At Morgan Stanley, we lead with exceptional ideas. Across all our businesses, we offer keen insight on today's most critical issues.

Personal Finance

Learn from our industry leaders about how to manage your wealth and help meet your personal financial goals.

Market Trends

From volatility and geopolitics to economic trends and investment outlooks, stay informed on the key developments shaping today's markets.

Technology & Disruption

Whether it’s hardware, software or age-old businesses, everything today is ripe for disruption. Stay abreast of the latest trends and developments.

Sustainability

Our insightful research, advisory and investing capabilities give us unique and broad perspective on sustainability topics.

Diversity & Inclusion

Multicultural and women entrepreneurs are the cutting-edge leaders of businesses that power markets. Hear their stories and learn about how they are redefining the terms of success.

Wealth Management

Investment Banking & Capital Markets

Sales & Trading

Investment Management

Morgan Stanley at Work

Sustainable Investing

Inclusive Ventures Group

Morgan Stanley helps people, institutions and governments raise, manage and distribute the capital they need to achieve their goals.

We help people, businesses and institutions build, preserve and manage wealth so they can pursue their financial goals.

We have global expertise in market analysis and in advisory and capital-raising services for corporations, institutions and governments.

Global institutions, leading hedge funds and industry innovators turn to Morgan Stanley for sales, trading and market-making services.

We offer timely, integrated analysis of companies, sectors, markets and economies, helping clients with their most critical decisions.

We deliver active investment strategies across public and private markets and custom solutions to institutional and individual investors.

We provide comprehensive workplace financial solutions for organizations and their employees, combining personalized advice with modern technology.

We offer scalable investment products, foster innovative solutions and provide actionable insights across sustainability issues.

From our startup lab to our cutting-edge research, we broaden access to capital for diverse entrepreneurs and spotlight their success.

Core Values

Giving Back

Sponsorships

Since our founding in 1935, Morgan Stanley has consistently delivered first-class business in a first-class way. Underpinning all that we do are five core values.

Everything we do at Morgan Stanley is guided by our five core values: Do the right thing, put clients first, lead with exceptional ideas, commit to diversity and inclusion, and give back.

Morgan Stanley leadership is dedicated to conducting first-class business in a first-class way. Our board of directors and senior executives hold the belief that capital can and should benefit all of society.

From our origins as a small Wall Street partnership to becoming a global firm of more than 80,000 employees today, Morgan Stanley has been committed to clients and communities for 87 years.

The global presence that Morgan Stanley maintains is key to our clients' success, giving us keen insight across regions and markets, and allowing us to make a difference around the world.

Morgan Stanley is differentiated by the caliber of our diverse team. Our culture of access and inclusion has built our legacy and shapes our future, helping to strengthen our business and bring value to clients.

Our firm's commitment to sustainability informs our operations, governance, risk management, diversity efforts, philanthropy and research.

At Morgan Stanley, giving back is a core value—a central part of our culture globally. We live that commitment through long-lasting partnerships, community-based delivery and engaging our best asset—Morgan Stanley employees.

As a global financial services firm, Morgan Stanley is committed to technological innovation. We rely on our technologists around the world to create leading-edge, secure platforms for all our businesses.

At Morgan Stanley, we believe creating a more equitable society begins with investing in access, knowledge and resources to foster potential for all. We are committed to supporting the next generation of leaders and ensuring that they reflect the diversity of the world they inherit.

Why Morgan Stanley

How We Can Help

Building a Future We Believe In

Get Started

Stay in the Know

For 88 years, we’ve had a passion for what’s possible. We leverage the full resources of our firm to help individuals, families and institutions reach their financial goals.

At Morgan Stanley, we focus the expertise of the entire firm—our advice, data, strategies and insights—on creating solutions for our clients, large and small.

We have the experience and agility to partner with clients from individual investors to global CEOs. See how we can help you work toward your goals—even as they evolve over years or generations.

At Morgan Stanley, we put our beliefs to work. We lead with exceptional ideas, prioritize diversity and inclusion and find meaningful ways to give back—all to contribute to a future that benefits our clients and communities.

Meet one of our Financial Advisors and see how we can help you.

Get the latest insights, analyses and market trends in our newsletter, podcasts and videos.

- Opportunities

- Technology Professionals

Experienced Financial Advisors

We believe our greatest asset is our people. We value our commitment to diverse perspectives and a culture of inclusion across the firm. Discover who we are and the right opportunity for you.

Students & Graduates

A career at Morgan Stanley means belonging to an ideas-driven culture that embraces new perspectives to solve complex problems. See how you can make meaningful contributions as a student or recent graduate at Morgan Stanley.

Experienced Professionals

At Morgan Stanley, you’ll find trusted colleagues, committed mentors and a culture that values diverse perspectives, individual intellect and cross-collaboration. See how you can continue your career journey at Morgan Stanley.

At Morgan Stanley, our premier brand, robust resources and market leadership can offer you a new opportunity to grow your practice and continue to fulfill on your commitment to deliver tailored wealth management advice that helps your clients reach their financial goals.

- Dec 21, 2022

2023 Outlook: Business Travel Bounces Back

Corporate travel budgets are recovering to pre-covid levels, our new survey finds. see where companies are spending in the year ahead..

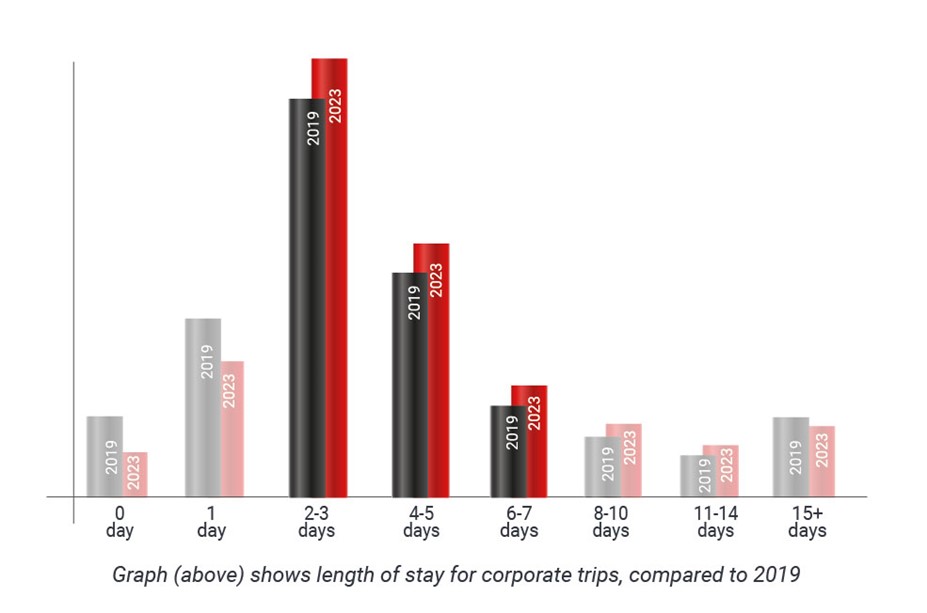

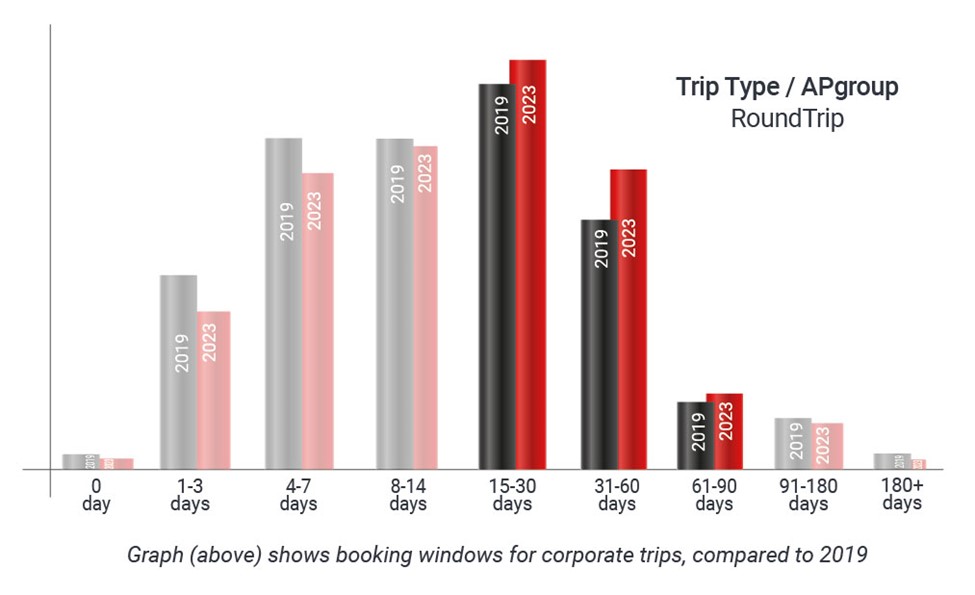

After grinding to a near halt during the COVID-19 pandemic, business trips—and profits for hotels and airlines catering to higher-paying corporate clients—are bouncing back even beyond pre-pandemic levels, per a recent survey from Morgan Stanley Research.

Despite higher airfares and room rates, the survey of 100 global corporate travel managers found that many respondents believe their company's travel expenditures are already back to pre-pandemic levels and will continue to grow. The biggest demand is coming from small companies, which means lower-cost airlines may benefit the more than their bigger peers.

“Travel budgets are expected to see a noticeable improvement in 2022, with 2023 nearly back to ‘normal,’” says Ravi Shanker, an equity analyst covering North American transportation. “Most interesting is that nearly half of the respondents expect 2023 budgets to increase versus 2019 overall. And of those that expect an increase in budgets, the majority believe 2023 budgets will be between 6% to 10% higher than 2019.”

Overall travel budgets show an improvement over previous surveys, with 2023 budgets expected to be 98% of 2019 levels on average.

Survey Highlights

- Smaller companies lead demand for corporate travel. More than two-thirds (68%) of companies with under $1 billion in annual revenue expect travel budgets to increase next year, versus just 41% of companies with annual revenues over $16 billion. Similarly, 32% of smaller companies said travel budgets had returned to pre-pandemic levels compared with 23% of big firms. “This trend could likely favor low-cost carriers, as smaller enterprises tend to be more localized and require less long-haul travel,” says Shanker. “However, the legacy carriers with strong corporate exposure should see gains as well.”

Nearly a quarter of both large and small companies say their firms are already back to pre-COVID travel levels, and 34% anticipate a full recovery by the end of 2023.

ESG Rate of Change

Holiday budgets hit by inflation, seeing a peak for food prices.

- Airfares are higher, but that’s not a drag on bookings. On average, corporate airfares are expected to be about 9% higher than pre-pandemic prices. “Clearly the expected increase in corporate airfares is not having a major impact on corporate travel as passenger volume is expected to be basically flat versus 2019,” says Shanker.

- Room rates will continue to rise, though not as fast as they have recently. As of this October, market room rates had spiked 20% to 25% over 2019. Next year they will rise even more, though by an average of just 8%, say respondents (9% in the U.S. and U.K.; 5% to 6% in Latin America, Asia and Africa).

- Hotels face economic and competitive headwinds. While overall travel budgets are growing, companies are cutting costs by trading down when it comes to accommodations. (Historically, budget hotels outperform upscale lodging in tough economic times.) Alternative sources of accommodation also threaten traditional hotels, with 31% of respondents saying they intend to use short-term rental services in the next year.

- Virtual meetings aren’t going away. Almost 18% of corporate travel will be replaced with virtual meetings, falling slightly to 17% in 2024, suggesting a degree of permanence in the shift with companies recognizing the benefits of virtual meetings ranging from cost savings to lower carbon footprints. Expect companies providing collaboration software to gain from this shift.

For more Morgan Stanley Research insights and analysis on global travel, ask your Morgan Stanley representative or Financial Advisor for the full reports, “Global Corporate Travel Survey: Snapping Back" (Nov. 8, 2022) and “Global Corporate Travel Survey: 2023 Travel Budgets Nearly Back to 2019 Levels, but ~20% of Meetings Could Still Shift to Virtual” (Nov. 8. 2022). Morgan Stanley Research clients can access the reports directly here and here . Plus more Ideas from Morgan Stanley’s thought leaders.

Sign up to get Morgan Stanley Ideas delivered to your inbox.

*Invalid email address

Thank You for Subscribing!

Would you like to help us improve our coverage of topics that might interest you? Tell us about yourself.

Dividends: A Volatility Shield

Dividend-paying stocks with steady distribution growth can offer outsized contributions to long-term portfolio returns.

Global Outlook: Tech & Beyond

Disruption in connected advertising, a digital-driven economic boom in India and more trends in tech, media and telecom.

Building Credit for Immigrants

Wemimo Abbey and Samir Goel present credit solutions for immigrants financially marginalized by America’s credit validation system.

- SOFTWARE CATEGORIES

- FOR REMOTE WORK

- Research Center

10 Future Business Travel Trends & Predictions for 2024 and Beyond

Corporate travel remains a crucial aspect of a business. Despite advancements in technology, business travel trends indicate that there’s no substitute for face-to-face interactions. Travel can also support business initiatives for networking, skills development, and recruitment. However, the presence of COVID-19 has thrown a wedge at some of those travel plans, which prompts the importance of risk assessments and possible changes in future travels.

In this business travel forecast, you can read all about the direction the industry is moving in. We’ve also included some business travel statistics so you can make data-driven decisions in your company’s business practices.

Business Travel Trends Table of Contents

- Business is almost always mixed with pleasure

- Unconventional accommodations are in

- Self-booking is becoming the norm

- More flexible corporate travel policies

- Technology continues to revolutionize corporate travel

- The rise of AI, virtual reality, and intelligent assistants

- Blockchain: the future of business travel

- Business travel as a perk

- Slower years for corporate travel and business tourism

- New travel markets are emerging

The business travel industry experienced a decline of 52% during the early months of the COVID-19 pandemic, but with the recent rollout of vaccines, business travel spending is expected to rise to $842 billion in 2021, which accounts for a 21% increase (Reuters, 2021). The majority of businesses have even reported that they are considering resuming their corporate travel plans for 2021, although there are no definite plans yet (GBTA, 2021).

Source: GBTA

One of the major changes to anticipate is the rise of a new type of corporate traveler. Members of Generation Z are taking over the workplace, and predictions point to this age bracket making up around 40% of the workforce by 2021 (Connecteam, 2020). At the end of 2024, business travel spending is expected to reach $1.4 trillion and make a full recovery from the pandemic in the succeeding year (Reuters, 2021). By this time, millennials and Gen Z-ers will be doing much of the traveling given their respective shares in the labor force.

This shift in the demographics of corporate travelers has influenced the global business travel forecast in the coming years. Many business travel trends center around technology and its abilities to enable self-service and make travel seamless.

1. Business is almost always mixed with pleasure

The rise of bleisure travel proves to be one of the most significant outcomes of the demographic shift in corporate travel, and this trend is expected to continue in the midst of COVID-19 vaccinations. With the workforce becoming younger, more employees are looking to do more than work during their trips away from the office.

Although 92% of organizations suspended business travel during the early months of the pandemic, pre-pandemic figures suggest that 90% of millennial business travelers added components of leisure to their affairs (National Geographic, 2020). This could very well occur within 2021 as COVID-19 vaccines are now available.

Bleisure travelers go on these trips once every two to three months. More than half of international business travelers plan to extend business trips to accommodate leisure activities at their destination.

Companies in the tourism industry can capitalize on this trend by focusing their marketing campaigns on local tourist attractions and events. If you’re more concerned of your employees not doing enough business, though, time tracking software can help ensure sufficient productivity.

Key takeaways:

- More employees are taking bleisure trips.

- Bleisure travelers go on trips at least every quarter.

- Business travelers are also willing to extend business trips for leisure activities.

2. Unconventional accommodations are in

Another business travel trend influenced by the new generation of corporate travelers is the growing popularity of unconventional accommodations. Business travelers have become more open to considering staying somewhere other than traditional chain hotels. More are opting to stay in apartments and other accommodations that have a more homey feel.

Smaller boutique hotels and home-like accommodations, like those offered by Airbnb, enjoy increased popularity among business travelers today. For instance, over 70% of millennial corporate travelers had stayed in a vacation rental during business trips (American Express, 2019).

These non-traditional accommodations provide opportunities for exploring the destination in new ways. More travelers also stay further away from the city center, as comfort and proximity to leisure activities are prioritized.

- More business travelers opt to stay in home-like accommodations.

- Small boutique hotels and home rentals have the edge over traditional chain hotels.

- Additionally, more corporate travelers prioritize comfort and proximity to leisure activities.

3. Self-booking is becoming the norm

More corporate travelers opt to book travel options and accommodations on their own. According to recent surveys, 68% of employees book business travel through tools not approved by the company instead of seeking the services of a travel agent (Expedia Group, 2021). After all, there are numerous self-booking options that business professionals can leverage. This trend towards self-booking may also be another offshoot of the generational shift in corporate travelers. After all, millennials prefer self-booking when they travel so that they can find flights and accommodations that meet their preferences.

In some cases, corporations push for self-enablement and provide tools that help employees resolve issues. When these self-service tools fail, though, corporate travelers will continue to rely on customer service from an agent. This is particularly true when emergencies arise, like in cases of canceled flights. Corporate travelers also tend to want to rely on a human for support in more complex issues like visas.

- Business travelers, especially millennials, prefer the self-booking process.

- However, business travelers will continue to rely on human support for complex issues and travel emergencies.

Most Popular Online Booking Software

Here are some of the best online booking software that you can choose from:

- YouCanBook.me is an online booking software that connects customer bookings right into your Google or Microsoft calendars. It also allows you to personalize your booking page and display your availability for multiple locations.

- Acuity Scheduling provides a user-friendly online booking platform to help your clients self-book their appointments. It lets you create branded and customized confirmations, reminders, and follow-ups to drive more client bookings.

- Bookeo is an industry-leading online booking software perfect for service providers, schools, and tour companies. It provides you with advanced marketing tools to help you maximize profit.

- SimplyBook.me lets you build your own personalized and mobile-optimized booking website. It allows you to integrate the system with your existing site or with your Facebook and Instagram pages.

- Checkfront easily handles customer bookings in a unified toolset. With its advanced rule system, it lets you enforce and set your own booking rules.

4. More flexible corporate travel policies

When was the last time you looked at your company’s corporate travel policy? There’s a good chance that some of these policies need tweaking. Recent business travel trends indicate that more corporate travelers are “going rogue (RateGain, 2019).” This means travelers are now more likely to go outside employer-approved channels when booking properties and transportation for their trips.

Corporate travelers need a booking process that provides better availability and allows them to choose from more property and rate options. Combined with emerging preferences for unconventional accommodations, the need for more varied booking options pushes corporate travel policies to become more flexible.

The good news is that companies that offer a plethora of travel options enjoy higher adoption rates for their corporate travel programs (TripActions, 2019). Allowing employees to make choices that align with their needs and preferences encourages a culture of transparency and reinforces trust between employers and employees.

Worried about reining in travel spending while empowering business travelers to make their own choices? Technology now allows companies to adopt a dynamic travel policy. A dynamic business travel policy adjusts according to available options at the time of booking. This way, business travelers will still be able to make their own choices while complying with company policies.

As far as flexibility is concerned, video meetings and teleconferencing have also become alternatives during the pandemic, with 31% of employees stating that remote setups are just as effective as business travel (Forbes, 2020).

Why did you book accommodations outside of approved channels?

Source: Expedia, 2018

- More corporate travelers are going rogue, i.e., not using employer-approved channels, during the booking process.

- Corporate travel policies are becoming more flexible.

- Dynamic travel policies also have a higher adoption rate.

5. Technology continues to revolutionize corporate travel

Technology plays a central role in the global business travel forecast. Mobile technology currently accounts for 39% of hotel bookings and 22% of airfare bookings (FCM Travel Solutions, 2019). These numbers will probably grow with the upcoming upgrade to 5G wireless internet. Also, once the COVID-19 travel restrictions ease up, this technological trend will likely continue.

International business travelers can expect to spend less time waiting in airport lines, thanks to facial recognition technology that speeds up immigration protocols and border control procedures. Other biometric technologies seeing increasing use at airports include fingerprint and retinal scanning.

Trip disruption technology (CWT, 2019) is also evolving to minimize the hassle caused by delayed flights and trains. Travel technology providers can now deliver real-time trip updates to travelers’ mobile devices. This way, business travelers can adjust their plans accordingly and minimize downtime.

Faster in-flight internet access is also in the works. Travel suppliers and mobile network operators are working together to bring high-speed internet into the cabin. With this technology, employees can stay productive even during long-haul flights .

Technology has also moved beyond airports and train stations to make business travel easier. Business travelers can now enjoy automated check-in and check-out processes. These technologies allow travelers to pick up their room key upon arriving at the hotel and head straight to their room. Centralized billing can save travelers from the hassle of having to compute expense costs separately.

- Upcoming upgrades to 5G wireless internet may result in more mobile bookings in the future.

- Facial recognition and biometric technologies will also reduce waiting time for international travelers.

- Trip disruption technology helps corporate travelers adjust to delays in the journey.

6. The rise of AI, virtual reality, and intelligent assistants

More advanced technologies like artificial intelligence (AI) and virtual reality are poised to bring more changes to the business travel industry. Travel suppliers can use these technologies to discover business travelers’ preferences and take advantage of upselling opportunities. Virtual reality is also predicted to enable personalization, allowing guests to adjust rooms based on their taste (FCM Travel Solutions, 2019).

The coming years also pose many possibilities for intelligent assistants like Siri, Cortana, and Google Now. These assistants are able to handle more complex tasks (Wishup, 2019), like provide updates to itineraries during disruptions and recommend services. All these technologies will greatly benefit business travelers looking to maximize their time during the journey.

Want to learn more about artificial intelligence? Here are some artificial intelligence statistics you may find interesting.

- Artificial intelligence and virtual reality can be used to discover travelers’ preferences.

- Siri and Cortana will soon be able to provide itinerary updates.

7. Blockchain: the future of business travel

Blockchain is also expected to improve security for corporate travelers by 2021. Blockchain’s built-in security protocols make it the perfect technology for making travel as convenient and seamless as possible (Revfine, 2020).

The technology makes data storage and access easier. The constant availability of information is crucial since the travel industry relies on the information exchange between companies. For instance, travel agents pass customer information to hotels and airlines.

Blockchain makes it possible to collect every bit of information involved in the travel process (Amadeus, 2019) – from traveler preferences to flight prices and hotel rates – into a file that’s duplicated across multiple computers. And since the technology decentralizes data and arranges it into permanent blocks, blockchain offers more security. Travel information is always available and safe from user errors or cybersecurity attacks.

Businesses in the tourism and hospitality industry can also take advantage of blockchain technology for luggage tracking, identification services, and customer loyalty schemes.

Outside the realm of travel, blockchain can even be leveraged for other complex tasks like COVID-19 vaccine distribution (Mobi Health News, 2020). Technology this flexible will probably have niftier applications for business travel in the near future.

Cryptocurrencies such as Bitcoin may also soon be accepted as payments by travel companies. If you’d like to learn more about cryptocurrencies, you can check out our guide and FAQs on Bitcoin .

- Blockchain can greatly improve the security of travel information

- Blockchain can also ensure that every bit of travel information is always accessible.

- Likewise, this technology can ease luggage tracking and support customer loyalty plans.

8. Business travel is a perk

Another important aspect of the business travel forecast is the fact that most employees now see corporate travel as a perk (TripActions, 2019). According to surveys, international business travelers consider travel as valuable to professional and personal growth.

Making up the largest segment of the workforce, millennials are also more willing to travel, as they consider it an enriching experience. Similarly, employees who travel often feel more empowered and engaged. Travel can even help improve confidence and interpersonal relationship skills.

More companies are acknowledging these effects and seeing the link between business travel. A robust, dynamic corporate travel program can be used as a tool to encourage employee engagement , improve employee retention, and drive organizational growth.

- Most employees consider corporate travel a perk.

- Millennials consider business travel an enriching experience.

- Frequent business travelers also feel more empowered and engaged.

9. Slower years for corporate travel and business tourism

Business travel growth can finally begin after a serious downturn in 2020 due to the pandemic (Reuters, 2021). And the industry is even expected to make a full recovery. However, certain practices in the age of COVID-19, such as video conferencing and other remote alternatives, will likely stick since 31% of organizations find them just as effective as actual trips (Forbes, 2020) with much lower costs.

In fact, 43% of business travelers already expect that they will travel less post-pandemic (Forbes, 2020). Besides financial reasons, the pandemic has ravaged economies and not all countries have shown an adequate response to the continuing spread of the coronavirus. Furthermore, the rollout of vaccines is concentrated in developed nations (BMJ, 2020), thus development projects in developing nations would likely be canceled or at least met with stiff travel restrictions.

As such, 61% of employees would rather leverage video conferencing platforms than physically venture out to other lands (Forbes, 2020).

- Global business travel spending is growing, but not as much as during previous years.

- Political tensions and trade issues have also contributed to this slower growth.

- Improvements in political issues will support weakening travel prices.

10. New travel markets are emerging

New countries are taking bigger shares of the market in business travel spending. More corporate travelers are flying to India and Indonesia, with these countries showing 11.3% and 8.7% in market growth, respectively. Surpassing South Korea in business travel spending in 2017, India is expected to break into the top 5 business travel markets by 2022 (GBTA, 2018). A report suggests that Asia has become the world’s largest business travel market (Hospitalitynet, 2019), even though the United States outpaces everyone in spending by a wide margin (WTTC, 2021).

Sweden and Norway, with respective market growth rates of 6.8% and 6.6 %, are quickly becoming popular business travel destinations as well (GBTA, 2018). China, however, will continue to dominate the business travel market, with a projected annual business travel spend of $129 billion by 2022.

Source: WTTC 2021

- India and Indonesia are becoming popular business travel destinations.

- Moreover, India will most likely be in the top 5 business travel markets by 2022

- Despite new markets, China will continue to be the top business travel market in the next couple of years.

Take advantage of these business travel trends

Travel remains an important business aspect for many companies today. If your employees are frequent travelers, it will be helpful to stay ahead of these business travel trends. This way, you can prepare for these changes and adjust your corporate travel policy accordingly, especially with COVID-19 still looming.

Information in these trends is also useful to travel management companies and businesses in the hospitality and tourism industry. Hotel owners or rental car companies can use these travel trends to gain insights into their customer base. These trends also present an excellent opportunity to adopt new business practices.

Many of these travel trends center around technology. It definitely won’t hurt to look into new software and applications that will give you that technological edge.

Want to get cracking on modifying your current business processes? Check out our article on the benefits of using business process management software .

References:

- Amadeus (2019). The Future of Business Travel . Retrieved from Amadeus

- American Express (2019). Trends on Business Travel’s Biggest Generation: Millennials . Retrieved from American Express

- BMJ (2020). Covid-19: Many poor countries will see almost no vaccine next year, aid groups warn . Retrieved from BMJ

- Expedia Group (2021). Business Travel Trends: How TMCs are keeping up with the corporate traveler . Retrieved from Expedia Group

- FCM Travel Solutions (2019). Business Travel 2020: The Trends & Tech that will Shape the Future of our Industry . Retrieved from FCM Travel Solutions

- GBTA (2018). GBTA Forecasts Seven Percent Growth in Global Business Travel Spend, Potentially Signifying End to Era of Uncertainty . Retrieved from GBTA

- Mobi Health News (2020). Blockchain could be the key to vaccine distribution, says IBM . Retrieved from Mobi Health News

- Pundora, D. (2019). 30 Benefits of Hiring a Virtual Travel Assistant . Retrieved from Wishup

- RateGain (2019). Delivering Duty of Care in the Age of Corporate Rogue Travel . Retrieved from RateGain

- Regan, R. (2020). Everything You Need To Know About Generation Z In The Workplace in 2021 . Retrieved from Connecteam

- Reuters (2021). Global business travel to grow 21% in 2021, trade group forecasts . Retrieved from Reuters

- Revfine (2020). Blockchain Technology within the Travel Industry . Retrieved from Revfine

- Statista (2021). Business tourism spending of G20 countries in 2019 . Retrieved from Statista

- TripActions (2019). 7 Business Travel Trends to Watch in 2020 . Retrieved from TripActions

- Wallin, B. (2020). How the death of business travel will change your next vacation . Retrieved from National Geographic

- Wyman, O. (2020). How Videoconferencing And Covid-19 May Permanently Shrink The Business Travel Market . Retrieved from Forbes

By Jenny Chang

Jenny Chang is a senior writer specializing in SaaS and B2B software solutions. Her decision to focus on these two industries was spurred by their explosive growth in the last decade, much of it she attributes to the emergence of disruptive technologies and the quick adoption by businesses that were quick to recognize their values to their organizations. She has covered all the major developments in SaaS and B2B software solutions, from the introduction of massive ERPs to small business platforms to help startups on their way to success.

Related posts

The Future of B2B Business: Trends and Predictions

15 Key CRM Software Trends & Predictions for 2024 and Beyond

11 Ecommerce Software Trends for 2024: Future Forecasts & Predictions

10 VoIP Software Trends for 2024: Latest Predictions To Watch Out For

8 Business Intelligence Software Trends for 2024: Predictions You Should Be Thinking About

20 Current Augmented Reality Trends & Predictions for 2024 and Beyond

Best Performance Appraisal Software in 2024

10 Best Free Brainstorming Apps & Tools in 2024

20 Best Accounting Software for Nonprofits in 2024

10 Best Free Marketing Automation Software in 2024

20 Best VPN Client Software in 2024

Payment Gateway Services Implementation: A Complete Guide

Wrike Pros & Cons: Analysis of a Top Project Management Tool

10 Best IT Security Software Solutions of 2024

12 Best Event Management Software for Venues & Restaurants in 2024

Best PLM Software and Systems for Food and Beverage in 2024

12 Best Video Editing Software for Mac in 2024

Top 10 Alternatives to Sage 50cloud: Popular Accounting Software for Small Business in 2024

What is Club Management Software? Analysis of Features, Types, Benefits and Pricing

Benefits of POS Software: Examples of Leading Solutions Explained

Leave a comment!

Add your comment below.

Be nice. Keep it clean. Stay on topic. No spam.

Why is FinancesOnline free?

FinancesOnline is available for free for all business professionals interested in an efficient way to find top-notch SaaS solutions. We are able to keep our service free of charge thanks to cooperation with some of the vendors, who are willing to pay us for traffic and sales opportunities provided by our website. Please note, that FinancesOnline lists all vendors, we’re not limited only to the ones that pay us, and all software providers have an equal opportunity to get featured in our rankings and comparisons, win awards, gather user reviews, all in our effort to give you reliable advice that will enable you to make well-informed purchase decisions.

EU Office: Grojecka 70/13 Warsaw, 02-359 Poland

US Office: 120 St James Ave Floor 6, Boston, MA 02116

- Add Your Product

- Research Team

- Terms of Use

- Privacy Policy

- Cookies Policy

- Scoring Methodology

- Do not sell my personal information

- Write For Us

- For Small Business

- Top Software

- Software reviews

- Software comparisons

- Software alternatives

Copyright © 2024 FinancesOnline. All B2B Directory Rights Reserved.

Business Travel Statistics [2007-2024]: Market & Trend Data Analysis

Business travel is on the rise. Companies still see it as essential and are willing to spend on in-person collaboration. This report unpacks the findings from our business travel statistics research.

![let's analyze the travel business trends in the world today Business Travel Statistics [2007-2024]: Market & Trend Data Analysis](https://travelfreak.com/wp-content/uploads/2024/03/business-travel-statistics-1200x800.jpg)

In many industries, travel is a regular necessity for business. Even in the post-COVID age of telecommuting and Zoom meetings, companies are willing to spend significant amounts on travel for in-person collaboration.

Why is this the case? How much is spent on business travel? Where does that money go? What are the trends in the business travel industry? Who travels for business, where are they going, and how long are they staying? These are all key questions for understanding the business travel industry.

I’ve dug deep into data from key sources in the industry, like the Global Business Travel Association, the Bureau of Transportation Statistics, and Expedia’s Bleisure Travel Trends Report. After extensive in-depth research, I extracted several key findings.

For decades, business travel looked very much the same. As younger people and women are traveling more for business, and as more people are adding leisure time to their business trips, the landscape of business travel is changing dramatically.

Key Business Travel Statistics

- Over $1 trillion is spent annually on business travel worldwide.

- Business professionals expect 25% more revenue generated from in-person collaboration over virtual meetings.

- China has the highest business travel spending at $360 billion in 2022.

- The largest percentage of business travel spending goes towards lodgings, with meals coming in second.

- The average business traveler is a 42-year-old male, but that is changing as more young people and more women are going on corporate trips than ever before.

Business Travel Spending Statistics

In 2019 (before the pandemic), the business travel industry accounted for $1.4 trillion in global spending. While 2022 spending was still lagging due to pandemic recovery ($1.03 trillion), the Global Business Travel Association (GBTA) predicts business travel spending will surpass pre-pandemic levels in 2024 and continue to grow to $1.8 trillion in 2027.

With so much being spent, the business travel market is a significant economic force. Not only does corporate travel inject money into the tourism industry and local economies, it also leads to improved productivity and profits. Even in the world of Zoom and telecommuting, the need for business trips isn’t going away anytime soon.

It’s telling that companies carve out a significant budget for corporate travel spending. Clearly, there is an expected return on investment for companies to be willing to make the spend, especially since the average business trip is often more expensive than leisure travel.

According to the ACCOR Business of Travel Report , business professionals expect 25% more revenue generated from traveling for in-person collaboration over virtual meetings .

It’s worth understanding how much is spent on business travel, where that money goes, and when companies decide business travel is worth it.

Here are the key business travel spending statistics to understand the economic impacts of the business travel industry.

Business Travel Spending by Country

Global business travel spending is highly concentrated in a few countries with industrial economies, with China and the United States far outpacing the rest of the world.

Here are the top 15 countries for business travel spending according to the 2023 Business Travel Index Outlook from the GBTA.

It’s no surprise that, with a few exceptions, these same countries are also the highest ranked for GDP. Interestingly, Russia is the only country in the top ten for GDP that doesn’t appear on this list.

Business travelers are almost universally traveling within or between these 15 countries.

The rest of the world combined only adds $207 billion to the total global business travel spending. As with many other metrics, this shows how much the world’s economic activity and wealth is concentrated within a few regions. These 15 countries make up only about half the global population, but they account for 85% of the global business travel spending.

Business Travel Spending Categories

Business travel can be broken into several spending categories to see where companies are spending the most money. The chart below shows the total 2022 spending across five categories according to the GBTA .

It’s easy to assume that airfare would be the leading expense for business trips. In reality, it’s only third on the list after lodging and meals. Lodging is the largest spending by far for corporate travel, accounting for more than double the amount of any other category.

Business Travel Spending vs Leisure Travel Spending

While business travel is a large industry, leisure travel is even bigger. The table below shows total travel spending divided between business and leisure travel according to Statista .

On average, only 15.2% of travel spending comes from business travel. 84.8% is from leisure travel.

However, that breakdown is not consistent across all travel industries. Hotels, dining, and tourist activities generally make much more money from leisure travelers, but many airlines actually earn a larger percentage of revenue from business travelers.

According to Investopedia , only 12% of airline passengers are business travelers. However, because business travelers pay higher rates, more often book last-minute, and are more likely to fly first class, they can account for up to 75% of airline profits.

While many leisure travelers try to save as much money on airfare as possible, corporations are often more likely to spend extra for upgraded business travel comfort.

Research from Business Traveler found that 33% of international business travel flights are in premium class, and 13% of domestic business travel flights are in premium class.

While leisure travel is significantly larger, business travel spending is still a critical component of the travel industry.

Business Traveler Demographics

Traditionally, the majority of business travelers fit within a very distinct demographic. The average business traveler is a 42-year-old man.

But times are changing. Younger people and women are traveling more for business, and these trends will likely change what business travel looks like in the future.

Here are the key business travel statistics relating to traveler demographics.

Business Traveler Age

Generally, people traveling for business are more likely to be in more advanced roles in their career, and people in leadership roles often travel more than others.

Business Travelers by Age

The vast majority of business travelers are in their 30s and 40s—people who are in the stage of working up the ladder in their career. The average age for business travelers is 42.

However, according to market research by Skift , the average age of business travelers is gradually shifting downward, and more younger people are traveling for work.

This will have dramatic affects on the business travel market, as younger travelers prefer Uber over taxis, vacation rentals over hotels, and are less likely to make booking decisions based on travel loyalty programs.

Business Traveler Gender

Historically, corporate travelers have dominantly been men. A Bureau of Transportation Statistics report found that 77% of business travelers that year were men.

However, that trend is beginning to change. The table below compares 2001 gender breakdown with updated 2022 statistics for business travelers.

Gender Difference in Business Travel Over Time

In 2022, 37% of business trips were made by women. That’s up 14% from the 2021 figures.

As workplaces around the world make slow progress toward gender equality, women will take more business trips than ever before.

Interestingly, while business travelers are much more likely to be men, the opposite is true for leisure travel, according to research by Forbes . The table below shows a comparison of the gender breakdown in business travel and leisure travel.

Gender Difference in Leisure and Business Travel

64% of travelers on leisure trips are women.

The demographics for business and leisure travel are not aligned. Where the average business traveler is a 42-year-old man, the average leisure traveler is a 47-year-old woman.

Clearly, women are more apt to travel than men outside the workplace, and the only reason that men are more likely to travel for work is due to overall gender inequality in business. It will be interesting to see if women surpass men in business travel as companies move towards gender equality in workplaces.

Yearly Business Travel Trends

As with most industries, business travel has been growing steadily. As companies continue to grow globally, international collaboration will become more important, and business travel will become even more essential.

The table below shows the global business travel spending over time from 2007 to 2022 according to Statista .

Prior to COVID-19, the only recent drop in business travel spending occurred in 2009, during the recession. From 2008 to 2009, business travel spending dropped 5.7%.

Over the next 10 years, business travel spending increased by 63% and peaked at $1408 billion in 2019. This progress was followed by a massive drop, as the COVID-19 pandemic put a damper on travel.

From 2019 to 2020, business travel spending dropped 53% due to pandemic travel bans.

While the travel industry as a whole has recovered quickly from the pandemic, business travel has had a slower return to pre-pandemic levels according to Deloitte Insights .

Still, growth is on the way. Global business travel spending is expected to surpass pre-pandemic levels in 2024 and continue to grow.

“Bleisure” Statistics

In recent years there has been an increase in business travelers participating in leisure activities or asking to add extra time to their business trips to enjoy free time at their destination. This growing form of business tourism has earned the nickname “bleisure.”

Bleisure trips should become a more important consideration for corporate travel managers when designing a company’s travel policy. When business travelers spend more time as tourists at their destination, they are more likely to see corporate trips as a perk of their job rather than a burden.

The Expedia Group conducted a survey of over 2,500 bleisure travelers worldwide , and I’ve unpacked the key statistics from their report that you need to know.

Bleisure Trip Length

Since bleisure involves combining tourism, downtime, and relaxation with business travel, no two trips are the same. There are definite trends in the bleisure market though.

The first important trend is that bleisure is becoming increasingly popular. On average, 60% of business trips include time added on for leisure.

The length of a business trip is important for travelers deciding whether to add on leisure time to corporate travel. The table below shows a breakdown of bleisure travelers based on the length of stay for business.

Business Trip Length

The large majority of business trips that turn into bleisure trips are 2 or 3 nights . 50% of survey respondents said they were most likely to extend business travel for leisure if they had to stay 2-3 nights. This time only includes the business travel portion of the trip, and most people adding leisure time into a trip will spend several extra days.

When adding leisure onto corporate travel, people spend 3.9 working days and 2.9 leisure days on average. That means leisure time can nearly double the length of a trip.

Bleisure Travel Destination Statistics

International business trips and domestic business trips are equally likely to become bleisure travel. 51% of domestic business trips are bleisure trips, and 52% of international trips include bleisure.

The destination also matters for business travelers when considering adding leisure time to corporate travel. The table below shows the top features of a destination that make a business traveler more likely to add leisure time to their trip.

Bleisure Destination Priorities

According to this research from Expedia Business Group, good food, beaches, natural sightseeing, and good weather are the top considerations that make for a popular bleisure destination.

Bleisure Traveler Statistics

The number of business travelers including leisure in business trips varies by profession. The table below shows the top five occupation categories for bleisure travel.

Bleisure Traveler Occupations

By far the most bleisure travelers work in technology, IT, or software . In general, technology workers travel more than most other professions, which is a key reason for why technology workers are more likely to include leisure time in their travels.

Another way to characterize bleisure travelers is by how frequently they leave on business travel.

Business Trip Frequency of Bleisure Travelers

Most business travelers adding leisure to a corporate trip are those who take business trips every 2-3 months. The average bleisure traveler takes 6.4 business trips each year .

Sources and Methodology

This report is based on a comprehensive and in-depth analysis of business travel spending, demographics, geographic trends, and yearly trends. I gathered this data from market research firms, academic studies, and government agencies.

The GBTA 2023 Business Travel Index Outlook , ACCOR Business of Travel Report , and Expedia’s Bleisure Travel Trends Report were key sources of information for understanding the landscape of business travel and the trends in the industry.

Other key sources for the business travel trends and demographics in this report include the Global Business Travel Association , Bureau of Transportation Statistics , Statista , Forbes , Business Traveler , and Investopedia . Any sources not included here are cited directly in the text.

There is a tremendous amount of information and data available across these sources, but it is disjointed and often difficult to interpret. I compiled raw data and individual findings from these sources into a single cohesive resource.

I used this wide range of information to generate the tables, graphs, and statistics in this report.

Final Business Travel Findings

Travel is a key part of many businesses. It drives innovation, improves productivity, and increases profits. While COVID-19 created a temporary pause, business travel is back, and will only be growing.

Business travel only accounts for about 15% of total global travel spending, but it is a key market segment for many industries, especially airlines. Business travelers are more likely to fly premium class and spend more on travel overall.

There are also several key factors driving change in the business travel industry. Business travel has traditionally been a male-dominated activity, but more and more women are traveling for business. Younger people are also traveling more for business than ever before. More people are creating “bleisure” trips by adding extra days for leisure onto business trips.

If companies can latch onto these trends and create supportive and inclusive travel policies, business travel can become both more profitable to companies and more rewarding for travelers.

Business Travel Statistics FAQs

Is business travel increasing.

While business travel still hasn’t recovered to pre-pandemic levels, it is steadily increasing.

What percentage of flights are business travel?

On average, around 12% of the passengers on a flight are traveling for business.

How big is the business travel market?

In 2022, the business travel industry accounted for $1 trillion in spending globally.

What companies spend the most on business travel?

Amazon is the company that spends the most on business travel.

Which industries have the most business travel?

Tech and IT industries have the most business travel.

Jakob Thygerson

Your email address will not be published. Required fields are marked *

Search our latest articles, reviews and gear guides

- TravelFreak on Instagram

- TravelFreak on Facebook

- TravelFreak on Twitter

- TravelFreak on Pinterest

Sign up now and get the best gear, travel tips, deals and destinations, straight to your inbox.

Thank you for signing up!

Destination Insights with

Skip to Content

Keep up with the latest travel trends

Smart business decisions rely on good insights. Keep your finger on the pulse of ever-changing global travel demand trends with actionable data, updated daily. Check out some top insights for your country below, or use the filters to find the data most relevant to you.

1}" > Fastest-growing destination globally

1}" > country with the most inbound interest, top insights for your selected country.

- Inbound destination demand

- Outbound destination demand

- Global trends

1}" > Top 3 sources of inbound demand

1}" > top city in demand (internationally), 1}" > top city in demand (domestically), 1}" > inbound demand growth, 1}" > top 3 destinations for outbound demand, 1}" > top city in demand internationally, 1}" > demand growth for top international city, 1}" > demand growth for outbound travel, 1}" > top 3 countries for worldwide demand, 1}" > top 3 cities for worldwide demand, 1}" > country with fastest growing inbound demand, 1}" > city with fastest growing inbound demand, click into the details of travel demand.

Switch between understanding country-specific demand trends, and comparing flight and accommodation demand across countries. Use the filters to refine your search.

Country-specific travel demand

Use the tabs below to discover inbound and outbound demand trends for your selected origin and destination countries., trends in country demand, city and regional demand, growth of demand, sources of demand.

View the demand trend for travel from a selected origin to a selected destination.

- Tap on the chart for more details

- The chart is horizontally scrollable

Understand the relative popularity of cities in your selected destination country. For a broader view of popular destinations for travellers in your origin country, set your destination filter to ‘Worldwide’.

Top demand by destination area

- {{$index+1}} {{item.code}} {{item.queries}}

Top demand by destination country

- {{$index+1}} {{item.country.name}} {{item.queries}}

Top demand by destination location

Top demand by destination city

Understand how demand has shifted over time for your destination country, the area it belongs to, and the cities within it.

Top growth by destination area

- {{$index+1}} {{item.code}} {{item.growthScale}}

Top growth by destination country

- {{$index+1}} {{item.country.name}} {{item.growthScale}}

Top growth by destination location

Top growth by destination city

- -10% to 10%

- -10% to -25%

- -25% to -50%

- -50% to -75%

Find out where inbound demand for your selected destination is coming from.

TOP DEMAND BY ORIGIN LOCATION

TOP DEMAND BY ORIGIN COUNTRY

- {{$index+1}} {{item.location}} {{item.queries}}

Visit Google Trends to learn more.

Comparative flight and accommodation demand data

See at a glance how different countries rank for accommodation and airline demand, with relation to inbound demand to and outbound demand from your primary country. use the filters above to select a primary country and up to 10 other countries to compare..

INBOUND INTEREST FROM SELECTED COUNTRIES TO PRIMARY COUNTRY

OUTBOUND INTEREST FROM PRIMARY COUNTRY TO SELECTED COUNTRIES

Explore these resources for additional insights

- Google Trends

Gauge consumer search behaviour over time on any topic.

- Grow with Google

Explore free training, tools and resources to grow your skills.

See how Cvent can solve your biggest event challenges. Watch a 30-minute demo.

9 Business Travel Trends to Watch in 2024

Business travel is making a steady comeback after experiencing a massive decline due to the pandemic. As we move into 2024, companies have the opportunity to reimagine corporate travel.

What will work trips look like for travelers? How will priorities and corporate travel preferences shift based on recent lessons? What will travel budgets look like? While uncertainties remain, industry experts are seeing several business travel trends that will define corporate travel in 2024 and beyond.

How Have Business Travel Trends Evolved in Recent Years?

The landscape of business travel is transforming, reflecting changes in the global economy, workforce diversity, and a shift toward sustainability. Travel is becoming more global, inclusive, and technology-driven. Let's explore pivotal trends that have reshaped professional travel in the past.

- Increased Globalization : More professionals are traveling internationally, forging connections, attending global events, and exploring new markets, highlighting the interconnectedness of today's economy.

- Increased Diversity : As more women and minorities enter the workforce, the demographic of business travelers is diversifying, emphasizing the importance of inclusivity.

- More Sustainable Travel : Travelers are increasingly making environmentally conscious choices, opting for sustainable options like carbon offset flights and eco-friendly types of hotel rooms .

- Use of Technology : Technology is essential to simplifying logistics, keeping travelers connected, and ensuring seamless work continuity.

- Growth of “Bleisure” Travel : The blend of business and leisure travel is growing, with professionals extending trips for leisure to maximize their time away.

9 Global Business Travel Trends of 2024

As the business world evolves, so does the way professionals travel. Here's a snapshot of the top trends shaping global business travel in 2024:

1. The Demand for Business Travel is Back

Business travel is expected to reach pre-pandemic levels by 2024 as more and more companies resume in-person meetings and events. According to GBTA's Business Travel Index Outlook report, business travel spending will reach $1.4 trillion in 2024 and nearly $1.8 trillion by 2027.

In 2023, the industry has started to steady itself, primarily driven by the resurgence of face-to-face meetings and events and the gradual return of international business travel. Moving into 2024, we expect this momentum will continue to grow rapidly.

2. Bleisure Gets Bigger: Blending Business and Leisure Travel

Modern business travelers’ preferences are changing as they seek to combine business trips with leisure activities, such as extending their stay for a weekend getaway.

This trend is largely driven by a demographic shift toward a younger workforce. Younger employees are increasingly seeking opportunities to combine work-related travel with leisure activities, reshaping corporate travel dynamics.

This "bleisure" trend offers traveling employees a sweet deal, with flexible travel schedules and a chance to unwind. This means guests are booking rooms for longer than their events will run, which is great for hotels.

3. Increased Focus on Sustainability

Organizations and business travelers are becoming more aware of their environmental impact and are looking for sustainable travel options, such as flying carbon offset and staying in eco-friendly hotel room amenities .

Some trends in sustainable business travel include:

- Sustainable hotels

- Sustainable transportation options

- Paperless travel

- Updated sustainable travel policies

- Use of corporate travel sustainability reports

4. Increased Use of Technology

Technology is going to be incredibly important for business travel in the future, playing a role in the entire meetings and events process.

Venue sourcing platforms will help planners efficiently find and compare event spaces based on their needs without needing to conduct site visits for every option. Virtual reality and augmented reality (VR/AR) are expected to become more widely used in business travel in 2024 for virtual site visits and training programs.

Corporate travel management platforms will optimize booking, provide traveler tracking, and give companies full visibility into their business travel spending. Further, businesses will rely heavily on end-to-end corporate travel technology for managing logistics, gaining insights, ensuring duty of care, and controlling costs.

AI and machine learning will power new business travel solutions that can analyze data to recommend hotels, predict flight delays, and more.

The business travel industry will continue to become increasingly technology-driven, with innovative solutions for venue sourcing, travel management, trip planning, expense reporting, and more taking center stage.

5. Growth of Secondary Markets

One major business travel trend for 2024 will be growth into emerging markets, especially in Asia and Africa.

The global business travel market is estimated to grow from $711.1 billion in 2021 to $2,997.2 billion by 2030, with a compound annual growth rate of 13.3%. Rapid expansion into emerging Asian and African markets will be a key driver propelling this growth.

India, Indonesia, and other Asian countries are among emerging business travel destinations. To serve this demand, business travel services are ramping up offerings in these markets, and alternative accommodations like home rentals are seeing huge growth to support business travelers.

Companies will need to adapt their travel programs and supplier partnerships to tap into these new regions.

6. Business Travelers Want Connectivity and Personalization

When it comes to technology, planners and travelers expect personalized experiences. In a tech-enabled world, guests of all ages want innovative and seamless digital solutions to simplify their travel and customize their stays.

This starts with the booking process. According to a recent survey , 80% of travelers say it's essential to book trips fully online. To that end. hotels should enable guests to easily view and filter amenities and services that will be available upon arrival.

On the road, 76% of global travelers appreciate travel apps that reduce friction and stress. Another 80% say utilizing personal devices seamlessly with on-property technology is key, from Wi-Fi to streaming apps.

Beyond messaging, travelers want mobile technologies they use daily, like touchless payments from phones or smartwatches, or tapping credit cards. The ability to leverage their own devices and platforms provides the personalized experience and connectivity travelers now expect.

7. Loyalty Programs Must Evolve Beyond Points to Experiences

Business travelers in 2024 crave more than just practical perks from their trips; they seek enriching experiences and meaningful rewards. Loyalty programs need to offer real benefits, enhancing travel beyond basic upgrades and conveniences.

Travelers want rewards that contribute to a memorable journey and strengthen their connection with the service provider. Practical benefits like late checkouts and room upgrades are expected; the true appeal lies in unique experiences, from exclusive events to complimentary services, adding a layer of luxury and personal value to their journeys.

8. Business Travel Will Shift to Purposeful, ROI-Focused Trips

In 2024, business travel will become more purposeful and ROI-focused. The days of casual briefcase trips are over. Now, every trip undergoes a careful evaluation of return on investment and return on expectation. Travel for clear ROI – like closing deals or contracts – will be more easily approved, while relationship-building trips will face more scrutiny.

With staffing shortages and supply chain issues, travel is less comfortable than before. Adding to this is the rising number of flight delays. All of this adds to travelers’ stress and threatens to undermine meeting experiences.

Particularly at hotels, staffing shortages can significantly impact the guest experience. In 2024, hotels will focus on empathy training and service to deliver exceptional experiences despite industry pressures.

Overall, brands that invest in people and purpose of travel will give business travel a new lease on life. ROI and "return on experience" will determine corporate travel policies, and only trips that justify the time and cost will get the green light.

9. Wellness Will Become Critical for Business Travelers

In 2024, wellness will play a crucial role in business travel programs. The pandemic has made travelers and companies prioritize health and immunity more than ever, and services at every price point must meet this demand with authentic, holistic wellness offerings.

From destination activities to hotel amenities to safety protocols, wellness cannot be an afterthought. It must be woven into every aspect of the business trip experience.

While safety remains paramount, companies are also factoring the “pleasure” aspect of travel into policies, recognizing activities that support mental health and enjoyment are beneficial for employees.

What Is the Future of Business Travel?

The future of business travel is bright. As the global economy settles and travel restrictions are lifted, we can expect to see even more people traveling for work. But business travel is not going to look the same as it did a few years ago or even in 2023.

Technology advancements in business travel will force hotels to use tools that reduce friction and streamline their travel operations while making their travel programs more sustainable.

Technology will define business travel planning , with travelers looking for more flexible and personalized options. Travelers will want to be able to book flights and hotels that allow them to change their plans at the last minute without incurring high fees. They will also be looking for travel experiences that are tailored to their individual needs and preferences.

Overall, the future of corporate travel will be defined by sustainable, personalized, mobile-centric, global experiences that keep travelers' health, safety, and productivity top of mind. Hotels and travel providers that can offer these things to business travelers will be the ones who succeed in the years to come.

Hope Salvatori

Hope is a Senior Content Marketing Associate who has been with Cvent for more than two years. She has 8 years of experience producing content for corporations, small businesses, associations, nonprofits, and universities. As a content professional, she has created content for a wide range of industries, including meetings and events, government and defense, education, health, and more.

More Reading

How to start an event planning business: the ultimate guide, how to run a meeting that gets real results: the ultimate guide, the speed networking guide: tips, benefits, and strategies for success.

The resources and staying power for a lasting partnership

Trusted by half of Fortune 500 companies

24/7 support from our ~1,500 customer success team

Our security and privacy teams protect your data

Subscribe to our newsletter

WAKING UP TO A

New era of business travel.

Post-pandemic predictions for 2024

WORK HAS EVOLVED.

That means big changes for business travel.

Corporate travel is undergoing a massive transformation right now. What’s driving it? Big societal shifts. Remote working is here to stay, offering employees greater well-being and more work-life balance. Meanwhile, organizations are dealing with an ever-changing financial landscape and new environmental pressures. And at the same time, consumer trends are bleeding more and more into corporate ones. Combined, this means a whole lot of new expectations and friction to manage when it comes to business travel.

Corporate travel is undergoing a massive transformation right now. What’s driving it? Big societal shifts. Remote working has stuck around, offering employees greater well-being and more work-life balance. Meanwhile, organizations are dealing with an ever-changing financial landscape and new environmental pressures. And at the same time, consumer trends are bleeding more and more into corporate ones. Combined, this means a whole lot of new expectations and friction to manage when it comes to business travel.

Travelport is shining a light on some of the ways our customers have quickly adapted to a changing landscape. Having acquired Deem earlier this year, we’re doubling down on our efforts to modernize business travel. And that starts by finding out what today’s business travelers care about most, and then using these insights to further support the modern retailing efforts of travel management companies (TMCs).

We’ve identified six key trends for the year ahead, using our own research, third-party industry sources, and through the collective brainpower of our customers. We’ve crafted examples of how they have modernized their approach to corporate travel to keep all stakeholders happy. So read on, as we bring you the very latest on the evolution of business travel.

CORPORATE TRAVEL IS BACK IN BUSINESS. BUT WHAT’S CHANGED?

Since the pandemic ended, there’s been lots of speculation about the future of traveling for work. But in 2022, according to GBTA, global business travel expenditure increased by 47 %, topping over one trillion US dollars. And that growth shows no signs of stopping. Spending is predicted to recover to pre-pandemic levels by the end of 2024 — faster than the previously projected mid-2026 forecast.

Why? First and foremost, because business travel is a logistical necessity for many people, like sales reps, client service managers, consultants, conferences and events staff, construction workers, circus folk etc. For these folks, being on the road is part and parcel of their role, and it’s budgeted for even more in the most uncertain of economic climates.Because nothing beats being face-to-face time with customers. And the others? They travel because their organizations want them to, remaining steadfast in the belief that meeting in person drives performance and growth . What might surprise you is to hear that almost nine out of ten (87%) of business travelers agree with them .

of employees think business travel is important to company growth

Source: Uber and GBTA report

Nonetheless, many companies are still struggling to get employees moving, and that’s because many are still working from home. In fact, by 2025 it’s projected that 32.6 million US employees will be remote workers. Since that changes the very nature of what ‘work’ looks like, there are also knock-on consequences for business travel, too.

Balancing what everyone wants and needs is a delicate act, and many companies are turning to TMCs to help them do it. So here are six key findings to take into 2024.

6 BUSINESS TRAVEL TRENDS FOR 2024

(AND HOW TO MANAGE THEM)

Research shows remote working offers employees a much better quality of life. So now, when they’re asked to hit the road, it’s important to remember people are giving up relatively much more than they were a few years ago. Business travel post-pandemic feels like a different (and bigger) ask. That doesn’t mean people don’t want to go, but when they do, they expect the same kind of freedom, flexibility, and personal time they enjoy in their daily lives.

of business travelers say their biggest priority is having options that support well-being, productivity, and aid recovery

Source: Travelport research 2022

To meet that need, our customers understand what ‘well-being’ truly means to people. For some, it means paying special attention to comfort, convenience, reward, and recovery time. For others, it means handier flight times, meeting times, or more R&R time. Overall, the goal is to create a feeling where work trips better reflect a normal day, causing less of an upheaval to one’s personal life. In 2024, employees will expect organizations to be flexible and look after their well-being — and this is even becoming as important as pay to many. This was one of the key takeaways from GBTA 2023 — mirroring the findings from Travelport’s third-party research study earlier this year .

OFFERING CHOICE, CUSTOMIZATION, AND RECOVERY TIME BUILDS GOOD WILL

In this strong employment market, well-being is a consideration when asking employees to travel. Research shows that if well-being suffers, people won’t stick around. Leavers create hassle for companies, as empty roles, recruitment costs, and training time all hit the bottom line either as costs or lost revenue.

of workers would consider leaving a company that does not focus on their well-being

Source: Gympass

Just like travel managers and TMCs, Travelport and Deem also believe the customer should always be at the center of any travel experience. After all, well-being isn’t just about healthcare benefits, lunchtime yoga, or hybrid working, it’s about all aspects of work life. But every individual has a specific definition of well-being — just like every business has a specific set of needs to be successful. So why do travel policies sometimes take a one-size-fits-all approach?

The most successful travel programs balance cost savings with traveler satisfaction. So we offer users a modern UI, robust content, and omnichannel support – and partnering with our customers to develop policies that prioritize wellness and productivity.

Direct Travel

Corporate travel managers and TMCs know it’s critical to provide transparency and give the traveler all the choices they need to make sure their needs are met, even if it’s limited somewhat by business policy. This may mean making exceptions and granting managers permission to override a rule, like adding extra legroom or access to a gym. It may mean building in extra recovery time, so they feel rested and ready for work on their return. And it means making sure employees don’t end up out-of-pocket by forking out for small comforts, like a convenient flight time.

Choosing travel technology that presents transparent, rich, and intelligent content and offers, while letting you set different permissions for different individuals makes this easy.

During the pandemic, many people were hired in locations far away from their designated offices. Others moved away from big cities, while being a ‘digital nomad’ became a career option. Companies meanwhile, got more freedom to hire talent from anywhere, including places where it costs them less. Fast-forward three years, and there’s now a new ask from these employees: to come to the office from time to time. So while ‘business travel’ may not have previously been a part of their job, now their ‘commute’ to a physical office might mean taking a flight instead of hopping in their car.

Visiting other offices isn’t something new, but the purpose, format, and frequency of visits is changing. Plus, it’s not just happening domestically anymore, but internationally, too. The EU, for example is taking steps to allow workers to move more freely between offices, albeit for a limited number of days per year, enabling them to fully immerse themselves in another way of life.

This trend has been dubbed ‘ super commuting ’ by some outlets, but unlike a regular, short-hop train or car journey, there’s more grounds for a business to pay for the trip. According to a Deloitte survey, relocated employees are now taking more trips to the company headquarters, most of which (70%) are either completely or partially paid for by the company. And that means there’s a new — or at least, an accelerated — type of business travel to account for in corporate travel policies.

Because the format of these visiting trips can vary quite a lot compared to typical business travel, e.g. to a conference, sales meeting, and so on. Visiting trips are infrequent and tend to be for longer. They’re usually designed to improve connectivity, morale, and retention, so may incorporate more leisure time and activities.

But the challenge with this (besides the income tax implications) is that many companies still rely on old travel policies that were written pre-pandemic, when this concept didn’t really exist, or at least, was an anomaly.

CORPORATE TRAVEL POLICIES ARE RIPE FOR MODERNIZATION

The many new types of working arrangements mean there’s a huge opportunity for travel managers, and many of them have already started to rethink corporate travel policies for these new and nuanced needs. For example, maybe you work for a big tech firm who takes out a long-term lease on corporate apartments for visiting staff , so your main challenge is finding suitable flights or car rental instead of accommodation. Or maybe your company no longer has a physical office, so your travel budget has been reallocated to get people together every so often. By refreshing your corporate travel policy, you can rise to these new challenges, and better balance the needs of travelers and the business.

Corporate travel policies exist to keep a lid on costs, and hitting budgets is sometimes a key measure of success when sending people on the road. But post-pandemic, business travel is about more than just cost containment . There are new metrics that travel managers and TMCs can help organizations improve, like well-being, retention, or productivity.

of business travelers want full transparency into what they are buying

Source: Travelport research

As consumers, we are all now much closer to the planning, booking, and servicing side of a trip than ever before. Plus, in our professional lives many people now enjoy more freedom working remotely, so it no longer feels natural for travel to be any different. All this means business travelers expect to see a wide variety of options, they expect more control over their trips, and they expect to be trusted to make responsible decisions.