with using Monzo abroad below.

What are the benefits of using a Monzo card abroad?

There are so many benefits that you can expect when using your Monzo card abroad. Here are a few of the top perks you can enjoy.

0% Foreign Exchange Fee When Using a Monzo Card Abroad

The number one benefit of using my Monzo card abroad was that I no longer had to pay those annoying 3% bank foreign exchange fees that my bank used to charge me. These fees look small on their own but add up for two weeks or more, which can take a massive chunk of your money. This could eat into the money you saved up for your travels.

No More Notifying Your Bank With Monzo

I hated calling my banking and notifying them that I was travelling because I usually forgot and had to do it while at the airport about to board a flight. No more!

Another benefit of the Monzo debit card is that you can use it abroad without notifying the bank. There is no charge for point of sale transactions (such as spending in hotels and shops) outside the UK.

Likewise, there is no charge for making online payments in a foreign currency. I am currently using my Monzo account for my international subscription that I pay in a foreign currency. Which normally can incur an extra charge, but I have been able to save a few pounds a month by doing this.

£200 Monzo Cash Withdrawals Limit

I no longer fear withdrawing my money from ATMs in other countries with my Monzo travel card. So if you are wondering, “does Monzo charge abroad fees?” the answer is yes, but it’s better than the rest.

They have something I call the Monzo travel transaction fee. When you use their cards, there is a £200 fee-free withdrawal limit for overseas ATMs over a month. If you withdraw more than £200, a 3% charge gets added to any withdrawals exceeding £200 during the 30 days.

The Monzo international fees daily cash withdrawal limit is £200, with a 3% charge after that.

The app can monitor the usage of this fee-free allowance to prevent any baller travel spending (because we are not Drake – we can’t YOLO our travel money away).

Mastercard Exchange Rate = Monzo Exchange Rate

When exchanging your money in a foreign country, that day’s Mastercards exchange rate is what you will get charged. This factor ensures that you will receive a competitive rate that responds to the live market. It acts like a Monzo.

Freeze Your Card if You Lose It

If, like me, you’ve had the pleasure (or mental breakdown) of losing your bank card while travelling and then spent most of your time calling your bank (and bawling) for help. Asking if they could cancel your card and your life as the fear of someone spending all your money like no one’s business is too much. Then Monzo can help.

With Monzo, it’s easy to freeze your card within the app as there is a Freeze card option. And if you only miss-placed your card, you can ”Defrost” it again and go on your merry way.

Monzo’s Welcome Intros When You Arrive in a Country

When you arrive in a new country, you’ll get a welcome screen. The screen gives you the basic information about the destination. Information such as the current exchange rate and any fees (if any) for the destination will all show up.

Track Spending While Travelling

Another thing I like about the Monzo card is if, like me, you want to keep an eye on your money whether in London or travelling. Monzo makes it easy by instantly sending a notification of every transition to your phone, which means no more waiting for a few days for the transaction to clear like regular banks.

There is also a summary breakdown of where you spend your money in categories like transport, eating out, travelling, and bills.

You can also see a summary of your spending with Monzo when you leave your travel destination. Seeing an overview of how much you spent whilst you were away.

READ MORE: 5 Day London Itinerary

Where can you use your Monzo travel card

You can use Monzo anywhere Mastercards are accepted.

Is Monzo the best Travel card?

I used my Monzo in Prague, Amsterdam, and a host of other countries, and I can say yes, Monzo is the best travel card I’ve used so far.

Does Monzo Non-Sterling Transaction Fees?

Monzo doesn’t charge any non sterling transaction fees, so you can use your card anywhere in the world without worrying about extra charges. Monzo

Just be aware that some ATM providers may charge their own fees, so it’s always best to check before you withdraw cash.

Can I Use Monzo in Dubai?

Yes, you can use your Monzo card in Dubai! However, since Dubai is not part of the European Economic Area (EEA), you won’t be able to use your Monzo card in the same way as you would at home. For example, you won’t be able to make contactless payments or withdraw cash from an ATM without being charged a fee. You will still be able to use your card for point-of-sale transactions and online purchases without any additional fees.

Using Monzo in France?

Can I use Monzo in France? Monzo works just like any other debit card in France. You can make purchases in stores, restaurants, and online without being charged any extra fees. You will also be able to withdraw cash from ATMs, although beware that some ATM providers may charge their own fees.

Monzo ATM Limit Abroad?

The limit for ATM withdrawals varies depending on which country you’re in.

Withdrawals in the European Economic Area (EEA)

If you use the free Monzo bank account, Monzo Plus or Monzo Premium, your withdrawals are fee-free.

Monzo Euro cash withdrawal?

Monzo offers a handy cash withdrawal service in Euros while you’re abroad. All you need is your Monzo card and your PIN. Withdrawals are limited to €200 per day, though you can make multiple withdrawals to withdraw more if needed. You’ll be charged cash withdrawal fees of 1.5% on the amount withdrawn, with a minimum charge of €0.99.

However, Monzo doesn’t use the MasterCard exchange rate – instead offering a fair rate that’s update every morning. This means you could potentially save money on your withdrawal, depending on the market rates. Monzo also doesn’t charge any ATM fees, so you can use your card at any ATM in the Eurozone without worry. All in all, Monzo’s euro cash withdrawal service is a convenient and affordable way to get access to cash while you’re abroad.

The rest of the world (outside the EEA)

In most countries, using the free Monzo account your limit is £200 per every 30 days, and they’ll charge 3% after that. However, with a Monzo Plus or Monzo Premium, the limits of up to £400 and up to £600 respectively, for free every 30 days. Then after that, they’ll charge 3%.

Is Monzo Good For Abroad? Final Thoughts

Is Monzo good for travelling? The short answer is yes. Monzo is one of the best travel cards that I have used, making travelling a lot easier. There’s nothing worse than getting back from travelling and paying an arm and a leg in exchange fees.

So, using Monzo has helped me save money. As well as using my Monzo bank card abroad, I’ve been using my card in London for some of the benefits listed above, and it’s made managing my money a little more fun. Who knew a bank could do that.

I can’t stop using my Monzo for travelling, and yes, you can use Monzo in the Czech Republic.

I hope this Monzo travel card review helped you, and If you have more questions about travelling with Monzo, you can check out their travel FAQ .

Sharing is caring!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Sharing is Caring

Help spread the word. You're awesome for doing it!

- Destinations

- All Inclusive

- City Breaks

- Summer 2024

- Pay Monthly Holidays

- Winter Holidays

- Faraway Escapes

- Holiday money

- Travel Money Card

- Travel Insurance

- Cruise Holidays

- Faraway Holidays

- Costa Del Sol

- Costa Dorada

- Gran Canaria

- Fuerteventura

- Praia Da Rocha

News & latest offers

FREE Spending Money with the Hays Travel Mastercard ®

Enjoy FREE holiday spending money until February 29th 2024 when you buy a Hays Travel Mastercard® online or in branch.

Load a minimum of £50 on purchase and get an extra £10 on us!

No wonder we're the Nation's Favourite Foreign Exchange provider.

Hays Travel Mastercard ®

The Hays Travel Money Card is the safe and easy way to take your money on holiday!

It is free to use in millions of locations worldwide where Mastercard Prepaid is accepted: including restaurants, bars, and shops when you spend in a currency loaded on the card.

This easy-to-use pre-paid card allows contactless transactions, chip and PIN, worldwide cash withdrawals wherever you see the Mastercard Acceptance Mark, and also 24/7 phone support.

Take your money card with you on every holiday, simply top up and go!

Buy in branch

Available Currencies

BRITISH POUNDS

Australian dollar

New Zealand dollar

Canadian dollar

South African Rand

Turkish Lira

Swiss Franc

Mexican Peso

Polish Zloty

Czech Koruna

Croatian Kuna

Swedish Krona

Japanese Yen

the Hays Travel Currency Card app

The Hays Travel Currency Card App enables you to fully manage your travel card account and stay in control of your holiday finances at home and abroad.

The app enables you to:

- Instantly top up multiple different currencies from anywhere in the world

- Check your real time balance

- Lock-in exchange rates when you top up and transfer money between currencies

- Keep track of your spending and view transactions

- Freeze/Unfreeze your card

- Check your card PIN

- Manage your personal details

download our app here

For information on how the card issuer uses your data, please click here

Hays Travel Prepaid Currency Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Apple and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC.

Terms and conditions apply. New card must be purchased with a minimum load of £50 by 29th February 2024.The free spending money of 10GBP will be automatically added to each qualifying cardholders account within 30 days of the initial load. Offer subject to availability. Voted the British Travel Awards Best Foreign Exchange Provider 2023.

Here Are the Four Best Travel Money Cards in 2024

François Briod

Co-Founder of Monito and money transfer expert, François has been helping Monito’s users navigate the jungle of money transfer fees, bad exchange rates and tricks for the last ten years.

Jarrod Suda

A writer and editor at Monito, Jarrod is passionate about helping people apply today’s powerful finance technologies to their lives. He brings his background in international affairs and his experiences living in Japan to provide readers with comprehensive information that also acknowledges the local context.

Links on this page, including products and brands featured on ‘Sponsored’ content, may earn us an affiliate commission. This does not affect the opinions and recommendations of our editors.

From the multitude of bank fees and ATM charges to hidden currency conversion fees, there's no question that spending your money abroad while travelling can be costly — and that's saying nothing about the cost of the holiday itself!

As you prepare for your trip abroad, the golden rule is that you'll save the most money by using the local currency of your destination. This means withdrawing local cash at foreign ATMs and using a debit card to pay directly in the local currency. For example, if you're from the UK, using your bank's debit card that accesses your British pounds will likely lose you money to hidden fees at ATMs abroad and at local merchants.

In general, we rate Revolut as the best travel card all around. Its versatile account and card can be used to spend like a local pretty much anywhere in the world. ✨ Get 3 months of free Revolut Premium as a Monito reader with our exclusive link .

If you're from the EU, UK, or US, here are a few more specific recommendations to explore:

- Best for travelling from the UK: Chase

- Best for travelling from the US: Chime ®

- Best for travelling from the Eurozone: N26

If it's not possible for you to spend in the local currency when travelling abroad, then spending in your home currency while using a card that doesn't charge any hidden exchange rate markups from your bank (e.g. only the VISA or Mastercard exchange rates to convert currency) is still a good bet for most people.

In this guide, we explore cards that waive or lower ATM fees and that hold multiple currencies. Spend on your holiday like a local and enjoy peace of mind after each tap and swipe!

Best Travel Cards (And More!) at a Glance

Best travel money cards.

- 01. What is the best best multi currency card? scroll down

- 02. Are prepaid currency cards really it? scroll down

- 03. Monito's best travel money card tips scroll down

- 04. FAQ about the best travel cards scroll down

Revolut: Best All-Rounder

Revolut is one of the most well-known fintechs in the world because it offers services across Europe, the Americas, Asia, and Oceania.

- Trust & Credibility 8.9

- Service & Quality 7.9

- Fees & Exchange Rates 8.3

- Customer Satisfaction 9.4

Revolut is available in many countries. You can double-check if it's available in yours below:

Here's an overview of Revolut's plans:

Revolut Ultra is currently only available in the UK and EU.

Like Wise, Revolut converts your currency to the local currency of your travel destination at an excellent exchange rate (called the 'Revolut Rate', which, on weekdays, is basically on par with the rate you see on Google), making it a good way to buy foreign currency before travelling abroad. As always though, bear in mind that Revolut's exchange rates might be subject to change.

Revolut's Standard Plan only allows currency exchange at the base mid-market exchange rate for transfers worth £1,000 per month. ATM withdrawals are also free for the first €200 (although third-party providers may charge a withdrawal fee, and weekend surcharges may also apply). These allowances can be waived by upgrading memberships.

N26: Good Bank For EU Travellers

One of the most well-known neobanks in Europe, N26 and its debit card operate in euros only. However, N26 is a partner with Wise and has fully integrated Wise's technology so that you never have to pay foreign transaction fees on your purchases outside of the eurozone. While N26 does not have multi-currency functionality, N26 will apply the real exchange rate on all your foreign purchases and will never charge a commission fee — making N26's card a powerful card for EU/EEA residents who travel across the globe.

- Trust & Credibility 7.9

- Service & Quality 8.0

- Fees & Exchange Rates 9.3

- Customer Satisfaction 8.1

These are the countries in which you can register for an N26 account:

And here is an overview of the various plans and account:

This low-fee option for banking is also ideal for travellers who do not belong to a European bank but frequent the Eurozone. For example, N26 is available for residents and citizens of Switzerland, Norway, and other European Economic Area countries that do not run on the Euro.

These citizens, who are in close proximity to the Eurozone, will save each time they spend with an N26 card while in Europe. N26 provides three free ATM withdrawals per month in euros but does charge a 1.7% fee per ATM withdrawal outside of Europe.

Take a look at our guide to the best travel cards for Europe to learn more.

Wise: Best For Multi-Currency Balances

Load up to 54 currencies onto this card at the real exchange rate, giving you access to truly global travel.

- Trust & Credibility 9.3

- Service & Quality 8.9

- Fees & Exchange Rates 7.6

- Customer Satisfaction 9.6

These are the countries in which you can order a Wise debit card:

Unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your home currency into up to 54 currencies. The live rate you see on Google or XE.com is the one you get with Wise.

An industry-low commission fee per transaction will range from 0.35% to 2.85%, depending on the currency.

Chase: Great UK Bank For Travel

A recent arrival from the USA, Chase is one of the UK’s newest digital challenger banks and comes with a rock-solid reputation and no monthly charges, no currency conversion charges, no withdrawal fees, and no other charges for everyday banking from Chase. It’s a simple, streamlined bank account with an excellent mobile banking app and a great cashback offer. However, it doesn’t yet offer more advanced features like international money transfers, joint accounts, business banking, overdrafts and loans, and teen or child accounts.

- Trust & Credibility 10

- Fees & Exchange Rates 10

- Customer Satisfaction 8.7

Chime: Great Account For US Travelers

Chime is a good debit card for international travel thanks to its no foreign transaction fees¹. Unlike multi-currency accounts like Revolut (which let you hold local currency), Chime uses the live exchange rate applied by VISA. This rate is close to the mid-market rate, and Chime does not add any extra markup to your purchases, although out-of-network ATM withdrawal and over-the-counter advance fees may still apply.

- Trust & Credibility 9.5

- Service & Quality 8.8

- Fees & Exchange Rates 9.8

While Chime waives ATM fees at all MoneyPass, AllPoint, and VISA Plus Alliance ATMs within the United States, this fee waiver does not extend to withdrawals made outside the country. For withdrawals abroad, Chime applies a $2.50 fee per transaction, with a daily withdrawal limit of $515 or its equivalent. This is in addition to any fees charged by the ATM owner. Therefore, we recommend Chime primarily for card purchases rather than relying on it for withdrawing cash while traveling internationally.

- No foreign transaction fees ¹;

- Uses VISA's exchange rate ( monitor here ):

- A $2.50 fee per ATM withdrawal made outside of the United States;

- More info: Read our Chime review or visit their website .

Best Travel Money Cards in 2024 Compared by Country

In the table below, see our comparison summary of the four best travel cards for 2024 by country:

Last updated: 8 January 2024

What's The Best Prepaid Card to Use Abroad?

Travel cards come in many varieties, such as standard credit cards or debit cards with no foreign transaction fees or cards that waive all foreign ATM withdrawal fees.

What is a Multi-Currency Card?

Multi-currency cards are a specific type of travel card that allows you to own all kinds of foreign currencies, which you can instantly access when you pay with your card abroad. By spending the local currency in the region of travel , you bypass poor foreign exchange rates. ATMs and cashless payment machines will treat your card like a local card.

We have already mentioned a few multi-currency cards in this review, but we will also introduce Travelex . Travelex's Money Card also allows you to top up several foreign currencies — albeit at exchange rates slightly poorer than the real mid-market rate .

Wise Account

Wise has one of the best multi-currency cards available on the market.

Read our full review for more details.

Revolut is impressive for its vast options in currencies and its additional services.

Our in-depth review explores Revolut's services in detail.

Travelex offers a prepaid travel money card that supports 10 currencies and waives all ATM withdrawal fees abroad.

- Trust & Credibility 9.0

- Service & Quality 5.8

- Fees & Exchange Rates 7.1

- Customer Satisfaction 9.3

Travelex charges fees, which fluctuate according to the exchange rates of the day, in order to convert your home currency into the currencies that it supports. But once the currency is on the card, you'll be able to spend like a local. Learn more with our full review .

Don’t Let Banks, Bureaux de Change, and ATMs Eat Your Lunch 🍕!

Are you withdrawing cash at an ATM in the streets of Paris? Exchanging currencies at Gatwick airport? Paying for a pizza with your card during a holiday in Milano? Every time you exchange currencies, you could lose between 2% to 20% of your money in hidden fees . Keep reading below to make sure you recognize and avoid them.

Currency Exchange Fees Eating My Lunch? What’s That?

You’re often charged a hidden fee in the form of an alarming exchange rate.

At any given time, there is a so-called “ mid-market exchange rate ” — this is the real exchange rate you can see on Google . However, the money transfer provider or bank you use to exchange currencies rarely offers this exchange rate. Instead, you will get a much worse exchange rate. They pocket this margin between the actual rate and the poor exchange rate they apply, allowing the bank or money transfer provider to profit from the currency exchange.

In other words, you or your recipient will receive less foreign currency for each unit of currency you exchange. All the while, the provider will claim that they charge zero commission or zero fees.

So the question now is… how can you avoid them? Thankfully, the best travel money cards will allow you to hold the local currency, which you can access instantly with a tap or swipe. Carrying the local currency avoids exchange rate margins on every purchase.

Top Travel Money Tips

- Avoid bureaux de change. They charge between 2.15% and 16.6% of the money exchanged.

- Always pay in the local currency and never accept the dynamic currency conversion .

- Don't use your ordinary debit or credit card unless it's specifically geared toward international use. Doing this will typically cost you between 1.75% and 4.25% per transaction. Instead, use one of the innovative travel money cards below.

By opting for a travel card without FX fees, you can freely swipe your card abroad without worrying about additional charges. However, saving money doesn't stop there. To make the most out of your travel budget, consider using Skyscanner , one of the most powerful flight search engines available that allows you to compare prices from various airlines and find the best deals.

With Skyscanner's user-friendly interface and comprehensive search options, you can discover cheap flights and enjoy your holidays with peace of mind and more money in your pocket.

Best Travel Money Card Tips

When you convert your home currency into a foreign currency, foreign exchange service providers will charge you two kinds of fees :

- Exchange Rate Margin: Providers apply an exchange rate that is poorer than the true "mid-market" exchange rate . They keep the difference, called an exchange rate margin .

- Commission Fee: This fee is usually a percentage of the amount converted, which is charged for the service provided.

With these facts in mind, let's see what practices are useful to avoid ATM fees, foreign transaction fees, and other charges you may encounter while on your travels.

Tip 1: While Traveling, Avoid Bureaux de Change At All Costs

Have you ever wondered how bureaux de change and currency exchange desks are able to secure prime real estate in tourist locations like the Champs-Élysées in Paris or Covent Carden in London while claiming to take no commission? It’s easy: they make (plenty of) money through hidden fees on the exchange rates they give you.

Our study shows that Bureaux de Change in Paris charges a margin ranging from 2.15% at CEN Change Dollar Boulevard de Strasbourg to 16.6% (!!) at Travelex Champs-Élysées when exchanging 500 US dollars into euros for example.

If you really want cash and can’t wait to withdraw it with a card at an ATM at your destination, ordering currencies online before your trip is usually cheaper than exchanging currencies at a bureau de change, but it’s still a very expensive way to get foreign currency which we, therefore, would not recommend.

Tip 2: Always Choose To Pay In the Local Currency

Don’t fall for the dynamic currency conversion trap! When using your card abroad to pay at a terminal or withdraw cash at an ATM, you’ve probably been asked whether you’d prefer to pay in your home currency instead of the local currency of the foreign country. This little trick is called dynamic currency conversion , and the right answer to this sneaky question will help you save big on currency exchange fees.

As a general rule, you always want to pay in the local currency (euros in Europe, sterling in the UK, kroner in Denmark, bahts in Thailand, etc.) when using your card abroad, instead of accepting the currency exchange and paying in your home currency.

This seems like a trick question - why not opt to pay in your home currency? On the plus side, you would know exactly what amount you would be paying in your home currency instead of accepting the unknown exchange rate determined by your card issuer a few days later.

What is a Dynamic Currency Conversion?

However, when choosing to pay in your home currency instead of the local one, you will carry out what’s called a “dynamic currency conversion”. This is just a complicated way of saying that you’re exchanging between the foreign currency and your home currency at the exact time you use your card to pay or withdraw cash in a foreign currency, and not a few days later. For this privilege, the local payment terminal or ATM will apply an exchange rate that is often significantly worse than even a traditional bank’s exchange rate (we’ve seen margins of up to 8%!), and of course, much worse than the exchange rate you would get by using an innovative multi-currency card (see tip #3).

In the vast majority of times, knowing with complete certainty what amount you will pay in your home currency is not worth the additional steep cost of the dynamic currency conversion, hence why we recommend always choosing to pay in the local currency.

Tip 3: Don't Use a Traditional Card To Pay in Foreign Currency/Withdraw Cash Abroad

As mentioned before, providers make money on foreign currency conversions by charging poor exchange rates — and pocketing the difference between that and the true mid-market rate. They also make money by charging commission fees, which can either come as flat fees or as a percentage of the transaction.

Have a look at traditional bank cards to see how much you can be charged in fees for spending or withdrawing $500 while on your holiday.

These fees can very quickly add up. For example, take a couple and a child travelling to the US on a two-week mid-range holiday. According to this study , the total cost of their holiday would amount to around $4200. If you withdraw $200 in cash four times and spend the rest with your card, you would pay $123 in hidden currency exchange and ATM withdrawal fees with HSBC or $110 with La Banque Postale. With this money, our travellers could pay for a nice dinner, the entrance fee to Yosemite Park, or many other priceless memories.

Thankfully, new innovative multi-currency cards will help you save a lot of money while travelling. Opening an N26 Classic account and using the N26 card during the same US holidays would only cost $13.60.

Need Foreign Cash Anyway?

In many countries, carrying a wad of banknotes is not only useful but necessary to pay your way since not every shop, market stall, or street vendor will accept card payments. In these cases you'll have two options to exchange foreign currency cheaply:

1. Withraw at an ATM

As we've explored in great depth in this article, withdrawing money from a foreign ATM will almost always come with fees — at the very least from the ATM itself, and so it's therefore the best strategy to use a travel debit card that doesn't charge in specific ATM withdraw fees on its own to add insult to injury. That said, if you need cash, we recommend making one large withdrawal rather than multiple smaller ones . This way, you'll be able to dodge the fees being incurred multiple times.

2. Buy Banknotes (at a Reasonable Rate!)

As we've also seen, buying foreign currency at the airport, at foreign bank branches, or in bureaux de change in tourist hotspots can be surprisingly expensive. Still, not all exchange offices are equally pricey . If you're looking for a well-priced way to exchange your cash into foreign currency banknotes before you travel, Change Group will let you order foreign currency online and pick them up at the airport, train station, or a Change Group branch just before you leave for your holiday. A few pick-up locations in the UK include:

- London centre (multiple locations),

- Glasgow centre,

- Oxford centre,

- Luton Airport,

- Gatwick Airport,

- St. Pancras Station.

(Note that Change Group also has locations in the USA, Australia, Germany, Spain, Sweden, Austria, and Finland!)

Although its exchange rates aren't quite as good as using a low-fee debit card like Revolut, Change Group's exchange rates between popular currencies tend to be between 2% to 3%, which is still a lot better than you'll get at the bank or at a touristy bureau de change in the middle or Paris or Prague!

FAQ About the Best Travel Money Cards

Having reviewed and compared several of the industry's leading neobanks, experts at Monito have found the Wise Account to offer the best multi-currency card in 2024.

In general, yes! You can get a much better deal with new innovative travel cards than traditional banks' debit/credit cards. However, not all cards are made equal, so make sure to compare the fees to withdraw cash abroad, the exchange rates and monthly fees to make sure you're getting the best deal possible.

- Sign up for a multi-currency account;

- Link your bank to the account and add your home currency;

- Convert amount to the local currency of holiday destination ( Wise and Revolut convert at the actual mid-market rate);

- Tap and swipe like a local when you pay at vendors.

Yes, the Wise Multi-Currency Card is uniquely worthwhile because it actually converts your home currency into foreign currency at the real mid-market exchange rate . Wise charges a transparent and industry-low commission fee for the service instead.

More traditional currency cards like the Travelex Money Card are good alternatives, but they will apply an exchange rate that is weaker than the mid-market rate.

The Wise Multi-Currency Card is the best money card for euros because unlike banks, credit unions, airport kiosks, and foreign ATMs, Wise is transparent about never charging a hidden exchange rate margin when you convert your local currency into euros with them.

The live rate you see on Google or XE.com is the one you get with Wise . An industry-low commission fee will range from 0.35% to 2.85%. USD to EUR transfers generally incur a 1.6% fee.

Learn more about how to buy euros in the United States before your trip.

There are usually three types of travel cards, prepaid travel cards, debit travel cards and credit travel cards. Each have pros and cons, here's a short summary:

- Prepaid travel cards: You usually need to load cards with your home currency via a bank wire or credit/debit card top-up. You're then able to manage the balance from an attached mobile app and can use it to pay in foreign currencies or withdraw cash at an ATM abroad tapping into your home currency prepaid balance. With prepaid travel cards, as the name indicates, you can't spend more than what you've loaded before hand. Some prepaid card providers will provide ways to "auto top-up" when your balance reaches a certain level that you can customize. On Revolut for example, you can decide to top-up £100/£200/£500 from your debit card each time your balance reaches below £50.

- Debit travel cards: Some innovative digital banks, like N26 or Monzo, offer travel debit cards that have the same advantages than a Prepaid Travel Cards, except that they're debit card directly tapping into your current account balance. Like a Prepaid travel card, you can't spend more than the balance you have in your current account with N26 or Monzo, but you can activate an overdraft (between €1,000 or €10,000 for N26 or £1,000 for Monzo) if you need it, for a fee though.

Note that even if they're Prepaid or Debit cards, you can use them for Internet payments like a normal credit card.

- Credit travel cards: You can find credit cards made for international payments offering good exchange rates and low fees to withdraw money abroad, but you'll need to pay interests in your international payment if you don't pay in FULL at the end of every month and interest on your ATM withdrawals each day until you pay them back.

Why You Can Trust Monito

Our recommendations are built on rock-solid experience.

- We've reviewed 70+ digital finance apps and online banks

- We've made 100's of card transactions

- Our writers have been testing providers since 2013

Other Monito Guides and Reviews on Top Multi Currency Cards

Why Trust Monito?

You’re probably all too familiar with the often outrageous cost of sending money abroad. After facing this frustration themselves back in 2013, co-founders François, Laurent, and Pascal launched a real-time comparison engine to compare the best money transfer services across the globe. Today, Monito’s award-winning comparisons, reviews, and guides are trusted by around 8 million people each year and our recommendations are backed by millions of pricing data points and dozens of expert tests — all allowing you to make the savviest decisions with confidence.

Monito is trusted by 15+ million users across the globe.

Monito's experts spend hours researching and testing services so that you don't have to.

Our recommendations are always unbiased and independent.

What are you looking for?

Wise vs monzo: which is best in 2024 [in-depth & unbiased].

Planning a trip has to be one of the best things in the world.

Discovering where you’ll stay, what you’ll do, and what delicious foods you’ll try.

However, people often forget about one of the most important factors - the money!

Nobody likes spending their hard-earned cash, even when it comes to travel. That’s why it’s vital you make the most of your money, and one of the best ways to do this is by having a great travel card.

There are plenty of them to choose from, so honestly, it can feel a little overwhelming if you’re deciding which one to go for.

That’s where we come in!

In this guide, we’re going to be looking at the similarities and differences between Monzo and Wise .

We’ve been using both these platforms for several years now, so have got plenty of experience with each one.

Both of them have a lot to offer, and each has its own benefits.

So let’s take a look at which one is most suited to you…

Travellerspoint

Great Features of Wise for Travel

For this section, I’m just going to be talking about Wise’s free personal plan , as I’ll compare the business plans later on in the article.

Wise is a fantastic option for frequent travelers , as they offer so many handy features.

Here are some of the benefits of having a Wise account:

- They offer multi-currency accounts so you can hold money in 50+ currencies

- Money can be exchanged between currencies for the real exchange rate

- You can withdraw up to £200 per month for FREE from international ATMs

- You can spend a Wise debit card in 175 countries

- Wise is available in over 60 countries, and your card can be shipped out to you (for a fee, this differs depending on where in the world you are)

- Great security with two-factor authentication and the ability to freeze your card if it gets lost or stolen

- Wise offers virtual cards as well as a debit card

- You’ll benefit from low transfer fees

- Wise is great for receiving payments in foreign currencies

- Although not specifically travel-related, a Wise account is FREE to open, and there are no monthly fees

For more information on this awesome travel card, you can check out our in-depth Wise Review !

Wise Business

Now it’s time to look at the benefits of opening a Wise business account. Unlike personal accounts, these are tailored specifically towards self-employed individuals or digital nomads who work on the go.

The best part about having a business account with Wise is that they’re FREE to open so you’ll be subject to no monthly charges or hidden fees . However, there are so many other handy features.

So let’s take a look at the benefits of opening a Wise business account!

Key Features of a Wise Business Account

- You can earn up to 0.5% cashback with a Wise Business debit card

- Wise offers batch payments; you can pay up to 1,000 people in just one click

- Virtual cards can be created to separate expense types

- Wise Business accounts can be connected with other platforms like Xero

- Quick payments - 50% of payments are instant or arrive within the hour

- Money can be moved between currencies in seconds

Great Features of Monzo for Travel

As with Wise, this section is just going to detail Monzo's free personal plans . We’ll take a look at their business plans later on.

- You can withdraw between £200-600 per month for FREE from international ATMs (depending on which plan you choose)

- Monzo offers a fantastic exchange rate, as it’s based on Mastercard rates

- You can freeze your card if it gets lost or stolen

- Monzo offers an overdraft feature, and you won’t be charged if you go into it

- You can order a replacement card to over 100+ countries (free if you’re in the UK, but you’ll need to pay £30 for international shipment)

- There’s a bill-splitting feature which is extremely handy if you’re traveling as a group

Additional Monzo Features

Here are some of Monzo’s other awesome features:

- The ability to sync up your salary

- Saving pots - includes Cash ISAs and easy-access saving accounts

- Compatible with both Google and Apple Pay

- You can apply for loans with Monzo

- Monzo offers clear monthly budgeting

Monzo Paid Features

Monzo has two paid plans, and these offer specific features of their own that you can’t access on a free plan .

Here are some of the ‘paid features’:

- Virtual cards - handy for online payments if you’re using a Monzo card abroad

- Credit tracker - this allows you to track and monitor your credit score

- Included travel insurance

- Discounted airport lounge access

- Interest on balance and regular pots - 1.50%/1.49% AER/Gross on up to £2,000

Comparing Monzo Personal Plans

There are three personal accounts available with this platform; Monzo, Monzo Plus, and Monzo Premium.

To give you more of an understanding, the table below will help you to grasp the key differences.

The below screenshot offers a snapshot of the key differences between just the two paid plans if you aren’t interested in the free option.

As you can see, Monzo has a lot to offer when it comes to their personal plans . The paid plans offer the most features by far, as you’ll benefit from higher fee-free atm withdrawals abroad, virtual cards, and interest on your balance and regular saving pots.

Monzo Premium and Monzo Plus also offer you phone insurance, worldwide family travel insurance, and discounted airport lounge access.

Don’t get me wrong, the free plan offers all the basic things you’ll need and is still fantastic value. However, there are plenty of reasons why you may want to upgrade!

Another great thing about Monzo is that they also offer joint accounts, Monzo Flex (which is an alternative to a credit card), and accounts for 16-17-year-olds.

Our Monzo Review goes into all these accounts and their benefits in more depth if you’re interested.

Monzo Business Accounts

Monzo offers two business plans; Monzo Lite and Monzo Pro . We haven’t used Monzo specifically for business, as we have a fantastic Revolut account that does everything we need.

You can read more in our in-depth Revolut review here .

However, we’ve read some great things about these business accounts, and customers seem to be very happy with them!

Unlike Wise which only offers a free account, Monzo also offers a paid business plan . Let’s take a look at the differences between this and the platform’s free plan, so you know what you’re getting for your money.

Comparing Monzo Business Accounts

The table below will give you a quick idea of the key differences between Monzo Lite and Monzo Pro.

Of course, the main difference between these two accounts is that one’s free, while you’ll have to pay £5 a month for the other. However, paying this amount is well worth the upgrade in my opinion.

With Monzo Pro, you’ll have extra features such as virtual cards and tax pots, and multiple users will have access to the account.

If you’re after a business plan then just make sure you do your research, and then you can decide for yourself. When it comes to money, it’s best not to go solely off someone else's opinion.

Some of the additional features that Monzo Pro offers include:

- The ability to integrate your account with other platforms - Xero, FreeAgent, or QuickBooks

- Auto-export transactions - any transactions will be added straight to a Google Sheet so you can keep track of your spending

What are the key differences between Wise and Monzo?

So what are the differences between a Monzo account and a Wise account ? To make this section easier to digest, I’m going to split it up into personal plans and business plans.

Then afterward, I’ll take a look at each company in more depth, and what each one has to offer.

Comparing Wise and Monzo personal plans

As the table shows, there are plenty of differences between Wise and Monzo. For starters, both platforms offer a free account, but Monzo also has paid plans available.

One of the best things about Wise is its widespread availability, as you can open an account in 65 countries . With Monzo, you have to be in the United Kingdom or United States so you’re a lot more restricted.

Nevertheless, Monzo allows up to £600 monthly no-fee ATM withdrawals abroad (depending on the plan you choose), while Wise has a limit of £200 which is significantly less.

In all honesty, there’s a nice cohesion there between the two, especially when it comes to international transfers. However, I’ll talk about this more later!

Comparing Wise and Monzo business plans

First of all, Wise only offers a free business plan, while with Monzo, you’ve got two options.

Now, there are plenty of similarities when it comes to these two platforms including multi-user access, integrated accounting, and virtual cards. This is rather impressive considering Wise business accounts are FREE to open!

Wise also offers bulk payments which are extremely handy for business owners , whereas Monzo is yet to introduce this feature.

However, with Monzo , you will have access to budget and categorized spending and other additional features that Wise doesn’t offer. This includes tax pots, invoicing, and auto-export transactions.

Both platforms have impressive business plans available, and you’ll want to dive a little deeper into the specific features and services before you make a decision.

Wise Vs Monzo: A Breakdown of the key differences

Both Monzo and Wise have a variety of fantastic features and services, however, it’s time to compare them and see who comes out on top.

Below, we’ll take a look at some of the most important features when it comes to travel cards!

1. Withdrawing money from ATMs abroad

Arguably one of the most important factors for frequent travelers - withdrawing money from an ATM while abroad! If you’re not careful, you can lose a lot of money by doing this.

Both Wise and Monzo allow you to withdraw up to £200 of no-fee ATM withdrawals, with their free accounts. However, if you opt for a paid plan with Monzo you’ll be able to withdraw up to £600 (depending on which plan you choose).

This is a much larger amount, although you can just opt for a free account with both, and take advantage of the combined no-free withdrawals.

Anyway, thanks to its high monthly limits, Monzo wins this one hands down!

2. Virtual Cards

Both Wise and Monzo offer virtual cards, and these are a vital feature for security purposes.

This is especially the case if you need to pay for things online such as a visa or tour tickets, as it’s all too easy for your details to be corrupted (unfortunately, fraudsters are very smart these days).

As virtual cards have different details compared to your standard card, they can simply be disposed of afterward.

For this feature, you’ll need to opt for one of the paid personal plans with Monzo, as they’re not included with the free plan.

As you can use virtual cards with Wise for free, they’re the clear winner for this one.

3. International money transfers

The interesting thing about Monzo is that you can’t receive or send money overseas through the platform. Instead, they have a partnership with Wise that allows you to do international transfers.

The overseas payment fees are set up by Wise, and you’ll need to research this separately. These fees do change depending on the currency and the amount of money you’re receiving or sending.

As you can’t receive international transfers to your Monzo account, you’ll need to have a Wise account too. You can then transfer money between the two via a domestic bank transfer.

As Monzo requires Wise for international transfers, Wise wins this one.

4. Replacing lost cards

Both Wise and Monzo allow you to freeze your card if it’s been lost or stolen which is extremely reassuring. Each platform will also send replacements out to you, but the price of this will differ depending on where you are in the world.

With Monzo, if your card has been stolen or you’ve been a victim of fraud then there’s no fee for UK delivery. However, for other reasons, you’ll need to pay £5. Wise charges £2.50 for UK delivery.

Both Monzo and Wise will also ship the card internationally . With Monzo, this costs £30, whereas, with Wise, it all depends on where you’re shipping it to.

I’m going to say there are no winners for this one, as it’s hard to compare without Wise’s specific prices for international delivery.

5. Transfer fees

Both Monzo and Wise are known for their low transfer fees. However, Wise actually put up their fees back in 2022 and this seemed to increase the cost of our conversions.

For that purpose, I’d say Monzo is the clear winner!

With Monzo, there are no transfer fees for depositing money in a Monzo bank account or any other UK bank account .

However, as I mentioned previously, it’s important to remember that this doesn’t apply to international money transfer services as you’ll also need a Wise account. This is thanks to their partnership, so just keep that in mind.

6. Locations where you can open an account

No matter the features or services offered by a platform, they’re of no use to you, if you can’t open an account in your country of origin.

You can only open a Monzo card in the United Kingdom and the United States, and that’s relatively restrictive when it comes to travel cards.

Thanks to its widespread availability, Wise is easily the winner!

You can open a Wise card in 65 countries at the minute , which means it’s available to millions of other people compared to Monzo. Just make sure you check it’s available in your location before downloading the app and applying.

Other differences between Wise and Monzo that aren’t travel-related

1. user-friendliness.

This is another key factor to consider when choosing between Monzo and Wise. You want to make sure you opt for a travel card that’s simple to use, and one that allows you to access your account quickly.

We’ve used Monzo and Wise for several years now and in our opinion, both of them are easy to use.

Monzo and Wise both have a popular app that allows you to access your account right from your mobile phone. However, you can also use the desktop version if you wish.

I’d say there are no clear winners for this one, as both travel apps and desktop versions are very simple to use.

2. Customer Support

No matter how careful you are with your money, it’s likely you’re going to need customer support at some point. This could simply be due to a technical fault or error, but either way, this is something to think about.

Wise offers great customer service, as they have an online help center and a support team. This team can be contacted through a variety of platforms including email, Facebook, Twitter, and Whatsapp.

The best way to contact Monzo is on the phone or through their Monzo app.

Both Monzo and Wise offer 24/7 customer service, however, Monzo offers a live chat service within their mobile app which makes them the winner.

3. Reputation

Monzo has a rating of 4.1 on the Google Play Store, and 4.9 on the Apple Store. They have thousands of excellent reviews, with people commenting on the wide variety of features, and great customer service.

However, there are some negative reviews regarding technical glitches within the app, and the fact that they’ve brought in limited free card replacements.

With a rating of 4.8 on Google Play and 4.7 on the Apple Store, Wise has got plenty of amazing reviews too. Some of these include comments about user-friendliness and smooth transfers.

Some of the negative reviews focus on app malfunctions (like Monzo), customer support, and technical issues to do with their account.

There seems to be pros and cons to both, but Wise seems to have the better ratings.

4. Additional Features

In terms of additional features, Monzo has to be the clear winner!

Although Wise offers a multi-currency account, plenty of banking services, and they’ll save you money on fees, there aren’t too many additional features.

They are starting to roll some out now like assets and saving jars, but Monzo has a lot more to offer in this regard.

For starters, they offer loans, overdrafts, Monzo Flex (which is similar to a credit card), interest on saving pots, and joint accounts.

There are also plenty of awesome features for travelers if you opt for a paid plan. This includes family travel insurance, discounted airport lounge access, and phone insurance.

Overall Verdict: Wise Vs Monzo - which one is better for travel?

When it comes to using Wise and Monzo abroad, there are endless benefits. From Wise’s multi-currency accounts and widespread availability to Monzo’s additional features, both of these platforms are great options.

Monzo bank accounts are covered by the FCSC (Financial Services Compensation Scheme), whereas Wise is covered by the FCA (the Financial Conduct Authority) in the UK. So, no matter which one you choose, you know your cash is in good hands.

A Monzo travel card is suitable for everyday use in the UK and abroad, while Wise can be used in 175 countries so both offer plenty of flexibility. However, the fact that you can hold up to 50 currencies with Wise is a big stand-out feature!

Another thing to consider is international transfers as you’ll require an account with both if you opt for Monzo . With Wise, you also don’t need to pay for virtual accounts as they come included with the free account. Unfortunately, they’re only included in Monzo’s paid plans.

Wise is a fantastic option for sure, but Monzo has so many incredible features that Wise just can’t match. This includes loans, overdrafts, Monzo Flex (a credit card alternative), and joint accounts.

Not only that, but the paid plans include worldwide family travel insurance and discounted airport lounge access - both extremely handy for frequent travelers!

Overall, I recommend that you go for one of each as they both have so much to offer but I’ll go into this more now…

Why not go for both Wise and Monzo?

To be honest, it’s not so much which one of these you should go for, but rather, why not just have both?

For starters, you can get a free account with both platforms and each one offers slightly different things. You’ll also get to take advantage of two lots of no-fee ATM withdrawals!

If you’re looking to do international transfers with Monzo then you’ll need an account with Wise anyway, so it makes sense to try them both out.

This way you can see which one works best for you, or simply have an account with both which is what we do!

The Future of Wise and Monzo

Both of these providers are a great option when it comes to managing your finances. However, what suits one person may not suit another, so it’s important to do your research.

At the time of writing, Monzo has far more to offer in terms of additional features but this may change in the future. Likewise, they currently rely on Wise for international transfers, and Wise itself offers an incredible multi-currency account.

If you want my opinion, then I recommend keeping an eye on these companies, as they’re bound to introduce more features in the coming years.

How to sign up for Wise and Monzo

Signing up for both Wise and Monzo is extremely easy. First of all, download the app for each platform:

- Find Wise here

- Find Monzo here

Once you’ve downloaded the app, you’ll be required to enter some personal details like your name, birthday, email address, and home address.

After entering these details, your account will then need to be verified with a form of ID . This can typically be a passport or driver's license, and with Monzo, you’ll then need to do a selfie video for comparison.

Once that’s sorted, you just need to wait for your card to be sent out to you. If you’re in the UK, this will take a couple of days but allow longer if you’re abroad.

Remember with Monzo, you’ll need to pick which account you want to go for too. As Wise only offers one type of personal account and it’s free, you won’t need to take any further steps.

Other travel cards to try

Revolut is a fantastic alternative, and it’s one of our favorite travel cards!

Not only do they offer one of the best exchange rates around, but you’ll save tons of cash when it comes to transfer fees, foreign currency fees, and sending money abroad.

You’ll benefit from tons of additional features too including cashback, cryptocurrency trading, stock trading, and the ability to ‘split bills’. Better yet, the paid plans include travel insurance, and even FREE airport lounge passes in some cases.

Not only that but there are a variety of personal and business plans to choose from with Revolut .

For more information, you can check out these two in-depth guides:

- Wise Vs Revolut

- Monzo Vs Revolut

2. Starling Bank

Like Monzo, Starling offers fully-regulated bank accounts which are protected by the FSCS. This means Starling can be used as your primary bank account, and they have a super easy application process.

The highlight of having a Starling bank account is that there’s no cap on FREE ATM monthly withdrawals. Yes, you heard that right, and that’s a huge bonus for us travelers!

You’ll also have access to 24/7 UK-based customer support. However, if I’m being honest, we’ve never been huge fans of this bank.

Unlike other travel cards such as Wise, Monzo, and Revolut, they don’t seem to offer any other additional features. Not only that but when we looked into them, the exchange rate didn’t seem to be as good.

Wise Vs Monzo? Which one takes the top spot for you…

Choosing the perfect travel card isn’t easy as each one has so much to offer. This is especially the case when it comes to Wise and Monzo!

Hopefully, this guide has given you an idea of what each platform has to offer. Whether you’re looking to send money abroad or withdraw funds while on holiday, both Wise and Monzo can save you lots of cash.

As I previously mentioned, I honestly believe you’ll benefit from having an account with both. But of course, that decision is entirely up to you!

Companies are constantly updating their features too, so you might find that these platforms will offer even more services in the months and years to come.

Here are some other guides that you may find helpful:

- Safetywing Review

- Ultimate Travel Packing List

- Best Travel Jobs

Leave a comment

Let us know what you think.

5 million people can't be wrong

Get your Hays Travel Money Prepaid Mastercard ® Currency Card

- Choose your currencies

- Tell us about you

- Make your payments

Ready to start?

Hays Travel Money Prepaid Currency Card is issued by PrePay Technologies Limited pursuant to license by Mastercard International. PrePay Technologies Limited is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011 (FRN: 900010) for the issuing of electronic money and payment instruments. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Exchange Rates

Which digital bank – Monzo, Starling, or Chase?

In our quest to find the best digital bank in the UK, we take a look at the top three. Monzo, Starling and Chase.

Recent FCA data shows that nearly 1 in 12 of all personal current accounts are now with a digital bank such as Monzo or Starling .

Innovation, ease of use, and customer service are some of the key reasons people are making the switch. And with the average person now likely to have friends, relatives or work colleagues using a digital bank, this trend is only going to increase. Is it time you switched to digital banking?

At the time of writing there are six digital banks in the UK, but not all of these offer personal current accounts. The big two are Monzo and Starling, but we’ll also include the newly formed Chase Bank in this guide as although it doesn’t yet offer all of the features of its older counterparts, it is slowly coming up to speed.

Revolu Click Here t , is the other big name in fintech. In fact, it has more customers than all of the other digital banks put together, but does not yet have a banking licence in the UK. Instead, it is an e-payments provider and as such falls out of the scope of this article.

Chase vs Monzo vs Starling – which digital bank should I choose?

We’re not going to turn this into a Monzo vs Starling vs Chase debate, but instead run through a key list of personal banking features and see how each one performs, so you can decide which one best suits your needs.

Before we do that though, let’s get a brief overview of each of the challengers.

Starling bank overview

Despite the fanfare around Monzo, Starling was the first digital challenger to launch personal current accounts in the UK. It offers everything you need for day-to-day banking and continues to be a leader when it comes to innovative new features.

This innovation has seen Starling gain over 3m personal and business account customers since its launch in 2017.

Monzo – bank account overview

Monzo’s marketing success stems back to when it was pre-pay travel card. Since then, it has gone from strength to strength in terms of features, customer loyalty, and growth.

What Starling does quietly behind the scenes Monzo shouts about loud and proud, leading to it to be dubbed the ‘noisy neighbour’ (a term taken from the rivalry between Manchester United and Manchester City).

Fortunately for Monzo it backs up the marketing hype with one of the best accounts around, and the largest subscriber base of any UK digital bank. It currently serves over 5m current account customers across its business and personal lines.

Tip: If you sign up for a Monzo bank account via our link you’ll get a free £5 welcome bonus

Chase UK – bank account overview

Chase added itself to the Monzo vs Starling debate, when it launched its current account in winter 2021. It is the newest of the three main digital challenger banks. Don’t let that fool you though. It is backed by JP Morgan Chase the largest consumer bank in the US, and has gained more than a million customers in its first 12 months. That’s more than Monzo and Starling managed together during their first year of operation.

Despite this rapid growth, Chase’s offering in the UK is still a little immature. It initially launched without the ability to accept direct debits (added in 2022), or ability to handle cash deposits, and still isn’t a member of CASS the current account switching service

What it offers over the other two is 1% cashback on spending (thought this comes with some caveats), 5% interest on ‘round-ups,’ and some of the most generous foreign ATM withdrawal limits around. Whether that is enough to attract and keep customers whilst the rest of the features are fleshed out remains to be seen.

See our full review of the Chase UK bank account here .

Opening an account a digital bank account with Monzo, Starling, and Chase

Opening an account with Starling, Monzo, or Chase is fast, free, and easy. The process is all done in app and requires that you take a photo of your ID, confirm your address, and take a short video selfie.

Account verification can take anything from a few minutes to a couple of hours, whilst your information is checked. In our tests it took a few attempts at uploading the ID to Chase, whereas the Starling and Monzo process was completed without hiccups. All accounts were open within an hour or less.

We’ve included links below should you want to open any of the three accounts:

>> Open a Starling bank current account

>> Open a Monzo current account