London Travelcard

The London Travelcard is a transport pass which entitles you to unlimited travel on London’s public transport. You can use a travelcard to travel on the London Underground, overground, public buses, DLR (docklands light rail), TFL rail and other trains, as long as you travel within London’s travel zones.

It is designed for people who are planning on using London’s public transport a lot when visiting London or for people who commute into London on a daily basis. Still, a London Travelcard may sometimes not be the cheapest option even if does entitle you to unlimited travel.

London Travelcard: What do I need to know before I buy one?

When buying a London Travelcard there are three things that you need to know:

1. The duration of the card:

You can buy a travelcard for one day, 7 days, one month or annual.

2. The travel zones of London that will be using:

When you buy a travelcard you need to choose what travel zones you want use. If you are going to travel between zones 1 and 2, you will need a travelcard that is valid for these two zones, but if you are going to travel between zones 1 and 5 every day, you will need a travelcard that covers zones 1 to 5. This does not apply to travelling by bus, as any travelcard will allow you to travel on buses to and from any zone within London’s travel zones. So for example, if you have a travelcar for zones 1 and 2, you can still use a bus to get to zone 3 or zone 5 with that travelcard at no extra cost.

Most of London’s tourist attractions are located in zone 1, and only a few of the most popular attractions can be found outside zone 1, such as Camden Town Market which is in zone 2. Make sure you know what zone your hotel is in before you buy a travelcard.

3. Off-peak or Anytime

If you are buying a 1 day travelcard (which we don’t normally recommend as an oyster card has a daily cap that is cheaper than a one day travelcard – see below) you will have to choose if you want it to travel anytime of the day, or just during off-peak times (Monday – Friday from 9.30 am; all day Saturdays, Sundays and bank holidays).

This does not affect 1 day travelcards for zones 1 to 4, so if you are visiting London you probably don’t need to worry about this at all as you are unlikely to be travelling to zone 5, 6 or beyond.

Which Travelcard to buy if you are planning a trip to London

1 day travelcard.

The price of the 1 day London travelcard for zones 1, 1-2, 1-3 and 1-4 costs £15.20. We don’t normally recommend using the 1 day travelcard, as it is actually cheaper to use an oyster card, a visitor oyster card, or a contactless card as these payment methods have a daily cap. The daily cap applied to these zones are: £8.10 for travel within zones 1-2; £9.60 for zones 1-3 and £11.70 for zones 1-4. Once you have reached this daily cap you will be able to travel within the same travel zones for free. It is still necessary to tap in and tap out on the yellow reader with your oyster card, visitor oyster card or contactless card when using public transport.

Find out more about choosing between an oyster card, a travelcard or using contactless on London Transport here: Oyster card, Travelcard or Contactless .

7 day Travelcard

The 7 day travelcard for London travel zones 1-2 costs £40.70. When comparing oyster card/visitor oyster card/contactless fares to a 7 day travelcard, I would probably say that it is convenient to get a 7 day travelcard if you are going to be travelling around London for more than 6 days. If you are going to be in London less than 6 days then I would recommend using an oyster card (vistor oyster card or contactless if you are a UK resident).

Where to buy a London travelcard

Buying a London Travelcard at an underground station

It is possible to buy a London travelcard at any underground station in London, by either using a ticket machine at the ticket office or a manned desk in a the ticket office (if available). When you buy a 7 day, monthly or annual London travelcard at an underground station you will normally get an oyster card with the travelcard incorporated in it. So your oyster card will be pre-loaded with the travelcard you have chosen. This way you can also use this oyster card with pay as you go for any trips that are not included in the travelcard.

So, as an example, if you have a 7 day travelcard for zones 1 – 4 in your oyster card, you will be entitles to unlimited journeys within these travel zones for 7 days, and you can use your oyster as you normally would, by touching in and touching out. But, if one day you need to go to zone 6, you will be able to use the same oyster with pay as you go balance. One example when this might happen, is if you arrive at Heathrow airport (zone 6) but you want to buy a 7 day travelcard for zones 1 – 4. It will be much cheaper to use they oyster card with pay as you go for the journey from Heathrow to central London and the journey from central London to Heathrow Airport on your last day and adding a 7 travelcard for zones 1 – 4, than using a 7 day travelcard for zones 1 – 6.

Buying a London Travelcard at a train station

It is possible to buy a London travelcard at any train station located inside London’s Travel Zones . When you buy a travelcard at a train station, you will normally get a paper travelcard and not an oyster card.

Stansted, Luton or Gatwick airports are all outside London’s Travel Zones so these stations won’t normally sell London travelcards.

Buy a London Travelcard online

One of the easiest ways to buy a London travelcard is by buying it online. The price is exactly the same as what it would cost you to buy it in London but you will pay a little extra for delivery.

Buy a London travelcard at Heathrow airport

London travelcard fares from 5th march 2023, travelcard for children.

Children under the age of 11 travel free within London travel zones. Children over 11 can also benefit from reduced fares; you can learn more about this in our article: Travelling in London with kids .

Find out more

For more information, visit London’s official transport website: Transport For London

Related Posts

London underground, london travel zones, travelling in london with kids, contactless payment on london transport.

Save my name, email, and website in this browser for the next time I comment.

Notify me via e-mail if anyone answers my comment.

Type above and press Enter to search. Press Esc to cancel.

- Delay Repay |

- Accessibility Tools

- You are not signed in

- Buy tickets You have no items in your basket

Cheap ticket alerts

- Rangers and Rovers

- Flexi Season ticket

- Weekly season ticket

- Monthly season ticket

- Monthly plus season ticket

- Annual season ticket

- Using a smartcard

- Oyster cards and contactless

- Contactless PAYG extension

- Changes to peak times and tickets on some routes

- Advance tickets

- Anytime tickets

- Off-Peak tickets

- GroupSave train tickets

- Group Travel train tickets

- Evening Out tickets

- Sunday Out tickets

- Super Off-Peak tickets

- Semi Flex Return tickets

London Travelcards

- TfL Off Peak Fridays

- Tap2Go pay as you go travel

- 16-17 Saver

- 16-25 Railcard

- 26-30 Railcard

- Two Together Railcard

- Disabled Persons Railcard

- Family and Friends Railcard

- HM Forces Railcard

- Veterans Railcard

- Network Railcard

- Senior Railcard

- Paying with Apple Pay

- Paying with Google Pay

- Family train tickets

- Combined ferry and train tickets

- Price promise

- Business Direct

- Industrial action

- Train times

- Download SWR timetables

- Changes to your journey

- How busy is my train?

- Live times and updates

- Planned engineering works details

- April engineering work

- May engineering work

- June engineering work

- Platform zoning pilot scheme

- Network map

- Car parking

- Live station car parking

- Onward travel

- InPost parcel lockers

- Free Wi-Fi at our stations

- Airport links

- Class 158 "Express Sprinter"

- Class 159 "South Western Turbo"

- Class 444 "Desiro"

- Class 450 "Desiro"

- Class 458 "Juniper"

- Class 707 "Desiro City"

- What can you bring on board?

- First Class

- Window Seater

- Assisted Boarding Points

- Accessibility

- Assistance dogs

- Discounted fares

- Sunflower lanyards

- Wheelchairs, scooters and ramps

- Travel Assistance Card

- Travelling with a bike

- Travelling with kids

- A student's guide to train travel

- Travelling with pets

- Customer Council

- Meet the Manager

- Ticket checks and revenue protection

- Safeguarding

- Our performance

- National Rail Passenger Survey

- Our service quality report

- Destinations

- Things to do

- Day trips and breaks

- Business Life

- Local Highlights

- Sights and attractions

SWR Rewards

- Jack Reacher competition

- 2FOR1 Offers

- Upgrading the Island Line

- Heritage railways

- Delay Repay

- Changing your train tickets

- Strike ticket acceptance, refunds and compensation

- Making a claim after disruption

- Lost property

- Smartcard help and support

- Make a complaint

- My Account |

- Accessibility Tools |

- Cheap train tickets

- Season tickets

- Smart tickets

- Ticket types

- Railcards and discount cards

- How to buy train tickets

- Planned improvements

- Planned engineering calendar

- Engineering work weekly summary

- Our train stations

- On board facilities

- Assisted travel

- Customer Experience

- Staying safe

- Performance

- Where Next travel blog

- Competitions

- Island Line

- Train ticket refunds

You’re being redirected to an external website.

- Train Tickets /

- Ticket types /

The cheap and convenient way to travel around London

Buy train tickets to any destination in britain – no booking fee.

- Popular stations

- London Waterloo (WAT)

- Surbiton (SUR)

- Woking (WOK)

- Winchester (WIN)

- Guildford (GLD)

- Southampton Central (SOU)

- Basingstoke (BSK)

- Farnborough (Main) (FNB)

- Bournemouth (BMH)

- Portsmouth Harbour (PMH)

What is a London Travelcard?

A London Travelcard gives you unlimited travel within zones 1-4 or 1-6 on the Underground, Overground, TfL Rail, Docklands Light Railway, buses, trams, and most National Rail services in London.

You can also use your London Travelcard to get discounted fares on the Emirates Air Line and a third off River Boat fares on selected services.

Be the first to hear when our cheapest Advance tickets go on sale

Buying a ticket with us just got more rewarding!

Which London Travelcard is right for me?

one day london travelcard.

Anytime Day Travelcards can be used on the date shown on the ticket and for journeys starting before 04:30 the following day. Off-peak Day Travelcards can be used from 09:30 (Monday to Friday), at any time on weekends or bank holidays for the date on the ticket, and for journeys starting before 04:30 the next day.

London Weekly Travelcard

The London Weekly Travelcard offers seven days of travel for the price of five.

Monthly London Travelcard

Monthly Travelcards are typically more cost-effective than purchasing four consecutive 7-day Travelcards. They offer a saving of 11% compared to the continued use of 7-day Travelcards.

Group One Day London Travelcard

Travelling as a group of 10 or more? Get a Group One Day London Travelcard valid for the day from 09:30 (Monday to Friday), anytime on weekends or public holidays right up until 04:30 the next day.

London Travelcard season tickets

Your Travelcard season ticket can start any day of the week and you can travel right up until 04:30 on the day after your Travelcard expires.

Choose a seven-day, monthly, three-month, 6-month, custom or annual Travelcard season ticket.

How do I get a London Travelcard?

Travelcards can be sold with an Anytime , Off-Peak , Super Off-Peak , Advance or season (except Flexi Season ) train ticket to London on our website, app or at your local station.

You can add London Travelcards to your SWR touch smartcard , making it easier for you to tap in and out across the capital.

I want to...

See ticket offers

Be inspired

Check live train times

Read the latest news

Book travel assistance

Check engineering works

Engineering works will affect your journey

You need to enable JavaScript in your browser to see Live train arrivals and departures through this website� (and also instructions on how to enable JavaScript)

MASTERCARD BENEFIT INQUIRIES

Within the U.S.: 1-800-Mastercard (1-800-627-8372) | Outside the U.S.: Mastercard Global Service Phone Numbers

Availability of insurance benefits on your card may vary by card issuer. Please refer to your issuing financial institution for complete insurance benefit coverage terms, conditions and exclusions.

*Card registration required. Certain exceptions apply. Click here for terms and conditions .

†Requirements may vary. See card packaging for details or contact card issuer.

London Travelcard Prices 2024 - One Day, Weekly & Monthly Pass

- Adult travelcards

- Child travelcards

What is a travelcard?

How long does a travelcard last.

- Anytime and off-peak

- Where to buy travelcards

- Are travelcards the cheapest way to travel?

- Where to use travelcards

- Using travelcards on the bus

- Using travelcards on the train

- Which is best: travelcards or Oyster?

Travelcard prices for children

London travelcards come in two different types. The cheapest version just covers buses and trams, whilst the more expensive one includes the trains as well.

Travelcards bought at a National Rail station (the big overground hubs like Waterloo , shown with a symbol on the London underground map ) are printed on orange paper. Travelcards bought at an underground station are printed on pink paper. Other than the colour of the paper, there is no difference between the two. It’s also possible to load a travel card onto a blue Oyster card . (Note: It is not possible to load them onto a Visitor Oyster card or contactless card .)

If you buy a pass that includes the trains then you will also have to choose which fare zones you want it to cover. If you buy a one day travelcard then you’ll only have three options: zones 1-4, zones 1-6 or zones 1-9. If you buy a weekly, monthly or annual travelcard then you can choose a combination of different zones between 1-9.

Important note: there are no trams in central London, only in zone 3 and beyond (in places like Beckenham, Croydon and Wimbledon). So if you buy a zone 1-2 travelcard then you won’t find any trams to travel on.

What are the benefits of a travelcard?

- London travelcards can cover one day, one week, one month or one year, depending on how long you’re staying in London

- They’re very easy for tourists to understand: you simply choose the zones and dates you want it to cover, pay once, and then you can make an unlimited number of journeys between those dates

- Depending on which one you buy, travelcards can be valid on the tram, bus , Docklands Light Railway, London Underground , London Overground, TFL Rail and National Rail

- You can also benefit from a discounted fare on the cable car and Thames Clipper riverboat

What are the downsides of a travelcard?

- Depending on how many journeys you make, you might find that Oyster prices and contactless prices are cheaper than travelcard prices

- You’re only allowed to travel in the fare zones you chose at the start. If you later decide to travel outside the zones then you’ll have to buy a completely separate ticket

- Two people are not allowed to share one travelcard

- If you lose a paper travelcard then there’s no way of replacing it, or getting your money back

A travelcard lasts for one day , one week , one month or one year , and you choose which one you want when you buy it. You can then travel as many times as you like during that period.

You always have to choose a start date when you buy it. The date can be in the future, but it’s not possible to buy a dateless card.

One Day Travelcards (Anytime) – Valid for the date shown on the ticket, plus any journeys that start before 4.30 AM the next morning

One Day Travelcards (Off-peak) – Valid for the date shown on the ticket, but only after 9.30 AM on Mon-Fri, plus any journeys that start before 4.30 AM the next morning

Weekly, Monthly & Annual Travelcards – Valid between the start date and end date shown on the ticket. And they all have to be consecutive days (it’s not possible to buy a 7 day travel card that skips a day in the middle, for example).

Can two people share one travelcard?

No . Two people are not allowed to share one travelcard between them. And you can’t share an Oyster card that has a travelcard loaded on to it either.

What time is Anytime and Off-Peak?

Anytime – Anytime is valid for the dates shown on the ticket, and up to 4.30 AM the following morning. (So if your travelcard expires on the 10th, you can actually travel up to 4.30 AM on the 11th.)

Off-Peak – Off-Peak travelcard holders are restricted to travelling after 9:30 AM on Mon-Fri, but can travel at anytime during the weekend or on a public holiday.

Is it cheaper to use a travelcard?

Travelcards are not always the cheapest way to travel in London.

1-Day Travelcards – The Oyster daily cap and contactless daily cap are always cheaper than a one day travelcard (by around two-thirds).

Weekly Travelcards – Weekly travelcards are always cheaper than buying seven one day travel cards, but whether it works out cheaper than the Oyster card weekly cap depends on how many journeys you make. If you make two or more journeys on each of the seven days, or three or more journeys on six of the days, then a weekly travelcard is likely cheaper. But the only way of knowing for sure is to add up all your journeys on a calculator (sorry!).

Monthly Travelcards – Monthly travelcards are always cheaper than buying four weekly travel cards.

Annual Travelcards – Annnual passes give you 12 months travel for the price of ten and a half.

Where can you use a travelcard?

Buses – All travelcards are valid on TFL buses , regardless of which zones they cover. That’s because buses don’t have zones. So if you buy a zone 1-4 travelcard then you can ride the trams and trains in zones 1-4, but you can ride the buses all the way out to zone 6.

Trams – Bus & Tram travelcards don’t have zones, so they’re valid on all the buses, and all the trams. But Train, Bus & Tram travelcards are only valid on the trams if they cover zones 3 and beyond, because there aren’t any trams in zones 1-2.

London Underground, London Overground, Docklands Light Railway, TFL Rail, National Rail – A Train, Bus & Tram travelcard is valid on all of these trains as long as it covers the right zones (you choose which zones you want when you buy it). The exceptions are the Heathrow Express, Gatwick Express and Stansted Express, Heathrow Connect to Hayes and Harlington, and high-speed Southeastern services between St. Pancras and Stratford .

IFS Cloud Cable Car – You can’t actually use your travelcard to ride the cable car , but if you present it at the ticket window you’ll get a 25% discount off the price.

Thames Clipper – You can’t use it on the Thames Clipper river boat service either, but if you show it at the window you’ll get a 33% discount off some of the fares.

Where can you buy a travelcard?

Day Travelcards (for Bus & Tram only) – It’s not possible to buy a day travelcard for the Bus & Tram from the TFL website. It’s not possible to buy one in advance either. You can only purchase them on the day of travel from a train station or London Visitor Centre.

There are seven Visitor Centres in London: Euston station , King’s Cross , Liverpool Street , Paddington , Piccadilly Circus , Victoria and Heathrow airport.

These will always come as a paper ticket.

You can also buy a Bus & Tram pass from an Oyster Ticket Stop, but these ones will be put onto an Oyster card instead. Oyster Ticket Stops are just normal shops (usually newsagents) which have a blue Oyster sticker in their window. (Note: The usual £7 deposit will apply if you need to buy a new Oyster card, which will come on top of the day travelcard price. It is not possible to load a travelcard onto a London Visitor Oyster Card .)

Day travelcards do not require a photocard.

Day Travelcards (for Bus, Tram & Train) – Paper tickets for the Bus, Tram & Train are available to buy online from the TFL website and from train stations and Visitor Centres.

Group Day Travelcards – Group Day Travelcards can be ordered from the TFL website . They only last for one day and you need to be travelling in a group of at least ten people during off-peak hours (after 9:30 AM Mon-Fri, or any time during the weekend).

Weekly Travelcards – Weekly Travelcards can be bought online at TFL’s Visitor Shop , You can also have it loaded onto your Oyster card at a train station, Oyster Ticket Stop, London Visitor Centre or TFL’s Oyster website (but you need to set up an Oyster account with them first).

Weekly travelcards do not require a photocard.

Monthly Travelcards – Monthly Travelcards can be loaded onto your Oyster card at train stations, Oyster Ticket Stops, London Visitor Centres and TFL’s Oyster website .

Annual Travelcards – Annual travelcards can be loaded onto your London Oyster card at TFL’s Oyster website , and most London Overground, TFL Rail and National Rail stations… but not London Underground stations, London Visitor Centres or Oyster Ticket Stops.

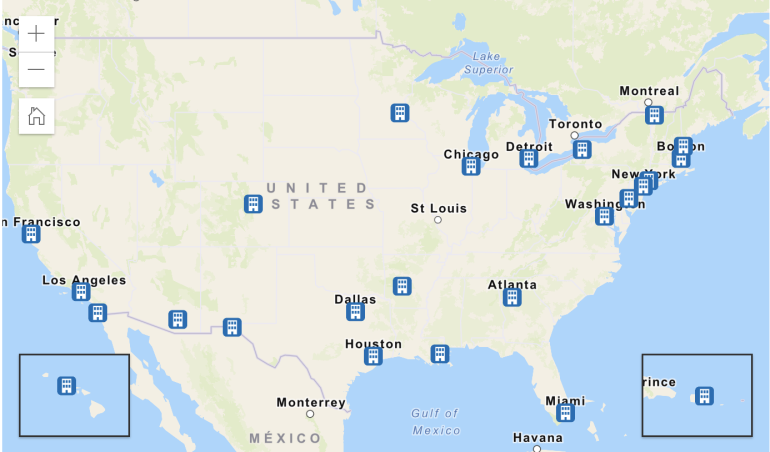

What zone travelcard do you need?

Most tourists will choose a travelcard that covers zones 1-2, which covers the touristy heart of London.

Zone 3 is for places like Highgate Cemetery , Kew Gardens , Wimbledon and London City Airport . Zone 4 will take you to Wembley Stadium . And if you’re flying into Heathrow then you might need a zone 1-6 travelcard.

How do you use a travelcard on a bus?

Using a travelcard on a London bus is easy. If you have a paper travelcard then just show it to the driver as you board the bus.

If you have an Oyster travelcard then touch it against the big round yellow reader by the front door (some buses also have Oyster readers by the middle door and back door). There’s no need to touch the travel card down again when you leave the bus – you only have to do that for trains.

How do you use a travelcard on a train?

Using a travelcard on the London Underground is easy. If you have a paper travelcard then just insert it face-up into the slot at the front of the barrier. The same ticket will then pop out of the slot on the top. The gate won’t open until you remove your travelcard from that slot.

If you have an Oyster travelcard then all you have to do is wave it in front of the big round yellow reader and the gate will open automatically.

Which is better: Travelcards or Oyster?

TFL travelcards are very easy to understand – you simply choose the starting date, the duration, which zones you need (probably just zones 1-2 if you’re here on holiday), and then you pay just once and can make an unlimited number of journeys until the travel card expires.

The downside is that travelcards are only available for fixed periods – either one day, one week, one month or one year – so if you’re visiting for a different number of days then you’re better off buying an Oyster card .

Train travelcards are also limited to the zones you buy it for, so if you decide to make an extra journey out of the blue then you’ll have to buy a completely different ticket, whereas the pay-as-you-go credit on an Oyster card can be used in all zones.

Your comments and questions

CC Hi, I want to know if I buy the one day card does it means it lasts 24 hrs? Or just till midnight of the day I purchase it?

Staff Hi CC. It actually lasts until 4.30 AM the next morning. So if it's dated for the 1st, it will last until 4.30 AM on the 2nd.

Leanne Hi there, I am travelling to London with 3 children aged 8, 10 & 11 and will need a travelcard that will cover us all. We have a few things planned but im not sure of which travelcards I need and for which zones? We will need to travel from Paddington station to Waterloo, and will be visiting the Cambridge Theatre and also Knightsbridge. Is it possible to buy a 3 day ticket that will cover those areas? Ive not been to London before so would like to plan as much as I can in advance. Thank you

Staff Hi Leanne. It's not possible to buy a 3-day card unfortunately - they only come as 1-day or weekly cards (or monthly). And the only travelcard that covers multiple people is the Group Day Travelcard, but that's for a minimum of ten people. The good news is that your 8 and 10 year old will travel for free on the tube, so I recommend that you use your contactless bank card, and you get an Oyster card for your 11 year old. That's because contactless and oyster fares are cheaper. The most you will pay each day is the 'daily cap' for zone 1, which is less than the cost of a 1-day travelcard (all of the places you mentioned are inside zone 1). Unfortunately you will also have to pay a £5 deposit the first time you buy a new Oyster card - but you can claim that back at the self-service ticket machine at the end if you want.

Leanne Thank you very much, that's very helpful

Csaba Is it possible to buy a new Oystercard and put a 7-day Travelcard on it at the newsagents generally? Do I have to have a minimum pay-as-you-go balance on it if using a Travelcard loaded onto my Oystercard?

Staff Hi Csaba. You can just have the travelcard on your Oyster card if you want. There's no need to have any pay-as-you-go credit on there as well, but you can do that as well if you want. You should be able to do it at any newsagent displaying the Oyster symbol in their window - not all of them have it.

Lafont If I have a travelcard on my Oyster card for zones 1 and 2, and I want to visit Hampton Court, how to proceed.

Staff Hi Lafont. Hampton Court is in zone 6, so you just need to add some pay-as-you-credit onto the same card to cover zones 2-6. You can see that fare here - city-guide.london/transport/adult-train-fares.php . When you tap it down on the gate the computer will recognise that the travelcard already covers zones 1&2 and just use the credit for the extra bit.

Pamela Laurie I need only a paper 1 day Oyster ticket, is it over 24 hours from when you buy it? ie. 12am one day till 12 am next day ?

Staff Hi Pamela. You buy it for a particular date. It will then last for the whole of that date, and up to 4.30 AM the next morning.

Ch What time can you use your travelcard from on a Sunday?

Staff Hi Ch. If it's a 1-day card then it's all day Sunday, right up to 4.30 AM Monday morning. If it was a midweek one then it would be different, because there are two cards available midweek: anytime and off-peak. The off-peak ones wouldn't start until 9.30 AM

Awi If I buy a zone 1-6 travelcard from Vauxhall rail station will that entitle me to the National Rail 2for1 promotion? Thanks

Staff Hi Awi. You have to be careful because you need a National Rail paper ticket for the 2for1 offer. Don't buy it from the underground station because then it will be a TFL ticket. That won't be valid. Buy it upstairs from the National Rail windows, and make sure they give you a paper ticket rather than putting it on an Oyster card, because that won't be valid either.

Diane Can you use a one day travelcard on any of the London tour buses?

Staff Hi Diane. No, sightseeing tour buses have got nothing to do with normal buses, so you'll have to buy a ticket from them.

Cathy If I buy a weekly travelcard from a train station, will the start day to use to card be the day I buy it? Or can I tell the counter staff which day I would like to start to use the travelcard? For example, I want to buy the paper travelcard at London Paddington Station on July 1st and I would like to start using it on July 6th. Is it possible? Thanks for your help.

Staff Hi Cathy. Sure. You can tell them which date you want it to start. It doesn't have to be the same day that you buy it. Paper tickets will then have the start date printed on the front.

Elle Hi, With weekly travelcards, do I need to get an identity card to go with it? Thanks

Staff Hi Elle. Not if you're an adult, no. You only need to provide a passport photo for monthly and annual travelcards, but not weekly ones. And a child would need a photocard

Ray Does the one day travelcard include journeys to Heathrow? Thank you Ray.

Staff Hi Ray. You have to choose the zones when you buy it. If you choose the one that covers zones 1-6 (or 1-9) then it will.

Cozzieanne Hi there, I'm soon going to be travelling four times a week from Ealing Broadway to Leytonstone station on the Central Line. If I buy an annual Zones 2-9 travelcard, does that mean that I can get on and off at literally any stop, on any line, at any time, as long as I'm within those zones? And does it include buses? Thank you! Cozzieanne

Staff Hi Cozzieanna. A zone 2-9 travelcard won't get you from Ealing Broadway to Leytonstone on the central line, because that journey goes straight through zone 1, so you'll need a zone 1-9 instead (actually, you only really need a 1-3 for that journey, unless you've got some other plans out to zone 9 that you haven't mentioned). A zone 1-9 travelcard will let you get on and off at any stop within zones 1-9, at any time, as many times as you like. And you can use it on the bus as well.

Graham Can a London Travelcard be used on both the Underground and on Network Rail trains? I'm planning to travel from Baker Street to Monument on the Circle Line, then from London Bridge to Waterloo East on normal Network Rail. Is the Travelcard valid for both journeys?

Staff Hi Graham, It works on both the underground and National Rail trains within the zones you buy it for. So assuming your travelcard covers zone 1 (which all those journeys are in), then it will be fine

Harmeen I just want to know that if I opt for a weekly travelcard for Zone 1 and 2, how many trips am I allowed in a week?

Staff Hi Harmeen. As many as you like. There's no limit with travelcards

Lailiyah McInnes Can I buy weekly travel card to London zone 1-2 and5? And how much the cost weekly and monthly .I just from Bromley south to Victoria to Fulham

Staff Hi Lailiyah. You can buy one for zones 1to5 (price is in the table above), but not zones 1,2+5. They don't sell one for just zone 5 on its own either. If you really wanted to then you could put a zone 1-2 travelcard on your oyster card, and then top it up with some pay-as-you-go credit as well. Then every time you tap it down on the gate the computer will recognise that you have a travelcard for zones 1-2, and only take the fare for zones 2-5 from the pay-as-you-go credit

Heather Is there a student discount on Oyster cards.

Staff Hi Heather. There is a discount, but you have to apply for an 18+ Student Oyster photocard to get them. All the details are here - tfl.gov.uk/fares/free-and-discounted-travel/18-plus-student-oyster-photocard

amar Can I use oyster card on traine

Staff Hi Amar. You can, yes. But it depends what train you’re talking about. It has to be within the Oyster zones. If you're talking about putting a travelcard onto an oyster card, then the train will have to be in the zones you buy the travelcard for

Jerry I need Travelcard from zone 2 to 8. How can I get one?

Staff Hi Jerry. It sounds a bit bonkers, but they don't sell travelcards for zones 2-8. You can get one for zones 1-8, or zones 2-9 instead which is a bit cheaper

Jerry I don`t understand why I have to pay more for something what we don`t need.

Staff Maybe you could try using a contactless card instead, because there's a cap for zones 2-8 on that. But if you want the weekly cap then it only works from Mon-Sun (not Tue-Mon, or any other combination of 7 days) - city-guide.london/transport/contactless-cards.php

Bob Scrivener Where do you find a zone map?

Staff Hi Bob. Here's one - content.tfl.gov.uk/standard-tube-map.pdf

Nigel Hi, I plan to come to London in the Autumn. It looks as if I’ll need to travel in zones 1-3 between my University and accommodation. Can you advise what the weekly cost is for a travel card

Staff Hi Nigel. All the prices are shown in the table above - at the moment it's £43:50 for zones 1-3

Karen Wilce Are there any concessions

Staff Hi Karen. If you mean senior concessions then you can get something called a Freedom Pass or a 60+ Oyster card, but you need to live in a London borough to qualify. If you live outside London then you can get a Senior Railcard. There are more details here - city-guide.london/transport/senior-train-fares.php

Theresa I have a monthly travel card zones 1 to 4, but i need to get to zone 6, what do i need to do.

Staff Hi Theresa. Assuming that it’s on an Oyster card, all you have to do is go up to a ticket machine and load some pay-as-you-go credit on to it. When you tap down on the gate the computer will recognise that the travelcard already covers zones 1-4 and just charge for the extra zones. You can see the price on our Oyster card page - city-guide.london/transport/oyster-cards.php

Anita Ganea My daughter is a 2nd year university student living in London, travelling to university and also to her place of work. She has now got a student oyster card and also has a 1/3 16-25 railcard. Does she have to link these to get the full benefits of the oyster card. I said that her travel will be a 1/3 cheaper if she gets the oyster card but obviously if she uses it as a pay as you go it is still the same, why is this?

Staff Hi Anita. She needs to get the railcard loaded onto her Oyster card, then she can use the Oyster card like normal and it will charge the discounted fares. She needs to take both cards to a London Underground station and then ask a member of TFL staff to load it on. You can usually find one standing behind the ticket barriers. Bear in mind that she doesn't get a discount on all Oyster fares, just off-peak ones, and zone 1-9 travelcards (if bought together with another National Rail ticket) - full details here 16-25railcard.co.uk/using-your-railcard/travel-times-tickets/

Steven Gatting Hi folks,,, returning uk resident arriving with Family from US for 7 day visit covering all areas on tube. Kis are 10. 14 and 16 . Shall I just get 7 day travel cards.Will be making plenty travel around the tube on all days. Thanks Steve Gatting

Staff Hi Steven, if you’re staying seven days then a weekly travelcard usually works out cheapest if you’re making at least two or more journeys on each of the seven days, or three or more journeys on six days, but it depends what zones you buy (most people only need zones 1-2). Your 10 year old will travel for free, but bear in mind your 14 and 16 year olds will have to pay for adult passes because it won’t be worth paying out extra for photocards to qualify for the kid prices.

Michael Just to make sure it will work: I want to buy a weekly 1-2 zones paper travel card at Paddington railway station. All I need is to bring £37 and paper-sized photo, right? No need to buy Oyster card or something like that?

Staff Hi Michael. You can only get a paper travelcard if it’s a 1-day travelcard. Weekly ones will go onto an Oyster card. If you don’t have an Oyster card you’ll have to go to an Oyster Ticket stop shop (newsagent) in the National Rail part of Paddington (and pay £5 deposit for a new card on top). The underground bit only has self-service machines. If you do have an Oyster card then you can load it on at a self-service machine. You don’t need a photo

Selina Rahman Hi, If I want to travel from Woodford to Bermondsey by train and then bus from Bermondsey to Bricklayer's Arms by bus, can I buy a weekly oyster card from zone 2-4? If not, please suggest how I can make this journey with the most economical option? Thanks,

Staff Hi Selina. Thats okay for Woodfood to Bermondsey (assuming you don't choose a route that passes through zone 1). theres more than one bricklayers arm’s in london so we don't know which one you're talking about, but it should be alright because buses don’t have zones. all travelcards are valid for bus travel in zones 1-6, regardless of which zones they cover

Polya Genova Why when I transfer via Wimbledon from Streatham to Fulham Broadway I am overcharged for zone 1.??? I notice 3 times on my way going but mot charge in my way back. The pink rider was no clear sound.

Staff Hi Polya. You're only supposed to tap down on the pink readers if your journey would normally take you across London through zone 1, and you're changing trains to bypass zone 1. But the journey you're doing wouldn't normally go through zone 1 anyway, so I would stop tapping down on the pink reader and see if that helps - just tap down at the beginning and end of your journey instead

Lorraine I am travelling to london from Leigh on sea going to Wood Green station / Shepherd’s Bush there are 6 of us all together 2 adults 4 chikdren under 11 years we have bought the Kidszania tickets What would be the cheapest fares to travel on the tube

Staff Hi Lorraine. your national rail tickets would be separate, but if all four kids are under 11 then they travel for free on the tube, and the adults should just use their contactless cards to pay (oyster is the same price as contactless, but you have to pay a £7 deposit to get hold of the cards)

MR JOHN ROZNOWSKI Is there any discount for ENCTS pass holders who live outside London?

Staff Hi John. Not if you want to buy a travelcard, but you should be able to use it to travel for free on TFL buses (with time restrictions) if it has the red rose symbol on it. Theres some more information here - city-guide.london/transport/senior-bus-fares.php

Engrid Hello, Do children travel for free with a parent who purchases a travel card?

Staff Hi Engrid. Only if they’re under 11. They travel for free with a fare paying adult - city-guide.london/transport/child-train-fares.php

Pauline My partner and myself are travelling on Avanti train from Lancaster for the day.Can we buy I day travel cards when we buy our train tickets in Lancaster. Thankyou

Staff Hi Pauline, we cant really help with what’s for sale in Lancaster, but we doubt that the train company will sell them. But you’d be better off just using your contactless card to pay anyway (assuming that you both have one), because the ‘daily cap’ for contactless is half the price of a 1-day travelcard - city-guide.london/transport/adult-train-fares.php

John Evans RAIL CARDS OR SENIOR BUS PASS Are they valid with one day travel card off peak

Staff Hi John. A senior bus pass with the red rose symbol lets you travel for free on TFL buses, with time restrictions, but you cant use them to buy a travelcard, A Senior Railcard will give you a discount on “Anytime Day Travelcard Zones 1-9 when bought as part of ticket to London from outside London (subject to minimum fare)” - city-guide.london/transport/senior-train-fares.php

James allison Is their a pensioner discount

Staff Hi James. Not for travelcards, no, unless you have a senior railcard as mentioned in the comment above. But you can travel for free on the buses and trains if you have a freedom pass or 60+ oyster card (with time restrictions). More info here - city-guide.london/transport/senior-train-fares.php

Paul Hoelzley Good afternoon, We are Canadian seniors (82 & 76) and will be in London for 5 days early January 2023. Could you kindly help us and advise us on what is the cheapest card to use during our stay. There seem to be so many different choices and fares and this is very confusing to us. Thank you for taking the time to answer our question (s). Regards, Paul H.

Staff Hi Paul. A Visitor Oyster card will be the cheapest, and you can buy it online before you go and have it delivered to you in Canada - more information about that here: city-guide.london/transport/visitor-oyster-cards.php . You’ll have to choose how much credit you want on it, so just work out which fare zones you’ll be travelling through each day (most tourists just need zone 1), and look at the ‘daily cap’ for that zone in the fares chart. That will be the maximum you will be charged that day. Add up all the daily caps for the five days, and thats how much credit you’ll need. Alternatively… you can just buy a weekly travelcard when you arrive in London. You’ll lose a little bit of money, but its a lot less complicated because you can make unlimited journeys for the whole week

Mark Hi, we will be travelling to London from Melbourne in September. Four adults For five full days. We are flying into Gatewick. What is the best way to get to accommodation near Hyde park and where should we get recommended pass?

Staff Hi Mark. I would buy tickets for the Gatwick Express into Victoria on their website, and then get Visitor Oyster Cards for everyone and have them delivered to Australia before I travel. Oyster cards have the cheapest fares, and you can use them on the tube to wherever it is you're staying around Hyde Park. Info about where to get Visitor Oyster cards here - city-guide.london/transport/visitor-oyster-cards.php

Ali Need a travel pass ticket in London for tube and buss

Staff Hi Ali. We've explained how you can get one on this page

Jordi Hello, I'm going to travel to London for a 7 days in July. 2 adults and 1 of 14 years. We move for zones 1-3. Wich is the best option? and Where can I buy better?

Staff Hi Jordi. It depends how many journeys you're making. If you make two or more journeys on each of the seven days, or three or more journeys on six of the days, then a weekly travelcard should be cheaper. Otherwise the adults should use their contactless cards if they're from the UK, or Oyster cards if they're from abroad (which have the same fares as contactless, but you have to pay a £5 deposit on top). The 14-year old should get an Oyster card and have the 'Young Visitor Discount' applied to it, as explained on this page - city-guide.london/transport/child-train-fares.php

Keith Morgan How much will a 1-6 zone one day travelcard for 2 adults and two children with a family railcard

Staff Hi Keith. You dont get a discount if you buy the travelcard on its own. You need to be coming into London on another train. According to their terms: “With your Railcard you can get 1/3 off Anytime Day Travelcard when bought as part of your journey to London from outside London Zones 1-9 (subject to a minimum fare which is currently £20,30)” - familyandfriends-railcard.co.uk/help/faqs/

DEREK SPELLER Good afternoon.......we are travelling into Heathrow from Canada in August and staying in Paddington. The London Transport Travelcard will allow us onto the Tube at Heathrow but NOT the Heathrow to Paddington Airport Train.....am I correct?

Staff Hi Derek. That's correct, yes. You can use an Oyster card on the Heathrow Express, but not a travelcard. If you want to use a travelcard on the tube from heathrow to paddington then you'll have to get one covering zones 1-6

Muraleedharan vp Which are the places covered by differrnt zones?

Staff Zone 1-2 covers the central touristy part of London, which is good enough for 99% of tourists. but maybe you'll want zone 3 for kew, and zone 6 for heathrow

Reda Weekly travel card zone 2 to zone 4. Travelling from zone 4 to zone 4 without crossing zone 1 , why I got charged £2.50 at the end of the day.

Staff Hi Reda. Is the travelcard loaded onto an Oyster card? £2.50 is a zone 1 fare, so the only thing I can think of is that you didn’t tap out at the end.

B Walker Can I purchase a weekly anytime travel card as ticket? Not plastic oyster

Staff Hi B Walker. Only if you buy it online from the TFL shop - visitorshop.tfl.gov.uk/en/london-travelcard . If you buy it anywhere in London then it will be loaded onto an Oyster card.

Veronica We are a family of five traveling into London Kings Cross on 7th Oct children are aged 15,15,14, We are staying for 9 nights at Twickenham and will be travelling in/out London and going to attractions. What would be the best travel option?

Staff Hi Veronica. We always recommend that adults use their contactless bank card. (oyster cards have the same fares, but you have to pay a deposit on top.) and then get oyster cards for the kids. but get the ‘young visitor discount’ applied to the oyster cards when you arrive in London, which is explained here - city-guide.london/transport/child-train-fares.php

Veronica Which zone is Twickenham in. Should I order the child oyster card before we arrive and do they require a photo

Staff Its in zone 5. you can order it in advance if you want to, they don’t require a photo. its all explained on our oyster card page - city-guide.london/transport/oyster-cards.php

PEDRO Do foreign children between 11 and 15 have a discount with the one-day travelcard? I think no...

Staff Hi Pedro. They can do, but only if you get them an Oyster Zip photocard as well. But you have to pay extra for those, which will wipe out any savings you make. So we dont recommend getting one if its just a one-off visit - city-guide.london/transport/child-train-fares.php

Alex If I buy a travelcard at Heathrow and need to travel to Hammersmith but only on the next day do I need to make another journey (in zones 1 and 2), can I buy a 7 day travelcard at the same time as buying some PAYG but somehow POST-DATE the 7 day travelcard so it is only active from the NEXT day?

Staff Hi Alex. You can do. You always have to choose the start date when you buy a travelcard so i would do that first, then load some credit on after. Another way is to just buy a zone 1-2 travelcard at heathrow, from the first day, and load some extra credit on to cover the zones 2-6 bit

Alex Hello again. Travelling from Buckhurst Hill to Hampton Wick with a Zone 1-2 Travelcard and PAYG. I see this necessitates a National Rail Journey from Zone 1 to 6. Will it cost a Zone 1 to 6 fare from PAYG despite the travelcard because it's National Rail and not Overground/Underground? Does one have to check in/check out at a station on the border of zones 2-3? Pink card reader or something?

Staff As long as the National Rail station is within the oyster zones (which your stations are) then you can pay with a travelcard and oyster - theres no difference. you dont have to tap down on a pink reader. you only use those if you're making a detour to avoid zone 1, on a journey that would normally go through zone 1. you just have to tap down at the beginning and end of your journey like normal

ELHAMUDDIN ZAHID Hello I am student and have class two days a week and live in zone 5 which option will be cheap for me. Many thanks

Staff Hi Elhamuddin. The easiest and cheapest thing to do is to just use your contactless card - city-guide.london/transport/contactless-cards.php

Alex Hi. I just phoned up TFL and got my PAYG balance refunded (£8:70) from my oyster into bank account. I'm no longer on London and couldn't do it at machine in London as I still had a valid travelcard on my last day! Now the oyster card has been removed from the app! Is the card still valid should I return to London in the future? Or did refunding the PAYG balance cancel the card? I paid £7 for the card. Perhaps they canceled the card and refunded the £7 as well as the £8:70?

Staff Hi Alex. The card gets voided at the same time as the refund, so you wont be able to use it anymore. The deposit would have been converted into PAYG credit after 12 months, but if you've had it less than that then you don't get it back.

JOHN Hello everyone, I have a crucial to me question that puzzles me when I try to buy online a London weekly anytime travelcard for my planned trip to London next month, i.e. November 2022, landing at Heathrow airport. As far as I understand, a 7-Days (weekly) London anytime travelcard does not have a peak, or, off-peak option (As 1-day travelcards do). They are valid throughout the whole day (And, if I am not mistaken valid until 04:30 am of the next day after their expiry). I am trying to buy the card from abroad (within EU) prior my arrival & ordering it to be mailed to my home country. I choose adult, Ticket Duration = 7 Day (only option), Ticket Zone = Zones 1-6, Then it requires me to choose (Under: “Admission)” an option, BUT, the only option available in the: “Peak”. Then date of first use which I provide and then the total price is £70.30. Question is, in the field entitled: “Admission” the only option being: “Peak”, What do they mean by the word: Peak ? If I choose Peak (the only option available) will I purchase a weekly anytime travelcard that I will be able to use throughout the whole day, OR, will I be able to ONLY use it during Peak hours (i.e. prior 09:30 am) which does NOT make any sense as a 7-Days (weekly) anytime travelcard (As the name clearly states) is valid throughout the whole day ? I am at a loss. What do they mean by the option: Peak ? Can somebody please help me ? Many thanks in advance for your time & effort. Looking forward to your reply/assistance. Many thanks & Best Regards

Staff Hi John. The way they've worded it does look a bit confusing (they should have called it 'anytime') but it will definitely be valid for an entire week, both off-peak and peak hours. That's the only version you can buy for a weekly travelcard.

JOHN Many thanks for your reply ref London weekly anytime travelcard. Much appreciated. If I land to Heathrow during weekend will I be able to buy a London weekly anytime travelcard from Heathrow Visitor Center, OR, from a Heathrow ticket machine ? In this case do I need an oyster card ? Can I use the very same card to travel (By tube and/or overground rail) from, AND, to Heathrow airport (E.g. Heathrow to Waterloo)? In the latter case, are there any specific tube/overground trains I cannot use, i.e. express ? Many thanks in advance for your time & effort. Looking forward to your reply/assistance. Many thanks & Best Regards

Staff You won't be able to buy a paper travelcard at Heathrow, but you will be able to get one loaded onto an Oyster card. Assuming that you haven't got an Oyster card already, that will add another £7 deposit on top. But if you do get an Oyster card then you may as well forget the travelcard and load some credit onto it instead, and pay normal Oyster fares, which might work out cheaper depending on how many days you're staying. Oyster credit can be used on buses and trains in all the zones, including Heathrow. But if you catch the Heathrow Express then the credit will be used to pay the normal Heathrow Express fare instead (rather than a cheaper Oyster fare - you'd have to catch the tube for that). More info about all that here - city-guide.london/transport/oyster-cards.php - If you want a paper travelcard then your only option is to get it from the TFL site and have it posted to you.

Matt Greer Are weekly travelcards discontinuing in January 2023? If so, what is replacing it for tourist weekly travel?

Staff Hi Matt. There was talk about scrapping them last year as well, but nothing has happened so far. If they do disappear then people will have to use the weekly cap on Oyster and contactless instead (which is the same price as a weekly travelcard). So tourists will have to buy an Oyster card.

Eva Ticket type Hi, I found Super Off-Peak Day Travelcardincludes London Travelcard with Travel conditions Same day return off-peak travel including unlimited bus, tube, tram and DLR journeys around London. I would like to use with the 2 for 1 promotion wisiting London Eye. I would like to be sure that this train ticket is accepted by them. thank you

Staff Hi Eva. It has to be from a National Rail station rather than an underground station (so it has to be printed on orange paper), and you have to book the London Eye in advance rather than turn up on the day. You can check the ticket here - daysoutguide.co.uk/travel-by-train/is-my-ticket-valid-for-2for1-and-other-offers

Muhammad Athar Masood I am coming to London on March 29 and shall stay here upto April 11. During my stay, I intend to travel in almost all zones of the city using bus, tube, tram or train whichever convenient. Please guide me if should buy a Travle Card or an Oyester Card.

Staff Hi Muhammad. Price-wise you're probably going to be better off with an Oyster card rather than a travelcard, but there are advantages and disadvantages to each. Have a read of this page which explains them all - city-guide.london/transport/oyster-contactless-travelcard-comparison.php

Sandr Hi, Me and my husband are coming to London with our kids age 8,15,16.We will be there one week.Is the seven days travelcard best options for us?

Staff Hi Sandr. Travelcards usually work out cheaper if you make 2 or more journeys on each of the 7 days, or three or more on 6 of the days. Otherwise you’ll be better off with Oyster cards (unless you have UK bank cards, then you can just use contactless instead)

Sandra Thank you very much for your answer.We surely will be using it more than 2 times a day.And my daughter age 8 doesn't have to have a travelcard?My daughter age 15 has a child travelcard?Does it have to be with a photo? Thanks for your help.

Staff You can only get a child travelcard if you have a child photocard, but you have to pay extra money for those which means you’d wipe out all the savings. So its not worth it. Your 8 year old travels for free. Its all explained on our child fares page - city-guide.london/transport/child-train-fares.php

Kathe Conway Hello, riding here i am curious, i will be in london for seven days thinking it is best to get a travel card, can you buy this at Heathrow ? Also if for one day I am traveling to zone four does it make more sense just to buy a single trip that day? sorry so confusing :)

Staff Hi Kathe. You can get it loaded on to an oyster card, but youll need the oyster card first. You can have a paper one posted to you if you order it online (even abroad - its all described in the ‘Where can you buy a travelcard?’ section above). If you want to use it from heathrow into central london that would be zones 1-6, which would also cover zone 4. You wouldnt be travelling zones 1-6 all week though, so it would be a bit of a waste of money. I would probably recommend getting an oyster card instead, which you can get from heathrow - city-guide.london/transport/oyster-cards.php

Giuluano Hi there, how much cost me a travel card zone 1to 6 on Sunday?

Staff Hi Giuluano. Sunday is off-peak so get the off-peak one - 15,20

Richard Can I buy the 1 day Travelcard at any national trainstation (planning for Knockholt)? As this is a requirement for 2for1

Staff Hi. Richard. You can, yes (assuming you mean one of the stations in London). But you have to get it from the windows/machines upstairs, in the National Rail part of the station. If you go downstairs to the London Underground part then it will be printed on different paper, which is no good for the offer.

Richard Thanks. Indeed we drive from SevenOaks to Knockholt national railstation, with our Diesel from the Netherlands, which I want to leave outside LEZ. Thus parking in Knockholt (which is in Zone 6) and then use for the Saturday and Sunday the 2 day paper travelcard. This should allow our group of 6 to have the cheapest means of transportation into London, benefitting from 2FOR1, as long as we purchase the cards at Knockholt national Railwaystation (Can we purchase them at this station!? ). Can you confirm this is the best strategy? Thx

Staff Knockholt is in zone 6, so they should sell them. Its not the cheapest way of travelling (using contactless/oyster would be cheaper) but you’d make all the money back and more from doing the 2-for-1 offer, so it sounds like a good plan. You can buy the off-peak ones if youre travelling at the weekend. And its definitely a lot cheaper than driving into london. If youre talking about this saturday and sunday remember the coronation is on, so everywhere will likely be packed

JOSE CARVALHO If I have a travelcard card for zones 1 and 2, and I want to go Canning Town (zone 2/3) and return, how to proceed.

Staff Hi Jose. if you coming from the direction of zone 1 or 2, and get off at Canning Town, then you're fine, your travelcard will cover the whole journey. If you’re going into zone 3 and your travelcard is on an oyster card, then you can just load on some extra pay-as-you-go credit to cover the fare for zone 2-3 (which can be seen here - city-guide.london/transport/adult-train-fares.php )

Lynn I am arriving in London from overseas and need just one train ticket from Paddington Station to Kings Cross Station. What is the best way to pay for this trip please

Staff Hi lynn. If it's just a one-off then I would buy a single ticket from the self-service machine in the station

Derek Scriven Is there still a concession on 1 day travelcards with a senior railcard?

Staff H Derek. There is, but only this specific one - "Anytime Day Travelcard Zones 1-9 when bought as part of ticket to London from outside London" - senior-railcard.co.uk/using-your-railcard/travel-times-tickets/

Richard I want to find out about the cheapest weekly cost for travel card from Brockley station to Reading.

Lala If I want to travel to London zones 1-6 and I need the weekly travel cards, how much is it and how do I buy it? I also have a 16-25 Railcard, can it be applied when buying?

Staff Hi Lala. the prices for zone 1-6 are all shown in the table at the top. The different ways to buy it are described under ‘Where can you buy travelcards’. The railcard wont get you a discount on a weekly travelcard. The only travelcard you can get a discount on is a “one day travelcard, zones 1-9, when bought together with a National Rail ticket to London (when coming from outside London)”

ALAN Can I use a Rail Travel Voucher issued by Transport for Wales for a cancelled journey to buy a TFL Travelcard?

Staff Hi Alan. I wouldn't imagine so, but it's probably best to ask Transport for Wales - tfw.wales/help-and-contact/rail/contact-us

Edward Gould Do I need a photo for an annual season travel card

Staff Hi Edward. You’ll need to get an oyster card and register it on the TFL website. You’ll then be able to buy the annual travelcard through that website and load it straight onto your card

Malcolm Oates What is price of off-peak one day travelcard zones 1-6 for a senior railcard holder. it was 34% off.

Staff Hi Malcom. The normal price is £15,20 and the discount would only apply if you bought the ticket as part of a longer National Rail journey from outside zones 1-9 - senior-railcard.co.uk/about-the-railcard/using-your-railcard/

Tahira If I bought a Train, Bus & Tram Travelcard covering zones 5-6, what buses would be covered? Will it always be buses up to zone 6? Or is my case different?

Staff Hi Tahira. Buses don't have zones, so whichever train travelcard you buy it will always cover buses in train zones 1-6

Steve Hi, I’m traveling to Leicester square on the Friday bank holiday from Bedford with two adults and two 15 year olds just for the day. Do we just get the one day travel card or is there a better option. Tia

Staff HI Steve. The fares will be cheaper if you just use your contactless card. But you’ll have to have one card each. if your kids don’t have one then I would get them one day travelcards - city-guide.london/transport/oyster-contactless-travelcard-comparison.php

Steve Thank you for your help

Ron Travelling from Richmond to Stratford using Overground line Do I need to use pink reader anywhere to get cheaper fare using contactless? Thanks

Staff Hi Ron. You need to avoid zone 1, so it will make the journey a lot longer. If you want to do it then you could change onto the Overground at Gunnersbury and tap the pink reader there (don't go through any ticket barriers, because that would end your journey)

You must enable javascript to leave a comment

> Forum: London Buses, Taxis & Trains

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Find the best credit card for you

The 11 best travel credit cards of april 2024, the best travel credit cards could earn over $2,000 in rewards over the next five years based on our calculations..

The best travel credit cards offer more than just great cash-back , points or miles incentives — they also come with a range of perks that can take your next trip from basic to bougie without spending extra money.

Some travel card features are nearly standard across the board: no foreign transaction fees , travel insurance and various travel credits. More premium cards take things up by offering lounge access and credits for expedited airport security.

To help you choose the best travel rewards card for your needs, CNBC Select analyzed dozens of popular travel cards using an average American's annual spending budget and dug into each card's perks and drawbacks to find the best of the best based on consumer habits. (See our methodology for more information on how we choose the best travel credit cards.)

Best travel credit cards

- Best for no annual fee: Discover it® Miles

- Best for dining when traveling: American Express® Gold Card

- Best for authorized user perks: Capital One Venture X Rewards Credit Card (see rates and fees )

- Best for welcome bonus: Chase Sapphire Preferred® Card

- Best for earning points on rent: Bilt Mastercard®

- Best for lounge access: The Platinum Card® from American Express

- Best for luxury travel: Chase Sapphire Reserve®

- Best for fair credit: Discover it® Secured Credit Card

- Best for low annual fee: Capital One Venture Rewards Credit Card (see rates and fees)

- Best for low interest: First Tech Credit Union Choice Rewards World Mastercard®

- Best for students: Bank of America® Travel Rewards for Students

Best for no annual fee

Discover it® miles.

Automatically earn unlimited 1.5x Miles on every dollar of every purchase.

Welcome bonus

Discover will match all the Miles earned for all new cardmembers at the end of your first year.

0% Intro APR for 15 months on purchases

Regular APR

17.24% to 28.24% Variable

Balance transfer fee

3% intro balance transfer fee, up to 5% fee on future balance transfers (see terms)*

Foreign transaction fee

Credit needed.

Good / Excellent

*See rates and fees , terms apply.

Read our Discover it® Miles review.

- Miles program

- Generous welcome bonus

- No blackout dates

- No limit to the amount of miles you can earn and miles never expire

- No Global Entry or TSA PreCheck statement credit offerings

- Travel spending does not receive additional rewards

- No airport lounge access

Who's this for? The Discover it Miles card comes with a generous rewards program and welcome bonus — all for zero annual fee.

Standout benefits: Discover has a welcome bonus that's hard to beat: It will do a mile-for-mile match of all miles earned the first year (for new card members in their first year only). If you rack up 35,000 miles within the first 12 months, Discover will match you with 35,000 miles. That's a total of 70,000 miles or $700 toward travel. (Based on our calculations, the average card user will earn around 32,777 miles in the first year.) Plus, the card has no foreign transaction fees.

[ Jump to more details ]

Best for dining when traveling

American express® gold card.

4X Membership Rewards® points at Restaurants (plus takeout and delivery in the U.S.) and at U.S. supermarkets (on up to $25,000 per calendar year in purchases, then 1X), 3X points on flights booked directly with airlines or on amextravel.com, 1X points on all other purchases

Earn 60,000 Membership Rewards® points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership.

Not applicable

See Pay Over Time APR

Excellent/Good

See rates and fees , terms apply.

Read our American Express® Gold Card review .

- Up to $120 dining credit annually ($10 a month) for purchases made with Grubhub, Goldbelly and other eligible restaurants (after a one-time enrollment)

- Up to $120 Uber Cash annually ($10 a month) for U.S. Uber Eats orders and U.S. Uber rides (card must be added to Uber app to receive the Uber Cash benefit)

- Strong rewards program with 4X points earned at restaurants and 3X points earned on flights booked directly with airlines or amextravel.com

- Baggage insurance plan covers up to $1,250 for carry-on baggage and up to $500 for checked baggage that is damaged, lost or stolen

- No fee charged on purchases made outside the U.S.

- No introductory APR period

- $250 annual fee

- Estimated rewards earned after 1 year: $1,074

- Estimated rewards earned after 5 years: $2,969

Rewards totals incorporate the points earned from the welcome bonus

Who's this for? The American Express® Gold Card is a smart choice for consumers who love traveling and dining out due to its generous rewards rates. While the card comes with a $250 annual fee ( see rates and fees ), it offers premium rewards that help offset the cost.

Standout benefits: Travelers will appreciate the Amex Gold card's various statement credits. Cardholders get up to $120 in annual dining credit (up to $10 per month at Grubhub , Goldbelly, The Cheesecake Factory and other participating restaurants; enrollment is required) and up to $120 in Uber Cash ($10 per month) to put toward rides in the U.S. and dining via Uber Eats (you must add your Amex Gold Card as a payment method in the Uber app to enroll).

Best for authorized user perks

Capital one venture x rewards credit card.

Unlimited 2X miles on all eligible purchases, and 5 Miles per dollar on flights and 10 Miles per dollar on hotels and rental cars when booked via Capital One Travel portal

Earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

19.99% - 29.99% (Variable)

$0 at the Transfer APR, 4% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you

Foreign transaction fees

Read our Capital One Venture X Rewards Credit Card review.

- Large welcome bonus

- No foreign transaction fees

- Up to $100 statement credits for either Global Entry or TSA PreCheck®

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- High annual fee

- No introductory 0% APR period

Who's this for? The Capital One Venture X Rewards Credit Card is an excellent choice for frequent travelers who want a premium credit card at a lower price point than other high-end cards with similar benefits. Plus, up to four authorized users can be added for free (see rates and fees ).

Standout benefits: This card is loaded with benefits, including a $300 Capital One Travel credit to use toward purchases made through Capital One Travel and a 10,000-mile bonus on each account anniversary (worth at least $100 for travel). Cardholders also receive an up to $100 statement credit for either Global Entry or TSA PreCheck® , complimentary cell phone insurance , access to Capital One and partner airport lounges and more. Terms, conditions and exclusions apply. Refer to your Guide to Benefits for more details.

Best for welcome bonus

Chase sapphire preferred® card.

Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, and $50 annual Chase Travel Hotel Credit, plus more.

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

21.49% - 28.49% variable on purchases and balance transfers

Either $5 or 5% of the amount of each transfer, whichever is greater

- Terms apply.

Read our Chase Sapphire Preferred® Card review .

- Points are worth 25% more when redeemed for travel via Chase Travel℠

- Transfer points to leading frequent travel programs at a 1:1 rate, including: IHG® Rewards Club, Marriott Bonvoy™ and World of Hyatt®

- Travel protections include: auto rental collision damage waiver, baggage delay insurance and trip delay reimbursement

- $95 annual fee

- No introductory 0% APR

Who's this for? The Chase Sapphire Preferred has a loyal following among travelers looking for a travel-centric rewards program and a robust suite of perks. What makes this card shine the most is its generous welcome bonus offer.

Standout benefits: This card comes with many helpful benefits, such as an up to $50 Annual Chase Travel Hotel Credit, no foreign transaction fees, primary rental car insurance , trip cancellation and interruption insurance and baggage and trip delay insurance. Cardholders can also benefit from a 10% points boost on each card anniversary and complimentary DashPass membership for a minimum of one year through Dec. 31, 2024.

Best for earning points on rent

Bilt mastercard®.

Earn Bilt Points when you make 5 transactions that post each statement period - up to 1x points on rent payments without the transaction fee (up to 100,000 points each calendar year), 3x points on dining, 2x points on travel, and 1x points on other purchases.

Introductory fee of either $5 or 3% of the amount of each balance transfer, whichever is greater, for 120 days from account opening. After that, up to 5% for each balance transfer ($5 minimum).

See rates/fees and rewards/benefits ; terms apply.

- No annual fee

- Solid rewards on broad spending categories

- Ability to pay your rent with no transaction fees

- Transfer points to leading frequent traveler programs at a 1:1 rate, including American Airlines, United and World of Hyatt®

- No welcome offer

Who's this for? If you rent your home and don't have the Bilt Mastercard® , you're leaving points on the table. The Bilt Mastercard is the only card that lets you earn travel rewards on rent payments with no fees .

Standout benefits: Bilt makes it easy for even beginners to get maximum value from their points through a unique partnership with the award search engine point.me . With the BiltProtect feature, it also protects cardholders from using up their entire credit limit or risk going into debt by charging their rent every month. Other benefits include cell phone protection; Purchase Assurance Plus, which covers your purchases for 90 days; discounts with partner brands; and access to the Mastercard Luxury Hotels & Resorts portfolio, which offers amenities like upgrades, free breakfast and property credits.

Best for lounge access

The platinum card® from american express.

Earn 5X Membership Rewards® Points for flights booked directly with airlines or with American Express Travel up to $500,000 on these purchases per calendar year, 5X Membership Rewards® Points on prepaid hotels booked with American Express Travel, 1X points on all other eligible purchases

Earn 80,000 Membership Rewards® Points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

Credit Needed

Read our The Platinum Card® from American Express review .

- Up to $200 in annual airline fee credits

- $200 Uber Cash: Enjoy Uber VIP status and up to $200 in Uber savings on rides or eats orders in the US annually. Uber Cash and Uber VIP status is available to Basic Card Member only. Terms Apply.

- Get up to $200 back in statement credits each year on prepaid Fine Hotels + Resorts® or The Hotel Collection bookings, which requires a minimum two-night stay, through American Express Travel when you pay with your Platinum Card®.

- $240 Digital Entertainment Credit: Get up to $20 back in statement credits each month on eligible purchases made with your Platinum Card® on one or more of the following: Disney+, a Disney Bundle, ESPN+, Hulu, The New York Times, Peacock, and The Wall Street Journal. Enrollment required.

- $155 Walmart+ Credit: Use your Platinum Card® to pay for a monthly Walmart+ membership (subject to auto-renewal) and receive a statement credit that covers the full cost each month. $12.95 plus applicable taxes. Plus Up Benefits not eligible.

- $695 annual fee

- No special financing offers on new purchases

Who's this for? The Platinum Card® from American Express is for road warriors who want to make their travels more comfortable. It grants access to more airport lounges than any other card on the market and is loaded with lots of other travel and lifestyle benefits that help justify its high annual fee (see rates and fees ).

Standout benefits: Cardholders have an extensive list of opportunities to earn over $1,500 in statement credits each year and enjoy ongoing benefits like automatic hotel elite status with Hilton Honors and Marriott Bonvoy and various travel and shopping protections. Even if you only take advantage of half of this card's perks, it's worth paying the annual fee (see rates and fees ).

Best for luxury travel

Chase sapphire reserve®.

Earn 5X total points on flights and 10X total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3X points on other travel and dining & 1 point per $1 spent on all other purchases plus, 10X points on Lyft rides through March 2025

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $900 toward travel when you redeem through Chase Travel℠.

22.49% - 29.49% variable

5%, minimum $5