- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Use an American Airlines Flight Credit

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

How to use a flight credit on American Airlines

How to use a trip credit on american airlines, 4 steps to book a flight with american airlines flight credit, 4 steps to book a flight with american airlines trip credit, final thoughts on american airlines flight credits and trip credits.

If you've previously canceled an American Airlines flight, you may be wondering how to use American Airlines flight credits or how to use American airlines trip credits. The good news is that redeeming flight credits and trip credits to book American Airlines flights is quick and easy.

Before learning more about each, including how to redeem these American Airlines credits, you’ll want to understand how flight credits and trip credits are earned and how these travel credits function.

Here's a look at how to use an American Airlines flight credit.

» Learn more: The best airline credit cards right now

American Airlines issues flight credit for unused or canceled tickets. This type of compensation is different from trip credits because flight credits can generally be used for the passenger whose name was on the original ticket only.

Here's what you need to know about flight credits:

You can use these credits for flights only.

Flight credits can't be redeemed for extras like seats or bags.

Flight credit is valid for one year from the issue date unless otherwise noted.

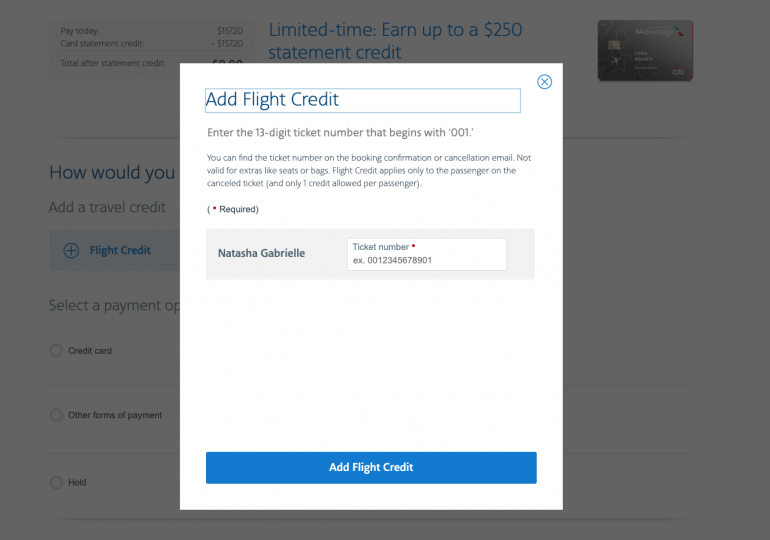

You can use one flight credit per passenger when booking at AA.com (contact American Airlines to book with more than one flight credit).

Only the same passenger named on the flight credit can book and travel.

American Airlines issues trip credit as compensation, refunds and for the remaining value of flight credit exchanges.

Here's what you need to know about trip credits:

Trip credit is valid for non-award bookings.

You can use trip credit for domestic or international flights originating in the U.S.

These credits can't be redeemed for extras like seats or bags.

Trip credit is valid for one year from the issue date.

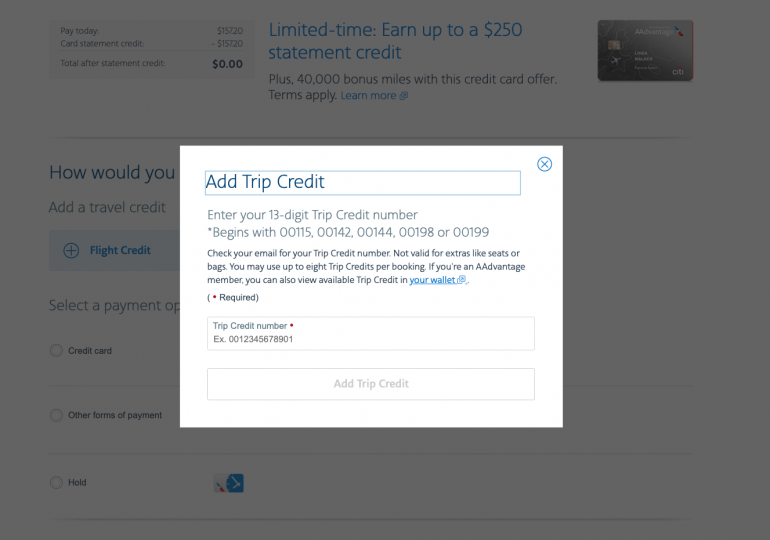

You can use eight trip credits in a single passenger reservation when booking at AA.com (contact American Airlines to book more than one passenger).

The trip credit recipient can use their credit to book and pay for travel for themselves or others.

» Learn more: Complete guide to American Airlines elite status

Where can you see your flight credit or trip credit balance?

American Airlines will send an email with flight credit and trip credit information directly to travelers. You can go back to the email to review your credit details.

You can also review your credit details another way.

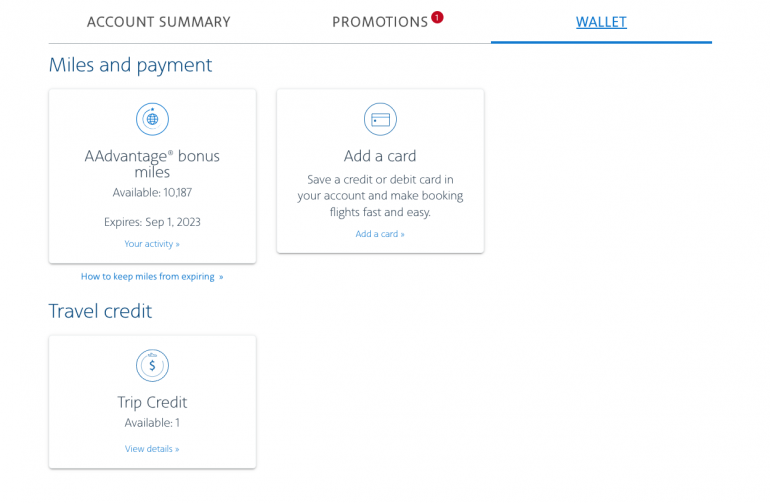

If you're an AAdvantage member, you can log in to your account and check any credits by clicking on your "Wallet." If you have active credits, they will be listed here.

How long are American Airlines flight credits and trip credits good for?

Most American Airlines travel credits are valid for one year from the issue date unless otherwise noted.

Special rules for eligible flight credits: If you're an AAdvantage member and have an original ticket issued from Jan. 1, 2020, to Dec. 31, 2021, the value of your unused ticket can be used by Sept. 30, 2022, for travel through Dec. 31, 2022.

What can I do if my flight credit or trip credit expired?

Make sure you check your flight credit and trip credit expiration dates. American Airlines won't make exceptions if your credit expires.

Here is a breakdown of what the airline's terms and conditions state about credit expirations:

American Airlines won't reissue trip credits past the expiration date and are not responsible for honoring invalid or expired trip credit.

American Airlines won't extend or reissue flight credits past the expiration date, and expired flight credits will not be honored.

» Learn more: Everything you need to know about the American Airlines AAdvantage program

Here is how to use American Airlines flight credit:

1. Have your flight credit details ready

You can find your flight credit ticket number in the email from American Airlines or by logging into your AAdvantage account and going to your wallet.

2. Browse and select flights

Search for and find your desired flights.

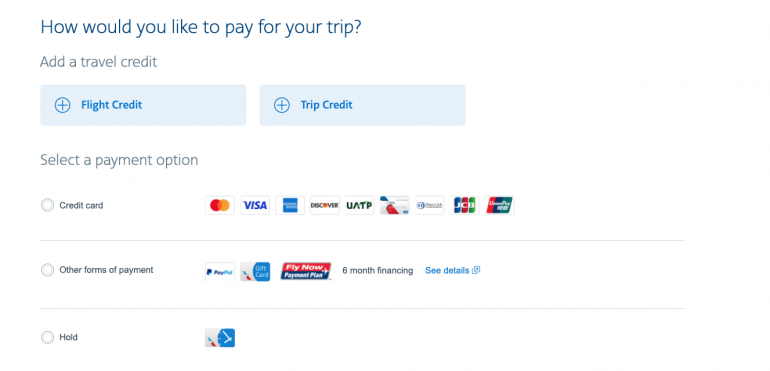

3. Click “+ Flight Credit” to apply your flight credit before checking out

After confirming your flight details, passenger details and selecting your seats, you'll see an option to add a flight credit before finalizing the payment and checkout process.

4. Finish the booking and checkout process

Once you apply your flight credit, you can complete the checkout process.

If you don't have enough credit to cover the cost of your flight, you'll choose a payment method to pay the difference.

If the ticket price is less than the value of your flight credit, you will receive the remaining credit balance issued as a credit to use for future travel.

The process of using an American Airlines trip credit is similar:

1. Have your trip credit details ready

You can locate your trip credit number in your email from American Airlines or in the wallet section of your AAdvantage member account.

2. Browse and select your flights

Search for and find the flights that you want to book.

3. Click “+ Trip Credit” to apply your trip credit before checking out

Once you confirm flight details, passenger details and select your seats, you'll be able to add a trip credit before finalizing the payment and checkout process.

Once you add your trip credit and see that it has been applied, you can continue through the checkout process.

If you don't have enough credit to cover the cost of your ticket, you'll choose a payment method to pay the difference.

If the ticket price is less than the value of your trip credit, you will receive the remaining value issued as a credit, which you can use for future trips.

American Airlines makes it easy to redeem travel credits when booking flights on their website. Now that you know how to use a flight credit and how to use a trip credit on American Airlines, you can put any remaining credits to use. Just make sure to keep on top of travel credit expiration dates so your credits don't go unused.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Capital One's website

2x-5x Earn unlimited 2X miles on every purchase, every day. Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

75,000 Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

on Citibank's application

1x Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

70,000 Earn 70,000 American Airlines AAdvantage® bonus miles after spending $7,000 within the first 3 months of account opening.

on Chase's website

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Our system is having trouble

Please try again or come back later.

Please tell us where the airport is located.

Any searches or unfinished transactions will be lost.

Do you want to continue your session?

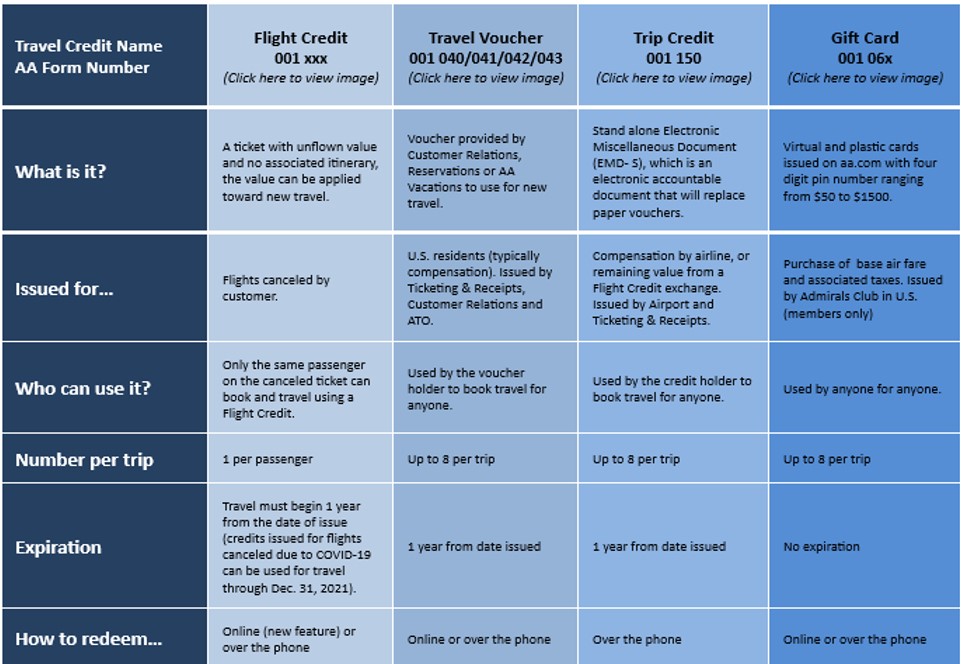

How To Use Your Travel Credits

November 6, 2023

Over the past several years—full of Covid travel and delayed flights—travel credits have felt more and more common. Whether you've needed to cancel a flight due to unforeseen circumstances or the airline has delayed your flight for a reason that's not super clear, it's possible your travel credits have begun to stack up.

Here's what you need to know about travel credits: where to find them (so you don't forget they exist!), how to use them, and some tips for extending their shelf life.

What are travel credits?

Airlines issue travel credits for a few different reasons. You can get one when you cancel a ticket or change to one that costs less than the original ticket. (Note: You’ll only get a credit on applicable tickets. For instance, basic economy is typically non-refundable and not eligible for credit, so if you cancel, you forfeit the value of the ticket. Some basic economy tickets may be eligible for partial credit, so contact the airline to find out what you qualify for.)

An airline may also issue a travel credit if there is an operational issue with the aircraft prior to your departure.

Travel credits vary from airline to airline, and there may even be different types of credits (with different names) within a single airline. For example, American Airlines offers trip credits, flight credits, and travel vouchers, all of which vary slightly in when they’re issued, how long and what they’re valid for, and who can use them. While trip credits and flight credits have slightly more rigid terms and conditions, travel vouchers—which you might get if you get involuntarily bumped from an overbooked flight—can typically be used by anyone, regardless of whether their name was on the original ticket.

Make sure you check the individual airline’s travel credit structure so you know what you’re eligible for.

Where to find your travel credits

Travel credits often appear in the loyalty account that you have with the airline. That’s your MileagePlus account with United, SkyMiles account with Delta, and so on. Each credit comes with a reference number, credit amount, and expiration date; the credit is usually attached to the original ticket number so you know for which flight the credit applies.

Some airlines also have a travel credit finder, where you can surface your credits using the confirmation number or PIN on your original booking, as well as the travelers’ last name; United offers one of these finders .

How to use your travel credits

Shop for your flight like you ordinarily would. For instance, if you have an American Airlines travel credit, you can go right to aa.com to book, or you can go to Google Flights and limit your search results to American Airlines flights.

When you’ve decided which flight to purchase, proceed to the checkout screen. Where there is the option to pay by credit card, all of your unused travel credits will appear (as long as you are signed into your loyalty account). Choose to pay by travel credit; if the credit is not enough for the whole flight, you can add a credit card or other payment method to cover the remaining balance.

If you’re not signed in or you don’t have a loyalty account, you can also pay by adding the travel credit manually using the reference number.

With most airlines, if you don’t use the full credit on a single ticket, you get the remainder back; the balance either stays in your account with the same reference number, or the airline reissues the credit—new reference number, new credit amount, new expiration date.

Important things to know about travel credits

Travel credits aren’t so cut and dried. They vary from airline to airline, and sometimes you can even bend the rules if you call the airline and speak with a customer service representative (but don’t tell them we told you that, and don’t bank on it working every time).

You can’t usually transfer travel credits to another person.

Unfortunately, travel credits can typically only be used by the person whose name was on the original ticket. You may be able to get around this if the credit holder uses the credit to book the flight for another person; you may need to get in touch with customer service to make this happen, though. Remember: Travel vouchers (not credits), like ones that the airline issues for bumping you from an overbooked flight, can typically be transferred to another person.

Not all credits can be used for upgrades.

If you’re thinking, “I’ll use my credits to treat myself to a better seat next time I fly,” think again. Some airlines restrict credit usage to only the fare price and any applicable taxes and fees. In other words, you might not be able to use credits on upgrades like bags, priority boarding, and better seats if you paid for a basic economy ticket. You’d need to use your travel credits toward a higher fare class (like economy or business) that includes the add-ons that you’re looking for.

You can usually use credits for flights on different airlines within the same alliance.

If you got credits through United, which is part of Star Alliance, then you should be able to apply your credits to trips through other partner airlines, like Lufthansa, Air Canada, and SAS. Note that you’ll probably need to book the flight through the airline offering your credit. In this case, you’d need to buy your flight on the United website.

Don’t forget the expiration date!

It’s easy to cancel the trip, get the credit, and then forget it ever existed…until 18 months later when it’s too late to redeem the credit. You can certainly try contacting the airlines’ customer support; if you’re lucky, the agent will reissue the credit, but that’s not guaranteed.

Most credits expire within a year, but the expiration date can take one of two forms: It could be a travel-by date (you must take the first flight in your trip by that date) or a book-by date (you just need to book your ticket by that date). Know which expiration date you’re working with so you don’t throw away that credit.

If the expiration date is drawing nearer, first try giving the airline’s customer service line a call and asking nicely if they’ll extend your credit. While some airlines take a strict approach to their terms of service, it’s always worth trying for an extension.

If that doesn’t work, there may be another workaround: You can book a refundable flight, and then cancel the flight. You’ll receive a new credit with a new expiration date, usually a year from the date you canceled. This tactic can vary from airline to airline, but if you’re nearing your expiration date and running out of options, you don’t have much to lose.

Published November 6, 2023

Last updated December 19, 2023

Articles you might like

How to Find Cheap Flights in 2024: The Ultimate Guide

Apr 8, 2024

Why Are Flights So Expensive Right Now?

Apr 2, 2024

10 Flight Booking Hacks to Score Cheap Flights and Travel for Less

Apr 1, 2024

Treat your travel to cheap flights

Most deals are 40-90% off normal prices with great itineraries from the best airlines. If it's not an amazing deal, we won't send it. Sign up for free to start getting flight alerts.

Winter is here! Check out the winter wonderlands at these 5 amazing winter destinations in Montana

- Plan Your Trip

How To Use A Trip Credit On American Airlines

Published: December 1, 2023

Modified: December 28, 2023

by Fay Shah

- Travel Tips

Introduction

Welcome to the world of air travel! Whether you are a seasoned traveler or someone planning their first trip, understanding the ins and outs of the industry can be quite daunting. One aspect that travelers often encounter is the use of trip credits, which can provide a convenient way to save money when booking flights. In this article, we will explore how to use trip credits specifically on American Airlines.

Trip credits are essentially a form of payment that can be used towards the purchase of a future flight. They can be obtained in various ways, such as compensation for flight disruptions or cancellations, as a reward from loyalty programs, or through special promotions. The great thing about trip credits is that they can help offset the cost of your next trip, making your travel experience more affordable.

To make the most out of your trip credits, it is important to understand how to check your balance, how to book a flight using your credits, and any restrictions or limitations that may apply. In this article, we will guide you through the process of using trip credits on American Airlines, providing you with the necessary information to make your travel plans smoother and more cost-effective.

Before we dive into the details, it is worth mentioning that American Airlines offers a user-friendly online platform where you can easily manage your trip credits. Whether you received your credits via email or they are linked to your frequent flyer account, you can conveniently access and utilize them through the airline’s website or mobile app.

Now let’s explore the steps to check your trip credit balance and how to use it when booking a flight on American Airlines.

Understanding Trip Credits

Trip credits are a valuable currency in the airline industry. They can be thought of as a virtual wallet filled with funds that can be put towards the cost of future flights. These credits are typically issued as compensation for flight delays, cancellations, or other inconveniences experienced during your travel journey. They can also be earned through loyalty programs or special promotions offered by airlines.

When it comes to American Airlines, trip credits are often referred to as eVouchers or travel vouchers. These vouchers are essentially electronic certificates that hold a monetary value, which can be used towards the purchase of flights or other eligible expenses.

It’s important to note that trip credits usually come with an expiration date. This means that you need to use them within a certain timeframe, otherwise, they will become invalid. The expiration date can vary depending on the airline and the specific circumstances under which the credits were issued. It’s always a good idea to check the terms and conditions associated with your trip credits to ensure you don’t miss out on using them.

Another thing to keep in mind is that trip credits are typically non-transferable. This means that they can only be used by the person or account holder to whom they were issued. However, some airlines may allow you to use your trip credits for someone else’s flight, provided you are the one making the booking.

It’s also worth mentioning that trip credits are usually applied before any other form of payment. So, if you have trip credits available, they will be deducted from the total cost of your flight before you are required to pay with cash, credit card, or any other payment method.

Now that we have a clear understanding of what trip credits are and how they work, let’s move on to the next step: checking your trip credit balance.

Checking Your Trip Credit Balance

Before you can start using your trip credits, it’s important to know how much you have available. Thankfully, American Airlines makes it easy to check your trip credit balance.

To begin, you will need to visit the American Airlines website or use their mobile app. Look for the section or tab dedicated to managing your trip credits. Once you have accessed this section, you will likely be prompted to log in to your account using your username and password.

After logging in, you should be able to see your trip credit balance displayed prominently on the screen. This will give you an idea of the funds you have available to use towards your future flights. In addition to the balance, you may also be able to view the details of each trip credit, including the expiration date and any restrictions or limitations that apply.

If you’re unable to locate the trip credit balance on your account, or if you have any questions or concerns about the amount, it’s a good idea to reach out to American Airlines customer service. They will be able to assist you and provide the necessary information to ensure a smooth and hassle-free experience when using your trip credits.

Now that you have checked your trip credit balance and are aware of the funds available to you, let’s move on to the next step: booking a flight using your trip credits.

Booking a Flight Using Trip Credits

Once you have checked your trip credit balance on American Airlines and are ready to book your flight, the process is straightforward and can be done online.

First, log in to your American Airlines account on their website or mobile app. Navigate to the flight booking section, where you can search for available flights based on your desired travel dates, destinations, and other preferences.

During the booking process, you will come across a payment section. Here, you will have the option to apply your trip credits towards the total cost of the flight. Select the option to use trip credits or redeem a voucher, depending on the terminology used by American Airlines.

Enter the amount of trip credits you wish to apply to the booking. Keep in mind that you may have to use the entire balance or a specific amount based on the terms and conditions associated with your trip credits.

After entering the amount, the system will automatically deduct the trip credits from the total cost of the flight. The remaining balance, if any, can be paid using another form of payment, such as a credit card.

Once you have completed the payment process, you will receive a confirmation of your booking, including the amount of trip credits used and any remaining balance that may be due. Make sure to review the details carefully to ensure everything is accurate.

If you encounter any issues or have questions while booking your flight using trip credits, don’t hesitate to reach out to American Airlines customer service for assistance. They are there to help and can provide guidance and support throughout the process.

Now that you know how to book a flight using your trip credits, let’s explore the next step: applying trip credits to an existing reservation.

Applying Trip Credits to an Existing Reservation

If you have already made a flight reservation with American Airlines but later obtained trip credits, don’t worry. It is possible to apply those credits to your existing booking, saving you money on your upcoming trip.

To apply trip credits to an existing reservation on American Airlines, follow these simple steps:

- Log in to your American Airlines account on their website or mobile app.

- Navigate to the “Manage Trips” or “My Reservations” section, where you can view your current bookings.

- Locate the specific reservation you want to apply your trip credits to.

- Look for an option to modify or change your reservation. Click on this option to access the booking details.

- Within the modification options, you should see an option to apply trip credits or redeem a voucher. Select this option.

- Enter the amount of trip credits you wish to apply to the reservation. Keep in mind that you may have to use the entire balance or a specific amount based on the terms and conditions associated with your trip credits.

- Continue with the modification process, following any prompts or instructions provided by American Airlines.

- Review the updated booking details, including the amount of trip credits used and any remaining balance that may be due. Make sure everything is accurate before finalizing the changes.

- Once you confirm the modifications, you will receive a confirmation of your updated booking, reflecting the applied trip credits.

If you encounter any difficulties or have questions while applying trip credits to an existing reservation, don’t hesitate to seek assistance from American Airlines customer service. They can help guide you through the process and ensure a seamless update to your booking.

Now that you know how to apply trip credits to an existing reservation, it’s essential to be aware of any restrictions and limitations that may apply. Let’s explore this in the next section.

Restrictions and Limitations

While trip credits can be a convenient way to save money on flights, it’s important to be aware of the restrictions and limitations that may apply when using them on American Airlines.

Here are some common restrictions and limitations to keep in mind:

- Expiration Date: Trip credits typically have an expiration date, meaning they must be used within a certain timeframe. Make sure to check the expiration date on your trip credits and plan your booking accordingly to avoid losing the credits.

- Non-Transferable: In most cases, trip credits are non-transferable and can only be used by the person or account holder to whom they were issued. Ensure that you are the one making the booking when using your trip credits.

- One-Time Use: Trip credits are usually intended for a one-time use and cannot be used partially or spread across multiple bookings. You may need to use the full value of your trip credits in a single transaction or forfeit the remaining balance.

- Flight Restrictions: Some trip credits may have specific flight restrictions or limitations. This can include restrictions on certain fare classes, blackout dates, or specific routes. Make sure to review the terms and conditions associated with your trip credits to understand any flight restrictions that may apply.

- Additional Costs: Keep in mind that trip credits may not cover all ancillary fees and additional costs associated with your booking, such as seat selection, baggage fees, or in-flight services. These expenses may need to be paid separately.

- Refunds and Cash Back: Trip credits are typically non-refundable and cannot be converted into cash. They are meant to be used towards future travel expenses with the issuing airline.

It’s important to thoroughly read and understand the terms and conditions associated with your trip credits to ensure a smooth and hassle-free experience when using them. If you have any questions or concerns about the restrictions and limitations, reach out to American Airlines customer service for clarification.

Now that we have addressed some common restrictions and limitations, let’s move on to the frequently asked questions about using trip credits on American Airlines.

Frequently Asked Questions

Q: Can I use trip credits to book a flight for someone else?

A: Generally, trip credits are non-transferable and can only be used by the person or account holder to whom they were issued. However, some airlines may allow you to use your trip credits for someone else’s flight if you are the one making the booking.

Q: Can I combine trip credits with other forms of payment?

A: Yes, in most cases, you can combine trip credits with other forms of payment, such as cash or a credit card. When booking a flight, you will have the option to apply your trip credits first, and any remaining balance can be paid with a different payment method.

Q: What happens if my trip credits expire before I can use them?

A: Unfortunately, if your trip credits expire, you will no longer be able to use them towards your flights. It’s important to keep track of the expiration date and plan your bookings accordingly to avoid losing the credits.

Q: Can I use trip credits for international flights?

A: In most cases, trip credits can be used for both domestic and international flights. However, it’s important to review the terms and conditions associated with your trip credits, as there may be specific restrictions or limitations on international bookings.

Q: Can I use trip credits to pay for baggage fees or other additional expenses?

A: Trip credits are typically applied towards the cost of the flight itself and may not cover additional expenses such as baggage fees, seat selection, or in-flight services. These additional costs may need to be paid separately.

Q: Can I get a refund for unused trip credits?

A: Trip credits are typically non-refundable and cannot be converted into cash. They are meant to be used towards future travel expenses with the issuing airline.

If you have any further questions or concerns about using trip credits on American Airlines, it is always best to reach out to their customer service. They will provide you with accurate and up-to-date information based on your specific situation.

Now that we have covered the frequently asked questions, let’s wrap up this article.

Using trip credits on American Airlines can be a great way to save money on your flights. Whether you have received them as compensation for a disrupted flight, earned them through loyalty programs, or obtained them through special promotions, trip credits provide a convenient way to reduce the cost of your travel expenses.

In this article, we have covered the essential steps to maximize your trip credits on American Airlines. We’ve discussed how to check your trip credit balance, book a flight using your credits, and apply trip credits to an existing reservation. We have also highlighted some important restrictions and limitations that you should be aware of when using trip credits.

Remember to always review the terms and conditions associated with your trip credits, including the expiration date, non-transferability, and any flight restrictions. This will ensure that you make the most out of your trip credits and have a seamless experience when planning and booking your flights.

If you have any questions or concerns about using trip credits on American Airlines, don’t hesitate to reach out to their customer service. They are there to assist you and provide you with the necessary guidance and support.

So, next time you have trip credits to use, follow the steps outlined in this article and enjoy the benefits of saving on your flights with American Airlines.

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

A Simple Guide To American Airlines Trip Credits, Flight Credits, Vouchers And Gift Cards

by Gary Leff on October 4, 2020

Fortunately American Airlines has created a comparison chart for their own employees to use. This was published internally for employees on September 26.

If you cancelled several tickets because of the pandemic, your received flight credits. Unfortunately you cannot combine more than one flight credit towards the purchase of a new ticket. The good news is that those can be used for travel through the end of 2021.

The good news is if you have a travel voucher or a trip credit, those can be combined – and you can book travel for anyone you wish using them. For instance if you exchanged a ticket for a less expensive ticket, and were given a trip credit for the difference that isn’t restricted to being used for travel by the original passenger. I’d bet many readers didn’t realize this!

This is a handy chart, and it would be nice if American Airlines posted it to their website, but you may want to bookmark this post as a reference since they do not.

More From View from the Wing

About Gary Leff

Gary Leff is one of the foremost experts in the field of miles, points, and frequent business travel - a topic he has covered since 2002. Co-founder of frequent flyer community InsideFlyer.com, emcee of the Freddie Awards, and named one of the "World's Top Travel Experts" by Conde' Nast Traveler (2010-Present) Gary has been a guest on most major news media, profiled in several top print publications, and published broadly on the topic of consumer loyalty. More About Gary »

More articles by Gary Leff »

[…] aren’t even sure which type of credit they have no less how it can be used. Thankfully, View from the Wing has published a handy chart (one issued to employees since it’s nearly impossible for them to make sense of the various […]

[…] Trip credits replace travel vouchers as American Airlines Elite Rewards option for 75,000 mile qualifiers. […]

[…] different payment methods American Airlines has, and the rules for each, can be complicated. Last summer American largely replaced ‘flight vouchers’ with ‘trip […]

[…] The various credits that American Airlines still has are confusing, so here’s a simple guide to flight credits (at issue here) versus trip credits. […]

[…] many ways the American Airlines move to ‘trip credits’ and away from ‘flight credits’ has been great. When you have a travel credit with the […]

Wow, didn’t realize that flight credit (the ones in the wallet) are only one per trip. That seems like an unfair restriction designed to maximize breakage. That’s gonna hurt.

Perhaps I’m overreacting, was it this way before they got put in the wallet (Ie., you couldn’t use two cancelled tickets towards one new one?).

In any case Gary, very useful post, thanks!

Another useful information would be to know whether a flight credit can be used to purchase more than one ticket, e.g., some of us may have a flight credit (or voucher) of, say USD 2,000, and can that flight credit be used against the purchase of a single itinerary, in which case the value of that new itinerary would obviously have to be higher than USD 2,000, or can that flight credit (or voucher) of USD 2,000 be used to purchase two itineraries of USD 1,000 each. Thanks.

I have an AA trip credit and a voucher but was told I can’t combine them to purchase a flight.

What do you suggest we do when we are supposed to get an email with a link to an evoucher and the email never arrived?

American is trying to charge us $50 per ticket – so 2 x $50 per round trip ticket, totalling $200 – to use our trip credit!!! Seriously!!??!!

I’ve been dealing with AA all weekend on related issues. Was told I would receive email with voucher info for remaining balance on a previous ticket I used to pay for new trip. 48 hours later, still no email. Called them and they said they would process within next 24 hours (we shall see). While I am supposed to receive a voucher, my son used an old ticket in his “wallet” for a new flight and he received an immediate email with trip credit info. Not sure how they are deciding on gets voucher and who gets trip credit. Called EXP desk and they could not clarify for me. A voucher and trip credit cannot be combined to pay for a new ticket but they can be used to book for other people. Fairly confusing at best.

I have a trip credit from individual ticket. Tried to use it purchasing 4 tickets and pay different with AA Exec credit card to get first bag benefits for all. No go.

Was told that you can’t use individual credit on a group itinerary even if you on itinerary. To use individual travel credit you have to buy individual ticket.

Why did AA add the new trip credit, when they had e-vouchers?

If I have value on an e-voucher for say $500 and use it to buy a ticket for $400, what happens to the remaining $100? Does it sit on the e-voucher, go away forever, or something else?

I have 3 different ticket numbers to use as travel credits. Can I rebook for all 3 at the same time and in the payment section be able to enter all 3 ticket numbers or do I have to rebook each person separate? Thanks

I have two “flight credits”. They are good for travel through December 31, 2021, and only I can use them. Any chance that the expiration date will be extended? I’m already flying overseas on American in October (and used one flight credit for that trip) and won’t be able to travel again until early 2022. American should have issued vouchers instead, as United Airlines did!

David G, your best bet to use those flight credits to book a cheaper flight than what you have credit for. Say for example you have $500 flight credit – book a $35 flight (find anything!) – you will then receive a voucher for the remainder good for one year from that date which can be used much more freely. Once you receive the voucher, you can cancel the cheap flight. Hope this helps

This might be out of date now. I’m adding this comment as this is the first google search result for “can you combine trip credits”. The website now says “You may redeem a single Trip Credit on aa.com or up to 8 by calling Reservations.”

AA is the WORST company and has a terrible company culture. Always been this way but now it’s even worse. They make it almost impossible to use travel credit. I hate this airline so much.

Not sure if anyone will see this, but I have a question. My honeymoon was canceled in 2020 due to covid, and we ended up with about $900 each in AA credits through Expedia that are due to expire 3/31/22. We figured we could just go on a few small trips instead, since our original destination still has covid policies in place that would keep us from being able to vacation there, but as soon as we booked a trip for $400 each, we were told that the rest of our credits had been forfeited because you can only book ONE flight with your total balance. Is this correct? I never would’ve booked a cheap flight for half our credits if I’d known we’d lose the rest. Any insight or advice would be very much appreciated.

Just applied my travel credit from a cancelled Vegas trip last year to another trip my wife and I will be taking later this month. I had the trip on hold and called AA reservations to pay with the credit. Took a while, but ended up working, plus they confirmed that I can use the balance of the travel credit towards a future trip if used before the expiration.

A couple of caveats- they could not apply the travel credit to multiple travelers under one itinerary ie. they had to split me and my wife into 2 separate record locators. Also, for some reason the balance of the travel credit ended up being transferred over to my wife’s AAdvantage account instead of remaining on mine.

Nothing major but some points to consider.

I just called AA, and they were able to combine 2 flight credits to use for a new reservation. FYI

I have an AA flight credit for over $1200 but they are not letting me apply the value of the $900 taxes. How do I get that back?

I have a number of TRIP CREDITS in AA parlance. Does the expiration date mean the TRIP CREDIT must be exchanged for a ticket by the expiration date, or must travel using that TRIP CREDIT commence by the expiration date, or must travel using that TRIP CREDIT be complete by the expiration date?

I am trying to use an evoucher with a trip credit and am will not allow us to do it. Will not fly aa again.

I received a trip credit for AA lack of service leading to a fall.. I do not plan to fly AA again How to convert trip credit to cash?

Question: is a flight that is booked via flight credit or trip credit (I have both) be refunded BACK to flight credit or trip credit if cancelled?

Very useful post, thanks.

Note AA Gift cards have a weird limitation and IMHO ridiculously annoying limitation that they cannot be used for itineraries originating outside the US, (and Puerto Rico etc).

I have been dealing with American Airlines for over a week trying to use a flight credit issued April 25, 2022. My wife needed to cancel because she was needed by her 100 year old step father who was diagnosed with a heart problem on the 21st of that month. Her step father passed away on January 25, 2023 at 101 as a result of the heart issue. We have been trying to book he a trip to use the credit after the celebration of life and finishing some legal matters for him yet American will not allow use to book any flight after March 24th. do i have any other options other than to watch them keep our funds and force us to purchase another ticket with new funds?

AA will not allow me to use a flight credit because it is not for the original route (LIB to DFW). When I cancelled the flight, I asked what the limitations of use on the credit would be. Was told non-transferable for initial trip but any leftover would be transferable and that I had to use within a year. Never was it mentioned that it would have to be for the original route. Today they are telling me that it’s a special provision for international flights. I cannot find this caveat listed on their website or other sources. Any suggestions?

Comments are closed.

Top Posts & Pages

- Cathay Pacific Worker Discovers Foreign Objects In Airbus A350 Engine Minutes Before Takeoff For Zurich

- Airline Passenger Takes Revenge On Middle Seat Karen Who Reaches Across To Close His Shade

- Back To The Future: Delta Air Lines Returns To Boarding Zones, Downgrades Diamond Elites

- Marriott Insiders Confess The Reasons They Refuse To Upgrade Guests - Even When They're Supposed To

- Amex Extends CLEAR Benefit On Several Premium Cards

Co-founder of frequent flyer community InsideFlyer.com, emcee of the Freddie Awards, and named one of the "World's Top Travel Experts" by Conde' Nast Traveler (2010-Present) Gary has been a guest on most major news media, profiled in several top print publications, and published broadly on the topic of consumer loyalty. More About Gary »

- Search Please fill out this field.

- Manage Your Subscription

- Give a Gift Subscription

- Sweepstakes

- Airlines + Airports

How to Use Airline Flight Credits — So You Never Lose Out Again

Here’s what you need to know about using flight credits — including the specific rules for Delta, American, and other top airlines.

:max_bytes(150000):strip_icc():format(webp)/ProfilePicturewithPurpleBackground-664a02d95891481192058cd33c92d512.png)

What are flight credits?

How to use a flight credit, what to know about flight credit expiration policies.

- Airline-specific Flight Credit Rules to Keep in Mind

Ralf Hahn/Getty Images

Fight credits can come in many different forms, but they are usually the result of a canceled flight. Since the ability to cancel or change a flight without fees has become more commonplace over the last few years, flight credits have also become something frequent fliers are dealing with more often.

Using flight credits can be confusing because their terms and conditions aren’t universal — every airline has its own set of rules regarding flight credits. Here’s everything you need to know about flight credits, including how to use them, when they expire, and how to extend them. Plus, we’ll look at flight credit policies from five major U.S. airlines.

Related: What to Do If Your Flight Is Canceled, According to a Travel Expert

Flight credits, also referred to as travel credits, are credits received after canceling a flight. They are usually tied to the original ticket, so keep that information handy when you are ready to re-book your flight.

Generally, you’ll be able to book a new flight using a credit on your airline’s website. If your original ticket had multiple forms of payment, you may need to call to complete a booking using a flight credit.

If you booked the original ticket through a travel agency, you’ll need to contact the travel agency to cancel the flight and again when you want to book a new ticket with the flight credit.

Flight credits usually have an expiration date. While the length of time a credit is valid varies by airline, more often than not, they are good for one year.

Remember that some airlines start the one-year clock when the original ticket was issued, not when the flight credit was generated. So, if you book a flight and then need to cancel it six months later, your flight credit may only be valid for an additional six months.

Anna Harrison, a travel advisor and owner of Travel Observations, an affiliate of Gifted Travel Network, who is also a member of the American Society of Travel Advisors, always reminds clients of another important factor when considering flight credit expiration dates. “Remember ‘fly by’ dates can be different than ‘book by’ dates,” she stresses.

Check with your specific airline to see if you need to book your travel by the flight credit expiration date or if you actually need to travel by that date. Whether or not you can extend a flight credit after its expiration depends on the specific airline. However, most flight credits can’t be extended after their original expiration date.

Caroline Purser/Getty Images

Airline-specific Flight Credit Rules to Keep in Mind

Delta air lines ecredits.

Delta Air Lines flight credits are called eCredits, and they can be used toward the payment of any Delta flight, including taxes and fees. Passengers can use up to five eCredits at a time.

Delta eCredits can be generated from an unused or partially used ticket, as compensation for service issues, from ticket exchanges that result in unused funds, or from e-gift certificates.

To redeem your Delta eCredit, you’ll need your 13-digit eCredit number that begins with 006.

Delta eCredits are valid for one year from the day the original flight was booked, and travel must be booked by the expiration date.

American Airlines Flight Credits

American Airlines has three types of travel credits: trip credit, flight credit, and travel vouchers. We’re focusing on flight credits, which are issued for canceled flights or unused tickets. AA flight credits can be used to book non-award flights only. These credits can’t be applied to extras like seat charges or baggage fees .

The flight credit must be used on travel that begins within one year of the original travel date, not from when you cancel the original flight. If you book your flights far in advance, this can leave you with a short amount of time to use the credit.

Reservations using flight credits can be booked online for flights within the U.S., Puerto Rico, and the U.S. Virgin Islands using the record locator or ticket number of the original flight. For reservations using more than one flight credit or for international travel, you’ll need to call American Airlines to book. American Airlines flight credits aren’t transferable — they can only be used for the person named on the original flight — and they can’t be extended past their expiration dates.

JetBlue Travel Bank Credits

JetBlue flight credits are also called travel bank credits. Travel credits can be used for JetBlue flights, including taxes, the air portion of a JetBlue Vacations package, change fees on Blue Basic fares, and increased flight costs due to a change on a Blue Basic ticket. The passenger name doesn’t have to match the name of the travel bank account holder, so it’s easy to use your JetBlue flight credits for someone else.

JetBlue travel credits can’t be used for any other charges, including baggage fees , Even More Space seats, or pet fees.

To redeem your JetBlue flight credits without a TrueBlue account, you’ll need to create a Travel Bank account. Once you have travel credits, you’ll get 2 emails from JetBlue containing your Travel Bank username and a temporary password, which will allow you to set up an account. If you have a TrueBlue account, you’ll be able to see the amount of your flight credits in the Travel Bank Credit section of your online account.

JetBlue travel credits are valid for one year from the original ticketing date. Unlike many airlines, you only need to book your travel by the expiration date, but travel can be completed after the credit expires. If a reservation made using a JetBlue travel credit is canceled, the credit expiration date will not reset. JetBlue travel credits can’t be extended.

United Airlines Future Flight Credits

If you cancel a United Airlines flight or change to a less expensive itinerary, you’ll receive a future flight credit. In addition to airfare, these flight credits can be used for extras like seat selection when they are chosen during the booking process. Future flight credits can only be used for the person named on the original flight that was canceled or changed.

To use a flight credit, choose your flight on the United website or mobile app as you normally would. During the checkout process, select Travel Credits as your payment method, and any credits you have will be applied to your total. You can combine multiple future flight credits to pay for one transaction, but they can’t be combined with travel certificates.

If you want to combine your future flight credits with PlusPoints, book your flight with the flight credits first, then request a PlusPoints upgrade.

Future flight credits expire one year after the date they were issued, and your travel must begin by that date to use the credit. Credits can’t be extended.

Southwest Airlines Flight Credits

Southwest flight credits, previously called travel funds, are created after canceling a flight or changing a flight to a lower-priced itinerary. They are easy to use online, and they never expire .

These flight credits are tied to your original flight number. When paying for a new flight, look for the payment section labeled Apply Flight Credits, LUV Vouchers, and gift cards . Then, enter the confirmation number from the original flight and the passenger’s first and last name.

If the original flight that generated the flight credit was a Wanna Get Away fare, it’s non-transferable. If the flight credit was generated from a Wanna Get Away Plus, Anytime, or Business Select fare, it can be transferred to someone else.

ALREADY A CARDHOLDER?

Special limited-time offer: Earn up to 75,000 bonus miles

Terms apply

Select a category to find the best travel credit card for you:

Select a card category:

- Travel Needs

- Everyday Purchases

- Admirals Club® Membership

- Business Owners

Offer available if you apply here today. Offers may vary and this offer may not be available in other places where the card is offered.

All your travel needs.

Limited-time: Earn 75,000 American Airlines AAdvantage® bonus miles plus travel benefits

Bonus miles earned after $3,500 in purchases within the first 4 months of account opening, citi® / aadvantage® platinum select® world elite mastercard®, $0 intro annual fee for the first year , then $99 *, variable purchase apr: 21.24% – 29.99% *, *pricing details.

EVERYDAY PURCHASES AND NO ANNUAL FEE*

American Airlines AAdvantage® MileUp® Mastercard®

Earn 15,000 american airlines aadvantage® bonus miles with our no annual fee credit card*, bonus miles earned after $500 in purchases within the first 3 months of account opening, bonus miles earned after $500 in purchases within the first 3 months of account opening, no annual fee *.

BEST VALUE FOR ADMIRALS CLUB® MEMBERSHIP

Citi® / AAdvantage® Executive World Elite Mastercard®

Earn 70,000 american airlines aadvantage® bonus miles and enjoy the only credit card with admirals club® membership, bonus miles earned after $7,000 in purchases within the first 3 months of account opening, annual fee $595 *.

BUSINESS OWNERS

CitiBusiness® / AAdvantage® Platinum Select® World Elite Mastercard®

Earn 65,000 american airlines aadvantage® bonus miles to redeem for business travel, bonus miles earned after you or your employees spend $4,000 in purchases within the first 4 months of account opening, make business travel more rewarding.

International credit cards

Find the country you live in and choose the card for you.

TERMS AND CONDITIONS

Offer availability.

American Airlines AAdvantage® bonus miles are not available if you have received a new account bonus for a Citi® / AAdvantage® Platinum Select® account in the past 48 months.

The card offer referenced in this communication is only available to individuals who reside in the United States and its territories, excluding Puerto Rico and U.S. Virgin Islands.

Bonus miles

Balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions) are not purchases. American Airlines AAdvantage® bonus miles typically will appear as a bonus in your AAdvantage® account 8-10 weeks after you have met the purchase requirements. Miles may be earned on purchases made by primary credit cardmembers and authorized users. Purchases must post to your account during the promotional period. Many merchants will wait for a purchase to ship before they post the purchase to your account. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account.

First checked bag free

For benefit to apply, the Citi® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember's American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, these benefits will be cancelled.

Eligible Citi® / AAdvantage® primary credit cardmembers may check one bag free of charge when traveling on domestic itineraries marketed and operated by American Airlines, or on itineraries marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. All flights on the itinerary must be domestic flights marketed by American Airlines and operated by American Airlines or American Eagle. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. For the Citi® / AAdvantage® credit card, up to four (4) companions traveling with the eligible primary credit cardmember will also get their first checked bag free of charge if they are listed in the same reservation. Waiver does not apply to overweight or oversized bags. This benefit cannot be combined with any existing AAdvantage® elite program benefits, or with First or Business class benefits, including any waiver of baggage charges. Please see aa.com/baggage » for baggage weight and size restrictions. Applicable terms and conditions are subject to change without notice.

Double miles on American Airlines purchases

Eligible American Airlines purchases are items billed by American Airlines as merchant of record booked through American Airlines channels (aa.com, American Airlines reservations, American Airlines Admirals Club®, American Airlines Vacations℠, Google Flights, and American Airlines airport and city ticket counters). Products or services that do not qualify are car rentals and hotel reservations, purchase of elite status boost or renewal, and AA Cargo℠ products and services. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account in 8-10 weeks.

Double miles at restaurants and gas stations

Earn 2 AAdvantage miles for each $1 spent on purchases at restaurants (including cafes, bars, lounges, and fast food restaurants) and at gas stations. Food and beverage purchases made at the American Airlines Admirals Club® will be awarded 2 AAdvantage miles for each $1 spent as part of the Double Miles on American Airlines purchases benefit.

Certain non-qualifying purchases: Restaurant purchases not eligible to receive double miles include, but are not limited to, supercenters, warehouse clubs, discount stores, restaurants / cafes inside department stores, bowling alleys, public and private golf courses, country clubs, convenience stores, movie theaters, caterers and meal kit delivery services. Gas station purchases not eligible to receive double miles include, but are not limited to, purchases made at warehouse clubs that do not code gas station purchases under a gas station code, discount stores, department stores and convenience stores.

Merchant classification for rewards categories: Merchants are assigned a merchant category code ("MCC"), which is determined in accordance with Visa/Mastercard/American Express procedures based on the kinds of products and services the merchants primarily sell. Citi does not control the assignment of these codes and are not responsible for the codes used by merchants. When you use your card to make a purchase, Citi is provided an MCC for that purchase. Citi groups similar merchant codes into categories for purposes of making rewards offers. Sometimes you may expect a purchase to fit within a rewards category, but if the code assigned to the merchant wasn't grouped into that category as recognized by Citi, your purchase will not qualify for additional miles. [For example, you won't earn additional miles for purchases at a restaurant located within a retailer if the restaurant is assigned a "retailer" code instead of a "restaurant" code.] Please also note – purchases made through mobile/wireless technology may not earn additional miles depending on how the technology is set up to process the purchase.

Citi® reserves the right to determine which purchases qualify for this offer. Miles may be earned on purchases made by primary credit cardmembers and authorized users. Balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions) do not earn miles. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account in 8-10 weeks.

1 mile per $1

AAdvantage® miles are earned on purchases, except balance transfers, cash advances, checks that access your credit card account, items and services returned for credit, unauthorized charges, interest and account fees, traveler’s checks, purchases of foreign currency, money orders, wire transfers (and similar cash-like transactions), lottery tickets, and gaming chips (and similar betting transactions). Miles may be earned on purchases made by primary credit cardmembers and authorized users. Miles earned will be posted to the primary credit cardmember’s AAdvantage® account in 8-10 weeks.

Preferred boarding

For benefit to apply, the Citi® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember's American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, this benefit will be cancelled. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. Up to four (4) companions traveling with and listed in the same reservation as the Citi® / AAdvantage® primary credit cardmember are eligible to board at the same time as the primary credit cardmember. Applicable terms and conditions are subject to change without notice.

Eligible credit cardmembers will board after Priority boarding is complete, but before the rest of economy boarding. The boarding benefit will display on your American Airlines boarding pass as Group 5. This benefit applies on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc.

$125 American Airlines Flight Discount

Earn a $125 American Airlines Flight Discount certificate (the "Flight Discount") after you spend $20,000 or more in purchases that post to your Citi® / AAdvantage® Platinum Select® credit card billing statement during your credit cardmembership year (every 12 months from the billing cycle after your anniversary month through the billing cycle of your next anniversary month). With the exception of special account status or circumstances (e.g. Military relief programs), the anniversary month will coincide with the month in which the annual fee is billed. To receive the Flight Discount, your account must be open for one full billing cycle after your anniversary month. For your first year of credit cardmembership, purchases qualify as of the date of your account opening. The Flight Discount expires one year from date of issue of the certificate. The Flight Discount is redeemable toward the initial ticket purchase of air travel wholly on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. for itineraries originating in the U.S., Puerto Rico, or U.S. Virgin Islands, and sold in US Dollars. The Flight Discount is also redeemable for air travel on any oneworld® carrier or American Airlines codeshare flight. The Flight Discount is redeemable online at aa.com, or by calling American Airlines Reservations. A reservations services fee may apply for travel booked through American Airlines Reservations. The Flight Discount is redeemable only toward the purchase of the base airfare and directly associated taxes, fees and charges that are collected as part of the fare calculation for travel. The Flight Discount cannot be used to pay the taxes and charges on mileage redemption tickets where only taxes and fees are being collected. The Flight Discount may not be used for flight products and/or services that are sold separately or non-flight products and/or services sold by American Airlines. If the ticket price is greater than the value of the Flight Discount, the difference must be paid only with a credit, debit or charge card, or with American Airlines Gift Cards. Any unused balance can be applied towards eligible future travel until the stated expiration date. If travel booked with the Flight Discount is cancelled or changed by the credit cardmember, the Flight Discount will be forfeited and the credit cardmember will be responsible for any applicable fare difference and the applicable change fee. The Flight Discount will not be replaced for any reason. The Flight Discount is non-refundable, may not be sold and has no cash redemption value. After qualification, please allow 8-12 weeks for delivery of the Flight Discount.

25% savings on eligible inflight purchases

Citi® / AAdvantage® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their Citi® / AAdvantage® card. Savings do not apply to any other inflight purchases, such as wireless internet access. This benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Offer is available on eligible flights as long as supplies last. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember's card account. Applicable terms and conditions are subject to change without notice.

Authorized user

Before adding an authorized user to your credit card account you should know:

You're responsible for all charges made or allowed to the credit card account by the authorized user. Miles earned on an authorized user’s credit card will be allocated to the AAdvantage® account of the primary credit cardholder and not the authorized user. Authorized users have access to your credit card account information. Before adding an authorized user, you must let him/her know that we may report credit card account performance to the credit reporting agencies in the authorized user's name. If we ask for information about the authorized user, you must obtain their permission to share their information with us and for us to share it as allowed by applicable law. Authorized users do not receive the first checked bag free or boarding benefits.

Fraud Disclosure

If Citi sees evidence of fraud, misuse, abuse, or suspicious activity, as determined by Citi in its sole discretion, Citi reserves the right to take action against you and your credit card account. This may include, without limitation and without prior notice, declining your credit card account application, stopping you from earning American Airlines AAdvantage® miles for purchases made with your card, suspending or closing your Citi® / AAdvantage® card account, and advising American Airlines of such activity. Citi may also take legal action against you to recover monetary losses, including litigation costs and damages. Examples of activities that may trigger such actions include, but are not limited to, the following: (1) application for a card account in an attempt to take advantage of a bonus offer that was not intended for you or for which you are not eligible per the terms of the offer; (2) repeated cancellation or conversion of your Citi card accounts within one year after account opening or conversion; (3) returns of purchases you made to satisfy all or a substantial portion of the purchase requirements for a bonus offer or excessive returns of purchases for which you have earned AAdvantage® miles or (4) using your account other than for personal, family or household purposes.

Card Account Disclosure

The Card Account is only available if you have an open AAdvantage® program membership in your name. Citi reserves the right to cancel your Card Account if you or American Airlines terminates or deactivates your AAdvantage® program membership.

American Airlines reserves the right to change the AAdvantage® program and its terms and conditions at any time without notice, and to end the AAdvantage® program with six months’ notice. Any such changes may affect your ability to use the awards or mileage credits that you have accumulated. Unless specified, AAdvantage® miles earned through this promotion/offer do not count toward elite-status qualification or AAdvantage Million Miler℠ status. American Airlines is not responsible for products or services offered by other participating companies. For complete details about the AAdvantage® program, visit aa.com/aadvantage » .

Travel booked on American Airlines may be American Eagle® service, operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc.

American Airlines, American Eagle, AAdvantage, AAdvantage Million Miler, MileSAAver, Business Extra, Flagship, Admirals Club, Platinum Pro, AAdvantage MileUp, AA Cargo, the Flight Symbol logo and the Tail Design are marks of American Airlines, Inc.

one world is a mark of the one world Alliance, LLC.

Citibank is not responsible for products or services offered by other companies. Cardmember program terms are subject to change.

Mastercard, World Elite and the circles design are registered trademarks of Mastercard International Incorporated.

© 2021 Citibank, N.A. Citi, Citi and Arc Design and other marks used herein are service marks of Citigroup Inc. or its affiliates, used and registered throughout the world.

American Airlines AAdvantage MileUp® Mastercard®

Statement credit and American Airlines AAdvantage® bonus miles are not available if you have received a statement credit or American Airlines AAdvantage® bonus miles for a new AAdvantage MileUp® account in the past 48 months.

Double miles on grocery store purchases

Earn 2 AAdvantage miles for each $1 spent on purchases at grocery stores. Grocery stores are classified as supermarkets, freezer/meat locker provisioners, dairy product stores, miscellaneous food/convenience stores, markets, specialty vendors, and bakeries.

Certain non-qualifying purchases: You won’t earn double miles for purchases at general merchandise/discount superstores, wholesale/warehouse clubs, candy/confectionery stores, cafes, bars, lounges, and fast food restaurants.

Merchant classification for rewards categories: Merchants are assigned a merchant category code (“MCC”), which is determined in accordance with Visa/Mastercard/American Express procedures based on the kinds of products and services the merchants primarily sell. Citi does not control the assignment of these codes and are not responsible for the codes used by merchants. When you use your card to make a purchase, Citi is provided an MCC for that purchase. Citi groups similar merchant codes into categories for purposes of making rewards offers. Sometimes you may expect a purchase to fit within a rewards category, but if the code assigned to the merchant wasn’t grouped into that category as recognized by Citi, your purchase will not qualify for additional miles. [For example, you won’t earn additional miles for purchases at a restaurant located within a retailer if the restaurant is assigned a “retailer” code instead of a “restaurant” code.] Please also note – purchases made through mobile/wireless technology may not earn additional miles depending on how the technology is set up to process the purchase.

AAdvantage MileUp® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their AAdvantage MileUp® credit card. Savings do not apply to any other inflight purchases, such as wireless internet access. This benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Offer is available on eligible flights as long as supplies last. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember's card account. Applicable terms and conditions are subject to change without notice.

No mileage cap

There is no maximum number of American Airlines AAdvantage® miles that you can accumulate through your Citi® / AAdvantage® credit card account.

You're responsible for all charges made or allowed to the credit card account by the authorized user. Miles earned on an authorized user’s credit card will be allocated to the AAdvantage® account of the primary credit cardholder and not the authorized user. Authorized users have access to your credit card account information. Before adding an authorized user, you must let him/her know that we may report credit card account performance to the credit reporting agencies in the authorized user's name. If we ask for information about the authorized user, you must obtain their permission to share their information with us and for us to share it as allowed by applicable law.

American Airlines AAdvantage® bonus miles are not available if you have received a new account bonus for a Citi® / AAdvantage® Executive account in the past 48 months.

Eligible Citi® / AAdvantage® primary credit cardmembers may check one bag free of charge when traveling on domestic itineraries marketed and operated by American Airlines, or on domestic itineraries marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. All flights on the itinerary must be domestic flights marketed by American Airlines and operated by American Airlines or American Eagle. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. For the Citi® / AAdvantage® card, up to eight (8) companions traveling with the eligible primary credit cardmember will also get their first checked bag free of charge if they are listed in the same reservation. Waiver does not apply to overweight or oversized bags. This benefit cannot be combined with any existing AAdvantage® elite program benefits, or with First or Business class benefits, including any waiver of baggage charges. Please see aa.com/baggage » for baggage weight and size restrictions. Applicable terms and conditions are subject to change without notice.

Enhanced airport experience

For benefits to apply, the Citi® / AAdvantage® Executive World Elite Mastercard® account must be open 7 days prior to air travel AND reservation must include the primary credit cardmember's American Airlines AAdvantage® number 7 days prior to air travel. If your credit card account is closed for any reason, these benefits will be cancelled. Citi® / AAdvantage® Executive credit cardmembers will have the following benefits: priority check-in (where available), priority airport screening (where available), and priority boarding privileges. The priority boarding benefit will display on your American Airlines boarding pass as Group 4.

These benefits apply when traveling on flights marketed and operated by American Airlines, or on flights marketed by American Airlines and operated as American Eagle® flights by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. Up to eight (8) companions traveling with the eligible primary credit cardmember will also get priority check-in (where available), priority airport screening (where available), and priority boarding privileges if they are listed in the same reservation. You may check in at any Business Class check-in position or First Class check-in when Business Class is not available, regardless of the class of service in which you are traveling on American Airlines.

These benefits will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. Exclusive lanes at security checkpoints are available, subject to TSA approval. Applicable terms and conditions are subject to change without notice.

Citi® / AAdvantage® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their Citi® / AAdvantage® credit card. Savings do not apply to any other inflight purchases, such as wireless internet access. This benefit applies to domestic flights marketed and operated by American Airlines or on domestic flights marketed by American Airlines and operated by Envoy Air Inc., Republic Airways Inc., SkyWest Airlines, Inc., Mesa Airlines, Inc., PSA Airlines, Inc., or Piedmont Airlines, Inc. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Offer is available on eligible flights as long as supplies last. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember's card account. Applicable terms and conditions are subject to change without notice.

Admirals Club® membership and credit card authorized user access