Tax-Free Shopping in Turkey

Best Places to Experience Istanbul’s Nightlife

Are you planning a shopping spree in Turkey? Did you know that you can save money by shopping tax-free? In this guide, we’ll cover everything you need to know about tax-free shopping in Turkey, from eligibility criteria to claiming tax refunds.

What is Tax-Free Shopping in Turkey? Tax-free shopping, also known as VAT (value-added tax) refund, is a system that allows tourists to claim back the VAT they paid on their purchases in a foreign country. Turkey offers tax-free shopping to non-resident visitors who spend a minimum amount on eligible goods.

Eligibility Criteria for Tax-Free Shopping in Turkey

Tax-free shopping is a great way for travelers to save money on purchases made in Turkey. However, not everyone is eligible for tax-free shopping, and it is important to know the eligibility criteria before making purchases. Here are some of the main eligibility criteria for tax-free shopping in Turkey:

- Non-Residency: To be eligible for tax-free shopping in Turkey, you must be a non-resident of the country. This means that you cannot be a citizen or a permanent resident of Turkey.

- Tourist Status: You must be a tourist to be eligible for tax-free shopping. You should be visiting Turkey for the purpose of sightseeing, leisure, or business travel. If you are a student or a resident who is temporarily out of the country, you may not be eligible for tax-free shopping.

- Minimum Purchase Amount: To be eligible for tax-free shopping in Turkey, you must make a minimum purchase of 108 Turkish liras (approximately $12) from a single store on the same day. The minimum purchase amount may vary depending on the type of store or the product category.

- Exporting Goods: You must export the goods that you have purchased outside of Turkey within three months from the date of purchase. You may be asked to provide evidence of your export, such as a stamp on your passport or a customs declaration form.

- Refund Processing Fee: Some stores or tax refund companies may charge a processing fee for tax refunds. You should check the terms and conditions of the tax refund program before making a purchase.

It is important to note that not all stores in Turkey offer tax-free shopping. You should look for the Tax-Free Shopping logo displayed in the store or ask the salesperson if the store participates in the tax refund program. By knowing the eligibility criteria for tax-free shopping, you can make informed decisions about your purchases and save money on your shopping in Turkey.

How to Get a Tax-Free Refund in Turkey

If you are eligible for tax-free shopping in Turkey, you can get a refund of the Value Added Tax (VAT) that you paid on your purchases. Here is a step-by-step guide on how to get a tax-free refund in Turkey:

- Look for the tax-free shopping logo: When shopping in Turkey, look for stores with a tax-free shopping logo displayed. This logo indicates that the store is a member of the tax-free shopping program.

- Shop and keep your receipts: Make your purchases and keep your receipts for each transaction. It is important to note that you must spend at least 118.00 TL (approximately $15) in a single store to be eligible for tax-free shopping.

- Request a tax-free form: When you are ready to check out, present your passport to the sales associate and request a tax-free form. The sales associate will verify your eligibility and give you the form to fill out.

- Fill out the tax-free form: Fill out the tax-free form with your personal information and the details of your purchases. Be sure to include your passport number, as this will be used to verify your eligibility.

- Get the tax-free form stamped: After you have filled out the form, take it to the customs desk at the airport or another designated location to get it stamped. You will need to show the goods that you purchased, so make sure to keep them with you.

- Claim your refund: Once you have your stamped tax-free form, take it to the designated refund location and present your form and receipts to claim your refund. The refund can be paid in cash or credited back to your credit card.

It is important to note that you must leave Turkey within 90 days of your purchase to be eligible for a tax-free refund. Also, not all stores participate in the tax-free shopping program, so be sure to look for the logo and ask the sales associates if you are unsure.

Benefits of Tax-Free Shopping in Turkey

Tax-free shopping in Turkey comes with a number of benefits that make it an attractive option for tourists looking to indulge in some retail therapy. Here are some of the key benefits of tax-free shopping in Turkey:

- Savings on purchases: The most obvious benefit of tax-free shopping is the savings you can make on your purchases. With tax-free shopping, you can enjoy discounts of up to 18% on the price of your purchases, which can add up to significant savings, especially if you are making high-value purchases.

- Hassle-free refund process: The tax refund process in Turkey is relatively easy and hassle-free, with a number of refund points available at airports and shopping centers across the country. This means that you can claim your refund quickly and easily without having to navigate complex procedures.

- Access to a wide range of products: Turkey is home to a vibrant retail scene, with a wide range of products available, from high-end fashion and luxury goods to traditional handicrafts and souvenirs. Tax-free shopping in Turkey means you can access this diverse range of products at discounted prices.

- More spending power: With tax-free savings, you can stretch your budget further and have more spending power to enjoy other activities during your trip, such as dining out, sightseeing, or taking part in cultural events.

- Souvenir shopping: Turkey is known for its traditional handicrafts and souvenirs, such as carpets, ceramics, and textiles. Tax-free shopping makes it easier and more affordable to take home these unique and authentic souvenirs as a reminder of your trip.

Overall, tax-free shopping in Turkey is a great way to save money while enjoying the diverse range of products and shopping experiences that this vibrant country has to offer.

Tax-Free Refund Options in Turkey: Cash or Credit Card?

When shopping in Turkey, tourists have the opportunity to take advantage of the tax-free shopping and receive a refund on the VAT (Value Added Tax) they paid on their purchases. One question that often arises for those who are eligible for tax-free shopping in Turkey is how they will receive their refund. The options for receiving a tax-free refund in Turkey are typically cash or credit card.

For those who opt for a cash refund, the process is fairly straightforward. After completing their purchases, shoppers must go to the tax refund desk at the store or at the airport before departing Turkey. At the desk, shoppers will need to present their passports, receipts, and tax-free shopping form, and they will then receive their refund in cash.

On the other hand, for those who prefer a credit card refund, the process is slightly different. When completing their tax-free shopping form, shoppers will need to provide their credit card information, including the card type, number, and expiration date. The refund will then be processed and credited back to the shopper’s credit card.

It’s important to note that some tax refund companies may charge a fee for processing credit card refunds. Additionally, the time it takes to receive a credit card refund may vary, depending on the processing time of the credit card company.

Ultimately, the decision to receive a tax-free refund in cash or on a credit card will depend on personal preference and convenience. Those who prefer to have cash in hand may opt for the cash refund option, while those who prefer the convenience of a credit card refund may choose that option instead. Either way, tax-free shopping in Turkey can provide significant savings on purchases and is a great way for tourists to take advantage of the country’s shopping opportunities.

Popular Tax-Free Shopping Brands and Centers in Turkey

- Harvey Nichols

- Istinye Park Shopping Center

- Kanyon Shopping Center

- Zorlu Center

- Akmerkez Shopping Center

- İstiklal Caddesi (Istanbul’s popular shopping street)

- Grand Bazaar

- Spice Bazaar

- Atatürk Airport

- Sabiha Gökçen Airport

- Antalya Airport

In conclusion, tax-free shopping in Turkey is a great way for visitors to save money on their purchases. It is important to keep in mind the eligibility criteria, the process of claiming refunds, and the benefits that come with it. Shopping at popular shopping districts and malls, such as Istinye Park, Zorlu Center, and Kanyon can also provide great opportunities for tax-free shopping. However, it is important to be aware of common mistakes to avoid and tips for maximizing tax savings. With a little bit of preparation and knowledge, tax-free shopping in Turkey can be a hassle-free and enjoyable experience.

Tax-free shopping in Turkey is a program that allows visitors to claim a refund on the value-added tax (VAT) they paid on eligible goods purchased in the country. The refund can be up to 18% of the purchase price, depending on the product category.

Foreign visitors who reside outside of Turkey are generally eligible for tax-free shopping, as long as they comply with certain requirements. This includes making purchases from approved merchants, spending a minimum amount on each transaction, and leaving the country within a specified timeframe.

To claim a tax refund in Turkey, you need to obtain a Tax-Free Shopping Cheque from the merchant at the time of purchase, and then present the cheque and your passport at a customs office when leaving the country. You can then either receive a cash refund at the airport or use a refund service to receive the money via credit card or bank transfer.

The main benefit of tax-free shopping in Turkey is that it allows visitors to save money on their purchases since they can receive a refund on the VAT paid. This can be particularly useful for big-ticket items, such as electronics or luxury goods. Additionally, tax-free shopping can be a way to experience the local culture and shopping scene, as visitors can explore the many bazaars, markets, and shopping malls in Turkey.

Some common mistakes to avoid when claiming a tax refund in Turkey include not complying with the eligibility criteria, failing to obtain the Tax-Free Shopping Cheque at the time of purchase, and not presenting the necessary documentation at the customs office. It’s important to read the instructions carefully and ask for help if you’re unsure about the process.

Most products are eligible for tax-free shopping in Turkey, including clothing, jewelry, electronics, and souvenirs. However, certain categories may have different refund rates or minimum spending requirements, so it’s best to check with the merchant or the tax refund service for details.

The tax-free shopping regulations in Turkey are subject to change, and there have been discussions about introducing a digital refund system and expanding the program to include services such as hotels and restaurants. It’s always a good idea to stay up-to-date on the latest regulations and requirements when planning your tax-free shopping in Turkey.

The Best Museums in Istanbul

The Best Beaches Near Istanbul

The Best Turkish Baths (Hamams) in Istanbul

Istanbul.tips

The Best of Istanbul in One Place

Tax-Free Shopping at Istanbul: Tax Refund at the New Istanbul Airport IST (2024 Rules)

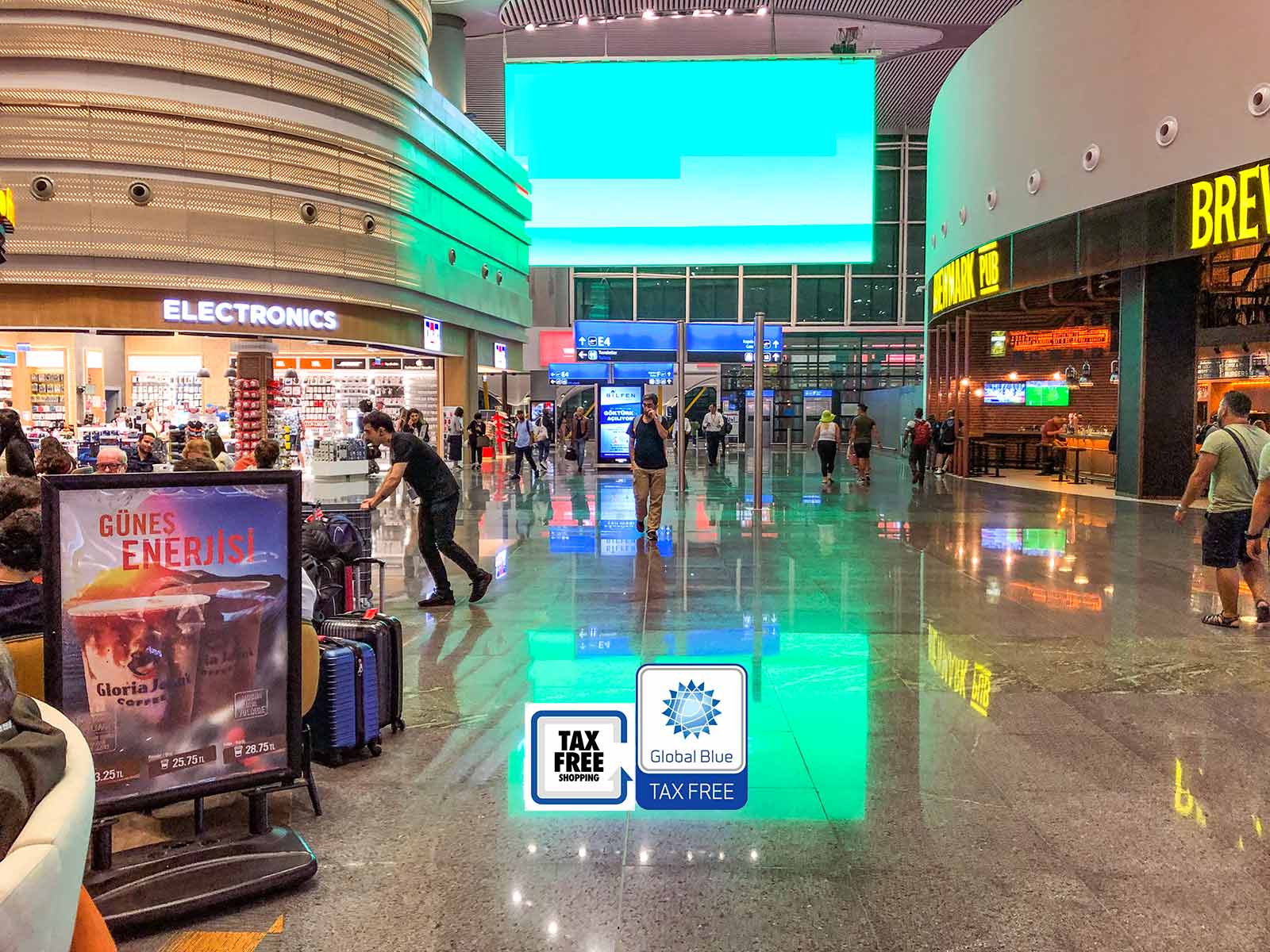

Are you planning to visit Istanbul and wondering how to make the most out of your shopping experience? Well, we have good news for you! Istanbul Airport offers a seamless tax-free shopping experience, allowing you to enjoy your purchases and even get a tax refund easy and fast. In this guide, we’ll walk you through the process of claiming your tax back at Istanbul Airport, and provide you with tips and recommendations on how to make a tax refund at Istanbul Airport.

Page Contents

🚗 First Time in Istanbul? Be Prepared & Carefree!

Istanbul: Private Airport Transfer with Meet and Greet 🌟 4.4 / 5 (318 reviews)

Istanbul: Turkey and Europe eSIM Roaming Mobile Data 🌟 4.1 / 5 (216 reviews)

Istanbul: Full-Day Highlights Tour with Guide and Lunch 🌟 4.5 / 5 (1101 reviews)

Tax Free Shopping in Istanbul: How?

Tax-Free Shopping is a program that allows non-resident visitors to claim back the Value Added Tax (VAT) they paid on purchases made during their stay in a foreign country. The benefits of tax-free shopping include saving money and getting a refund on the taxes you paid.

In Turkey, the VAT rate is 18%. To be eligible for a tax refund, the minimum purchase amount is 100 TL (approximately 12 USD) and the refund rate is an average of 3.25% (max). At Istanbul Airport, most shops offer tax-free shopping, and you can get a tax refund on items such as sunglasses, clothing, and electronics.

Who is Eligible for Tax Free Shopping in Istanbul?

Shoppers who are permanent residents outside Turkey and have not spent more than 6 months in Turkey are eligible for tax-free shopping and tax refund services for eligible purchases.

Tax-Free Goods and Non-Refundable Goods in Turkey

Not everything is suitable for a tax return. Here are some examples of tax-free goods that are eligible for a refund:

- Clothing and footwear

- Jewelry and watches

- Electronics

However, there are also some non-refundable goods, such as:

- Services (such as hotel stays, car rentals, and restaurant bills)

- Food and drink items

- Tobacco and alcohol products

Make sure to check with the store before making a purchase to confirm if the item is eligible for tax-free shopping and refund.

How Long Do I Have to Validate my Global Blue Tax-Free Form and Claim my Refund?

When you receive the Global Blue Tax Free Form, make sure to validate it within 3 months from the issuing date of the form. Additionally, the stamped form is only valid for 3 months from the date of the Customs stamp. Keep in mind these time limits to ensure you can claim your tax refund successfully.

How to Make Tax Refund at Istanbul Airport

Great, here are the simple steps to get your tax refund:

- When making a purchase, ask for a Global Blue Tax Free Form from the store.

- Fill out the form with your personal information and keep the receipts

- After making all your purchases and collecting all the coupons for refunds from the shops, put all the items in one suitcase (or bag) without removing the price tags.

- At the airport, head to the designated area for your flight and print your boarding pass. If you need any help, don’t hesitate to ask the attendant next to the machine.

- Move to the counter for handing over your luggage (suitcases) and let the attendant know that you need to get a tax refund, they would help you.

- Get Customs Validation

Tax Refund at Istanbul Airport For Passengers with Baggage

If you have Baggage , you can proceed to the customs points located at the check-in counters numbered G3-4-5 for approval procedures. Once the customs officer approves the form, you can proceed to the next steps to claim your tax refund.

Tax Refund at Istanbul Airport For Passengers with Hand Luggage

If you intend to carry your items onto the plane as hand luggage, and not have them delivered to the check-in counters as baggage, you can complete customs clearance at the customs office located on the right after the passport control point.

- When you’re ready to receive your refund, visit any Global Blue Refund Office or Kiosk at Istanbul Airport. Present the validated Tax Free Form and get your refund.

With these simple steps, you can easily claim your tax refund and enjoy your shopping experience at Istanbul Airport. If you have any questions, feel free to ask. Have a great trip!

Don’t Miss The Best Tours and Cruises in Istanbul

Istanbul airport tax free shopping guide.

Istanbul Airport offers a wide range of shops for tax-free shopping, including luxury brands, electronics, Turkish souvenirs, and more. Some of the best shops for tax-free shopping at Istanbul Airport include:

- Michael Kors

- Tiffany & Co.

Popular items to buy at Istanbul Airport duty-free shops include Turkish delight, Turkish coffee, baklava, Turkish rugs, and ceramics. For travelers looking to buy electronics, Istanbul Airport offers a variety of options such as Apple, Samsung, and Sony.

We’d love to suggest checking out our article titled “Duty-Free Shopping at Istanbul Airport: Your Ultimate Guide “ . It’s packed with useful information about the best shops for tax-free shopping at Istanbul Airport, along with tips and recommendations to help you get the most out of your duty-free shopping experience. We hope you find it helpful!

To find the best deals and discounts, we recommend checking the promotions and offers available at the airport. Istanbul Airport offers a loyalty program called Shop & Miles . This program allows you to earn miles for your purchases.

Istanbul Airport Tax Free Shopping Tips

To make the most out of your tax-free shopping experience at Istanbul Airport, consider these tips:

- Before making a purchase, compare prices and check the refund rate.

- Keep your receipts and tax-free forms organized.

- Don’t forget that there is a time limit for validating your Global Blue Tax Free Form. The form must be validated within 3 months from the issuing date of the form.

- Pack your tax-free purchases in your carry-on luggage to avoid damage.

- Declare your purchases at customs if required by your country of destination.

Conclusion: Fastest and Easiest Way to Get Your Tax Free Refund

Tax-free shopping at Istanbul Airport is a great way to save money and enjoy your shopping experience to the fullest. With this guide, you have all the information you need to claim your tax back and make the most out of your tax-free shopping experience. So, what are you waiting for? Start planning your tax-free shopping spree at Istanbul Airport today!

Istanbul Airport Tax Free Shopping FAQs

- Can you claim your tax back at Istanbul Airport? Yes, Istanbul Airport offers tax-free shopping and tax refund services for eligible purchases.

- How much is the tax-free refund in Turkey? The tax-free refund in Turkey is an average of 18% (max) of the purchase amount.

- How long does it take to get your tax refund? The time it takes to receive your tax refund may vary, but you can expect to receive it on the same day of your departure.

- Are there any restrictions on the amount of tax you can claim back? Yes, there are restrictions on the amount of tax you can claim back depending on the country and the type of product you purchased.

VAT Refund Guides All Over the World from Travel Tips Media

Tax-Free in Paris: How to Get VAT Refund in France 2024

Tax-Free in Phuket: VAT Refunds 2024 – A Guide for Travelers

Related Post

Istanbul in may: weather & things to do, events in 2024, explore maltepe in istanbul (asian side): things to do & see, hotels, restaurants (2024), traveling in istanbul with a baby: places to see and tips for a pleasant vacation, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Best Food Delivery Apps in Istanbul: How to Order Food In

April weather in istanbul: the ultimate guide for travelers (2024), how to make turkish coffee: step-by-step recipe.

Turkey Solved

Tax Refund In Turkey: All You Need To Know

Exploring the vibrant bazaars and breathtaking landscapes of Turkey can be even more rewarding if you understand the nuances of the Turkish tax refund system , Right? Don’t worry! We’ve got you covered for this!

Whether you’re a tourist seeking a refund on your shopping splurges or a resident navigating tax returns, this guide sheds light on how to reclaim your dues from the Turkish tax system. Let’s unravel the process, making sure you get every lira you’re entitled to.

Let’s dive in!

What Is The Vat (Kdv) Rate In Turkey?

The VAT (KDV) rate in Turkey varies depending on the type of goods or services being purchased. As of September 2021, the standard VAT rate in Turkey is 18%.

However, some goods and services are subject to reduced rates or exemptions. For example, basic foodstuffs, books, and some medical goods and services are subject to a reduced VAT rate of 8%.

Certain goods and services, such as exports and international transportation, are exempt from VAT.

It’s important to note that VAT is included in the price of goods and services in Turkey. When you make a purchase, the price you see on the label or the receipt will include VAT.

If you are eligible for a VAT refund, you can claim back the VAT you paid on your purchases minus any fees charged by the refund service provider.

Who Is Eligible To Get A Vat (Kdv) Refund?

In Turkey, visitors who are not residents of Turkey and who are leaving the country permanently are generally eligible to get a VAT (KDV) refund.

This means that if you are a tourist or a foreign national living in Turkey temporarily and leaving the country, you may be eligible for a VAT refund on goods purchased during your stay.

You need to meet some conditions to be eligible for a VAT refund in Turkey.

These conditions include: You must have a valid passport or travel document showing your entry into Turkey and departure from the country.

You must have purchased from a VAT-registered business participating in the VAT refund scheme. Look for the “Tax-Free Shopping” sign or ask the shop if they offer VAT refunds.

The total value of your purchases, including VAT, must be over the minimum amount set by the Turkish government.

As of September 2021, this minimum amount is 118.15 TRY . You must have the original receipts or invoice.

What Is The Tax Refund System In Turkey?

The standard VAT rate in Turkey is 18% . Turkey will reimburse between 10.5 % and 12.5 % of the amount you spend on products subject to standard VAT rates during your trip.

How Are Tax-Free Refunds Calculated In Turkey?

It can be challenging to figure out how much you will be reimbursed in Turkey and other countries that offer tax-free shopping.

First of all, to find out how much your tax-free refund will be, there are two things you need to know:

- The VAT rate in Turkey

- The VAT status of the product you purchased

We will use an example to try to explain how much your tax-free refund will be. Turkey applies an 18% VAT rate to its products.

In other words, of a 1200 TRY purchase, 183 TRY of that purchase goes towards tax.

Therefore, you should get 183/1200 or 15.3% of your tax-free purchase back; however, it is impossible to recover this entire amount fully.

Another thing you need to know when calculating your tax-free refund in Turkey is that you need to work with an intermediary refund agent to get your tax-free payment.

Although Planet Payment and Global Blue are the two most popular companies in this regard throughout Europe, other companies may mediate local or smaller tax-free transactions and can vary by country.

The commission these intermediary companies receive may also affect the amount you can get back.

These companies usually deduct a percentage from the total refund you will receive. The higher the prices of the products you buy, the lower the deduction percentage will be.

Since the commission received by tax-free refund agents can vary from company to company, this page will help you calculate tax-free refunds in Turkey.

The total amount you receive back will depend on the company, whether you want your refund in cash, and whether the payout credited to your account will be subject to currency conversions.

What Are The Documents Required For The Digital Customs Validation?

- Personal Details And Passport: You’ll need to have your passport or other valid travel document with you, as well as your personal information, such as your name, address, and contact information.

- Tax Free Form: You must have the Tax Free Form you received from the retailer when you purchased. This form must be fully completed with your details, the retailer’s details, the value of the goods purchased, and the amount of VAT paid.

- Purchased Goods: You’ll need to have the goods you purchased with you, as customs officials may ask to see them to verify that they are being taken out of the country.

You must have all three of these documents with you to complete the digital customs validation process for a VAT (KDV) refund in Turkey.

Without them, you may not be able to claim your refund.

Moreover, some retailers may have different procedures for issuing Tax-Free Forms, so it’s always a good idea to check with the retailer before purchasing to ensure you have all the necessary documentation.

How To Get A Tax-free Refund In Turkey?

The 4 steps necessary in Turkey to get tax back on your shopping:

- Choose stores that offer tax-free shopping .

- Have the necessary tax-free forms filled out at the store.

- Get your tax-free form verified by customs at the airport.

- Visit the airport offices of the tax refund company you work with.

Once you have completed these 4 steps, you can receive your tax-free refund from Turkey.

Thus, you will get the products you bought in Turkey for even less. Let’s take a look at each of these steps more closely.

Choosing A Tax-Free Shop

Generally, when you shop for large, global brands, these brands will have tax-free agreements, and the paperwork should be no problem.

You should ask whether it is possible to get a VAT refund when you enter the store.

You can make the process easier by choosing stores with the words “Tax-free” on their showcases.

Completing The Required Tax-free Form At The Store

At this stage, all you have to do is mention that you are a visitor from abroad and would like to benefit from tax-free shopping.

The store clerk will prepare the necessary documents to be filled out. All you will have to do is sign the documents.

Get Your Form Verified By Customs At The Airport In Turkey

You must have your tax-free form approved by customs before you leave the country. The customs officer may want to check the products you purchased.

According to tax-free regulations, all products bought in Turkey must remain unused until they leave the country.

It may take some time to process your tax-free refund at the airport. Therefore, we recommend that you be at the airport a minimum of 1 hour in advance of your usual arrival time.

Visit The Airport Offices Of The Tax Refund Company You Work With

After your tax-free form has been approved, you need to go to the office of the tax refund company you are working with to receive your tax-free refund.

If you depart from a large airport, you can simply locate their offices via the company’s or the airport’s website.

You must fill out a form stating how you want to receive your tax-free refund payment.

You can get it refunded to your credit card once you return to your country or ask to receive cash at the airport by paying an extra commission.

Cash tax-free refunds are not available at all airports. However, if using a heavily trafficked airport in Turkey, you should be able to receive payment in cash.

What Are The Other Things To Know About Tax-free Refunds In Turkey?

Tax-free refunds are available to people traveling to Turkey for tourist purposes. In other words, if you have a residence permit for the country you are visiting, getting a refund will not be possible.

You need to reach a minimum purchase threshold to get a tax-free refund. You cannot get tax-free reimbursement for expenses below this limit.

The minimum purchase threshold is calculated per invoice .

That is to say, if you make multiple separate purchases below the minimum threshold, even if the total exceeds the minimum threshold, you will not be able to get tax-free compensation.

Refunds for tax-free purchases in Turkey are only valid for VAT. You can also deduct the VAT fees applied to the commission charged by your tax refund company.

As we wrap up our guide to securing a tax refund in Turkey, remember, navigating this process successfully can lead to substantial savings.

This guide aims to empower you, whether you’re shopping in Istanbul’s grand markets or a part of Turkey’s dynamic economy, to understand and utilize the tax refund system to your advantage.

Refund Reclaimed!

But wait! There’s lot more that you might be interested in following:

- Tax Number In Turkey

- Tax Declaration In Turkey

- Income Tax Brackets In Turkey

Similar Posts

Tax Declaration In Turkey: Step-By-Step Guide

Navigating the tax declaration process in Turkey and need help? Whether you’re a local business owner, a foreign investor, or a working expat, understanding Turkey’s tax system is crucial for financial compliance and peace of mind. Don’t worry! We’ve got you covered! This guide will take you through the labyrinth of tax declarations in Turkey,…

Tax Consulting In Turkey: An Expats Guide

Diving into the complex world of Turkish taxation can feel like navigating the bustling Grand Bazaar—exciting yet overwhelming, right? Worry Not! We’ve got your back! Whether you’re a thriving business or a newcomer to the Turkish market, the right tax consulting can illuminate the path to fiscal compliance and optimization. This guide is your compass…

Income Tax Brackets In Turkey: Explained

Venturing into the world of income tax in Turkey? Understanding the country’s tax brackets is essential for anyone earning or doing business in this transcontinental nation. We’ve got your back dear expats! From the bustling bazaars of Istanbul to the coastal retreats of Antalya, our guide simplifies the Turkish income tax system, helping you navigate…

Tax Number In Turkey: An Expats Guide

Embarking on financial endeavors in Turkey? A tax number is your indispensable companion. Whether you’re a budding entrepreneur, a property investor, or simply a resident handling fiscal affairs, securing a Turkish tax number is a fundamental step. Worry not! We’ve got you covered for this! Our guide offers a clear path through the process, from…

Tax Return Software In Turkey: A Simple Guide

Navigating the labyrinth of tax returns in Turkey doesn’t have to feel like a voyage through the unknown. Looking to explore tax return software in Turkey? Don’t Worry! We’ve got you covered! With the right tax return software, what once seemed like deciphering ancient hieroglyphs can become as straightforward as sipping a cup of Turkish…

Turkish Tax System: How It Works

Venturing into the bustling economic landscape of Turkey? Understanding the Turkish Tax System is a pivotal piece of the puzzle for businesses and individuals alike. Worry not! We’ve got you covered for this! From the vibrant markets of Istanbul to the sunny shores of Antalya, this guide demystifies the complexities of Turkish taxes, providing clarity…

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Tulips in Istanbul – April to May

- Snowing in Istanbul Walking Tour in freezing cold weather with captions

- 24 Istanbul videos to inspire you before you come here.

- 24 place in Istanbul to see. Video on Youtube

- Youtube – Istanbul

- Corona Istanbul Turkey

- Leander’s Tower (Maiden’s Tower) Istanbul

- 10 things you need to know about Istanbul

- 7 Public Bazaar (Open Market) in Istanbul

- Bakırköy – Istanbul

VAT and tax-free shopping

The value-added tax (VAT) is always included in the prices displayed. But as a tourist, you can benefit form Tax Free shopping in over 2.000 retail outlets.

Tax Free Shopping On every purchase you make in Turkey, a value-added tax (KDV) is included in the price. As a tourist, you can claim that tax back and retrieve a refund some amount of the purchase price. There are however a few rules:

1. you must reside outside of Turkey 2. you must spend TL 108 + VAT or more in one shop in one day 3. the goods need to be exported within three months following the month of purchase 4. you must buy the goods in Tax Free affiliated stores (look for the Tax Free logo) 5. you must ask the shop owner to prepare the Global Refund Cheque when paying for your goods

How to retrieve your money?

Customs Office in the Atatürk International Airport of Istanbul Regardless of how you travel back home, you have to find the Customs Officers. You need to show the custom officials your purchases, Global Refund Cheques, receipts and passport after which they will stamp your Global Refund Cheque. If you travel by plane, you have to do this before all check-in formalities or have your goods as hand luggage. At the Atatürk International Airport, the customs office is located across the hall on the far right side upon entering.

Once you have your stamped Global Refund Cheque, you can retrieve your money in any Cash Refund Office in the world. The one at the Atatürk International Airport is located inside the tax-free zone and is open 24 hours a day.

Related posts

Leave a reply Cancel reply

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Executive summary

Accommodation Tax started to be applied as of 1 January 2023 in Turkey.

Accommodation Tax is imposed on:

- Overnight services provided in accommodation facilities.

- All other services such as eating, drinking, activity, entertainment services and the use of pool, sports, thermal and similar areas, which are sold together with the overnight service and provided at the accommodation facility.

Accommodation operators are required to collect a 2% accommodation tax either from their guests or agencies over the service fees. The tax is to be paid by declaring it to the Revenue Administration within the following month.

Detailed discussion

Accommodation Tax was first introduced into the Turkish tax legislation in 2019, but its implementation was postponed until 1 January 2023, largely due to the pandemic.

Following the promulgation of the General Communique on Accommodation Tax Application on 14 December 2022, this tax entered into force on 1 January 2023.

The subject of the Accommodation Tax is basically overnight services provided in accommodation facilities.

There is no restriction in terms of accommodation facilities in the relevant legal regulations. Overnight services provided in all facilities providing accommodation services, regardless of the type, class, quality of the facility, and whether it has a tourism operation certificate and/or a business establishment/operation certificate according to the relevant legislation are taxable.

Accordingly, overnight services offered in hotels, holiday villages, boutique hotels, private accommodation facilities, motels, hostels, apart hotels, thermal facilities, wellness facilities, farmhouses, village houses, and camp sites, among others, are subject to the tax.

All other services such as eating, drinking, activities, entertainment, use of pool, sports, thermal and similar areas, etc. are also subject to the tax if they are sold with overnight services and are provided at the accommodation facility. In this context, all services provided within the scope of the concepts such as bed & breakfast, half pension, full pension, all-inclusive, ultra-all-inclusive and similar are subject to the tax.

Rate and base of tax

The applicable rate is 2%. This tax will be calculated over the service fees falling into the scope of tax.

Liable party

Accommodation facility operators are subject to the tax. They will calculate and collect the tax either from their guests or travel agencies and will pay it by declaring it to the Revenue Administration within the following month.

Liabilities

The main responsibilities of accommodation facility operators are as follows:

- Establishing Accommodation Tax Liability prior to the commencement of operations, after the accommodation facility is fully or partially ready for operation.

- Calculating and showing the tax amount on invoices and other similar documents

- Filing the Accommodation Tax Declaration for each month by the 26th day of following month.

- Paying the collected tax amount to the Revenue Administration during the same time period.

- Retaining and upon request submitting information and documents proving the scope of the service provided and the concept in which the guest receives the service in question such as announcements, advertisements, pre-contracts, offers, reservations, contracts, and similar documentation.

Penalty provisions stated in the Tax Procedural Law are applicable for those who do not comply with the provisions regulating the Accommodation Tax.

In accordance with the legal regulations regarding the Accommodation Tax, if the following cases are determined by the Revenue Administration, unforeseen costs such as tax assessment, delay interest, tax loss penalty or irregularity penalties may be imposed on the taxpayer:

- Failure to establish Accommodation Tax liability

- Failure to submit the Accommodation Tax Declaration on time or an incomplete declaration of the tax base in the declaration

- Failure to comply with obligations such as certification, preservation and submission determined by the Tax Procedure Law

Further legislation or arrangements regarding the Accommodation Tax have not been published yet as of publication of this Alert. Thus, additional legislative information or arrangements are expected to be published to determine the additional details on its application, such as liability establishments and declarations.

_________________________________________

For additional information with respect to this Alert, please contact the following:

Kuzey Yeminli Mali Müsavirlik A.S. Istanbul, Turkey

- Yakup Gunes | [email protected]

- Aynur Curguc | [email protected]

The information contained herein is general in nature and is not intended, and should not be construed, as legal, accounting or tax advice or opinion provided by Ernst & Young LLP to the reader. The reader also is cautioned that this material may not be applicable to, or suitable for, the reader's specific circumstances or needs, and may require consideration of non-tax and other tax factors if any action is to be contemplated. The reader should contact his or her Ernst & Young LLP or other tax professional prior to taking any action based upon this information. Ernst & Young LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect the information contained herein.

Copyright © 1996 – 2024, Ernst & Young LLP

All rights reserved. No part of this document may be reproduced, retransmitted or otherwise redistributed in any form or by any means, electronic or mechanical, including by photocopying, facsimile transmission, recording, rekeying, or using any information storage and retrieval system, without written permission from Ernst & Young LLP.

EY US Tax News Update Master Agreement | EY Privacy Statement

How to Get TAX FREE Refund?

- How to Travel After Coronavirus?

- Telephone Abroad Usage

- Istanbul Airport Transportation

- History Shops in Turkey

- TAX FREE Refund

- Central Anatolia

- Mediterranean

- Beykoz Glass Museum

- Istanbul Butterfly Farm

- Istanbul Skateboarding Parks

- Nezahat Gokyigit Botanical Garden

- Sakura Time in Istanbul

- Abant in Winter

- Suluklu Lake

- Yedigoller & Abant Appointment

- Yedigoller in Winter

- Benelux European Tour

- Deutschland

- Volendam and Marken

- Travel Guide

- Privacy Policy

A certain part of the shopping you have made during your trips abroad is tax-free. How is “TAX FREE”, which is valid in almost all countries, ie tax refund calculated and how to get a refund? Especially recently, we answered the frequently asked questions about tax refunds in overseas iPhone and phone shopping. What is this Tax Free?

What is Tax Free?

You can get a tax-free refund of the taxes collected from you for the products or services you have purchased during your stay abroad. Moreover, let’s try to briefly explain how to get Tax refund step by step.

İçindekiler / Index

The laws valid in the vast majority of countries in the world today guarantee that the Tax can only be collected from the citizen, but not from the citizens of other countries or tourists.

For this reason, foreigners (tourists, students or temporary residents) should receive a refund of the amount of tax they paid for their expenditures in the country they are in. Value added tax paid during shopping abroad can be fully refunded.

Each country may have its own Tax Free return policy . It can only be valid for purchases above the specified limits. In fact, some countries may not refund TaxFree for service category such as hotel, tour and transportation.

Before you go to the country you will travel to, you may need to check the VAT Tax Free conditions of that country on the official website. If you have international tax refund procedures, go to the airport at least 45 minutes before . Depending on the density, your transactions may take a long time. It is a good idea to arrive early so that your flight is not compromised.

Tips for Tax-Free Shopping Abroad

Whether you go to any country abroad for vacation or business, we enjoy shopping by purchasing products or services specific to that country. We shop from many product groups such as souvenirs, clothes, cosmetics and electronics as much as economic conditions allow.

We can easily find products of brands and models that are not sold in our country, especially in countries abroad.

– But do I have to pay taxes abroad? If you are one of those who ask, I advise you to carefully read what I am going to tell you now. me..

Tax Free Shopping Abroad

Tricks of tax-free shopping known as Tax Free all over the world. We have answered your questions about tax-free shopping, which is perhaps the most fun part of traveling abroad. We explain step by step what you need to do before and after shopping about 100% effective tax free return methods .

It is worth remembering that the Tax Free system is a concept that only applies to live purchases that you make physically. In other words, Value Added Tax is not applied to your internet shopping from overseas online stores. For this reason, Tax Free refund of the non-tax is not made, as no tax is charged to you.

What to Do Before Shopping Abroad

While you are abroad, there should be a logo similar to the “ Global Blue Tax Free ” below on the showcase, entrance door or cashier section of the store you want to shop at. Stores or workplaces with this logo mean the place where Global Tax Free Shopping can be done.

If you can’t see this logo, ask the staff “ Can I shop tax free? ” ask. When you get a Yes answer from the store clerk, enjoy your tax-free shopping.

You entered the store for shopping in any country abroad, such as the Netherlands, Germany, Bulgaria, Greece, Georgia, Ukraine, America or Russia. The tax rates (VAT) will be different for each country. For example, in Spain tax rates are between 10%-16%, while in Luxembourg almost 0% tax is applied. Tax rates vary according to the welfare level of the countries.

IMPORTANT WARNING! For Tax Free, that is, tax-free shopping abroad, you need to physically purchase from the store in that country. In other words, you cannot get Taxfree refunds for products you buy from online stores operating in a foreign country while you are in your home country. Because foreign virtual shopping stores issue your invoice tax-free and there is no refund of non-tax.

Step by Step What You Need To Do For Tax Free Refund

How to apply for Tax Refund Abroad?

- Fill your cart according to your taste and come to the checkout section of the store for payment.

- The cashier can make direct tax-free sales by requesting your bank account information, passport and other identity information. This is the easiest tax-free form of shopping. This method is mostly used in our country.

- Another method is to issue the Tax Free Return Form, which is necessary for you to receive the tax amounts on your invoice at the airport. They will then deliver this form to you in a sealed envelope. They paste a barcode or QR code on the envelope. You are requested not to open this envelope until the Customs and Tax Free Office at the airport .

- Please keep the Return Form, Invoice and products delivered to you in an envelope without opening the package in order to be able to make a tax refund. Customs officials may want to see the product package unopened. However, I have never seen an officer checking the products one by one until today.

- When you arrive at the airport when you leave the country you are in, go to the Customs (Finance) Office after the Check-in procedures and just before the Passport Control and have the Tax Free Return Forms for your shopping approved by the officer. The Tax Free office never accepts forms not approved by the Customs Office. For this reason, be sure to complete your transactions at the Customs Office before passport control.

- Shopping Invoices and slips (included in envelope),

- Tax Return forms (included in envelope),

- Your bank information (Credit card number or IBAN number),

- Your contact information and

- They want your passport.

- The final step is the tax refund. Some tax refund companies make instant payments in cash, while others make EFT payments to your account number after 30 days. Global Blue offices usually pay cash. However, other Tax Free companies pay by money order or eft after a certain period of time.

Brussels Travel Guide

Tax Free Calculator

How is tax refund calculated for your purchases abroad?

Based on the term “ Tax Free Calculation “, which is frequently searched in internet search engines, I felt the need to make an explanation here. There are many applications and tools that make Tax Free accounts in the application markets and on the internet.

However, since the tax rates of countries change frequently, the margin of error is high. Tax rates vary even by category.

That’s why you shouldn’t rely too much on tax calculation tools. Instead, the invoice given to you at the time of purchase abroad clearly shows how much tax each product has. The most accurate and precise information is the rates written on the product invoice.

Tax Free calculation tools can only give you a prediction. It is not possible to get a clear result.

Where and How to Do Tax Free Shopping in Turkey?

In fact, Tax Free transactions are much easier in Turkey compared to many foreign countries. Tax-free shopping can be done in all stores with the Tax Free logo on the showcase glass. Companies called Global Blue Tax Free (Blue Logo) and Tax Free Zone (Red Logo) provide services in Turkey.

Tax Free Shopping Conditions in Turkey

- Foreign nationals coming to Turkey, dual citizens and Turkish citizens with a valid residence abroad. citizens can benefit.

- Not staying in Turkey for more than 6 months in the last 1 year.

- To shop worth at least 100TL + 18% VAT, i.e. 118 ₺ , or 100TL + 8% VAT, that is, 108 ₺ . You cannot get a tax refund for your spending below this limit.

- Only physical product-based shopping. In other words, you cannot get a tax refund for expenses in the service category (accommodation, flight tickets, transportation, etc.).

- Keeping the products you purchased while leaving Turkey in an intact (unused) condition.

- You must have the Tax Free invoiced products you purchased approved by the Customs Enforcement Office within 3 months.

Steps to Get Tax Free Tax Refund in Turkey

- Purchase a product/products with a minimum amount of 100 ₺ + VAT at a shop with the Tax Free logo.

- Request an Invoice in Tax Free format from the cashier before paying.

- Keep the original packaging of the product you purchased until the day of your flight.

- Have it approved by the officer in charge at the Customs Enforcement Office after the check-in process at the airport on the day of departure from Turkey.

- After passing through passport control, collect the tax refund fee from the Tax Free Office.

Tax Free Return Policies by Country

There is a common Customs Union agreement between European Union countries. For this reason, you can get your tax refund back in the country of origin for your purchases from member countries. For example, you went to Lisbon , Portugal, and you will exit from an airport in Spain, France, the Netherlands and Germany. Here, you have to complete the refund process of the taxes you have paid in all these countries in Germany.

How to Make Tax Free Transactions in Spain? (Very Difficult to Take)

I remember that I struggled for tax free during my trip to Spain about 2 years ago. In the cities of Barcelona and Seville , I made shopping mainly for Zara and electronics, amounting to 5.000 ₺ . After about 1 month for this shopping, approximately 600 ₺ tax refund was deposited into my account. However, they give you all kinds of difficulties in order not to receive this refund. If you are patient and follow what I say, you can easily get your tax refund.

Things To Do During Shopping:

I shopped at shopping centers called “ El-Corte Ingles ” in almost every city in Spain. Did I have all the invoices approved at the tax office of the shopping mall in Barcelona?

Things to do at the Airport:

I came to Barcelona El-Prat Airport to return to Istanbul. Here I did the Check-in process first. Immediately after, I came to the office with the “Custom Tax Office” sign.

Here, the staff told me to have the kiosk scan the barcode on the sealed envelope containing the Tax Free form. I also read. Are you sure on the screen? There were questions such as: I approved all of them and saw the green OK text. Officer:

After going through the Passport Control, he told me to go to the counter of the Tax Free company and deliver the envelope. I said okay.

After going through passport control, I found the counter that the officer said. However, they asked me to go to the Customs office again just to avoid a tax refund. They said it was a mistake and I had to fix it.

-Well, I passed the passport control, how do I get back to the Customs Office?

That’s when the tour guide helped. He stated that they told him the same thing. He said that he would cancel the passport exit and go back to the Customs office and have the error corrected. Thank you, he took my documents and had them re-approved.

I returned to Istanbul and exactly 30 days later they deposited 560 TL into my Credit Card account. Here is the victory!

How to Get a Dutch Tax Free Refund?

I had the chance to get Tax Free refund at Amsterdam Schipol airport 3 years ago. I can say that it is easier than Spain. I visited cities such as Paris , Luxembourg, Brussels and Cologne during the tour, which covers 5 countries ( Benelux Tour), which starts in Amsterdam and ends in Amsterdam.

In the meantime, I had the invoices of the products I purchased in Tax Free format. When I arrived at Schipol airport, I first got my tax refund back from the Customs Office and then the “ Global Blue Tax Free ” counter. Moreover, they paid cash. They even paid 6 € worth of tax deduction for the metal Eiffel Tower model I bought.

How to Get Germany Tax Free Refund?

I have traveled to Germany many times, but I have never had the chance to exit Germany. I have always departed from different EU countries.

My friend, whom I was traveling with, was talking about the fact that electronic products are more affordable in Germany than in other countries. He bought an Iphone X phone from a tax-free MediaMarkt store in Germany and easily got his tax refund back at the airport. When he returned to Istanbul, he told it to ballads 🙂

Tax Free for Airport Duty Free Shopping

There are Duty Free shops at airports around the world as well as at Turkish airports. In Duty Free stores with a rich product range, products from perfume to electronics, from electronics to clothing are sold. Moreover, shopping in Duty Free Stores is done completely tax-free . So you don’t have to deal with a mess like Tax Free refund.

It is very fun to shop at the many Duty Free shops only after passport control in the international terminal. Even if you don’t shop in these stores while waiting for your flight, it is quite fun to spend time just walking around.

In Duty Free Stores, the cosmetics and perfume categories, as well as the cigarette and alcohol categories, come to the fore. The reason for this is that the products are 100% original and economical prices.

Tax Free Shopping Limit and Tax Rates by Country

The taxation policy of each country is different from the other. Even the value added tax collected from foreigners varies from country to country. However, regardless of the rates, there is a lower limit for Tax Free purchases.

For example, you cannot get a tax refund for a product you bought for 3 € in a single invoice. There was a tax free limit of 80 € for Spain . They declared that they cannot process invoices below this value at the Tax Free office. This price has been determined as 100₺+VAT for Turkey .

Germany Tax Free Tax Rates and Limit

Two types of Value Added rates apply in Germany. Luxury Goods: 19% Vital Consumables: 7% Duration: 3 months

Tax Free Lower Limit on a single invoice for Germany: 50.01 €

Tax Free Tax Rates and Limit for Austria

Two different Value Added rates are applied for Austria. Luxury Goods: 20% Vital Consumables: 10% Time limit: 3 months Tax Free Lower Limit for Austria: 75.01€

Belgium Tax Free Tax Rates and Limits

There are 3 different Value Added rates valid in Belgium. Standard Tax Rate: 21% Vital Consumables: 12% Time limit: 3 months Low Tax Free Limit on a single purchase for Belgium: 125.01€

United Arab Emirates Tax Free Tax Rates and Limits

The tax rates in the United Arab Emirates are as follows: Standard Tax Rate: 17.5% Vital Consumables: 12.5% Time limit: 3 months Lower Tax Free Limit on one purchase for Dubai and United Arab Emirates: 375.001 (UAE) UAE Dirham You can receive the tax refund for your shopping from Global Tax Free member stores in Dubai-based United Arab Emirates in your own country. All you have to do is have the products and invoices approved by the Customs officer when leaving the United Arab Emirates.

Czech Republic Tax Free Tax Rates and Limits

3 rates are applied as Value Added Tax valid in the Czech Republic. Standard Tax Rate: 21% 1.Category Consumer Goods: 15% 2.Category Consumer Goods: 10% Time limit: – Czech Republic Tax Free Lower Limit: 2.01 (CZK)Czech Koruna

Tax Free Tax Rates and Limits in China

In the People’s Republic of China, 2 rates are applied as Value Added. Standard Tax Rate: 13% Vital Consumables: 19% Time limit: – Tax Free Lower Limit on a single invoice in China: 500.01 (RMB)Yuan

Denmark Tax Free Tax Rates and Limits

Denmark applies a single rate as the tax rate. Standard Tax Rate: 25% Time limit: 3 months /1 year Denmark Tax Free Lower Limit: 300.01 SEK

Estonian Tax Free Tax Rates and Limits

Estonia applies a single rate as the tax rate. Standard Tax Rate: 20% Time limit: 3 months /1 year Estonian Tax Free Lower Limit: 38.01 €

Tax Free Tax Rates and Limits for Morocco

The applicable tax rates in Morocco apply as follows. Standard Tax Rate: 20% Time limit: 30 days / – Tax Free Limit for Morocco: 2000 MAD Excluded Products: Food, gems, cigarettes, transportation, health, cultural goods.

France Tax Free Tax Rates and Limits

In France, tax rates apply under different categories. Standard Tax Rate: 20% Medicine & Health: 10% Books & Food: 5.5% Other Product Groups: 2.1% Term limit: 6 months /5 years France Tax Free Limit: 100.01 € Excluded Items: Cigarettes, Weapons, Health Expenses, Car and its spare parts, Postage Stamp and cultural items over 50 years old.

Finland Tax Free Tax Rates and Limits

Finland applies tax rates in 3 categories. Standard Tax Rate: 24% Food: 14% Books & Health Products (Medicine etc.): 10% Time limit: 3 months /2 years Finland Tax Free Limit: 40.01 €

Tax Free Tax Rates and Limits for South Korea

The tax rates in Korea apply as follows. Standard Tax Rate: 10% Term limit: 3 months / 2 years South Korea’s minimum Tax Free Limit: 30,000 (KRW) South Korean Won Excluded Products: Firearms, swords, explosives, Cultural heritage products, addictive products, Tobacco and cigarettes, prohibited products, books, stamps and raw food products.

Croatia Tax Free Tax Rates and Limits

3 rates are applied as Croatian Value Added Tax. Standard Tax Rate: 25% 1.Category Consumer Goods: 13% 2.Category Consumer Goods: 5% Time limit: – Tax Free Lower Limit on a single invoice for your shopping in Croatia: 740.01 (HRK)Kuna

Tax Free Tax Rates and Limits for the Netherlands

The Dutch tax rates apply as follows. Standard Tax Rate: 21% Food Tax: 9% Time limit: 3 months / – Tax Free Limit for Netherlands: 50.01 € Excluded Products: Gift shop products, cultural and artistic products.

Tax Free Tax Rates and Limits for Japan

Japan’s tax rates apply as follows. Standard Tax Rate: 10% Value Added-2 Tax: 8% Time limit: 30 days / Tax Free Limit for Japan: 5000 (JPY) Yen Excluded Products: –

UK Tax Free Tax Rates and Limits

As of January 1, 2021, the UK left the EU Customs Union within the framework of Brexit. For this, you must have it approved by the Customs Office before you leave the country in order to get a tax refund for a product you bought in the UK. Otherwise you cannot get a refund in any EU country.

Standard Tax Rate: 42.5% – 7.5% Time limit: – / – Tax Free Limit for the UK: £100.0 Excluded Products: –

Tax Free Tax Rates and Limits in Ireland

Ireland’s tax rates apply as follows. Standard Tax Rate: 23% Term limit: 3 months / 3 years Tax Free Limit for Ireland: 75.01 € Excluded Products: Children’s clothing, food, health, fuel and service industry.

Tax Free Tax Rates and Limits in Spain

Spain’s tax rates apply as follows. Standard Tax Rate: 21% Food and optical products: 10% Health, medicine, books, magazines and some foods: 4% Term limit: 3 months / 4 years Tax Free Limit for Spain: 80.01 € Excluded Products: Products whose import is prohibited.

Tax Free Tax Rates and Limits in Sweden

Sweden’s tax rates apply as follows. Standard Tax Rate: 25% Food tax rates: 12% Book, magazine tax rates: 6% Term limit: 3 months / 1 year Tax Free Limit for Spain: 200.01 (SEK) Swedish Krona Excluded Products: Products whose import is prohibited.

Tax Free Tax Rates and Limits in Switzerland

Switzerland’s tax rates apply as follows. Standard Tax Rate: 7.7% Tax rates on Food, Medicines, Books and Fruits and Vegetables: 2.5% (No Taxfree refunds) Term limit: 3 months / 4 years Tax Free Limit for Switzerland: 300.01 (CHF) Swiss Francs Excluded Products: Fuel, all products with a 2.5% tax rate and products whose importation is prohibited.

Tax Free Tax Rates and Limits in Italy

Italy’s tax rates apply as follows. Standard Tax Rate: 22% Fashion, leather, jewelry, glassware, sunglasses and alcohol: 22% Food: 10% Herbal products: 5% Milk and Dairy Products, Vegan and fruit: 2% Time limit: 3 months / 3 months Tax Free Limit for Italy: 154.95 € Excluded Products: Fuel, auto and auto spare parts.

Tax Free Tax Rates and Limits in Iceland

Iceland’s tax rates apply as follows. Standard Tax Rate: 24% Simple Foods and Books Tax Rate: 11% Time limit: 3 months / unlimited Tax Free Limit for Iceland: 6,000 ISK Excluded Products: Service industry.

Tax Free Tax Rates and Limits for Kazakhstan

Kazakhstan’s tax rates apply as follows. Standard Tax Rate: 12% Time limit: 3 months / 3 months Tax Free Limit for Kazakhstan: 53.020 KZT Excluded Products: Alcohol, coffee, cigarettes, fuel, power unit, transportation and special services sector.

Tax Free Tax Rates and Limits for Latvia

Latvia’s tax rates apply as follows. Standard Tax Rate: 21% Medicines, books and medical products: 12% Term limit: 3 months / 1 year Tax Free Limit for Latvia: 44.01 € Excluded Products:

Tax Free Tax Rates and Limits for Libya

Libya’s tax rates apply as follows. Standard Tax Rate: 11% Time limit: 3 months / – Tax Free Limit for Libya: 150,000 LBP Excluded Products: Food, beverages, gems, jewellery.

Tax Free Tax Rates and Limits for Lithuania

The tax rates in Lithuania are as follows. Standard Tax Rate: 21% Time limit: 3 months / – Tax Free Limit for Lithuania: 40.01 € Excluded Products: Service sector, discounted products.

Tax Free Tax Rates and Limits for Luxembourg

The tax rates in Luxembourg apply as follows. Standard Tax Rate: 17% Term limit: 3 months / 3 years Tax Free Limit for Luxembourg : 74.01 € Excluded Products: Service sector, transportation expenditures.

Hungary’s Tax Free Tax Rates and Limits

Hungary’s tax rates apply as follows. Standard Tax Rate: 27% Tax Rate for Simple Foods: 18% Health and Stationery: 5% Time limit: 3 months /1 year Tax Free Limit for Hungary: 63.01 HUF Excluded Products: Fuel, Service industry, Transportation, Sea and Air Freight.

Tax Free Tax Rates and Limits for Norway

The tax rates in Norway apply as follows. Standard Tax Rate: 25% Food Tax: 15% Time limit: 1 month / 1 year Tax Free Limit for Norway: 290 – 315 (NOK) Norwegian Krone Excluded Products: Books & Stationery, fuel and vehicles.

Tax Free Tax Rates and Limits for Poland

The tax rates in Poland apply as follows. Standard Tax Rate: 23% Food and Health Tax: 8% Handmade and Agricultural Product Tax: 5% Time limit: 3 months / 8 months Minimum Tax Free Limit for Poland: 200 (PLN) Zloty Excluded Products: –

Tax Free Tax Rates and Limits for Portugal

Portuguese tax rates are as follows; Mainland Tax Rates: Standard Tax Rate: 23% Food and Agricultural Product Tax: 13% Book, Drug, Medical and Magazine Tax: 6% Mainland Portugal minimum Tax Free Limit: €61.50 Time limit: 3 months / 8 months Applicable Tax Rates in Madeira: Standard Tax Rate: 22% Minimum Tax Free Limit for Madeira: 61.01 € Azores Island Tax Rates: Standard Tax Rate: 16% Minimum Tax Free Limit for Azores: 58.01 € Excluded Products: Precious products, car and spare parts products.

Tax Free Tax Rates and Limits for Russia

The tax rates in Russia are applied as follows. Standard Tax Rate: 20% Food, Children’s products, Medicines, Books and Water Tax: 10% Term limit: 3 months / 1 year Minimum Tax Free Limit for Russia: Rubles 10,000 (RUB) per day Excluded Products: Alcohol, cigarettes, car & spare parts, fuel and petroleum products.

Tax Free Tax Rates and Limits for Serbia

The tax rates in Serbia are applied as follows. Standard Tax Rate: 20% Tax on Food, Agricultural Products, Books and Educational Materials: 10% Term limit: 3 months / 1 year Minimum Tax Free Limit for Serbia: 6,000 (RSD) Serbian Dinar Excluded Products: Alcohol, cigarettes, coffee, fuel and petroleum products.

Tax Free Tax Rates and Limits for Singapore

The tax rates in Singapore are as follows. Standard Tax Rate: 7% Time limit: 2 months / – Minimum Tax Free Limit for Singapore: 100.01 (SGD) Singapore Dollars Excluded Products: –

Tax Free Tax Rates and Limits for Slovakia

The tax rates in Slovakia apply as follows. Standard Tax Rate: 20% Time limit: 2 months / 5 months Slovakia’s minimum Tax Free Limit: 100.01 € Excluded Products: Fuel.

Tax Free Tax Rates and Limits for Slovenia

The tax rates in Slovenia apply as follows. Standard Tax Rate: 22% Food, health and books Tax Rate: 9.5% Time limit: 2 months / 6 months Slovenia’s minimum Tax Free Limit: 50.01 € Excluded Products: Fuel, Mineral oils, Alcoholic beverages, Cigarettes.

Tax Free Tax Rates and Limits for Turkey

The tax rates in Turkey are applied as follows. Standard Tax Rate: 18% Standard Tax-2 Rate: 8% Book, Tax Rate on vital products: 1% Time limit: 3 months / 3 months Turkey’s minimum Tax Free Limit: 108 TL – 118 TL Excluded Products: Products whose import is prohibited.

Tax Free Tax Rates and Limits for Ukraine

Due to the ongoing war in Ukraine, all tax collection and refund transactions are temporarily suspended, so Tax Free refunds are not made. Standard Tax Rate: 0% Time limit: – month / – month Ukraine’s minimum Tax Free Limit: – Excluded Products: –

Greece’s Tax Free Tax Rates and Limits

Greek tax rates apply separately on the mainland and on the Greek islands. Standard Tax Rate (on Mainland): 24% Standard Tax Rate (on the islands of Lesvos, Chios, Kos, Leros and Samos): 17% Time limit: 3 months /3 months Greece Tax Free Limit: 50.01 € Excludes: Alcol and food.

All Questions About Tax Free

How to make tax free refund for international trips by road.

You can do it similarly to traveling by air. You can start the return process by applying to the Customs offices located at the land border gates. Do not forget that the product you buy must be unused and the package must be intact.

Why is there no taxfree refund for purchased services?

In tax free return conditions, many countries only refund certain categories of products. This is because the purchased product was actually purchased for use by you. Since you cannot document that your expenses in the service category are actually used by you, they are not considered Tax Free.

Can I get a new invoice if I use the invoices required for the product warranty for Taxfree?

When you want to take advantage of Taxfree while shopping abroad, stores and workplaces issue you 3 copies of invoice. Only 1 of them is received by the Taxfree office. The remaining 2 bills remain with you.

Is it possible to refund Tax free with slip or slip?

Taxfree refunds can only be made for postpaid purchases. In fact, a special invoice is required for the tax free application. Make sure to remind the attendant during the checkout after shopping.

Tax free iadesi yapılmaz ise ne yapmalıyım?

You have done all your work without any problems. However, what should you do if you have not been paid even though it has been more than 30 days? You don’t need to panic at all. Because Tax free payment companies are carefully selected by each country and are just as safe as a bank. Contact them using the barcode, QR code or tracking number they delivered to you. I recommend that you establish your communication via Email. If there is no problem or if the existing problem is solved, you will be returned by e-mail and a refund will be made.

No comments yet.

Terms of use

Privacy overview.

Business solutions

Accept payments

Tax Free solutions

Issue Tax Free forms online or in-store

Industry solutions

- Why Planet for Retail

- Why Planet for Hospitality

- Why Planet for Payments

Blogs and case studies

Guide to Tax Free shopping in Turkey

How to shop tax free in turkey.

- Step 1: Go shopping

- Look for Planet logo and ask for Planet Tax Free form when making a purchase

- Step 2: Get Customs validation

- Step 3: Get your refund

- Choose your preferred refund method - credit/debit card, cash or digital wallet

Shopping in Turkey

Go shopping and get your Tax Free form.

- 20% Standard VAT rate

- 10% Food, textiles, clothes, lether goods, carpets, shoes, bags and optics

- Non-Turkish residents who have not spent more than 6 months in Turkey

- 90 days after the issuing month of the Tax Free Form

- 3 months from the date of Customs Validation

- Post-validation Cash: EUR 1500

Get your Tax Free form approved by customs

Refund requirements, required for refunding:.

- Fully completed Tax Free forms stamped by Customs

Required for customs approval:

- Fully completed Tax Free form

- Unused purchased goods and receipts

- Passport and travel documents

Special note:

- Main Validation Points:

- Isparta Airport

- Hamzabeyli Cross Border

- Dereköy Cross Border

- Kapıkule Cross Border

- İpsala Cross Border

- Pazarkule Cross Border

- Sarp Cross Border

- Dilucu Cross Border

- Bodrum Yalıkavak Seaport

How can I get my refund?

- Visit any Planet Refund Office

- Present the validated Tax Free forms and get your refund

- Standard refund

- If you haven't received your refund at our Refund Point, provide your payment details on the Tax Free form, get Customs validation and return the Tax Free form by post using Planet prepaid envelope. You can also leave your Tax Free form in one of our Planet drop boxes.

What other refund options are available?

- Credit Card (Visa, Mastercard, AMEX, CUPs, WeChat, Alipay)

- *A cash fee will apply

- Remember to visit the customs office before you check your luggage - they will need to check your goods. If you are exporting high value items such as jewellery, watches or electronics, the export validation must be obtained at airside

- Receipts can be export validated at any point that the shopper leaves Turkey (airports, seaports, borders)

- All goods that are exported in a traveller's personal luggage are eligible for Tax refunds

- Refund amount is equal to the amount of VAT paid in store less the handling fee of the VAT refund operator

- Please allow enough time for the export validation process before your flight departs

Search for refund locations in Turkey

Contact our Planet support team.

Discover all destinations

Embark on an adventure of discovery as you explore all the captivating destinations the world has to offer.

- Privacy Policy

- Terms and Conditions

- Cookie Policy

VAT Refund In Turkey For Tourist, Step By Step Tutorial 2024

Tax free shopping in turkey.

Due to its geographical location and natural tourist attractions, Turkey interests many tourists. Shopping in this country is also very popular due to clothing stores in Istanbul and other Turkish cities. But one feature that makes shopping in Turkey attractive is the VAT refund in Turkey for tourists .

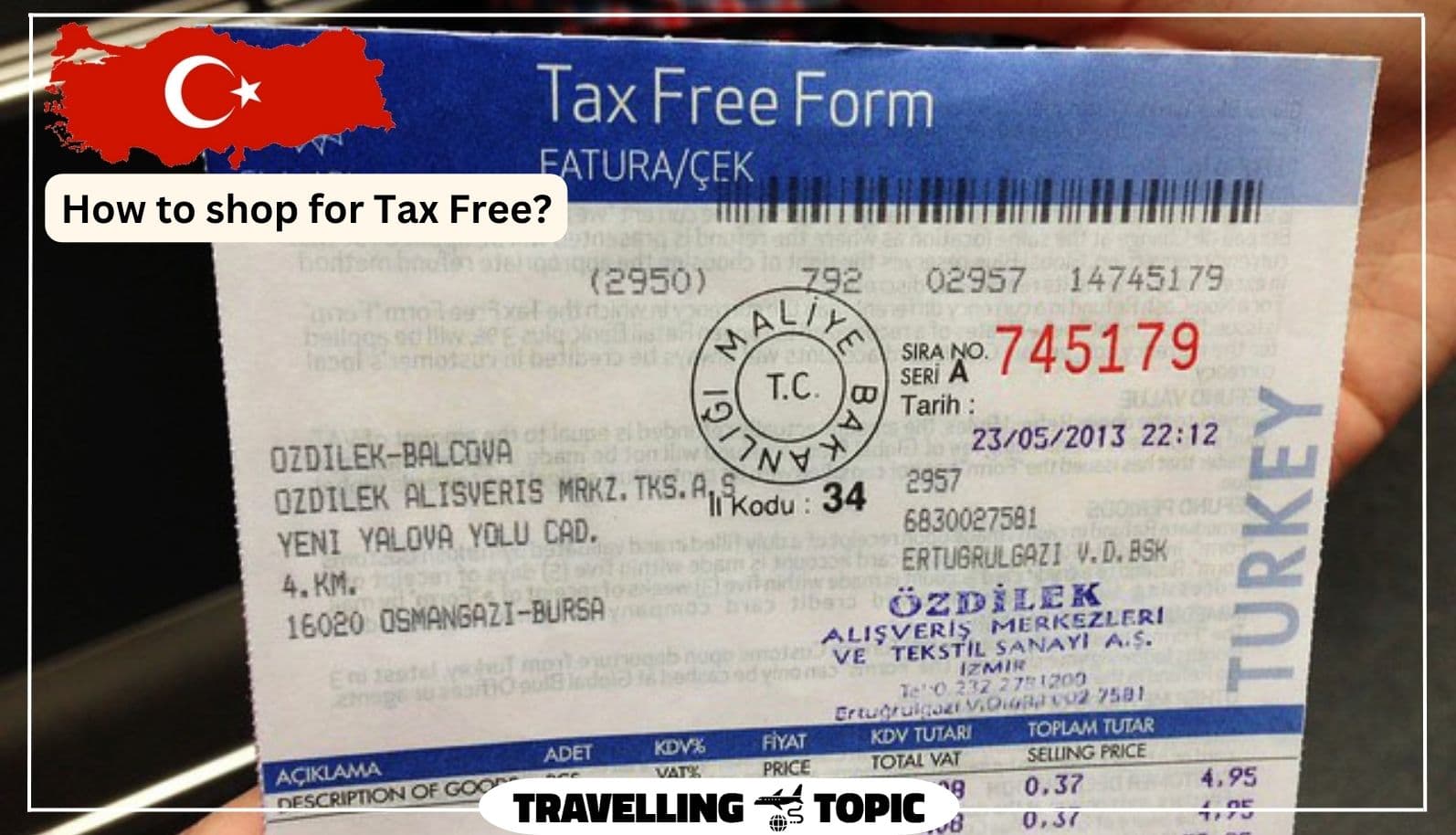

During my trip to Istanbul, I bought many goods from tax-free stores. By filling out the tax-free forms in the stores, I could get back the tax that I paid during the purchase. If you are also interested in learning about the terms of Turkey’s VAT refunds and how you can get back the taxes you paid, read this article to learn about my experience.

- Step By Step Tutorial

Table of Contents

How much is a VAT refund in Turkey for tourists?

How to shop for tax free, how do i get my tax back from airport turkey, where is the tax refund at istanbul airport.

Step 1: Shop at stores that have a tax-free label.

Step 2: After choosing the products and paying the fee, you must fill out the tax-free forms in the store.

Step 3: Go to the VAT Refund section at the airport and show the goods you bought along with the tax-free form you received from the store to the customs officer to confirm them.

Step 4: Go to the Global Blue section for your tax refund.

In Turkey, cosmetics, jewelry, watches, and electronic devices have 18% VAT, and clothes, shoes, bags, and the like have 8% VAT.

The most crucial point is that you must carry your passport with you on all the days you plan to shop. Most stores in Turkey, especially clothing stores, are familiar with the tax-free process. You only have to ask the cashier to issue you a tax-free certificate when you pay for your bought.

Each store issues a tax-free certificate separately according to its business policy. First, they will give you a general receipt of all the purchases; then, they will print a separate tax-free receipt and give it to you. The only thing you should be aware of is that all receipts and sheets must have the store’s mark.

Suppose you want only one person to process the tax refund at the airport. In that case, I suggest that you make all purchases under the name and passport of one person because, at the airport, only the person whose name is recorded in the receipts will be refunded the tax. In this way, you can save time, and there is no need for several people to stand in line to withdraw money.

Pay attention to the fact that the minimum purchase amount for tax-free in Turkey is 118 lira in 2024, which means that if you buy an item with a price of 100 liras, you cannot get back the tax you have paid.

Many stores put tax-free slips inside an envelope with instructions on how to do the VAT refund process in Turkey for tourists.

The first thing you should consider is that the baggage delivery and boarding pass section for the tax-free process differs from the routine flight. It doesn’t matter which airline ticket you bought and to which destination. If you want to get back the tax on your purchases, you must do it at the Vat refund section or the customs section.

Next, I explain the steps for vat refund in Turkey for tourist:

If your flight was Turkish Airlines, when you enter Istanbul International Airport, you should go to row G, called the VAT Refund section. This section has two parts. First, you must stand in line and hand over your documents to get a boarding passes; remember to declare that your purchases are tax-free. I suggest putting all your purchases in one suitcase and carrying only a piece of baggage.

You must go to the Custom area with your luggage when you get the boarding pass. There you have to hand over your passport and purchase receipts. The customs officer can check each of the purchases included in the invoice. For example, he may ask you to show the shirt you bought from Koton; if you can’t show the clothes you bought, they won’t give you a refund.

After checking each invoice, the customs officer puts a special stamp on it and gives it to you. Please note that only stamped invoices are valid for a refund.

If your ticket was related to other airlines, you should go to the section specified for you, which will guide you to the VAT Refund section.

At the Turkey Istanbul airport , after checking and stamping the passport, go a little further in the transit area. Next to the escalators is an exchange office called Global Blue , where you have to go and hand over the stamped invoices. Then they will pay your money.

The important thing is that this money is your right, So be sure to get your money. Just be careful that getting a flight card for tax-free mode will take longer and have a long queue. So be sure to get to the airport earlier than usual to do this process safely.

Is paying taxes in Turkey different for Turkish and non-Turkish people?

In the end, you should know that you should not use any of the goods you have purchased until the tax is refunded at the airport. Otherwise, the tax will not be refunded to you.

You should also know that you can receive your tax in cash at the airport for a small fee or get this amount back after returning to your country without reducing the cost.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Please enter an answer in digits: 6 + nine =

Related Articles

What To Wear In Turkey In December?+ Weather In December

What To Do In Istanbul Airport For 8 Hours?

12 Best Street Food In Istanbul, Price + Name + where to buy

Is GOLD Cheap In Turkey? | 4 Tips For Buying Gold In Turkey

Antalya vs Bodrum | Bodrum Or Antalya Which Is Better 2024?

How Much Lira For A Week In Turkey?

Search by Airport

Search by airline, duty free prices in turkey.

A list of all airports in Turkey with information on shopping, dining and duty free.

To plan ahead for your journey to Turkey you can use Duty Free Information to see what Duty Free shops, boutiques, and products are on offer at the airports in Turkey before you fly. We pride ourselves on the quality of our database and endeavour to have the most up to date information on what shops and boutiques are available to you on your journey at each airport and the airline that you are flying with.

We have a dedicated team of researchers with contacts at every major airport in the world which helps to ensure that our data is kept as up to date and relevant as possible. However, if you do spot something that is incorrect or out of date, then please let us know via our contact form in the the comments on any of our pages and you can help keep the database as accurate as possible.

Information about Turkey

Turkey, a transcontinental country straddling both Europe and Asia, is renowned for its rich history, diverse culture, and stunning landscapes. As a popular tourist destination, Turkey offers visitors not only an unforgettable travel experience but also the opportunity to shop for tax-free goods at competitive prices. In this post, we will discuss some facts about Turkey and provide an overview of duty-free shopping in the country, highlighting the advantages of purchasing items at Duty Free prices in Turkey.