Post Office Travel 4+

Travel money card & insurance, post office limited.

- #61 in Travel

- 4.5 • 7.6K Ratings

Screenshots

Description.

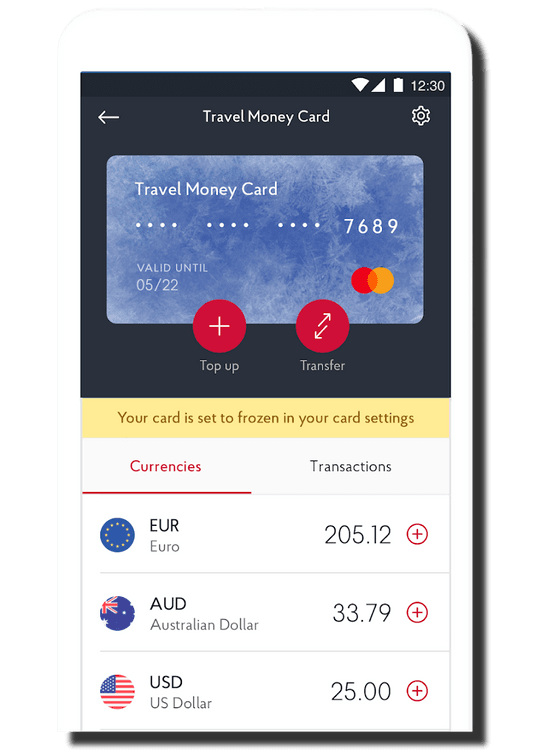

Buy, add, and manage your Travel Money Cards, travel insurance, holiday extras and more all in one place. Take the new-look Post Office travel app on your adventures today. Combining all the travel features our loyal app users love, this refreshed version’s now cleaner and simpler to use. So, it’s even easier to relax on your travels. Do all this on the move Manage your Post Office Travel Money Cards · Buy and activate new cards in the app · Add existing Travel Money Cards · Top up with any of 22 currencies, including US dollars and euros · Swap funds between different currencies · Check your PIN, balance, spending, and daily exchange rates · Freeze your card for security or to limit your spending · Add your cards to your Apple Wallet Buy and check your travel insurance · Get a quote and buy cover – plus any add-ons to tailor it to your trip · Link the app to your existing Post Office Travel Insurance policy · View and download your policy documents Get those holiday extras sorted · Book parking at 60 UK domestic airports · Find great deals on airport hotels · Check into lounges at 100+ airports · Fast track your security checks at 11 UK airports · Book airport transfers to your holiday accommodation · Hire a car with leading brands in over 60,000 locations What to do now Download the Post Office travel app today. Order or link your existing Travel Money Card and Travel Insurance policy. Or order a Travel Money Card at your nearest Post Office branch.

Version iOS App version 461.2

Bug fixes and performance improvements, all to make your experience the best that it can be. Recent updates include fixes to Apple Wallet, sign up and login journeys.

Ratings and Reviews

7.6K Ratings

Post office travel application

Now, the post office application has been very useful, as one can top up money whilst travelling as well as check ones balance on the travel money card. In conclusion, lastly, I found the travel money card particularly useful on 16th November 2019, evening time as one can search for useful tips and questions that one maybe concerned about before travelling, during and after travel, and for me, I found this application extremely useful, as there was information I needed to know before my travel, such as the currency of the country I am travelling to, and where to obtain the currency of the country I am travelling to shortly. Moreover, I thank the developers for making this useful, and appropriate travel application as I believe it is a safe as well as secure method of travelling with money, to the country of ones choice instead of carrying loads of cash around in different currencies, and risking theft issues or lost issues. Also, I found the help and advice section on the website useful, as I had forgotten my PIN number as I never used my travel money card for a while, and I was able to call up a number from the travel money website, and follow the on phone instructions to retrieve my PIN number once again. Next, thank you developers for making this travel application once again. Many thanks Hannah Boyce

Developer Response ,

Thanks very much for the fantastic feedback, glad you like the app and the product.

Dreadful new App not working for 3 days now

Rang customer services 3 days ago now as newly downloaded App top up button gives an error that it can’t fetch the rates right now so have to go on main website to do that. Then when you use the card it doesn’t update the balance. It retrieve the pin either. The card was then unsupported in an ATM when I tried doing a balance enquiry. Different information from service staff who told me I needed to load another £50 minimum on card and buy something using chip and pin to use card for for first time. However that’s £3 commission just to load on £50 of your own money ! I don’t even need sterling on the card as the whole point is for using it abroad to TRAVEL!! So I had already bought Euros. The lady in the post office said I can’t use the card at all for online purchases however I managed to pay for my holiday eventually over the phone in euros once they had removed the security 3 times! A smarter assistant also said I don’t need to add sterling to buy something in U.K. - the euros will auto convert- which they did. Still stuck with a non working app and took 3 hours to finally get the card loaded and working to pay for holiday. Agh. Why so complicated

Thank you for your feedback. This will be shared with our development teams who are committed to improving the app experience for all.

No problems at all

I have had and used this Post Office Travel Card for the last eight years with no issues whatsoever, it expired earlier this year and a replacement arrived in good time for this year’s use. I did have a little hiccup with the first login online for the first use but very soon sorted out and hay presto of and running again, brilliant. I did have a lot of issues with another company travel card whereby EVERY TIME I tried to login on the app or online it wouldn’t recognise me and had to reset password wasted six and a half hours, still getting no results so cancel the subscription 😡. Update to review April 2024 I have been away from UK to USA and CANADA this time and have had no end of problems trying to login into the app on my phone or Laptop, issue with the app freezing on my phone or going round in circles on laptop with password/security reset issues I’ve uninstalled and reinstalled all to no avail it would not let me use face recognition ID Very disappointed after such a brilliant service the first time around until the new card and updated app 😡😡😡 I to like so many others am looking for an alternative card & app.

Thank you for your feedback. It looks like you might need more help here, please contact us directly at [email protected]

App Privacy

The developer, Post Office Limited , indicated that the app’s privacy practices may include handling of data as described below. For more information, see the developer’s privacy policy .

Data Used to Track You

The following data may be used to track you across apps and websites owned by other companies:

Data Linked to You

The following data may be collected and linked to your identity:

- Contact Info

- Identifiers

Data Not Linked to You

The following data may be collected but it is not linked to your identity:

- Diagnostics

Privacy practices may vary based on, for example, the features you use or your age. Learn More

Information

- App Support

- Privacy Policy

Get all of your passes, tickets, cards, and more in one place.

More by this developer.

Post Office EasyID

You Might Also Like

Jet2 - Holidays and Flights

loveholidays: hotels & flights

Virgin Atlantic Holidays

On the Beach Holiday App

ViewTrail - Trailfinders

Post Office Travel Card Review

Travelling is one of the most exciting and liberating experiences out there. Whether you’re jetting off to a far-off destination or just exploring your own country, having the right travel card can make the whole experience easier and more enjoyable.

Are you planning a trip? If so, you may be wondering if the Post Office Travel Money Card is a good option for you. In this article, we’ll take a close look at the Post Office Travel Money Card, how it works, and what you need to know before using it.

By the end of this guide, you’ll have all the information you need to make an informed decision about whether or not the Post Office Travel Money Card is right for your next trip.

Table of Contents

Benefits of Having a Travel Card

First and foremost, travel cards are an excellent way to earn miles and points. This can be incredibly valuable if you are a frequent traveller or want to visit somewhere far off where you’ll have to pay high airfare. Plus, you can use these miles and points to book travel, hotels, flights, vacation packages, and more.

Another major advantage of travel cards is their versatility. As you travel, you’ll have the ability to withdraw cash from ATMs using your card, pay for purchases using your card, and even get roadside assistance on select cards. You’ll also have access to excellent trip cancellation and travel insurance.

Plus, travel cards are typically easier to qualify for than other types of credit cards. This is because many companies view travel cards as a “safe” type of credit. However, having a travel card can also help to improve your credit score.

Post Office Travel Cards: What Are They?

The Post Office Travel card is a Mastercard prepaid card, which can be loaded with a choice of 23 currencies. ATMs are available in more than 200 countries where you can spend and withdraw money.

You can load your account with any currency before travelling and then use it abroad without having to convert your currency.

Post Office Travel offers a contactless card that can be accessed through its app.

Post Office Travel Cards Benefits and Features

Here’s a quick look at the Post Office Travel card’s main features and benefits:

- Payments for low-value items can be made quickly and conveniently using contactless technology

- Compatible with Apple Pay and Google Pay

- With the Travel app, you can manage your card, top it up, transfer currencies, as well as freeze it.

- You can choose from 23 different currencies and top it up whenever you need it

- Accepted everywhere Mastercard is accepted

- Call centre assistance is available 24/7

- Whenever there is currency left over, it can be transferred into another currency by using the wallet-to-wallet feature

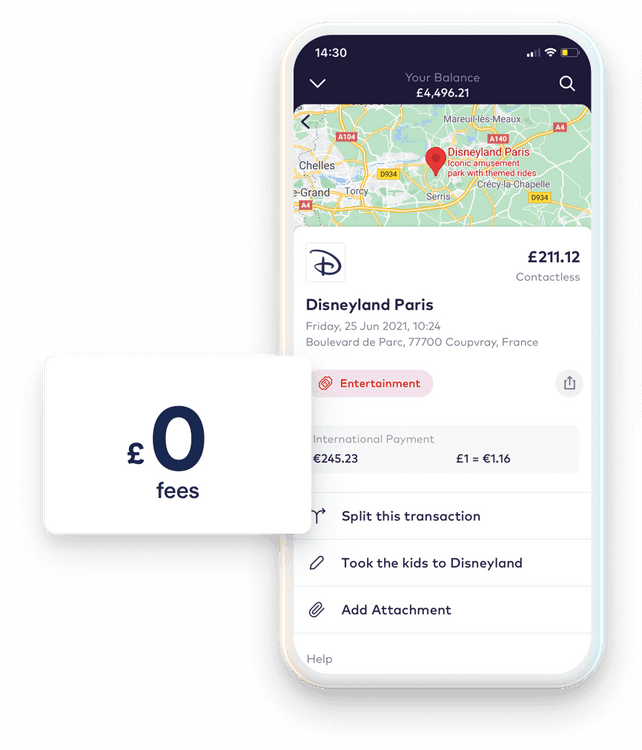

- If you use a local currency supported by your card to spend abroad, there are no fees

Post Office Travel Card Costs

Travel money cards from the Post Office cost nothing to order and no fees apply when you pay for purchases using the currency you hold. Provided your available balance is in a currency accepted by the card, you can shop, dine, and drink without any charges.

When using your card in a country that doesn’t support the currency of your card, you will have to pay a 3% foreign transaction fee. Using your card in Brazil, for example, will result in a 3% foreign transaction fee since the Brazilian Real isn’t a supported currency.

Despite the card’s currency support, you’ll still have to pay ATM withdrawal fees. Each currency has a different ATM fee.

An example would be:

- Euro – 2 Euros

- Canadian Dollar – 3 Canadian Dollars

- US Dollar – 2.5 United States Dollars

- Swiss Franc – 2.5 Switzerland Francs

- Australian Dollar – 3 Australian Dollars

- Pound Sterling – 1.5 Pounds Sterling plus 1.5% commission

Regarding fees, one final note. There is a three-year validity period on all Post Office Travel cards. After your card expires, you will be charged a maintenance fee of £2 per month.

Exchange Rates

Exchange rates fluctuate based on the demand for currencies at the Post Office. Thus, you’ll receive a particular amount of travel money depending on the current exchange rate.

For travel money cards, you can get exchange rates at Post Office branches and on the website. Be sure to remember that rates may differ whether you are purchasing online, by phone, or in person.

In addition to the margin, the exchange rate at the Post Office will probably include a markup. When you search for the rate on Google or currency websites, you’ll most likely get an accurate one. Consequently, a margin will reduce the amount you receive when exchanging EUR, USD, or another currency.

A Post Office Travel Money company profits by offering its customers a better rate than the base rate. U.K. pounds are converted into U.S. dollars at a rate of 1.23 dollars per pound, for example.

If you exchange £400 through Post Office Travel Money, you can get 1.18 USD per pound. In this case, there is a difference of £16 or 4%. Exchange rates are better when you exchange large sums of money .

Exchange Rates for In-Branch Travel Money

According to the Post Office, in-branch exchange rates are determined by many factors, including branch location, competitor pricing, convenience, etc. The company will always strive to offer the best possible rate within these parameters. Online orders/distribution is the cheapest method for many retailers, as they can use centralised packing costs. Because of this, online exchange rates are always better than branch rates.

Comparing Post Office Travel Money Rates to Other Providers

There are several new services that it’s worth comparing directly to Post Office Travel Money.

Online-Only Banks

There have been several purely mobile banks launched in recent years both in the UK and across Europe. With services like Monzo, N26, Revolut, Monese, or Bunq, consumers can access a wide range of banking options.

Each of these modern financial institutions provides services such as money transfer agencies and international travel cards, and it makes sense to compare them with Post Office Travel Money.

For example, Monzo facilitates international money transfers through the popular exchange company Wise. For example, when sending a thousand pounds to a Swedish account using Monzo/Wise, the recipient receives 12,103 Swedish crowns versus 11,546 with Western Union, a difference of around 5%.

Other Currency Providers

It may also be possible to transfer money at a better rate in some countries. Using Xendpay, you could send 500 pounds to Saudi Arabia, and the beneficiary would receive 2,289 Saudi Riyals instead of 2,158 Saudi Riyals with Post Office Travel Money.

Supported Currencies

Prepaid travel cards from Post Office can be loaded with any of the following 23 currencies:

- CAD – Canadian dollar

- JPY – Japanese yen

- USD – US dollar

- AUD – Australian dollar

- CHF – Swiss franc

- AED – UAE dirham

- CNY – Chinese yuan

- DKK – Danish kroner

- PLN – Polish zloty

- CZK – Czech koruna

- ZAR – South African rand

- GBP – Pound sterling

- TRY – Turkish lira

- HKD – Hong Kong dollar

- THB – Thai baht

- HRK – Croatian kuna

- SGD – Singapore dollar

- HUF – Hungarian forint

- SEK – Swedish kronor

- SAR – Saudi riyal

- NOK – Norwegian krone

- NZD – New Zealand dollar

Sending Money With the UK Post Office

Many Post Office branches and their website offer Post Office Travel Money. They offer convenient and quick foreign exchange services. They are useful for local currency exchanges because they are so widely available. Post Office services like international money transfers and travel cards offer additional options for sending and spending overseas.

How to Get and Use a Post Office Travel Card?

Post Office travel cards are only available to UK residents over 18 years old.

Ordering Your Card

To order a Post Office Travel card, you can do one of three things:

- You can order through the Post Office Travel app

- Visit the Post Office website to apply online

- Get your card at your local Post Office. It will be necessary to bring photo identification, like a passport or driver’s licence

Your card should be available immediately if you apply at a branch. Your card will be delivered within two to three days after you apply online or via the app.

Card Activation

It’s necessary to activate your travel card before you can use it. You’ll find detailed instructions in your welcome letter.

Using Your Card

ATMs and online sites that accept MasterCard accept Post Office travel cards, too. If you are buying something in person, you’ll need your PIN to verify your purchase and possibly your signature if the Chip and PIN system is not widely available in the country.

In some countries, contactless payments are also allowed for small amounts, although the rules and limitations vary.

According to its terms and conditions, you should not use your Post Office card in certain situations.

Some of them include:

- Tolls on the road

- Petrol pumps with self-service

- Deposits for car rentals or hotels

- Airline or cruise ship transactions

Adding Money to Your Card

With the Post Office Travel app, you can add money to your card easily. Additionally, you can add money at a local branch or on the Post Office website.

Buying Back Currencies

Having unused currency on your card gives you a few options. You may be able to withdraw cash at your local Post Office branch or ATM, but there may be a fee.

Wallet-to-wallet transfers are also available in the app. You can transfer unused balances from one currency to another. In preparation for your next trip to Europe, you can convert unused USD into EUR.

Each currency listed above can be topped up for between fifty pounds and five thousand pounds on your card. Your card can hold up to ten thousand pounds, as well as carry out transactions of up to thirty thousand pounds annually.

Different currencies have different limitations on cash withdrawals. For example, in a single transaction, you may withdraw up to 450 euros or 500 dollars.

App Overview

On Google Play and the App Store, you can download the Post Office Travel app for free. With the app, you can activate and order your card, check your balance, add money to it, and more.

In addition to transferring leftover currency between wallets, it’s possible to convert it to another currency you prefer by using the new wallet-to-wallet feature.

Furthermore, you can book airport parking, purchase travel insurance through the app, and use other features.

Contacting the Post Office

If you need assistance, you may reach the contact centre by dialling 0344 335 0109 in the United Kingdom or 0044 20 7937 0280 from abroad. Customer service is available each day of the week at any time of the day.

In addition, you can reach Customer Services at the Post Office in the following ways:

- Postal mail at PO Box 3232, Cumbernauld, G67 1YU, Post Office Travel Card

- Send an email to [email protected]

Post Office Travel Card: FAQs

Here are some common travel card problems you might encounter.

When I lose or damage a card, what do I do?

Post Office currency cards are easy to replace if lost or damaged. Your card will be blocked, and another one will be sent to you. App users can also freeze their cards.

How should I deal with a declined or blocked card?

The first thing you need to do is ensure that you have enough money in your account via the app. If you don’t have enough money in your account to purchase your item, call the customer care centre.

If I forget my PIN, what should I do?

Call the customer service centre if you cannot remember your travel money card PIN. If you need a new one, they can issue it for you.

My card is about to expire. What should I do?

A new card should automatically be sent to you. You can call the contact centre if it hasn’t arrived after the expiration date, and they’ll issue you another.

Post Office Prepaid Travel Card Summary

Travel cards from the Post Office are handy if you want to keep your money safe while you’re away from home. The convenience of not carrying cash around with you and not having to change money during your trip will make your trip much more enjoyable.

Because it’s a contactless card, you can pay in local currencies quickly and easily. This helps you budget because you can only spend what’s on it.

If you travel frequently or take multi-destination holidays, the card is convenient since you can store 23 currencies on it. A card that supports a variety of currencies might be more useful if you love exploring far-flung areas.

The exchange rate is a drawback to take into account. Post Office rates may be competitive (compared to airport exchange rates, for example), but they will likely include a margin or markup. ATMs also charge fees when you use your card.

Comparing other travel money cards could help you find a better deal, so make sure to shop around.

by Matt Woodley

Using the Post Office Travel Money Card: Pros and Cons

Table of Contents

What is the post office travel money card, pros of the post office travel money card, cons of the post office travel money card, user experiences and reviews, how to get and use the card, best practices for cardholders, alternatives to the post office travel money card.

T he Post Office Travel Money Card is a convenient and secure way for UK residents to manage their finances while traveling abroad. This prepaid card allows travelers to load funds in multiple currencies, offering a practical alternative to carrying cash or using credit cards overseas. It’s particularly popular among those who seek a controlled and budget-friendly travel spending method.

The Post Office Travel Money Card is a prepaid, multi-currency card that can be loaded with up to 23 different currencies. It functions similarly to a debit card but is specifically designed for international travel. The card can be used to make purchases at millions of locations worldwide where MasterCard is accepted and to withdraw money from ATMs.

- Convenience and Ease of Use : The card is straightforward to obtain and use. Travelers can easily load funds onto the card online or at a Post Office branch.

- Security Features : The card is not linked to a bank account, reducing the risk of fraud. Additionally, if lost or stolen, it can be easily replaced.

- Wide Acceptance : Being a MasterCard product, it’s accepted at a vast number of outlets and ATMs worldwide.

- Currency Exchange Rates : Users benefit from competitive exchange rates compared to traditional currency exchange services.

- Budget Control : The prepaid nature allows travelers to manage their spending effectively, avoiding the risk of debt.

- Fees and Charges : Although the card offers free purchases, there are fees for certain transactions, such as ATM withdrawals and inactivity.

- Limitations in Usage : Some countries and establishments may not accept the card, limiting its utility in certain situations.

- Reloading Issues : Adding more funds to the card can be less straightforward, especially in remote areas or during non-business hours.

- Customer Service Concerns : Some users have reported issues with customer service, particularly in resolving card-related problems quickly.

- Comparison with Other Travel Money Options : While the card has many benefits, it may not always be the best option compared to other travel money products, like credit cards with no foreign transaction fees.

Feedback from users generally highlights the convenience and security of the card. However, some have noted the fees and reloading issues as drawbacks. It’s essential to consider both the positive and negative aspects to make an informed decision.

Obtaining the card is a simple process, either online or at a Post Office branch. Users need to load the card with the desired amount and can start using it immediately. For reloading, options include online transfers or visiting a Post Office.

To maximize the benefits of the card:

- Keep track of spending and remaining balance.

- Be aware of the fees for different transactions.

- Have an alternative payment method as a backup.

Other options include other brands of travel money cards, credit cards with no foreign transaction fees, and traditional cash exchange. Each has its pros and cons, depending on individual travel needs and spending habits.

The Post Office Travel Money Card is a valuable tool for travelers seeking a secure and convenient way to manage their funds abroad. While it has several advantages, potential users should also be aware of its limitations and fees.

Q: How does the Post Office Travel Money Card work? A: It’s a prepaid card that you load with currency before traveling. You can use it for purchases and ATM withdrawals anywhere MasterCard is accepted.

Q: Are there any fees associated with the card? A: Yes, there are fees for certain transactions like ATM withdrawals, and there may be inactivity fees if the card is not used for a prolonged period.

Q: How do I load money onto the card? A: You can load money online or at any Post Office branch. The process is simple and can be done in multiple currencies.

Q: What should I do if my card is lost or stolen? A: Contact the Post Office immediately to report the lost or stolen card. They will arrange for a replacement and transfer the balance from the old card.

Q: Can I use the card in any country? A: The card is accepted in most countries worldwide. However, it’s always best to check the specific country’s acceptance before traveling.

Q: How does the card compare to using a regular debit or credit card abroad? A: Unlike regular cards, the Travel Money Card is prepaid, which helps in budget management. However, some regular cards might offer better exchange rates or lower fees, so it’s worth comparing options.

Q: Is the Post Office Travel Money Card a good option for all travelers? A: It depends on individual needs. The card is excellent for those who want a secure, budget-friendly way to carry money abroad. However, for those who travel frequently or to less common destinations, other options might be more suitable.

Related Posts

Expert Tips for Managing Hays Travel Money Effectively

Navigating TUI Travel Money for Better Holiday Finance

John Lewis Travel Money: Convenience and Value Combined

Marks & Spencer Travel Money : Maximizing Value with M&S Travel Money on Your Trips

Leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

create unique & memorable travel experiences with VOLodge

About volodge.

1325 Derry Rd E Suite 3, 2nd Floor, Mississauga, ON L5S 0A2, Canada

Sign up for the exclusive offers and best deals from us

© 2023 | VOLodge.com | All Rights Reserved

- Argentina

- Australia

- Deutschland

- Magyarország

- Nederland

- New Zealand

- Österreich

- Singapore

- United Kingdom

- United States

- 繁體中文 (香港)

Post Office Travel Card review

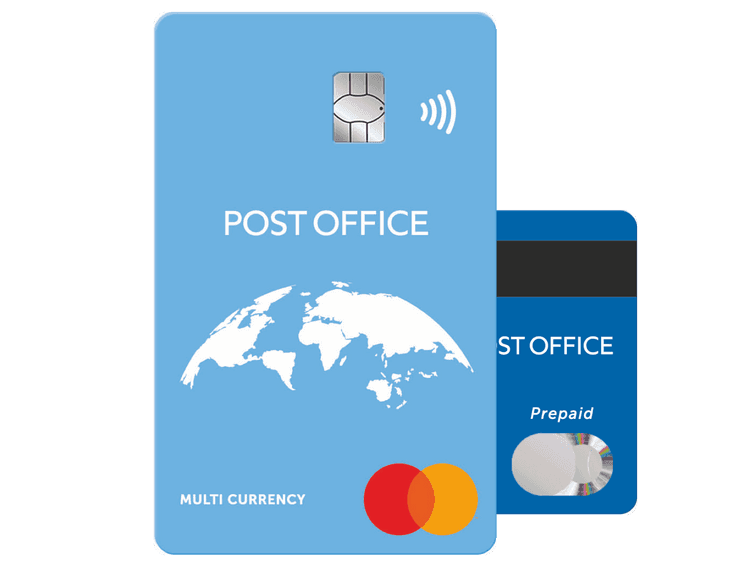

The Post Office Travel Card is a prepaid travel card you can load in cash or online, to switch to the currency you need for spending and withdrawals. It’s not linked to your regular bank account, and can be managed from your smartphone, for secure spending across 23 currencies.

Before you order a Post Office Travel Card check out this full review - we’ll look at what the card can do , how to order your card and how much it’ll cost .

And to help you compare we’ll also touch on Post Office Travel Card alternatives like Wise and Starling, which may offer cheaper and more flexible options for taking travel money abroad.

TL;DR - it's a solid prepaid card

- The card supports most major currencies for holidays, including Euros (Europe), Lira (Turkey) and UAE Dirhams (Dubai)

- Several top-up methods , with the option of doing so online or in-store

- Only convert what you want to spend; good for holiday budgeting

However, there are some downsides.

- There are better exchange rates available with other travel cards

- You'll get a worse exchange rate (a.k.a "buy-back rates") when converting leftover foreign currency to pounds

Find out more about the card on the Post Office website or click the button below to purchase a card. Order a card

Not sure yet? Continue reading to decide whether this is the right prepaid card for you.

What's in this guide?

What is the post office travel money card, how does it work.

- Fees & limits

How do I get a Post Office Travel Money Card?

What happens when the card expires, what are the alternatives.

The Post Office Travel Money Card is a prepaid card you can top up in cash or from your bank account, in any of 23 supported currencies.

Once you have funds on your card you can use it as you would a regular debit card, for contactless and mobile payments, and cash withdrawals. There’s no fee to spend currencies you hold on your card, although other transaction fees do apply depending on how you use the account.

Use your Post Office card to buy travel money before you head off on holiday, or top up as you go online.

As pictured, you can also manage, view and freeze your card in the Post Office app for security.

- Top up your card in cash at a Post Office or online by purchasing one of 23 different currencies

- If you choose to top up in GBP and convert later, you’ll be charged an administration fee of 1.5%, from a minimum of 3 GBP up to a maximum of 50 GBP

- Exchange rates are shown in the Post Office app, and may include a markup on the market exchange rate - but rates often improve if you top up more

- It’s free to spend currencies you hold. You can also spend unsupported currencies, but a foreign transaction fee of 3% will apply

It’s worth noting that the Post Office exchange rates are shown in the Post Office app before you convert your funds. They may include a markup, which is an extra fee added into the rate applied to switch to the currency you need.

Another thing worth noting is that the exchange rate gets better for higher top up amounts - meaning you’ll pay a smaller markup the more you add to your card.

Using a markup is pretty common but does make it tricky to see what you’re really paying for your foreign currency transactions.

Spending limits and card fees

Before you order a Post Office Travel Card it’s good to know a bit about the fees and limits that apply to card usage.

When you transact with your Post Office Travel Money Card, there are also fees to pay.

While these do vary slightly by currency, they’re roughly similar.

It’s easy to get your Post Office Travel Card online or in person by calling into a Post Office near you. Here’s what you’ll need to do.

- Head to the Post Office website

- Select "Order Your Card >"

- Top up in your preferred currency - there’s a minimum top up of 50 GBP, through to a maximum of 5,000 GBP

- Input personal details following the prompts

- Delivery of your card will take 2-3 days by post

- Head to your local Post Office branch

- Show a valid form of ID (driving licence, passport or EEA ID card)

- Apply in branch and load your card

The expiry date for your card will be printed on the back of the card - usually it’s valid for 3 years from the point you order it.

Once your card has expired you’ll pay a monthly inactivity fee of £2 per month if you don’t redeem your balance within 12 months of the card expiring. This fee continues until there’s no remaining balance, at which point your account will be closed.

If you’re not sure whether the Post Office Card is right for you, check out a few alternatives to see which gives you the best balance of cost and convenience.

The Wise card allows you to hold and exchange 50+ currencies, and spend in 170+ countries. It's a fully-fledged debit card, meaning it works at home just as well as it does abroad.

There’s no markup on the exchange rate, and they are super transparent about the fees (usually around 0.4% for foreign spending) they'll charge you.

Starling card

The Starling debit card is a good option for international spending as there are no foreign transaction fees and no ATM fees .

You can sign up entirely online for an account with no monthly fees which you can manage from your phone, with instant notifications and a whole range of banking features. Get a Starling Card

Frequently Asked Questions

Post Office is a trusted institution and will keep customer funds safe according to all applicable legal requirements.

When it comes to travel money, the Post Office works in partnership with First Rate Exchange Services, which is a registered business and holds a Money Services Business License in the UK.

You can hold up to 23 different currencies:

- Australian dollars

- Canadian dollars

- New Zealand dollars

- Croatian kuna

- Turkish lira

- South African rand

- Swiss francs

- Polish zloty

- Pounds sterling

- Chinese yuan

- Czech koruna

- Danish kroner

- Hong Kong dollars

- Hungarian forint

- Japanese yen

- Norwegian krone

- Saudi riyal

- Singapore dollar

- Swedish kronor

Suggested companies

Post office.

Post Office Travel Money Card Reviews

Visit this website

Company activity See all

Write a review

Reviews 3.7.

Most relevant

The Post Office Travel Money Scam Card

The Post Office Travel Money Card, as offered by First Rate Exchange Services Ltd, is a complete scam. I recently put £1,250.02 on one for a trip to Thailand. First of all, they will rip you off on the exchange rate; giving you thousands of Baht less than other providers. Second, their 'Schedule of Fees' for ATM withdrawals is entirely false and fictional. They say 80 THB, the true figure is 220 THB; 175% more than the quoted amount. These people are crooks and fraudsters, and best avoided. Michael Harrold.

Date of experience : February 01, 2024

Post office travel money card was…

Post office travel money card was excellent when I use abroad I can top up freeze unfreeze East to top up online text I manage to withdraw cash from ATM too V good service

Date of experience : April 11, 2024

Reply from Post Office Travel Money Card

Thank you for your great review and feedback!

Would not recommend

Would not recommend. Loaded with US dollars, as in Barbados that is widely accepted. However, when I used card I was charged a commission fee. My children then said , should have got a Monzo card as they give you the rate on the day with no commission. Another scam from the great institution of the Post Office!!

Date of experience : April 26, 2024

Thank you for your review, we’re sorry to read that the Travel Money Card hasn’t met with your expectations on this occasion, we would like to understand more so we can help resolve this. Could you call us at 0207 937 0280 or email us at [email protected] , Thanks -Aaron

Didn't get delivered on time. Can't move balances. No online alternatives.

Still haven't received my card after 6 days. Called the help line and was told to order another card in branch to get it instantly but there is no way to transfer a balance from an online order onto a new card. Long and short of it is, if I want the use of this service before my holiday I need to spend more of my money and order fresh again. I also don't live in a town with a branch that can do this so I'd need to travel to even do this. Bad delivery service, no means to swap balances, no online card alternatives (it's 2024 - this could be an online digital app like many other cards), and no "help" from the help line worth the effort of calling. Won't be using the card in future and will continue to just buy cash for travelling from other brokers.

Date of experience : May 02, 2024

Postoffice travel money card is a great…

Postoffice travel money card is a great little card to take away I have used this all over in Europe and worldwide highly reccommend 🎉

Date of experience : April 25, 2024

Thank you for your great review and feedback, we are so pleased that you would recommend Travel Money Card!

No fees and easy to use

The Travel Money Card was so easy to use and having the physical card as well as the app meant my husband and I could pay for things from the same account when needed. There are no transaction fees as there are with most bank cards used overseas so would definitely recommend and use next time we go abroad.

Date of experience : March 02, 2024

So easy !!!

Fantastic card ease of use can't see me going back to cash / currency for future holidays

Date of experience : April 28, 2024

Thank you for your great review and feedback, it really means a lot to us!

so far, so good

I am an older person and view apps and phone banking as necessary evils and with great distrust. However it is almost impossible to live without them and some products do help make life easier. This is the premise behind the PO Travel card which allows you to carry foreign currency in the equivalent of a use-abroad deposit account card. While it wasn't entirely pain-free to set up it was bearable with minimal faff, and it worked 100% the small handful of times I tried it in shops abroad. Assuming the remainder of the currency I put in that card does not vanish before I next go abroad I will continue to use it. I'm unsure of the exact advantage it gives over my UK bank account card and using that abroad, perhaps not getting fleeced by fluctuating exchange rates. I was told it is more efficient than just buying a wad of Euros at the Post Office.

Date of experience : April 01, 2024

Quite easy to follow instructions

Date of experience : May 13, 2024

Post Office Travel Card

Ordered a Post Office travel card and unfortunately loaded a reasonable sum in USD on 08 April 2024, on the expectation that it would arrive in 2-3 days as advertised on the Post Office portal. After 6 days, no card so this is followed by a telephone call. 43 minutes later, following scripted dialogue from the operator, I move on. We're now 12 days on and still no travel card. 14 e-mails, 2 complaints and another 40+ minute phone call and still no travel card or refund or compensation. The Post Office are also unable to evidence actually posting the travel card... Post Office - you should be ashamed of yourselves - your customer service is absolutely appalling at best.

Date of experience : April 08, 2024

I am sorry to hear that we have been unable to assist you when you contacted Customer Services. Please contact us via email on [email protected] and we will be able to take a further look into your account and give assistance.

Great card which is very easy to use

Great card which is very easy to use. App keeps you updated on transactions and balance among other things. Used it in USA, UAE and Europe. Topping up is simple via the app

Thank you for your great review and feedback, it really helps us and we're so glad to hear that you've used your Travel Money Card in so many great places!

Perfect for saving foreign currency…

Perfect for saving foreign currency through out the year for my holidays.

Date of experience : May 03, 2024

Thank you for your great review and feedback, it really helps us!

Lessons in travelling

I've found the Post Office travel money card very useful and easy to use on two European trips in the past four months. For a number of reasons my current trip, to Australia, has not been so smooth. I found it impossible to top up on either the app or the website, which proved to be my bank's fault - it declined the transaction, despite having allowed it in the past. The TMC app and website fell short by not explaining at all why things were not working out. And I fell short by switching off my UK phone SIM card to avoid international call rates, which meant that I couldn't receive messages from my bank which would have explained why I couldn't top up. So, faults with me, my bank and (really least of all) the TMC, all now resolved.

Date of experience : March 21, 2024

I wouldn't go on holiday without it!

I've had my Post Office Travel Money Card for years and carry all my holiday spending money on it. Its so easy to use and I've always been able to access cash if I've needed it, from an ATM. The App makes everything easy to manage and I can transfer from my bank whenever I need to because who sticks to budget when they're on holiday?! 😅

Date of experience : March 05, 2024

Thank you so much for your great review and feedback, it really helps us. It's really good to hear that you have been using your Travel Money card for so long with us, so thanks again and we hope that you continue to enjoy it for many more years!

I got a travel card from post office to…

I got a travel card from post office to be delivered i put £50 on there but was charged £50.70 ...post office said it was not them , monzo state it was not them ..so whose took the 0.70..gonna cost a bomb with further instalments on the card ..may have to look elsewhere or just use good old fashioned cash

Thank you for your review, we’re sorry to read that the Travel Money Card hasn’t met with your expectations on this occasion, The Post Office charge a 1.5% fee for loads made in Sterling, to remain in Sterling on the card. For purchase of all other currencies, your Sterling goes through the rate of that day and the funds are then locked in at this rate on the card for spending. In order for us to look into this further for you, could you call us at 0207 937 0280 or email us at [email protected]

The App is very easy to use

The App is very easy to use, I can check my balance, transactions and top up my card. The card is accepted everywhere. I have used the card in USA (Florida) and in Europe.

Date of experience : April 22, 2024

Thank you for your great review and feedback, it really means a lot!

Just found out that the Post office…

Just found out that the Post office travel card does prize draws. Really good rates when im in thailand/pound to baht. Spend money on the card often when abroad

Date of experience : April 24, 2024

It is very useful to have a Travel card with you as you know how much money you have to spend !!

It is very useful to have a Travel money card when on holiday. The staff at the Post Office are very helpful to get it loaded and set up. Also the staff at head office are there for you if you need help

Date of experience : April 18, 2024

Useless. Card worked ok until it didn't. Stopped working while on holiday. Tried to check balance at local Spanish ATMs but they would not recognise the card. The app wouldn't open and when I tried opening the account via the browser it would not let me in. Eventually I was locked out. Luckily I also had a TUI money card which was easier to set up and works perfectly. Would advise you get card from a travel agent or bank. Do not rely on the Post Office.

Date of experience : April 20, 2024

Hi there, I am sorry to hear that this. Please contact us via email on [email protected] or telephone 0344 335 0109 and we will be able to take a further look into your account and give assistance.

Used my card for the first time in…

Used my card for the first time in Portugal and found it extremely easy and hassle free, it will be my method of payment when abroad from now on.

Date of experience : March 14, 2024

- Skip navigation

- Find a branch

- Help and support

Popular searches

- Track a parcel

Travel money

- Travel insurance

- Drop and Go

Log into your account

- Credit cards

- International money transfer

- Junior ISAs

Travel and Insurance

- Car and van insurance

- Gadget insurance

- Home insurance

- Pet insurance

Travel Money Card

- Parcels Online

For further information about the Horizon IT Scandal, please visit our corporate website

- Travel Money

Get competitive rates and 0% commission for your holiday cash

Foreign currency

Find our best exchange rates online and enjoy 0% commission on over 60 currencies. And you can choose collection from your nearest branch or delivery to your home

Go cashless with our prepaid Mastercard®. Take advantage of contactless payment, load up to 22 currencies and manage everything with our app, making travel simple and secure

Order travel money

- UAE Dirham AED

- Australian Dollar AUD

- Barbados Dollar BBD

- Bangladesh Taka BDT

- Bulgarian Lev BGN

- Bahrain Dinar BHD

- Bermuda Dollar BMD

- Brunei Dollar BND

- Canadian Dollar CAD

- Swiss Franc CHF

- Chilean Peso CLP

- Chinese Yuan CNY

- Colombian Peso COP

- Costa Rican Colon CRC

- Czech Koruna CZK

- Danish Kroner DKK

- Dominican Peso DOP

- Fiji Dollar FJD

- Guatemalan Quetzal GTQ

- Hong Kong Dollar HKD

- Hungarian Forint HUF

- Indonesian Rupiah IDR

- Israeli Sheqel ILS

- Icelandic Krona ISK

- Jamaican Dollar JMD

- Jordanian Dinar JOD

- Japanese Yen JPY

- Kenyan Shilling KES

- Korean Won KRW

- Kuwaiti Dinar KWD

- Cayman Island Dollar KYD

- Mauritius Rupee MUR

- Mexican Peso MXN

- Malaysian Ringgit MYR

- Norwegian Krone NOK

- New Zealand Dollar NZD

- Omani Rial OMR

- Peru Nuevo Sol PEN

- Philippino Peso PHP

- Polish Zloty PLN

- Romanian New Leu RON

- Saudi Riyal SAR

- Swedish Kronor SEK

- Singapore Dollar SGD

- Thai Baht THB

- Turkish Lira TRY

- Trinidad Tobago Dollar TTD

- Taiwan Dollar TWD

- US Dollar USD

- Uruguay Peso UYU

- Vietnamese Dong VND

- East Caribbean Dollar XCD

- French Polynesian Franc XPF

- South African Rand ZAR

- Brazilian Real BRL

- Qatar Riyal QAR

Delivery options, available branches and fees may vary by value and currency. Branch rates will differ from online rates. T&Cs apply .

Why get your holiday cash from Post Office?

- Order online, buy in branch, or choose delivery to your home or local branch

- 100% refund guarantee* if your holiday’s cancelled, at the same exchange rate, excluding bank and delivery charges. Just send your receipts and evidence of cancellation to us within 28 days of purchase. *T&Cs apply

- Order euros or US dollars to collect in branch in as little as 2 hours

Euros and US dollars in 2 hours

Click and collect euros and US dollars in 2 hours. Terms and conditions apply

Today’s online rates

Rate correct as of 16/05/2024

Travel Money Card (TMC) rates may differ. Branch rates may vary. Delivery methods may vary. Terms and conditions apply

Safe and secure holiday spending

Manage your holiday funds on a Travel Money Card with our free travel app. Top it up, freeze it, swap currencies, view your PIN and more.

New-look travel app out now

Our revamped travel app’s out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user experience. Find out what’s changed .

Need some help?

Travel money card lost or stolen.

Please immediately call: 020 7937 0280

Available 24/7

Travel money help and support

Read our travel money FAQs or contact our team about buying currency online or in branch:

Visit our travel money support page

Other related services

Travelling abroad? These tips will help you get sorted with your foreign ...

We all look forward to our holidays. Unfortunately, though, more and more ...

The nation needs a holiday, and Brits look set to flock abroad this year. The ...

Hoi An in Vietnam is still the best-value long haul destination for UK ...

Our annual survey of European ski resorts compares local prices for adults and ...

The nation needs a holiday. And, with the summer season already underway, new ...

If you’re driving in Europe this year, Andorra’s your best bet for the cheapest ...

One of the joys of summer are the many music festivals playing across the ...

Prepaid currency cards are a secure way to make purchases on trips abroad. They ...

Thinking of heading off to Europe for a quick city break, but don’t want to ...

Knowing how much to tip in a café, restaurant, taxi or for another service can ...

Post Office Travel Money unveils the first Islands in the Sun Holiday Barometer ...

To avoid currency conversion fees abroad, always choose ‘local currency’ ...

Long-haul destinations offer the best value for UK holidaymakers this year, ...

Kickstarting your festive prep with a short getaway this year? The Post Office ...

Eastern Europe leads the way for the best value city breaks this year. And ...

IMAGES

VIDEO

COMMENTS

Post Office® Log in to your Travel Money Card Account is a webpage where you can access your online account for your travel money card, a convenient and secure way ...

Manage your Post Office Travel Money Cards. · Buy and activate new cards in the app. · Add existing Travel Money Cards. · Top up with any of 22 currencies, including US dollars and euros. · Swap funds between different currencies. · Check your PIN, balance, spending, and daily exchange rates. · Freeze your card for security or to limit ...

Manage your Post Office Travel Money Cards. · Buy and activate new cards in the app. · Add existing Travel Money Cards. · Top up with any of 22 currencies, including US dollars and euros. · Swap funds between different currencies. · Check your PIN, balance, spending, and daily exchange rates. · Freeze your card for security or to limit ...

In our travel app: order and store up to three Travel Money Cards in the Post Office travel app. Delivery will take 2-3 days ; Online: follow our application process to order your card online. Your card will take 2-3 days to be delivered. Once it arrives you can link it to our travel app to manage on the go

Simpler, safer holiday spending. Buy, activate, top up and manage your Travel Money Card - for safe, easy payment anywhere in the world. Use the app to move funds between 22 currencies to suit your travel plans. Check your balance, transactions, PIN and daily exchange rates. Make secure payments using your phone or smart device.

play_appsLibrary &. Buy, add, and manage your Travel Money Cards and travel insurance in one place. .

Before leaving the UK, make sure you have activated your Travel Money Card. Activation can be done through the free Post Office Travel app - download now from the Apple App Store or Google Play. The app allows you to top up, track spend, view balances and freeze spend.

The easiest way to purchase or manage your Post Office Travel Money Card

Before leaving the UK, make sure you have activated your Travel Money Card. Activation can be done through the free Post Office Travel app, click the link below to download. The app allows you to top up, track spend, view balances and freeze spend. Activation can also be done by calling our automated line on +44(0) 20 7937 0280.

The savvy way to pay on holiday Travel Money Card. Travel Money Card. A safe-to-use, prepaid, reloadable, multi-currency card that's not linked to your bank account. No charges when you spend abroad*. Make contactless, Apple Pay and Google Pay™ payments. Manage your account and top up or freeze your card easily with our Travel app.

Manage your Post Office Travel Money Cards. · Buy and activate new cards in the app. · Add existing Travel Money Cards. · Top up with any of 22 currencies, including US dollars and euros ...

Australian Dollar - 3 Australian Dollars. Pound Sterling - 1.5 Pounds Sterling plus 1.5% commission. Regarding fees, one final note. There is a three-year validity period on all Post Office Travel cards. After your card expires, you will be charged a maintenance fee of £2 per month.

Pros of the Post Office Travel Money Card. Convenience and Ease of Use: The card is straightforward to obtain and use. Travelers can easily load funds onto the card online or at a Post Office branch. Security Features: The card is not linked to a bank account, reducing the risk of fraud. Additionally, if lost or stolen, it can be easily replaced.

Top up your card in cash at a Post Office or online by purchasing one of 23 different currencies. If you choose to top up in GBP and convert later, you'll be charged an administration fee of 1.5%, from a minimum of 3 GBP up to a maximum of 50 GBP. Exchange rates are shown in the Post Office app, and may include a markup on the market exchange ...

Ordered a Post Office travel card and unfortunately loaded a reasonable sum in USD on 08 April 2024, on the expectation that it would arrive in 2-3 days as advertised on the Post Office portal. After 6 days, no card so this is followed by a telephone call. 43 minutes later, following scripted dialogue from the operator, I move on.

An Post is authorised by the Minister for Finance to provide Foreign Currency Cash. See our currency card terms and conditions. Purchase or top up 15 currencies on a single card with An Post's currency card. Get commission-free foreign currency today with this prepaid credit card.

New-look travel app out now. Our revamped travel app's out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user ...

Google Pay. Add your Travel Money Card to Google Pay™ for fast, simple, secure payments all over the world. Spend on your card via your phone - no need to rummage around for physical cards. Use it anywhere you see the MasterCard™ Acceptance Mark and contactless or Google Pay sign. Simply tap your device for contactless payments with no ...

Our Australia Post Travel Platinum Mastercard app makes managing your travel money faster and easier. Check your balance, reload in-app, track your spending and switch between currencies. Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386837) arranges for the issue of the Australia Post Travel Platinum ...

New-look travel app out now. Our revamped travel app's out now. It makes buying, topping up and managing Travel Money Cards with up to 22 currencies a breeze. Buying and accessing Travel Insurance on the move effortless. And it puts holiday extras like airport hotels, lounge access and more at your fingertips. All with an improved user ...