A traveler’s guide to Capital One miles

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Personal finance

- • Credit cards

- • Rewards credit cards

- • Credit card comparisons

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- The Capital One miles program is flexible and user-friendly, making it a great choice for new travel rewards users.

- The Capital One Venture X in particular is a good option for travelers who are looking for a luxury travel card, but without the high annual fee associated with other popular products.

- As with any travel card, it's still important to make sure potential Capital One miles redemptions make sense for your travel and spending habits.

If you’re looking for a prime example of how a credit card rewards program can offset travel costs and maximize value, look no further than Capital One miles. This rewards program is user-friendly, flexible and offers a number of valuable redemption options.

In this guide we’ll take a closer look at what Capital One miles are, how you can earn and redeem them, which credit cards earn Capital One miles and everything else you need to know about this rewards program.

Capital One miles basics

Capital One miles — also known as Capital One Rewards or Capital One Travel Rewards — is the rewards program for several Capital One credit cards. With this program, you’ll earn miles on all qualifying purchases, which you can then redeem for travel or non-travel options. The number of miles you’ll earn vary depending on the card you have, but several Capital One cards allow you to earn more miles for certain types of travel purchases.

Who is the Capital One miles program best for?

The Capital One miles rewards program is best for people who travel frequently and would rather earn and redeem flexible travel rewards instead of cash back.

How to earn Capital One miles

Many people don’t take advantage of the full potential of their travel rewards cards because the process can be confusing and overwhelming. Luckily, earning miles toward your next flight or hotel stay is easy with Capital One.

Earn with eligible credit card spending

To earn miles, simply use one of the Capital One credit cards that earn miles — the Capital One VentureOne Rewards for Good Credit card, Capital One VentureOne Rewards credit card, Capital One Venture Rewards credit card, Capital One Venture X Rewards credit card, Capital One Spark 2X Miles for Business or Capital One Spark 1.5X Miles Select for Business.

With these Capital One cards, there’s no limit to the number of miles you can earn. No matter which card you have, you’ll earn miles on all purchases you make. With the more premium cards, however, you’ll earn boosted miles on certain types of travel purchases — like the 10X miles on hotels and rental cars and 5X on miles booked through Capital One Travel with the Capital One Venture X Rewards Credit Card.

Earn with a credit card welcome bonus

All of the above-mentioned Capital One cards with the exception of the Capital One VentureOne Rewards Credit Card for Good Credit offer welcome bonuses for new cardholders, offering you the chance to earn thousands of extra miles as long as you meet certain spending requirements.

For example, you can earn 75,000 miles after spending $4,000 within the first three months for both the Capital One Venture and Capital One Venture X . Or, you could earn 50,000 miles after spending $4,500 within the first three months with the Capital One Spark 2X Miles for Business.

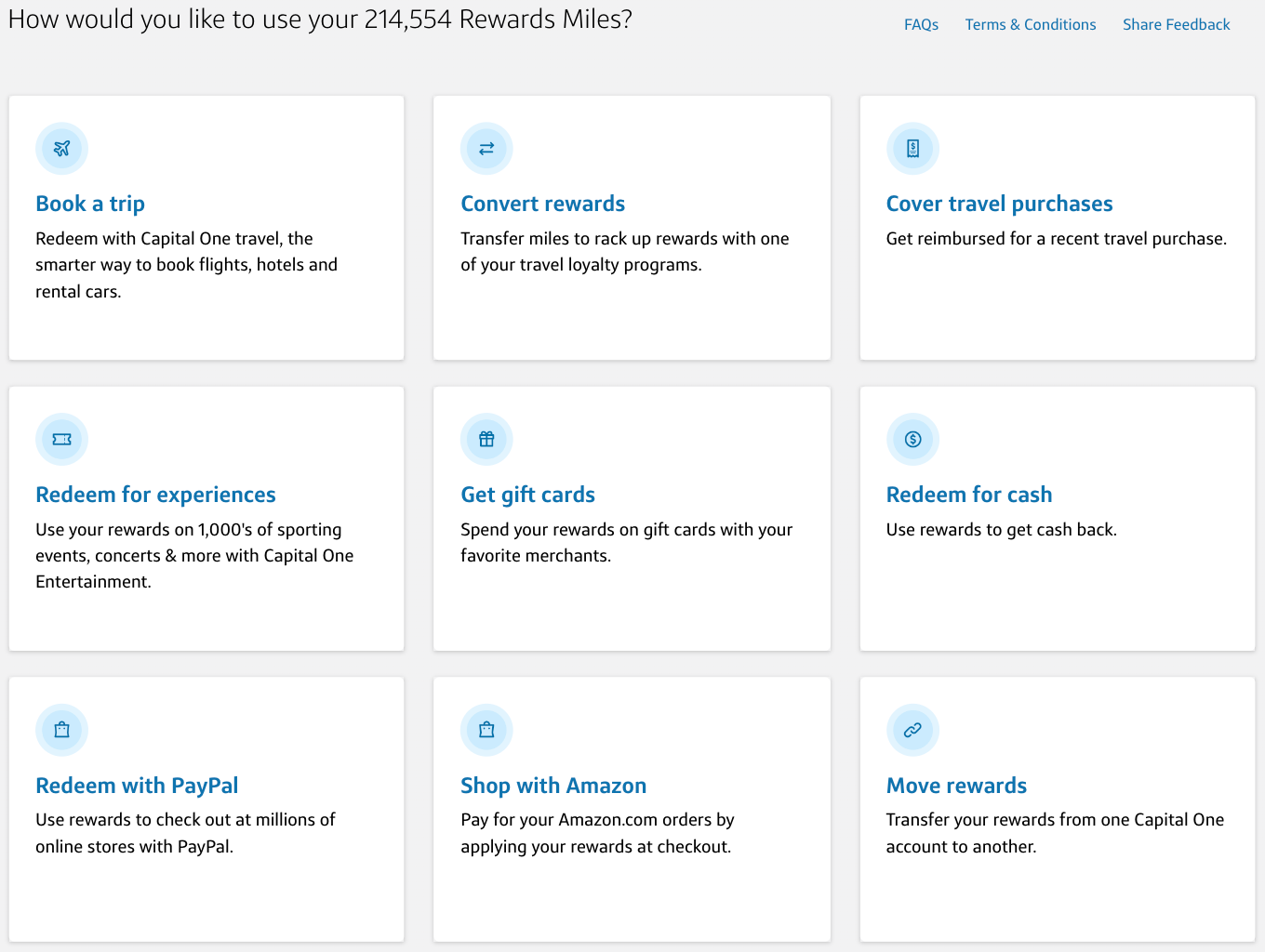

How to redeem Capital One miles

To redeem your Capital One miles, log in to your account via the website or Capital One mobile app . Then, go to the rewards page and choose which redemption option you’re interested in. Here are all of the ways you can redeem your Capital One miles:

Redeem for travel purchases

The best way to redeem Capital One miles is for travel purchases , including transfers to Capital One travel partners. Through the Capital One travel portal , you can redeem your miles for flights, hotel stays, car rentals, vacation packages and more. Alternatively, you can redeem your miles to cover qualifying travel purchases made with your card within 90 days of purchase.

Redeem for transfers to travel partners

Capital One has more than 15 airline and hotel partners you can transfer your rewards to. As with booking travel through Capital One Travel, this is one of the best ways to redeem your rewards, since you’ll usually get far more value out of your miles.

Redeem for gift cards

If you don’t want to use your miles for travel, you can also redeem them for gift cards to popular merchants. Some merchants include Apple, Best Buy and Barnes & Noble.

Redeem for cash back

You can also choose to redeem your miles for cash through the “cash” section of the redemption portal. Cash back can be redeemed in the form of a statement credit, account credit or check. However, keep in mind that this is not the best way to use Capital One miles since you’ll get far less value out of this redemption method.

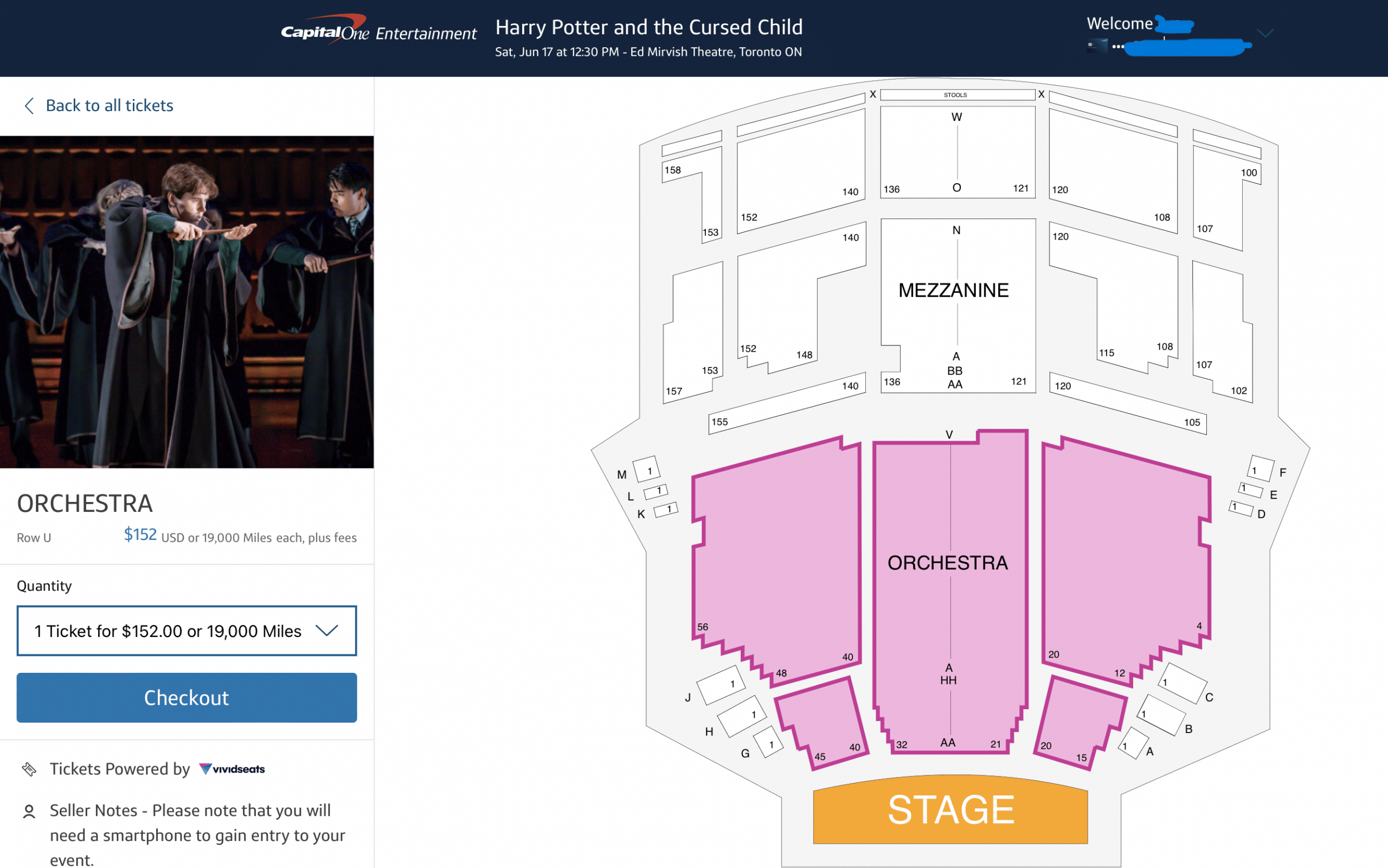

Redeem for event tickets

Another option is to redeem your miles for tickets to a wide variety of events — including sports, dining and music events — through Capital One Entertainment .

Redeem for PayPal or Amazon shopping

If you want to redeem your miles for online shopping purchases, you have two options: PayPal or Amazon. With PayPal, you’ll shop with a participating merchant and choose the option to checkout with PayPal. Then, you’ll choose your linked Capital One card and pay with Capital One Rewards.

Shopping with Amazon follows a similar process. First, you’ll link your eligible Capital One card to its Shop with Points program. Then, you’ll shop on Amazon and choose the option to pay with Capital One Rewards.

How much are Capital One miles worth?

According to valuations from Bankrate , Capital One miles are worth about 1.7 cents each. This valuation falls into the mid- to high-range for credit card rewards programs. Of course, how you choose to redeem your rewards ultimately determines the value of your rewards.

How do Capital One miles compare to other programs?

For comparison, here is how Capital One miles stack up against other major credit card rewards programs:

Credit card rewards program

Capital One miles transfer partners

Transferring miles to Capital One transfer partners is easy. Once you’re logged in to your account, go to the Capital One rewards page. Then, select the option to transfer rewards and choose which partner you’d like to transfer your miles to. Keep in mind that when you transfer your miles to a loyalty partner, transfers are irreversible.

Note that Capital One miles transfers can take up to five business days to process, but travelers on a time crunch are not out of luck. Several Capital One travel partners offer instant transfers, while others take 24 to 36 hours (rather than five business days).

Airline partners

- Accor Live Limitless (2:1)

- Aeromexico Club Premier

- Air France/KLM Flying Blue

- Air Canada (Aeroplan)

- Cathay Pacific Asia Miles

- Avianca LifeMiles

- British Airways

- Emirates Skywards

- Etihad Guest

- EVA Air (2:1.5)

- Finnair Plus

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

- TAP Air Portugal

- Turkish Airlines

Hotel partners

Top credit cards that earn capital one miles.

There are a number of Capital one credit cards that earn miles, all with varying rewards structures, welcome bonuses, benefits and more. The top Capital One credit cards for earning miles include:

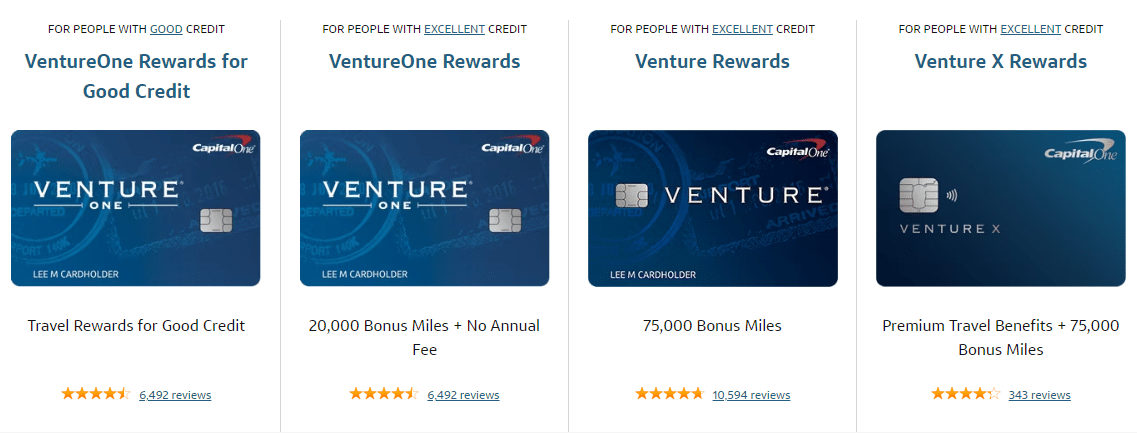

Capital One VentureOne Rewards Credit Card

The Capital One VentureOne Rewards Credit Card offers a fair amount of value for a no-annual-fee travel card. It offers a welcome bonus of 20,000 miles (worth $200) if you spend $500 within the first three months, which is very attainable. For rewards, you’ll earn 5X miles on hotels and rental cars booked through Capital One Travel and 1.25X miles on all other purchases.

Notable travel perks include 24/7 travel assistance services, no foreign transaction fees, an auto rental collision damage waiver and travel accident insurance.

Capital One Venture Rewards Credit Card

Another top Capital One card for earning miles is the Capital One Venture Rewards Credit Card . Travelers looking to earn miles can enjoy 5X miles on hotels and rental cars booked through Capital One Travel and 2X miles on all other purchases. Plus, new cardholders can earn 75,000 bonus miles (worth $750 in travel) after spending $4,000 within the first three months of account opening.

This card comes with a $95 annual fee, but the cost of the card’s membership can be easily recouped if you take advantage of the up to $100 credit for TSA PreCheck or Global Entry. Some other travel benefits include two free Capital One Lounge visits per year, no foreign transaction fees, 24/7 travel assistance services, an auto rental collision damage waiver and travel accident insurance.

Capital One Venture X Rewards Credit Card

If you’re interested in a lower-cost luxury travel card, consider the Capital One Venture X Rewards Credit Card . This card has a $395 annual fee, which is much lower than The Platinum Card® from American Express’s $695 annual fee or the Chase Sapphire Reserve®’s $550 annual fee.

As for rewards, the Capital One Venture X earns 10X miles on hotels and rental cars booked through Capital One Travel, 5X miles on flights booked through Capital One Travel and 2X miles on all other purchases. New cardholders can also earn 75,000 miles after spending $4,000 with the first three months of card membership.

Notable travel benefits include up to a $300 annual travel credit for bookings through Capital One Travel, up to a $100 credit for TSA PreCheck or Global Entry, 10,000 bonus miles every account anniversary (worth $100 in travel), no foreign transaction fees and unlimited access to Capital One Lounges and more than 1,300 partner lounges.

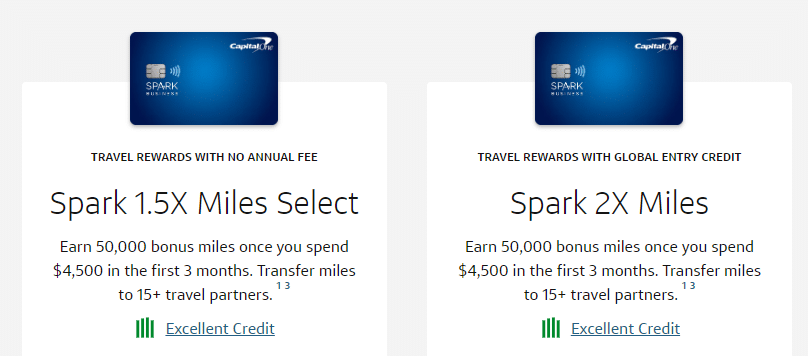

Capital One Spark 2X Miles for Business

For business owners looking to earn travel rewards, the Capital One Spark Miles for Business is a great card to consider. This card comes with a $95 annual fee, but that fee is waived for the first year. To start with, you can earn 50,000 miles after spending $4,500 within the first three months of account opening. You’ll also earn 2X miles on all purchases.

Some notable travel benefits include up to a $100 credit for TSA PreCheck or Global Entry and no foreign transaction fees. As for business benefits, you’ll get perks like streamlined purchase records, free employee cards, customized spending limits for employee cards, itemized annual spending reports and more.

Capital One Spark 1.5X Miles Select for Business

Capital One also has a no-annual-fee business card that earns miles, the Capital One® Spark® Miles Select for Business *. With this card you’ll earn 1.5X miles on all purchases, along with the chance to earn 20,000 bonus miles when you spend $3,000 within the first three months of card membership. You’ll also get a 0 percent intro APR on purchases for nine months, followed by a variable APR of 13.99 percent to 23.99 percent.

Like the Capital One Spark 2X Miles, you’ll get free employee cards, customized spending limits for employee cards, streamlined purchase records and itemized annual spending reports. This card also comes with no foreign transaction fees, auto rental collision coverage and roadside assistance.

FAQs about Capital One miles

Do capital one miles expire, can you share miles with friends and family members, how many capital one miles do you need for a flight, the bottom line.

The Capital One miles program is user-friendly, flexible and easy to understand. You can earn miles quickly on eligible purchases made with a Capital One travel card of your choice . Plus, there are no special categories you’ll need to remember for earning rewards and there’s no cap on the number of rewards you can earn. As for redeeming miles, the sky’s the limit — your next flight, hotel stay or vacation could be covered just by using your Capital One travel card.

For more travel tips & tricks, check out Bankrate’s travel toolkit .

The information about the Capital One Spark 1.5X Miles Select for Business card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Related Articles

Capital One SavorOne Cash Rewards Credit Card benefits guide

Balance transfer or rewards card with a shorter intro APR: Which is right for you?

Best Barclays business cards

Not a rewards junkie? That’s OK

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

Capital One VentureOne Review: Low-Cost Travel Card Falls Short

Weigh the rewards against the offerings of other no-annual-fee travel cards before committing. You might even get more value from the regular Capital One Venture Rewards Credit Card , which charges a fee.

- No annual fee

- Intro APR period

- Flexible rewards redemption

- Rewards have limited flexibility

- Requires good/excellent credit

19.99%-29.99% Variable APR

0% intro APR for 15 months on purchases and balance transfers; balance transfer fee applies

Rewards rate

Bonus offer

Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel.

Ongoing APR

APR: 19.99%-29.99% Variable APR

Cash Advance APR: 29.99%, Variable

Balance transfer fee

Balance transfer fee applies

Foreign transaction fee

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Transfer your miles to your choice of 15+ travel loyalty programs

- Enjoy 0% intro APR on purchases and balance transfers for 15 months; 19.99% - 29.99% variable APR after that; balance transfer fee applies

Compare to Other Cards

Detailed review: Capital One VentureOne Rewards Credit Card

If you’re not a heavy spender, the annual fee for a top travel credit card could cost you more than the rewards you’d earn. With the Capital One VentureOne Rewards Credit Card — the $0 -annual-fee version of Capital One's popular travel card — you can earn rewards without worrying about a fee eating into their value ( see rates and fees ).

But several no-annual-fee travel cards can offer you higher ongoing rewards, not to mention more lucrative sign-up bonuses to get you on your way. You're better off exploring your options first.

» MORE: Best travel credit cards with no annual fee

Capital One VentureOne Rewards Credit Card : Basics

Card type: Travel .

Annual fee: $0 .

Sign-up bonus: Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel.

Rewards: Unlimited 1.25 miles per dollar spent on all purchases, plus 5 miles per dollar spent on hotels and car rentals booked through Capital One Travel.

Interest rate: Enjoy 0% intro APR on purchases and balance transfers for 15 months; 19.99% - 29.99% variable APR after that; balance transfer fee applies .

Foreign transaction fees: None.

Credit score requirement: The Capital One VentureOne Rewards Credit Card is available to applicants with good to excellent credit. However, some applicants with less-than-excellent credit may be offered a different version of this card, one that has the same cash back rewards but not the sign-up bonus or intro APR period. If this is the case, you'll be told during the application process and given the chance to accept or decline.

» MORE: Is it worth paying an annual fee for a credit card?

Benefits and perks

Savings on fees and interest.

If you’re not a frequent flyer and you pay with credit only occasionally, the $0 annual fee is a strong selling point. You'll earn rewards while paying nothing to carry the card, assuming you pay your balance in full each month to avoid interest. The Capital One VentureOne Rewards Credit Card also travels well internationally; it charges no foreign transaction fees, and it's a Mastercard (and therefore widely accepted). And should you need some time to pay off a large purchase, the card offers an introductory 0% APR period for purchases, a relatively rare feature on a travel credit card.

Redemption flexibility

The redemption process on the Capital One VentureOne Rewards Credit Card is as flexible as it gets for travel cards. Miles are worth 1 cent apiece when redeemed for travel. You can redeem three ways:

Use your miles to book travel through Capital One's travel platform.

Use your card to pay for travel, and then redeem your miles for statement credit against the expense.

Transfer your miles to leading travel loyalty programs.

Aeromexico (1:1 ratio).

Air Canada (1:1 ratio).

Air France-KLM (1:1 ratio).

Avianca (1:1 ratio).

British Airways (1:1 ratio).

Cathay Pacific (1:1 ratio).

Emirates (1:1 ratio).

Etihad (1:1 ratio).

EVA (2:1.5 ratio).

Finnair (1:1 ratio).

Qantas (1:1 ratio).

Singapore Airlines (1:1 ratio).

TAP Air Portugal (1:1 ratio).

Turkish Airlines (1:1 ratio).

Accor (2:1 ratio).

Choice Privileges Hotels (1:1 ratio).

Wyndham Rewards (1:1 ratio).

» MORE: Capital One credit cards mobile app review

Drawbacks and considerations

Low rewards rate.

This card's 1.25% base rewards rate is underwhelming when you consider that you can find no-fee rewards cards with 1.5% back or more. Compare it with these options:

The Wells Fargo Autograph℠ Card has a $0 annual fee and earns 3 points per dollar on restaurants, travel and transit, gas and EV stations, popular streaming services, and select phone plans. All other purchases earn 1 point. Points are worth 1 cent each.

The $0 -annual-fee Bank of America® Travel Rewards credit card earns 1.5 points per dollar on all spending, with points worth 1 cent apiece when redeemed toward travel.

The Discover it® Miles also has a $0 annual fee and earns 1.5 miles per dollar spent on everything. Miles are worth 1 cent apiece whether redeemed for travel or cash back.

Not ideal for bigger spenders

If you plan to put more than $12,750 a year on your card — about $1,060 a month — you'd get more value from the regular Capital One Venture Rewards Credit Card , even taking into account that card's annual fee of $95 ( see rates and fees ). That's because it gives you 2 miles per dollar spent on most purchases. Plus, this card has a much bigger sign-up bonus: Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel. You'll also get an application fee credit for Global Entry or TSA Precheck. Use our calculator to compare your estimated rewards with each card:

A cash-back card gives more flexibility

When it comes to travel credit cards, redemption is understandably geared toward travel. If you want to use your rewards for anything else, you typically get less value. Such is the case with the Capital One VentureOne Rewards Credit Card , where miles are worth 1 cent apiece when you redeem them for travel, but about half that when you use them to get cash back. Consider the Citi Double Cash® Card instead. It pays you 2% cash back on every purchase: 1% when you buy something and 1% when you pay it off. The annual fee is $0 .

Visit NerdWallet's best credit cards roundup for more potential alternatives.

For higher rewards, consider this card, which gives you 2% cash back on every purchase (1% when you buy something + 1% when you pay it off). You can use your cash back for travel — or for anything else. The annual fee is $0 .

How to decide if it's right for you

If you’re looking for a low-cost travel card, the Capital One VentureOne Rewards Credit Card is a decent choice. But overall, other no-annual-fee cards can offer more upfront and ongoing value.

And if you're OK with paying an annual fee in exchange for greater benefits and perks, check out our best travel credit cards page for even more options.

- The best credit cards of 2024

- Best travel credit cards

- Best rewards credit cards

- Best cash back credit cards

Methodology

NerdWallet reviews credit cards with an eye toward both the quantitative and qualitative features of a card. Quantitative features are those that boil down to dollars and cents, such as fees, interest rates, rewards (including earning rates and redemption values) and the cash value of benefits and perks. Qualitative factors are those that affect how easy or difficult it is for a typical cardholder to get good value from the card. They include such things as the ease of application, simplicity of the rewards structure, the likelihood of using certain features, and whether a card is well-suited to everyday use or is best reserved for specific purchases. Our star ratings serve as a general gauge of how each card compares with others in its class, but star ratings are intended to be just one consideration when a consumer is choosing a credit card. Learn how NerdWallet rates credit cards.

About the author

Sara Rathner

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

- Credit Cards

How To Cover Travel Purchases With Capital One Miles [Step-by-Step]

Ashley Onadele

Senior Content Contributor

117 Published Articles

Countries Visited: 15 U.S. States Visited: 10

Stella Shon

News Managing Editor

87 Published Articles 626 Edited Articles

Countries Visited: 25 U.S. States Visited: 22

Keri Stooksbury

Editor-in-Chief

34 Published Articles 3142 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

![15 travel loyalty programs capital one How To Cover Travel Purchases With Capital One Miles [Step-by-Step]](https://upgradedpoints.com/wp-content/uploads/2023/06/AdobeStock_233666426.jpeg?auto=webp&disable=upscale&width=1200)

What Qualifies as a Capital One Travel Purchase?

How to cover travel purchases with capital one miles, transfer capital one miles to airline and hotel programs, book travel with capital one miles, best credit cards for earning capital one miles, final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Capital One’s travel rewards credit cards earn valuable Capital One miles, which are versatile for many reasons. Not only can you transfer your miles to Capital One’s hotel and airline partners, but you can also redeem them for airfare, hotels, or rental cars through the Capital One travel portal.

However, there’s another lesser-known way to redeem Capital One miles: covering qualifying travel on your statement credit within 90 days of purchase.

It’s easy to use your Capital One miles in this way once you know how — keep reading to learn the step-by-step process!

Capital One has 10 travel categories that qualify as a “travel purchase” on your statement credit:

- Car rental agencies

- Cruise lines

- Limousine services

- Travel agents

Each Capital One mile is worth 1 cent when redeemed for travel within 90 days of the purchase.

Of course, there are more obvious travel categories in the list above, such as airlines and hotels. However, where Capital One miles become even more useful is the ability to use them to cover all other travel-related expenses, from cruises to train tickets. On the other hand, travel agents can be a trickier category to figure out. If you’re working one-on-one with a personal travel agent, they may (or may not) fall into Capital One’s travel category depending on what systems they use. Meanwhile, online travel agents (OTAs) like Expedia and even Costco Travel will fall under this travel category, and therefore you can cover these expenses within 90 days of purchase.

Other travel expenses not explicitly mentioned by Capital One include tours and tickets to museums or other attractions, so you may want to consider purchasing them through an online travel agency (OTA) or a travel agent instead.

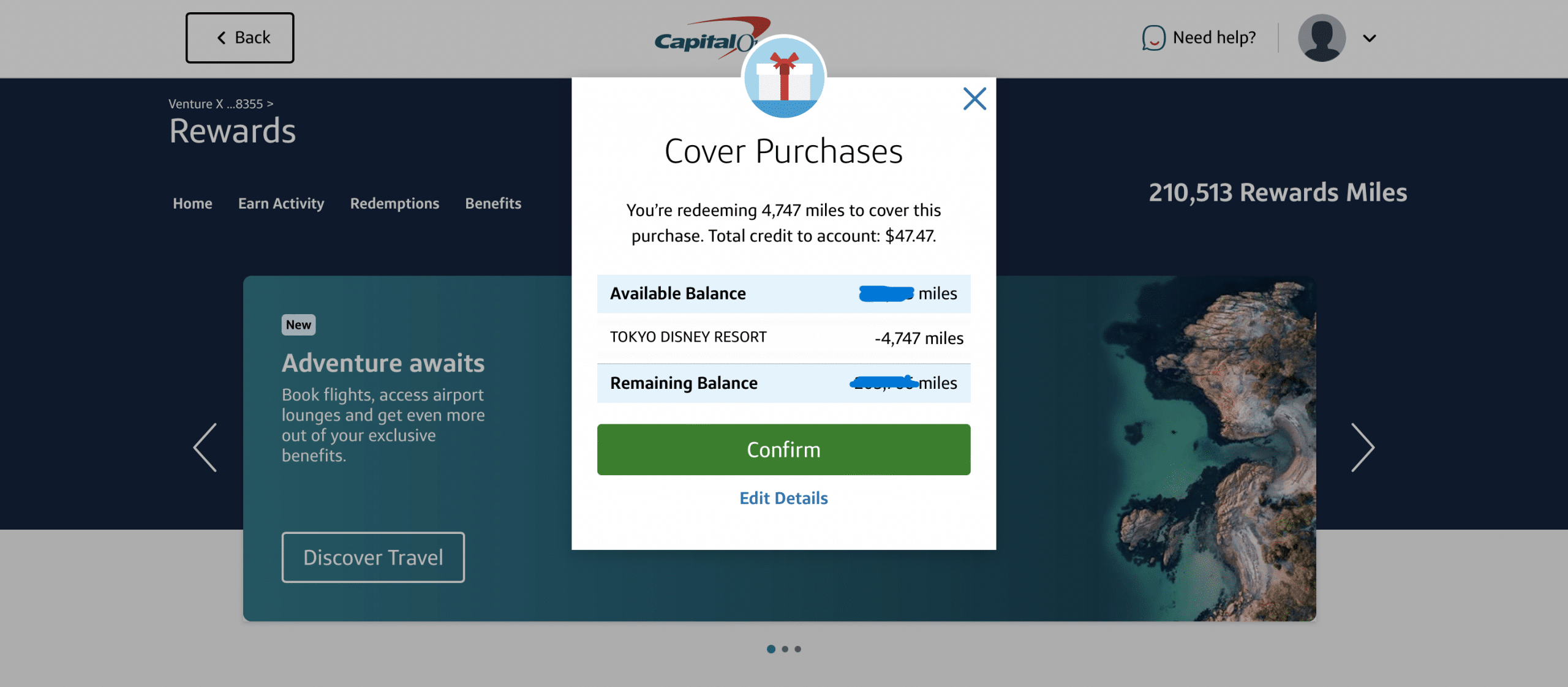

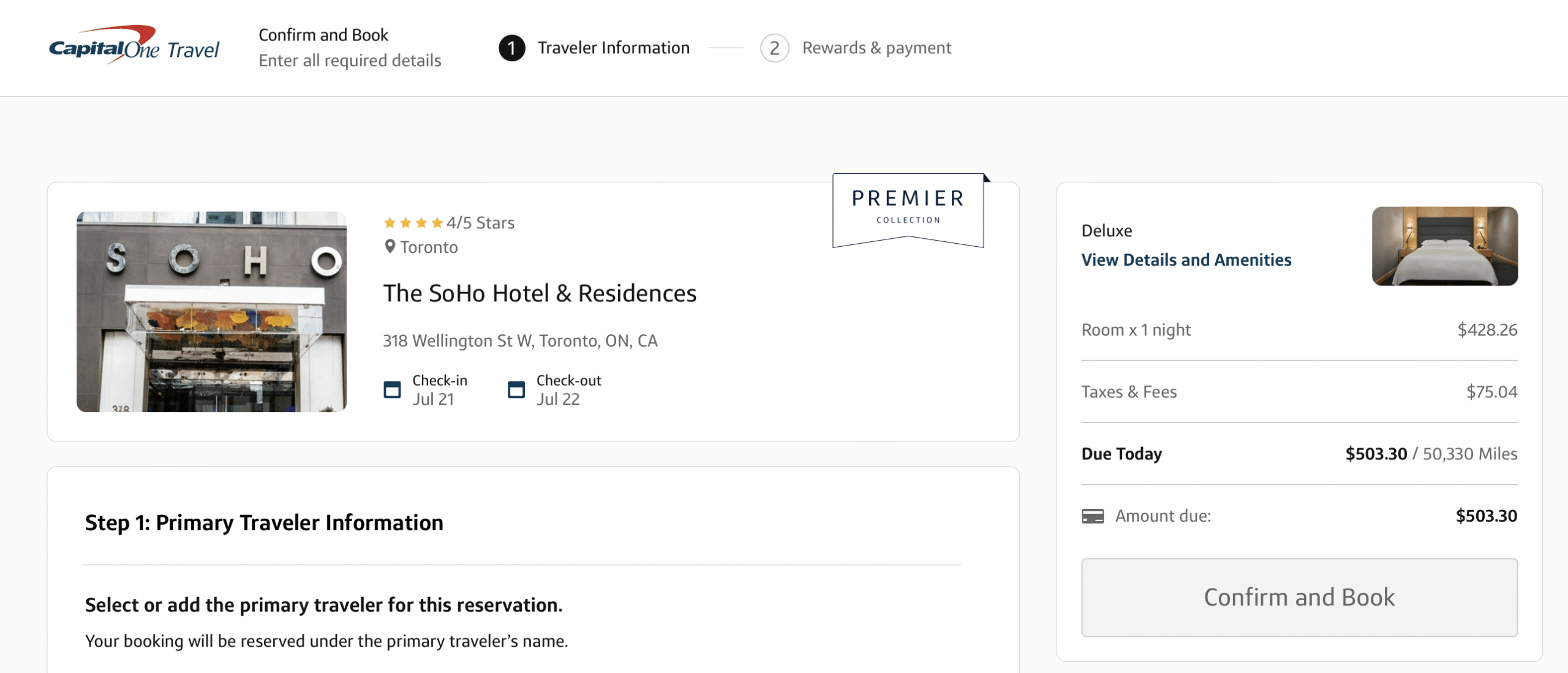

Capital One makes it easy to cover all or part of a travel purchase with your Capital One miles. From either your desktop or mobile app , you’ll log in to your Capital One account and click on the box that displays your rewards balance.

Click on View Rewards if you’re on the desktop version. On the mobile app, you’ll just select your card to see your rewards balance. Next, you can see all the ways that you can redeem your miles, including Cover travel purchases.

Then, a box will appear that displays all of your qualifying travel purchases within the past 90 days.

From here, you’ll be able to scroll through your eligible travel purchases . As you can see in the screenshot above, you can see what the expense was, the amount, and how many miles you’ll need to cover the entire cost. If you don’t have enough miles or don’t want to use your entire balance, you can also elect to cover part of the purchase.

Other Ways To Use Capital One Miles for Travel

Using your Capital One miles to cover eligible travel purchases is just one of the ways to maximize these travel rewards. Remember that you can also transfer your miles to more than a dozen airline and hotel transfer partners or book new travel through the Capital One Travel portal.

In general, transferring your miles out to Capital One’s airline and hotel transfer partners is the best way to get the most value out of your miles.

For example, the screenshot below shows the cash rate for a Virgin Atlantic flight from San Francisco (SFO) to London (LHR), where an Economy Classic fare costs $765. If you were to book this same flight through Capital One Travel, you would either pay a similar cash rate or spend 76,500 Capital One miles as each mile is worth 1 cent per point through the portal .

Now if you decided instead to transfer your Capital One miles directly to Virgin Red (which you can then easily move to Virgin Atlantic), you would see that the same flight requires just 17,500 Virgin Points and $151.70 in taxes and fees. Thanks to a 1:1 transfer rate, you would need nearly 60,000 Capital One miles fewer by transferring your miles to Virgin Red — which is a fantastic deal despite the taxes and fees.

Sometimes, there are transfer bonuses that give your bonus miles when transferring your Capital One miles to transfer partners. Our Transfer Partner Calculator makes it easy to determine how many miles you need to transfer for the redemption that you want.

Note that the minimum transfer amount required for each loyalty program is 1,000 miles. Transfer times will vary , between instant transfers like with Wyndham Rewards to upwards of 36 hours with Singapore Airlines KrisFlyer .

It’s worth noting that transfer ratios from Capital One to a partner can vary as well. Thankfully, however, all but 2 transfer partners transfer at a 1:1 ratio. Accor Live Limitless (ALL) and EVA Infinity MileageLands transfer at 2:1 and 2:1.5, respectively.

Don’t want to deal with the headache of transferring your Capital One miles? The simplest way to book travel with your miles is by using the Capital One Travel portal . You can book flights, hotels, and rental cars through the portal at a rate of 1 cent per mile.

Capital One Venture X Rewards Credit Card holders also get exclusive access to The Premier Collection . Similar to Amex’s Fine Hotels + Resorts , The Premier Collection offers a portfolio of luxury hotels with premium perks for Capital One Venture X cardholders. Premier Collection hotels can be booked directly through the Capital One Travel portal . Perks include up to $100 experience credit (varies by hotel), complimentary breakfast for 2, a space-available room upgrade, and more.

You can use your Capital One miles to cover travel purchases within 90 days, transfer miles to select airline and hotel partners, or book travel directly through the Capital One Travel portal. The best option for maximizing the value of your miles is almost always to transfer out to loyalty partners , especially if you can take advantage of a transfer bonus.

There are 3 personal credit cards that earn Capital One miles:

Capital One Venture X Rewards Credit Card

The Capital One Venture X card is an excellent option for travelers looking for an all-in-one premium credit card.

The Capital One Venture X Rewards Credit Card is the premium Capital One travel rewards card on the block.

Points and miles fans will be surprised to see that the Capital One Venture X card packs quite the punch when it comes to bookings made through Capital One, all while offering the lowest annual fee among premium credit cards.

Depending on your travel goals and preferences, the Capital One Venture X card could very well end up being your go-to card in your wallet.

- 10x miles per $1 on hotels and rental cars purchased through Capital One Travel

- 5x miles per $1 on flights purchased through Capital One Travel

- 2x miles per $1 on all other purchases

- $300 annual travel credit on bookings made through Capital One Travel

- Unlimited complimentary access for cardholder and 2 guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- 10,000 bonus miles awarded on your account anniversary each year

- Global Entry or TSA PreCheck credit

- Add authorized users for no additional annual fee ( rates & fees )

- No foreign transaction fees ( rates & fees )

- $395 annual fee ( rates & fees )

- Does not offer bonus categories for flights or hotel purchases made directly with the airline or hotel group, the preferred booking method for those looking to earn elite status

- Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel

- Receive a $300 annual credit for bookings through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Get 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary

- Earn unlimited 10X miles on hotels and rental cars booked through Capital One Travel and 5X miles on flights booked through Capital One Travel

- Earn unlimited 2X miles on all other purchases

- Unlimited complimentary access for you and two guests to 1,300+ lounges, including Capital One Lounges and the Partner Lounge Network

- Use your Venture X miles to easily cover travel expenses, including flights, hotels, rental cars and more—you can even transfer your miles to your choice of 15+ travel loyalty programs

- Elevate every hotel stay from the Premier or Lifestyle Collections with a suite of cardholder benefits, like an experience credit, room upgrades, and more

- Receive up to a $100 credit for Global Entry or TSA PreCheck ®

Financial Snapshot

- APR: 19.99% - 29.99% (Variable)

- Foreign Transaction Fees: None

Card Categories

- Credit Card Reviews

- Travel Rewards Credit Cards

- Best Sign Up Bonuses

Rewards Center

Capital One Miles

- Benefits of the Capital One Venture X Card

- Best Ways to Use Venture X Points

- Capital One Venture X Credit Score and Approval Odds

- Capital One Venture X Lounge Access

- Capital One Venture X Travel Insurance Benefits

- Capital One Venture vs Venture X

- Capital One Venture X vs Amex Platinum

- Capital One Venture X vs Chase Sapphire Reserve

- Best Credit Cards with Priority Access

- Best Credit Cards for Airport Lounge Access

- Best Capital One Credit Cards

- Best Luxury and Premium Credit Cards

- Best Metal Credit Cards

- Best High Limit Credit Cards

- Choice Privileges Loyalty Program Review

Capital One Venture Rewards Credit Card

Get 2x miles plus some of the most flexible redemptions offered by a travel credit card!

The Capital One Venture Rewards Credit Card is one of the most popular rewards cards on the market. It’s perfect for anyone in search of a great welcome offer, high rewards rates, and flexible redemption options.

Frequent travelers with excellent credit may benefit from this credit card that offers a lot of bells and whistles. And it offers easy-to-understand rewards earning and redemption.

- 5x miles per $1 on hotels and rental cars booked through Capital One Travel

- Global Entry or TSA PreCheck application fee credit

- Access to Capital One transfer partners

- $95 annual fee ( rates & fees )

- Limited elite benefits

- Enjoy a one-time bonus of 75,000 miles once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel

- Earn unlimited 2X miles on every purchase, every day

- Earn 5X miles on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Enrich every hotel stay from the Lifestyle Collection with a suite of cardholder benefits, like a $50 experience credit, room upgrades, and more

- Transfer your miles to your choice of 15+ travel loyalty programs

- How To Find the 75k or 100k Bonus for the Capital One Venture

- Travel Insurance Benefits of the Capital One Venture

- Capital One Venture Card vs. Capital One VentureOne Card [Detailed Comparison]

- Chase Sapphire Preferred vs Capital One Venture

- Best Travel Credit Cards

- Best Everyday Credit Cards

- Best Credit Cards for Groceries and Supermarkets

- Best Credit Card Sign Up Bonuses

- Capital One vs. Citi Credit Cards – Which Is Best? [2024]

- Recommended Minimum Requirements for Capital One Credit Cards

Capital One VentureOne Rewards Credit Card

The card offers unlimited miles at 1.25x per $1 and no annual fee. When you consider the flexible rewards, frequent travelers come out on top.

Interested in a travel rewards credit card without one of those pesky annual fees? Then say hello to the Capital One VentureOne Rewards Credit Card.

In addition to no annual fee, the Capital One VentureOne card offers no foreign transaction fees.

But is this card worth its salt, or is it merely a shell of the more popular Capital One Venture card?

- No annual fee ( rates & fees )

- Ability to use transfer partners

- Fraud coverage

- Weak earn rate at 1.25x miles per $1 spent on all purchases

- No luxury travel or elite benefits

- $0 annual fee and no foreign transaction fees

- Earn a bonus of 20,000 miles once you spend $500 on purchases within 3 months from account opening, equal to $200 in travel

- Earn unlimited 1.25X miles on every purchase, every day

- Enjoy 0% intro APR on purchases and balance transfers for 15 months; 19.99% - 29.99% variable APR after that; balance transfer fee applies

- APR: 19.99% - 29.99% (Variable),0% intro on purchases for 15 months

- No Annual Fee Cards

- Benefits of the Capital One VentureOne Card

- Capital One Venture X Card vs. Capital One VentureOne Card [Detailed Comparison]

- Capital One Platinum Card vs. VentureOne and Venture Cards [Detailed Comparison]

- Best Virtual Credit Cards

- Best Instant Approval Credit Cards

- Capital One Transfer Partners

- easyJet Review – Seats, Amenities, Customer Service, Baggage Fees, & More

- The 5 Best First Credit Cards For Beginners [April 2024]

In addition, these business cards earn Capital One miles:

Capital One Venture X Business Card

The Capital One Venture X Business card offers at least 2x miles on all purchases, and comes packed with premium perks.

The information regarding the Capital One Venture X Business card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

The Capital One Venture X Business card is a great all-around premium rewards card that helps you rack up miles on all of your business expenses.

From 2x miles on all purchases, airport lounge access, an annual travel credit, complimentary employee cards, and more, there is plenty to love about the Capital One Venture X Business card.

- Unlimited complimentary access for cardholder and 2 guests to 1,300+ lounges, including Capital One Lounges and Priority Pass lounges

- No-additional-fee employee cards ( rates and fees )

- No preset spending limit

- No foreign transaction fees ( rates and fees )

- $395 annual fee ( rates and fees )

- 10x and 5x bonus categories are limited to Capital One Travel bookings

- Earn unlimited 2X miles on every purchase, everywhere—with no limits or category restrictions

- This card has no preset spending limit, so you get purchasing power that adapts to your spending needs. The annual fee on this card is $395

- Earn 150,000 bonus miles once you spend $30,000 in the first 3 months from account opening

- Redeem your miles on flights, hotels and more. Plus, transfer your miles to any of the 15+ travel loyalty programs

- Earn unlimited 10X miles on hotels and rental cars and 5X miles on flights booked through Capital One Travel, where you’ll get the best prices on thousands of options

- Every year, you’ll get 10,000 bonus miles after your account anniversary date. Plus, receive an annual $300 credit for bookings through Capital One Travel

- Empower your teams to make business purchases while earning rewards on their transactions, with free employee and virtual cards. Plus, automatically sync your transaction data with your accounting software and pay your vendors with ease

- Skip the lines with up to a $100 statement credit on TSA PreCheck ® or Global Entry. Then enjoy unlimited complimentary access to Capital One Lounges and a network of 1,300+ lounges worldwide, including Priority Pass™ and Plaza Premium Group lounges

- This is a pay-in-full card, so your balance is due in full every month

- Elevate your stay at luxury hotels and resorts from the Premier Collection with a $100 experience credit and other premium benefits on every booking

- APR: All charges made on this account are due and payable in full when you receive your periodic statement. The minimum payment due is the New Balance as indicated on your statement.

Capital One Spark Miles for Business

The Capital One Spark Miles card is a low-annual-fee business card that earns 2x transferable miles on every $1 you spend. (Information collected independently. Not reviewed by Capital One.)

The Capital One Spark Miles for Business is a great option for business owners looking for an uncomplicated rewards card that earns double miles on every purchase they make and offers access to transfer partners, all for a low annual fee.

- Unlimited 2x miles per $1 spent on all purchases

- 5x miles per $1 spent on hotel and rental cars purchased through Capital One Travel

- 2 complimentary visits to a Capital One Lounge per year

- Up to a $100 Global Entry or TSA PreCheck credit

- No foreign transaction fees

- Free employee cards

- Extended warranty coverage

- Annual fee: $0 intro for the first year, $95 after that

- Earn a one-time bonus of 50,000 miles – equal to $500 in travel – once you spend $4,500 on purchases within the first 3 months from account opening

- Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won’t expire for the life of the account

- Unlimited 5X miles on hotels and rental cars booked through Capital One Travel

- Transfer your miles to 15+ travel loyalty programs

- Redeem your miles instantly for any travel-related purchases, from flights and hotels to ride-sharing services

- Skip the lines with up to a $100 statement credit on TSA PreCheck ® or Global Entry

- $0 intro annual fee for the first year; $95 after that

- Free employee cards which also earn unlimited 2X miles from their purchases

- APR: 26.24% (Variable)

- Business Credit Cards

- Best Capital One Business Credit Cards

- Best Ways To Redeem Capital One Miles

- Capital One Miles Program Review

- How Much Are Capital One Miles Worth?

- Best High Limit Business Credit Cards

Capital One Spark Miles Select for Business

(Information collected independently. Not reviewed by Capital One.)

The Capital One Spark Miles Select for Business is an excellent option for business owners looking for straightforward earning with no blackout dates, no seat restrictions, and no minimum when redeeming your miles.

- Earn a one-time bonus of 20,000 miles once you spend $3,000 on purchases within the first 3 months from account opening.

- Get unlimited 1.5 miles on every purchase with your business credit card with no blackouts or seat restrictions, and no minimum to redeem.

- Earn 5X miles on hotel and rental car bookings through Capital One Travel.

- Use your miles on flights, hotels, vacation packages and more—you can even transfer miles to any of our 15+ travel partners.

- We’ve got you covered with zero fraud liability if your card is lost or stolen. Plus, get automatic fraud alerts via text, email or phone call.

- 0% intro APR for 9 months; 18.24% – 28.24% variable APR after that.

- APR: 0% Intro APR for the first 9 months after account opening,Ongoing APR: 18.24% - 28.24% Variable

- Foreign Transaction Fees:

- Best 0% APR Business Credit Cards

In addition to lucrative welcome bonus offers, Capital One makes it easy to earn miles — especially on travel purchases. Each of these cards come with access to Capital One Travel, but Capital One Venture X cardholders come out ahead by earning 10x miles on hotels and rental cars and 5x miles on flights when booked directly through the portal. All of the other cards above will earn 5x miles on hotels and rental cars through the portal.

Each of these cards also earns between 1.25x and 2x miles on all other eligible purchases , making it easy to earn a lot of Capital One miles .

Most people are familiar with redeeming Capital One miles through transfer partners or via the Capital One Travel portal. Another great option to use your miles is to cover all or part of your travel purchases on your statement credit — and it’s easy and convenient to do so!

For Capital One products listed on this page, some of the above benefits are provided by Visa ® or Mastercard ® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

The information regarding the Capital One Venture X Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One Venture Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One VentureOne Rewards Credit Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One Spark Miles Select for Business was independently collected by Upgraded Points and not provided nor reviewed by the issuer. The information regarding the Capital One Venture X Business Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Information regarding the Capital One Spark Miles for Business was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Frequently Asked Questions

What does capital one consider a travel purchase.

Capital One considers quite a lot under the category of “travel purchase.” Airlines, hotels, rail lines, car rental agencies, limousine services, bus lines, cruise lines, taxi cabs, travel agents, and timeshares all count as travel purchases.

Can Capital One miles go towards any airline purchase?

Yes, Capital One miles can be used to cover qualifying travel within 90 days of purchase — including airline purchases. However, there may be exceptions like airline gift cards bought at the grocery store, which would not code as a travel or airline purchase on your statement.

Between Capital One covering your travel purchases vs. redeeming for cash, which is best?

Redeeming miles for your travel purchases within the past 90 days will get you 1 cent per point in value. However, redeeming your Capital One miles for cash will only get you 0.5 cents per point in value.

Does Capital One cover electronics purchases?

Select Capital One credit cards may offer extended warranty coverage on qualifying purchases. However, you’ll want to check your cardmember agreement for what your card does and does not.

What’s the difference between account credit and cover past travel purchases with Capital One?

The main difference between an account credit and covering past travel purchases with a Capital One credit card is that you can only use your miles to cover select travel expenses within 90 days of purchase. Account credits would usually be a result of returning a purchase or redeeming a travel credit.

Was this page helpful?

About Ashley Onadele

Ashley discovered a love for travel in college that’s continued as her family has grown. She loves showing parents how they can take their families on trips using points and has contributed to numerous publications and podcasts.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

Related Posts

![15 travel loyalty programs capital one Capital One Miles Transfer Partners & How To Use Them [2024]](https://upgradedpoints.com/wp-content/uploads/2019/07/Emirates_Inaugural_Worlds_Shortest_A380_Business_Class_Middle_Row_Seat_Cherag_Dubash.jpg?auto=webp&disable=upscale&width=1200)

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

- Book Travel

- Credit Cards

Capital One Miles

Best Ways to Earn

Best ways to redeem.

With its range of 12 credit cards, Capital One lets you earn miles easily through lucrative welcome bonuses and everyday spending.

Then, as you accumulate Capital One miles, you can transfer them to a long list of partner loyalty programs and redeem them for aspirational luxury travel. Alternatively, you can simply redeem your miles for statement credits.

In this guide, we’ll cover everything there is to know about Capital One miles, including how to optimize your earning and redeeming within the program.

Earning Capital One Miles Through Welcome Bonuses

The easiest way to rack up Capital One miles is through credit card welcome bonuses. Currently, 12 credit cards comprise the Capital One lineup.

Capital One miles can straightforwardly be earned through seven personal and business credit cards. In addition, miles can also be earned in a roundabout way through five cash back credit cards.

The amount you can earn through signup bonuses is different for every card, and the offers change from time to time. Some cards may not even offer bonuses at all.

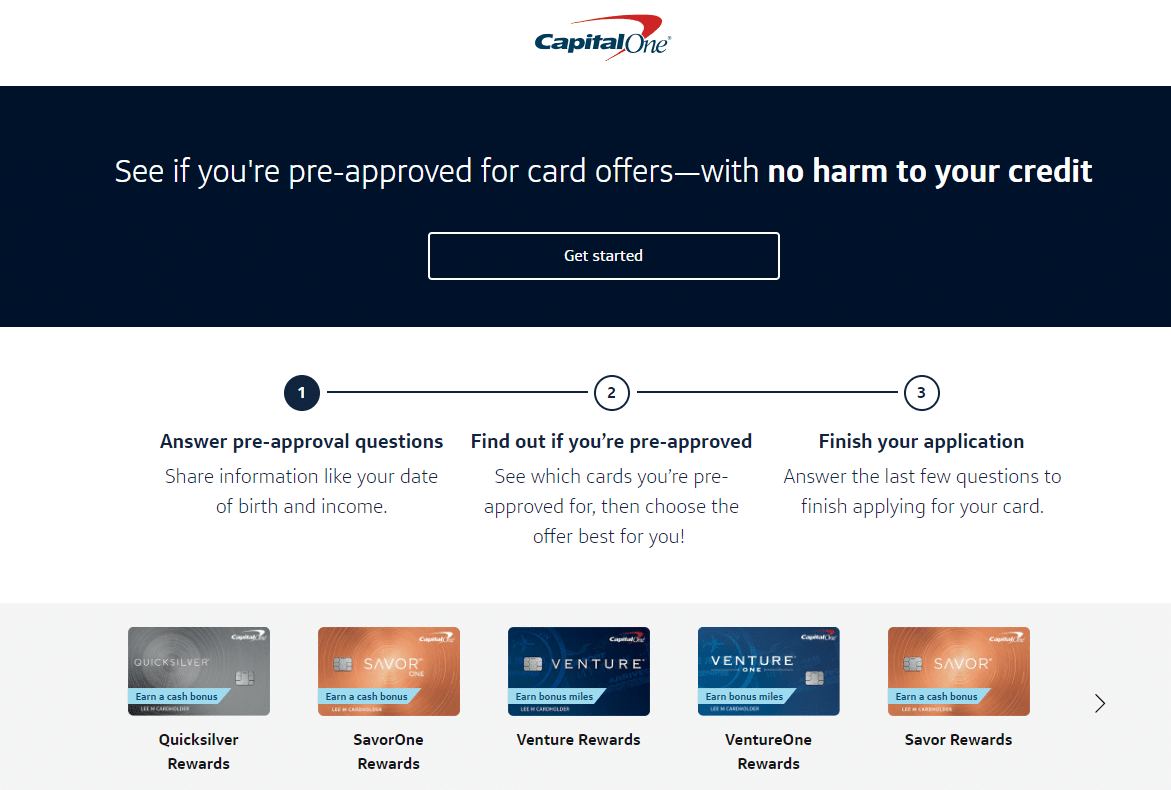

It’s also possible to get targeted offers that are higher than publicly available offers, and you can check through this landing page if you’re eligible for one.

Capital One Miles Credit Cards

Five credit cards earn Capital One miles directly: three personal cards under the Venture brand, and two business cards under the Spark brand.

Capital One’s flagship personal credit card is the Capital One Venture X , which is seen as a competitor to other high-end cards, like the Chase Sapphire Reserve and the Platinum Card by American Express.

Capital One Venture X usually offers a welcome bonus in the range of 75,000 miles, although it has previously been as high as 100,000 miles.

Aside from the generous welcome offer, the card’s hefty annual fee of $395 is offset by a $300 credit for Capital One Travel, a $100 experience credit with the Premier Collection of luxury hotels, and a $100 credit for Global Entry or TSA PreCheck. The Venture X also comes with a slew of travel perks, such as unlimited airport lounge access and Hertz President Circle status.

The mid-tier counterpart of Capital One Venture X is the Capital One Venture Rewards , which commands a modest $95 annual fee. Like the Venture X, the Venture Rewards’s welcome bonus ranges between 75,000 and 100,000 miles; however, given its lower annual fee, its travel benefits are limited to a $100 credit for Global Entry or TSA PreCheck and three complimentary airport lounge visits.

Lastly, the Capital One VentureOne is the entry-level personal card that carries no annual fee. Its welcome bonus is usually modest, ranging from 20,000 miles to a high of 40,000 miles.

For business cards, Capital One’s top-tier offering is the Spark 2x Miles card, which earns an unlimited 2x miles as its primary feature. With an annual fee of $95, its usual welcome bonus is 50,000 miles upon spending $4,500 within the first three months of opening.

Meanwhile, Capital One’s no-fee small business card is the Spark 1.5x Miles Select card, which carries a slightly lower 1.5x multiplier for spending. While its miles-earning power is lower than the Spark 2x Miles card, its welcome bonus is typically the same at 50,000 miles.

There’s also the Capital One Venture X Business card; however, it’s only available to certain Capital One business clients. If you’re eligible, you’ll need to go through your Capital One relationship manager to apply for the card.

Capital One Cash Back Credit Cards

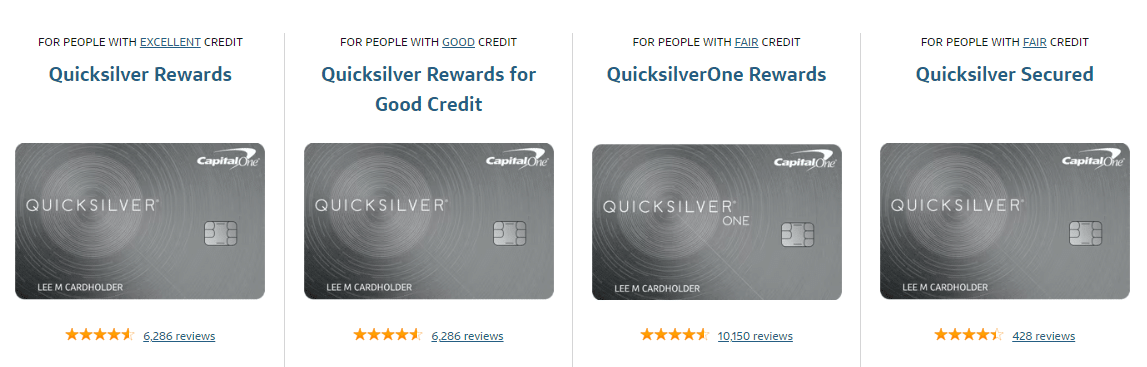

An interesting feature of Capital One’s cash back credit cards is that you’re allowed to convert cash back to miles, as long as you also hold a miles-earning card. One cash back cent can be converted to one mile.

Currently, there are seven cards that earn cash back: seven personal cards under the Quicksilver and Savor brands, and four business cards under the Spark brand.

The Quicksilver line of cards all offer a uniform 1.5% cash back on purchases. Only the Capital One QuicksilverOne Rewards card carries an annual fee of $29. The rest of the lineup, namely Capital One Quicksilver Rewards , Capital One Quicksilver Rewards for Good Credit , and Capital One Quicksilver Rewards Secured , don’t come with an annual fee.

The Quicksilver line is intended for applicants who have fair to good credit, so cards don’t come with many perks. Only the Quicksilver Rewards card, meant for those with excellent credit, offers a $200 cash bonus after spending the first $500.

In contrast, the Savor line of cards, which includes Capital One SavorOne Rewards for Good Credit , Capital One SavorOne Rewards , and Capital One Savor Rewards , is meant for those with good to excellent credit. The cards feature better earning rates and welcome bonuses.

The flagship card, Capital One Savor Rewards , comes with a $95 annual fee, but it’s offset by the welcome offer of $300 cash bonus upon spending $5,000.

Meanwhile, the no-fee Capital One SavorOne Rewards card offers a $200 cash bonus upon spending $500, which you may view as a better deal given the smaller minimum spend requirement.

As for business cards, the Spark line of cards includes the Capital One Spark 2% Cash Plus , Capital One Spark 1.5% Cash Select , Capital One Spark 1.5% Cash Select for Good Credit , and Capital One Spark 1% Classic . As their names suggest, the cards are differentiated by their cash back earning rate.

The Capital One Spark 2% Cash Plus comes with a welcome offer of $500 cash back upon spending $5,000 and another $500 upon spending $50,000 in the first six months. Its annual fee of $95 has historically been waived in the past.

Meanwhile, the Spark 1.5% Cash Select has no annual fee, yet it still comes with a welcome bonus of $500 upon spending $4,500 in the first six months.

Meant for those with fair to good credit, the two other Spark cards don’t charge annual fees, but they also don’t come with any welcome bonuses.

Again, you can convert cash back to miles at a rate of 1 cent = 1 mile, as long as you also hold a card that earns miles. Hence, if you accrue $500 in cash back as a welcome bonus on the Quicksilver Rewards card, you can subsequently convert it to 50,000 miles.

Earning Capital One Miles Through Credit Card Spending

After collecting miles through credit card signup bonuses, spending on your miles and cash back credit cards is the next best way to earn more Capital One miles.

You’ll earn different amounts of miles or cash back rewards that can be converted to miles, depending on the card you’re using and the category of your spend.

- 10 miles per dollar spent on hotels and rental cars booked through Capital One Travel

- 5 miles per dollar spent on flights booked through Capital One Travel

- 2 miles per dollar spent on all other purchases

- 5 miles per dollar spent on hotels and rental cars booked through Capital One Travel

- 1.25 miles per dollar spent on all other purchases

- 2 miles per dollar spent on all purchases

- 1.5 miles per dollar spent on all purchases

- 1.5% cash back per dollar spent on all purchases

- 4% cash back per dollar spent on dining, entertainment, and streaming services

- 3% cash back per dollar spent at grocery stores

- 1% cash back per dollar spent on all other purchases

- 3% cash back per dollar spent on dining, entertainment, popular streaming services, and grocery stores

- 2% cash back per dollar spent on all purchases

- 1% cash back per dollar spent on all purchases

Among Capital One’s miles-earning cards, Capital One Venture X and Capital One Venture Rewards are your best bet, since both cards offer two miles per dollar spent on all categories. Plus, if you book through the Capital One Travel portal, you can earn 5–10 miles per dollar spent.

Meanwhile, amongst the cash back cards, the Savor Rewards card is the best choice, as it could potentially earn you 3–4% cash back, which is equivalent to 3–4 miles per dollar spent on different purchase categories.

Earning Capital One Miles Through Refer-a-Friend

Another way to earn extra Capital One miles is through Capital One’s refer-a-friend program. Not every cardholder will get the same amount per referral; thus, in order to see if you’re eligible and how much you can earn, simply sign into your account through the dedicated landing page .

Capital One Venture X Rewards cardholders can earn 25,000 miles per referral, up to a maximum of 100,000 miles per calendar year.

Venture Rewards, VentureOne Rewards, Spark 2x Miles, and Spark 1.5x Miles cardholders can earn between 10,000–20,000 miles per approved referral, up to a maximum of 50,000 miles per calendar year.

Lastly, all eligible cash back cards can earn between $100–200 per referral, depending on the card and what offer you get.

Redeeming Capital One Miles

Capital One miles are fairly flexible to redeem. While they can easily be redeemed as statement credits, you can derive better value by transferring them to other airline or hotel loyalty programs.

By transferring your miles to an airline loyalty program, for example, you can get outsized value by using your miles to book business class or First Class seats.

That being said, redeeming miles for statement credits is a lot more straightforward, and it isn’t a terrible option, especially if you don’t have any upcoming trips planned.

Transferring Capital One Miles to Other Loyalty Programs

Capital One miles can be transferred to an impressive range of 15 airline and three hotel transfer partners. Unless there is a bonus promotion, you can transfer Capital One miles to all available loyalty programs at a rate of 1:1, with a couple of exceptions as noted below.

Transfer bonuses do come up from time to time, and they generally range between 20-30% extra points or miles, depending on the program you’re transferring to.

The following are Capital One’s transfer partners:

- Aeromexico Club Premier

- Air Canada Aeroplan

- Air France/KLM Flying Blue

- Cathay Pacific Asia Miles

- Avianca LifeMiles

- British Airways Executive Club

- Emirates Skywards

- Etihad Guest

- Eva Air Infinity MileageLands (1 Capital One mile to 0.75 Eva Air mile)

- Finnair Plus

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

- TAP Miles&Go

- Turkish Airlines Miles&Smiles

- Accor Live Limitless (2 Capital One miles to 1 Accor point)

- Choice Privileges

- Wyndham Rewards

Transfer times to most programs on the list tend to complete instantly, with the exception of the following:

- Accor Live Limitless (up to two business days)

- Cathay Pacific Asia Miles (up to 24 hours)

- Choice Privileges (up to 24 hours)

- Eva Infinity MileageLands (up to 36 hours)

It’s always best to have specific travel plans before transferring Capital One miles to another loyalty program. Once once you transfer your miles, you won’t be able to transfer them back.

The best airline program to transfer your miles depends on your own travel goals and your personal circumstances, like which airlines fly out of your nearest airport.

However, if you’re looking for suggestions, Air Canada’s Aeroplan program is great for redeeming premium seats on flights it operates, as well as those operated by its Star Alliance and other partner airlines.

On the other hand, British Airways Executive Club , with Avios as its currency, is a great program for booking short-haul Oneworld partner flights in parts of Asia and Oceania. British Airways Avios can also be transferred to Qatar Airways Privilege Club, and can consequently be used to book coveted Qsuites and First Class seats on Qatar Airways.

Singapore KrisFlyer is the only means to redeem Singapore Airlines Suites awards. The highly-sought after experience lets you have your own private suite, with the option of having a double bed in the sky if you’re flying with someone else.

Finally, Air France/KLM Flying Blue can be an excellent option for flights from North America to Europe, especially if you take advantage of Promo Rewards. Every month, Flying Blue’s Promo Rewards offers certain routes to be redeemed at a discount.

Redeeming Capital One Miles as Statement Credits or Cash

Capital One miles can be redeemed as statement credits to cover a travel purchase you have previously made, or as cash at a lower rate.

You can redeem your Capital One miles for any travel expense you’ve made with your eligible Capital One card within the last 90 days.

Miles can be redeemed at a rate of 1 cent per mile, and there’s no minimum amount of miles required to cover a portion or all of your travel purchase.

You can redeem miles for travel expenses by navigating to the Rewards page on your Capital One account, and clicking on the “Cover travel purchases” option.

From there, you can choose what purchase you want to cover, and how many miles you would like to use to cover that purchase.

If you don’t have any eligible travel expenses in the past 90 days, you can redeem your miles for a statement credit on your credit card, or by receiving a check in the mail. However, the redemption rate for converting miles to cash is significantly lower at 0.5 cents per mile.

If you redeem this way, you’re getting half the value compared to offsetting travel purchases, and potentially even less compared to transferring to loyalty programs.

Redeeming Capital One Miles Through Capital One Travel

You can also redeem Capital One miles directly and immediately when you book travel through the Capital One Travel portal.

However, it’s not necessary to limit yourself to redeeming through Capital One Travel. While miles can be redeemed at 1 cent per mile through Capital One Travel , it’s the same redemption rate you’ll get by simply redeeming your Capital One miles against all your travel purchases, as described above.

What’s more, if you redeem miles directly through Capital One Travel, you’ll be missing out on the generous earning rates you’d otherwise earn if you pay with a qualifying card.

Also, hotels booked through Capital One Travel won’t count for status earning activity, and you most likely will not receive your elite status benefits at one of the major hotel chains. This is because Capital One Travel acts as an online travel agency, similar to Expedia.

If you wish to book a hotel where you’d normally get elite status benefits or earn elite qualifying night status, you’ll be better off booking through the hotel directly and then applying your Capital One miles to the purchase afterwards, unless you book through Premier Collection.

Premier Collection is Capital One’s preferred partner hotel program. Similar to Fine Hotels & Resorts by American Express, you’ll have access to elevated benefits if you are a Venture X or Venture X Business cardholder.

With Premier Collection, you’ll receive a $100 hotel credit, daily breakfast for two, and when available, room upgrades, early check-in, and late checkout.

Remember that Premier Collection rates can be more expensive. You should always compare the prices of a Premier Collection package with booking directly with the hotel, or with other similar preferred hotel programs like Marriott STARS and Luminous.

Other Options for Redeeming Capital One Miles

Capital One provides other redemption options aside transferring to another program and statement credits. However, these options provide significantly less value for your points, and should generally be avoided.

Capital One Entertainment is a platform where you can book tickets for concerts, sporting events, dining, and other experiences. While you may find some good deals, you should remember that you’re getting only 0.8 cents per mile redeeming this way.

Similar to Capital One Entertainment, you can also redeem Capital One miles for gift cards, Amazon credits, and Paypal rebates at a suboptimal rate of 0.8 cents per mile.

Transferring Capital One Miles

Capital One uniquely and generously allows you to transfer your miles to someone else for free. This added feature can be incredibly useful, as you can share your miles with anyone, even if they don’t live in the same household. You can also transfer an unlimited number of miles.

Once transferred, the miles can be redeemed per usual by your beneficiary – they can, for example, transfer them to their own airline or hotel loyalty programs.

In order to transfer your points to someone else, you’ll have to call Capital One, as the option isn’t available online.

Capital One miles are a great currency to collect. They are extremely flexible in that you can transfer them to one of many airline and hotel loyalty programs, or you can simply redeem them for statement credits to offset your own travel purchases. You can also transfer an unlimited number of miles to anyone.

The best way to earn Capital One miles is through credit card signup bonuses, especially with the Venture X and the Venture Rewards cards. Both cards also let you earn 2 miles per dollar spent on all purchases, and 5–10 miles per dollar spent on bookings through the Capital One Travel portal.

On the other hand, the best way to redeem Capital One miles is by transferring them to one of the 15 airline loyalty program partners. That way, you can book premium cabin seats without having to pay full price.

In all, you should definitely consider adding Capital One cards to your arsenal if you’re already in the US credit card game or if you’re planning to.

How To Transfer Capital One Miles

Vault’s viewpoint.

- If you have a Capital One credit card that earns miles, you can transfer your miles to Capital One’s 18 hotel and airline transfer partners to book travel.

- We’ll walk you through each step of transferring your miles.

- Capital One miles are worth 1.21 cents apiece on average, according to Newsweek Vault’s valuations, but the right award booking can net you greater value for your rewards.

Step by Step on How To Transfer Capital One Miles

Transferring your Capital One miles to travel partners is easy, and the process for doing so is mostly the same whether you do it in a web browser or on the mobile app (though the exact layout of pages may be slightly different). Here’s the step-by-step guide for how to do it:

1. Log In to Your Account and Find the Miles Transfer Page

From your account dashboard, find the tile that says “Explore Rewards and Benefits” and click on the “View Rewards” button.

On the next page, you’ll be presented with several options to redeem your miles. (You may need to scroll down to see them all.) Click on the tile that says “Convert rewards.”

2.Find Your Desired Transfer Partner

You’ll be taken to a page listing all of Capital One’s transfer partners, their transfer ratios and any current transfer bonuses. From the list, find the partner you want to transfer your miles to, then click the “Transfer Miles” text to the right of the partner’s name.

3. Link Your Partner Loyalty Account

You’ll see a pop-up prompting you to enter your partner loyalty account information to link it to your Capital One account. If you don’t yet have an account with the loyalty partner, you can create one on the partner’s website.

Once you’ve entered your information, click “Next.”

4. Enter Your Desired Transfer Amount and Complete the Transfer

Enter how many Capital One miles you want to transfer in the box provided, then click the “Complete Transfer” button to finalize the transaction. Remember, all transfers are final, so double-check that all your information is correct before proceeding with this step.

After your transfer is successful, you’ll get an email confirming the details of the transfer.

Value of Capital One Miles

Newsweek Vault values Capital One miles at 1.21 cents per mile, based on average calculations that take into account redemption options like cash back, statement credits and gift cards as well as transfers to travel partners. But, as with any credit card rewards program with flexible rewards, how much your miles are worth depends on exactly how you redeem them.

Aside from point transfers, these are some common redemption options and the value they give you for your miles:

- Statement credit to cover eligible travel purchases: 1 cent per mile. Keep in mind you can only use this option to offset specific purchases that Capital One considers “travel,” up to the amount of the purchase. You can’t redeem your miles for a general statement credit at the 1 cent/mile rate.

- Gift cards: varies by gift card, most are 0.8 cents per mile

- Cash back: 0.5 cents per mile

- Shop with PayPal: 0.8 cents per mile

- Shop with Amazon: 0.8 cents per mile

Note that these values only apply to Capital One cards that earn miles—such as the Capital One Venture Rewards Credit Card or Capital One Venture X Rewards Credit Card . Capital One cards that earn cash back, such as the Capital One Savor Cash Rewards Credit Card , have different redemption options and redemption rates. Cash back cards also don’t have direct access to transfer partners like miles-earning cards do.

Speaking of transfer partners, the value you’ll get out of your Capital One miles via point transfers can vary widely depending on the transfer partner and specific award booking. While the transfer ratios between Capital One and a travel partner are fixed (generally 1:1, with a few exceptions), the amount of points you’ll need to spend on any particular booking is determined by the specific loyalty program’s award rates and award availability.

Many travel rewards experts like to use the cents-per-point valuation method when calculating what rewards points/miles are worth in any given award booking. You can calculate it with the following formula:

Cents-per-point value of an award booking = [cash value of the booking – any taxes and fees paid in cash] / [points cost of a booking]

Even within the same rewards program, different bookings can have different values depending on the date or fare class. For example, take this one-way Air Canada flight from Boston to Montreal.

Here’s the cost of the flight in Aeroplan points, plus $38 Canadian Dollars (approximately $28 in United States Dollars) in taxes and fees. Capital One miles transfer to Aeroplan at a 1:1 ratio (barring any transfer bonuses), so the cost in Capital One miles is the same as the cost in Aeroplan points.

And here’s how much the same flight would cost in cash (prices shown in USD).

Using the cents-per-point valuation equation mentioned above, using your Capital One miles (converted to Aeroplan points) to book an economy flight would give you 1.6 cents/mile based on the following calculations:

[150 – 28] / 7,700 = 0.016 = 1.6 cents/mile

A business class flight would give you 2.2 cents/mile. While both can be considered worthwhile redemption, the business class flight gives you more monetary value for your miles.

However, that doesn’t mean a business class flight is the better option for everyone. If you don’t value luxury and would never pay $346 for a business class flight in the first place, the cents/mile calculation isn’t an accurate measure of the value you, personally , will get from this particular redemption.

Should You Transfer Your Capital One Miles?

Transferring your Capital One miles to travel partners is generally the best way to redeem them, as long as you can find a good deal on a flight or hotel award booking. But before you make the transfer, make sure you’ve considered the following:

- Have you confirmed award availability? Miles transfers are final, so make sure you find an award booking you want, confirm that it’s available and are otherwise ready to book before you finalize the transfer.

- Are you getting good value for your points? Aim to get at least 1 cent per mile on the award booking, as that’s the baseline value you’d get by redeeming your miles for a statement credit against travel purchases. If the cents-per-mile value is less than 1 cent, consider paying for the booking in cash, then either redeem your miles for a statement credit or save them for future use.

- Are there any transfer bonuses? Sometimes, Capital One will offer transfer bonuses to specific partners. For example, a 25% transfer bonus to an airline partner that normally has a 1:1 transfer ratio would mean 1,000 Capital One Miles can net you 1,250 points in that airline’s rewards currency. Transfer bonuses are a good way to boost the value of your miles, but you should only transfer points if you know for sure you’re going to make a booking with that partner.