U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

Expat Travel Insurance: The 5 Best Options for Globetrotters

Travelex Insurance Services »

Allianz Travel Insurance »

World Nomads Travel Insurance »

GeoBlue »

IMG Travel Insurance »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Best Expat Travel Insurance Options.

Table of Contents

- Rating Details

- Travelex Insurance Services

- Allianz Travel Insurance

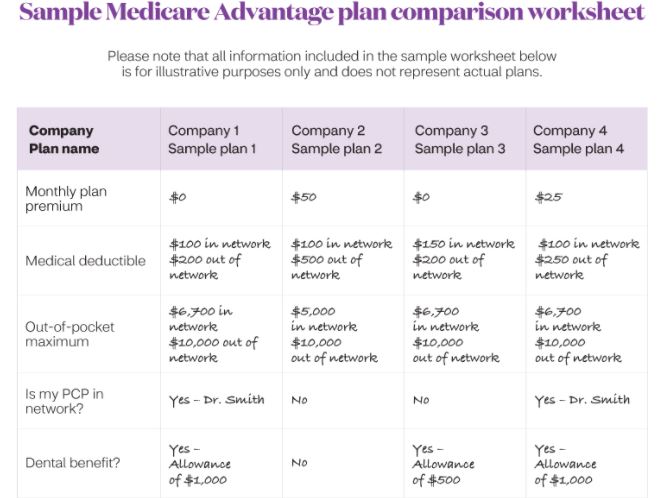

Americans living abroad for all or even part of the year have a different set of considerations when it comes to finding a travel insurance plan. For example, expats may not need coverage for the same issues as people taking regular vacations, such as trip cancellations and interruptions, trip delays, and lost or delayed baggage. Instead, expats often primarily need health insurance or medical insurance for travel that works both at home and abroad, as well as coverage for emergency medical evacuation.

That said, not all travel insurance companies cover preexisting conditions within their trip insurance plans for expats. Further, some insurance providers limit coverage in a traveler's home country, especially for those who would normally reside in the United States. That's why, ultimately, U.S. citizens living abroad need to compare health plans that can work when they're away based on their coverage options, limitations and costs. Read on to find out which expat insurance plans U.S. News recommends and what each plan has to offer.

- Travelex Insurance Services: Best Premium Coverage for Expats

- Allianz Travel Insurance: Best for Comprehensive Coverage

- World Nomads Travel Insurance: Best for Adventure Travelers

- GeoBlue: Best for Medical-Only Coverage

- IMG Travel Insurance: Best Travel Health Insurance for Seniors

Best Expat Travel Insurance Options in Detail

Kids-included pricing

Preexisting conditions coverage available

Coverage can be expensive

- Trip cancellation coverage worth up to 100% of the trip cost (maximum of $50,000)

- Trip interruption coverage worth up to 150% of the trip cost (maximum of $75,000)

- Travel delay coverage worth up to $2,000

- Missed connection coverage worth up to $750

- Emergency medical coverage worth up to $50,000 (dental limit of $500)

- Emergency medical evacuation and repatriation coverage worth up to $500,000

- Baggage and personal effects coverage worth up to $1,000

- Baggage delay coverage worth up to $200 (12-hour delay required)

- Sporting equipment delay coverage worth up to $200 (24-hour delay required)

- Accidental death and dismemberment coverage worth up to $25,000

Includes a range of comprehensive travel insurance benefits

Coverage can be purchased on an annual basis

Annual plan coverage lasts for trips of up to 45 days at a time

- Trip cancellation coverage worth up to $3,000

- Trip interruption coverage up to $3,000

- Emergency medical coverage up to $20,000

- Emergency medical transportation insurance up to $100,000

- Baggage loss and damage coverage up to $1,000

- Baggage delay coverage up to $200

- Travel delay coverage up to $600

- Rental car damage and theft coverage up to $45,000

- Travel accident coverage up to $25,000

150-plus adventure sports are covered

Choose the level of protection you need

Preexisting conditions typically not covered

- $10,000 in insurance for trip cancellations

- $100,000 in coverage for emergency medical expenses

- $500,000 in coverage for emergency medical evacuation

- $3,000 in protection for your bags and gear

Get comprehensive travel health insurance that works anywhere in the world

Customize your policy to suit your unique needs

Comes without coverage for trip cancellations, baggage and more

Travel medical coverage can be extended for up to 12 months

Limits can be high based on age and other factors

Deductibles of up to $2,500 can apply

No ongoing coverage for preexisting medical conditions

- Up to $250,000 in protection for emergency medical evacuations

- Prescription drug coverage

- Up to $50,000 in coverage for repatriation of remains

- Up to $50,000 in protection for political evacuations

Why Trust U.S. News Travel

Holly Johnson is an award-winning writer who has been covering personal finance, travel and insurance topics for more than a decade. She has researched travel insurance options for her own vacations and family trips to more than 50 countries around the world, which has led to her having personal experience navigating the claims and reimbursement process. Johnson works alongside her husband, Greg, who has been licensed to sell travel insurance in 50 states, in their family business.

You might also be interested in:

9 Best Travel Insurance Companies of 2024

Holly Johnson

Find the best travel insurance for you with these U.S. News ratings, which factor in expert and consumer recommendations.

8 Cheapest Travel Insurance Companies Worth the Cost

U.S. News rates the cheapest travel insurance options, considering pricing data, expert recommendations and consumer reviews.

Does My Health Insurance Cover International Travel?

Private health insurance typically doesn't cover international travel expenses.

5 Best Travel Insurance Plans for Seniors (Medical & More)

Discover coverage options for peace of mind while traveling.

June 1, 2020

Due to travel restrictions, plans are only available with travel dates on or after

Due to travel restrictions, plans are only available with effective start dates on or after

Ukraine; Belarus; Moldova, Republic of; North Korea, Democratic People's Rep; Russia; Israel

This is a test environment. Please proceed to AllianzTravelInsurance.com and remove all bookmarks or references to this site.

Use this tool to calculate all purchases like ski-lift passes, show tickets, or even rental equipment.

Safer travel starts with travel protection

If you were referred by a travel agent, enter the ACCAM number provided by your agent.

{{travelBanText}} {{travelBanDateFormatted}}.

{{annualTravelBanText}} {{travelBanDateFormatted}}.

Type the country where you will be spending the most amount of time.

Age of Traveler

Ages: {{quote.travelers_ages}}

Travel Dates

{{quote.travel_dates ? quote.travel_dates : "Departure - Return" | formatDates}}

Plan Start Date

{{quote.start_date ? quote.start_date : "Date"}}

International Travel Insurance

International travel is exciting whether it's a quick visit to Paris, an African safari or a week in the Caribbean. Wherever your adventure takes you, international travel insurance can help you travel with peace of mind. If you become sick or injured while traveling; or if circumstances cause you to cancel or interrupt your trip, international travel insurance is there to help you. And, with our OneTrip Prime plan , kids 17 and under are covered for free when traveling with a parent or grandparent (not available on policies issued to Pennyslvania residents). If something goes wrong when you're far from home, we're here to help. Just call our 24-hour assistance hotline.

View international travel insurance products .

International Travel Articles

The rewards of international travel are incredible — but before your adventure begins, you have to get through customs. We'll help you plan your next overseas trip, figure out what to pack, and protect yourself while you're traveling.

Featured Articles

Share this page.

- {{errorMsgSendSocialEmail}}

Travel Insurance with Benefits for International Travel

Travel overseas is one of the most wonderful experiences, but if something goes... More »

What's the Best International Travel Insurance?

Heading overseas soon? Luck you! Just make sure that you have travel insurance... More »

Maximize Your Travel Budget with Currency Exchange Habits

With all the trip planning that goes into making getaways equal parts fun... More »

{{articlePreview.snippet}} Read More

Terms, conditions, and exclusions apply. Please see your plan for full details. Benefits/Coverage may vary by state, and sublimits may apply.

Insurance benefits underwritten by BCS Insurance Company (OH, Administrative Office: 2 Mid America Plaza, Suite 200, Oakbrook Terrace, IL 60181), rated “A” (Excellent) by A.M. Best Co., under BCS Form No. 52.201 series or 52.401 series, or Jefferson Insurance Company (NY, Administrative Office: 9950 Mayland Drive, Richmond, VA 23233), rated “A+” (Superior) by A.M. Best Co., under Jefferson Form No. 101-C series or 101-P series, depending on your state of residence and plan chosen. A+ (Superior) and A (Excellent) are the 2nd and 3rd highest, respectively, of A.M. Best's 13 Financial Strength Ratings. Plans only available to U.S. residents and may not be available in all jurisdictions. Allianz Global Assistance and Allianz Travel Insurance are marks of AGA Service Company dba Allianz Global Assistance or its affiliates. Allianz Travel Insurance products are distributed by Allianz Global Assistance, the licensed producer and administrator of these plans and an affiliate of Jefferson Insurance Company. The insured shall not receive any special benefit or advantage due to the affiliation between AGA Service Company and Jefferson Insurance Company. Plans include insurance benefits and assistance services. Any Non-Insurance Assistance services purchased are provided through AGA Service Company. Except as expressly provided under your plan, you are responsible for charges you incur from third parties. Contact AGA Service Company at 800-284-8300 or 9950 Mayland Drive, Richmond, VA 23233 or [email protected] .

Return To Log In

Your session has expired. We are redirecting you to our sign-in page.

About Aetna

- News & analysis

Initiatives

Health section, international health insurance for individuals.

Enjoy peace of mind wherever you travel with global medical coverage.

We have over 30 years experience in international health insurance. And more than 500,000 members trust us with their care worldwide. We offer:

- Medical insurance

- Dental insurance

- Multiple plan options

- Both short-term and long-term business travel coverage

Visit Aetna International

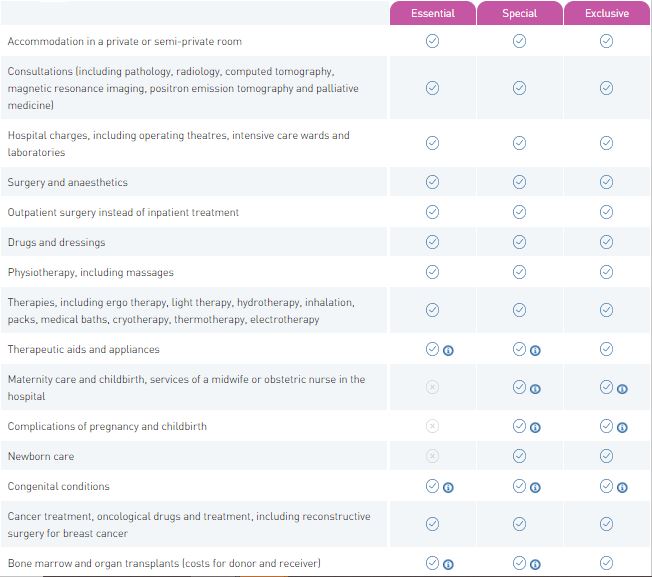

Designed to help expats find first-class international medical coverage, this type of plan offers a wide range of options to fit a busy lifestyle.

Choose this plan if you:

- Do not use health care or have health insurance in the U.S.

- Want plans that cover doctor visits as well as hospital stays

- Need a maximum per person coverage up to $1.6 million per year

International health insurance for US citizens

This style of coverage gives you access to the highest level of health care and services, regardless of your location.

This insurance plan offers you:

- Worldwide coverage

- 24-hour member support team

- Generous annual maximum coverage

- Emergency medical evacuation

- Coverage for maternity, dental and wellness check-ups

International health insurance for non-US citizens

Legal notices

Aetna is the brand name used for products and services provided by one or more of the Aetna group of companies, including Aetna Life Insurance Company and its affiliates (Aetna).

Health benefits and health insurance plans contain exclusions and limitations.

See all legal notices

Also of interest:

You are now being directed to the AMA site

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its affiliated companies are not responsible or liable for the content, accuracy or privacy practices of linked sites, or for products or services described on these sites.

You are now being directed to the Give an Hour site

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its affiliated companies are not responsible or liable for the content, accuracy or privacy practices of linked sites, or for products or services described on these sites.

You are now being directed to the CVS Pharmacy® site

You are now being directed to the cdc site.

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its its affiliated companies are not responsible or liable for the content, accuracy or privacy practices of linked sites, or for products or services described on these sites.

Aetna® is proud to be part of the CVS Health family.

You are now being directed to the CVS Health site.

You are now being directed to the Apple.com COVID-19 Screening Tool

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its affiliated companies are not responsible or liable for the content, accuracy, or privacy practices of linked sites, or for products or services described on these sites.

You are now being directed to the US Department of Health and Human Services site

You are now being directed to the cvs health covid-19 testing site, you are now being directed to the fight is in us site.

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its affiliated companies are not responsible or liable for the content, accuracy, or privacy practices of linked sites, or for products or services described on these sites.

You are now leaving the Aetna® website

Please log in to your secure account to get what you need.

You are now leaving the Aetna Medicare website.

The information you will be accessing is provided by another organization or vendor. If you do not intend to leave our site, close this message.

Get a link to download the app

Just enter your mobile number and we’ll text you a link to download the Aetna Health℠ app from the App Store or on Google Play.

Message and data rates may apply*

This search uses the five-tier version of this plan

Each main plan type has more than one subtype. Some subtypes have five tiers of coverage. Others have four tiers, three tiers or two tiers. This search will use the five-tier subtype. It will show you whether a drug is covered or not covered, but the tier information may not be the same as it is for your specific plan. Do you want to continue?

Applied Behavior Analysis Medical Necessity Guide

By clicking on “I Accept”, I acknowledge and accept that:

The Applied Behavior Analysis (ABA) Medical Necessity Guide helps determine appropriate (medically necessary) levels and types of care for patients in need of evaluation and treatment for behavioral health conditions. The ABA Medical Necessity Guide does not constitute medical advice. Treating providers are solely responsible for medical advice and treatment of members. Members should discuss any matters related to their coverage or condition with their treating provider.

Each benefit plan defines which services are covered, which are excluded, and which are subject to dollar caps or other limits. Members and their providers will need to consult the member's benefit plan to determine if there are any exclusions or other benefit limitations applicable to this service or supply.

The conclusion that a particular service or supply is medically necessary does not constitute a representation or warranty that this service or supply is covered (i.e., will be paid for by Aetna) for a particular member. The member's benefit plan determines coverage. Some plans exclude coverage for services or supplies that Aetna considers medically necessary.

Please note also that the ABA Medical Necessity Guide may be updated and are, therefore, subject to change.

Medical necessity determinations in connection with coverage decisions are made on a case-by-case basis. In the event that a member disagrees with a coverage determination, member may be eligible for the right to an internal appeal and/or an independent external appeal in accordance with applicable federal or state law.

Aetna® is proud to be part of the CVS® family.

You are now being directed to CVS Caremark ® site.

ASAM Terms and conditions

By clicking on “I accept”, I acknowledge and accept that:

Licensee's use and interpretation of the American Society of Addiction Medicine’s ASAM Criteria for Addictive, Substance-Related, and Co-Occurring Conditions does not imply that the American Society of Addiction Medicine has either participated in or concurs with the disposition of a claim for benefits.

This excerpt is provided for use in connection with the review of a claim for benefits and may not be reproduced or used for any other purpose.

Copyright 2015 by the American Society of Addiction Medicine. Reprinted with permission. No third party may copy this document in whole or in part in any format or medium without the prior written consent of ASAM.

Precertification lists

Should the following terms and conditions be acceptable to you, please indicate your agreement and acceptance by selecting the button below labeled "I Accept".

- The term precertification here means the utilization review process to determine whether the requested service, procedure, prescription drug or medical device meets the company's clinical criteria for coverage. It does not mean precertification as defined by Texas law, as a reliable representation of payment of care or services to fully insured HMO and PPO members.

- Applies to: Aetna Choice ® POS, Aetna Choice POS II, Aetna Medicare ℠ Plan (PPO), Aetna Medicare Plan (HMO), all Aetna HealthFund ® products, Aetna Health Network Only ℠ , Aetna Health Network Option ℠ , Aetna Open Access ® Elect Choice ® , Aetna Open Access HMO, Aetna Open Access Managed Choice ® , Open Access Aetna Select ℠ , Elect Choice, HMO, Managed Choice POS, Open Choice ® , Quality Point-of-Service ® (QPOS ® ), and Aetna Select ℠ benefits plans and all products that may include the Aexcel ® , Choose and Save ℠ , Aetna Performance Network or Savings Plus networks. Not all plans are offered in all service areas.

- All services deemed "never effective" are excluded from coverage. Aetna defines a service as "never effective" when it is not recognized according to professional standards of safety and effectiveness in the United States for diagnosis, care or treatment. Visit the secure website, available through www.aetna.com, for more information. Click on "Claims," "CPT/HCPCS Coding Tool," "Clinical Policy Code Search."

- The five character codes included in the Aetna Precertification Code Search Tool are obtained from Current Procedural Terminology (CPT ® ), copyright 2023 by the American Medical Association (AMA). CPT is developed by the AMA as a listing of descriptive terms and five character identifying codes and modifiers for reporting medical services and procedures performed by physicians.

- The responsibility for the content of Aetna Precertification Code Search Tool is with Aetna and no endorsement by the AMA is intended or should be implied. The AMA disclaims responsibility for any consequences or liability attributable or related to any use, nonuse or interpretation of information contained in Aetna Precertification Code Search Tool. No fee schedules, basic unit values, relative value guides, conversion factors or scales are included in any part of CPT. Any use of CPT outside of Aetna Precertification Code Search Tool should refer to the most Current Procedural Terminology which contains the complete and most current listing of CPT codes and descriptive terms. Applicable FARS/DFARS apply.

LICENSE FOR USE OF CURRENT PROCEDURAL TERMINOLOGY, FOURTH EDITION ("CPT ® ")

- CPT only Copyright 2023 American Medical Association. All Rights Reserved. CPT is a registered trademark of the American Medical Association. You, your employees and agents are authorized to use CPT only as contained in Aetna Precertification Code Search Tool solely for your own personal use in directly participating in health care programs administered by Aetna, Inc. You acknowledge that AMA holds all copyright, trademark and other rights in CPT. Any use not authorized herein is prohibited, including by way of illustration and not by way of limitation, making copies of CPT for resale and/or license, transferring copies of CPT to any party not bound by this agreement, creating any modified or derivative work of CPT, or making any commercial use of CPT. License to sue CPT for any use not authorized herein must be obtained through the American Medical Association, CPT Intellectual Property Services, 515 N. State Street, Chicago, Illinois 60610. Applications are available at the American Medical Association Web site, www.ama-assn.org/go/cpt.

U.S. Government Rights

This product includes CPT which is commercial technical data and/or computer data bases and/or commercial computer software and/or commercial computer software documentation, as applicable which were developed exclusively at private expense by the American Medical Association, 515 North State Street, Chicago, Illinois, 60610. U.S. Government rights to use, modify, reproduce, release, perform, display, or disclose these technical data and/or computer data bases and/or computer software and/or computer software documentation are subject to the limited rights restrictions of DFARS 252.227-7015(b)(2) (June 1995) and/or subject to the restrictions of DFARS 227.7202-1(a) (June 1995) and DFARS 227.7202-3(a) (June 1995), as applicable for U.S. Department of Defense procurements and the limited rights restrictions of FAR 52.227-14 (June 1987) and/or subject to the restricted rights provisions of FAR 52.227-14 (June 1987) and FAR 52.227-19 (June 1987), as applicable, and any applicable agency FAR Supplements, for non-Department of Defense Federal procurements.

Disclaimer of Warranties and Liabilities.

CPT is provided "as is" without warranty of any kind, either expressed or implied, including but not limited to the implied warranties of merchantability and fitness for a particular purpose. No fee schedules, basic unit, relative values or related listings are included in CPT. The American Medical Association (AMA) does not directly or indirectly practice medicine or dispense medical services. The responsibility for the content of this product is with Aetna, Inc. and no endorsement by the AMA is intended or implied. The AMA disclaims responsibility for any consequences or liability attributable to or related to any use, non-use, or interpretation of information contained or not contained in this product.

This Agreement will terminate upon notice if you violate its terms. The AMA is a third party beneficiary to this Agreement.

Should the foregoing terms and conditions be acceptable to you, please indicate your agreement and acceptance by selecting the button labeled "I Accept".

The information contained on this website and the products outlined here may not reflect product design or product availability in Arizona. Therefore, Arizona residents, members, employers and brokers must contact Aetna directly or their employers for information regarding Aetna products and services.

This information is neither an offer of coverage nor medical advice. It is only a partial, general description of plan or program benefits and does not constitute a contract. In case of a conflict between your plan documents and this information, the plan documents will govern.

Dental clinical policy bulletins

- Aetna Dental Clinical Policy Bulletins (DCPBs) are developed to assist in administering plan benefits and do not constitute dental advice. Treating providers are solely responsible for dental advice and treatment of members. Members should discuss any Dental Clinical Policy Bulletin (DCPB) related to their coverage or condition with their treating provider.

- While the Dental Clinical Policy Bulletins (DCPBs) are developed to assist in administering plan benefits, they do not constitute a description of plan benefits. The Dental Clinical Policy Bulletins (DCPBs) describe Aetna's current determinations of whether certain services or supplies are medically necessary, based upon a review of available clinical information. Each benefit plan defines which services are covered, which are excluded, and which are subject to dollar caps or other limits. Members and their providers will need to consult the member's benefit plan to determine if there are any exclusions or other benefit limitations applicable to this service or supply. Aetna's conclusion that a particular service or supply is medically necessary does not constitute a representation or warranty that this service or supply is covered (i.e., will be paid for by Aetna). Your benefits plan determines coverage. Some plans exclude coverage for services or supplies that Aetna considers medically necessary. If there is a discrepancy between this policy and a member's plan of benefits, the benefits plan will govern. In addition, coverage may be mandated by applicable legal requirements of a State or the Federal government.

- Please note also that Dental Clinical Policy Bulletins (DCPBs) are regularly updated and are therefore subject to change.

- Since Dental Clinical Policy Bulletins (DCPBs) can be highly technical and are designed to be used by our professional staff in making clinical determinations in connection with coverage decisions, members should review these Bulletins with their providers so they may fully understand our policies.

- Under certain plans, if more than one service can be used to treat a covered person's dental condition, Aetna may decide to authorize coverage only for a less costly covered service provided that certain terms are met.

Medical clinical policy bulletins

- Aetna Clinical Policy Bulletins (CPBs) are developed to assist in administering plan benefits and do not constitute medical advice. Treating providers are solely responsible for medical advice and treatment of members. Members should discuss any Clinical Policy Bulletin (CPB) related to their coverage or condition with their treating provider.

- While the Clinical Policy Bulletins (CPBs) are developed to assist in administering plan benefits, they do not constitute a description of plan benefits. The Clinical Policy Bulletins (CPBs) express Aetna's determination of whether certain services or supplies are medically necessary, experimental and investigational, or cosmetic. Aetna has reached these conclusions based upon a review of currently available clinical information (including clinical outcome studies in the peer-reviewed published medical literature, regulatory status of the technology, evidence-based guidelines of public health and health research agencies, evidence-based guidelines and positions of leading national health professional organizations, views of physicians practicing in relevant clinical areas, and other relevant factors).

- Aetna makes no representations and accepts no liability with respect to the content of any external information cited or relied upon in the Clinical Policy Bulletins (CPBs). The discussion, analysis, conclusions and positions reflected in the Clinical Policy Bulletins (CPBs), including any reference to a specific provider, product, process or service by name, trademark, manufacturer, constitute Aetna's opinion and are made without any intent to defame. Aetna expressly reserves the right to revise these conclusions as clinical information changes, and welcomes further relevant information including correction of any factual error.

- CPBs include references to standard HIPAA compliant code sets to assist with search functions and to facilitate billing and payment for covered services. New and revised codes are added to the CPBs as they are updated. When billing, you must use the most appropriate code as of the effective date of the submission. Unlisted, unspecified and nonspecific codes should be avoided.

- Each benefit plan defines which services are covered, which are excluded, and which are subject to dollar caps or other limits. Members and their providers will need to consult the member's benefit plan to determine if there are any exclusions or other benefit limitations applicable to this service or supply. The conclusion that a particular service or supply is medically necessary does not constitute a representation or warranty that this service or supply is covered (i.e., will be paid for by Aetna) for a particular member. The member's benefit plan determines coverage. Some plans exclude coverage for services or supplies that Aetna considers medically necessary. If there is a discrepancy between a Clinical Policy Bulletin (CPB) and a member's plan of benefits, the benefits plan will govern.

- In addition, coverage may be mandated by applicable legal requirements of a State, the Federal government or CMS for Medicare and Medicaid members.

See CMS's Medicare Coverage Center

- Please note also that Clinical Policy Bulletins (CPBs) are regularly updated and are therefore subject to change.

- Since Clinical Policy Bulletins (CPBs) can be highly technical and are designed to be used by our professional staff in making clinical determinations in connection with coverage decisions, members should review these Bulletins with their providers so they may fully understand our policies.

- While Clinical Policy Bulletins (CPBs) define Aetna's clinical policy, medical necessity determinations in connection with coverage decisions are made on a case by case basis. In the event that a member disagrees with a coverage determination, Aetna provides its members with the right to appeal the decision. In addition, a member may have an opportunity for an independent external review of coverage denials based on medical necessity or regarding the experimental and investigational status when the service or supply in question for which the member is financially responsible is $500 or greater. However, applicable state mandates will take precedence with respect to fully insured plans and self-funded non-ERISA (e.g., government, school boards, church) plans.

See Aetna's External Review Program

- The five character codes included in the Aetna Clinical Policy Bulletins (CPBs) are obtained from Current Procedural Terminology (CPT®), copyright 2015 by the American Medical Association (AMA). CPT is developed by the AMA as a listing of descriptive terms and five character identifying codes and modifiers for reporting medical services and procedures performed by physicians.

- The responsibility for the content of Aetna Clinical Policy Bulletins (CPBs) is with Aetna and no endorsement by the AMA is intended or should be implied. The AMA disclaims responsibility for any consequences or liability attributable or related to any use, nonuse or interpretation of information contained in Aetna Clinical Policy Bulletins (CPBs). No fee schedules, basic unit values, relative value guides, conversion factors or scales are included in any part of CPT. Any use of CPT outside of Aetna Clinical Policy Bulletins (CPBs) should refer to the most current Current Procedural Terminology which contains the complete and most current listing of CPT codes and descriptive terms. Applicable FARS/DFARS apply.

LICENSE FOR USE OF CURRENT PROCEDURAL TERMINOLOGY, FOURTH EDITION ("CPT®")

CPT only copyright 2015 American Medical Association. All Rights Reserved. CPT is a registered trademark of the American Medical Association.

You, your employees and agents are authorized to use CPT only as contained in Aetna Clinical Policy Bulletins (CPBs) solely for your own personal use in directly participating in healthcare programs administered by Aetna, Inc. You acknowledge that AMA holds all copyright, trademark and other rights in CPT.

Any use not authorized herein is prohibited, including by way of illustration and not by way of limitation, making copies of CPT for resale and/or license, transferring copies of CPT to any party not bound by this agreement, creating any modified or derivative work of CPT, or making any commercial use of CPT. License to use CPT for any use not authorized herein must be obtained through the American Medical Association, CPT Intellectual Property Services, 515 N. State Street, Chicago, Illinois 60610. Applications are available at the American Medical Association Web site, www.ama-assn.org/go/cpt.

Go to the American Medical Association Web site

You are now leaving the Aetna® website.

We're working with 3Won to process your request for participation. Please select "Continue to ProVault to begin the contracting and credentialing process.

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its affiliates are not responsible or liable for the content, accuracy or privacy practices of linked sites, or for products or services described on these sites.

Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its affiliated companies are not responsible or liable for the content, accuracy, or privacy practices of linked sites, or for products or services described on these sites.

Proceed to Healthcare.gov site

Guides, services and help for expats around the world

Help, advice and events, spotlight on..., information for british expats, useful 3rd party services for expats.

Best travel insurance options for expats

Last updated: 9 October 2023 at 14:41

Travelling while living abroad introduces a number of different challenges regarding what kind of cover your travel insurance may provide you, but not all travel insurance companies will provide travel insurance for non-UK residents.

When travelling, many people simply choose one of the options presented to us either by the travel agent, airline company or travel website. However, as an expat, your personal situation might exclude you from all the benefits available so it is vital that you read all the terms, conditions and small print to ensure that you are fully covered while travelling.

It is also advised that, rather than wait until you are about to travel to arrange your travel insurance, you should purchase travel insurance as close to when you made your booking as possible - ideally on the same day. This is to ensure you are covered if your travel plans get re-arranged or cancelled due to unforeseen events.

If you have a travel plan which you purchased before you moved abroad, you must also read the small print as it is unlikely to provide cover for your travels once you have moved abroad.

Companies offering travel insurance policies for expats and non-UK residents

Expatriate Healthcare Travel Insurance

Expatriate Healthcare’s, International Travel Insurance TravelCare policy covers all nationalities, travelling anywhere in the world.

You can cover a specific single trip or, for total flexibility, an annual policy that covers you for any trip you take abroad; regardless of how often you travel.

Perfect for people who

- Expats under 70 years old

- Seeking global cover

- Children over 5 travelling alone

Important Facts

- Visit as many countries in your destination area

- Europe only cover

- Global cover

- Contracts in English

- Free online quotes

Staysure Expat Travel Insurance

Staysure Overseas SL offers Expat Travel Insurance to the over 50s, bringing our quality products and excellent value for money to those living outside the UK.

- Live abroad and travel anywhere in the world

- Are over 50

- Need global cover

- Instant quote

- Instant cover

We do not accept any responsibility for information, offers or product suitability of any product or content on third party sites.

- Travel insurance for US citizens living abroad

Travel insurance for US citizens residing abroad and visiting the USA

Compare travel medical insurance for us citizens visiting usa, travel insurance for us citizens living abroad visiting usa.

Are you a US citizen living abroad? It is a challenge to find travel insurance for US citizens visiting USA as travel insurance plans or health medical insurance plans offer coverage for travelers traveling outside their home country. Here US citizens will be assumed to be living in the United States.

The brochure usually has eligibility requirements like "US citizens traveling outside US" or "Non US citizens coming to the US or any other country"... but excludes US citizens living abroad and visiting the US. There are many US citizens living abroad to work, study or settle in another country. These people often visit US for holidays or to visit families and friends for a short duration. Insurance providers assume these US citizens home country to be US and don’t offer coverage.

However there are a few companies that American Visitors Insurance work with to provide travel insurance for US citizens abroad visiting USA. These plans are available to them as long as they are temporarily visiting US and are returning to their home country outside the US.

International Travel Insurance plans are normally for people traveling outside their home country. There are US citizens who are residing outside the USA and visit US for short durations visiting family, for holidays, business, during Christmas and Thanksgiving holidays or other similar occasions. US citizens who are in this category are not eligible for domestic healthcare in US as they are permanently residing abroad.

Some companies consider the US to be the home country for US citizens regardless of where they live and this makes them ineligible for the international travel insurance plans offered by these companies while visiting the US.

However, they do make exceptions for this specific situation with special conditions included. The common conditions include are that the traveler must be residing outside the US continuously for 6 or more months. American Visitor Insurance provides international travel and health insurance plans for US citizens residing abroad making short term visits to US occasionally.

Patriot America Plus and Patriot Platinum America can be used by US citizens as long as they maintain a residence outside the US and are visiting the country for a short visit. The Patriot America Plus insurance plan offered by IMG is specifically designed for short term visitors to USA and is a hugely popular choice among tourists to America.

The policy covers "acute onset of pre-existing conditions" up to the maximum of the plan purchased for persons under 70 years of age. The company recently added the benefit of copays of $25 for urgent care centers and $15 for walk-in clinics which are paid INSTEAD of the deductible each time these facilities are used.

There is a sports rider that can be added for additional cost to cover skiing, snorkeling, surfing, and other common recreational sports. Persons under 70 years of age can get up to $1 million maximum coverage.

There are two insurance providers who offer short term travel medical insurance for US citizens living outside the United States, but who are visiting the US. The travel insurance providers are:

- Global Underwriters

- International Medical Group (IMG)

Diplomat America insurance from Global Underwriters offers coverage for US citizens visiting USA. IMG's Patriot America Plus and Patriot Platinum America plans offer coverage for US citizens visiting USA

American traveler insurance including trip cancellation coverage

US citizens should consider buying travel insurance especially if traveling outside their home state. The travel insurance plans are designed for US vacationers with coverage for insuring the health of the traveler as well the trip expenses cost. Some examples of coverage benefits are trip cancellation, trip delay, Quarantine travel insurance , medical evacuation, injury of family member, travel companion or pet, theft of passport, traffic accident, inclement weather resulting in delay or cancellation of common carrier.

- Non refundable cost of the trip.

- Unexpected medical expenses of the traveler.

- Loss or damage to the insured’s possessions.

IMG Trip insurance

The travel insurance offered by IMG is a three-tiered series of plans: Travel Lite , Travel SE and Travel LX . These plans offer coverage for unexpected medical expenses dues to accident or sickness as well as insure your trip expense investment in case of a trip cancellation or delay.

Travel LX insurance has 'Cancel for any reason' benefit included and provides coverage up to $100,000. The Travel SE and Travel LX plans offer Trip Delay benefit up a maximum of $2,000 per person and $2,500 per person respectively which satisfy many countries Covid travel insurance quarantine requirements.

Safe Travels Trip protection insurance

Safe Travels Trip protection insurance plans for trip cancellation expenses from Trawick International offer coverage for non refundable trip expenses incurred when a trip is cancelled. These are

- Safe Travels Voyager insurance

- Safe Travels Protect insurance

- Safe Travels First Class Trip Protection

- Safe Travels Explorer Plus

- Safe Travels Journey insurance

- Safe travels Explorer insurance

- SafeTravels Armor insurance

- Safe Travels Defend insurance

- Safe Travels Single Trip Protection

The Safe Travels First Class Trip Protection , Safe Travels Voyager insurance and SafeTravels Armor have an optional benefit that is the ' Cancel for any Reason ' which is available as a rider at an additional cost.

The Safe Travels Voyager insurance and Safe travels Explorer insurance is quite popular as it offers Covid19 quarantine accommodation coverage.

Trip Protector Preferred insurance

- Available for US citizens and residents traveling outside the United States

- Includes $2000 in travel delay benefits for Covid quarantine/lodging.

- Trip cancellation up to $50,000/Trip interruption up to 200% of trip cost

- Offers $500,000 medical for sickness and injury/$1,000,000 medical transportation

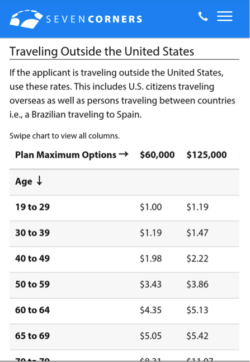

Seven Corners Trip Protection Insurance Plans

The Trip Protection Series by Seven Corners offers plans with good, better, best plan with Trip Protection Basic and Trip Protection Choice . There is an additional cost for the number of days which exceed 30 days, but you can have a trip last up to 180 days.

Trip Protection Elite from Seven Corners offers cancel for any reason for residents of Missouri, New York, Pennsylvania and Washington travelling in the United States /internationally. you can have a trip last up to 90 days.

There is also the optional coverage for loss of ski days and equipment and lost golf rounds and rental. Note that insuring a trip for $0 to $500 gives the same, lowest rate available.

Travel Insurance Services Trip Protection Insurance Plans

Travel Insurance Select Insurance and Trip Care Complete Insurance from Travel Insurance Services,offers choice of three options to meet your needs and budget: Elite, Plus, and Basic. These plans includes coverage for trip cancellation, trip interruption, trip delay, medical expense, emergency evacuation, and baggage loss/delay coverage. Each option includes different features, benefits, and coverage limits.

Travel Insurance Select Plus and Elite plans offers "Optional cancel for any reason benefit" if purchased within 21 days of the date initial payment/deposit is received. (not available to residents of NY) and Trip Care Complete Insurance also offers "Optional cancel for any reason benefit" up to 75% of Trip Cost.

Information about US mobile passport control and TSA pre check for US passport holders.

US expatriate insurance

Health insurance for U.S. expats is essential for providing access to quality healthcare while living abroad. Expatriates often need coverage that goes beyond what their domestic U.S. health insurance provides because most U.S.-based health insurance plans do not cover medical expenses incurred outside the United States.

Testimonials - From Our Customers

Appreciate all the help that you provided me. It really worked well and I was able to purchase the cover I was looking for. Know more »

I am pleased to say that your company is very professional in the field of Insurance. Know more »

Thank you American Visitor Insurance! You went way beyond what I would expect from an insurance company. Know more »

Trip Cancellation Insurance

Highlights of trip cancellation insurance coverage benefits

Best Covid19 travel with trip protection insurance for US citizens.

Compare travel Insurance with cancel for any reason benefit.

Best trip cancellation insurance with quarantine coverage.

Rental car Insurance for damage, theft, repair of rented cars.

Trip cancellation insurance for trip expenses if the trip is cancelled.

Trip interruption insurance for travel expenses when a trip is Interrupted.

Travel insurance coverage due to lost, damaged, delayed or stolen luggage.

Emergency medical evacuation travel insurance coverage.

Cost of travel insurance factors

Factors to consider while buying travel insurance.

Travel insurance cost calculator

Travel Insurance cost calculator, Trip cost calculator

Select the best travel insurance plans...

Best trip cancellation insurance, itravelinsured travel se insurance.

- Trip Cancellation: Up to $100K of the trip cost

- US Residents on domestic and worldwide trips

- iTravelInsured Travel SE Quarantine Benefit: Travel SE plan offers Coverage for accommodations due to a covered Trip Delay $2K/$125 per person per day is included in the basic coverage.

iTravelInsured Travel LX Insurance

- Trip Cancellation: Up to $100K of Trip Cost

- iTravelInsured Travel LX Quarantine Benefit: Travel LX plan offers Coverage for accommodations due to a covered Trip Delay $2,500/$250 per person per day is included in the basic coverage.

iTravelInsured Travel Lite Insurance

- Inexpensive coverage for trip cancellation & interruption

- iTravelInsured Travel Lite Quarantine Benefit: Travel Lite plan offers Coverage for accommodations due to a covered Trip Delay $500/$125 per person per day is included in the basic coverage. US Residents on domestic and worldwide trips.

Travel Sport Insurance

- Trip Cancellation: 100% of insured trip cost per person

- US Residents on domestic and worldwide trips.

- Quarantine Benefit: Coverage for accommodations due to a covered Trip Delay which is $5K/$250 per person per day and is included in the basic coverage.

Vacation Rental Insurance

- Coverage for airline reissue or cancellation fee reimbursement.

- Maximum Trip Length is 31 days.

Safe Travels Voyager Insurance

- Trip Cancellation: Up to 100% of Trip Cost Insured

- Up to 100% of Trip Cost Insured

- Quarantine coverage

- Provides a minimum coverage of $3K for potential or extended quarantine lodging expenses.

Safe Travels Single Trip Insurance

- Trip Cancellation: Trip Cost: Up to a Maximum of $30K.

- Maximum Trip Length 90 Days

Safe Travels First Class Insurance

- Trip cancellation: 100% of Trip Cost Up to a maximum of $50K. ($30K age 81+)

- US residents traveling within the United States and abroad

- Cancel for Any Reason available in most states

Safe Travels Armor Insurance

- Trip Cancellation: Trip Cost: Up to a Maximum of $15K.

Safe Travels Protect Insurance

- Trip cancellation: 100% of Trip Cost Up to a maximum of $14K.

Safe Travels Explorer Insurance

- It covers Trip Cancellation coverage from $150 to $10K.

- Provides a minimum coverage of $1K for potential or extended quarantine lodging expenses

- Offers coverage of $50K for emergency medical expenses

- Offers comprehensive trip cancellation coverage

Trip Protector Preferred Insurance

- Available for US citizens and US residents whose home country is US and must be travelling outside USA

- Includes $2000 in travel delay benefits for quarantine/lodging.

- Trip cancellation up to $50K/Trip interruption up to 200% of trip cost

- Offers $500K medical for sickness and injury/$1M medical transportation

Travel Insurance Select Plan Insurance

- Trip Cancellation: Basic - $15K Max

- Trip Cancellation: Plus - $100K Max

- Trip Cancellation: Elite - $100K Max

Trip Care Complete Insurance

- Trip Cancellation: Basic - $10K Max

- Trip Cancellation: Plus - $25K Max

- Trip Cancellation: Elite - $30K Max

Trip Protection Basic

- Trip Cancellation: 100% of trip cost up to $30K

- Provides coverage for U.S residents and U.S citizens who wish to travel within the U.S or travel overseas /internationally

Trip Protection Elite

- Provides coverage for residents of Missouri, New York, Pennsylvania and Washington travelling in the United States /internationally.

Trip Protection Economy

- Trip Cancellation: 100% of trip cost up to $20K

Trip Protection Choice

- Trip Cancellation: 100% of trip cost up to $100K

- Provides coverage for U.S residents and U.S citizens who wish to travel within the U.S or travel overseas /internationally.

Safe Travels Defend Insurance

Safe travels rental plus.

- Vacation rental coverage for trip cancellation, trip interruption, trip delay and emergency medical.

- Trip cancellation: 100% of Trip Cost Up to a maximum of $10K.

Safe Travels Flex

- Trip cancellation: 100% of Trip Cost Up to a maximum of $25K.

Trip Cancellation insurance Faq's

Trip Insurance is cover in a travel insurance that provides protection towards travel and trip related events. It provides coverage for travel delays, trip cancellation, trip interruption, missed flight, loss or damage of baggage and lost passport. Under trip insurance travelers can choose trip cancellation, trip interruption cover for covered reasons. Travelers can include an extra rider in the travel insurance policy or cancel for any reason. Cancel for any reason coverage allows the traveler to cancel the planned trip for reasons that may not be covered otherwise.

No, trip cancellation is a part of trip insurance cover that needs to be included while purchasing International travel insurance.

There are some very advantageous credit cards out there to help travelers, particularly with money exchange fees when making purchases abroad. However, you should look over your benefits carefully. Certainly travel items charged to the card may be covered and refundable, but what if you get sick at your destination? What if your luggage is lost? What if you need to quarantine or get delayed in one leg of your trip? A trip cancellation plan can put your mind at ease. They are specifically designed to help in all aspects of travel from interruptions that may come up (an emergency back home), unintended trip delays (testing positive for COVID, missing a flight or having a flight cancelled), helping you get your minor children home if you can't, and medical expenses should you become sick or hospitalized. There are plans to help you get your pet home safely and insure your expensive golf clubs or sports equipment get with you to your destination! You have invested so much into your trip planning, you may as well have full peace of mind that your investment is protected and you are taken care of by experts who have dealt with the most unlikely of scenarios!

Note that iTravelInsured Travel SE has kids under 10 "free" with a paying adult. This can make a family trip very economical while making sure all members are covered just in case! The iTravel LX is a great option if you are concerned about including cancel for any reason coverage.

That depends. Did you look over their policy carefully? The cruise policy may be focussed on getting your money back for what you paid for the cruise. What about your plane tickets to get you to the initial port and home from the last port? What if your luggage is lost on the way? What if you get sick or hurt during your cruise? Be sure that you have health insurance that is good while you are away from home. Going abroad or even out of state can increase deductibles and/or coinsurance or you may not even be covered. Find out ahead of time! Know the limitations of the cruise insurance and figure out if you would like to be more secure in your purchase. Finally, trip cancellation insurance companies are experts at helping travelers and they have thought of a lot of things going wrong that you may not have! So, consider your options carefully.

Yes, changes can be made to the trip insurance policy after you have brought the policy.

Travelers can change information like travel dates, destinations, trip costs, travelers personal information, mailing address corrections, etc.

No, trip insurance should be brought 24 hours before the trip departure date.

Travelers can justified in asking if it is worth buying trip cancellation plans. Given the cost of a trip which is often an annual vacation, or sometimes a once in a lifetime travel experience, trips especially if it involves traveling overseas can be quite expensive. A planned vacation can involve expensive airline tickets, hotel reservations and cruise bookings, much of these done well in advance of the actual vacation. Given the hectic nature of our work and lifestyles, one cannot be absolutely certain that none of our planned travel plans will not need last minute changes.

A serious medical situation of an immediate family member or even work related pressures can force a change in travel plans. It is here that Trip protection or trip cancellation insurance can make all the difference. Even if the trip starts on schedule, there can be unplanned adverse situations such as lost baggage, delay in flights resulting in missed hotel or cruise bookings or even a medical ailment during the trip. Again, in these situations trip insurance can be invaluable. There are different types of trip insurance plans available, some which cover cancellation for clearly defined specific reasons, some others which provide trip protection insurance for cancellation for any reason.

At American Visitor Insurance, we work with different insurance providers who specialize in Trip insurance. Compare trip insurance plans of different providers to find the best trip cancellation insurance for your specific needs.

The cost of trip or cancellation insurance depends on the ages of the travelers and how much you want to insure your trip for. Remember that you will only receive the non-reimbursable portion of your trip deposit or trip costs. Two people in their thirties traveling for less than 30 days with a trip cost of $500 each can get a policy from $40 to $100 depending on the details of the coverage they desire. The more expensive plans will include coverage for "cancel for any reason."

There are different factors for buying best health insurance for USA visitors. Visitors should compare fixed benefits and comprehensive visitor insurance plans. Foreign visitors to USA travel insurance customers should understand the concepts of deductibles and co-insurance and Pre-existing conditions travel health insurance. A prudent and well informed traveler will make the correct choice while buying tourist insurance in USA for his or her unique needs.

There is no denying that travel insurance to USA is unfortunately very expensive. The main reason for this is simply because the cost of healthcare in the USA is very expensive and the travel insurance USA costs are directly related to the healthcare costs. One more factor for some USA travel insurance plans to be very expensive is that there are specially designed travel insurance for USA plans available for older travelers, with higher medical coverage as well as some plans with coverage for pre-existing ailments.

There are many international travel health insurance plans for coverage both in the USA as well as around the world offered by US insurance providers. Given the several travel insurance international options, it can be confusing to find the best health insurance for international travel for your needs. What is very useful in making this decision is to compare travel insurance USA of different companies.

The travel insurance comparison allows travelers compare prices as well as coverage benefits in an objective manner. The traveler can change relevant factors like the medical maximum coverage required, the international traveler insurance deductible, any international travel health insurance plans with coverage for pre-existing ailments, travel insurance international coverage for Covid19 ... The global travel insurance comparison also allows travelers to buy the best travel insurance based on ones needs by completing an online application and paying using a credit card. One completing the purchase the travel insurance plan is emailed to the customer.

Trip Cancellation insurance reimburses the traveler for pre-paid, non-refundable expenses if one cancels the trip before the start of the journey. ... Covered reasons to cancel your trip include – injunry, sickness, death of an immediate family member or of a traveling companion, hurricane damages in your travel destination or cancellation of the airline flight.

The Cancel for Any Reason (CFAR) add-on option is available on several trip cancellation insurance plans. This is a great option which gives the travelers flexibility to cancel their trip for any reason which is otherwise not covered in the basic trip cancelation insurance plan. However they have to cancel the trip more than 48 hours before the scheduled departure date.

We often get queries from travelers asking to buy a travel insurance plans that only offers trip cancellation coverage. Most travel insurance plans are comprehensive which include coverage for health of the traveler, trip interruptions and cancellations, trip delays and luggage loss or delay. If a traveler’s primary concern is that of their trip being cancelled then it is logical to buy the cheapest trip cancellation plan which has this coverage.

There are two general categories of travel insurance. There are trip cancellation policies (we will consider travel insurance from a credit card in this category) and travel medical insurance. MOST trip cancellation policies also cover medical expenses while on your trip. However, some cheaper plans and many offered through credit cards, do NOT. I recently checked my own credit card coverage and the coverage is limited to what I purchased using my card (so flights, hotel reservations only). If I get sick, that insurance alone will not cover me. This is getting to be more of an issue as our own domestic US policies often do not cover us well outside of our home state.

The other type of policy is a travel medical policy. This does NOT cover trip cancellation; however, if you are not able to go on your trip, you can simply cancel your policy before it begins for a full refund of the policy. If you purchase a comprehensive policy, you will also get many travel benefits like you do with the trip cancellation policies, such as: lost baggage, trip interruption, and accidental death benefits.

They may not be as high as with a trip cancellation plan, but they give some peace of mind and they allow you to choose more specifically the amount and type of medical coverage you need while you are traveling. Some policies offer coverage for acute onset of pre-existing medical conditions, for example. All policies offer some coverage of emergency medical evacuation and repatriation. So, the answer to the question is Yes and No. Be sure you have a travel insurance plan that will cover what is important to you while on your trip.

Cancel for any reason Faq's

The cancel for any reason (CFAR) insures the traveler for any non-refundable trip expenses or pre-paid trip deposits should the traveler cancel his trip for any reason that is not covered by the regular trip cancellation coverage. This benefit is separate and additional to the trip cancellation coverage.

The ‘Cancel for any reason’ coverage is considered as the fall back cover for travellers who worry they may have to cancel their trip for any unforeseen reason not covered by trip cancellation coverage and want to recover at least part of their planned travel expenses.

The traveller has to ensure that they are eligible to buy the Cancel for any reason (CFAR) coverage. For this the traveller has to buy the CFAR within a clearly defined number of days after the initial trip deposit (usually 21 days).

Travelers can then compare available CFAR plans and insure for the full trip cost. To ensure eligibility for this coverage, the cancellation of the trip has to be done in time within the policy eligibility guidelines which is usually 48 hours before the start of the trip.

The ‘Cancel for any reason’ coverage may be either included within the trip cancellation insurance plan or it may be an additional add on option that can be purchased for an additional amount.

- The CFAR coverage requires the traveller to purchase CFAR insurance within a certain number of days of making your initial trip deposit.

- The trip cancellation must occur within a defined number of days before the scheduled trip departure.

- The traveller must insure 100% of all pre-paid travel arrangements that have cancellation penalty.

- Some CFAR plans have a maximum limit of per-person trip cost.

- The CFAR coverage will pay only for the non-refunded amount. Any refund received by the travel vendor will be deducted from the CFAR refund.

The travel restrictions are on constant review depending on the severity of the coronavirus cases around the world. If the concern is about a sudden requirement of cancellation due to the surge of covid19 then Cancel for Any Reason (CFAR) coverage is the good option to get coverage for the non-refundable trip expenses.

Factors that determine the cost of US travel insurance plans

The cost of Schengen visa insurance depends on the following:

The cost of travel insurance is directly proportional to the age of the traveler. The older the traveler and greater will be the cost of the visitors health insurance.

Comprehensive travel insurance which provide exhaustive coverage are more expensive than fixed benefit travel insurance.

The price of visitors medical insurance is directly dependant on the maximum medical coverage and inversely proportional to the deductible of the plan chosen.

Travel insurance depends on the coverage region. The cost for visitor health insurance for the United States is most expensive.

The longer the duration of visitor medical insurance required, the higher will be the cost.

Additional add-on benefits like adventure sports coverage… will increase the cost of coverage.

Resourceful tourist insurance USA information

Find the best travel insurance, how does travel insurance work, how to buy travel insurance, travel insurance glossary, travel insurance for specific groups, compare travel insurance plans, international travel health insurance useful links, visiting usa, forum entries, factors to consider, insurance for us citizen and non us citizen purchasing insurance for visiting the us.

- I am an American citizen, but my wife is not. When in the payment window, I am only asked my citizenship, and not my wife's. Is this a problem? Do we need to buy separate plans?

- How close to traveling can we need to get this plan? We will be traveling in May.

General - FAQ's

01. what travel insurance covers the usa.

US Travel insurance plans for coverage can be purchased online at American Visitor Insuranceto get a medical and travel insurance cover in the United States. International travel insurance provides coverage forunexpected medical emergencies during the travel period. Travel insurance is particularly important during the Covid19 pandemicfor safe travel to the US.

American visitor insurance offers customers with some of the best US travel insurance options which can be compared to find the most appropriate product for one’s needs. Formore details travelers can call the customer service or email and the team will be glad to help.

02. Do US citizens need travel insurance/health insurance to visit the USA if they live abroad?

While it is not a legal requirement for the US citizens living abroad to buy health insurance while they visit the US, it is very important given the very high cost of US healthcare.

While there are more travel insurance options for Non US citizens visiting the US, there are only a few travel health insurance plans available for US citizens who live overseas and are visiting the US to cover them for any unexpected medical coverage in case of sickness or injury. While most plans do not cover US citizens in the US, there are a few plans that provide coverage for US citizens visiting the US if they can show proof of a foreign residential address and they are going back to that country after a short visit to the US.

The following plans cover US citizens living overseas and visiting the US for a short visit:

- Patriot America Plus from IMG

- Diplomat America from Global Underwriters

- Patriot America Lite

- Patriot Platinum

Even though it is not a legal requirement to have travel insurance,it is highly recommended to purchase one, so that they can enjoy their short trip in the US without worrying about the expensive medical treatment in case of unexpected situations. Most of the US domestic health insurance plans will not cover the US citizens visiting US for a short time as they are not residing in the US for at least some time like 3 months, 6 months.

Apart from these plans there are trip cancellation insurance plans available which provide in network benefits to the customer within the PPO network. These networks include "United Healthcare'' , "First Health Network'', "Coventry Healthcare''...The trip insurance plans cover trip cancellation benefits which can be very useful during flight bookings and cruise bookings. This benefit can save a lot of money in case of unexpected incidents where you may need to cut short the trip or cancel the trip.

There are great trip insurance plans in the market. Choosing the right plan carefully keeping your requirements in mind is an important task.

03. How much does expat health insurance cost in the USA?

The cost of expat insurance depends on the age , duration that they want the insurance for, policy maximum options selected, deductible selected. It also depends on the plan that is chosen and the number of people on the plan.

The cost of an expat health insurance can vary from $300 -$420 per month. If you are a US citizen looking to get covered in the US during your short visit to the US, then you need to purchase proper travel insurance coverage. Normally US expats traveling to other countries get coverage, however there are few plans that cover travel insurance for US expats visiting USA.

04. Which is the most suitable insurance for US citizens visiting the US from abroad?

There are only a few plans which provide coverage for US citizens within the US. Here are the plans listed:

These plans provide coverage for :

- Emergency medical treatment

- Trip Interruption

- Emergency medical evacuation

- Lost baggage and delay

- Coverage for unexpected sickness and injury

- Emergency medical evacuation and repatriation

- Acute onset of pre existing conditions

- Urgent Care visit

- Emergency dental coverage

- Emergency eye coverage

Trip cancellation Insurance are also suitable for US citizens visiting the US from abroad . These plans will also insure the trip expenses, such as airline and hotel bookings and any unexpected trip cancellation expenses along with providing coverage to the health of the traveler. It is important to choose the right plan by comparing trip cancellation plans on American Visitor Insurance and looking at the benefits that you need.

US citizen cruise travel insurance

Popular destinations for american travelers.

Travel to Africa

Travel to Asia

Travel to Australia

Travel to Caribbean

Travel to Europe

Travel to Latin America

Travel to New Zealand

Travel to North America

Travel to Oceania

Travel to South America

Travel to Canada

Travel to Mexico

Travel to UK

Travel to USA

Popular cities among us travelers.

Travel Insurance for Toronto

Travel Insurance for London

Travel insurance for vancouver.

Travel Insurance for Paris

Travel Insurance for Rome

Travel Insurance for Amsterdam

Travel Insurance for Jerusalem

Travel Insurance for Tokyo

Resourceful travel insurance information.

Travel medical insurance resources

Choose international travel insurance resources for travel outside your home country.

Compare travel insurance factors

Important factors to consider while deciding on the best travel medical insurance.

Types of travel insurance online

Understanding different US travel insurance options, fixed benefits vs comprehensive coverage.

Travel insurance Claims Procedure

Travel medical insurance online claims process for getting medical care in a hospital.

US visitors insurance providers

You can find reliable US insurance providers like International Medical Group(IMG), Seven Corners, WorldTrips, Global Underwriters, Travel Insure, GeoBlue, HTH Worldwide and INF insurance.

Ask me a Question?

More us citizen international travel insurance categories.

Travel Insurance for US Citizens

Travel insurance for Quarantine coverage

Senior Citizens travel insurance over 65

Long stay Europe visa insurance

US citizen covid travel insurance

International travel medicare coverage

US citizens traveling outside USA Forum

US citizens traveling to Europe Blog

US citizens traveling outside USA Blog

Travel insurance FAQs for US Citizens

GlobeHopper Senior Insurance

Travel insurance for US citizens visiting USA

- Call: (877)-340-7910

- Contact

- Individual Tax

- Business Tax

- International Tax

- Inbound Tax

- Outbound Tax

- Expatriate Tax

- Transfer Pricing

- Tax Treaties

- Real Estate Accounting Services

- Family Office

- REAL ESTATE Desk

- INTERNATIONAL Desk

- SAP Business One Value Proposition

- SAP Business One Capabilities

- SAP Business One Multi Countries

- SAP Business One Subsidiaries

- SAP Business One Industries

- Financial Statement Preparation

- Construction Audit

- Construction Cost Certification

- Construction Business Valuation

- Construction Employee Benefit Audit

- U.S. Outsourced Accounting

- LATAM Outsourced Accounting

- U.S. Outsourced Tax Services

- LATAM Outsourced Tax Services

- Subsidiary Accounting Services

- Global Entity Incorporation

- Global Director Services

- Global Document Retrieval

- Global Time & Attendance

- Global Background Checks

- USA Worker's Compensation

- Specialties

- Our Methodology

- HR Consulting

- BPO Services

- Candidate Services

- U.S. Client Payment

- H&CO Ethics Hotline

US Citizens Living Abroad: Expat Health Insurance

Thousands of Americans realize their lifelong dreams and move overseas to chase these dreams. From experienced executives looking for new business ventures, a retired couple longing to explore new cultures, to spirited students on a gap year hoping to gain some work experience, becoming an American expat has no age limits. However, living abroad comes with a set of challenges. Moving to a new country means adapting to things you are not used to, which can be stressful. In your environment, you'll find yourself worrying about things such as understanding highway signboards, where to find an internet provider, or interpreting different dishes on the menu. While these challenges are easy to embrace, one main challenge stands out; expat health insurance. Here, we discuss everything you need to know about expat insurance for Americans living abroad.

How to Manage Social Security for American Expat and His Family Abroad

The amount of Social Security benefits you receive depends on your earning history and how old you started making contributions. Although these benefits don't provide a comfortable life, they are vital in supplementing your income, other pensions, and retirement accounts. If you live in the country, managing your Social Security is straightforward. But if you live abroad and qualify for Social Security, there's much you need to know about these benefits.

While it's possible to receive your payments while living in most countries, the US Treasury Department prohibits Social Security from sending money to American expats living in Cuba and North Korea. However, anyone affected by the sanction can recoup their benefits after relocating.

American expats living in the following eight countries- Moldova, Azerbaijan, Belarus, Turkmenistan, Kyrgyzstan, Kazakhstan, Tajikistan, and Uzbekistan- can only receive their Social Security payments under the condition that they show up in person at a U.S embassy or consulate after every six months.

Common Issues You May Receive When Collecting Your Social Security Benefits Abroad

Other than the conditions set for the above countries, you are free to receive your Social Security benefits when living as an expat in any other country. However, there are specific issues that you and your spouse are likely to encounter when receiving these benefits.

Bi-Lateral Social Security and Totalization Agreements

Suppose you worked less than 40 quarters under Social Security in the United States and contributed to an equivalent in a foreign country. In that case, you can still receive your Social Security benefits under the bilateral agreements known as the Totalization Agreement .

The Totalization Agreement aims at:

- Eliminating dual Social Security taxation, which occurs when you are an American expat working abroad and are required to pay social insurance taxes for both countries.

- Filling gaps in benefit protection for workers who have divided their careers between the United States and another country. The benefits gap occurs if you are an expat in a country without a Totalization Agreement.

Receiving U.S Social Security for Foreign Spouses

Your foreign spouse may be eligible for social security benefits but must meet certain conditions. For instance, if your spouse is not a U.S citizen or a green card holder, their Social Security payments will stop if you have not been in the country for six consecutive months.

However, there are certain exceptions to this rule. First, your foreign spouse may receive social security benefits abroad if you lived with them in the United States for at least five years as a married couple. Second, your foreign spouse can receive the benefits if they are residents or citizens of a country with bilateral social security agreements. In both cases, the foreign spouse will receive Social Security survivor benefits.

Effects of Windfall Elimination Provision on Social Security Benefits

The Windfall Elimination Provision (WEP) may affect you as an American expat who has earned a pension with a foreign government but is also eligible for U.S Social Security benefits. For example, this happens if you are an expat working for a foreign employer but contributed to the U.S Social Security System in the past.

WEP controls the situation where you might be double-dipping by reaping benefits from both plans. The system helps determine the benefits on record for the primary beneficiary and auxiliaries. WEP minimizes your Social Security benefits, but the reduction cannot be more than 50%.

Types of Medical Insurance Available for American Expats Abroad

There are numerous risks associated with moving abroad without medical coverage. For example, you may incur massive medical bills or experience limited access to medical care in a foreign country. Since you never know when you may get sick, it's wise to get an expat's health insurance when working or living abroad.

Getting health insurance coverage when moving abroad saves you the trouble of finding immediate medical attention in case of an emergency. In addition, it helps you meet the requirements by the US Department of State that requires all US expats to purchase health insurance before traveling.

When moving abroad, you have three medical insurance options, depending on the country you're relocating to:

International Private Healthcare Insurance

If you're relocating to a foreign country without an exemplary public healthcare system, rely on international private insurance. You might want to seek medical attention in private hospitals in such a country since they are well-equipped and provide better services than public hospitals. However, access to these quality medical services is too costly to pay out of your pocket.

National Public Insurance

There are countries with reliable state-run public health insurance schemes. If you work in such a country, you will be automatically enrolled by paying monthly contributions, similar to taxes. As a result, you will access affordable healthcare services in public hospitals and clinics.

Combination of Public and Private Health Insurance