Travel Insurance

An illness, an accident or an unexpected situation can arise before or during any type of vacation. Such an event might cause you to cut short your cruise or cause your trip to be canceled altogether. Unfortunately, most cruise lines impose penalties for canceling a cruise, up to and including loss of the entire cruise price.

Because a cruise is a significant investment, most cruise lines offer some form of insurance to protect their passengers from financial loss in the event of an emergency. Details and prices vary from cruise line to cruise line, as do coverage limits and exclusions.

If you decide to purchase insurance, you will have two options, to go with the cruise line's plan or to use our independent insurance provider, Generali Global Assistance. Use the summaries below to compare policies and prices.

Generali can provide insurance coverage to all customers, regardless of their country of citizenship, except residents of the province of Quebec, Canada.

For more information or a complete copy of a policy, ask your Vacations To Go cruise counselor.

Independent Insurance Coverage

Generali Global Assistance

Cruise Line Coverage

Quick Quote

- Airline Travel Insurance Review

- Country Travel Health Insurance

- Country Traveler Information

- Cruise Company Insurance Review

- Insurance Carrier Review

- Travel Company Insurance Review

- City Guides

Celebrity Cruises Travel Insurance - 2024 Review

Celebrity cruises travel insurance.

- Strong Insurance Partner

Sharing is caring!

Celebrity Cruises is considered by many to be one of the top cruising brands in the world. Over the years their desire for excellence in all levels of customer service has helped propel them to a long list of awards over the years including the 2020 Travvy Award for Best Premium Cruise Line. Celebrity Cruise Lines aims to provide their customer with the best cruise vacation possible, whilst also working hard to sustain the environment and striving to leave the world a better place. Celebrity pride themselves on their luxurious accommodations which invites you to “revel in stylish design.” Onboard experiences include world-class entertainment, state-of-the-art fitness and wellness centers, casinos, and so more. As with many other cruise lines in this day and age, Celebrity have also partnered a number of with renowned wolrd-class chefs which has helped earn them the 2020 WAVE Award for Best Onboard Dinning.

With over 300 destinations across all seven continents, Celebrity strive to offer something for everyone.

Sample Cruise Itinerary

In this review we consider the travel insurance protection offered by Celebrity when booking, and then compare it against other plans available in the wider marketplace. To do this, we need to go on a Celebrity cruise, so let's haul up the anchor and set sail.

For our example, we chose an 8-day cruise that departs from Athens, Greece, and travels to Italy and Spain before returning back to Athens. We selected cruise dates of 10/03/2022 – 10/10/2022. For our travelers, they are two adults who are aged 55 and 60 and the cruise price per person is $3,609 which gives us a total of $7,218.

As airfares are purchased separately and pricing can vary massively for this part, we have not considered the airfare within the pricing for the amount to be insured, however you will of course want to insure your airfare in your trip insurance.

Comparison Quotes

Celebrity Cruises offers it's CruiseCare Travel Protection as an add-on to your cruise booking. It contains both insurance and non-insurance benefits. Their current program is administered by Aon Affinity, with some of the coverages being underwritten by Arch Insurance Company. Whilst Arch is certainly a strong insurance partner, the overall CruiseCare Program is not, in our opinion, a strong travel insurance plan due to low coverage limits.

Based on our sample couple, ages 55 and 60, we created comparison quotes using Cruise Insurance 101’s travel insurance marketplace engine. For the comparison we used the trip cost as the cruise cost for both travelers, namely $3,609 per person for a total of $7,218.

When traveling outside the United States, we recommend to our customers that they should have a minimum of $100,000 in Medical Insurance cover, a minimum of $250,000 in Medical Evacuation cover, and whenever possible to purchase a plan that gives them a Pre-existing Medical Condition Waiver. These are the criteria we used to choose the selected quotes.

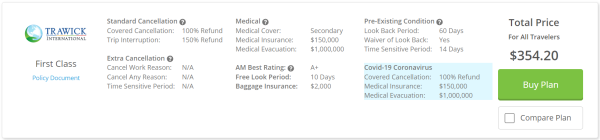

The least expensive plan with adequate coverage on our quote from Cruise Insurance 101 is the Trawick First Class . We will compare this plan to the CruiseCare plan that Celebrity currently offers.

This Trawick policy allows for cancellation for the most common reasons such as: unforeseen illness, accidental injury, or death of a family member. This is also the case with Celebrity’s CruiseCare plan. However, some travelers may also want the ability to cancel for any reason whatsoever, without then forfeiting their entire vacation investment. This is where a Cancel For Any Reason (CFAR) policy will allow the insured traveler to cancel for any reason not listed in the policy and still receive something in return. Trawick’s CFAR offers a 75% cash refund, whilst Celebrity’s CruiseCare CFAR offers a 90% refund, which is impressive, but this 90% refund is only in the form of future cruise credits. Not cash. It’s also important to point out that Trawick allows you to insure all the pre-paid, non-refundable expenses (which can include airfare, tours and excursions, etc). The Celebrity CruiseCare plan will only cover the cruise portion of your travels. This means that if you want to insure your flgihts as well (which you will), then you will need to buy a travel insurance plan in any event.

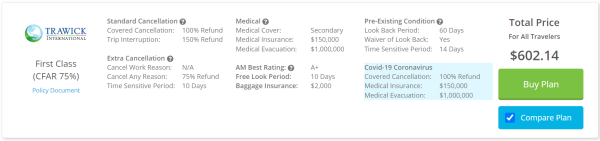

The Cancel For Any Reason (CFAR) policy that we chose for our comparison is the Trawick First Class (CFAR 75%). We chose this plan because it is the most affordable CFAR policy available that also meets the medical coverage limits that we recommend. In our example we compare this plan to the Celebrity CruiseCare Protection Plan (with CFAR).

Next, we break down the benefits of each policy in a side-by-side comparison so you can see the strenghts and weaknesses of each plan, and the price for each plan.

Cost Comparison

In our opinion, overall Celebrity’s CruiseCare Travel Protection plans are insufficient. They provide only a fraction of the recommended limits of $100,000 in Medical Insurance, and $250,000 in Medical Emergency Evacuation cover. Also, something which is very important to many cruise travelers who have a medical condition, Celebrity Cruises does not offer a Pre-existing Medical Condition Waiver, which would waive their 60-day Look Back Period contained under their plans. Furthermore, whilst the CFAR policy provides a high percentage return, it only provides it as a cruise credit which is then only valid for one year instead of a cash refund option. A cruise credit is fine if you want to travel again with Celebrity and can medically do so within a year, but if not, you lose your entire holiday investment. Finally, as mentioned above, it’s also important to consider that Celebrity’s plans will only insure the cruise portion of your trip, not your flights or any other pre-paid expenses. If you have the need to cancel your trip and haven't got additonal travel protection in place, you are likely to lose your flight cost and any other non-refundable expenses you have paid.

By shopping for cruise insurance through Cruise Insurance 101, our two travelers can save anywhere from $130.80 to $202.86, which could be applied to airfare, additional tours, or shopping as well as gaining superior protection and a cash refund CFAR benefit.

In the following sections, we discuss what to look for when shopping for travel insurance for your Celebrity cruise.

Trip Cancellation

A significant concern for travelers is Trip Cancellation . If you become ill or have an accidental injury before your departure date, you may need to cancel your vacation, resulting in financial losses. This makes Trip Cancellation a very valuable feature if you’re keen to protect your vacation's financial investment.

The trip cancellation offered in the Celebrity Cruise insurance is a non-insurance benefit , which means that Celebrity Cruises offers the coverage and pays any claims, not an insurance provider. Their plans permit cancellation for the following reasons:

- Unexpected injury, illness, or death of traveler or family member.

- Residence uninhabitable by natural disaster, fire, flood, burglary

Unfortunately, Celebrity’s list of cancellation reasons lacks some of the most important coverages we would typically expect to see in a comprehensive travel insurance plan. We recommend policies that also include:

- Default or bankruptcy of the common carrier or travel supplier

- Cancel For Work Reason (traveler required to work during the trip)

- Employer-initiated transfer of 250 miles or more

- Destination uninhabitable or unreachable by fire, flood or natural disaster

- Mechanical breakdown of a common carrier

- Traveler involved in accident en-route to departure

- Mandatory evacuation

- Documented theft of passports or visas

- Jury duty, or subpoena.

Celebrity CruiseCare Travel Protection will provide a full refund if you have to cancel for a covered reason, but their Cancel For Any Reason policy only provides a 90% refund in the form of a future cruise credit, not a cash refund. Also, their protection plans do not cover any travel arrangements booked outside of your cruise, such as flights and transfers.

Both the Trawick First Class policy and the Trawick First Class (CFAR 75%) policy can cover all of your travel arrangements, regardless of where you booked them. Additionally, they both offer a 100% refund for covered Trip Cancellations, a 150% refund for covered Trip Interruptions (more on this below), and a wide list of covered reasons, including if you need to cancel due to contracting COVID.

Trip Interruption

A Trip Interruption is a situation during your trip that causes you to miss some or the rest of your vacation. Trip Interruption cover is similar to Trip Cancellation, but when an event occurs during your trip.

The most common trip interruption events are an injury or illness of a traveler. If you are unfortunate to have an injury or illness on your vacation but you can continue traveling after some treatment, the trip interruption benefit in the travel insurance reimburses the unused portion of your trip, and also covers the cost for you to rejoin the trip in progress.

Trip interruption also includes cover if a family member has a sudden grave illness or has sadly passed away. If your covered situation requires that your end your trip early to return home, Trip Interruption also reimburses for the unused portion of the trip, plus the added cost of going home early.

In the Celebrity CruiseCare Travel Protection insurance policy, Trip Interruption benefits include up to 150% of the total trip costs if you need to interrupt due to a covered reason. That amount includes reimbursement of unused trip costs plus the added cost of transportation home.

Travel insurance plans like the Trawick First Class also offer 150% of trip costs for interruption. Therefore, they cover up to 100% of the unused costs, plus up to an additional 50% to cover transportation costs to return home.

Cancel For Any Reason

Cancel For Any Reason cruise insurance gives a cruise traveler the highest level of flexibility and refund if they need to cancel their trip for any reason that is not covered in the policy schedule.

If you cancel your Celebrity cruise for a reason not listed in their policy, they will grant you future cruise credits for 90% of the prepaid, non-refundable cancellation fees paid to them. However, cruise credits expire after one year and they are non-transferrable and not redeemable for cash. Remember it is Celebrity, and not their insurance policy, that provides this part of the CruiseCare Travel Protection. Whilst a 90% CFAR cruise credit is attractive, it is only useful if you can use it. When it comes to refunds, we always prefer cash since future credits may not be used and will then expire. Cash doesn't have an expiration date!

Alternatively, travel insurance policies like Trawick First Class with Cancel For Any Reason included pays out 75% as a cash refund of all prepaid, non-refundable trip costs, including any arrangements made outside of Celebrity Cruises. This could include flights, hotels, rental cars, excursions, and transfers.

As you would expect there are a number of stipulations for a Cancel For Any Reason policy to pay out, but these are quite straightforward:

- Purchase the policy within 10 to 21 days (depending on policy bought), of your initial payment or deposit date,

- Insure 100% of the prepaid trip costs subject to cancellation penalties or restrictions. If you have yet to book your entire trip, buy your travel insurance for what has already been booked, within 10-21 days (depending on policy), and add to it as you book additional parts of your trip,

- Cancel your trip 2 days or more before your scheduled departure date.

Medical Insurance for Emergency Treatment

One of the most important factors in selecting trip insurance is having sufficient Medical Insurance when you travel. Anything can happen at anytime, often when we least expect it, be it accidental injuries or a sudden illness.

If you have a medical emergency when traveling and you don’t have sufficient medical insurance coverage when overseas, you may find yourself with huge, unexpected hospital bills to pay out of your own pocket. Many Americans mistakenly believe that countries which have universal health care for their own citizens will treat them for free if they have a medical emergency. Unfortunately, this is not the case.

Instead, Americans receive treatment at private hospitals, not public ones, and they must pay like anyone else does. Admission for inpatient care can cost $3,000-$4,000 per day in a private hospital, and then you need to factor in the additional costs of treatment, x-rays, surgeries, and specialists.

A common misconception is that Medicare will pay for hospitalization overseas. Unfortunately, it won’t. Medicare does not pay for medical providers outside the US. Some Medicare supplements plans do cover overseas, but these have a small lifetime limit or reduced benefits, and will pay for emergencies only. They can also still require you to pay 20% of the costs. As a result, you could go on your dream vacation and end up with medical bills in the thousands.

Cruise Insurance 101 urges overseas travelers to take travel medical insurance of at least $100,000 per person . In our opinion, in a medical emergency, $100,000 would provide ample health care and will help protect your retirement savings from a potentially massive unexpected financial burden.

Celebrity CruiseCare Travel Protection provides a $25,000 benefit for Medical Insurance that would cover illness or injury. Compared to Trawick’s First Class policy which includes $150,000 of medical coverage per person, you can immediately see that the Trawick plan is much better suited to ensure you receive proper treatment without ending up in debt.

Emergency Medical Evacuation

Medical Insurance isn’t the only potentially expensive part of a trip. Emergency Medical Evacuation transports you from the place of injury or illness to the closest hospital. Once you’re stable enough for transport, Medical Evacuation brings you home via commercial flight or, if necessary, private medical jet.

Medical evacuation flights can be very expensive and cost up to $25,000 per hour of flight time. Regular health insurance does not cover this. In addition, the US State Department does not offer any medical treatment or evacuation assistance for US citizens. Cruise Insurance 101 advises travelers to carry at least $250,000 of Medical Evacuation cover to assure there’s enough coverage to get them back home from almost anywhere in the world if they were to experience a serious medical event.

Celebrity CruiseCare Travel Protection includes Medical Evacuation up to $50,000 per person. By contrast the Trawick First Class plans both provide $1,000,000 per person for Medical Evacuation. Whilst $50,000 may initially sound like quite a lot of cover, when one takes into account the sort of costs possible with emergency evacuation, and the substantially greater levels of cover available with a full comprehensive travel insurance plan, the Celebrity CruiseCare Travel Protection plan starts to look somewhat lacking in substance if the worst were to happen.

Pre-existing Medical Conditions

A significant concern for senior travelers can be pre-existing medical conditions. A Pre-Existing Medical Condition is one in which you’ve received medical treatment, testing, medication changes, added new medications, or received a recommendation for a treatment or test that hasn’t happened yet. Most travel insurance policies exclude pre-existing conditions unless you purchase the policy within the required time-period from your initial trip deposit date (called the Time Sensitive Period). Otherwise, the insurer will look backward 60, 90, or even 180 days (depending on the policy) from the date you purchased the insurance to see if there are any pre-existing medical conditions they won’t cover. This is called the Look Back Period. Any medical conditions older than this Look Back Period, unchanged or stabilized with no medication dosage changes are covered, as are any new conditions that arise after you purchase the policy.

If you must cancel, interrupt, or seek medical treatment for a medical condition while traveling, travel insurance policies typically exclude claims related to Pre-existing Medical Conditions. However, if you purchase the policy within a few days of your Initial Trip Payment or Deposit date, many policies add a Waiver to the policy that covers Pre-existing Conditions. As a result, there is no Look Back Period and Pre-existing Conditions are covered. What's more, most of the plans on Cruise Insurance 101 that offer a pre-existing condition waiver offer it at no additional cost. All you need to do is buy the plan within the time senstive period to get the added protection.

The CruiseCare Travel Protection covers Pre-Existing Conditions provided that:

- Your payment for this plan is received within the Time Sensitive Period (14 days of Initial Trip Payment) and

- You insure 100% of the cost of all Travel Arrangements that are subject to cancellation penalties and

- You or the individual with the Pre-Existing Condition, are not disabled from travel at the time You make Your payment for this plan, and

- Trip cost per person does not exceed $15,000 per person

The Trawick First Class policies also cover Pre-existing Medical Conditions, and the same 14-day Time Sensitive Period applies. Additionally, the Trawick policy does not have a cap on the trip cost.

Price and Value

In our opinion Celebrity’s CruiseCare Travel Protection plans carry minimal coverage and are more expensive than other options available on the wider travel insurance marketplace. The medical insurance cover is only $25,000, while the medical evacuation cover is only $50,000, which we feel may not be adequate for a serious illness or injury. Turning to their Cancellation reasons we feel these are rather limited and adding the Cancel For Any Reason option substantially increases the cost of the insurance yet only grants future cruise credits that will expire after just one year. Overall, we believe it offers limited value for the price charged.

In contrast, by comparison shopping, we found the standard Trawick First Class policy comes in at $354.20. It includes far superior medical and evacuation benefits, a 100% refund for trip costs for covered cancellation, a 150% refund for covered trip interruption, and a very robust list of cancellation reasons.

Choosing the CruiseCare Travel Protection plan with Cancel For Any Reason didn’t provide any better value. Their Cancel For Any Reason option will certainly provide a 90% cover, but only as a future cruise credit for up to one year, not a cash refund. Again, by comparison shopping, we found the Trawick First Class (CFAR 75%) policy for $602.14. It includes $150,000 of medical insurance and a substanial $1,000,000 for medical evacuation. Plus, it includes a Cancel For Any Reason provision that refunds 75% of your trip costs back in cash, not future cruise credit. It has far superior coverage levels over Celebrity’s policy at a more affordable rate.

Celebrity’s CruiseCare Travel Protection plans provides travelers with a minimal insurance policy for a high cost that could leave travelers unpleasantly surprised if they were to have an emergency. Medical coverage and medical evacuation limits are worryingly low, and there are a limited number of covered cancellation and interruption reasons, as well as insufficient trip cost reimbursement. Overall, we rate it a 7 out of 10.

Travelers planning a Celebrity vacation will find the best value for their money and peace of mind when they shop for travel insurance at Cruise Insurance 101 Travel Insurance Marketplace. There, you can review dozens of options and select the best policy to fit your needs.

To help you find the best policy, Cruise Insurance 101 recommends having at least $100,000 in travel medical coverage and $250,000 emergency medical evacuation when traveling within 2 to 3 hours of the US. If traveling further afield we recommend $500,000 of emergency evacuation cover. And, if you purchase the policy within the 14-21 days of initial trip payment, please consider a travel insurance policy with includes a pre-existing condition waiver to ensure that you get the most coverage for your money.

If you are planning a Celebrity cruise in 2022 or beyond, be sure to pack insurance before you travel. You never know when you may need it.

Have questions? Chat with us online, send us an email at [email protected] or alternatively call us at +1(786) 751-2984 . We would love to hear from you.

Safe Travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

Peter was very helpful and answered all…

Peter was very helpful and answered all our questions.

Choosing a plan was quick and easy

Choosing a plan was quick and easy. The questions did not take long at all to answer and a plan was recommended in a short period of time.

Lady Coinbits

My agent, Shanna was awesome. Helped me find the best policy or my needs and explained everything to me.

Cruise Care Vacation Protection

Phone: Miami (305) 459-1770

Authorized Travel Partner for Royal Caribbean , Celebrity Cruises & Azamara Club Cruises

Celebrity Cruises CruiseCare Package of Benefits

Celebrity wants this to be the best vacation of your life. So to make sure you have nothing to think about except having a good time, Celebrity offers the CruiseCare Guest Protection Plan. CruiseCare protects you both before and during your cruise. With CruiseCare, if your plans go awry and you cancel your cruise, you're protected either by insurance if you cancel for a covered reason or by cruise credits from Celebrity Cruises if you cancel your cruise for any other non-insured reason.

**Prices subject to change. Celebrity CruiseCare The Cancellation Penalty Waiver and Cruise Vacation Cancellation Enhancement Program - non-insurance features provided by Celebrity Cruise Line

- Cancellation Penalty Waiver*: up to 100% of cash back for Celebrity cancellation fees if you cancel for a specified reason

- Cancel For Any Reason Cruise Vacation Enhancement: up to 90% of Celebrity cancellation fees in the form of a future cruise credit if you cancel for any other reason

- Trip Interruption: up to 150% of total trip cost if you can't start or finish your cruise vacation because you're sick or hurt, there's a death in the family or another covered reason

- Trip Delay: up to $2,000 ($250/day) for catch-up expenses if you’re delayed for 3 or more hours

- Missed Connection: up to $300 if you miss your trip departure for covered reasons by 3 or more hours

- Accident Medical: up to $25,000 if you get hurt on your cruise vacation

- Sickness Medical: up to $25,000 if you get sick on your cruise vacation

- Emergency Medical Evacuation: up to $50,000 if you need emergency medical transportation

- Baggage Protection: up to $1,500 if your bags are lost, stolen, or damaged

- Bag Delay: up to $500 to buy necessary personal items if your bags are delayed for 24 hours or more

Worldwide Emergency Assistance, services provided by CareFree Travel Assistance™ Enjoy 24/7 global assistance during your trip. Services include:

- CareFree Travel Assistance™

- Medical Assistance

- Emergency Services

CruiseCare is not in effect until the plan cost has been received by Celebrity, in addition to any cruise deposits/payments due. This is not a complete description of all benefits and limitations. For full terms and conditions of coverage, ask your Vacations To Go cruise counselor. Prices, terms and conditions listed in this summary are subject to change without notice and need to be reconfirmed with your Vacations To Go cruise counselor at the time of booking. If you book a Celebrity cruise, you can purchase insurance from Celebrity or from the independent insurance provider, Generali Global Assistance (formerly CSA Travel Protection). Click here to see details of the Go Plan from Generali Global Assistance.

- Need help? 1-888-751-7804 1-888-751-7804

- Let Us Call You CALL ME

- Drink Packages

- Shore Excursions

- Manage Reservation

- Upgrade with MoveUp

- Join Captain's Club

Already booked? Sign in or create an account

- South Korea

- New Zealand

- Grand Cayman

- St. Maarten

- U.S Virgin Islands

- New England & Canada

- Pacific Coast

- Antarctic Ocean

- Panama Canal

- Transatlantic

- Transpacific

- Cruise Ports (+300)

- Mediterranean

- Perfect Day at CocoCay

- All Inclusive

- Bucket List Cruises

- Cruise & Land Package

- Groups & Events

- New Cruises

- Popular Cruises

- Specialty Cruises

- Destination Highlights

- Group Excursions

- Private Journeys

- Shore Excursions Overview

- Small Group Discoveries

- 360° Virtual Tours

- Celebrity Apex® NEW

- Celebrity Ascent℠ COMING SOON

- Celebrity Beyond℠ NEW

- Celebrity Constellation®

- Celebrity Edge®

- Celebrity Eclipse®

- Celebrity Equinox®

- Celebrity Infinity®

- Celebrity Millennium®

- Celebrity Reflection®

- Celebrity Silhouette®

- Celebrity Solstice®

- Celebrity Summit®

- Explore Edge Series

Galapagos Expedition Series

- Celebrity Flora®

- Celebrity Xpedition®

- Celebrity Xploration®

- The Retreat

- All Suites. All Included

- Iconic Suite

- Penthouse Suite

- Reflection Suite

- Royal Suite

- Signature Suite

- Celebrity Suite

- Aqua Sky Suite

- Horizon Suite

- Concierge Class

- Eat & Drink

- Entertainment

- Spa & Wellness

- Cruising 101

- Cruise Fare Options

- Cruise Tips

- First Time on a Cruise

- What is Included on a Cruise

- Future Cruise Vacations

- Accesible Cruising

- Manage Cruise

- Healthy at Sea

- Travel Documents

- Royal Caribbean International

- Celebrity Cruises

- 40% Off Every Guest + Savings Bonus

- 3rd and 4th Guests Sail Free

- Alaska Cruisetour Savings

- Exciting Deals

- View All Offers

- All Included

- Cruise & Land Packages

- Dining Packages

- Photo Packages

- Wi-Fi Packages

- View All Packages

- Captain's Club

- Celebrity Points

- Loyalty Exclusive Offers

Everyone saves 40% on every sailing and receives an added savings bonus of up to $200 per stateroom. Plus, on select sailings, 3rd and 4th guests sail for free.

CruiseCare Travel Protection

We want this to be the best vacation of your life. And, to make sure you have the most carefree vacation possible, we offer CruiseCare®. CruiseCare® is an optional travel protection add-on to your cruise booking that’s available through Celebrity for US residents in all states except New York 1 . For New York residents who wish to purchase the product, please visit https://travelcruisecare.com.

Call to add

1-888-751-7804

New York residents may call Aon Affinity Services

1-800-797-4516

Why Travel Protection?

Cancellation penalty waiver program – non-insurance features provided by celebrity cruises.

Allows you to cancel and waives the normally non-refundable cancellation charges if you need to cancel for specified reasons. In addition, CruiseCare® Cancel For Any Reason Cruise Vacation Enhancement makes sure that in the event you choose to cancel for a reason not eligible under the plan, at any time up until departure, Celebrity will provide you with a cruise credit equal to 90% of the non-refundable value of your cruise vacation prepaid to Celebrity, for your use towards a future cruise (excluding Flights by Celebrity).

Trip Interruption & Trip Delay 2

Provides coverage if you can’t start or finish your cruise vacation because you’re sick or hurt, there’s a death in the family, or for another covered reason. For Trip Delays, the plan reimburses up to $2,000 for covered out-of-pocket expenses to catch up to your cruise. For trip interruption the plan covers up to 150% of your total trip cost.

Baggage and Bag Delay Protection 2

If your baggage or personal property is lost, stolen, or damaged, the plan covers up to $1,500. If your bags are delayed or misdirected for more than 24 hours, the plan reimburses up to $2,000 for the purchase of necessary personal items due to a covered delay.

Medical Expense, Evacuation & Repatriation Benefits 2

Should you become injured or sick during your vacation, the plan reimburses for covered medical expenses for up to one year from the date of your accident or illness. It is important to evaluate your current insurance to ensure that you have adequate medical coverage while you are traveling. Depending on your plan, Medicare and other health insurance providers may not cover expenses incurred outside of the US. Coverage is up to $25,000 for Accident or Sickness Medical Expenses, up to $50,000 for Emergency Evacuation and up to $25,000 for Repatriation.

24/7 Emergency Assistance 3 – emergency travel assistance provided by CareFree Travel Assistance TM

Provides 24-hour travel assistance, medical assistance and emergency services, such as: pre-trip health, safety, and weather information, assistance with travel changes, lost luggage assistance, emergency cash transfer assistance, medical consultation, emergency legal, medical and dental assistance and more.

Need to file a claim?

Claims may be filed through Aon Affinity for guests who purchased Celebrity’s CruiseCare® plan. 1 A claim may be filed online at www.aontravelclaim.com . To view terms, conditions and exclusions, visit: https://www.archinsurancesolutions.com/coverage/Celebrity .

1 This Celebrity CruiseCare® plan is an optional travel protection add-on to your cruise booking and is available through Celebrity for residents in all states except New York. New York state residents who are interested in travel protection may contact Aon Affinity by visiting https://travelcruisecare.com or calling Aon Affinity at 1-800 797-4516. If added, CruiseCare® is not effective until the plan cost has been paid. Plan cost is not automatically included as part of your initial cruise deposit.

2 Travel Insurance benefits are administered by Aon Affinity and underwritten by Arch Insurance Company, with administrative offices in Jersey City, NJ (NAIC #11150) under Policy Form series LPT 2013 and applicable amendatory endorsements. This is a brief overview of the coverages. Subject to terms, conditions, and exclusions. This is a general overview of travel insurance benefits available. Coverages may vary in certain states and not all benefits are available in all jurisdictions. Please refer to your certificate of benefits or policy of insurance for detailed terms, conditions and exclusions that apply.

This program was designed and is administered by Aon Affinity. Aon Affinity is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc. (TX 13695); (AR 100106022); In CA & MN, AIS Affinity Insurance Agency Inc. (CA 0795465); in OK, AIS Affinity Insurance Services Inc.; in CA, Aon Affinity Insurance Services Inc. (CA 0G94493), Aon Direct Insurance Administrations and Berkely Insurance Agency and in NY, AIS Affinity Insurance Agency.

3 Worldwide Emergency Assistance are emergency travel assistance provided by CareFree Travel Assistance TM . CEL_12162022

View Terms, Conditions and exclusions here.

Consumer Notices | Privacy Policy

www.archinsurancesolutions.com/consumer-notices-aon &

www.archinsurancesolutions.com/documents/archprivacynotice.pdf

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Is Cruise Travel Insurance Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What is cruise travel insurance?

What does cruise travel insurance cover typically, how much is travel insurance for a cruise, do i need it if i have other travel protections, is cruise travel insurance worth it.

Cruise travel insurance covers the cruise itself, not related travel.

It's usually purchased through the cruise operator, typically before booking.

Check to make sure your credit card doesn't offer similar insurance before buying cruise insurance.

Cruising is one of America's favorite travel experiences. According to a 2021 report from Cruise Lines International Association, an industry trade association, 82% of cruisers will cruise again. As well, 62% of non-cruisers are open to the idea.

And why not? Cruises often give travelers the chance to experience multiple destinations plus enjoy onboard entertainment, activities and dining for a set, all-inclusive price . Cruises simplify budgeting in a year when travel prices have been hard hit by inflation .

But what happens if something goes wrong with your ship, or you can’t make it onboard because of health concerns? Cruise travel insurance might be the answer. It protects your payment and covers you against illness or injury.

Before you pay for a cruise travel insurance policy, here's a look at what it is, how it works and if it's worth it.

Cruise travel insurance is add-on insurance coverage that — just like travel insurance — will reimburse you for delays, interruptions, medical situations or other problems during the cruise.

Depending on which cruise line you're traveling with, you might be able to buy a travel insurance policy when booking your trip (through the cruise line directly) or at a later date (either through the cruise line or separately from a third party).

Protecting travel costs can be a smart money move. A September 2022 survey of 737 past cruisers by InsureMyTrip found that the average trip cost for an insured cruise vacation so far this year is $6,367, an increase of nearly 15% from before the pandemic.

Can you buy travel insurance after booking a cruise? It depends. Some cruise lines require the purchase of a travel insurance policy before the final payment date when charges become nonrefundable. Others require the purchase of coverage a certain number of days before departure. Read the fine print to find out the deadline to purchase and the specifics of its coverage.

Circumstances covered by cruise travel insurance vary by policy and by issuer. Many cruise lines partner with an insurance company to underwrite its policy benefits.

Some common benefits available as part of travel insurance from a cruise line include:

Trip cancellation and interruption . If you cancel your trip or unexpectedly cut it short for an eligible reason, such as severe weather or illness, you'll get back some or all of the upfront costs, depending on the policy.

Cancel For Any Reason . This coverage tends to be more flexible, forgiving and expensive at time of purchase. Policyholders can cancel for any reason not listed in the policy and still receive a portion of their trip cost back, either as cash or as a future cruise credit (assuming they meet other eligibility requirements).

Trip delay . Cruise delay insurance protection protects expenses if your trip is delayed beyond a set number of hours.

Baggage protection . This insures your luggage if it is lost, stolen, damaged or delayed, and gives money to buy necessary items until bags are recovered.

Medical coverage . If you get sick or injured during the trip, the policy covers treatment and related expenses up to a limit.

Emergency evacuation . When emergency evacuation is necessary, the policy covers the transport cost up to a limit.

COVID coverage . If your trip is canceled or interrupted due to COVID, the policy covers the unused prepaid expenses, medical treatment and emergency evacuation, up to policy limits.

When comparing policies, choose a policy that includes all of the benefits, protections and coverage limits that are important to you. While you may be tempted to choose the lowest-priced option, that policy may not have the coverage you need.

We examined cruise insurance prices for a seven-day trip in February 2023 from the U.S. to Mexico. The example traveler was 35 years old, from Georgia, and planned to spend $2,500 on the trip, including airfare.

The average price of each company’s most basic coverage plan was $124. These policies didn't include optional add-ons, such as Cancel for Any Reason coverage or coverage for pre-existing medical conditions .

Separately, we looked at five different cruise insurance add-ons for a similar trip. With this option, the average cost of basic coverage was cheaper than a standalone policy at $111.20. Keep in mind that cruise insurance policies offered by cruise lines typically cover the cruise portion of the trip only, but do include some Cancel For Any Reason coverage.

If you already have a standalone travel insurance policy or a credit card with travel protections, you may wonder if you need to purchase a cruise travel insurance policy.

Credit card travel insurance

Many travel credit cards include travel protections such as trip cancellation, interruption, delayed or lost luggage reimbursement, and emergency evacuation benefits. Before buying a cruise travel policy, compare the coverage benefits and limits to determine if you already have coverage with a credit card.

One benefit that cruise travel insurance policies offer that credit cards don't is the ability to cancel for any reason. Although you may not get back 100% of the cruise price, these policies allow you to cancel for any reason and get a portion of the price back as a credit toward a future trip. If the policy is priced low enough, it may be worth buying the insurance offered through your cruise line for that benefit alone.

Travel insurance policy

Standalone travel insurance policies can be purchased to cover one person or a family for a specific trip or multiple trips within a period of time. These policies are available at a variety of price points to meet a traveler's budget. When comparing policy options, you can balance price versus coverage options.

If you're traveling multiple times within a short period of time, it may be more economical to buy a more comprehensive travel insurance policy instead of separate policies for each trip.

Cruise travel insurance can be worth it to address your concerns about traveling and protect your investments. These policies offer numerous protections that will cover your expenses in case your trip is canceled, interrupted or delayed, or if you get sick during the trip.

Before buying this coverage, compare your options against your credit card benefits. You might also shop for general travel insurance policies to see if you can get a better deal than what’s offered through your cruise line.

If you’re not covered by your credit card, cruise travel insurance can be worth the added cost. It will give you peace of mind before setting sail, when signing up for that adventurous land excursion and when clicking "Book" for an expensive vacation in the COVID travel landscape.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

60,000 Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

- Need help? 1-888-751-7804 1-888-751-7804

- Let Us Call You CALL ME

- Drink Packages

- Flights by Celebrity℠

- Hotels by Celebrity

- Manage Reservation

- Shore Excursions

- Upgrade with MoveUp

- My Tier and Points

- Join Captain's Club

Already booked? Sign in or create an account

- South Korea

- New Zealand

- Grand Cayman

- St. Maarten

- U.S Virgin Islands

- New England & Canada

- Pacific Coast

- Antarctic Ocean

- Panama Canal

- Transatlantic

- Transpacific

- Cruise Ports (+300)

- Mediterranean

- Perfect Day at CocoCay

- All Inclusive

- Bucket List Cruises

- Cruise & Land Package

- Groups & Events

- New Cruises

- Popular Cruises

- Specialty Cruises

- Destination Highlights

- Group Excursions

- Private Journeys

- Shore Excursions Overview

- Small Group Discoveries

- 360° Virtual Tours

- Celebrity Apex®

- Celebrity Ascent℠ NEW

- Celebrity Beyond℠

- Celebrity Constellation®

- Celebrity Edge®

- Celebrity Eclipse®

- Celebrity Equinox®

- Celebrity Infinity®

- Celebrity Millennium®

- Celebrity Reflection®

- Celebrity Silhouette®

- Celebrity Solstice®

- Celebrity Summit®

- Celebrity Xcel℠ COMING SOON

- Explore Edge Series

Galapagos Expedition Series

- Celebrity Flora®

- Celebrity Xpedition®

- Celebrity Xploration®

- The Retreat

- All Suites. All Included

- Iconic Suite

- Penthouse Suite

- Reflection Suite

- Royal Suite

- Signature Suite

- Celebrity Suite

- Aqua Sky Suite

- Horizon Suite

- Sunset Suite

- Concierge Class

- Galapagos Accommodations

- Eat & Drink

- Entertainment

- Spa & Wellness

- Cruising 101

- Cruise Fare Options

- Cruise Tips

- First Time on a Cruise

- What is Included on a Cruise

- Future Cruise Vacations

- Accessible Cruising

- Captain's Club Rewards

- Cruise Insurance

- Flights by Celebrity

- Healthy at Sea

- Manage Cruise

- The Celebrity Store

- Travel Documents

- Royal Caribbean International

- Celebrity Cruises

- 75% Off 2nd Guest

- 3rd and 4th Guests Sail Free

- Galapagos 20% Savings + Free Flights

- Resident Rates

- Exciting Deals

- View All Offers

- All Included

- Cruise & Land Packages

- Dining Packages

- Photo Packages

- Wi-Fi Packages

- View All Packages

- Captain's Club Overview

- Join the Club

- Loyalty Exclusive Offers

- Tiers & Benefits

- Celebrity Cruises Visa Signature® Card

Enjoy 75% off your second guest’s cruise fare. Plus, additional guests in your stateroom sail free on select sailings.

Frequently Asked Questions

- Cancellation Policy FAQs

- FAQs Overview

What is Celebrity's cruise or Cruisetour cancellation and refund policy?

In the event of a cancellation of a Cruise or CruiseTour, any applicable Taxes/Fees or Fuel Supplement charges shall be refunded. For bookings made outside of the United States and Canada, a different cancellation policy may apply. Contact your local office or travel agency for details.

Cancellation notices are effective when received by the Operator.

For Passengers who have booked a CruiseTour and desire to cancel their tour portion while retaining the Cruise, refunds of the CruiseTour Fare (including any applicable supplement charges) shall be made in accordance with the following cancellation policy. Guests who convert their CruiseTours to a cruise only booking within forty-two (42) days of the start date of the tour segment of the CruiseTour will be subject to a cancellation charge. The amount of that charge varies depending on the location of the CruiseTour and/or its length. For the specific amount of the charge, visit Our FAQ section .

The cancellation charge policies set forth above vary for single occupancy or for the third, fourth or higher occupants in a stateroom or for groups. Consult your travel agency or call Celebrity for further details.

Cancellation by the Passenger after the Cruise or CruiseTour has begun, early disembarkation of the Passenger for any reason, including pursuant to any provision of this Ticket Contract, or “no-shows” shall be without refund, compensation, or liability on the part of the Carrier whatsoever.

If Carrier received payment via credit card, the refund will be made to that credit card. If Carrier received payment from your travel agent, the refund will be provided back to that travel agent.

Carrier reserves the right to offer promotional cruise fares or other offers that may modify the cancellation policies set forth above.

For cancellations of air flights, hotel stays, transfer services, shore excursions, pre-purchased amenities, CruiseCare, pre-booked services (such as spa, photography or wedding services) and pre-booked arrangements such as specialty dining, see the applicable terms and conditions for any applicable cancellation charges.

Cancellation of Cruise For Australian and New Zealand Residents

The following cancellation charges will then apply to your cruise. Standard Cruises & Cruisetours (Cruise Portion Only).

Days Prior to Cruise Departure and cancellation Charges:

- 151 or more days : deposit is refundable except in the case of non- refundable deposit promotions and airfares

- 150-71 days: loss of deposit

- 70-46 days: 25% of fare*

- 45-31 days: 50% of fare*

- 30-15 days: 75% of fare*

- 14 days or less: 100% of fare

Cancellation of Cruise for UK & Ireland Residents

For cancellations received, the following cancellations charges will apply:

· 5 days or less before departure 100%

· 6 to 14 days before departure 90%

· 15 - 28 days before departure 75%

· 29 - 69 days before departure 50%

· 70 days or more before departure deposit only (including any increased deposit amount for any ’advanced purchase’ flight tickets.

Please be advised that if your booking was made prior to 01/07/2021, the final payment is due 57 days prior to the start of your cruise.

Please be advised that the minimum cancellation charge will always be the loss of deposit including any increased deposit amount if you have purchased advance purchase air fares. Please note that any amendment or transfer fees will also be charged when a booking is cancelled.

Is cruise/vacation cancellation protection available?

Cruise cancellation protection is available through Celebrity’s CruiseCare® plan, which is designed and intended for US residents, excluding residents from New York.

FOR NEW YORK RESIDENTS ONLY: New York state residents who are interested in travel protection may contact Aon Affinity by visiting https://travelcruisecare.com or calling Aon 1-800 797-4516.

FOR ALL OTHER US RESIDENTS: Any questions regarding the terms and conditions of the insurance benefits of CruiseCare® plan, including cancellation coverage, should be directed to Aon Affinity by calling 1-800 797-4516.

Canadian residents may visit https://www.celebritycruises.com/ca/cruise-insurance for more information on travel protection.

How can I request a refund?

If we cancel a voyage, or delay embarkation by three (3) days or more and you elect not to sail on the delayed voyage or a substitute voyage we offer, you can obtain a refund or a future cruise credit (FCC). Although our practice is to issue a future cruise credit automatically, you may instead submit your request for a refund by contacting us . Refund requests must be made within six (6) months of the date the cruise was cancelled or the scheduled embarkation date, whichever is earlier.

Please note this policy does not apply to guests booked on chartered sailings. If you were booked on a chartered sailing that was canceled or embarkation was delayed by three (3) or more days, and you wish to inquire about refunds or future credits, you must contact the third party reseller that sold you the cruise.

Previewing: Promo Dashboard Campaigns

- Celebrity Cruises

Celebrity Travel Protection Insurance

By houtxaj , June 8, 2019 in Celebrity Cruises

Recommended Posts

Does this type of travel insurance protect you while on board ship and while in ports? And if so, how does it work? We are unsure if this protection offered is worth the expense. Thanks for any informative feedback.

Link to comment

Share on other sites.

helen haywood

Can't answer your question relative to Celebrity's insurance....but go to insuremytrip.com and compare policies and ask questions of the agents and decide for yourself which is the best option.

cruiserchuck

You would need to read the terms and conditions, bit travel insurance general would cover you from the time you leave home until the time you return home. We always go with a third party insurer, not one offered by Celebrity.

If by "protect" you mean medically, yes, up to the policy limits. You are also covered for extra expenses on the last day of the cruise until midnight of that day. I have had extensive conversations with the insurance company and have used the policy on three different cruises for covered expenses, but never yet for medical. We buy an annual medical insurance travel policy that gives us more medical and $250, 000 evacuation coverage and is very reasonable. Also if you purchase your air thru Celebrity your flights are covered as well.

Luckiestmanonearth

Does Celebrity insurance cover a situation when something happens to an elderly parent (meaning needing to cancel due to family member illness or death)?

ipeeinthepool

26 minutes ago, houtxaj said: Does this type of travel insurance protect you while on board ship and while in ports? And if so, how does it work? We are unsure if this protection offered is worth the expense. Thanks for any informative feedback.

As you get older third-party travel insurance starts to get really expensive and if you are a US citizen you need some good medical coverage because Medicare does not cover you outside the country. Medicare supplement plans aren't very good either with a very small limit. We use the Celebrity insurance to cover the cost of the trip if something happens to us or a relative before the trip and it does offer a last minute cancel for any reason feature with 75% returned in future Celebrity Credits. We purchase a yearly GeoBlue policy for medical and evacuation. Many good reviews on Geo Blue coverage in difficult medical situations overseas.

Ontario Cruiser

Can Canadians get the Celebrity insurance?

CruisinNole

1 hour ago, houtxaj said: Does this type of travel insurance protect you while on board ship and while in ports? And if so, how does it work? We are unsure if this protection offered is worth the expense. Thanks for any informative feedback.

I have used the Celebrity insurance for medical purposes and was pleased with the care I received. It covered my medical expenses on the ship and the entire amount for the procedure that I had to have done at a hospital while in port. I did not have to stay in medical on the ship overnight but because I was there past midnight, I received reimbursement for one night of the cruise. The claim forms were in my inbox when I returned home and I was able to file my claim electronically. I was very pleased with the insurance.

Just as a general observation, it is not a great idea to base your decisions on travel insurance on comments from others who may or may not have purchased comparable insurance, and may or may not have really understood what they bought. In addition, policies can change over time, so even knowledgeable comments about a policy from a few years ago may not apply to the policy today.

I agree with the comment that you have to read the terms and conditions yourself. Or at a minimum quiz the person selling the policy. Ask lots of questions, it is their job to know the answers. But don't rely on comments by non-insurance people on a message board. Tom & Judy

katiegirl1264

yes important to do your own research

ALWAYS CRUZIN

2 hours ago, Luckiestmanonearth said: Does Celebrity insurance cover a situation when something happens to an elderly parent (meaning needing to cancel due to family member illness or death)?

Check your current charge card for travel insurance. We cruise 4-6 times a year. I had a Citi Bank card which had it included at no additional charge. Then they cancelled that perk. I switched to another banks card. The only one I found that had an excellent Travel protection package but it cost me $95.00 a year for the card. Still a lot less than paying extra for the coverage. The coverage is $5000 per person total. So, needless to say, if your cruise is more. You will still need to get it somewhere else. About the only thing it does not cover is medical and if you just do not want to go. You must book with it to get the coverage. I use it on the cruise for everything. I also get 2-1/2% money back on everything I buy. I like it.

2 hours ago, helen haywood said: Can't answer your question relative to Celebrity's insurance....but go to insuremytrip.com and compare policies and ask questions of the agents and decide for yourself which is the best option.

Yes or square mouth.com. We've used both and it's important to buy from a third-party when you have to make a claim. If the insurance company is slow as we've seen in the past insure my trip will go to bat for you. After they went to the insurance company on our behalf we had a money in a week. If you don't have a third-party you're dealing with the insurance company by yourself not something I recommend.

Is elderly make sure you have evacuation insurance that will get you home and a big number.

The insurance websites are good sources of information, but I doubt they will ever recommend the insurance through the cruise line because they don't sell the product. The insurance through the cruise line offers some valuable advantages over third-party insurance companies at a much lower price. If your primary concern is medical, then perhaps you would be better off buying a specific medical insurance policy with significant evacuation coverage. You can purchase those policies on an annual basis or for a specific trip. Nothing will provide better medical coverage than the dedicated medical policies. There are many excellent reviews about Geo Blue and I have also used them with great results. Never by anything based on fear. I am amazed at the argument that if the insurance sold to you by a third party agent is slow or non-responsive the agent will help you. Maybe they could have helped me more by selling a policy from a better company that doesn't require their intervention for me to get results.

5 hours ago, Ontario Cruiser said: Can Canadians get the Celebrity insurance? Ontario Cruiser

Yes, they can, but I only have experience with the cancellation insurance. We buy our health insurance by the year from BCAA. We had to cancel a 30 day cruise when we were in the 75% penalty time frame. Celebrity paid us the 25% and their insurance paid the other 75% down to the last penny. I was very impressed.

Yes, Celebrity insurance worked for us for an emergency. It wasn't an elderly parent, but our 32 year old son died unexpectedly the day before our cruise and they refunded our money. They were very helpful and I don't remember it being a hassle to do the paper work.

As a general rule of thumb, your best value and coverage will be from non-cruiseline policies.

https://www.cruzely.com/should-i-buy-cruise-insurance/

Shop through sites such as squaremouth.com or insuremytrip.com. Decide which coverage you need most, then find a policy that meets your needs, (cruise line insurance is pretty much one size fits all.) Check the coverage that your credit card may provide. We use our Chase Sapphire Reserve to pay for travel, and it has great coverage. We do not need medical as our supplemental insurace provides coverage for out of country medical costs. The most important coverage to us is medical evacuation. Read policies carefully! Most cover transport to the nearest qualified facility - no matter if that's Timbuktu, or Tasmania. They will not get you home if you require continuing care. We have an annual policy through MedJet Assist. It covers us for any trip more then 150 miles from home. If we are hospitalized and need continued care, they will transport us to a hospital of our choice. It does not require that a doctor certify that a transfer is necessary (as does another major insurance policy).

FLbeachbaby

5 hours ago, Daisy May said: Yes, Celebrity insurance worked for us for an emergency. It wasn't an elderly parent, but our 32 year old son died unexpectedly the day before our cruise and they refunded our money. They were very helpful and I don't remember it being a hassle to do the paper work. Sherry

So sorry for your unimaginable loss. I hope you get to or have gotten to enjoy some time away.

36 minutes ago, sippican said: As a general rule of thumb, your best value and coverage will be from non-cruiseline policies.

Sorry, but this really isn't good advice. The Best Value depends on your own circumstances and risk tolerance. The insurance offered through the cruise line is a much better value for many people.

1 hour ago, ipeeinthepool said: Sorry, but this really isn't good advice. The Best Value depends on your own circumstances and risk tolerance. The insurance offered through the cruise line is a much better value for many people.

Others might agree with my opinion (especially if they read the article, or do an online search), and many won't, but one thing's for certain, it is a great value if you are the cruise line, or a travel agent!

1 hour ago, sippican said: Others might agree with my opinion (especially if they read the article, or do an online search), and many won't, but one thing's for certain, it is a great value if you are the cruise line, or a travel agent!

Really??? Do you have any idea about the source of that article. The author is paid by all of the third party insurance companies with links in that article. Hardly an unbiased source. Is it any wonder the blogger favors third party insurance. There are a number of other threads on cruise line insurance that can provide better info than this article. So to be clear, everyone needs to decide what they want to insure and get the best protection for those needs. If it's medical and evacuation, buy a specific medical policy. It will provide the best coverage at the cheapest price. Be careful about relying on supplemental Medicare policies, many are limited to about $50k and may require you to pay for the services first. If you're concerned about protecting your investment if you need to cancel, perhaps your credit card will offer protection or perhaps the cruise line insurance will provide adequate coverage. The cruise line rates are not based on age and can be much cheaper for older travelers. Good Luck

https://studentloanhero.com/featured/cruises-blogger-makes-9000-a-month/

18 hours ago, FLbeachbaby said: So sorry for your unimaginable loss. I hope you get to or have gotten to enjoy some time away.

Thank you. We just keep going. We have been on a couple of cruises since then. They seem even more special now.

Thank you everyone for the informative feedback. It is most welcome.

The one thing that might be most important is to make your insurance decision within 15 days of your first payment for the cruise. For many policies, this is the period in which you can get coverage for preexisting conditions (they call it waiver of the lookback period, or some such). We didn't do any insurance homework until near final payment for our cruise and discovered we would have had to pay a lot more to get preexisting coverage by then, if it was even available. Turned out we didn't need it, fortunately.

If you have a refundable deposit, you can cancel your cruise and rebook and then get insurance.

27 minutes ago, mayleeman said: The one thing that might be most important is to make your insurance decision within 15 days of your first payment for the cruise. For many policies, this is the period in which you can get coverage for preexisting conditions (they call it waiver of the lookback period, or some such). We didn't do any insurance homework until near final payment for our cruise and discovered we would have had to pay a lot more to get preexisting coverage by then, if it was even available. Turned out we didn't need it, fortunately. If you have a refundable deposit, you can cancel your cruise and rebook and then get insurance.

This is one example where the cruise line insurance can provide good protection at a good value. There is an effective cancel for any reason provision where you can get 75% of your deposit, although in cruise credits. For many that is as good as money. That can be supplemented with a Medical policy like Geo Blue which doesn't have any pre-existing condition constraints. You just need to have other medical insurance before the trip.

8 hours ago, mayleeman said: The one thing that might be most important is to make your insurance decision within 15 days of your first payment for the cruise. For many policies, this is the period in which you can get coverage for preexisting conditions (they call it waiver of the lookback period, or some such). We didn't do any insurance homework until near final payment for our cruise and discovered we would have had to pay a lot more to get preexisting coverage by then, if it was even available. Turned out we didn't need it, fortunately. If you have a refundable deposit, you can cancel your cruise and rebook and then get insurance.

Pre-existing conditions is the most misunderstood part of a travel policy....intentionally fogged by the insurance and travel industry. Why? because they want you to pay far in advance and if decide to cancel that cruise, you don't get that money back....and they get your money right away.

Read the definition of "pre-existing conditions" in the policy you are thinking about purchasing. Here's the key thing that most don't know....or just miss. If you have a medical condition that is stable and has been stable during the lookback period (number of days back from the day you are buying the policy), then you do NOT have a pre-existing condition that would cause the policy not to pay a claim. What does stable mean...that's defined in the same definition.....it essentially means that you have had no change in medication and no change that caused you, or should have caused you to make a special trip to your doctor...you do not have a "pre-existing condition". (please don't just trust me, I'm not an insurance agent/specialist/whatever....read the policy....it's not confusing).

More can be found in the insurance forum on CC, but try to understand the policy before you buy.

We almost always buy our Travel insurance just before final payment. Note: while you're researching travel insurance, whether it be from the cruise line or an independent agent, consider MedJet Assist insurance in addition. (search cc for info).

Please sign in to comment

You will be able to leave a comment after signing in

- Welcome to Cruise Critic

- New Cruisers

- Cruise Lines “A – O”

- Cruise Lines “P – Z”

- River Cruising

- Cruise Critic News & Features

- Digital Photography & Cruise Technology

- Special Interest Cruising

- Cruise Discussion Topics

- UK Cruising

- Australia & New Zealand Cruisers

- Canadian Cruisers

- North American Homeports

- Ports of Call

- Cruise Conversations

Announcements

- New to Cruise Critic? Join our Community!

Write Your Own Amazing Review !

Click this gorgeous photo by member SUPERstar777 to share your review!

Features & News

LauraS · Started 4 hours ago

LauraS · Started Friday at 07:21 PM

LauraS · Started Friday at 03:17 PM

LauraS · Started Thursday at 04:15 PM

LauraS · Started Thursday at 03:00 PM

- Existing user? Sign in OR Create an Account

- Find Your Roll Call

- Meet & Mingle

- Community Help Center

- All Activity

- Member Photo Albums

- Meet & Mingle Photos

- Favorite Cruise Memories

- Cruise Food Photos

- Cruise Ship Photos

- Ports of Call Photos

- Towel Animal Photos

- Amazing, Funny & Totally Awesome Cruise Photos

- Write a Review

- Live Cruise Reports

- Member Cruise Reviews

- Create New...

- Celebrity Cruises

Need advice on "Vacation Protection Plan"

By TroubleT , May 5, 2012 in Celebrity Cruises

Recommended Posts

We never travel without Vacation Protection Plan. And we always purchase one from the cruise line (or travel agency we buy the whole package from - like air included, transfers, travel insurance, etc.). We've been in the situation when luggage was lost/delayed or flight schedule was changed and we had a very good coverage from Vacation Protection Plan. However, now we need something better for the medical reasons (like emergency evacuation, treatment at the hospital, etc.). We don't mind paying more but it has to be something we could count on (the less wording in small print the better - I mean all exceptions Insurance companies can add at the end of the contract). Any names or advices will be kindly appreciated.

Link to comment

Share on other sites.

Cruise Critic rules don't allow specific references to any site. Typing Travel insurance in any search engine should be a good start. Some of them access many different policies, and allow comparisons of the main features with an easy to understand breakdown. I always go to a .com to insure my trip and have always been satisfied.

Insuremytrip.com is a great place to research travel insurance policies. You type in some basic information (i.e. trip cost, destination, your age etc.) and it provides detailed information and pricing for several different travel insurers. Since everybody's needs are different, it is good to do a little research on a website like Insuremytrip.com so you can find what is best for you. In general it is not a good idea to purchase travel insurance through the cruise line or your travel agent; generally you can receive better policies for less money when you do-it-yourself.

FYI Cruise Critic does not permit people to recommend or review travel agencies (Cruise Critic is owned by a travel agency so they do not want the boards to be used to steer business away from Cruise Critic's parent company). There is no rule prohibiting people from naming or providing links to helpful travel related sites that are not travel agencies.

We always get it thru Insuremytrip.com. Better coverage and better prices. Get the primary health coverage.

Thank you all for your help! Looks like the site gives lots of options (need to choose the right one!):)

If you are USAA Insurance eligible (eg. Retired military) you can get discounts and better service for similar policy as that available through Insuremytrip. Fewer policy choices, however.

If you are looking for additional medical evacuation coverage, check with the benefits provided with the credit card you used to pay for your cruise. It may be high enough to ease your mind without paying for another policy.

(WinCE).thumb.jpg.71a11389c748c809314af80836e82cf9.jpg)

By all means check Insuremytrip.com. Be certain to read all the info for each policy considered. They differ on things such as pre-existing conditions. Must policies require purchase of a full trip cost policy within a few days of initial payment for a waiver on pre-existing conditions. Policies also have different times for pre-existing condition consideration. Some have 120 days, others have 60 days. This is important if you purchase a policy late.

Two companies allow purchase at time of final payment and cover pre-existing conditions as long as you are capable of traveling at time of purchase. These are CSA and HTH. Both are owned by the same Corp. These firms, and some others, have much better coverage for medical evacuation than the usual cruise ship sponsored policy.

I have been using CSA at final payment time so I have no cancellation cost if I find I must cancel a cruise prior to final payment. I have not had a claim with CSA, but some on CC report good results.

I think CSA premiums are a bit higher than some, but the late purchase benefit is worth it for me. I also can self insure for some of the cruise cost and still have the medical benefits.

I would also suggest posting your inquiry on

Cruise/Travel Insurance - Cruise Critic Message Boards

where this subject is discussed extensively.

This topic is now archived and is closed to further replies.

- Welcome to Cruise Critic

- New Cruisers

- Cruise Lines “A – O”

- Cruise Lines “P – Z”

- River Cruising

- Cruise Critic News & Features

- Digital Photography & Cruise Technology

- Special Interest Cruising

- Cruise Discussion Topics

- UK Cruising

- Australia & New Zealand Cruisers

- Canadian Cruisers

- North American Homeports

- Ports of Call

- Cruise Conversations

Announcements

- New to Cruise Critic? Join our Community!

Write Your Own Amazing Review !

Click this gorgeous photo by member SUPERstar777 to share your review!

Features & News

LauraS · Started 4 hours ago

LauraS · Started Friday at 07:21 PM

LauraS · Started Friday at 03:17 PM

LauraS · Started Thursday at 04:15 PM

LauraS · Started Thursday at 03:00 PM

- Existing user? Sign in OR Create an Account

- Find Your Roll Call

- Meet & Mingle

- Community Help Center

- All Activity

- Member Photo Albums

- Meet & Mingle Photos

- Favorite Cruise Memories

- Cruise Food Photos

- Cruise Ship Photos

- Ports of Call Photos

- Towel Animal Photos

- Amazing, Funny & Totally Awesome Cruise Photos

- Write a Review

- Live Cruise Reports

- Member Cruise Reviews

- Create New...

- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Citi Double Cash Citi Diamond Preferred Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Credit Cards Best American Express Credit Cards Best Bank of America Credit Cards Best Visa Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards