Philippine Consulate General

The Republic of the Philippines

PHILIPPINE CONSULATE GENERAL

New york, usa.

travel tax exemption

The travel tax is a levy imposed by the philippine government on individuals who are leaving the country irrespective of the place where the air ticket is issued and the form or place of payment, as provided for by presidential decree (pd) 1183, as amended..

The following individuals are REQUIRED by the Philippine government to pay the Travel Tax every time they leave the country irrespective of the place where the air ticket is issued and the form or place of payment, as provided for by Presidential Decree (PD) 1183, as amended:

- Filipino citizens

- Sec. 13 Quota or Preference Immigrant Visa

- Sec. 13 A Visa issued to an Alien Spouse of Philippine Citizen

- Sec. 13 B Child born outside the Philippines by a 13A Mother

- Sec. 13 C Child born in the Philippines by a 13A Mother

- Sec. 13 D Loss of Citizenship by a Filipino Woman by her Marriage to an Alien

- Sec. 13 E Returning Resident

- Sec. 13 G Former Natural-born Citizen of the Philippines who was Naturalized by a Foreign Country

- TRV Temporary Residence Visa

- RA 7919 Alien Social Integration Act of 1995

- RC /RFC Recognition as Filipino Citizen

- RA 7837 Permanent Resident

The following Filipino citizens are EXEMPTED from the payment of travel tax pursuant to Sec. 2 of PD 1183, as amended:

- Overseas Filipino workers

- Filipino permanent residents abroad whose stay in the Philippines is less than one year

- Infants (2 years and below)

- Other individuals qualified to avail of exemption. Please see complete list below, including the requirements to avail of the exemption.

Note: In all cases, the passenger will be required to bring and present his/her original passport.

The Tourism Infrastructure and Enterprise Zone Authority (TIEZA) is now accepting online application for Travel Tax Exemption Certificate (TEC). Click here to apply.

For more information, please visit TIEZA’s website here.

- The Philippines

- The President

- The Government

- The Department of Foreign Affairs

- The Secretary of Foreign Affairs

- The Consul General

- The Consulate

- History of the Consulate General

- Consulate Directory

- Non-Working Holidays

- Consulate Finder

- Announcements and Advisories

- Press and Photo Releases

- Cultural & Community Events

- Consular Outreach

- Online Appointment

- Assistance-to-Nationals

- Civil Registration

- Dual Citizenship (RA 9225)

- Notarial Services

- Overseas Voting

- Travel Document

- Passport Tracker

- Schedule of Fees

- Citizen’s Charter

- Adopt a Child from the Philippines

- Foreign Donations to the Philippines

- Foreign Medical Missions to the Philippines

- GSIS Pensioners Abroad

- Importation of Motor Vehicles to the Philippines

- Importation of Personal Effects to the Philippines

- Importation of Pets and Plants to the Philippines

- J1 Visa Waiver

- National Bureau of Investigation (NBI) Clearance

- Philippine Centenarians

- Philippine Driver’s License Renewal

- PRC Registration of New Professionals

- Renunciation of Philippine Citizenship

- Restrictions in Bringing Medicine & Other Regulated Products to the Philippines

- Shipment of Human Remains to the Philippines

- Social Security System (SSS)

- Travel Tax Exemption

- Videoconference Hearing

- Sentro Rizal

- Promoting Philippine Culture

- Doing Business & Investing in the Philippines

- Traveling to the Philippines

- Fil-Am Community Directory

- Filipino Businesses

- Filipino International Students

- Request Message of the Consul General

- Procurements

- Airport Transfer

Things to Do

Traveloka PH

14 Apr 2022 - 5 min read

Travel Tax in the Philippines: Everything a Traveler Needs to Know

Paying the travel tax is one of the steps a traveler must do before flying out for an international trip. Here's a guide on what you need to know about this tax.

What is Travel Tax?

The Philippine travel tax is an additional fee you need to pay every time you go abroad.

You can read up on it in greater detail under Presidential Decree 1183 , but all you need to know about it is that you are required to pay this fee no matter which country you are headed to.

Who is required to pay the travel tax?

If you fall under any of the following demographic, you are required to pay the travel tax:

Who is exempted from paying the travel tax?

Manila to singapore flight.

Jetstar Asia Airways

Start from ₱ 2,849.85

Manila (MNL) to Singapore (SIN)

Fri, 17 May 2024

Cebu Pacific

Start from ₱ 3,075.56

Sat, 4 May 2024

AirAsia Berhad (Malaysia)

Start from ₱ 3,753.91

Tue, 14 May 2024

There are also other individuals who are exempted from paying the travel tax:

I fall under the travel tax exemption. What do I need to avail of it?

Depending on your case, you will need:

1. Original documents required by your embassy or agency , which can include but are not limited to:

2. Travel to the nearest TIEZA Travel Tax Field Office in the Philippines , either in the airports or in the provincial field offices.

Show your original documents, as well as photocopies.

3. Pay a PHP 200 processing fee.

Wait for your Travel Tax Exemption Certificate to be released, and present this to the authorities at the airport.

How much do I have to pay?

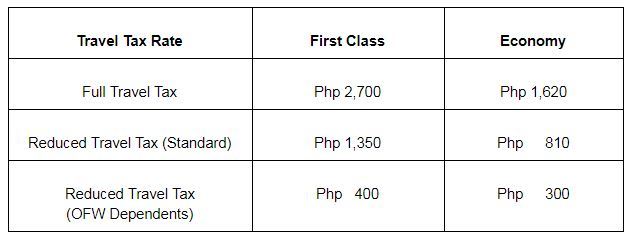

Depending on your ticket, your travel tax will vary. See the table below:

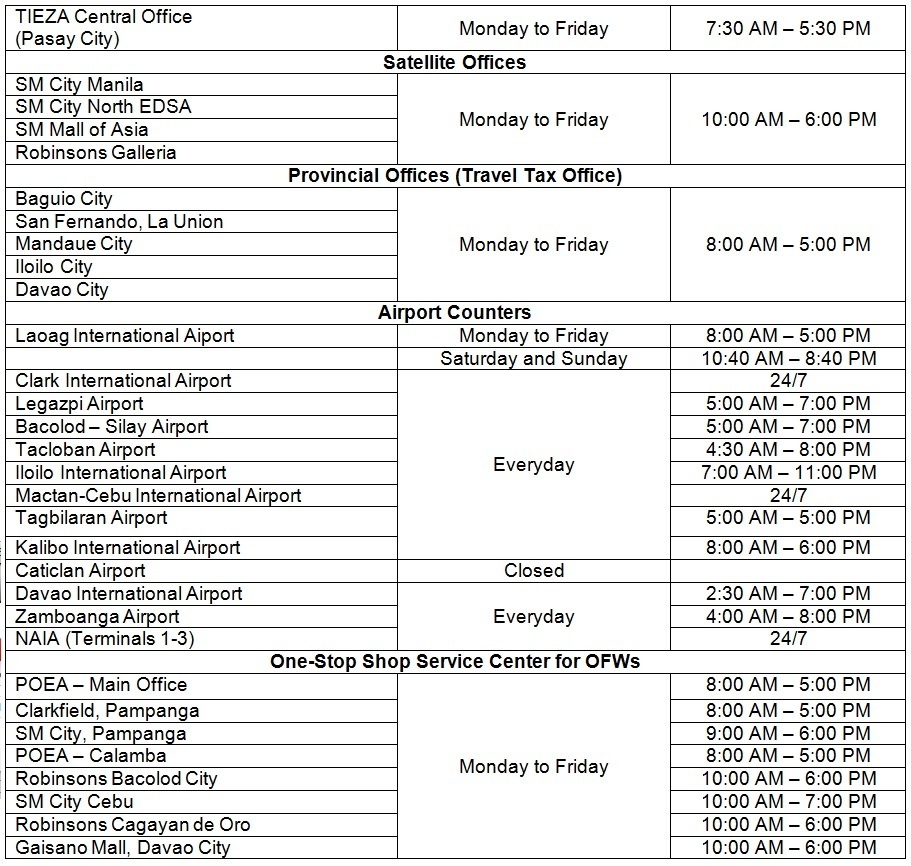

Where do I pay the Philippine travel tax?

You can pay your travel tax in advance in several malls. Check out these mall counters that accept travel tax payments:

You can also pay your travel tax on the day of your flight in the airport counters. You need to show your ticket and passport.

Meanwhile, there are also provincial offices and other government offices where you can pay the travel tax:

You can also pay online. Here's how:

Where does that money go.

As per Section 73 of the Republic Act No. 9593 , the money earned from the travel tax is divided accordingly:

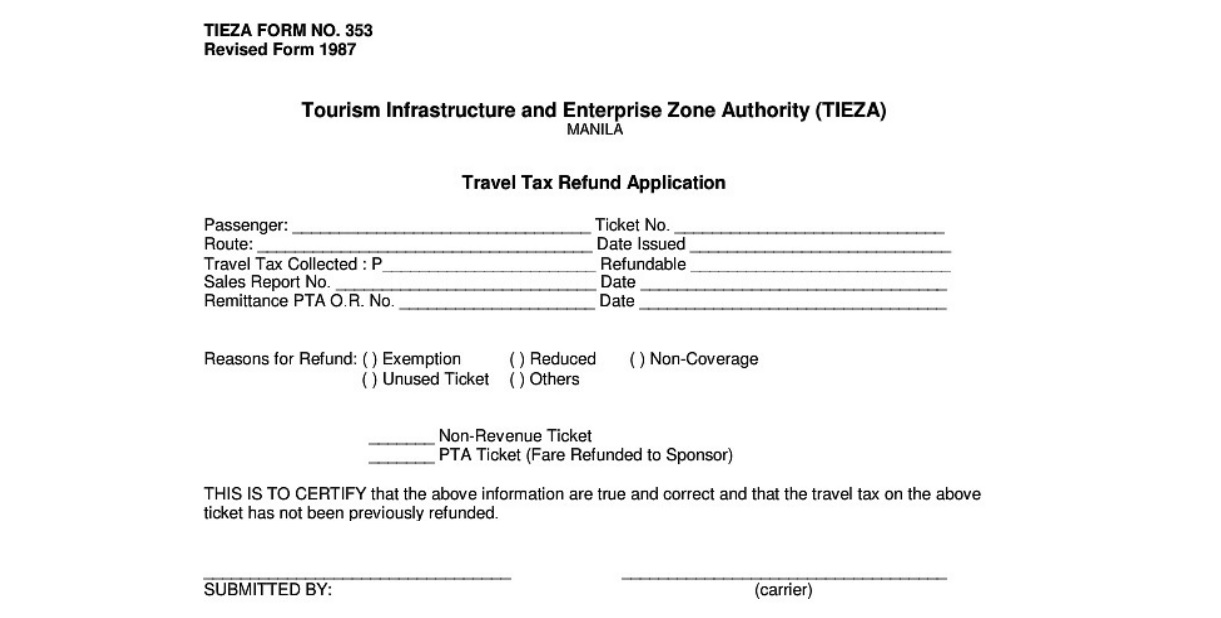

How do I get a refund?

You qualify for a refund if you fall under one of the following conditions:

What do you need to present to get a refund?

Depending on your case, prepare the following:

Now you know your travel tax basics. Make sure you keep them in mind when you plan and book your trips with Traveloka!

Payment Partners

About Traveloka

- How to Book

- Help Center

Follow us on

- Traveloka Affiliate

- Privacy Notice

- Terms & Conditions

- Register Your Accommodation

- Register Your Experience Business

- Traveloka Press Room

Download Traveloka App

Philippine Consulate General Los Angeles California

Travel tax exemption and duty free privileges.

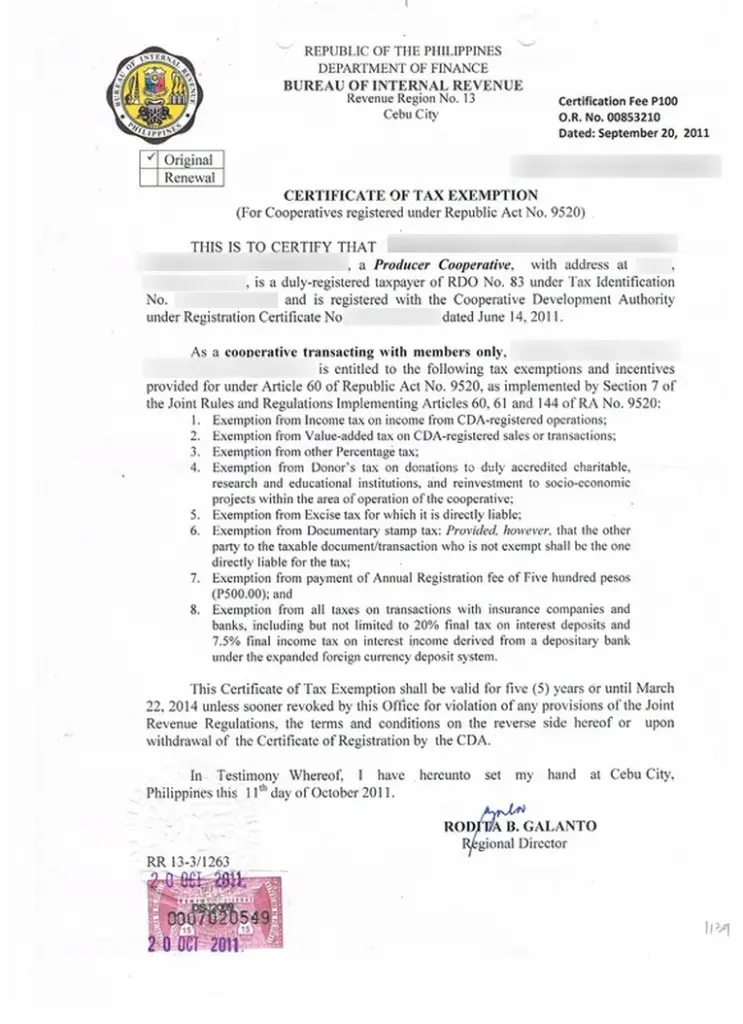

Travel Tax Exemption

The following individuals are required by the Philippine Government to pay the Travel Tax every time they depart the country for an overseas destination:

(a) Filipino citizens

(b) Permanent resident aliens

(c) Permanent resident aliens

The following Filipino citizens are exempted from the payment of Travel Tax pursuant to Sec. 2 of PD 1183, as amended:

(a) Filipino overseas contract workers.

(b) Filipino permanent residents abroad whose stay or visit in the Philippines is less than one year.

(c) Infants (2 years and below).

Also exempted are foreign diplomatic representatives in the Philippines, United Nations employees, US military personnel, international carrier crew, Philippine foreign service personnel (i.e., officials and employees of the Philippine Government who are assigned in Philippine foreign service posts and who are returning to their country of assignment), Philippine government employees (who are on official travel), bona fide students on scholarships and personnel of multinational companies.

Non-immigrant aliens, who have not stayed in the Philippines for more than a year, is exempted from the Travel Tax.

For more information on travel tax exemption, read this or contact the Philippines’ Tourism Infrastructure and Enterprise Zone Authority (TIEZA) here

Duty and Tax Free Privileges

Section 105 of the Tariff and Customs Code of the Philippines (TCCP) as amended by Executive Order No. 206 provides duty and tax free privileges to the following individuals, the extent of which depends on their particular status:

(1) Returning Resident. A Returning Resident is a Filipino national who had gone abroad and is now returning. Only those Returning Residents who have uninterrupted stay abroad of at least six (6) months prior to their return to the Philippines are entitled to duty and tax-free privileges.

(2) Overseas Contract Workers (OCW). An OCW is a Filipino national who is working in a foreign country under an employment contract. Only OCWs who have uninterrupted stay abroad for at least six (6) months are entitled to duty and tax-free privileges.

(3) Former Filipino. A former Filipino national is one who has acquired foreign citizens abroad and is now returning. Only former Filipinos who are coming to settle permanently in the Philippines and have stayed abroad for six (6) months are entitled to the duty and tax exemption privileges.

What is the extent of duty and tax-free privileges of returning Filipinos or Balikbayans?

The extent varies as follows:

(1) Returning Resident – Personal effects and household goods used by him and abroad for at least six (6) months and the dutiable value of which is not more than Ten Thousand Pesos (PhP10,000.00) are exempt from duties and taxes. Any amount in excess of PhP10,000.00 is subject to fifty percent (50%) duty for the first PhP10,000.00 exemption across the board as provided for under Section 105 (F) of the Tariff and Customs Code of the Philippines.

(2) Overseas Contract Worker (OCW) – in addition to the privileges granted to Returning Residents as described above, an OCW may be allowed to bring in, duty and tax free Ten Thousand Pesos (PhP10,000.00) worth of used home appliances provided:

- The quantity is limited to one of each kind.

- The privilege has not been enjoyed previously during the calendar year which must be declared under oath by the owner.

- The owner’s passport is presented at the port/airport of entry.

- Any amount in excess of PhP10,000.00 will be subject to taxes and duties.

Are family members of returning residents, OCW and former Filipinos also entitled to certain privileges?

Yes, provided they themselves satisfy the specifications outlined in Section 105 of TCCP.

What are the conditions and limitations attached to tax exemption privileges?

The following are the conditions imposed in availing of the duty and tax privileges:

(1) The Bureau of Customs must be presented with a written endorsement from the relevant government agency (2) The goods extended duty and tax-free privileges are not to be sold, bartered nor traded (3) The quantity is not commercial.

(4) The goods are not prohibited importations. Goods that are restricted or prohibited require endorsement from the proper regulatory agency.

For more information on duty and tax free privileges, contact the Philippines’ Bureau of Customs

BIR Income Tax Calculator Philippines

Travel Tax Philippines [Latest Rates: 2024]

As the saying goes, ‘The only certainties in life are death and taxes,’ and if you’re planning to travel out of the Philippines, you’ll have to deal with the latter before you can enjoy your trip.

You’re probably aware that the Philippine government imposes a travel tax on citizens, residents, and foreigners who have stayed in the country for over a year, but you might not know the intricacies of who needs to pay, how much it costs, or how it could affect your travel plans.

Whether you’re booking a leisurely vacation, gearing up for a business trip, or sending off your loved ones, it’s crucial that you’re familiar with the requirements and process of this tax.

As you consider the impact on your budget and prepare for your journey, you’ll find that understanding the nuances of the Travel Tax can help you avoid common pitfalls, and there are some tips and tricks that could save you time, money, and hassle.

Key Takeaways

- Travel tax is a levy imposed on individuals departing from the Philippines to support tourism infrastructure and cultural heritage preservation.

- Certain individuals, such as overseas contract workers, returning residents, and former Filipino citizens, may be exempt from paying the travel tax.

- The Travel Tax Exemption Certificate (TEC) can be applied for online through the TIEZA website, and the original passport must be presented.

- Travel tax rates vary depending on destination, ticket class, and traveler category, and the TIEZA website provides detailed information on current rates and applicable passenger categories.

Understanding Travel Tax

To grasp the concept of travel tax in the Philippines, it’s essential to know that certain individuals may be exempt, but you’ll need to visit the TIEZA website to understand the specific requirements.

Instituted by Presidential Decree (PD), the travel tax is a levy imposed on individuals departing from the Philippines. It’s designed to bolster tourism infrastructure and cultural heritage preservation.

However, you might qualify for a Travel Tax Exemption. To determine your eligibility, you’ll have to present your original passport for any application related to the exemption.

This is an indispensable step, ensuring that your identity and travel records are accurately assessed.

Should you find that you’re eligible, TIEZA’s online portal simplifies the process by allowing you to apply for a Travel Tax Exemption Certificate (TEC) from the comfort of your home.

This digital convenience saves you time, making your travel preparations more efficient.

Lastly, don’t forget to check the Consulate General’s website for any holidays that might affect consular service availability.

Knowing these dates in advance can prevent any unwelcome surprises during your travel tax exemption application process.

Who Needs to Pay Travel Tax in the Philippines?

You might wonder if you’re on the hook for travel tax when heading out of the Philippines.

It’s key to know if you fall under the category of travelers who must pay, or if you meet the exemption criteria.

Let’s take a look at who’s obligated to pay and what conditions might let you off the hook.

Eligible Travelers

Understanding who must pay the travel tax when departing from the Philippines is crucial, as it generally includes all travelers except for certain exempted groups like returning residents and overseas contract workers.

If you’re planning to leave the country, you’ll likely need to settle this tax unless you belong to an eligible group.

Here’s what you need to remember:

- Always have your Philippine Passport ready to verify your identity and travel tax eligibility.

- Returning residents can avail of the exemption, keeping more cash in their pockets.

- Overseas Contract Workers (OCW) are spared from the tax, a small relief for their global contributions.

- Former Filipinos also enjoy exemption privileges, easing their visits back to their roots.

- Visit the TIEZA website for a full rundown on exemptions and apply online for a Travel Tax Exemption Certificate (TEC).

Exemption Criteria

While most travelers must budget for the travel tax, certain groups may find themselves exempt, sparing them this additional cost before departure.

The exemption criteria for the travel tax in the Philippines benefit returning residents, overseas contract workers (OCW), and former Filipino citizens.

To enjoy these exemptions, it’s essential to present your original passport in all cases. You can apply for the Travel Tax Exemption Certificate (TEC) online through the TIEZA platform.

Rates and Categories

You’ll find that travel tax rates in the Philippines vary, with specific categories of passengers eligible for different rates or exemptions.

It’s essential to understand which category you fall into, as this determines how much you’ll need to pay, or if you’re exempt altogether.

The TIEZA website offers detailed information on the current tax rates and applicable passenger categories, ensuring you’re well-informed before your trip.

Current Tax Rates

To determine your travel tax, it’s essential to know that rates vary depending on your destination, ticket class, and traveler category. The Travel Tax in the Philippines, collected by TIEZA, applies to international travelers.

Here are the current tax rates you should be aware of:

Applicable Passenger Categories

Understanding the current tax rates is crucial. Now let’s focus on which passenger categories these rates apply to and what exemptions may be available for you.

If you’re a returning resident, an overseas contract worker (OCW), or a former Filipino, you might be exempt from travel tax when your air ticket is issued.

Remember, this tax is a levy on individuals departing the Philippines, but exemptions are there to alleviate the financial burden for specific groups.

To claim your exemption, check out the TIEZA website for the necessary requirements. You’ll need to present your original passport without exception.

TIEZA’s online platform allows you to apply for the Travel Tax Exemption Certificate (TEC). Conditions and limitations do apply, so make sure to review them thoroughly on TIEZA’s website.

Exemptions and Privileges

Often, travelers departing from the Philippines aren’t required to pay the travel tax if they meet certain conditions listed on the TIEZA website.

This levy imposed on travelers can be fully or partially exempted, granting you some financial relief as you embark on your journey.

To vividly paint the picture for you, here are some key points about the exemptions and privileges that could apply to your travel plans:

- Filipino Overseas Workers are fully exempt from the travel tax, lightening their financial burden.

- Filipino students studying abroad can apply for a fifty percent (50%) exemption, making their educational journey more affordable.

- Diplomats and officials of international organizations enjoy a full waiver, acknowledging their global service.

- Infants aged two years and below don’t have to pay the tax, easing travel for young families.

- Athletes and delegates attending international competitions sanctioned by the Philippine Sports Commission may be granted full exemption as a form of support.

Remember to check the TIEZA website for the complete list of exemptions and privileges and to apply for your Travel Tax Exemption Certificate (TEC) online.

Don’t miss out on these opportunities to save on your travel expenses!

Payment Process

While you may qualify for an exemption from the Philippine travel tax, it’s essential to know the steps for paying it if required.

Should you not be eligible for an exemption, or you’re simply preparing for your travel requirements, understanding the payment process is crucial.

To begin with, you’ll need to visit the official website of the Tourism Infrastructure and Enterprise Zone Authority (TIEZA).

TIEZA is responsible for managing travel tax collections in the Philippines. On their website, you’ll find clear instructions and the necessary forms for the payment process.

You’re required to present your original passport when making the payment, which serves as your primary identification. This ensures that the travel tax is correctly attributed to you as the traveler.

For your convenience, TIEZA also offers an online platform for processing payments. This means you can settle your travel tax from the comfort of your home or office.

After completing the online transaction, ensure to print out the confirmation or receipt provided.

Lastly, keep in mind the place of payment when planning your travel tax settlement. While the online option is often the most convenient, TIEZA has authorized physical locations where payments can be made in person if needed.

Impact on Travel Budget

Securing a travel tax exemption can significantly reduce your expenses, allowing for a more cost-effective trip from the Philippines.

As you’re planning your journey, knowing that you mightn’t have to shoulder the additional cost of travel tax can be a relief.

This is especially true for eligible individuals who are leaving the country, as the Philippine government has provisions to ease the financial burden of travel.

Here’s how the exemption can impact your travel budget:

- Extra funds for travel essentials : With the savings from the tax exemption, you can allocate more money for other travel necessities.

- Increased travel opportunities : The money saved could enable you to visit additional destinations or extend your trip.

- Budget-friendly fares : Use the exemption to offset the cost of airfare, possibly allowing you to opt for more convenient or direct flights.

- Accommodation upgrades : Redirect the funds to enhance your stay with better accommodation options.

- Cultural experiences : Spare cash means more opportunities to immerse yourself in cultural events or local cuisine.

Avoiding Common Issues

To steer clear of complications when claiming your travel tax exemption in the Philippines , ensure you’re familiar with the necessary requirements and have your original passport on hand.

It’s crucial to be aware that the Philippine government mandates this document for all exemptions without exception. So, don’t forget it!

Also, stay informed about the operational hours and official holidays to plan your visit to the Consulate General, avoiding unnecessary setbacks.

This preparation helps you tackle any issues head-on and ensures you’re not caught off-guard.

Moreover, before setting off on your journey, whether within the country or outbound, understand the fuel surcharge and its associated refund policies.

Such knowledge will ease your travel experience, letting you manage your finances more effectively.

Additionally, delve into the fare conditions and services offered by your carrier, paying close attention to those concerning oxygen service and unaccompanied minors.

This step is particularly important if you’re traveling from or within an Enterprise Zone. Being well-informed prevents misunderstandings and guarantees that you receive the services you expect from your chosen airline.

In conclusion, don’t let the Travel Tax in the Philippines gobble up your wallet like a ravenous beast! Secure your exemption like a savvy traveler and guard your precious funds.

Remember, every peso saved is a victory against the monstrous jaws of travel expenses. So, be proactive, leap onto TIEZA’s website, and snatch that Travel Tax Exemption Certificate with the agility of a ninja.

Make your travel budget bulletproof and your adventures absolutely epic!

Articles airasia Flights: All You Need to Know about Travel Tax in the Philippines

Explore other articles and discussions on this topic.

14/12/2023 • FAQs

Information.

What is the Philippine Travel Tax? The Philippine Travel Tax is a fee you need to pay before leaving the country for international flights. The amount of the travel tax may vary depending on the type of flight ticket you have. Travelers are typically required to pay the travel tax before they check in for their international flight. Please note that policies and fees are subject to change, and it's advisable to check with relevant authorities or official sources for the most latest information on Philippine Travel Tax.

How much is the Philippine Travel Tax? Your travel tax varies according to the type of ticket you have. Check the table below for more information.

Who is required to pay the Philippine travel tax?

The obligation to pay travel tax applies to:

Who is exempted from paying the travel tax? The payment of travel tax is exempted for the following categories of Filipino citizens:

Where to pay the Philippine travel tax? To process your travel tax payment online, you may refer to this link: https://tieza.gov.ph/online-travel-tax-payment-system/ . Please be informed that Philippine Travel Tax will not be offered online if the transaction is for a child or with a child/infant. You also can pay your travel tax at the airport counters on the day of your flight by presenting your ticket and passport.

How do I get a refund ? You may visit https://tieza.gov.ph/travel-tax-refund/ for more information on Travel Tax Refund Policies and Requirements.

- Disclaimer and Affiliate Disclosure

- Privacy Policy

Travel Tax Philippines: All You Need to Know to Fly Without Hassle

Published by Ms. D on January 29, 2024 January 29, 2024

Ever wondered how much the travel tax Philippines is? Traveling outside the Philippines can be an exciting adventure, but it often comes with various considerations, including the travel tax. If you’re planning a trip abroad, it’s essential to understand what this tax is about, who needs to pay it, and how much it costs.

Table of Contents

What is travel tax philippines.

The Philippine travel tax is a levy imposed on individuals departing from Philippine airports for international destinations. This tax is collected to generate revenue for the country’s tourism infrastructure and related projects.

The requirement to pay travel tax is applicable to:

1. Filipino citizens. 2. Taxable foreign passport holders. 3. Non-immigrant foreign passport holders who have resided in the Philippines for over a year.

How Much is the Philippine Travel Tax?

The amount of travel tax in the Philippines varies depending on the passenger’s class of travel and destination. As of the latest information available, the rates are as follows:

- First class passengers: PHP 2,700

- Economy class passengers: PHP 1,620

If you are qualified, you may apply for Reduced Travel Tax (RTT), which is a tax reduction program designed to lower the cost of travel for eligible individuals. There are two types of RTT, namely standard and privileged.

Standard Reduced Travel Tax

As per the Tourism Infrastructure and Enterprise Zon Authority (TIEZA) , the following individuals may apply for standard reduced travel tax.

- Minors (from 2 years and one (1) day to 12th birthday on date of travel)

- Accredited Filipino journalist whose travel is in pursuit of journalistic assignment

- Those authorized by the President of the Republic of the Philippines for reasons of national interest

The standard reduced travel tax for first-class passengers is PHP 1,350, and for economy passengers, it is PHP 810 .

Privileged Reduced Travel Tax

The privileged reduced travel tax is exclusively available to dependents of Overseas Filipino Workers (OFW), namely:

- Legitimate spouse of an Overseas Filipino Worker (OFW)

- Unmarried children of an OFW, whether legitimate or illegitimate, who are below 21 years of age

- Children of OFWs with disabilities even above 21 years of age.

The privileged reduced travel tax for first-class and economy-class passengers is PHP 400 and PHP 300 , respectively.

How to Avail of the Reduced Philippine Travel Tax

To help you get started applying for RTT, here’s a general step-by-step guide.

Step 1: Understand the criteria for eligibility for RTT and determine whether you pass for the standard or privileged reduced travel tax.

Step 2: Gather all necessary supporting documents to prove your eligibility. Depending on your eligibility, the requirements can vary. Check the complete details here – Reduced Travel Tax | Tourism Infrastructure and Enterprise Zone Authority (tieza.gov.ph)

Step 3: If you have not yet purchased your airline ticket or made any travel arrangements, you can apply for the RTT in advance online as long as you have all the requirements already. Do note that filing for RTT online is limited to those who have not yet purchased their airline ticket and have not yet paid the full travel tax rate. Online RTT applications submitted after 5 P.M. or on weekends are processed on the next working day.

If you have already purchased an airline ticket and prefer to pay your RTT at the airport, proceed to step 4.

Step 4: Arrive at the airport or designated government office where travel tax payments are processed. Look for the travel tax counter or designated personnel.

Step 5: Present your supporting documents to the personnel at the travel tax counter. This will verify your eligibility for the reduced travel tax rate.

Step 6: Pay the reduced travel tax amount applicable to your category. The personnel will inform you of the exact amount to be paid based on your eligibility.

In case you have paid for the full travel tax amount despite being eligible for RTT, TIEZA advises you to apply for a refund of the excess travel tax paid ON-SITE at any TIEZA Travel Tax Office or airport counter.

Step 7: Once the reduced travel tax is paid, you will receive a receipt or clearance indicating that the tax has been settled. Keep this document safe, as you may need it during your travel.

Step 8: With the reduced travel tax paid and clearance obtained, proceed with your travel plans as usual.

Philippine Travel Tax Discounts for Senior Citizens and PWDs

Under current laws, senior citizens and PWDs are entitled to a 20% discount on the travel tax and terminal fee.

Who Is Exempted From Travel Taxes in the Philippines?

There are certain categories of individuals who are exempt from paying travel tax in the Philippines. They are the following:

- Foreign Diplomatic and Consular Officials and Members of their Staff

- Officials, Consultants, Experts, and Employees of the United Nations (UN) Organization and its agencies

- United States (US) Military Personnel including dependents and other US nationals with fares paid for by the US government or on US Government-owned or chartered transport facilities

- Overseas Filipino Workers (OFW)

- Filipino permanent residents abroad whose stay in the Philippines is less than one (1) year

- Philippine Foreign Service Personnel officially assigned abroad and their dependents

- Officials and Employees of the Philippine Government traveling on official business (excluding Government-Owned and Controlled Corporations)

- Grantees of foreign government funded trips

- Bona-fide Students with approved scholarships by appropriate government agency

- Infants (Up to second birthday on date of travel)

- Personnel (and their dependents) of multinational companies with regional headquarters, but not engaged in business, in the Philippines

- Balikbayans whose stay in the Philippines is less than one (1) year

- Family members of former Filipinos accompanying the latter

Where to Pay Philippine Travel Tax

Passengers can settle their travel tax at designated counters in Philippine airports before departure. These counters are typically located in the international departure area of the airport.

How to Pay Philippine Travel Tax Online?

If you plan to pay the Philippine travel tax, here is a guide that provides step-by-step instructions on how you can do it.

Step 1: Go to the official website of the Tourism Infrastructure and Enterprise Zone Authority (TIEZA) – Tourism Infrastructure and Enterprise Zone Authority (tieza.gov.ph)

Step 2: Look for the Travel Tax section on the top of the page beside the About Us tab.

Step 3: Within the Travel Tax section, select Pay Travel Tax Online .

Step 4: Click on the MYEG icon on the laptop photo. The link should direct you here – Online Travel Tax Services System (tieza.online)

Step 5: Fill out the form with the required details.

Step 6: Proceed and select your preferred payment method. This could be through e-wallets, online bank transfers, or credit/debit cards.

Step 7: Follow the prompts to complete the payment process.

Step 8: After successful payment, make sure to keep a copy of the payment confirmation for your records.

How Much is the Terminal Fee in NAIA?

The terminal fee at Ninoy Aquino International Airport (NAIA) varies depending on the terminal and the type of flight. As of 2023, the NAIA charges PHP 300 for domestic flights and PHP 750 for international flights.

How Much is the Travel Tax from the Philippines to Canada?

Filipino passengers traveling from the Philippines to Canada are subject to a travel tax. The amount varies depending on the passenger’s class of travel. First class passengers are charged PHP 2,700 while economy class passengers are charged PHP 1,620.

Is Travel Tax Included in PAL Ticket?

For Philippine Airlines (PAL) tickets, the travel tax is typically not included in the ticket price. Passengers are required to settle the travel tax separately before departure.

Can I Pay Travel Tax at the Airport?

Yes, passengers can pay their travel tax at the airport before their flight. There are designated counters in Philippine airports where travelers can settle this fee conveniently.

Want to Travel Locally in the Philippines?

If you are planning to explore the local destinations in the Philippines, make sure to check out our 15 Top Destinations in the Philippines – Our Recommendations 2024

The author of Budget and Life is a content writer based in the Philippines. Her passion for writing has led her to take up writing as a full-time profession. She has garnered a lot of experience in the field and is skilled at crafting engaging and informative content.

Leave a Reply Cancel reply

You must be logged in to post a comment.

Related Posts

10 Things to Do Before Moving to the Philippines – Insider Tips From a Local!

Preparing to move to the Philippines soon? Let me help you get ready for the new culture and environment! Born and raised in the Philippines, here are 10 recommendations I can give to every foreigner Read more…

2024 Yabu: House of Katsu Review – A First-Timer’s Impression

Have you ever heard of Yabu: House of Katsu? If you’re a fan of Japanese cuisine, you’re in for a treat. Our recent visit to Yabu was a delightful experience, and we’re excited to share Read more…

Fully Booked Bookstore Experience

For all book enthusiasts heading to the Philippines, Fully Booked is an absolute must-visit destination. This bookstore in the Philippines is a go-to destination for all your book needs! If you are curious to learn Read more…

The Philippines Today

The Philippines Today, Yesterday, and Tomorrow

Philippine Travel Tax (11 Commonly Asked Questions)

The Philippine Travel tax has become one of the most reliable sources of funding for the government.

In fact, 50 percent of the total travel tax collected is retained by TIEZA. TIEZA or Tourism Infrastructure and Enterprise Zone Authority replaced the PTA or Philippine Tourism Authority.

The CHED (Commission on Higher Education) gets 40 percent of the collected tax and the National Commission For Culture and the Arts get the remaining 10 percent of travel tax collected.

Enumerated hereunder are the common questions asked by Filipinos and Tourists alike about the Philippines travel tax.

1. What is the Philippine Travel Tax ?

Philippine travel tax is a levy imposed by the Philippine government on individuals who are leaving the Philippines irrespective of the place where the air ticket is issued and form or place of payment.

2. Who Must Pay The Travel Tax?

- Citizens of the Philippines

- Taxable Foreign Passport Holders

- Non-immigrant foreign passport holders who have stayed in the Philippines for more than one (1) year

3. Which Philippine government agency has the power to collect Travel Tax?

The TIEZA or Tourism Infrastructure and Enterprise Zone Authority is the government agency mandated by law to collect the travel tax.

4. What is the Travel Tax For?

The Philippine Travel Tax was originally imposed to curtail unnecessary foreign travel and to conserve foreign exchange. Later, the tax was used to generate much-needed funds for tourism-related programs and projects. It is recognized that tourism promotion alone is not enough to attract tourists to the Philippines. Adequate tourism facilities and infrastructures need to be provided for the growth of the tourism industry. The Travel Tax plays an important role in funding the development and maintenance of these tourism facilities and infrastructures to enhance the countries competitiveness as a major tourism destination.

5. Are those exempted from paying travel tax also exempted from paying terminal fee?

Under the law, only the following are exempted from paying terminal fee

- OFW (Overseas Filipino Worker)

- Pilgrims endorsed by the National Commission of Muslim Affairs

- Athletes endorsed by the Philippine Sports Commission

- Others authorized by the Office of the President

6. How Much Is The Travel Tax?

Under the law, the rate for a 1st class passenger is 2,700 pesos and the rate for economy class is 1,620 pesos. This rate is the full travel tax.

7. Where to pay Travel Tax in the Philippines?

The Following Companies operating in the Philippines are delegated to collect the tax upon issuance of tickets: 1. Airline Companies 2. Shipping companies 3. Travel agencies

For tickets issued outside the Philippines or for internet-booked tickets, pay the travel tax directly at 1. TIEZA Travel Tax Offices 2. Travel Tax Counter at major international airports like NAIA or Mactan-Cebu international airport or Clark International Airport.

Philippine Travel Tax Online Payment now available.

8. What are the documents required when paying travel tax?

Bring your original passport and airline ticket

9. Who are exempted from paying the Philippine Travel Tax?

- Overseas Filipino workers

- Filipino permanent residents abroad whose stay in the Philippines is less than one year Family members accompanying such are also exempted

- Infants (2 years and below

- Foreign Diplomatic and Consular Officials and Members of their Staff

- Officials, Consultants, Experts, and Employees of the United Nations (UN) Organization and its agencies

- United States (US) Military Personnel including dependents and other US nationals with fares paid for by the US government or on US Government-owned or chartered transport facilities

- Crew members of airplanes plying international routes

- Filipino permanent residents abroad whose stay in the Philippines is less than one (1) year

- Philippine Foreign Service Personnel officially assigned abroad and their dependents

- Officials and Employees of the Philippine Government traveling on official business (excluding Government-Owned and Controlled Corporations)

- Grantees of foreign government-funded trips

- Bona-fide Students with approved scholarships by the appropriate government agency

- Personnel (and their dependents) of multinational companies with regional headquarters, but not engaged in business, in the Philippines

- Those authorized by the President of the Republic of the Philippines for reasons of national interest

10. May a travel tax be refunded? Yes, travel tax can be refunded like

- When there is undue tax – you are exempt but you paid

- Tax inadvertently paid twice for the same ticket

- Entitled to exemption or reduced tax

- Offloaded passengers /canceled flights

- Downgraded ticket

- Reduced Travel Tax

- Travel Tax Exemption

- Unused ticket

11. Where are the locations of TIEZA travel tax offices?

Provincial Offices

Laoag Travel Tax Unit Departure Lobby Laoag International Airport Laoag City, Ilocos Norte Telefax: (077) 772-1162 Monday to Friday, 8 am – 5 pm Saturday and Sunday, 8 am – 9 pm

Baguio Travel Tax Unit Department of Tourism Building Governor Pack Road Baguio City Tel. No.: (074) 442-6226 Monday to Friday, 8 am – 5 pm

San Fernando, La Union Travel Tax Unit Mabanag Hall, San Fernando, La Union Telefax: (072) 607-1963 Monday to Friday, 8 am – 5 pm

Clark/DMIA Travel Tax Unit Departure Lobby Diosdado Macapagal International Airport Clarkfield Pampanga Monday to Sunday, 4 am – 1 am

SM City San Fernando, Pampanga Travel Tax Unit 3/F Government Service Center, SM City Pampanga San Fernando, Pampanga Monday to Friday, 10 am – 6 pm

Kalibo Travel Tax Unit Departure Area Kalibo International Airport Kalibo, Aklan Monday to Sunday, 8 am – 12midnight

New Bacolod-Silay Airport Travel Tax Unit Departure Area New Bacolod-Silay Airport Brgy. Bagtic, Silay City Monday to Sunday, 5 am – 7 pm

Iloilo Travel Tax Unit DOT Region VI Bldg., Capitol Grounds, Bonifacio Drive, Iloilo City Tel. No.: (033) 366-0480 Telefax: (033) 335-0245 Monday to Friday, 8 am – 5 pm

Iloilo International Airport Travel Tax Unit Departure Area IIA Cabatuan, Iloilo M-T-TH-F-Sunday, 8 am – 11 pm Wednesday and Saturday 8 am – 5 pm

MCIA Travel Tax Unit International Departure Area Mactan Cebu International Airport Lapu-Lapu City, Cebu Tel. No.: (032) 236-3481 24/7 Operation

Cebu Travel Tax Unit Cebu Travel Tax Field Office Andres Soriano Avenue, cor P.J. Burgos Street, Centro, Mandaue City Telefax: (032) 253-3532 Monday to Friday, 8 am – 5 pm

Cagayan de Oro Travel Tax Unit 2nd Floor Lingkod Pinoy Center Robinsons Cagayan De Oro Rosario Crescent, cor. Florentino St. Limketkai Center, Cagayan De Oro City Monday to Friday, 10 am – 6 pm

Davao Travel Tax Unit Door 12, Tourism Complex, Ramon Magsaysay Park, Davao City Telefax: (082) 221-7123 Monday to Friday, 8 am – 5 pm

Davao International Airport Travel Tax Unit Departure Area, Davao International Airport Sasa, Davao City Monday to Sunday, 3 am – 6 pm

SM City Cebu Travel Tax Service Counter Government Service Center North Reclamation Area, Cebu City 6000 Metro Cebu Monday to Saturday, 10 am – 7 pm

Zamboanga Travel Tax Unit NSValderosa Street, Zamboanga City Tel. No.: (062) 991-8687 Telefax: (062) 992-6246 c/o Lantaka Hotel Monday to Friday, 8 am – 5 pm

Metro Manila Travel Tax Offices

TIEZA CENTRAL OFFICE TIEZA Building 6th & 7th Floors, Tower 1, DoubleDragon Plaza Macapagal Avenue corner EDSA extension 1302 Bay Area, Pasay City Philippines Tel. No.: (02) 512-0485 Email.: [email protected] Monday to Friday, from 07:30 am – 05:30 pm

SM CITY MANILA TRAVEL TAX SERVICE COUNTER 5/F Government Service Center, SM City Manila Tel. No.: (632) 463-9934 Monday to Friday, 10 am – 5 pm

NAIA TERMINAL 1 TRAVEL TAX COUNTER Departure Lobby, NAIA, Pasay City Tel. No.: (632) 879-6038 24/7 Operation

SM CITY NORTH EDSA TRAVEL TAX SERVICE COUNTER Government Service Express The Annex Lower Ground Floor, Beside SM Bowling Center

Tel. No.:(632)533-5026 Monday to Friday, 10 am – 5 pm

NAIA TERMINAL 2 TRAVEL TAX COUNTER Departure Lobby, Centennial Terminal 2, Pasay City Tel. No.: (632) 879-5160 24/7 Operation

ROBINSONS GALLERIA TRAVEL TAX SERVICE COUNTER Edsa Cor. Ortigas Ave., Ugong Norte, Quezon CityTel. No.:(632)475-6347 Monday to Friday, 10 am – 6 pm

NAIA TERMINAL 3 TRAVEL TAX COUNTER Departure Lobby, NAIA Terminal 3, Pasay City Tel. No.: (632) 877-7888 loc. 8166 24/7 Operation

POEA MAIN TRAVEL TAX COUNTER Ortigas Ave., Mandaluyong City Tel. No.: (632) 533-5174 Monday to Friday, 8 am – 5 pm

You may want to read:

- Where do Filipino emigrants in Germany come from the regions of the Philippines?

- 28th World Travel Awards Nominees

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

Knowledge and Science Bulletin Board System

Exploring the World of Knowledge and Understanding

Understanding the OFW Family Travel Tax: What You Need to Know

By knbbs-sharer

If you are an Overseas Filipino Worker (OFW), you are required to pay a travel tax before leaving the country. This tax is imposed by the Philippine government as a way to generate revenue and support the country’s tourism industry. The travel tax applies to all outbound passengers, but OFWs and their dependents may be exempted from it.

In this article, we will walk you through the basics of the OFW Family Travel Tax, its exemptions, and how to go about paying it. Our aim is to help you avoid any confusion and make the process as smooth as possible.

The OFW Family Travel Tax: A Brief Overview

The OFW Family Travel Tax is a levy imposed on OFWs and their dependents who are leaving the country. The tax is collected by the Philippine Tourism Authority (PTA) through its authorized collection agents: airline companies, international shipping lines, and the Philippine Travel Tax Office.

The tax is calculated based on the class of ticket that the passenger purchases for their outbound travel. It ranges from PHP 1,620 (economy class) to PHP 2,700 (first-class), and it’s valid for one year from the date of payment.

Exemptions from OFW Family Travel Tax

OFWs and their dependents are eligible for exemption from the travel tax if they meet certain conditions. These conditions are:

1. Valid Overseas Employment Certificate (OEC)

OFWs must have a valid OEC issued by the Philippine Overseas Employment Administration (POEA) as proof of their employment abroad. The exemption also applies to their dependents, as long as they are accompanied by the OFW.

2. Permanent Residency Abroad

OFWs who are permanent residents abroad are exempted from paying the travel tax upon presentation of their foreign permanent resident card.

3. Balikbayan status

Filipinos returning from abroad who have been away for at least one year are entitled to a one-year tax exemption. They are considered as balikbayans or returning Filipinos.

How to Pay the OFW Family Travel Tax

If you or your dependent(s) are not exempted from paying the OFW Family Travel Tax, you can pay it through any of the following modes:

1. At the airport or seaport

You can pay the tax at the airport or seaport before departure.

2. Online payment

You can also pay the travel tax online through the PTA’s website. Payment can be made using your credit card or through bank transfers.

In summary, the OFW Family Travel Tax is a mandatory fee that OFWs and their dependents must pay before leaving the country. The amount varies depending on the class of the ticket purchased for outbound travel. However, OFWs and their dependents may be exempted from paying the tax if they meet certain conditions such as having a valid OEC or being permanent residents abroad.

It’s essential to be familiar with the OFW Family Travel Tax and its rules to avoid delays and inconveniences when traveling. By keeping in mind the information provided in this article and staying up to date with any changes to the policy, OFWs can save time and money and focus on their overseas employment or travel goals.

(Note: Do you have knowledge or insights to share? Unlock new opportunities and expand your reach by joining our authors team. Click Registration to join us and share your expertise with our readers.)

Share this:

Discovery new post:.

- Exploring with Kids: How to Make Travel and Exploration Fun for the Whole Family

- The Ultimate Guide to Choosing the Right 5th Wheel Travel Trailer for Your Family

- 5 Reasons Why Jayco Travel Trailers are Perfect for Family Road Trips

- Why Myrtle Beach Travel Park Should Be Your Next Family Adventure Destination

Hi, I'm Happy Sharer and I love sharing interesting and useful knowledge with others. I have a passion for learning and enjoy explaining complex concepts in a simple way.

Related Post

Embark on a royal adventure: the ultimate guide to luxury travel and tourism, exploring nature’s wonders: a journey with rebecca adventure travel, embark on an unforgettable royal adventure travel experience, explore the colors and traditions of global cultural festivals, 5 simple strategies for learning english faster and more effectively, 5 common great dane health issues you need to know about, 2023 food business trends: from sustainability to automation.

- Toggle Accessibility Statement

- Skip to Main Content

TIEZA Travel Tax Exemption Certificate (TEC) Online Application

TIEZA provides a simple and contactless way to apply for your Travel Tax Exemption Certificate (TEC) through the official TIEZA website .

Here’s an easy to follow video to guide you on your online TEC Application.

- AFP CHIEF OF STAFF GENERAL BRAWNER VISITS SINGAPORE, REAFFIRMS STRONG PH-SG DEFENSE TIES

- PHILIPPINES, SINGAPORE DISCUSS STRENGTHENING TIES DURING VISIT OF SINGAPORE FOREIGN MINISTER DR. VIVIAN BALAKRISHNAN

- PHILIPPINE SALO-SALO MARKS START OF FILIPINO FOOD MONTH, COMMEMORATIVE ACTIVITIES FOR PH-SG 55TH ANNIVERSARY OF TIES

- PHILIPPINES AND SINGAPORE LAUNCH COMMEMORATIVE LOGO TO CELEBRATE 55 YEARS OF DIPLOMATIC RELATIONS

- DFA Statement on Tensions in the Middle East Region

- PHILIPPINES RECOGNIZED AS SUSTAINABLE DIVE DESTINATION OF THE YEAR AT ASIA DIVE EXPO (ADEX)

- Singapore Minister for Foreign Affairs Dr. Vivian Balakrishnan to visit the Philippines from 15 to 17 April 2024

- PHILIPPINE SALO-SALO: A CULINARY CELEBRATION OF FILIPINO HERITAGE AT THE GRAND MERCURE ROXY HOTEL SINGAPORE

- e-Apostille Service for PSA Documents

- DMW Receives Digital Society Award at Singapore’s Festival of Innovation

- REDUCTION IN CONSULAR FEES EFFECTIVE 01 APRIL 2024

- ACM MANILA GALLEON INTERNATIONAL CONFERENCE EXPLORES RICH LEGACY OF MARITIME TRADE

- EMBASSY HOLDS PRODUCTIVE WORKSHOP ON WEBSITE CONTENT MANAGEMENT

- WAX FIGURE OF MISS UNIVERSE PIA WURTZBACH UNVEILED BY MADAME TUSSAUDS

- GIVE MOTHER EARTH A 60-MINUTE BREAK | EARTH HOUR 2024

- PHILIPPINE AMBASSADOR ATTENDS ANNUAL DIPLOMATIC RECEPTION HOSTED BY SINGAPORE PRESIDENT THARMAN

- PH AMBASSADOR ADDRESSES ASEAN AND EU AMBASSADORS AT LUNCHEON HOSTED BY EUROPEAN UNION AMBASSADOR

- HEALTH SECRETARY HERBOSA VISITS SINGAPORE, DISCUSSES PHILIPPINES-SINGAPORE HEALTH COOPERATION

- 2024 NATIONAL WOMEN’S MONTH PHOTO CONTEST

- DFA STATEMENT ON REMARKS OF CHINESE FOREIGN MINISTRY SPOKESPERSON

- THREE FILIPINO CHANGI AIRPORT PERSONNEL AWARDED BY CHANGI AIRPORT MANAGEMENT

- PHILIPPINE AMBASSADOR WELCOMES NEW KOREAN AMBASSADOR TO SINGAPORE

- THAI AMBASSADOR-DESIGNATE CALLS ON PHILIPPINE AMBASSADOR

- PH EMBASSY CELEBRATES INTERNATIONAL WOMEN’S DAY, CALLS ON FILIPINO COMMUNITY TO SUPPORT PH ADVOCACY OF GENDER EQUALITY AND WOMEN EMPOWERMENT

- AMB MACARAIG MEETS WITH NEW IISS-ASIA EXECUTIVE DIRECTOR

- PHILIPPINE TOURISM PROMOTIONS BOARD TO HOLD LOVE THE PHILIPPINES – BISITA, BE MY GUEST PROGRAM IN SINGAPORE

- PHILIPPINE SENATOR ALAN CAYETANO VISITS SINGAPORE ANTI-SCAM CENTRE

- NEW TIMOR-LESTE AMBASSADOR TO SINGAPORE H.E. ALEXANDRE TILMAN PAYS COURTESY CALL ON PHILIPPINE AMBASSADOR

- CALL FOR NOMINATIONS FOR ASEAN PRIZE 2024

- DFA Statement on 05 March 2024 Ayungin Shoal Incident

- PH Embassy Kicks-Off 2024 National Women’s Month Celebration with Purple Friday and #WecanbeEquALL Campaign

- PH EMBASSY LEVERAGES ART EXHIBIT TO ENCOURAGE OVERSEAS FILIPINOS’ CONTINUED CAPACITY-BUILDING AND SKILLS DIVERSIFICATION

- WHATSAPP CHANNEL OF THE PHILIPPINE EMBASSY IN SINGAPORE

- AMB MACARAIG RETURNS TO SINGAPORE AFTER SUCCESSFUL 6TH INFORMAL CONSULTATIONS ON PHILIPPINES-SINGAPORE ACTION PLAN

- PHILIPPINES PARTICIPATES IN SINGAPORE AIRSHOW, ASIA’S BIGGEST AVIATION AND AEROSPACE EVENT

- PH DIPLOMATS IN SG HOLD OWN ART EXHIBIT TO FIRM UP PEOPLE-TO-PEOPLE TIES

- PH EMBASSY BIDS FAREWELL TO WELFARE OFFICER CLARIN, WELCOMES NEW WELFARE OFFICER TEVES IN SINGAPORE

- NATIONAL VOTER’S DAY

- PHILIPPINES PARTICIPATES IN 4TH ASEAN DIGITAL MINISTERS’ MEETING AND RELATED MEETINGS

- PHILIPPINES ASSUMES LEADERSHIP OF COUNTER-TERRORISM INFORMATION FACILITY IN SINGAPORE

- PH EMBASSY PRESENTS 2024 ACTIVITIES AND UPDATES AT FIRST UGNAYAN OF THE YEAR, MEETS WITH FILCOM ORGS IN SINGAPORE

- FILIPINO TEEN BOWLING CHAMP AND WINNER OF SINGAPORE INTERNATIONAL OPEN VISITS PH EMBASSY

- PHILIPPINES PARTICIPATES IN 12TH IISS SHANGRI-LA DIALOGUE SHERPA MEETING

- PHILIPPINE EMBASSY HONORS THE LEGACY OF DR. JOSE RIZAL ON HIS 127TH MARTYRDOM ANNIVERSARY WITH THE THEME “RIZAL: PUNDASYON NG KAHAPON, ISINASABUHAY NGAYON”

- EMBASSY CLOSURE IN JANUARY 2024

- DFA SUMMONS CHINESE AMBASSADOR TO PROTEST BACK-TO-BACK HARASSMENTS IN THE WEST PHILIPPINE SEA

- EMBASSY CLOSURES IN DECEMBER 2023

- ADVISORY: INCREASING CASES OF COVID-19 INFECTIONS IN SINGAPORE

- PH Embassy in Singapore Observes 18-Day Campaign to End Violence Against Women (VAW), Kicks off Campaign with 2017 RACCS Webinar and Outreach Services for OFWs

- PHILIPPINE EMBASSY CONCLUDES ART TREK 15 WITH BRIDGING HORIZONS: NAVAL CULTURAL EXCHANGE THRU ARTS

- PHILIPPINES HIGHLIGHTS PASKONG PINOY DURING ASEAN GALA NIGHT 2023

- PH & MEXICAN EMBASSIES STAGE MANILA GALLEON EXHIBIT IN SINGAPORE

- BEWARE OF ILLEGAL RECRUITMENT OF FILIPINOS OVERSEAS

- PHILIPPINE EMBASSY WARNS AGAINST FAKE CERTIFICATION SCAM TARGETING TRAVELERS

- PH EMBASSY CONTINUES TO SHOWCASE FILIPINO ARTISTS WITH “SHADES OF THE WIND”, IN PARTNERSHIP WITH ONE EAST ASIA

- PH EMBASSY WELCOMES VISITING PH LOCAL GOVERNMENT OFFICIALS PARTICIPATING IN FOREIGN STUDY MISSION ON SMART AND SUSTAINABLE CITIES AND COMMUNITIES

- JOIN US AT THE 8TH SINGAPORE FINTECH FESTIVAL (SFF), 15-17 NOVEMBER 2023, SINGAPORE EXPO

- PHILIPPINE ARMY OFFICER GRADUATES COMMAND AND STAFF COURSE OFFERED BY SINGAPORE ARMED FORCES

- FILIPINO COMMUNITY IN SINGAPORE GATHERS AT BALIK BAYANIHAN 2023

- ART TREK 15 CONTINUES WITH EXHIBIT FEATURING FILIPINO AND SINGAPOREAN ARTISTS, ENTITLED “HARMONY ACROSS HORIZONS : A CULTURAL TAPESTRY OF TRADITIONS”

- FILIPINO MUSIC ARTISTS TAKE CENTER STAGE AT AXEAN FESTIVAL 2023 IN SINGAPORE

- PHILIPPINES JOINS ITB ASIA 2023, ASIA’S LEADING TRAVEL TRADE SHOW

- STATEMENT OF THE DFA SPOKESPERSON ON THE 22 OCTOBER 2023 AYUNGIN SHOAL INCIDENT

- BEWARE OF FACEBOOK PAGE “LENDING PH-63”

- FILIPINO ACTOR KIMSON TAN TO STAR IN UPCOMING SINGAPOREAN FILM “KING OF HAWKERS”, CALLS ON PHILIPPINE AMBASSADOR

- ASEAN AND DIALOGUE PARTNERS REAFFIRM SHARED COMMITMENT TO DEEPEN REGIONAL CYBERSECURITY COOPERATION

- PHILIPPINES, SINGAPORE DISCUSS BILATERAL COOPERATION ON CYBERSECURITY, COMMIT TO STRENGTHEN COLLABORATION IN DIGITAL DOMAIN

- DICT SECRETARY UY SPEAKS AT SICW HIGH LEVEL PLENARY, SHARES VIEWS ON PH EFFORTS TO STRENGTHEN ITS CYBERSECURITY MEASURES AMIDST GLOBAL CHALLENGES

- PHILIPPINES JOINS 8TH SINGAPORE INTERNATIONAL CYBER WEEK 2023

- WORK OF FILIPINO ARTIST RONALD VENTURA FEATURED AT WHITESTONE GALLERY OPENING

- YOUNG CACAO ARTIST JOHN PAUL CHOA OPENS SOLO EXHIBIT AT PH EMBASSY FOR ART TREK 15

- FILIPINO FILM “IN MY MOTHER’S SKIN” PREMIERS IN SINGAPORE

- PH EMBASSY PARTNERS WITH WATERWAYS WATCH SOCIETY FOR COASTAL CLEANUP, LEARNS ENVIRONMENTAL CONSERVATION THROUGH TEAMWORK

- PH EMBASSY, DA OFFICIALS EXPLORE AGRICULTURAL INNOVATIONS DURING VISIT TO REPUBLIC POLYTECHNIC’S “THE GREENHOUSE”

- DFA STATEMENT ON THE KILLING OF TWO (2) FILIPINO NATIONALS AS A RESULT OF HAMAS ACTIONS AGAINST ISRAEL

- PHILIPPINE EMBASSY’S SENTRO RIZAL OFFERS INTIMATE VENUE FOR FILIPINO WEDDINGS

- PH EMBASSY AND KJEM BRILLIANT KIDZ NURTURE CREATIVITY WITH THE INAUGURAL ART TREK FOR KIDS

- FILIPINA ARTIST EXPRESSES PERSPECTIVE ON CHILDREN WITH AUTISM, HOLDS SOLO EXHIBIT FOR ART TREK15

- MWO-SINGAPORE ACCREDITS FILIPINO-OWNED ENGINEERING COMPANY, OFFERS EMPLOYMENT OPPORTUNITIES TO 800 FILIPINO WORKERS

- PRESIDENT MARCOS ENCOURAGES SINGAPORE BUSINESS LEADERS TO INVEST IN PHILIPPINES’ STRATEGIC INVESTMENT PRIORITIES

- MESSAGE OF SECRETARY FOR FOREIGN AFFAIRS HON. ENRIQUE A. MANALO ON THE CELEBRATION OF WORLD MARITIME DAY 2023

- ART TREK SEASON OFFICIALLY STARTS WITH AN EXHIBIT OF THE WORKS OF ANITA MAGSAYSAY-HO, LYRA GARCELLANO

- ART TREK 15 OPENS AT GAJAH GALLERY WITH AN ALL FILIPINO LINEUP

- FILIPINOS WIN PLAYOFFS FOR 8-BALL CHAMPIONSHIP OF THE AMERICAN POOLPLAYERS ASSOCIATION -SINGAPORE (APA) LEAGUE

- PHILIPPINES AND SINGAPORE’S INFRASTRUCTURE ASIA TEAM UP TO LAUNCH NAIA PUBLIC-PRIVATE PARTNERSHIP ROADSHOW

- PHILIPPINE ART TREK IS BACK IN SINGAPORE!

- PRESIDENT MARCOS EYES MORE FOREIGN INVESTMENTS TO THE PHILIPPINES AT 10TH ASIA SUMMIT IN SINGAPORE

- PH EMBASSY HOLDS INTRODUCTORY TRAINING WORKSHOP ON ARTIFICIAL INTELLIGENCE

- STATEMENT ON THE PASSING OF PHILIPPINE EAGLE GEOTHERMICA

- PHILIPPINE STATEMENT ON THE 2023 VERSION OF CHINA’S STANDARD MAP

- FILIPINO CULTURE AND FASHION PREVAIL AT “MARIA CLARA & IBARRA” BALL IN SINGAPORE

- DFA Spokesperson’s Statement in Response to the Statement of the Chinese Foreign Ministry Spokesperson on 07 August 2023

- DFA STATEMENT ON THE 05 AUGUST 2023 INCIDENT ON THE AYUNGIN SHOAL

- NATIONAL DAY GREETING FOR SINGAPORE

- ASEAN MISSIONS IN SINGAPORE GATHER FOR FUN WALK TO CELEBRATE 56TH ASEAN DAY

- SEVEN EMBASSY PERSONNEL BAG AWARDS AT DFA FOUNDING ANNIVERSARY CELEBRATION

- PH EMBASSY PARTNERS WITH SANDIGAN, PROVIDES FREE LEGAL AID CLINIC TO FILIPINOS IN SINGAPORE

- MANILA FAME, PHILIPPINES PREMIER TRADE SHOW FOR QUALITY HOME, FASHION , AND LIFESTYLE PRODUCTS IS BACK

- AMB MACARAIG REPRESENTS PH IN THE ASIA EUROPE FOUNDATION GOVERNORS’ MEETING IN BARCELONA

- DFA LAUNCHES MICROSITE ON THE 2016 ARBITRAL AWARD

- STATEMENT OF SECRETARY FOR FOREIGN AFFAIRS ENRIQUE A. MANALO ON THE 7TH ANNIVERSARY OF THE AWARD ON THE SOUTH CHINA SEA ARBITRATION, 12 JULY 2023

- VICE PRESIDENT DUTERTE GRACES PHILIPPINE EAGLE AVIARY OPENING IN SINGAPORE

- CEBU CHOCOLATE QUEEN TELLS STORY AT CHOCOLATE BREAKS HOSTED BY PHILIPPINE, MEXICAN AMBASSADORS

- “KWENTO NG ALON” TRAVELING EXHIBIT HITS SINGAPORE SHORES

- FREE LEGAL AID CLINIC ON 16 JULY 2023

- PH INDEPENDENCE MONTH CULMINATES WITH RYAN CAYABYAB AND THE RYAN CAYABYAB SINGERS CONCERT IN SINGAPORE

- SYMBOLIC TURNOVER OF ASSISTANCE-TO-NATIONALS FUNCTIONS (ATN) FROM PH EMBASSY TO MIGRANT WORKERS OFFICE (MWO)-SINGAPORE

- BUSINESS TIMES FEATURES PHILIPPINES AND SINGAPORE’S ALIGNED INVESTMENT PRIORITIES

- TURNOVER OF ASSISTANCE-TO-NATIONALS FUNCTIONS TO THE MIGRANT WORKERS OFFICE

- PH EMBASSY HOSTS DIPLOMATIC RECEPTION IN CELEBRATION OF 125TH ANNIVERSARY OF PH INDEPENDENCE AND NATIONHOOD

- FLAG RAISING CEREMONY WITH THE FILIPINO COMMUNITY MARKS 125TH ANNIVERSARY OF PH INDEPENDENCE AND NATIONHOOD IN SINGAPORE

- Message of Secretary for Foreign Affairs Enrique A. Manalo on the Commemoration of the Day of the Seafarers 2023

- DFA TURNS OVER ASSISTANCE-TO-NATIONALS FUNCTIONS FOR OFW TO DMW

- PHILIPPINE VICE PRESIDENT AND SECRETARY OF EDUCATION SARA DUTERTE VISITS SINGAPORE AS SEAMEO COUNCIL PRESIDENT

- Message of Secretary for Foreign Affairs Enrique A. Manalo on the Occasion of Kalayaan 2023 “Kalayaan. Kinabukasan. Kasaysayan.”

- PH EMBASSY AND ISEAS YUSOF ISHAK INSTITUTE SINGAPORE TO FURTHER COORDINATE WITH SIGNING OF DEED OF DONATION FOR PH STUDIES PROJECT

- AMBASSADOR MACARAIG HOSTS DINNER FOR SUCCESSFUL PH PARTICIPATION IN THE 20th SHANGRI-LA DIALOGUE

- SENATOR LEGARDA HIGHLIGHTS ROLE OF MINILATERAL COOPERATION IN COMPLEMENTING ASEAN CENTRALITY AT 20th SHANGRI-LA DIALOGUE IN SINGAPORE

- “RULE OF LAW, DIPLOMACY AND DIALOGUE, CRUCIAL FOR REGIONAL PEACE AND STABILITY” – PH DEFENSE CHIEF

- PH ARMED FORCES CHIEF SPEAKS AT SHANGRI-LA DIALOGUE, UNDERSCORES IMPORTANCE OF MARITIME SECURITY AND TECH ADVANCEMENT FOR A SECURE ASIA-PACIFIC

- PH AND SINGAPORE SIGN HUMANITARIAN ASSISTANCE AND DISASTER RELIEF ARRANGEMENT

- PH SENDS HIGH-LEVEL DELEGATION TO 20TH IISS SHANGRI-LA DIALOGUE IN SINGAPORE

- PH AND ANGOLA AMBASSADORS SEEK TO STRENGTHEN BILATERAL TIES

- Important Reminder: The Use of Philippine Passports or IDS as Loan Collateral is Illegal

- AMBASSADOR MACARAIG RECEIVES HOUSE COMMITTEE ON HOUSING AND URBAN DEVELOPMENT

- AMB MACARAIG, PH NAVY CHIEF ADACI HOST RECEPTION ABOARD BRP ANTONIO LUNA (FF151)

- PH JOINS 13TH IMDEX ASIA OPENING CEREMONY

- PH EMBASSY SPEARHEADS SG BUSINESS MISSION TO CLARK; PARTNERS WITH BCDA, FILINVEST, AND CEBU PACIFIC

- AMBASSADOR MACARAIG WELCOMES PH NAVY AND COAST GUARD OFFICIALS TO SINGAPORE, LOOKS FORWARD TO PH PARTICIPATION IN IMDEX ASIA 2023

- PH NAVY SENDS OFF CONTINGENT TO FIRST-EVER ASEAN-INDIA MARITIME EXERCISE

- PH EMBASSY, SINGAPORE BUSINESSES JOIN CEBUPAC’S INAUGURAL FLIGHT BETWEEN SINGAPORE AND CLARK CITY

- PH EMBASSY, MWO AND PRC CONDUCT SPECIAL PROFESSIONAL LICENSURE EXAMS IN SINGAPORE

- MINISTER BALAKRISHNAN CONVEYS SINGAPORE’S MESSAGE OF CONDOLENCES ON THE PASSING OF FORMER SFA DEL ROSARIO

- ONLINE CONDOLENCE BOOK FOR FORMER SFA ALBERT F. DEL ROSARIO

- DFA STATEMENT ON THE PASSING OF FORMER SECRETARY FOR FOREIGN AFFAIRS ALBERT F. DEL ROSARIO

- AMBASSADOR MACARAIG, MINISTER GAN TO STRENGTHEN ECONOMIC COOPERATION BETWEEN PH AND SINGAPORE

- 2023 Special Professional Licensure Examination (SPLE)

- PH AMBASSADOR AND MINISTER FOR MANPOWER TO COOPERATE FURTHER TO PROTECT FILIPINO WORKERS IN SINGAPORE

- PHILIPPINES IS ONCE AGAIN OFFICIAL COUNTRY PARTNER TO ASIA DIVE EXPO (ADEX) 2023

- AMBASSADOR MACARAIG MEETS WITH HEALTH MINISTER ONG

- PARTICIPANTS IN THE NATIONAL WOMEN’S MONTH PHOTO CONTEST RECEIVE CERTIFICATES AND PRIZES FROM AMBASSADOR MACARAIG

- PH AMBASSADOR CALLS ON EDUCATION MINISTER, DISCUSSES COOPERATION IN EDUCATION

- 2 PH RESTAURANTS, FILIPINA CHEF BAG AWARDS AT ASIA’S BEST 50 AWARDING CEREMONY

- WIINERS OF NATIONAL WOMEN’S MONTH PHOTOCONTEST FILIPINA CAN? CAN!

- PH AMBASSADOR CALLS ON SINGAPORE’S MINISTER FOR DEFENSE

- AMBASSADOR MACARAIG TOURS ROBERTSON QUAY’S STPI AND ALKAFF BRIDGE, ENDS DAY WITH FILIPINO-INSPIRED DINNER AT KUBÔ

- AT-SUNRICE GLOBAL CHEF ACADEMY’S SUNDAY LUXE SERIES FEATURES FILIPINO CULINARY HERITAGE

- HERITAGE ACADEMY GRADE 5 STUDENTS VISIT THE EMBASSY FOR A TOUR AND SENTRO RIZAL FAMILIARIZATION

- NOMINATIONS TO THE 2023 BAGONG BAYANI AWARDS

- WORLD WATER DAY 2023

- PH EMBASSY CONDUCTS 1ST POST ARRIVAL ORIENTATION SEMINAR (PAOS) FOR 2023

- FILIPINAS CAN? CAN! (PHOTO CONTEST)

- PH EMBASSY IN SINGAPORE CELEBRATES INTERNATIONAL WOMEN’S DAY

- AIDHA CELEBRATES INTERNATIONAL WOMEN’S DAY WITH CAMPUS INAUGURATION AT THE CATAPULT

- FOWS CONDUCTS COURSE ORIENTATION, WELCOMES BACK STUDENTS AT THE PH BAYANIHAN CENTER

- PH EMBASSY PARTICIPATES IN FAST’S ANNUAL WORKPLAN RETREAT

- CALL FOR NOMINATIONS FOR THE ASEAN PRIZE 2023

- PH EMBASSY KICKS OFF WOMEN’S MONTH CELEBRATION, ORGANIZES FIRST RESPONDER TO SEXUAL ASSAULT AND HARASSMENT TRAINING FOR EMBASSY PERSONNEL

- PHILIPPINE MADRIGAL SINGERS WOW SOLD-OUT AUDIENCE IN SINGAPORE

- IN-PERSON UGNAYAN RESUMES, AMBASSADOR MACARAIG MEETS WITH THE FILCOM LEADERS IN SINGAPORE FOR THE FIRST TIME

- PH EMBASSY CELEBRATES NATIONAL ARTS MONTH THROUGH VARIOUS PLATFORMS

- PH AMBASSADOR PAYS COURTESY CALL ON CAMBODIAN AMBASSADOR

- HIGH COMMISSIONER OF MALAYSIA RECEIVES AMBASSADOR MACARAIG

- DMW UNDERSECRETARY ALLONES CALL ON AMBASSADOR MACARAIG

- PH AMBASSADOR AND ReCAAP-ISC EXECUTIVE DIRECTOR AGREE ON THE IMPORTANCE OF COOPERATION IN ENSURING SAFE AND SECURE SEAS

- ABISO SA MGA PILIPINO: MAG-INGAT SA ILLEGAL RECRUITMENT AT CYBERCRIME SA TIMOG-SILANGANG ASYA

- AMBASSADOR MACARAIG BEGINS ROUND OF COURTESY CALLS, MEETS WITH THE DEAN OF DIPLOMATIC CORPS AND UZBEK AMBASSADOR

- UNIVERSITY OF THE PHILIPPINES LOS BAÑOS, UNIVERSITY OF SASKATCHEWAN INK MOU ON ACADEMIC AND RESEARCH COOPERATION

- PH AMBASSADOR HOSTS SALU-SALO FOR EMBASSY PERSONNEL, ENCOURAGES THEM TO CONTINUE WORKING TO PURSUE PH INTERESTS

- AMBASSADOR MACARAIG ATTENDS ANNUAL DIPLOMATIC RECEPTION HOSTED BY SINGAPOREAN PRESIDENT

- PH EMBASSY KEYNOTES PH CHAMBER OF CUSTOMS BROKERS, INC. (CCBI) INTERNATIONAL SUMMIT

- PH EMBASSY SUPPORTS BARANGAY NUS BOOTH AT mOSAic@NUS FEST 2023

- AEROSPACE ENGINEERING FACULTY AND STUDENTS CALL ON PH AMBASSADOR

- PH SPACE AGENCY CHIEF CALLS ON PH AMBASSADOR TO SINGAPORE

- PH AMBASSADOR TO SINGAPORE ADVOCATES WILDLIFE CONSERVATION FOR FUTURE GENERATION

- PH EMBASSY JOINS PHILSA AT GLOBAL SPACE TECHNOLOGY CONFERENCE (GTSC) 2023

- PH EMBASSY ATTENDS SEMINAR ON BUSINESS AND ECONOMIC PRIORITIES UNDER INDONESIA’S ASEAN CHAIRMANSHIP

- PH EMBASSY’S ATN SECTION AND MIGRANT WORKERS OFFICE HOLD CONSULTATION MEETING, REAFFIRM COMMITMENT TO ASSIST OFWS IN DISTRESS

- PH EMBASSY, BUREAU OF TREASURY CONDUCT FINANCIAL LITERACY ROADSHOW ON RETAIL TREASURY BONDS (RTB)

- PH AMBASSADOR MACARAIG PRESENTS HIS CREDENTIALS TO PRESIDENT HALIMAH YACOB

- ADVISORY ON SCAM

- SYSTEM MAINTENANCE (10 FEBRUARY 2023)

- FILIPINA HAILED AS 2023 ASIA’S BEST FEMALE CHEF

- PHILDEL OF UN WORKSHOP ON PREVENTING EXTREMISM CALL ON AMBASSADOR MACARAIG

- PH AMBASSADOR-DESIGNATE MACARAIG ARRIVES IN SINGAPORE

- CEBU’S CHOCOLATE QUEEN INTRODUCES THE “CHOCOLATE BREAK” TO THE PHILIPPINE EMBASSY IN SINGAPORE

- PH EMBASSY ASSISTS FILIPINO NATIONAL IN DISTRESS

- FILIPINO CURATOR OF NATIONAL GALLERY SINGAPORE DISCUSSES FUTURE PROJECTS WITH PH EMBASSY

- PH EMBASSY RECEIVES REFRESHER COURSE ON GOVERNMENT PROCUREMENT

- PHILIPPINE EMBASSY HOLDS PLANNING CONFERENCE, IDENTIFIES KEY PRIORITIES FOR 2023

- PH DEFENSE OFFICIALS TAKE PART IN ANNUAL SHANGRI-LA DIALOGUE SHERPA MEETING, HOLD BILATERAL MEETINGS WITH COUNTERPARTS

- PH EMBASSY ATTENDS PHILCHAM’S SPECIAL ANNUAL GENERAL MEETING

- TOURISM PROMOTIONS BOARD REPRESENTATIVE IN SG VISITS PH EMBASSY, RENEWS COMMITMENT TO BE PARTNERS IN PROMOTING PH TOURISM

- PH EMBASSY ATTENDS 22ND COMMENCEMENT EXERCISES OF AIMS LEARNING INTERNATIONAL

- PH LABOR ATTACHÉ VICTORINO TO CONCLUDE TOUR OF DUTY IN SINGAPORE

- FILIPINO GALLERY MONO8 VISITS PH EMBASSY IN SINGAPORE

- PH EMBASSY PARTICIPATES IN 14th NAUTICAL FORUM IN SINGAPORE

- PHILIPPINE EMBASSY SUPPORTS PHILCHAM’S WEBINAR ON FRANCHISING IN THE PHILIPPINES

- MULTILINGUAL POETRY READING FEATURES RENOWNED POETS, INCLUDES FILIPINO AUTHOR AND MUSICIAN

- FILIPINO GALLERIES AND ARTISTS AMONG PARTICIPANTS IN INAUGURAL ART SG, SOUTHEAST ASIA’S LARGEST EVER ART FAIR

- PHILIPPINE EMBASSY ATTENDS INAUGURAL FOOD TECH 2023, LAUNCH OF SINGAPORE STANDARD FOR FOOD E-COMMERCE

- SINGAPOREAN SCHOOL HERITAGE ACADEMY VISITS THE PHILIPPINE EMBASSY FOR AN INTRODUCTORY GREETING

- COACH RIO PAYS A COURTESY CALL ON THE PHILIPPINE EMBASSY IN SINGAPORE

- PHILIPPINE EMBASSY ATTENDS THE LAUNCH OF THE FUN DAY FOR MIGRANT DOMESTIC WORKERS, AN INITIATIVE OF THE ASSOCIATION OF EMPLOYMENT AGENCIES SINGAPORE

- FROM A MDW TO AUTHOR: JANE DUPINGAY SUCCESSFULLY LAUNCHES HER POETRY COLLECTION “LANGUAGE OF MY HEART”

- PH EMBASSY TEAMS WITH INTEGRATED BAR OF THE PHILIPPINES, PROVIDE FREE LEGAL AID TO FILIPINOS

- SINGAPORE ART WEEK 2023 KICKS OFF WITH THE BEST OF SOUTHEAST ASIA AT S.E.A. FOCUS, FILIPINOS AMONG THE HIGHLIGHTS

- LEGAL AID CLINIC ON 15 JANUARY 2023

- RENAMING OF POLO-SINGAPORE TO MIGRANT WORKERS OFFICE (MWO)-SINGAPORE

- SINGAPORE PE MEETS WITH NON-PROFIT AIDHA, DISCUSSES EMPOWERMENT OF MIGRANT DOMESTIC WORKERS

- PH EMBASSY IN SINGAPORE FETES RIZAL WITH FLAG RAISING AND WREATH LAYING CEREMONIES, READING AND DISCUSSION OF HIS LIFE AND WORKS

- MESSAGE OF SECRETARY FOR FOREIGN AFFAIRS ENRIQUE A. MANALO ON THE 126TH COMMEMORATION OF RIZAL DAY

- FLORA OF SOUTHEAST ASIA EXHIBIT IN SINGAPORE FEATURES PHILIPPINE FLORA

- PH EMBASSY PERSONNEL RECEIVES TRAINING ON SINGAPORE’S FAMILY JUSTICE SYSTEM

- SEASON’S GREETINGS

- PUBLIC HOLIDAY NOTICE

- PHILIPPINE STATISTICS AUTHORITY REGISTERS 338 OVERSEAS FILIPINOS IN SINGAPORE IN PILOT PHILSYS ID REGISTRATION

- PSA PILOT IMPLEMENTATION OF PHILSYS ID REGISTRATION IN SINGAPORE,18 December 2022, Sunday

- PH EMBASSY RESUMES OVERSEAS VOTERS’ REGISTRATION FOR 2025 PH ELECTIONS

- PH EMBASSY IN SINGAPORE OPENS TEMPORARY OFFICE AT TRIPLEONE SOMERSET, BUSINESS AS USUAL BEGINNING 12 DECEMBER

- ART TREK 14 MARKS BOTH END OF ERA AND NEW BEGINNING FOR PH ARTS FESTIVAL IN SINGAPORE

- EMBASSY’S NEW APPOINTMENT AND QUEUE SYSTEMS

- Consular Appointment System Temporarily Unavailable from 5 December, 5:00PM until 6 December, 9:00AM

- ADVISORY ON EMBASSY CLOSURE (7-9 DECEMBER 2022)

- IMPORTANT REMINDERS FOR FILIPINOS IN SINGAPORE

- SFA MANALO CALLS FOR CONTINUED COOPERATION ON OCEAN AT 2ND WORLD OCEAN SUMMIT

- PINOY POP BAND SB19, INDIGENOUS WEAVES HEADLINE PH IN ASEAN GALA NIGHT IN SINGAPORE

- PH EMBASSY IN SINGAPORE JOINS 18-DAY ANTI-VAW CAMPAIGN

- ADVISORY ON EMBASSY RELOCATION

- PHILIPPINE CULTURE FEATURED IN MEDIACORP SHOW “LITTLE GLOBETROTTERS”

- PH LEGISLATIVE STAFF TAKE PART IN TRAINING ON PUBLIC POLICY AND LEADERSHIP IN SINGAPORE

- PH EMBASSY JOINS CELEBRATION OF SUCCESS OF AIDHA GRADUATES

- TEAM PHILIPPINES WINS FIRST PLACE IN 21ST AMBASSADORS’ CUP 2022

- FILIPINO ARTISTS FEATURED IN THE “TEXTURES OF SOLITUDE” EXHIBIT

- PH EMBASSY CELEBRATES MUSEUMS AND GALLERIES MONTH THROUGH ART WORKSHOPS

- SUSTAINABLE FASHION, PROMOTION OF LOCAL TEXTILES AND FABRICS, AN ADVOCACY OF THE PHILIPPINE EMBASSY IN SINGAPORE

- PH EMBASSY CELEBRATES NATIONAL STATISTICS MONTH, CONDUCTS ADVANCED EXCEL TRAINING FOR EMBASSY PERSONNEL

- MESSAGE OF SECRETARY FOR FOREIGN AFFAIRS ENRIQUE A. MANALO ON THE COMMEMORATION OF WORLD MARITIME DAY 2022

- PH EMBASSY PERSONNEL VISIT ASIAN CIVILISATIONS MUSEUM, GAIN APPRECIATION OF EARLY ASIAN MARITIME TRADE

- FILIPINO CUISINE ELEVATED TO GREATER HEIGHTS

- FILIPINOS IN SINGAPORE FLOCK TO NUS AUDITORIUM TO MEET PRESIDENT MARCOS JR.

- FILIPINO ARTISTS PERFORM IN SINGAPORE, SHOW OFF TALENTS AT THE ASEAN MUSIC SHOWCASE FESTIVAL 2022

- Joint Press Statement between the Republic of the Philippines and the Republic of Singapore on Strengthening the Philippines-Singapore Partnership 07 September 2022

- ITNEG WEAVING TRADITION FEATURED IN NANYANG ACADEMY OF FINE ARTS’ 3RD SOUTHEAST ASIAN ART FORUM 2022

- MINDANAO TO BECOME SINGAPORE’S NEXT INVESTMENT DESTINATION

- FILIPINO MIGRANT DOMESTIC WORKERS FEATURED AT THE DO YOU SEE ME? EXHIBITION

- INVITATION TO THE PRESIDENT’S MEETING WITH THE FILIPINO COMMUNITY, 6 SEPTEMBER 2022

- FACEBOOK GETS ACCREDITATION FROM POLO-SINGAPORE, OFFERS EMPLOYMENT FOR ADDITIONAL 200 OFWS TO SINGAPORE

- SINGAPORE TERRORISM AND THREAT ASSESSMENT 2022 REPORT

- MINISTER MALIKI VISITS PH EMBASSY, SIGNS CONDOLENCE BOOK FOR PRESIDENT RAMOS

- SPOTLIGHT ON FILIPINO CULTURE AT SENGKANG GENERAL HOSPITAL’S “YOU SPARKLE! AWARDS 2022”

- NEW FILIPINO-INSPIRED RESTAURANT KUBÔ OPENS IN SINGAPORE

- POLO-SINGAPORE CONDUCTS JOB SITE VISIT OF GOODWOOD PARK HOTEL

- ONLINE CONDOLENCE BOOK FOR THE LATE FORMER PRESIDENT FIDEL V. RAMOS

- PH EMBASSY GRACES ATENEO LEADERSHIP AND SOCIAL ENTREPRENEURSHIP GRADUATION RITES

- PH EMBASSY PARTICIPATES IN FAST’s 7th EDUCATION AND HEALTH FAIR FOR MIGRANT DOMESTIC WORKERS

- FILIPINO ART FILMS FEATURED AT THE NATIONAL GALLERY OF SINGAPORE’S INTERNATIONAL FILM FESTIVAL

- PH EMBASSY IN SINGAPORE, CFO PARTNER TO RECONNECT OVERSEAS FILIPINOS THROUGH CFO BALINKBAYAN FORUM 2022

- STATEMENT OF FOREIGN AFFAIRS SECRETARY ENRIQUE A. MANALO ON THE 6TH ANNIVERSARY OF THE AWARD ON THE SOUTH CHINA SEA ARBITRATION

- ORDER OF SIKATUNA CONFERRED ON H.E. JOSEPH DEL MAR YAP

- PH EMBASSY IN SINGAPORE CELEBRATES PH EAGLE WEEK

- 4 DISTINGUISHED OVERSEAS FILIPINO INDIVIDUALS AND ORGANIZATIONS IN SINGAPORE RECEIVE PRESIDENTIAL AWARDS

- H.E. JOSEPH DEL MAR YAP BIDS FAREWELL; ENDS TOUR OF DUTY AS PH AMBASSADOR TO SINGAPORE

- Requests on Giving Voluntary Evidence via Video Conference within Embassy Premises

- PH EMBASSY IN SINGAPORE CELEBRATES 124TH PH INDEPENDENCE DAY WITH DIPLOMATIC RECEPTION

- PH CHAMBER OF COMMERCE SINGAPORE INTRODUCED DURING THE PH NATIONAL DAY RECEPTION

- SECRETARY LOCSIN GRACES GROUNDBREAKING CEREMONY OF PH EMBASSY’S NEW CHANCERY IN SINGAPORE

- PH EMBASSY IN SINGAPORE COMMEMORATES 124th INDEPENDENCE DAY WITH FILCOM

- PH EMBASSY PERSONNEL BENEFIT FROM SKILLS DEVELOPMENT TRAININGS

- PH AMBASSADOR YAP LEADS CULMINATING BAYANIHAN WALK HOUR

- PH EMBASSY IN SINGAPORE RESUMES IN-PERSON FLAG-RAISING CEREMONY, COMMEMORATES NATIONAL FLAG DAYS

- SUNDAY CONSULAR AND LABOR SERVICES (22 MAY 2022)

- AMBASSADOR YAP EXPRESSES APPRECIATION FOR SUPPORT FOR OVERSEAS VOTING IN SINGAPORE

- 2022 Overseas Voting Result

- DFA UNDERSECRETARY DULAY VISITS PH EMBASSY IN SINGAPORE, OBSERVES OVERSEAS VOTING

- EMBASSY CLOSURE FOR CONSULAR AND LABOR SERVICES

- Notice of Meeting by the Special Board of Canvassers (SBOC), 9 May 2022

- Third Philippines-Singapore Business & Investment Summit

- Reminder for Poll Watchers

- Advisory on Prohibited Acts During Voting Period

- DFA Statement on the passing of Philippine Ambassador to China, H.E. Jose Santiago “Chito” Sto. Romana

- FILIPINO YOUTHS DECIDE, VOTE FOR PH’s NEXT LEADERS

- MORE FILIPINOS IN SINGAPORE CAST VOTE ON A WEEKDAY

- MEDIA ACCREDITATION TO COVER PHILIPPINE OVERSEAS VOTING IN SINGAPORE

- 30-DAY PH OVERSEAS VOTING OPENS, 2,370 FILIPINOS IN SINGAPORE CAST VOTE ON FIRST DAY

- PH EMBASSY IN SINGAPORE CELEBRATES PAHIYAS FESTIVAL THROUGH FIESTA FILIPINAS SEASON 2

- PH EMBASSY IN SINGAPORE CONDUCTS FINAL TESTING AND SEALING OF VOTE COUNTING MACHINES

- PH EMBASSY IN SINGAPORE ENDS MONTH-LONG CELEBRATION OF THE 2022 NATIONAL WOMEN’S MONTH

- PH EMBASSY IN SINGAPORE INTENSIFIES ELECTION INFO DRIVE, CONDUCTS VOTERS EDUCATION FORUM

- MISS UNIVERSE CATRIONA GRAY UNVEILS HER WAX FIGURE AT MADAME TUSSAUDS SINGAPORE

- PH EMBASSY PARTNERS WITH FDCP, NUS FOR FILM SHOW

- PH EMBASSY IN SINGAPORE CELEBRATES 2022 NATIONAL WOMEN’S MONTH

- FILCOM IN SINGAPORE LEARNS ABOUT HALALAN 2022, VTL AT PH EMBASSY’S UNANG UGNAYAN

- PHILIPPINE STATEMENT AT THE EMERGENCY SPECIAL SESSION OF THE UN GENERAL ASSEMBLY ON UKRAINE

- UPDATES ON PH VACCINATION ROLL OUT

- OFWS IN SINGAPORE LEARN ABOUT SECURING OEC THROUGH POPS-BAM

- PH, SG TO RESTORE TWO-WAY QUARANTINE-FREE TRAVEL THROUGH VTL BEGINNING 4 MARCH

- FILCOM IN SINGAPORE SHINES AT THE 50TH CHINGAY PARADE

- CALL FOR NOMINATIONS FOR THE ASEAN PRIZE 2022

- PH EXPRESSES SUPPORT FOR THAILAND’S APEC CHAIRMANSHIP IN 2022

- PHILIPPINE EPASSPORT RENEWAL CENTER (PaRC) OPENS FIRST ASIA-PACIFIC SITE IN SINGAPORE

- PH and SG REAFFIRM CLOSE BILATERAL TIES DURING SECRETARY LOCSIN’S WORKING VISIT TO SINGAPORE

- LAUNCH OF THE EPASSPORT GLOBAL ONLINE APPOINTMENT SYSTEM (GOAS)

- PH EMBASSY IN SG CONGRATULATES RECIPIENTS OF THE 2021 PRESIDENTIAL AWARDS

- PHILIPPINE STUDIES PROJECT OF THE ISEAS – YUSOF ISHAK INSTITUTE EXTENDED UNTIL 2023

- FILIPINO CONTEMPORARY ART FEATURED AT S.E.A. FOCUS 2022

- PH VACCINATION ROLLOUT REACHED 100 MILLION MARK

- MESSAGE OF PRESIDENT RODRIGO ROA DUTERTE ON THE COMMEMORATION OF RIZAL DAY

- PH EMBASSY IN SINGAPORE COMMEMORATES MARTYRDOM OF DR. JOSE RIZAL

- PH EMBASSY IN SINGAPORE RECEIVES DONATION OF HAND SANITIZERS FROM BORDEN EAGLE GROUP

- COFFEE TABLE BOOK ON 50 YEARS OF PH-SG FRIENDSHIP LAUNCHED

- PH EMBASSY EXTENDS ASSISTANCE TO 200 RETURNING FILIPINOS STRANDED AT CHANGI AIRPORT

- PH EMBASSY IN SINGAPORE HOLDS TALK ON WOMEN’S RIGHTS

- AZKALS CALL ON WITH PH EMBASSY IN SINGAPORE

- PH VACCINATION REACHES 94 MILLION MARK

- AZKALS GET SUPPORT FROM KABABAYANS IN OPENING GAME AGAINST SINGAPORE

- PH EMBASSY IN SINGAPORE HOLDS ONLINE LEGAL CLINIC

- FILIPINO NURSE BEARS PH FLAG IN SUZUKI CUP OPENING CEREMONY IN SINGAPORE

- FOURTH UGNAYAN REACHED A WIDER AUDIENCE AS THE YEAR ENDS

- PHILIPPINE HIGH FASHION FEATURED AT PRIVATO ASIA SINGAPORE

- SECOND PHILIPPINE FILM FESTIVAL IN SINGAPORE A SUCCESS AMIDST COVID-19 PANDEMIC

- PH EMBASSY IN SINGAPORE LAUNCHES 18-DAY CAMPAIGN TO END VIOLENCE AGAINST WOMEN (VAW)

- PH AND SINGAPORE SIGN FINTECH COOPERATION AGREEMENT

- PH AMBASSADOR TO SINGAPORE WELCOMES PARTICIPANTS OF DAP-LKYSPP COURSE ON PUBLIC POLICY AND PUBLIC SECTOR LEADERSHIP

- PHILIPPINES, SINGAPORE INK MOU ON SCIENTIFIC AND TECHNOLOGICAL COOPERATION

- PH AMBASSADOR TO SINGAPORE GRACES THE LAUNCH OF ATENEO ONLINE LEARNING COURSE

- PH EMBASSY IN SINGAPORE CONCLUDES VOTER REGISTRATION, RECORDS OVER 27,000 REGISTRANTS

- PH AMBASSADOR TO SINGAPORE WITNESSES THE RENEWAL OF MOU BETWEEN INFRASTRUCTURE ASIA AND THE PUBLIC-PRIVATE PARTNERSHIP CENTER OF THE PHILIPPINES

- PH AMBASSADOR TO SINGAPORE RECEIVES PH TOURISM OFFICIALS, EXCHANGES VIEWS ON TOURISM INDUSTRY AMID COVID-19 PANDEMIC

- CNA 983 LIVE INTERVIEW OF PHILIPPINE AMBASSADOR TO SINGAPORE JOSEPH DEL MAR YAP

- PH AMBASSADOR TO SG JOINS PANEL DISCUSSION AT THE 7TH RHT CHINA-ASEAN BUSINESS ALLIANCE (CABA) ASEAN SUMMIT