Capital One Main Navigation

- Learn & Grow

- Life Events

- Money Management

- More Than Money

- Privacy & Security

- Business Resources

All about booking with Capital One Travel

Planning the perfect getaway? Save yourself from seemingly endless online searches and choose a better way: Capital One Travel . Capital One Travel is an online booking platform that covers every step of your trip and is designed to help you plan, book and travel with confidence.

This guide breaks down exactly how it works and what it offers.

Key takeaways

- Capital One Travel is an online booking experience where eligible cardholders can book flights, hotels and rental cars.

- Depending on your card, you can earn as much as 10X miles on hotels and rental cars and 5X miles on flights booked through Capital One Travel.

- Booking through Capital One Travel gives you access to smarter tools like price prediction, price drop protection and more.

- Venture X cardholders receive a $300 annual credit for bookings through Capital One Travel.

- Eligible cardholders also receive an experience credit and premium benefits on every hotel booking from the Premier or Lifestyle collection.

Go further with Capital One Travel

Earn extra rewards and find our best prices for flights, hotels and car rentals.

What is Capital One Travel?

Capital One Travel is an online booking experience for Capital One rewards credit cardholders in partnership with Hopper. It launched in 2021 to make trip planning and travel enjoyable and hassle free for eligible Capital One cardholders.

Capital One Travel sorts through thousands of options to help you get Capital One’s best prices for flights, hotels and car rentals and confidently book your travel online. 1 As a bonus, eligible cardholders can earn extra rewards when booking through Capital One Travel.

Capital One Travel features and benefits

Cardholders can sign in to Capital One Travel to compare prices and book flights, hotels and rental cars. But that’s just the start.

You’ll have access to unique tools and offers before and after you book, giving you a rewarding, flexible travel experience. Here’s a closer look at some of the benefits of Capital One Travel:

Cancel your flight for any reason

Need to make your travel booking more flexible? For a small fee when booking, you can add the option to cancel your flight for any reason.

This option gives you the ability to cancel your flight up to a set time within your scheduled departure. Capital One Travel will issue a refund—typically 70%-90% of the ticket price—to your original payment method.

Sometimes, you’ll also have the option to choose an airline credit worth 100% of your original ticket cost instead of the refund. Airline credit availability depends on the airline’s policies. If you choose this option, Capital One Travel will still cover any related cancellation or rebooking fees. 2

Freeze the price of a flight

Want a little extra time to decide on a flight but don’t want to stress about the price going up? For some flights offered through Capital One Travel, you can “freeze” the price for a specific period of time by paying a small fee.

When you freeze the price of the flight, Capital One Travel will hold that price for you until the expiration date of your frozen price. That expiration date will be given to you before completing your purchase.

If the price of the flight increases after you freeze it (and before your frozen price expires), Capital One Travel will cover any fare increase up to your maximum refund limit. And if the price goes down, you’ll pay the current lower price. 3

Earn bonus rewards

When you book that fabulous hotel room for the weekend or reserve a car rental for a scenic drive, you’re earning extra rewards you can put toward your next trip.

Venture X and Venture X Business cardholders get 10X miles on hotels and rental cars and 5X miles on flights booked through Capital One Travel.

And when booking through Capital One Travel with other eligible U.S.-issued Capital One cards, earn 5X miles or 5% cash back on hotels and car rentals, depending on the card:

- Travel credit cards : Venture, VentureOne

- Cash back credit cards : Quicksilver, QuicksilverOne, Quicksilver for Good Credit, Quicksilver Student, Quicksilver Secured and Capital One Walmart Rewards® Card

- Dining and entertainment credit cards : Savor, SavorOne, SavorOne Student, SavorOne for Good Credit

- Business credit cards : Spark Miles, Spark Miles Select, Spark Cash Select, Spark Classic, Spark Cash Plus

Get price prediction and price watch alerts for flights

Looking for the best time to book flights? When you search for flights on Capital One Travel, you’ll see a recommendation to either book now or wait for a better price. Capital One Travel uses artificial intelligence (AI) to analyze billions of data points and predict how flight prices will fluctuate.

To get started, you can set a price alert for the destination and dates you’re interested in flying. Capital One Travel will monitor prices 24/7 and let you know when it’s time to book. With help from our price predictions and alerts, you can save an average of 15% on flights. 4

Get free price drop protection for flights

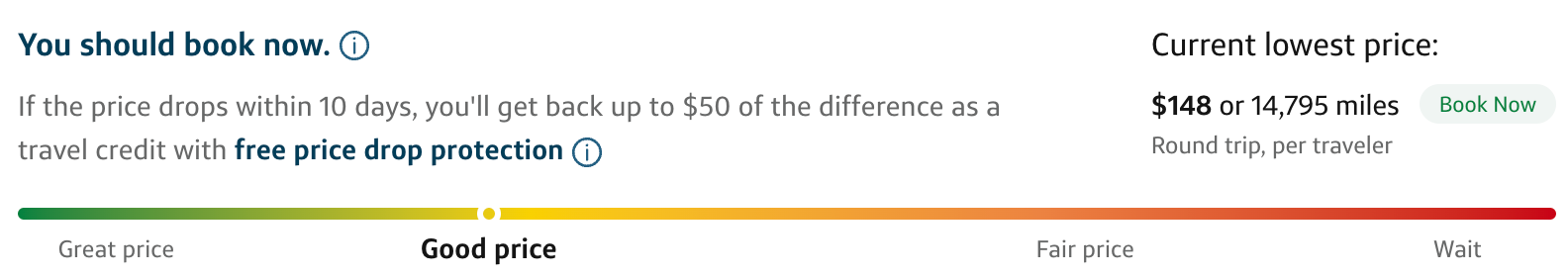

Did you book a flight to visit loved ones based on Capital One Travel recommendations? If you booked at a recommended time, Capital One Travel will keep watching the price for 10 days. If it drops, you get up to $50 in travel credit for the difference. 5

Get Capital One Travel's best prices, guaranteed

If you find a better price on the same flight, hotel or car rental, Capital One Travel will match it. Simply submit a request within 24 hours of booking with us, and Capital One Travel will give you a travel credit for the difference. For hotels, we also proactively adjust our prices to guarantee they match or beat other travel sites. 6

Redeem rewards for travel

Have you been saving up your rewards? Apply them to any trip booked through Capital One Travel. Or use a combination of rewards and your card when booking. The choice is yours.

Stay in style

Elevate your stay with rooftop drinks, meals at signature restaurants, room service and other unique amenities when you book with the Premier Collection or Lifestyle Collection . The collections also include a $50 or $100 experience credit (depending on the collection) and other premium benefits like room upgrades, early check-in and late checkout when available—all to make it even easier to upgrade your next getaway. 7

Capital One Travel FAQ

Check out these frequently asked questions about Capital One Travel.

How can I access Capital One Travel?

If you have access through your card, you’ll see the option to start booking trips when you sign in and view your rewards . Through the site, you can pay for flights, hotels and car rentals with your Capital One card, your rewards or both. Don’t have an eligible Capital One card? You can compare options and benefits to get started.

Do I need a Capital One travel rewards credit card to use Capital One Travel?

If you have any eligible Capital One credit card, you can use Capital One Travel to plan your next getaway. Travel rewards credit cards earn miles on hotels and car rentals when booking through Capital One Travel, and other eligible cards earn cash back.

You can see if you’re pre-approved for an eligible card today—with no harm to your credit.

Can I transfer miles instead of booking through Capital One Travel?

You may be able to transfer your Capital One miles to one of Capital One’s loyalty programs .

Does Capital One offer travel insurance?

Some Capital One rewards credit cards may offer travel insurance . And some coverage may be available through your card’s network . You can check your card’s benefits and terms to determine if you qualify for travel coverage, lost luggage reimbursement or travel accident insurance.

Capital One Travel in a nutshell

Capital One Travel provides advanced booking tools, price guarantees and the ability to earn and redeem your rewards—all to help you travel smarter. All you need is a Capital One travel rewards credit card or any eligible Capital One card to use it. So if you’re jetting off to a new place soon, start planning your trip today with Capital One Travel .

Other ways to maximize your travel benefits

Who wouldn’t want to get the most out of their credit card? Here are some things to know about Capital One travel rewards credit cards:

Get a one-time 75,000-mile bonus with the Capital One Venture X card and receive an additional 10,000 bonus miles every year, starting on your first anniversary. ( View important rates and disclosures .)

Earn unlimited 2X miles per dollar on every purchase, every day and get 75,000 bonus miles upon signup with the Capital One Venture card . ( View important rates and disclosures .)

Earn unlimited 1.25X miles with no annual fee with the Venture One card from Capital One . ( View important rates and disclosures .)

Explore travel rewards card options by comparing Capital One Venture cards .

Learn how Venture X cardholders can get access to a worldwide network of airport lounges thanks to a complimentary Priority Pass membership .

Related Content

All about the capital one venture card.

video | April 23, 2024 | 1 min video

All about Capital One Lounges

video | December 12, 2023 | 1 min video

All about Venture X

article | February 20, 2024 | 9 min read

Everything you need to know about the Capital One travel portal

Editor's Note

Capital One's new travel portal, launched in 2021, has significantly improved since its beta release. It now allows Capital One credit cardholders , including those with the issuer's cash-back cards , to directly use their rewards for travel purchases. The portal also features updated flight search capabilities and the issuer's hotel programs: the Premier Collection and the Lifestyle Collection .

In this guide, we will explain what you need to know about the Capital One portal.

What is the Capital One travel portal?

Credit card issuers often provide bonus rewards when using their travel portals, but they can be frustrating due to poor customer service and user interfaces. However, Capital One differentiates itself by integrating technology from Hopper, a trusted app for predicting the lowest prices for flights and hotels. With access to vast amounts of data, Capital One claims a 95% accuracy rate in price predictions.

The portal also offers customer-friendly features like price drop protection, best price guarantee and price match with competitors. Suppose the portal advises you to book a flight. In that case, you will receive automatic price drop protection, ensuring a partial refund as a travel credit if the ticket price decreases within a specified time frame (generally up to $50 after booking).

Capital One has also addressed customer concerns by adding more support staff to reduce phone hold times. Three paid add-on features are available for users: cancel-for-any-reason (CFAR) coverage, price freeze protection and rapid rebooking .

CFAR coverage allows you to cancel your flight up to three hours before travel and receive back 70-90% of the ticket price. On the other hand, price freeze protection lets you pay a fee to lock in a price, protecting against sudden price increases. Rapid rebooking lets you select a same-day or next-day flight for up to $5,000 on any airline if your flight is delayed more than two hours or you risk not making your connection.

Here's a list of some top Capital One cards that offer access to Capital One Travel:

- Capital One Venture X Rewards Credit Card

- Capital One Venture Rewards Credit Card

- Capital One VentureOne Rewards Credit Card

- Capital One SavorOne Cash Rewards Credit Card

- Capital One Quicksilver Cash Rewards Credit Card

- Capital One Spark Cash Plus

- Capital One Spark Miles for Business

You can access the portal through this link .

Related: Best Capital One credit cards

How to book flights through the Capital One travel portal

To book airfare using the Capital One travel portal, log into your account and hover over the "Flights" tab to search for one-way or round-trip flights. Enter your desired departure and arrival cities.

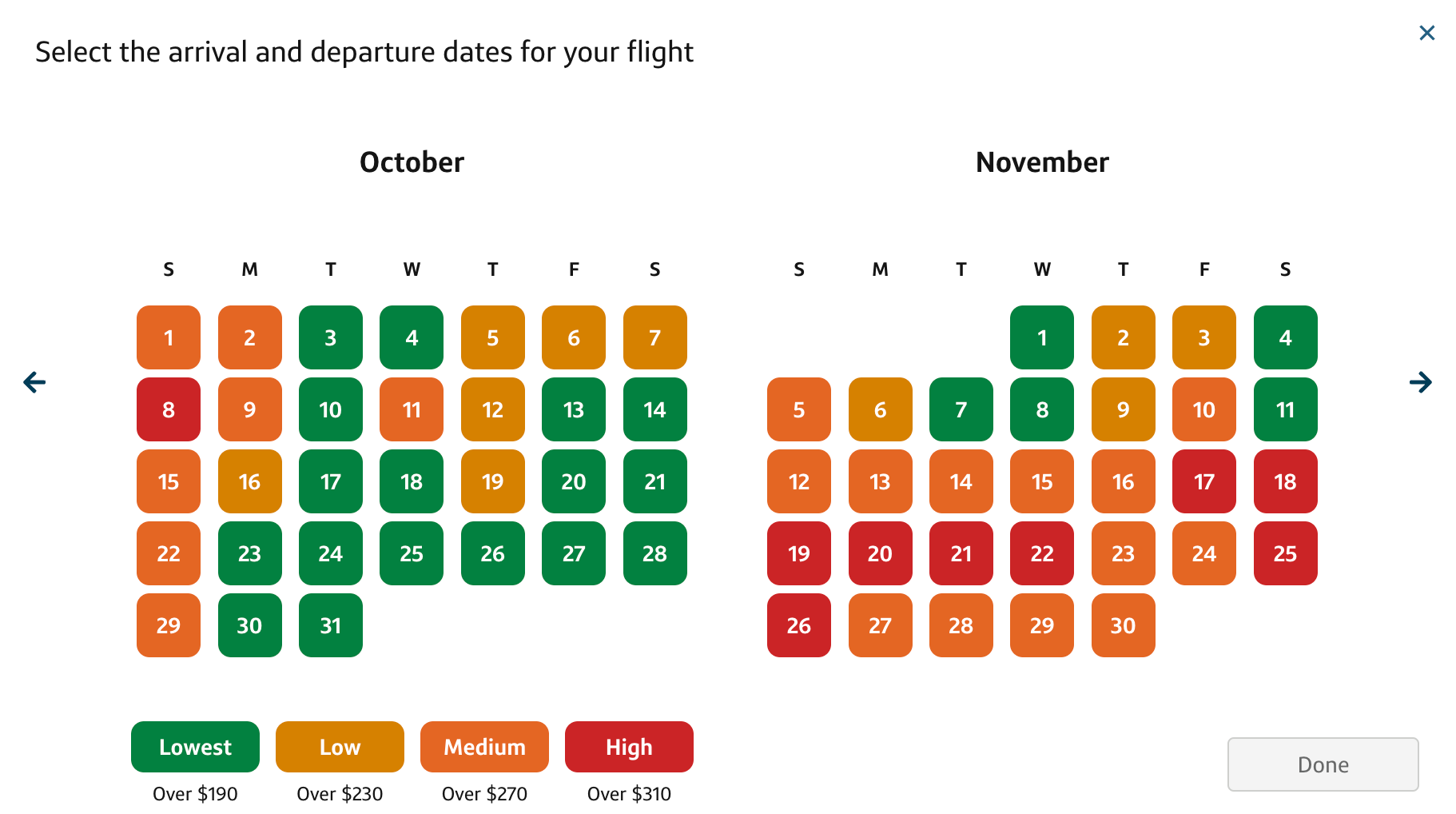

When selecting departure and return dates, it's not just a matter of merely selecting the convenient dates for you. Capital One brings in Hopper's familiar, color-coded interface, allowing you to see which dates offer the lowest prices in economy class.

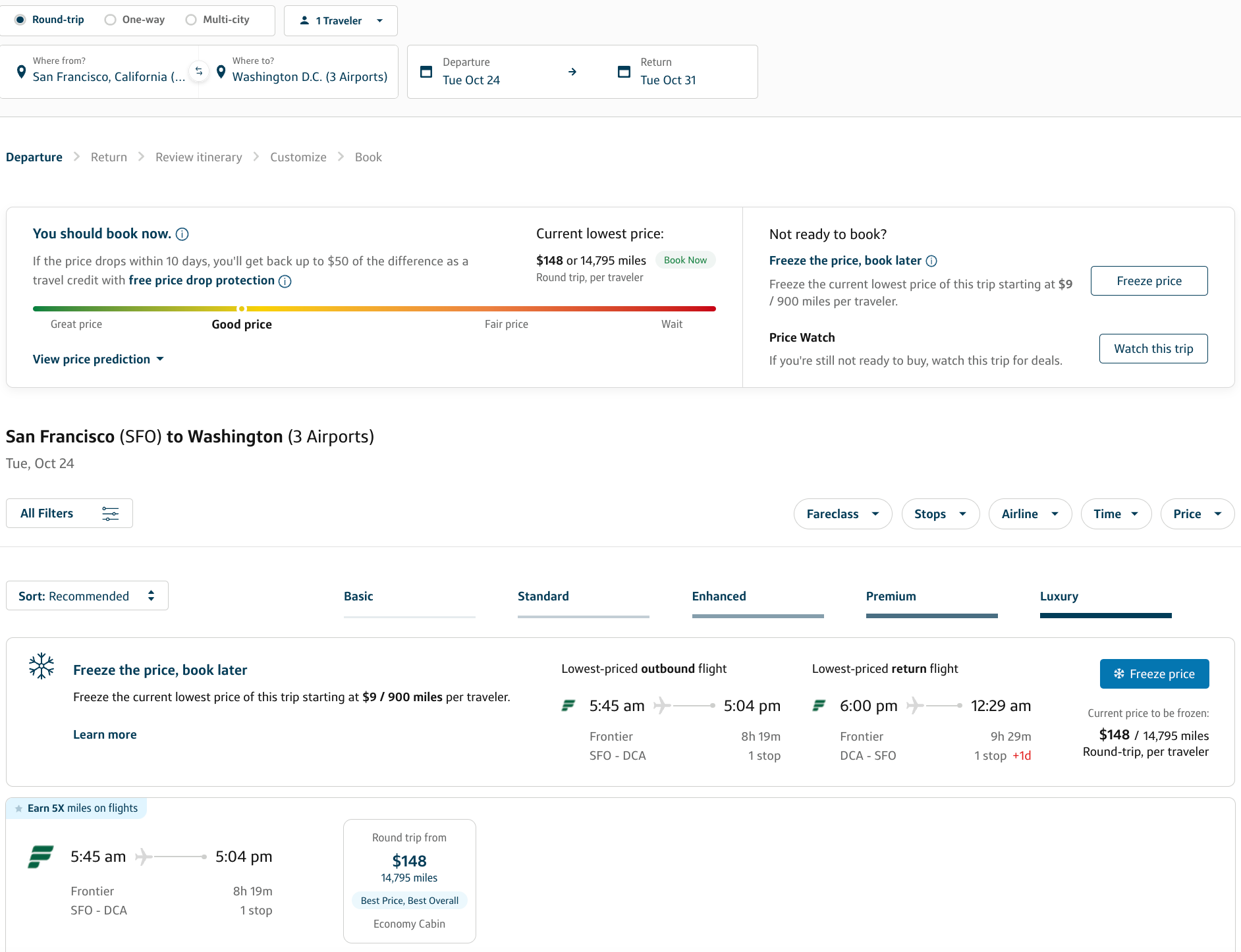

You'll see Capital One's booking recommendation and flight options on the next screen.

From the results page, you can narrow the parameters by:

- Fare class (cabin)

Then, you can sort your results by:

- Recommended

- Price (low to high)

- Departure time (earliest to latest)

- Arrival time (earliest to latest)

- Stops (least to most)

- Duration (shortest to longest)

There are a few other interesting features worth mentioning. Above all the options, you can see the price prediction tool come into effect with clear messaging on whether or not it's a good time to book.

If the site's algorithms advise you to book, that will trigger free price drop protection. You'll get back up to $50 of the difference as a future travel credit if you book now and the price drops in the specified time period (10 days in the above example).

If you're not ready, you can press "Watch This Trip" to receive emails about the best time to book whenever better prices become available. Unfortunately, this feature applies to the route and date, not the specific flight(s) you want to watch — though you can exclude basic economy and connecting flights.

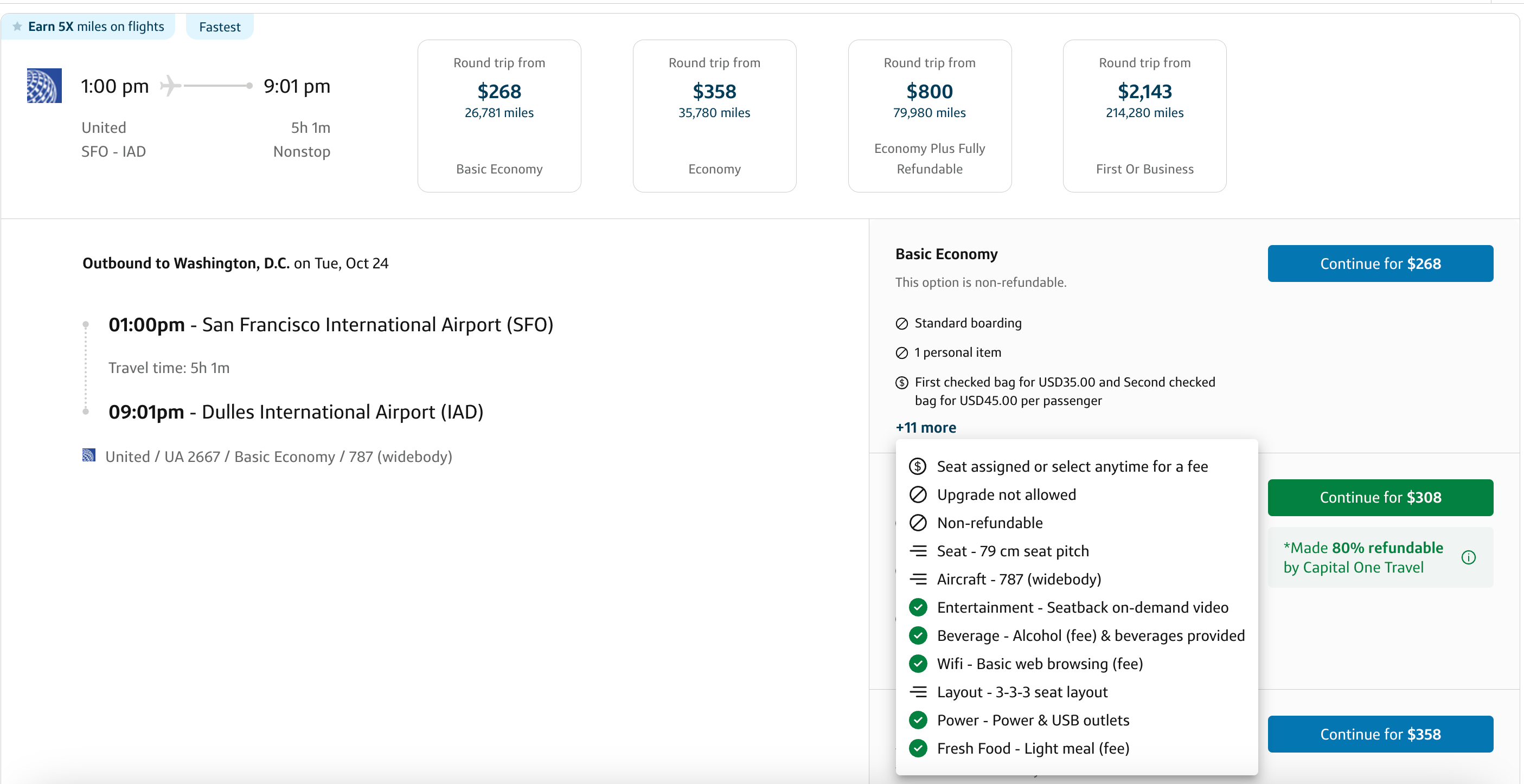

Pay attention to the fare class when booking flights. Basic economy differs between airlines. For example, United Airlines does not allow full-size carry-on bags, but Delta Air Lines does. Additionally, cancellation policies vary across fare classes.

Capital One has tried to standardize fare classes across all airlines on its platform, making it easier for users. When searching through Capital One Travel, you'll see the following labels:

- Basic : The best-priced options are often basic fares with restrictive policies and few amenities.

- Standard : Typically, main and economy fares include amenities like carry-on bags and seat selection.

- Enhanced : These fares include more legroom, priority boarding, and free beverages and snacks.

- Premium : These fares include cradled or reclined seats, priority boarding, and premium snacks and beverages.

- Luxury : These fares feature reclined seats with personalized services and premium meals. Priority boarding is also included.

After selecting your desired flight, Capital One Travel provides an extensive overview of what to expect during your journey. This includes detailed information on seat measurements, aircraft layout and onboard amenities like power outlets, fresh food options and whether lounge access is included. These comprehensive details surpass what you typically find on other travel portals or even when booking directly with airlines.

The payment side is quick and easy too. Enter the traveler information, with fields for frequent flyer numbers and Known Traveler Numbers (for instance, your TSA PreCheck number).

As a holder of the Capital One Venture card , I can apply my miles at a rate of 1 cent each toward the purchase. However, if you want to save your miles for later, press "Do not apply my rewards." You can use your credit card to pay for your reservation instead.

Note that the Capital One Venture X card offers 5 miles per dollar spent on flights booked through Capital One Travel.

Other options available in the booking process include purchasing the abovementioned add-ons: CFAR and price freeze. The price for these features will vary, depending on factors like your trip cost, how far in advance you're booking, whether the price is rated as "low" or "high," and other elements.

Related: Everything you need to know about Capital One's new rapid rebooking feature

How to book hotels through the Capital One travel portal

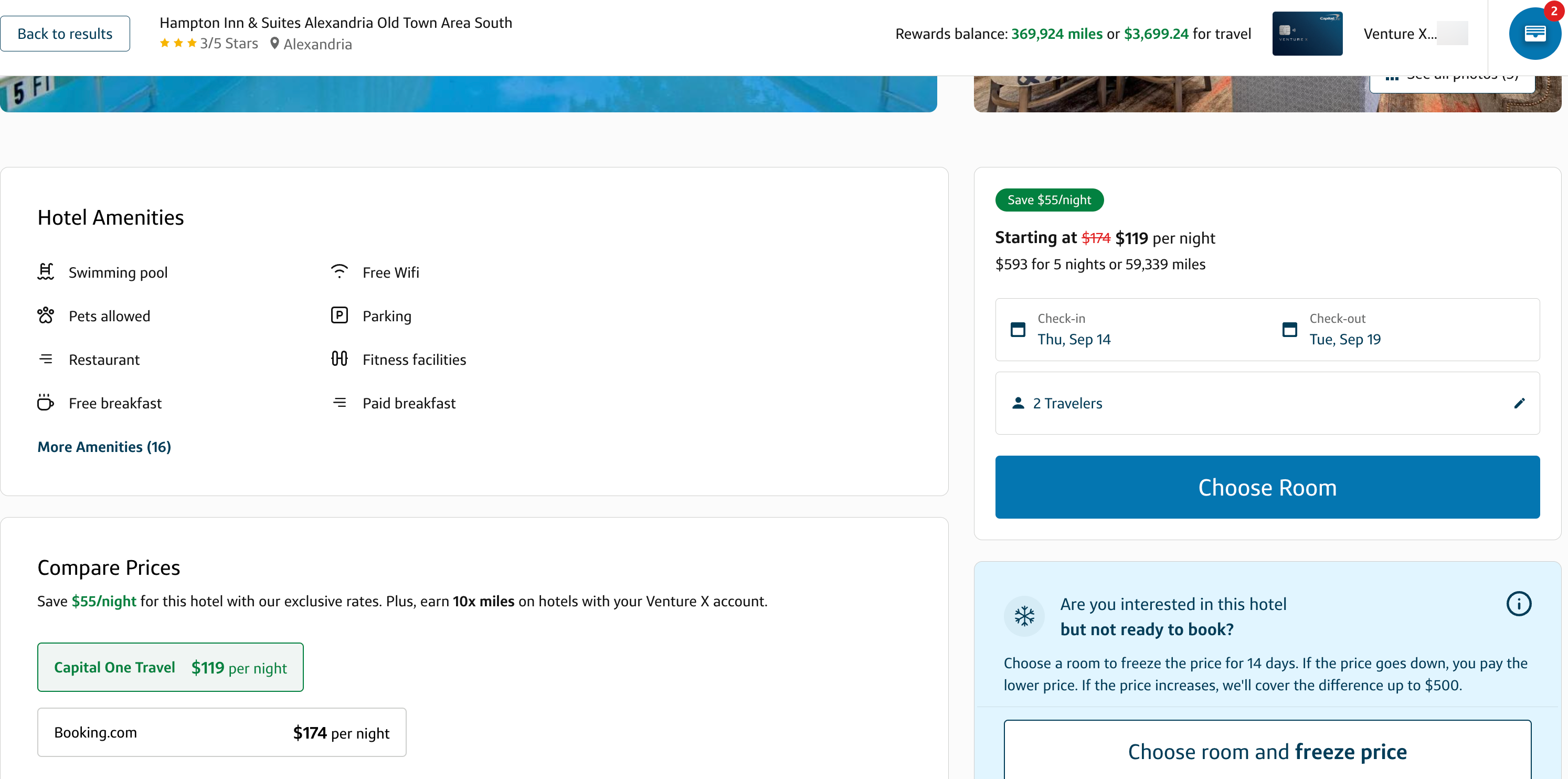

There are fewer distinctive features when booking your hotels through the Capital One travel portal, but the process is similar to the above.

To find a hotel, hover over the "Hotels" tab on the landing page and enter your destination, dates and number of travelers. Unlike flight bookings, there is no color-coded calendar for prices.

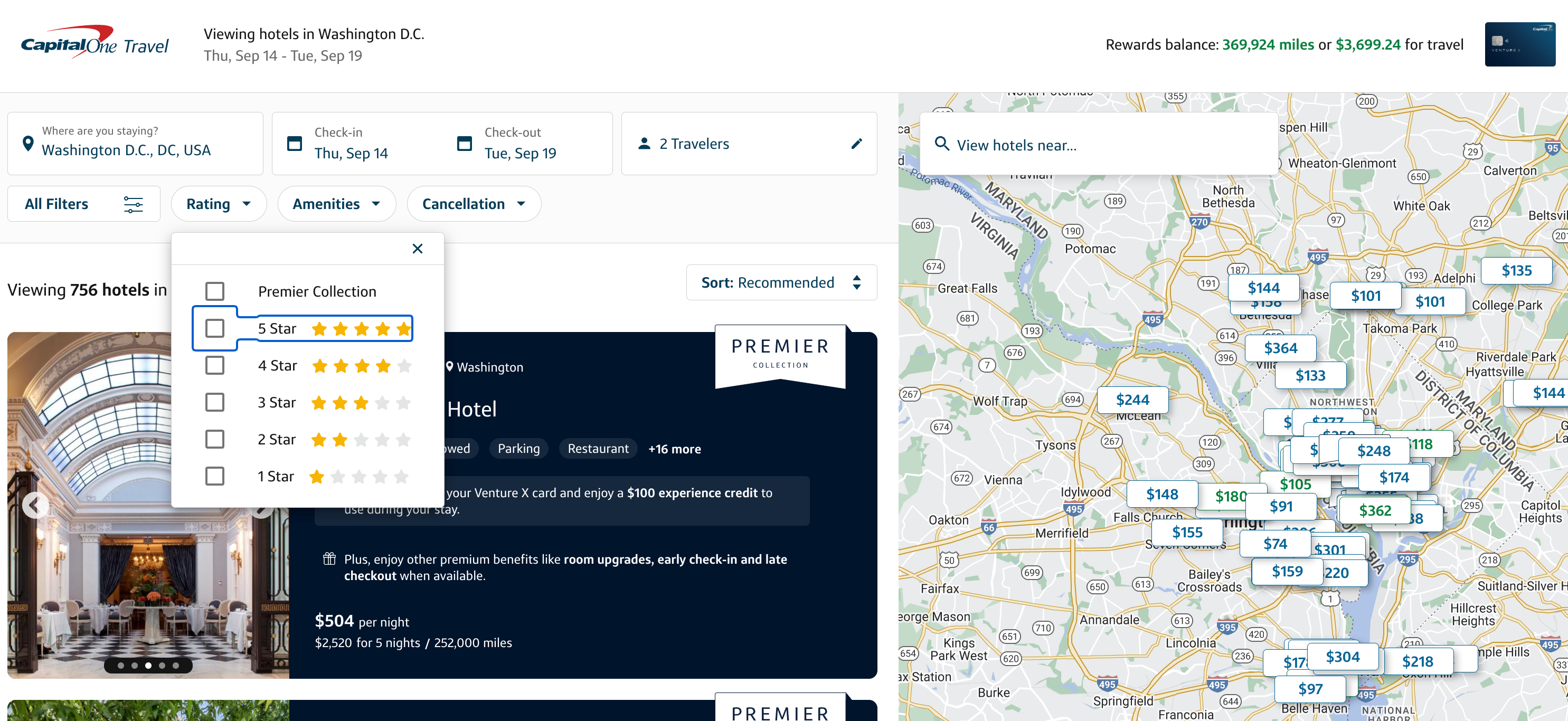

You'll then see a list and map format with various options. Filter your search by rating and price per night. Sort the listings by recommended, price (low to high) or star rating (high to low).

If your city has Premier Collection hotels, those options will appear toward the top. These hotels include benefits like an on-property "experience credit" of up to $100, daily breakfast for two people and complimentary Wi-Fi. Access is limited to those with premium credit cards from Capital One: Capital One Venture X Rewards Credit Card and Capital One Venture X Business (a business credit card formerly known as the Spark Travel Elite card).

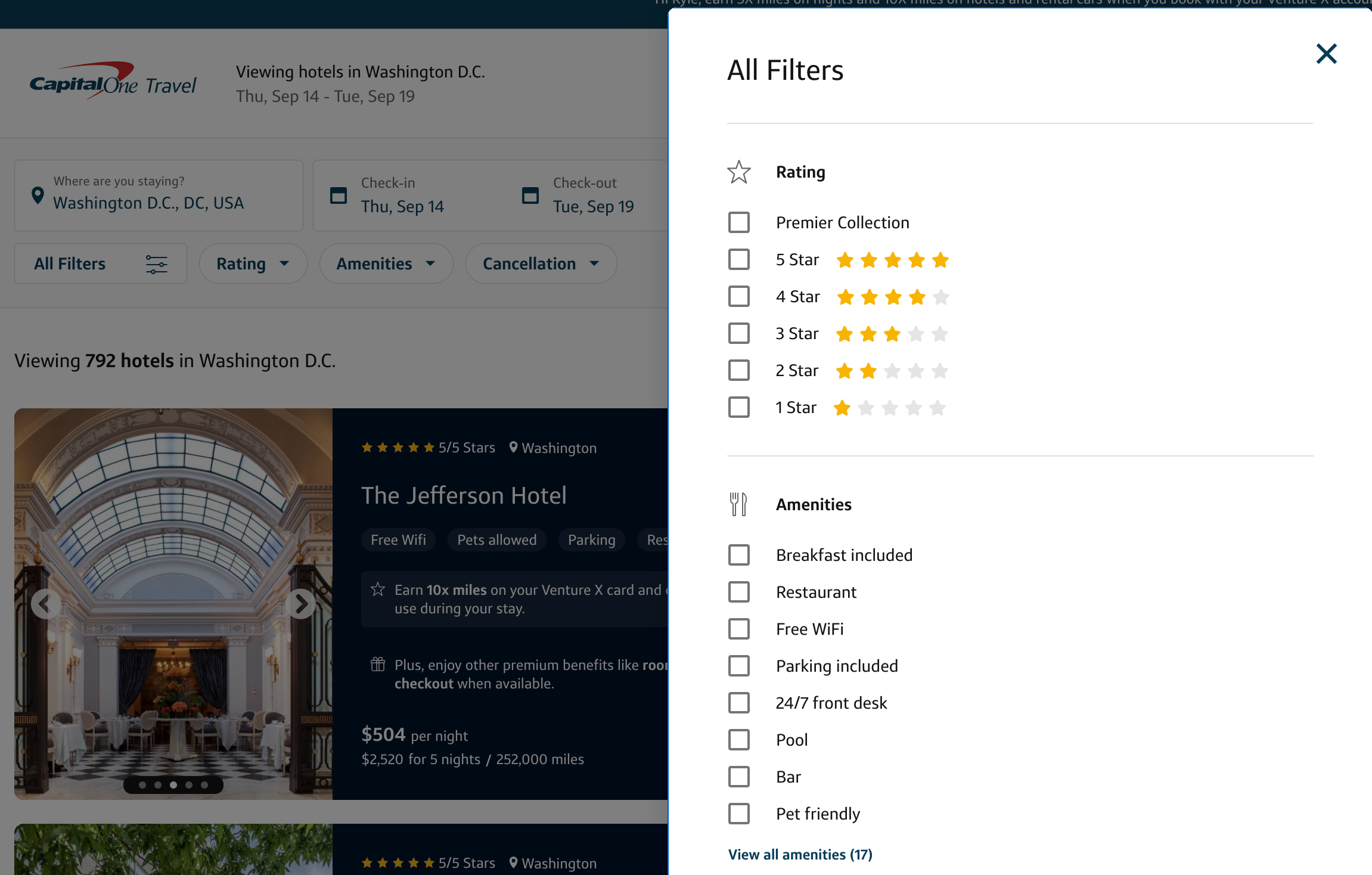

If you click "All filters," you can sort by the amenities that matter to you or even look up specific properties.

While the search features are more limited than booking flights, you'll get a detailed description of each hotel and can find out about amenities, rates, location and cancellation policy.

The payment process for booking hotels is the same as for flights. You can redeem your Capital One miles for the trip or pay with your card.

Paying with your card may be the better option here, as multiple cards offer bonuses on hotels booked through Capital One Travel:

- Venture X: 10 miles per dollar spent

- Venture, VentureOne and Spark Miles: 5 miles per dollar spent

- SavorOne, Quicksilver and Spark Cash Plus: 5% cash back

However, if you book hotels in a major loyalty program — like Marriott Bonvoy or Hilton Honors — through Capital One Travel, you likely won't receive points. You also won't enjoy any elite status perks.

Related: The best hotels in San Francisco for a golden getaway

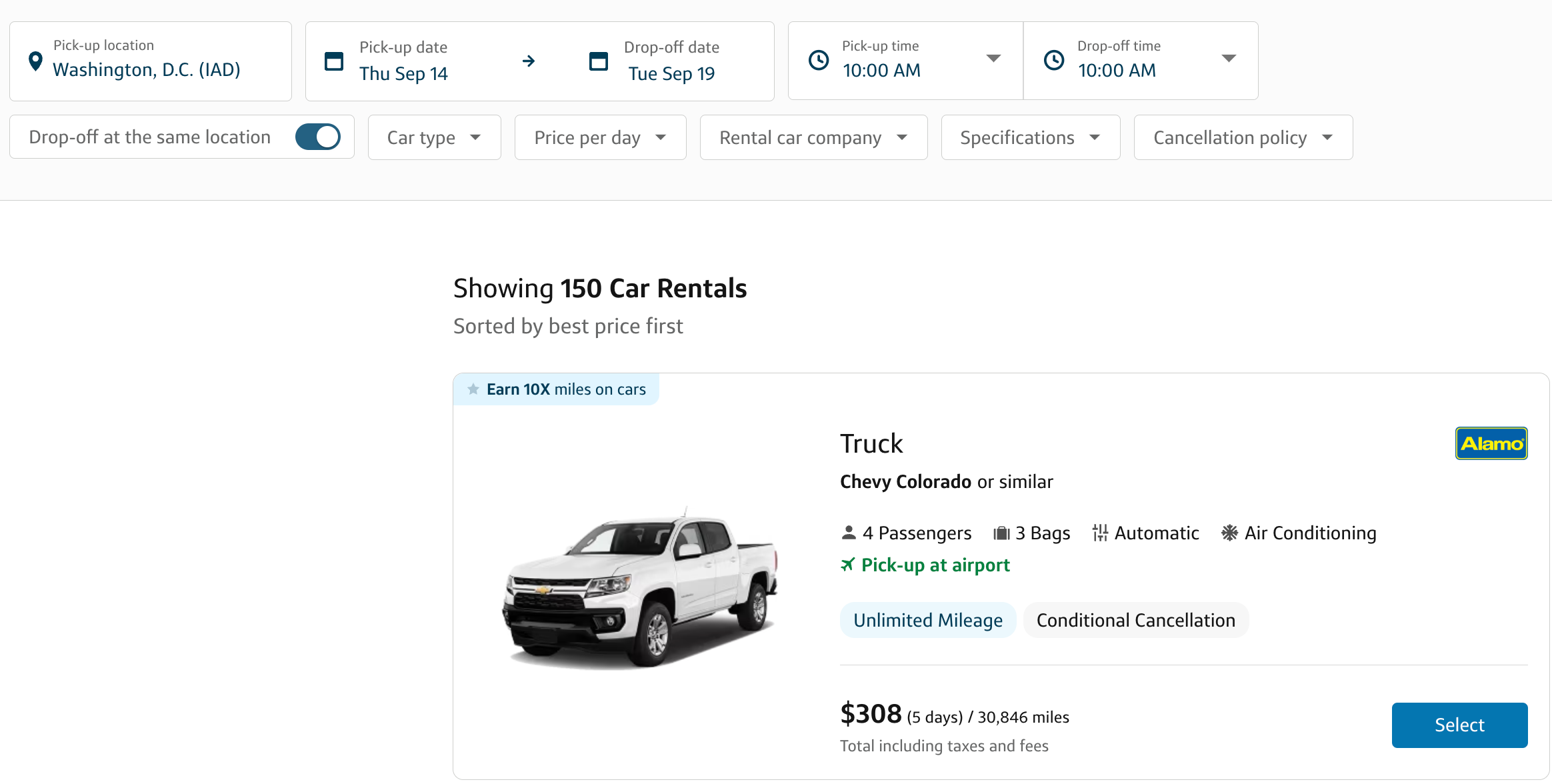

How to book rental cars through the Capital One travel portal

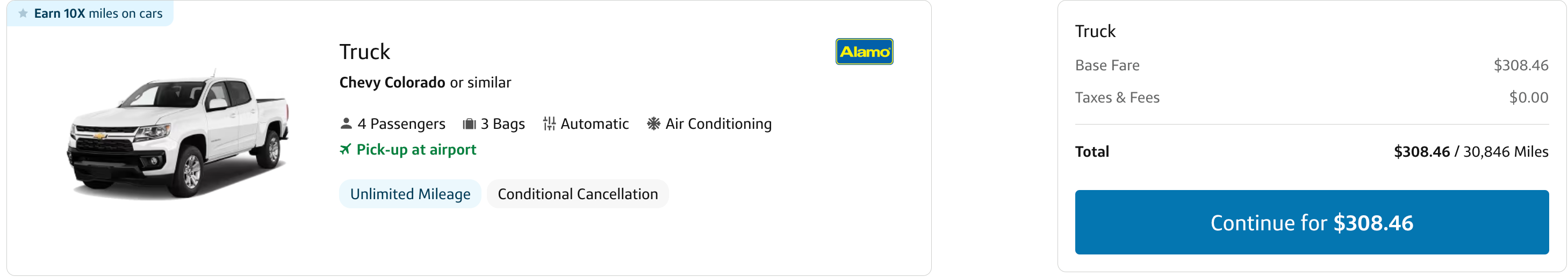

The process for rental cars is straightforward. Click "Car Rentals" at the top and enter your search criteria. You'll receive a list of options that can be filtered by car type, price per day, rental car company and specifications.

You can then reserve the car in a few clicks, with clear information about pick-up and drop-off.

With some rental car agencies — Hertz, Thrifty and Dollar — you can add your rewards number to the booking and likely enjoy the associated benefits. The option to add your loyalty number generally won't appear for other companies.

This is particularly appealing for Venture X cardholders , as you can earn 10 miles per dollar spent on rental car bookings and still enjoy the complimentary Hertz President's Circle status* that's included on the card.

Note that these car rentals earn rewards at the same rate as hotels booked through Capital One Travel:

*Upon enrollment eligible cardholders will maintain Hertz President's Circle status through Dec. 31, 2024. Please note, enrolling through the normal Hertz Gold Plus Rewards enrollment process (e.g., at Hertz.com) will not automatically detect a cardholder as being eligible for the program and cardholders will not be automatically upgraded to the applicable status tier. Additional terms apply.

Related: Stacking rental car perks with Hertz and the Venture X

Further things to consider about the Capital One travel portal

Capital One Travel packs a punch for cardholders, but there are a few additional things to remember.

First, consider checking alternative platforms like Google Flights for better prices or alternate routings before booking with Capital One. Credit card portals sometimes have higher prices and don't always show all available flight options. Be sure you're not paying more for the same itinerary.

Additionally, if you're planning on using your Venture miles or Spark miles at a rate of 1 cent apiece , you should always book directly with the travel provider (whether it's an airline, hotel or car rental company). Then, use the miles to cover that purchase. This ensures you get all of the benefits of booking directly while using your rewards at exactly the same redemption value.

Also, with 18 transfer partners , Capital One offers a range of options for transferring your miles at a 1:1 ratio. Before booking through the portal, compare prices against Capital One transfer programs. For instance, a $150 United flight can cost 15,000 Capital One miles through the portal or just 7,500 Avianca LifeMiles (plus minimal taxes and fees). In this instance, it makes more sense to transfer your Capital One miles to Avianca LifeMiles.

As noted, hotel and car rental reservations through Capital One Travel likely won't be eligible for perks in a given loyalty program. If your elite status is important, it's advisable to book directly with major chain hotels and most car rentals. However, if you're booking independently owned hotels or elite status isn't a concern, the Capital One travel portal may be a better option.

Finally, remember that Venture X cardholders enjoy $300 in annual credits for bookings made via Capital One Travel. Unlike the $300 credit on the Chase Sapphire Reserve , this only applies to purchases made through the portal. As a result, even if you'd rather book flights, hotels or car rentals directly with travel providers, you should still spend at least $300 on your Venture X through Capital One travel each year.

Related: 7 tips to help keep an airline from losing your luggage

Bottom line

Capital One has made significant advancements in the travel space, including improved transfer partners, the introduction of a premium card and the opening of its flagship lounge in Dallas Fort Worth International Airport (DFW).

The Capital One travel portal offers a user-friendly interface. With its detailed pricing and fare class information, you might consider especially using it for flight bookings. Additional features like CFAR coverage, price drop protection, rapid rebooking and price freeze add value for cardholders.

You can also earn bonus rewards for many Capital One Travel purchases across most of the issuer's card portfolio, making it a great option as you plan upcoming trips.

Additional reporting by Stella Shon.

Introduction to the Capital One Travel Portal

Utilizing rewards for bookings, how to use capital one travel, what is the capital one premier collection.

- Cards that are eligible for the travel portal

Capital One Miles Value in the Capital One Travel portal

Capital one travel portal: your guide to booking and rewards.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate credit cards to write unbiased product reviews .

The information for the following product(s) has been collected independently by Business Insider: Capital One Venture X Business Card†, Capital One Savor Cash Rewards Credit Card†, Capital One Spark Miles for Business†, Capital One Spark Miles Select for Business†, Capital One Spark Cash Plus†, Capital One Spark Cash Select for Excellent Credit†, Capital One Spark 1% Classic†, Capital One Walmart Rewards® Mastercard®†, Journey Student Rewards from Capital One†. The details for these products have not been reviewed or provided by the issuer.

The Capital One Travel portal is an online travel platform that allows customers to book flights, hotels, and rental cars. The site provides exclusive travel deals, discounts, and tools to help you save on your next vacation. Select Capital One credit card customers can earn elevated rewards for every purchase made through the portal or redeem them for bookings. It's a great tool that lets you make all your travel reservations in one place and takes the guesswork out of redeeming miles.

However, Capital One Travel also has several downsides. You're giving up loyalty rewards with those programs by booking hotels and rental cars through Capital One. The Price Freeze function also doesn't work as promised and redeeming Capital One miles for travel bookings may not be the best way to maximize your rewards.

Overview of the Portal

The Capital One Travel Portal offers excellent value for money and flexibility, with various travel options to suit any budget. It also provides a range of rewards, discounts, and tools to help you save on your travels.

With the added convenience of booking flights, hotels, and car rentals all in one place, it is the perfect choice for anyone looking to book their next trip. While some of its features are more gimmicky than others, the fact remains that this portal provides ease and convenience for travelers who don't want to deal with multiple booking platforms and loyalty programs.

The Capital One Travel portal is a travel booking platform powered by Hopper, an app that helps travelers pick the best times to book and travel at the lowest prices. Capital One Travel offers competitive prices, exclusive discounts, and access to a wide selection of flight, hotel, and rental car options for Capital One cardholders. Customers can use the portal to earn and redeem rewards on travel bookings.

Additionally, the portal provides helpful tools such as a price calendar to find the cheapest airfares and price drop protection that will refund the fare difference if it drops post-booking. The portal also has a price freeze feature, which allows users to "freeze" a specific airfare for up to $25 or 2,500 miles.

Benefits of Booking Through the Portal

One of the key benefits of using the Capital One Travel portal is that certain types of bookings will earn you higher rewards when you pay with an eligible Capital One credit card. For example, the Capital One Venture X Rewards Credit Card earns 10 miles per dollar on hotels and rental cars and 5 miles per dollar on flights booked through Capital One travel. And with the Capital One Venture Rewards Credit Card , you'll earn 5 miles per dollar on hotels and rental cars booked through the portal.

This works out well for Capital One Venture X Rewards Credit Card cardholders' flight bookings since Capital One lets you enter your frequent flyer number on the booking page. You'll not only earn elevated Capital One miles, but you'll also earn airline miles and elite-qualifying miles through your chosen frequent flyer program. You won't get the same benefits on hotel or rental car bookings, so that's worth weighing into your booking decision.

Above all else, the Capital One Travel portal provides convenient and easy travel booking. You can use it to compare airfare from multiple airlines at once, helping you find the best deal on your next trip. Additionally, you can use your Capital One miles to pay for travel bookings at a rate of 1 cent per mile, or get discounted rates on certain flights or hotel stays. Finally, customers have access to customer service representatives who can answer questions and assist with bookings.

How to Use Capital One Miles

The Capital One Travel portal can be a great way to earn elevated rewards and enjoy extra perks. Booking flights through this portal can make sense since you can double-dip, earning rewards with your credit card and frequent flyer miles from airlines. However, you won't earn hotel points or elite night credits on Capital One bookings, which means you'll miss out on possible elite benefits with major hotel loyalty programs. Depending on how often you travel, this could be a significant downside.

Transferring Capital One miles to one of the 18 airline or hotel partners can be a much better value proposition. If you redeem your miles for business and first-class travel, you'll usually get more than the 1 cent per mile your rewards are worth through the Capital One Travel portal. For example, a sample of fun, valuable ways to use the Capital One VentureOne welcome bonus of 20,000 miles after spending $500 on purchases within three months from account opening.

However, not all card members want to learn the ins and outs of various loyalty programs to get the most value. Some people want simplicity and the Capital One Travel portal offers just that. If you prefer convenience over value, booking with the Capital One Travel portal is a smart move. But if you're willing to put in the legwork for a high-value redemption, transferring Capital One miles to an airline or hotel program is the best option.

Using the Capital One Travel Portal is straightforward. Simply head to travel.capitalone.com and log into your account. From here, you can select between a flight, hotel, or rental car tab. Enter your destination and travel dates, then browse through the available options.

You can filter results by price, airline, hotel type, and more to find the best deal. Once you've made your selection, you can book directly with Capital One and either pay with your eligible Capital One card or use miles to pay for all or part of your trip.

Before booking anything, check out the travel offers section underneath the tabs mentioned above. Here, you'll find travel credits in select target markets. If you make a qualifying booking, you'll get a travel credit that's applicable toward future bookings.

How to Book Flights Through the Capital One Travel Portal

You can book flights with both domestic and international airlines through the Capital One travel portal. On the Capital One Travel homepage, select the "Flights" tab and enter the number of travelers, departure city, destination, and travel dates. You can book both one-way and round-trip flights.

When you select your travel dates, a color-coded calendar will show the cheapest and most expensive travel dates. This is great when your travel dates are flexible and you just want to find the lowest fare.

Choose your outbound and return dates on the calendar and select "done." Next, select the blue "search flights" button to generate your search results. On the results page, you can sort by price, departure time, arrival time, number of stops, and duration. You can also filter results by fare class, stops, airline, time, and price.

Capital One offers a price predictor tool at the top of the page, recommending whether it's a good time to book a particular price. You'll also get the option to freeze a specific price and book it later, though this feature isn't reliable in my experience. If you're not ready to book, you can select "watch this trip" to receive alerts when fares drop.

You'll also get the option to purchase cancel for any reason insurance (CFAR travel insurance) during the flight booking process. And, if Capital One Travel recommends you buy a specific flight now, it will apply free price drop protection to that flight for 10 days. If the price drops within that time period, Capital One will credit you the difference in fare, up to a maximum of $50.

How to Book Hotels Through the Capital One Travel Portal

Booking hotels through Capital One Travel is similar to booking flights. On the top of the Capital One Travel page, select the "Hotels" tab. Enter your destination, travel dates, number of travelers, and rooms, then select "Search Hotels."

Unlike the flight search tool, there is no calendar function displaying the lowest rates. However, the hotel search tool does have a city map to help you narrow down your options and find the cheapest rates. Hotel search results can also be filtered by star rating, amenities, price, and amenities. You can also sort results by price and star rating.

Once you select your room and rate, you'll be directed to the checkout page to see your total amount due in miles or cash. You can choose to pay either the cash rate or redeem miles. Note that some hotels charge additional service fees at check-in. These will be displayed on the checkout page, but you won't pay them until you get to the hotel.

How to Book Rental Cars Through the Capital One Travel Portal

To book a rental car, select the "Rental Cars" tab on the Capital One Travel portal and enter your pick-up and drop-off location, rental dates, pick-up and drop-off time, and driver age. Drivers under the age of 25 may be subject to additional fees. Click "Search Cars" to be redirected to the results page.

You can filter results by vehicle type, price per day, rental car company, cancellation policy, and other factors. As with flights and hotel bookings, Capital One displays both the total cash rate and mileage redemption rate (including taxes and fees). Once you've selected your vehicle, you'll get to a booking page displaying your total. During booking, you'll pay the rental cost minus taxes. The taxes will be collected at pick-up.

The Capital One Premier Collection is a curated list of luxury hotels and resorts worldwide that eligible cardholders can access via the Capital One Travel portal. Each property offers special benefits and includes bonus points and money-saving extras, including daily breakfast for two, experience credits, and room upgrades when available.

In addition to earning bonus points, eligible cardholders can also redeem Capital One miles toward their Premier Collection bookings. That's a huge plus, considering some of the properties in the collection are quite pricey. For example, Montage Hotels often have room rates of $1,000 per night or higher. Being able to redeem miles for these stays is a great way to save on upscale hotel bookings.

Capital One Premier Collection Hotels

Some Premier Collection hotels are operated by major hotel chains, while others are independent. Regardless of the hotel's affiliation, booking through the Premier Collection can help you secure added benefits typically reserved for elite members or those willing to pay extra for them.

There are currently seven major hotel chains represented in the collection. They include upscale brands like 1 Hotels, Design Hotels, Leading Hotels of the World, Montage, Preferred Hotels & Resorts, Small Luxury Hotels of the World, and Viceroy Hotels.

Some of these names may be more familiar than others. They include high-end hotels like the Montage Laguna Beach, Viceroy Los Cabos, Hotel Cafe Royal London, and the Wittmore in Barcelona.

Who Can Book the Capital One Premier Collection?

The only Capital One credit cards that have access to the Premier Collection are the Capital One Venture X Rewards Credit Card and Capital One Venture X Business Card† . Both of these are premium cards with high annual fees; for example, the Capital One Venture X Rewards Credit Card costs $395 per year ( rates and fees ) but comes with an annual $300 travel credit you can apply toward Premier Collection bookings. In addition to all the hotel-specific benefits, cardholders who book a Premier Collection stay will earn 10 miles per dollar spent — the highest travel booking payout of any transferable points card.

The Capital One Venture X Business Card was previously known as the Capital One Spark Travel Elite, and it's very similar to the Venture X. It has the same $395 annual fee, $300 travel credit, and 10,000 annual bonus miles.

Both cards are great for travel enthusiasts and those looking to earn generous rewards on their daily spending. While the Premier Collection access is not enough reason to get a Venture X card (the list of participating hotels is limited), it is an excellent addition to the various other benefits these cards offer.

Capital One Premier Collection Benefits

Booking through Premier Collection provides travelers with various perks, including special amenities and bonus miles. The following benefits are available at Premier Collection properties worldwide:

- 10 miles per dollar on hotel bookings

- $100 experience credit per stay

- Daily breakfast for two

- Space-available room upgrade

- Early check-in and late check-out

- Complimentary Wi-Fi

The experience credit will vary by property, but you'll need to charge the qualifying expense to your room to receive it. The hotel will then apply the credit to your folio upon checkout.

The daily breakfast can be especially valuable in high-priced destinations like the Maldives, where the remote setting often translates to breakfast charges of $50 or more per person. Having breakfast included in the cost of your stay, along with $100 toward some of the most expensive spa treatments in the world, is an excellent value in exchange for booking a stay through Capital One's Premier Collection.

Capital One Credit Cards That Are Eligible for the Travel Portal

You don't necessarily need a high-priced travel credit card to use the Capital One Travel portal. The platform is open to many Capital One cardholders, including those who carry a student credit card or small-business credit card issued by Capital One.

Over a dozen options are available, ranging from no-annual-fee credit cards like the Capital One Quicksilver Cash Rewards Credit Card to the Capital One Venture X Rewards Credit Card, a premium credit card :

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Capital One VentureOne Rewards Credit Card

- Capital One Quicksilver Cash Rewards Credit Card

- Capital One QuicksilverOne Cash Rewards Credit Card

- Capital One Quicksilver Student Cash Rewards Credit Card

- Capital One Quicksilver Secured Cash Rewards Credit Card

- Capital One Savor Cash Rewards Credit Card†

- Capital One SavorOne Cash Rewards Credit Card

- Capital One SavorOne Student Cash Rewards Credit Card

- Capital One Spark Miles for Business†

- Capital One Spark Miles Select for Business†

- Capital One Spark Cash Plus†

- Capital One Spark Cash Select for Excellent Credit†

- Capital One Spark 1% Classic†

- Capital One Walmart Rewards® Mastercard®†

- Journey Student Rewards from Capital One† (no longer available to new applicants)

At 10 miles per dollar spent on hotels and rental cars and 5x on flights booked through the portal, Capital One Venture X Rewards Credit Card cardholders will earn the most rewards on Capital One Travel bookings. The Capital One Venture X Rewards Credit Card includes $300 per year in credits toward Capital One Travel bookings, which helps offset much of the card's $395 annual fee.

Capital One miles are worth 1 cent each in the Capital One Travel Portal. This is pretty generous, considering miles are earned at a rate of 2 to 5 per dollar spent with the Capital One Venture Rewards Credit Card and 2 to 10 miles per dollar on the Capital One Venture X Rewards Credit Card.

However, it's possible to get more value from your miles by skipping the portal and instead transferring rewards to Capital One's transfer partners . You can transfer miles to 18 airline and hotel loyalty programs to book award travel.

Business Insider's points and miles valuations peg the value of Capital One miles at 1.7 cents each, because it's possible to get outsized value from transferring miles to partners and booking award flights or stays. Be sure to read Insider's guide on how to earn and redeem Capital One miles to find out more about maximizing your rewards.

Yes, the Capital One Travel Portal allows you to book a wide range of airlines and hotels, offering the flexibility to use your miles without blackout dates or restrictions.

Yes, you can earn Capital One miles on bookings made through the portal, further increasing your rewards.

The portal provides tools to predict price trends for flights and flexible booking options that allow you to filter searches based on free cancellation policies, offering you peace of mind and potential savings.

Yes, Capital One offers the flexibility to pay with a combination of cash and miles, giving you more options to utilize your rewards.

For changes or cancellations, you can either manage your booking directly through the portal or contact Capital One's customer support for assistance.

Editorial Note: Any opinions, analyses, reviews, or recommendations expressed in this article are the author’s alone, and have not been reviewed, approved, or otherwise endorsed by any card issuer. Read our editorial standards .

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

**Enrollment required.

***Terms, conditions, and exclusions apply. Refer to your Guide to Benefits for more details. Travel Accident Insurance is not guaranteed, it depends on the level of benefits you get at application.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply

- Main content

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

Capital One Travel: Your Guide To Booking Flights, Hotels & Car Rentals

Carissa Rawson

Senior Content Contributor

256 Published Articles

Countries Visited: 51 U.S. States Visited: 36

Keri Stooksbury

Editor-in-Chief

33 Published Articles 3136 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

Director of Operations & Compliance

1 Published Article 1172 Edited Articles

Countries Visited: 10 U.S. States Visited: 20

Why Book Travel Through Capital One Travel?

What are capital one miles worth, how to access capital one travel, how to book a flight through capital one travel, how to book a hotel through capital one travel, how to book a rental car through capital one travel, rental cars, other ways to use capital one miles, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Trying to figure out how to use your rewards? Whether you’re a longtime fan of Capital One Miles or you’ve just jumped on the Capital One Venture X Rewards Credit Card train, there’s a lot to love about this flexible point currency.

Although it’s possible to transfer your Capital One miles out to a variety of partners, you can also use Capital One Travel to earn and redeem rewards for your stays. Let’s take a look at Capital One Travel, how it works, and when you should use it.

Capital One is heavily pushing its customers toward its travel portal — and for good reason. There’s a lot to love about Capital One Travel, and if you’re the kind of person who values simplicity and high rewards over elite status, it could be a good match for you.

Earn Miles or Points by Paying With a Credit Card

There are 2 ways in which you’ll earn miles or points when booking through Capital One Travel.

As a Capital One cardholder, you’ll earn a varying amount of miles depending on which card you use to pay:

Capital One Venture X Rewards Credit Card

The Capital One Venture X card is an excellent option for travelers looking for an all-in-one premium credit card.

The Capital One Venture X Rewards Credit Card is the premium Capital One travel rewards card on the block.

Points and miles fans will be surprised to see that the Capital One Venture X card packs quite the punch when it comes to bookings made through Capital One, all while offering the lowest annual fee among premium credit cards.

Depending on your travel goals and preferences, the Capital One Venture X card could very well end up being your go-to card in your wallet.

- 10x miles per $1 on hotels and rental cars purchased through Capital One Travel

- 5x miles per $1 on flights purchased through Capital One Travel

- 2x miles per $1 on all other purchases

- $300 annual travel credit on bookings made through Capital One Travel

- Unlimited complimentary access for cardholder and 2 guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- 10,000 bonus miles awarded on your account anniversary each year

- Global Entry or TSA PreCheck credit

- Add authorized users for no additional annual fee ( rates & fees )

- No foreign transaction fees ( rates & fees )

- $395 annual fee ( rates & fees )

- Does not offer bonus categories for flights or hotel purchases made directly with the airline or hotel group, the preferred booking method for those looking to earn elite status

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

- Receive up to a $100 credit for Global Entry or TSA PreCheck ®

Financial Snapshot

- APR: 19.99% - 29.99% (Variable)

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

Capital One Miles

- Benefits of the Capital One Venture X Card

- Best Ways to Use Venture X Points

- Capital One Venture X Credit Score and Approval Odds

- Capital One Venture X Lounge Access

- Capital One Venture X Travel Insurance Benefits

- Capital One Venture vs Venture X

- Capital One Venture X vs Amex Platinum

- Capital One Venture X vs Chase Sapphire Reserve

- Best Credit Cards with Priority Access

- Best Credit Cards for Airport Lounge Access

- Best Capital One Credit Cards

- Best Luxury and Premium Credit Cards

- Best Metal Credit Cards

- Best High Limit Credit Cards

- Choice Privileges Loyalty Program Review

The Capital One Venture X card earns 10 miles per $1 spent on hotels and rental cars booked through Capital One Travel, 5 miles per $1 spent on flights booked through Capital One Travel, and 2 miles per $1 spent everywhere else.

Capital One Venture Rewards Credit Card

Get 2x miles plus some of the most flexible redemptions offered by a travel credit card!

The Capital One Venture Rewards Credit Card is one of the most popular rewards cards on the market. It’s perfect for anyone in search of a great welcome offer, high rewards rates, and flexible redemption options.

Frequent travelers with excellent credit may benefit from this credit card that offers a lot of bells and whistles. And it offers easy-to-understand rewards earning and redemption.

- 5x miles per $1 on hotels and rental cars booked through Capital One Travel

- Global Entry or TSA PreCheck application fee credit

- Access to Capital One transfer partners

- $95 annual fee ( rates & fees )

- Limited elite benefits

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

- How To Find the 75k or 100k Bonus for the Capital One Venture

- Travel Insurance Benefits of the Capital One Venture

- Capital One Venture Card vs. Capital One VentureOne Card [Detailed Comparison]

- Chase Sapphire Preferred vs Capital One Venture

- Best Travel Credit Cards

- Best Everyday Credit Cards

- Best Credit Cards for Groceries and Supermarkets

- Best Credit Card Sign Up Bonuses

- Capital One vs. Citi Credit Cards – Which Is Best? [2024]

- Recommended Minimum Requirements for Capital One Credit Cards

The Capital One Venture card earns 5 miles per $1 spent on hotels and rental cars booked through Capital One Travel and 2 miles per $1 spent on everything else.

Capital One Spark Miles for Business

The Capital One Spark Miles card is a low-annual-fee business card that earns 2x transferable miles on every $1 you spend. (Information collected independently. Not reviewed by Capital One.)

The Capital One Spark Miles for Business is a great option for business owners looking for an uncomplicated rewards card that earns double miles on every purchase they make and offers access to transfer partners, all for a low annual fee.

- Unlimited 2x miles per $1 spent on all purchases

- 5x miles per $1 spent on hotel and rental cars purchased through Capital One Travel

- 2 complimentary visits to a Capital One Lounge per year

- Up to a $100 Global Entry or TSA PreCheck credit

- No foreign transaction fees

- Free employee cards

- Extended warranty coverage

- Annual fee: $0 intro for the first year, $95 after that

- Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening

- Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won’t expire for the life of the account

- Unlimited 5X miles on hotels and rental cars booked through Capital One Travel

- Transfer your miles to 15+ travel loyalty programs

- Redeem your miles instantly for any travel-related purchases, from flights and hotels to ride-sharing services

- Skip the lines with up to a $100 statement credit on TSA PreCheck ® or Global Entry

- $0 intro annual fee for the first year; $95 after that

- Free employee cards which also earn unlimited 2X miles from their purchases

- APR: 26.24% (Variable)

- Business Credit Cards

- Best Capital One Business Credit Cards

- Best Ways To Redeem Capital One Miles

- Capital One Miles Program Review

- Capital One Transfer Partners

- How Much Are Capital One Miles Worth?

- Best High Limit Business Credit Cards

The Capital One Spark Miles card earns 5 miles per $1 spent on hotels and rental cars booked through Capital One Travel and 2 miles per $1 spent on everything else.

Capital One Venture X Business Card*

Capital One Venture X Business Card

The Capital One Venture X Business card offers at least 2x miles on all purchases, and comes packed with premium perks.

The information regarding the Capital One Venture X Business card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

The Capital One Venture X Business card is a great all-around premium rewards card that helps you rack up miles on all of your business expenses.

From 2x miles on all purchases, airport lounge access, an annual travel credit, complimentary employee cards, and more, there is plenty to love about the Capital One Venture X Business card.

- Unlimited complimentary access for cardholder and 2 guests to 1,300+ lounges, including Capital One Lounges and Priority Pass lounges

- No-additional-fee employee cards ( rates and fees )

- No preset spending limit

- No foreign transaction fees ( rates and fees )

- $395 annual fee ( rates and fees )

- 10x and 5x bonus categories are limited to Capital One Travel bookings

- Earn unlimited 2X miles on every purchase, everywhere—with no limits or category restrictions

- This card has no preset spending limit, so you get purchasing power that adapts to your spending needs. The annual fee on this card is $395

- Earn 150,000 bonus miles once you spend $30,000 in the first 3 months from account opening

- Redeem your miles on flights, hotels and more. Plus, transfer your miles to any of the 15+ travel loyalty programs

- Earn unlimited 10X miles on hotels and rental cars and 5X miles on flights booked through Capital One Travel, where you’ll get the best prices on thousands of options

- Every year, you’ll get 10,000 bonus miles after your account anniversary date. Plus, receive an annual $300 credit for bookings through Capital One Travel

- Empower your teams to make business purchases while earning rewards on their transactions, with free employee and virtual cards. Plus, automatically sync your transaction data with your accounting software and pay your vendors with ease

- Skip the lines with up to a $100 statement credit on TSA PreCheck ® or Global Entry. Then enjoy unlimited complimentary access to Capital One Lounges and a network of 1,300+ lounges worldwide, including Priority Pass™ and Plaza Premium Group lounges

- This is a pay-in-full card, so your balance is due in full every month

- Elevate your stay at luxury hotels and resorts from the Premier Collection with a $100 experience credit and other premium benefits on every booking

- APR: All charges made on this account are due and payable in full when you receive your periodic statement. The minimum payment due is the New Balance as indicated on your statement.

The Capital One Venture X Business card earns 10 miles per $1 spent on hotels and rental cars booked through Capital One Travel, 5 miles per $1 spent on flights booked through Capital One Travel, and 2 miles per $1 spent everywhere else. *(Information collected independently. Not reviewed by Capital One.)

You’ll still earn points even when paying with a different credit card; cards including the Chase Sapphire Reserve ® will earn you 3 Chase Ultimate Rewards points per $1 on all travel, even when using Capital One Travel to book.

Earn Points With Your Loyalty Program

Flights booked through Capital One Travel are counted as paid tickets . This is true whether you use your Capital One miles for a redemption or use cash. Because of this, you’ll be able to earn frequent flyer miles on any flights that you book. Signing up is free and easy — there’s no reason for you to miss out on these miles!

The same can’t be said of hotel programs. Nearly all hotel chains will skip out on benefits if you don’t book your stay directly with the hotel . Not only will you miss out on your perks, but you’ll also lose the ability to earn elite night credits for your stays, which can be a real blow if you’re trying to earn elite status. Keep this in mind when you’re using Capital One Travel for hotel bookings.

Ease of Use

If you’re not a huge points and miles geek, it can make sense for you to book with Capital One Travel. This is because it’s simple; you simply log in, look for the flights/hotels/rental cars that you need, and then book. You won’t have to sift through endless programs trying to find the best rates, and it’s especially easy when you’re looking to redeem your Capital One miles. They’ll always be worth 1 cent each when used for travel via Capital One Travel , which is a solid redemption. It’s not the best, however, as you’ll see later on.

Price Match Guarantee

In a bid for your business, Capital One offers a price match guarantee on all of its hotel bookings . If you find a publicly available price within 24 hours that is better than the one you’ve booked, Capital One will match it.

Capital One also offers price-drop protection for its flights . If the Capital One price prediction tool recommends you purchase a flight and you do, the same tool will automatically keep monitoring the cost of the flight. If prices drop again, you’ll get a refund on some or all of the price difference.

Bottom Line: There are a lot of reasons to book with Capital One Travel, though you’ll want to be wary of limitations that arise from booking with a third party.

We value points and miles according to a variety of factors, including how easy they are to use and redeem. Although you can use your Capital One miles for travel on Capital One Travel, there are plenty of other ways they can be redeemed.

The most valuable use of your miles occurs when you transfer them to any one of Capital One’s hotel and airline partners. In these cases, you can get outsized value for every mile. This is why we consider Capital One miles to be worth 1.8 cents each — nearly double the amount you’ll get when redeeming them within Capital One Travel.

You need to be a Capital One cardholder in to access Capital One Travel . Once on the page, you’ll log in to your account. After logging in, you’ll be brought to the portal’s home page:

From here, you can choose to book flights, hotels, or rental cars.

Booking a flight through Capital One Travel is fairly intuitive. After you log in and reach the landing page, you’ll want to select Flights in the toolbar up top:

This will bring you to the search page for flights. You’ll want to input all your information, including departure airport, destination, and dates of travel:

Like Google Flights , Capital One Travel will give you an estimation of price within a calendar feature:

Unlike Google Flights, however, Capital One has partnered with the booking site Hopper to tell you when you should book. You’ll be presented with detailed information regarding price predictions :

As you can see in the screenshot above, you have the option to freeze your price or set a price watch alert. If you’re looking to book immediately, you’ll want to scroll down, where Capital One will give you a list of results:

When selecting a flight, Capital One Travel will also give you a breakdown of information and the ability to book economy or first class tickets:

Once you’ve selected your outbound flight, you’ll pick the return. If booking a one-way, you’ll be taken to the checkout page.

Hot Tip: Capital One’s price drop protection automatically monitors the cost of flights you purchase and refunds you if prices fall.

As is normal with checkout pages, you’ll need to fill in your passenger information and credit card information. You can also select seats and choose whether or not you’d like to redeem miles. Capital One will give you 1 cent per point of value when using your miles through Capital One Travel . While this isn’t terrible, there are much better uses of those miles — such as transferring to a partner and booking a reward seat.

Once you’ve input all your info, you’ll hit Confirm and Book . That’s it!

Bottom Line: Booking flights through Capital One Travel is both intuitive and easy. Plus, you’ll be able to earn frequent flyer points on your booking.

If you’re looking to book a hotel through Capital One Travel, the process is simple. As before, you’ll start by logging into your account. Once you’ve hit Capital One Travel’s landing page, you’ll select Hotels in the top toolbar:

You’ll be taken to Capital One’s hotel search bar, where you can put in your travel destination and dates:

Once you select Search Hotels , you’ll be taken to a results page featuring an interactive map:

Along with filtering by rating and price, Capital One offers a variety of ways to narrow down your search:

As we mentioned above, Capital One Travel offers a hotel price match guarantee , which means you won’t find cheaper prices elsewhere. If you do happen to stumble across one on a publicly available site within 24 hours of booking, you can submit a price match request and, if approved, Capital One Travel will drop the cost down to the rate you’ve found.

Selecting a hotel from the search results will open a new tab where you can alter your information:

Scrolling down, you’ll be able to select the room type you prefer:

Once you’ve picked your room, you’ll be taken to the checkout page where you’ll fill out your traveler and payment information. You can also choose to use your Capital One miles for a value of 1 cent per point towards your booking:

Hot Tip: Be aware that booking hotels through Capital One Travel counts as a third-party booking — which means you won’t receive any elite status benefits or credit towards earning elite status when booking this way.

Once everything is filled in, you simply need to select Confirm and Book .

Just as with flights and hotels, you’ll log in to your account. From the landing page, you’ll select Car Rentals from the top toolbar:

You’ll be taken to the rental car search page where you can enter your information, including dates of travel and location:

Once you’ve hit Search Cars , you’ll be taken to the results page:

You can choose from a variety of filters, including the rental car company you’ll be booking, what type of car you prefer, and the cancellation policy of your booking. After picking the car you’d like to reserve, you’ll have the chance to review your booking:

If everything is correct, you’ll hit Reserve , which will take you to the checkout page where you can enter driver information and your method of payment:

As with hotels and flights, you can apply your Capital One miles to your rental car booking at a rate of 1 cent each. Again, there are better ways to use your miles, which we’ll discuss below.

Hot Tip: Check out our handy guide on how to save money on car rentals , including options with points, upgrades, cash savings, and more!

How Do the Prices Compare to Other Sites?

Is it actually worth it to book through Capital One Travel rather than other sites? How do the prices compare? Let’s take a look.

Here’s a flight from Los Angeles (LAX) to London (LHR) in mid-May 2022:

Interestingly, Capital One Travel notes that this isn’t the best time to book. The cheapest options available are $715, and they’re all nonstop. However, Google Flights comes back with very different results:

Not only does Google suggest that prices are currently low, but it also returns an option that is nearly $200 less than what Capital One Travel is offering . A closer look reveals that although Capital One Travel has the outbound leg available of this cheap flight for $736 roundtrip, it doesn’t offer the same returns. Here’s what’s available from Google:

Meanwhile, here are the options you can get on Capital One:

Bottom Line: While Capital One allows you to book flights through its Capital One Travel portal, its prices aren’t always competitive with other offerings. Make sure to check a few other websites for flights to ensure you’re getting the best deal.

So how do hotels on Capital One fare when compared to other booking options? This is especially pertinent as Capital One has its own price guarantee.

Here’s a night at the all-inclusive Secrets the Vine Cancun in early June from Hotels.com :

Booking with Hotels.com will earn you 1 stamp towards a free night stay . After 10 stamps you’ll get a free night, which can be especially valuable when booking costly stays.

And here are the results from Priceline , an online travel agency:

Bookings with both Priceline and Hotels.com can also be stacked with shopping portals . Using Rakuten with Priceline, for example, will earn you 5% back on your booking; this can either come in the form of $25.35 or 2,535 American Express Membership Rewards .

Booking Directly

Here’s how much it costs when booking directly with the hotel:

Secrets the Vine Cancun is a member of AMR Resorts , which was recently purchased by Hyatt. Although you can’t earn or redeem points with the property until later in 2022, Hyatt is offering a promotion for its cardholders for many new all-inclusive properties, including this one. Now through May 15, 2022, eligible cardholders will receive 10 points per $1 spent at these hotels.

This means that booking and paying with your The World of Hyatt Credit Card will earn you 5,070 World of Hyatt points. We value World of Hyatt points at 1.5 cents each, which means you’ll be getting $76.05 worth of points back on this booking.

Capital One Travel

Finally, here’s the rate within Capital One Travel:

With the 3 other sites we compared charging $507, Capital One Travel is a few dollars cheaper. But saving $15 doesn’t match the benefits other options are providing, like Hotels.com’s $200 resort credit.

There is, however, one case where booking via Capital One Travel is your best option. First, you won’t want to use Capital One Travel unless you don’t care about elite status — as we’ve mentioned above — so boutique properties can be a good option to book .

Second, as we mentioned above, those who hold the Capital One Venture X card earn 10 miles per $1 spent on hotels booked through Capital One Travel. In this situation, you’d earn 4,915 Capital One miles on your booking. We value Capital One miles at 1.8 cents each, which means you’ll earn $88.47 worth of miles . All in, you’ll net $403.53, which wins out compared to most other options.

How good are rental car prices compared across multiple sites? The results are less exciting. Here’s what a 5-day rental from Los Angeles looks like at Capital One Travel:

RentalCars.com offers nearly the same price:

AutoSlash, meanwhile, saves you a full $65 on the cheapest rental car:

Bottom Line: The Capital One Venture X card offers 10 miles per $1 on rental cars booked through Capital One Travel and it comes with some nice car rental insurance coverage too.

Of course, redeeming your miles through Capital One Travel is just one way that they can be used. There is a multitude of uses for those miles.

Transfer to Travel Partners

Nearly always, the best use of your Capital One miles comes from transferring to hotel and airline partners. Capital One has many transfer partners from which to choose:

Hot Tip: Check out our guide on the best ways to redeem Capital One miles for max value .

Cover Travel Purchases

Just as when using your miles at Capital One Travel, Capital One will allow you to redeem your miles for recent travel purchases at a rate of 1 cent each .

Redeem for Cash-back

You can redeem your Capital One miles for cash-back, but this is a terrible use of miles. Capital One will only give you 0.5 cents of value per mile when redeeming to cash.

Get Gift Cards

There are a variety of gift cards available using your Capital One miles, but these still aren’t a great redemption. Your value will vary — and can even be as high as 1 cent per mile , but transferring to other partners will still give you better value.

Shop With Amazon

You can use your miles on a linked Capital One card, which will give you a value of 0.8 cents per mile .

Pay With PayPal

Paying with your Capital One miles through PayPal will net you 1 cent per mile , just the same as redeeming your miles within Capital One Travel.

Bottom Line: You can redeem your Capital One miles in a variety of ways, but only transferring them to hotel and airline partners will grant you more than 1 cent per mile in value.

Capital One Travel is robust — and can be a good option for eligible cardholders who aren’t concerned about elite status. However, you’ll find better value for your miles when transferring to one of Capital One’s many travel partners. Regardless, you can find good deals within the travel portal, and the best price guarantee, combined with price drop protection, can make this portal tempting for many travelers.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One Venture Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One Venture X Business Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding The World of Hyatt Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Information regarding the Capital One Spark Miles for Business was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

How do i book travel with capital one.

You can go to Capital One Travel to book travel with Capital One.

What airline can I use my Capital One miles on?

Capital One miles can be used with virtually any airline, whether you’re booking through Capital One Travel or booking directly with the airline.

How do I see my trips on Capital One?

After logging in to Capital One Travel , you’ll find your trips in the My Trips section in the upper left-hand corner of the page.

Can you book Southwest through Capital One Travel?

Unfortunately, you cannot book Southwest flights through Capital One Travel . You can, however, book flights directly with Southwest and pay with your Capital One card. You can then redeem miles against your purchase within 90 days via Purchase Eraser.

Does Capital One use Expedia?

No, Capital One uses a proprietary blend of search tools for its Capital One Travel portal.

Was this page helpful?

About Carissa Rawson

Carissa served in the U.S. Air Force where she developed her love for travel and new cultures. She started her own blog and eventually joined The Points Guy. Since then, she’s contributed to Business Insider, Forbes, and more.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![capital one travel rewards customer service number Booking Travel With Orbitz – Everything You Need to Know [2023]](https://upgradedpoints.com/wp-content/uploads/2017/09/orbitz-computer.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

GOBankingRates works with many financial advertisers to showcase their products and services to our audiences. These brands compensate us to advertise their products in ads across our site. This compensation may impact how and where products appear on this site. We are not a comparison-tool and these offers do not represent all available deposit, investment, loan or credit products.

Capital One Customer Service: How To Get in Contact Fast

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology .

20 Years Helping You Live Richer

Reviewed by Experts

Trusted by Millions of Readers

When you want answers, sometimes, you need to talk to a real person. Whether you’re dealing with possible identity fraud or just have a few questions about your account, getting in touch with your credit card’s customer service can be vital. And, if you’re having a problem like trying to freeze a stolen credit card, waiting on hold can feel like an eternity.

If you’re a Capital One customer, there’s good news — you’ve got various contact options when it comes to reaching out for help. Keep reading for a guide to contacting Capital One customer service as quickly as possible.

What Is The Capital One Credit Card Customer Service Phone Number?

Capital One’s Fraud Protection department can be reached at 1-800-427-9428. It’s the fastest way to connect to someone who can help freeze your credit card , prevent further purchases, and begin identifying fraudulent transactions that were made without your knowledge.

Some other numbers that are worth knowing:

- If you have a question or problem relating to credit card online support, you’ll want to call 1-866-750-0873.

- If you have an existing Capital One credit card account and have a question or issue unrelated to fraud, call 1-800-227-4825 (1-800-CAPITAL).

- For general questions, the best Capital One phone number is 1-877-383-4802. You’ll be greeted with voice prompts that can help direct you to the right customer service representative for your question or problem.

How Do I Get A Live Person On The Phone At Capital One?

After dialing the customer service number, you’ll need to get through the automated voice system. Take a deep breath — a little patience will go a long way here. Here’s a tip–saying “agent,” “representative,” or pressing “0” on your phone’s keypad can help you bypass some steps. It doesn’t always work, but it’s always worth a try.

No matter how long it takes to get connected with someone, you can save yourself some time by making sure you have all your credit card information ready. You’ll need your account number and, if you’re calling from a different number, you’ll need the phone number associated with the account.

You may also be required to share the reason for your call, such as a stolen or lost credit card , or a list of the most recent purchases you remember making on the card in question.

You’ll likely be placed on hold during the process, but stay calm. Hanging up and calling back will almost always return you to the first step.

How Can I Chat With Capital One Customer Service?

Instead of juggling your phone while simultaneously reviewing your most recent purchases on-screen or trying to hear over background noise in a loud location, you might prefer text-based chat. With Capital One, you’ve got that option.

Capital One features a virtual agent called “Neo.” You can access Neo from within the mobile app, via text message, or from Capital One’s online banking platform after signing in to your account. The virtual agent may not be able to help with every problem, and you’ll still want to call if you suspect your credit card is being used without your knowledge.

How Do I Contact Capital One From Canada or Overseas?

Whether you’re an American customer or are served by Capital One Canada, it’s still easy to get in touch with Capital One customer service. For American customers calling from Canada, the regular customer service numbers will work and are still toll-free. If you’re calling from anywhere outside the U.S. and Canada, you can call Capital One customer service collect at 1-804-934-2001.

In Canada, Capital One serves customers across all 10 provinces and three territories. To get in touch with Capital One Canada customer service, dial 1-800-481-3239 from within Canada or the U.S., or call collect at 1-804-934-2010 from anywhere else.

Getting in Touch Quickly With Capital One: Summary

In a world where most people are used to instant communication and quick answers, a few minutes on the phone might feel like a long wait. However, it can sometimes be the most straightforward path toward resolving your problems.

Connecting with Capital One’s customer service doesn’t have to be a chore. With the right phone numbers, knowing how to navigate automated phone systems, and the option to access Capital One’s automated chat service through a mobile app or via Capital One’s website, you should be able to reach a speedy resolution to any problems or issues you might be having.

Editorial Note: This content is not provided by any entity covered in this article. Any opinions, analyses, reviews, ratings or recommendations expressed in this article are those of the author alone and have not been reviewed, approved or otherwise endorsed by any entity named in this article.

Share This Article:

- Banking 101 Guide

- Banking Terms

- What are the biggest banks in the U.S.?

- Best Bank Promotions for this month

GOBankingRates' Best Banks

- Best High-Yield Savings Accounts

- Best Checking Accounts

- Best CD Accounts & Rates

- Best Online Banks

- Best National Banks

- Best Neobanks

- Best Money Market Accounts