Bring on the benefits.

Daily cash that grows in a savings account. 1.

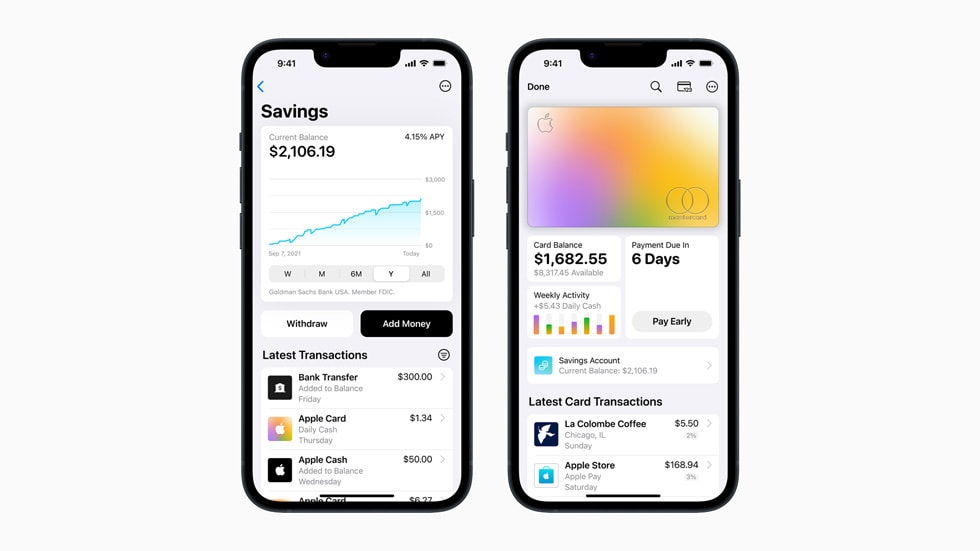

With Savings, you can choose to send your Daily Cash to a high-yield Savings account where it can earn 4.40% annual percentage yield (APY). 2 And because it’s all built into the Wallet app, it’s simple to get started. All it takes is a few steps to open an account and you're in.

Get started with savings

Just remember 3, 2, and 1%.

No matter where you shop with Apple Card, you always get unlimited Daily Cash back. That's real cash 3 you get back every day. Use it right away 4 with Apple Pay, send it to a friend with Apple Cash, 5 or watch it grow in a high-yield Savings account. Buy anything from Apple — including services like Apple Music or Apple TV, games and apps from the App Store, even in-app purchases — and enjoy 3% cash back.

cash back with Apple and select merchants when you use Apple Card with Apple Pay. 6

Get 3% back on everything you buy from Apple and at select merchants when you use Apple Card with Apple Pay.

cash back when you use Apple Pay.

Use Apple Pay wherever you see one of these symbols.

cash back when you use the titanium card or your virtual card number wherever Mastercard is accepted.

Learn how to order your titanium card

Grow your Daily Cash in a Savings account. 1

Apple Card gives you up to 3% unlimited Daily Cash back on every purchase. That’s real cash you can use right away, to send to a friend or use wherever Apple Pay is accepted when you send Daily Cash to Apple Cash. And with Savings, you can choose to send your Daily Cash into a high-yield Savings account where it can earn 4.40% annual percentage yield (APY). Add money from your bank account to Savings at any time, directly in the Wallet app. If you need to move money out, withdrawals to Apple Cash are typically instant, and usually take 1-3 business days with other bank accounts. 7 No minimum deposits, fees, or balances required. 8 And, you’re covered by FDIC insurance. 9

Open a Savings account

Enroll in Savings

Healthy finances. Family style.

Share the benefits of Apple Card with anyone in your Family Sharing group — whether it’s a partner, a child, or someone else you trust. 10 It’s a great way for everyone on the account to work toward healthy finances together. Add a Co-Owner 11 to build credit as equals 12 and manage the account together. You can also add kids and young adults as Participants. 13 And if a Participant is over 18, they can have the option to start building their own credit history. 14 Plus, everyone gets to enjoy their own unlimited Daily Cash back when they use Apple Card for their purchases. 15

Learn how to add someone to your Apple Card Family

Pay for new Apple products over time, interest-free. 16

Apple Card Monthly Installments lets you buy new Apple products, like iPhone, Mac, iPad, and more, and pay them off with interest-free monthly payments. You get 3% Daily Cash back, all up front. Simply choose Apple Card Monthly Installments as your payment option when you make your purchase at an Apple Store, in the Apple Store app, or on apple.com.

Learn more about Apple Card Monthly Installments

Accepted globally, with no foreign transaction fees. 17

Because Apple Card is part of the Mastercard network, it's accepted anywhere in the world. Plus, you have access to Mastercard benefits, like identity theft protection. And because Apple Card is designed to have no fees at all, you won't get charged any foreign transaction fees.

See all Mastercard benefits for Apple Card customers

Zero Liability Protection

Whether you pay in store, over the phone or online, you’re not responsible in the event someone makes unauthorized purchases with your card 1 . To learn more about Zero Liability, visit mastercard.com/zeroliability .

Mastercard ID Theft Protection TM

Monitor your credit file for fraud, receive alert notifications about suspicious activity and get assistance from a resolution specialist 2 . To enroll, visit applecard.idprotectiononline.com .

ShopRunner is an online membership that unlocks free two-day shipping and free returns at dozens of top stores, including Under Armour, Saks OFF 5TH, Bloomingdale’s, and more. Valued at $79 per year, you can enjoy this exclusive perk for free. Sign up now at shoprunner.com/mastercard .

Mastercard Travel & Lifestyle Services

With Mastercard you can always feel like a VIP. Enjoy free nights at partner hotels, hundreds of staycation offers, amenities and upgrades at properties in our portfolio, savings and status upgrades on cars and RV rentals and personal airport concierge service for that extra peace of mind. To book travel, visit travel.mastercard.com 3 .

Priceless Experiences®

With Priceless Experiences, you can make memories that will last a lifetime, including playing a round of golf with a legendary pro player, enjoying a virtual cooking class with a celebrity chef, jumping into online fitness, wellness and lifestyle lessons, and much more. Start exploring at priceless.com .

Priceless Golf

Mastercard gets you access to the TPC Network of clubs, travel packages to bucket-list destinations, golf schools, and much more. World and World Elite cardholders can secure tee times through the Hidden Network of private courses and enjoy Honorary Observer and Pro-Am positions at select PGA TOUR events. To learn more and book your Mastercard Golf experience, go to priceless.com/golf .

Terms and conditions

1. Conditions and exceptions apply.

2. Certain terms, conditions and exclusions apply. Cardholders need to register for this service. This service is provided by Iris® Powered by Generali. Please see your guide to benefits for details or call 1-800-MASTERCARD.

3. Certain terms, conditions and exclusions apply. Visit travel.mastercard.com for full details.

Advertiser Disclosure

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out. We only recommend products we either use ourselves or endorse. This site does not include all credit card companies or all available credit card offers that are on the market. See our advertising policy here where we list advertisers that we work with, and how we make money. You can also review our credit card rating methodology .

[Expired] Earn 5% Back on Travel and Dining With Targeted Apple Card Offer

James Larounis

Senior Content Contributor

547 Published Articles 1 Edited Article

Countries Visited: 30 U.S. States Visited: 35

Keri Stooksbury

Editor-in-Chief

33 Published Articles 3136 Edited Articles

Countries Visited: 47 U.S. States Visited: 28

![apple card travel offer [Expired] Earn 5% Back on Travel and Dining With Targeted Apple Card Offer](https://upgradedpoints.com/wp-content/uploads/2023/08/en-us-large@2x.png?auto=webp&disable=upscale&width=1200)

Targeted Offer

Final thoughts.

We may be compensated when you click on product links, such as credit cards, from one or more of our advertising partners. Terms apply to the offers below. See our Advertising Policy for more about our partners, how we make money, and our rating methodology. Opinions and recommendations are ours alone.

Update: The offer mentioned below has expired and is no longer available.

There’s a new targeted offer out for those who hold an Apple Card, and it offers 5% Daily Cash back on eligible travel and dining purchases. While not everyone will get this offer, for those that do, this is an incredible amount of Daily Cash back for these categories and can be used towards a high-yield savings account.

To start, this offer is targeted, and is likely highly targeted at that. Most people will not be targeted, though you can check your Apple Card within your Apple Wallet to see if you are. If targeted, there is no enrollment needed as the offer will automatically be enabled on your card. The offer is also available on all forms of the Apple Card, including the Apple Wallet version and physical card.

If you are targeted, you’re in for a real treat. Through September 20, 2023 , you can get 5% Daily Cash back on travel and dining purchases , up to $1,300 in Daily Cash — a generous amount that’s not usually seen with most credit card offers. This equates to $26,000 in spending .

Eligible travel purchases include: restaurants , cocktail lounges, discotheques, nightclubs, taverns, bars, eligible delivery services, and fast food restaurants.

Eligible travel purchases include: purchases with airlines and air carriers , car rental agencies , on lodging and resorts , timeshares, as well as travel agencies and tour operators.

These are 2 fairly broad categories, so it should be quite easy to accumulate the Daily Cash.

If you have other family members on your account, they won’t be able to contribute to this offer as it is only for the primary account holder only. Apple also says those “have engaged in or plan to engage in abuse or gaming in connection with this offer” will be deem ineligible for it, so you’ll want to use it only for yourself and not for any other friends or colleagues.

Once you accumulate your 5% Daily Cash back, this goes into a Daily Cash account within your Apple Wallet, which is a high-yield savings account. It earns interest like any other normal savings account, and you can use this money just like you can with a normal savings account.

This is an excellent offer for those consumers who are targeted. While most people won’t be eligible, if you are, it’s well worth taking full advantage of this offer and ensuring you use your Apple Card for all dining and travel purchases through September 20, 2023.

The information regarding the Apple Card was independently collected by Upgraded Points and not provided nor reviewed by the issuer.

Was this page helpful?

About James Larounis

James (Jamie) started The Forward Cabin blog to educate readers about points, miles, and loyalty programs. He’s spoken at Princeton University and The New York Times Travel Show and has been quoted in dozens of travel publications.

INSIDERS ONLY: UP PULSE ™

Get the latest travel tips, crucial news, flight & hotel deal alerts...

Plus — expert strategies to maximize your points & miles by joining our (free) newsletter.

We respect your privacy . This site is protected by reCAPTCHA. Google's privacy policy and terms of service apply.

UP's Bonus Valuation

This bonus value is an estimated valuation calculated by UP after analyzing redemption options, transfer partners, award availability and how much UP would pay to buy these points.

Home » Make It » Apple Card Promotions: $75 Sign-Up Bonus + $125 Family Share Offer

Apple Card Promotions: $75 Sign-Up Bonus + $125 Family Share Offer

Apple Card is offering new users a cashback sign-up bonus. Existing cardholders can also add family members as authorized users and earn up to $125 in Daily Cash.

See all available Apple Card promotions, referral bonuses, and other offers below.

This post may contain affiliate links, meaning I get a commission at no cost to you if you decide to make a purchase through my links. Visit this page for more information. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

What is the Apple Card?

Apple Card is a fee-free credit card designed primarily to be used with Apple Pay on an Apple device such as an iPhone, iPad, Apple Watch, or Mac. Launched in 2019, it now boasts over 6.7 million American cardholders.

This credit card offers 2% cashback (called Daily Cashback) when you use your iPhone or Apple Watch to pay with Apple Card and 3% Daily Cash when you use Apple Pay at Apple and the following select merchants:

- Panera Bread

- Walgreens (including Duane Reade)

- Exxon Mobil

- Ace Hardware

- Uber and Uber Eats

Daily Cash automatically goes on your Apple Cash card, which you can use on anything that you pay for using Apple Pay. If you don’t have an Apple Cash account, your Daily Cash will be redeemed as a statement credit.

If this is a card you’re interested in getting, make sure to sign up using one of the Apple Card offers below to receive a sign-up bonus.

Apple Card Promotions

Offer #1: apple card $75 sign-up bonus.

New users can get a $75 Daily Cash bonus when you apply using the link below to open a new Apple Card.

How To Receive Cashback Bonus:

- Apply for a new Apple Card using this link .

- Make your first purchase using the Apple Card within 30 days of account opening.

- Receive $75 in Daily Cash after your first transaction posts to your Apple Card account.

Bonus Terms & Conditions:

- Valid only for new Apple Card holders who apply under this promotion at apple.co/referdailycash, open an account by January 16, 2024 and make a purchase within 30 days of opening the Apple Card account. Accounts opened after June 6, 2023 do not qualify.

- Not valid for existing Apple Card users who merge their Apple Card accounts to become Co-Owners with other existing Apple Card users, or for Co-Owners or Participants added on a new Apple Card Family account. For clarity, any spend by Apple Card Family Participants and Co-Owners does not qualify.

- $75 cash back is earned as Daily Cash and is transferred to the new account’s Apple Cash card after the first transaction posts to the new Apple Card account.

- A return of a purchase on which the new account earned the $75 Daily Cash bonus may result in a $75 Daily Cash adjustment charge to the new account. An additional purchase made during the offer period may qualify the new account for re-fulfillment of the $75 Daily Cash bonus, but re-fulfillment may be delayed.

- Changes to the new account status during the offer period may delay the fulfillment of the Daily Cash bonus.

- An Apple Cash card is required to use Daily Cash, except if you do not have an Apple Cash card, in which case you can only apply your Daily Cash as a credit on your statement balance. The Apple Cash card is issued by Green Dot Bank, Member FDIC. See apple.com/apple-pay for more information.

- Daily Cash is earned on purchases after the transaction posts to your account. Actual posting times vary by merchant.

- Daily Cash is subject to exclusions, and additional details apply. See the Apple Card Customer Agreement for more details.

- If the new account holder has engaged in or plans to engage in abuse or gaming in connection with this offer the new account will not be eligible for this offer.

Offer #2: Apple Card Family $125 Offer

Share your Apple Card with anyone you call family and each person will receive $25 Daily Cash when they spend $25 in their first 30 days.

You can add anyone age 13 or over to your Apple Card as an authorized user (Apple calls them a “participant”. This is a great option for kids and young adults because they can learn about credit and healthy spending habits while you set the spending limits.

Your credit limit can be extended to your participants and you can also see where they’re spending with Apple Maps.

Every participant gets their own titanium card, and participants age 18 or over can even use Apple Card to build their credit history.

Offer #3: Apple Card Referral Bonus

Existing Apple Card users can invite friends and offer them $75 in Daily Cash as a referral bonus. However, there is no incentive for the referrer.

New users must make a purchase within 30 days of opening their Apple Card account to receive the $75 Daily Cash bonus.

How To Refer A Friend:

- Open the Wallet app on iOS.

- Tap on the Apple Card.

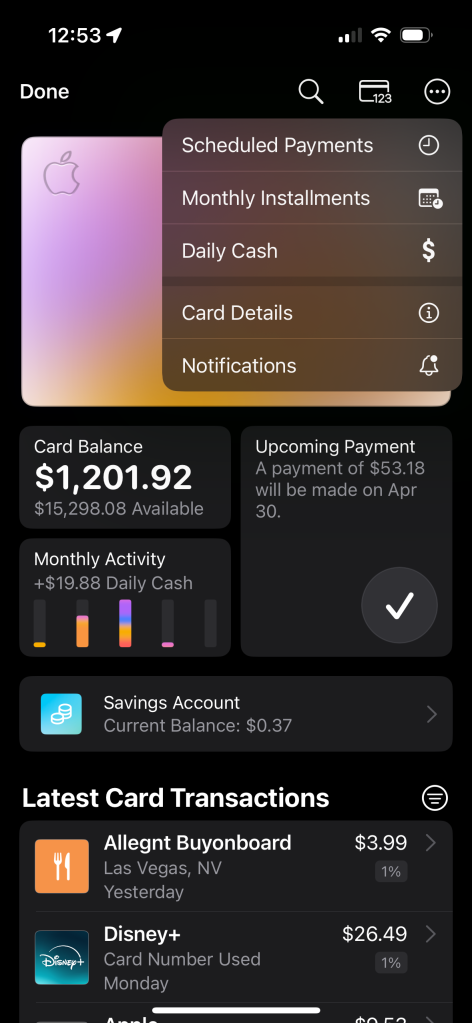

- Select “Daily Cash” in the three-dot menu icon on the top-right corner.

You should see a “Get More from Apple Card” section in the middle of the following screen with the referral promotion.

The Bottom Line

Unsurprisingly, this has been a very popular credit card ever since it launched. While the card benefits and perks are better compared to the average card, it’s not great enough to make my list of the best credit cards .

However, this will appeal to many because its cashback program is good for a credit card that doesn’t charge an annual fee or really any fees for that matter. The Apple Card has very few fees that are common with other cards.

For example, you’re not assessed a fee for late or missed payments (but it will still result in interest charges on your total balance). If you travel internationally, the card also doesn’t charge a foreign transaction fee.

One recent feature that’s made available to Apple Card users is a savings account that earns a 4.15% APY. That yield is much better than what big national banks are offering, but it’s almost a full percentage lower than what the best high-yield savings accounts offer.

About John Pham

John Pham is a personal finance expert, serial entrepreneur, and founder of The Money Ninja. He has also been fortunate enough to have appeared in the New York Times, Boston Globe, and U.S. News & World Report. John has a B.S. in Entrepreneurship and a Masters in Business Administration, both from the University of New Hampshire.

Can you please email me the link? Apple card wants proof of promotion via friend’s email with friend’s email address on it. Thank you!!!

Apple Introduces Apple Card, With up to 3% Cash Back

Update: Some offers mentioned below are no longer available. View the current offers here .

Coming soon to your digital wallet: an Apple co-branded Mastercard, issued by Goldman Sachs. That's right — the Apple credit card we've been hearing about since last year is finally official.

The tech giant unveiled Apple Card at its service-focused event in Cupertino today. Apple CEO Tim Cook introduced the new card at a packed Steve Jobs Theater, explaining that "there's some things about the credit card experience that could be so much better." Namely, fees, sign-ups, security and rewards.

First, let's chat rewards. As Apple's VP of Internet Services Jennifer Bailey explained on stage, the company developed a straightforward model it's calling Daily Cash. Rather than arriving after your statement closes, as the name implies, Daily Cash will arrive in the form of Apple Cash after a transaction posts. You'll earn 3% cash back on Apple purchases, 2% on all purchases made via Apple Pay and 1% cash back on physical card purchases.

So assuming you're paying with Apple Pay, you're getting a return that's on par with many other cash-back cards , such as the Citi® Double Cash Card. If you're looking for the best return on your spending as well as the option to redeem rewards for travel, you'll still be better off with a travel rewards credit card like the Chase Sapphire Preferred Card or Capital One Venture Rewards Credit Card, but at least Apple Card comes with some bonus categories, even if they're not as competitive as, say, the Capital One Savor Cash Rewards Credit Card with 4% back on dining and entertainment. The information for the Capital One Savor Cash Rewards Credit Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Apple also set out to minimize fees. As the company explains:

"There are no fees associated with Apple Card: no annual, late, international or over-the-limit fees. Apple Card's goal is to provide interest rates that are among the lowest in the industry and if a customer misses a payment, they will not be charged a penalty rate."

Apple's promising lower interest rates as well.

Speaking of that physical card, it's made of titanium, and it looks fantastic — at least based on the on-screen demo we saw in Cupertino today. It has an incredibly simple design, with only your name and a chip, plus a magnetic strip on the rear, and will be used to process transactions with merchants that don't yet accept digital payments, such as restaurants and antiquated mass-transit systems.

To get the full functionality (and value) from your Apple Card, you'll want to use the app. You'll get a list of transactions, detailed trend reports, payment reminds, rewards tracking and more. Even customer service communications are handled via text — simply send a request via Messages to get support.

Apple Card is expected to be available this summer, with sign-ups exclusively available through the Wallet app. And, since it's Wallet-based, you won't need to wait for a physical card — once approved, your card will be available to use via the app right away.

Be sure to check out additional in-depth coverage on Apple Card below:

- Why You Should Care About the Apple Card, Even If You Aren't Getting It

- Questions and Answers About Apple's New Credit Card

- Will the Apple Card Be the Best Credit Card for Apple Purchases?

For the latest travel news, deals and points and miles tips please subscribe to The Points Guy daily email newsletter .

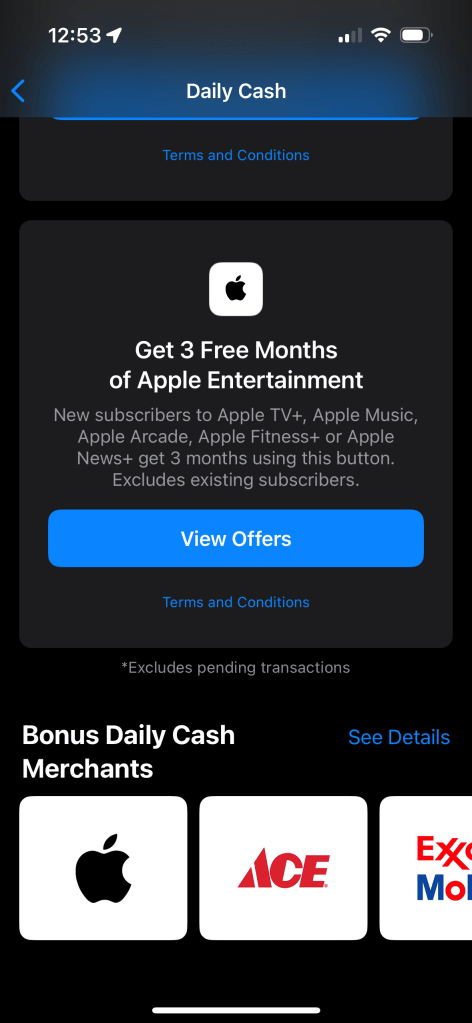

Apple Card teams up with Nike for 10% cash back

Apple Card has shared its latest promotion for customers – 10% Daily Cash up to $50 back on purchases at Nike . Here are the details…

Apple Card customers started getting emails today about the new limited-time promo:

Now through May 2, you’ll earn a total of 10% Daily Cash back when you use your Apple Card with Apple Pay at Nike.com , in select Nike apps, or at U.S. Nike stores. Take advantage of this limited-time offer and earn up to $50 back.

Here’s the fine print on the Nike deal:

10% Daily Cash: Valid 4/25/24 through 5/2/24 (“Offer Period”). All Existing Apple Card holders will earn a total of 10% Daily Cash on up to $500 in total Qualifying Purchases made at Nike using your Apple Card with Apple Pay. The 10% earn rate includes the 3% standard earn on Nike purchases plus an additional 7% bonus earn. The maximum total Daily Cash you can earn through this offer is $50 (which is $35 in Bonus Daily Cash). Qualifying Purchases at Nike include purchases made within the U.S. by Existing Apple Card holders using Apple Card with Apple Pay at participating Nike stores, Nike.com, the Nike mobile app, the Nike SNKRS app, or Swoosh.com (collectively “Nike Platforms”). Excluded from Qualifying Purchases are Nike products sold outside of the Nike Platforms by third party merchants. Existing Apple Card holders are defined as current Owners, Co-Owners, Participants or Apple Card holders who merge Apple Card accounts during Offer Period. Total qualifying spend is determined independently for Existing Apple Card holders within the same Apple Card Family. This means that each Existing Apple Card holder within the same Apple Card Family is eligible to earn a total of 10% back, up to $50 Daily Cash, based on their own Qualifying Purchases at Nike using their Apple Card with Apple Pay, subject to $500 total qualifying spend. After meeting the $500 maximum spend amount, all purchases made at Nike will earn the Daily Cash rate noted in your Apple Card Customer Agreement. You can choose to direct Daily Cash to a Savings account or to an Apple Cash card. If you do not have either set up to receive your Daily Cash, it can be applied as statement credit. Apple Card and Savings accounts are issued or provided by Goldman Sachs Bank USA, Salt Lake City Branch, Member FDIC. The Apple Cash card is issued by Green Dot Bank, Member FDIC. Actual posting times vary by merchant. Daily Cash is subject to exclusions, and additional details apply. See the Apple Card Customer Agreement for more information. If we determine that you have engaged in or plan to engaged in abuse or gaming in connection with this offer, you will not be eligible for this offer.

FTC: We use income earning auto affiliate links. More.

Check out 9to5Mac on YouTube for more Apple news:

A new kind of credit card. Created by Apple, no…

Michael is an editor for 9to5Mac. Since joining in 2016 he has written more than 3,000 articles including breaking news, reviews, and detailed comparisons and tutorials.

Michael Potuck's favorite gear

Satechi USB-C Charger (4 ports)

Really useful USB-C + USB-A charger for home/work and travel.

Apple Leather MagSafe Wallet

My slim wallet of choice for iPhone 12

Manage push notifications

You are using an outdated browser. Please upgrade your browser to improve your experience.

Apple Card promotion offers users 10% cash back on Nike purchases

Apple Card holders are eligible for 10% cashback on NIke purchases

With Nike's limited-time offer, Apple Card holders can earn a maximum of $50 in immediate cash back. The new promotional offer is valid from April 25 through May 2, 2024, and covers purchases made through all of Nike's official platforms.

Purchases made through Nike.com , Swoosh.com , and Nike's official SNKRS app are all eligible for the promotion, as are purchases made in-person at Nike locations. The ten percent cash back promotion applies only to purchases made by Apple Card and through Apple Pay .

Nike purchases made through Apple Pay and with an Apple Card usually reward users with three percent cash back. With Nike's latest promotion, such purchases will receive an additional seven percent up to $500 made through Apple Pay and via Apple Card until May 2, 2024.

covers purchases made through all of Nike's official platforms. One could probably save more than 10% by buying at a third party site.

bonobob said: covers purchases made through all of Nike's official platforms.

One could probably save more than 10% by buying at a third party site.

Very likely true though often size, color, and style selections are limited. I've very forgiving on color with a good discount is involved.

Top Stories

Amazon discounts the Apple Studio Display to $1,299.97 ($300 off)

New iPad Pro unexpectedly rumored to debut with M4 chip

Retro gold rush: these emulators are coming to the App Store soon

The Worst of WWDC - Apple's biggest missteps on the way to success

Apple said to have restarted discussion for OpenAI integration into iOS 18

New iPad Air & iPad Pro models are coming soon - what to expect

Featured deals.

Save up to $350 on every Apple M3 MacBook Pro, plus get up to $80 off AppleCare

Latest news.

Crime blotter: NYPD officer acquitted for 2021 punch in Apple Store

In this week's look at the Apple crime blotter, Canadian Police are looking into iPhone thefts, fraud has been alleged in third-party Apple Store pick-ups, an iPhone was stolen in a viral video, and more!

New iPhone 16 leak blows the cover off of screen sizes & camera bump

Frequent leaker Sonny Dickson has revealed a photo purporting to show the forthcoming iPhone 16 lineup, and the screen sizes for each of the four models.

Amazon discounts the Apple Studio Display to $1,299 ($300 off)

Save $300 on the Apple Studio Display at Amazon this weekend, with prices dropping to as low as $1,299.97 (the lowest price on record).

Apple Pencil coming on May 7 could buzz users with haptic feedback

The next generation of Apple Pencil could have haptic feedback, buzzing a user's fingers as they draw and write.

New iPad Pro rumored to debut with M4 chip

A new rumor claims that the forthcoming iPad Pro, scheduled to debut on May 7, could be the first Apple product with the next-generation M4 chip powering it.

Some users are randomly getting locked out of their Apple ID accounts

Overnight, a notable portion of iCloud users were getting logged out of their accounts across all of their devices, and the only way back in was to perform a password reset.

A report suggests that Apple is still looking across the spectrum of AI providers for iOS 18, with OpenAi again in conversations with the iPhone maker.

Apple is allowing emulators to be submitted to the App Store. Here's what's on the way so you can play your favorite retro games on your iPhone.

Latest Videos

All of the specs of the iPhone SE 4 may have just been leaked

When to expect every Mac to get the AI-based M4 processor

Latest reviews.

Unistellar Odyssey Pro review: Unlock pro-level astronomy with your iPhone from your backyard

Ugreen DXP8800 Plus network attached storage review: Good hardware, beta software

Espresso 17 Pro review: Magnetic & modular portable Mac monitor

{{ title }}

{{ summary }}

- a. Send us an email

- b. Anonymous form

- Buyer's Guide

- Upcoming Products

- Tips / Contact Us

- Podcast Instagram Facebook Twitter Mastodon YouTube Notifications RSS Newsletter

Apple Card Promo Offers 10% Daily Cash at Nike

Apple Card users can get extra Daily Cash back this week for Nike purchases thanks to a special Apple Pay promotion Apple is running with Nike.

Customers can earn up to $50 back, which means the extra cash is available for up to $500 in purchases.

Daily Cash is a benefit available to Apple Card owners. With each purchase, immediate cash back rewards are available. Apple typically provides two percent cash back for Apple Pay purchases, three percent for Apple Pay purchases at Apple locations, and one percent for everything else. Some retailers, such as Nike, have special deals with Apple where users can get three percent cash back.

The limited time deal is a seven percent total increase in Daily Cash back on Nike purchases.

Get weekly top MacRumors stories in your inbox.

Top Rated Comments

Nobody wears Nikes like that anymore. It’s Adidas, New Balance, and then other brands like On Running, Salomon, reebok, Etc.

Nobody wears Nikes like that anymore. It’s Adidas, New Balance, and then other brands like On Running, Salomon, reebok, Etc. Hopefully with the MLS deal, Apple lets go of this dead horse and works with Adidas instead.

Popular Stories

iOS 18 Rumored to Add These 10 New Features to Your iPhone

Apple ID Accounts Logging Out Users and Requiring Password Reset

Apple's Regular Mac Base RAM Boosts Ended When Tim Cook Took Over

The MacRumors Show: Apple's iPad Event Finally Announced!

Apple Event Rumors: iPad Pro With M4 Chip and New Apple Pencil With Haptic Feedback

Apple Announces 'Let Loose' Event on May 7 Amid Rumors of New iPads

Next article.

Our comprehensive guide highlighting every major new addition in iOS 17, plus how-tos that walk you through using the new features.

App Store changes for the EU, new emoji, Podcasts transcripts, and more.

Get the most out your iPhone 15 with our complete guide to all the new features.

A deep dive into new features in macOS Sonoma, big and small.

Revamped models with OLED displays, M3 chip, and redesigned Magic Keyboard accessory.

Updated 10.9-inch model and new 12.9-inch model, M2 chip expected.

Apple's annual Worldwide Developers Conference will kick off with a keynote on June 10.

Expected to see new AI-focused features and more. Preview coming at WWDC in June with public release in September.

Other Stories

3 days ago by Tim Hardwick

3 days ago by Joe Rossignol

4 days ago by MacRumors Staff

4 days ago by Joe Rossignol

6 days ago by Tim Hardwick

How to find the current Daily Cash promotions for your Apple Card

If you buy through a BGR link, we may earn an affiliate commission, helping support our expert product labs.

While the Apple Card has been in people’s wallets for a few years now, the company has done a pretty terrible job at marketing where you can earn a boost on your Daily Cash outside of the usual rewards the card offers everywhere.

- 3% Daily Cash: You earn 3% back on every purchase made directly with Apple (including stores, App Store, and services) when you use Apple Pay.

- 2% Daily Cash: For all other purchases made using Apple Pay, you get a standard 2% Daily Cash back.

- 1% Daily Cash: If you choose to use the physical card instead of Apple Pay (at stores that don’t accept it), you’ll earn only 1% Daily Cash back.

However, in addition to these three levels of rewards, Apple Card also offers 3% Daily Cash back when you use Apple Pay with your Apple Card at select merchants. These merchants change periodically, but it’s easy to keep track of who is currently offering the additional rewards.

Here’s how to do it.

Tech. Entertainment. Science. Your inbox.

Sign up for the most interesting tech & entertainment news out there.

By signing up, I agree to the Terms of Use and have reviewed the Privacy Notice.

How to find Daily Cash promotions for your Apple Card

1. Open the Wallet app on your iPhone.

3. Click the three dots (…) in the top right corner and select Daily Cash .

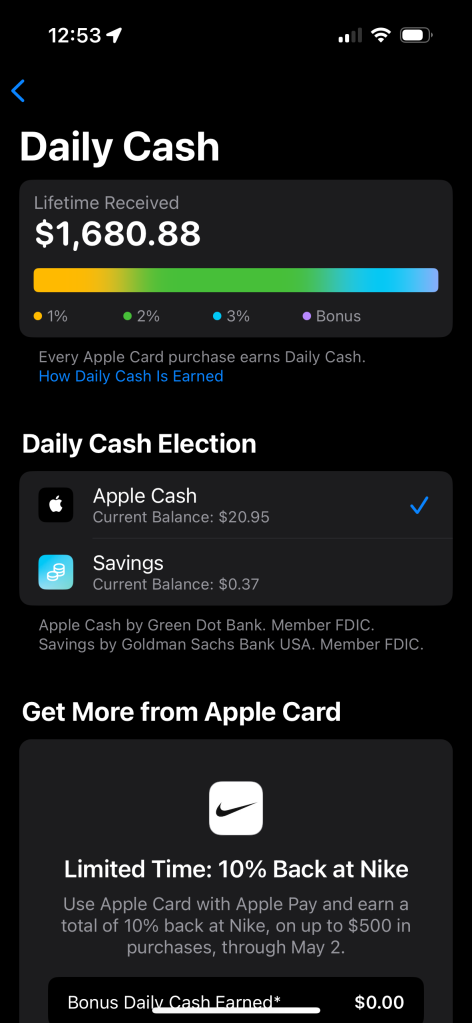

- Lifetime Daily Cash Earned: Track your total cash back rewards.

- Daily Cash Election: Choose to deposit Daily Cash into your Apple Cash account or your Apple Savings account.

- Get More from Apple Card: See if any specific merchants are currently offering a temporarily increased Daily Cash percentage (example below is Nike offering 10%)

- Progress Towards Offers: Keep an eye out for limited-time promotions, like earning bonus Daily Cash for adding new users to your Apple Card Family.

5. Scroll to the bottom of this screen to find Bonus Daily Cash Merchants .

That’s it! Apple will also send emails occasionally about additional offers to earn savings through Apple Pay, but this is the easiest way to find all of the current promotions for your Apple Card to earn some extra Daily Cash. Happy hunting!

This article talks about:

Joe Wituschek is a Tech News Contributor for BGR.

With expertise in tech that spans over 10 years, Joe covers the technology industry's breaking news, opinion pieces and reviews.

- 14 apps that I'll always keep on my iPhone's Home Screen

- Prime Day 2024: Amazon's massive yearly sales event returns this July

Use these 8 mind-blowing iOS secrets that I just learned today

You can buy this flame-throwing robot dog for less than $10,000

World’s largest 3D printer can print a house in under 80 hours

Apple Watch Series 10: Release date, price, and everything we know

Latest news.

One of Prime Video’s best new series just debuted with a 100% on Rotten Tomatoes

Scientist claims he has evidence we live in a simulation

Arzopa Z1RC review: It’s not all hype

NASA found a lake of lava that is ‘smooth as glass’ on Io

Sign up for the most interesting tech & entertainment news out there.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Apple Card Q&A: How It Works and What to Expect

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

UPDATE June 2021: The Apple Card is now available . Below is our article from March 29, 2019, after the card was first announced, updated to reflect the latest features of the card.

Apple, with its usual product-launch hoopla, touted how different its new Apple Card is from the competition. But the product's differentiators — and there are significant ones — are more subtle than sublime.

Apple has partnered with Goldman Sachs as the card issuer and Mastercard as the network to launch a credit card into a market that is already fiercely competitive. Issuers, including deep-pocketed megabanks, have been regularly improving and innovating their card offerings, especially in recent years.

Still, Apple has come up with a different digital-first flavor of credit card. Here’s how it will work.

» MORE: Should you get the Apple Card ? What to know before you bite

TERMS TO KNOW • Apple Card : The credit card. • Daily Cash : The card's cash-back rewards currency. • Apple Pay: Mobile payment system compatible with iPhone 6 and later. It allows wireless checkout at store terminals and in apps and websites that support it. • Apple Cash card: Virtual debit card that lives on your iPhone for sending and receiving money (similar to Venmo and PayPal). This is where Daily Cash will be credited. • Wallet app: A native iPhone app that includes your credit cards to be used with Apple Pay, as well as perhaps airplane boarding passes, loyalty cards and other virtual cards you’ve added.

How do I apply for the Apple Card ?

Instead of filling out an online form or a paper one, you apply for the Apple Card through the iPhone Wallet app. To see the application in Wallet, you must be running iOS 12.4 or higher. Approval (or rejection) will come in minutes, and you’ll have immediate access to the credit line on the account. That means you can start using the account via Apple Pay right away. Not all credit card issuers allow you to immediately use your credit line upon approval , but it’s not unusual. American Express, for example, offers it on all its credit cards.

If you want to use the physical version of the Apple Card , however, there's a separate hoop to jump through. You don't get that sleek titanium card automatically; you must request it separately once your Apple Card application is approved. (To do that, go to the Wallet app and tap "Apple Card." Tap the more options button (the one with the three dots), tap "Get Apple Card ," and then follow the instructions.)

» MORE: How to apply for the Apple Card in 3 steps

How good does your credit need to be?

Apple isn’t saying specifically, although it says it wants to make the card widely available, which suggests it might not require excellent credit (a FICO score of 720 or better).

Can I add authorized users?

Yes, through the Apple Card Family feature — although Apple uses the term "participants" instead of "authorized users." Participants ages 13 and up can make purchases with the card.

(At card launch, there was no way to add authorized users until the Apple Card Family feature rolled out in May 2021.)

» MORE: Credit card authorized users: What you need to know

Is there a sign-up bonus?

At launch, there was no sign-up bonus. But since then, the card has occasionally rolled out modest bonus offers — around $50 or so — for new applicants.

How do I pay with the Apple Card ?

Via an apple pay terminal.

The Apple Card will live among other credit cards tucked in your iPhone Wallet app and will work with Apple Pay terminals the same way those cards do. If you haven’t tried Apple Pay at the checkout register, it works like this to use the card you designated as the default:

Pay with iPhone via Face ID. Double-click the side button, glance at your iPhone to authenticate with Face ID or enter your passcode. Then, hold the top of your iPhone near the contactless reader.

Pay with iPhone via Touch ID. Rest your finger on Touch ID (but don’t press it to activate Siri). Hold the top of your iPhone near the contactless reader.

Pay with Apple Watch. Double-click the side button and hold the display near the contactless reader. Wait until you feel a gentle tap.

With successful payment, you’ll see “Done” and a checkmark on the display.

You can also use Apple Pay in apps and on websites that offer that checkout option.

» MORE: Best credit cards to use at Apple

Without Apple Pay

The physical card can be used normally, by swiping or inserting it into payment readers. But this version won't have a card number on it, nor will it have a CVV security code, expiration date or signature.

If you need to enter the card number online or on paper, those usual numbers are in the Wallet app.

» MORE: How the Apple Card stacks up against the competition

How do I get cash-back rewards?

Earning rewards.

The Apple Card will earn cash back, which it calls Daily Cash, at the following rates:

If you use Apple Pay, cash-back rewards are good: 2% back on all purchases is above average and 3% is competitive for purchases from a specific retailer. But limiting those rates to Apple Pay purchases only is a big restriction.

The physical card’s 1% cash back is not competitive today. The new normal is 50% more, 1.5% back .

Spending rewards

Daily Cash will be credited daily to customers’ Apple Cash card within their phones. (That's more frequent than with most cards, where your rewards are typically credited monthly.) If you’ve never used it, the Apple Cash card already sits in your iPhone Wallet. Apple Cash can be used right away for purchases using Apple Pay, to put toward your Apple Card balance or to send money to friends and family by text message.

There is no option to receive a check by mail. The other redemption option is direct deposit into a bank account. You can do that by transferring money from Apple Cash to a bank account anytime for free.

In sum, earning rewards with the Apple Card is a mixed bag, but using your cash back is adequately flexible.

What fees can I expect?

Good news: The card charges no annual fee, late fees or foreign transaction fees.

Simple cash-back cards often have no annual fees, so that’s not a competitive edge. But its lack of late fees or any charges for making purchases abroad is more unusual for this category of card.

Apple also touted no over-the-limit fees, but those fees have been essentially extinct for years.

So all you’ll have to pay to hold the card are interest charges when you carry a balance from month to month. When the card began accepting applications in August 2019, Apple said the interest rate was a variable APR of 12.99% to 23.99%, based on creditworthiness. The low end of that range is around 1 to 3 percentage points lower than many top cash-back credit cards from major banks, although credit union cards tend to carry even lower rates.

Apple won't offer balance transfers from other cards at launch.

How will Apple Card 's security features work?

Mobile payment systems like Apple Pay are more secure than a physical card. So it’s mostly the system, not the card, that will make Apple Card secure when using Apple Pay. In fact, Apple’s description of Apple Card ’s security is very similar to its description of the Apple Pay service launched in 2014.

Whether you’re using Apple Card or a different card in the Wallet for an Apple Pay transaction, the phone stores a unique number — different from your credit card number — and each transaction is authorized with a one-time, unique dynamic security code.

For Apple Card itself, the company created additional security and privacy measures so Apple doesn’t know where a customer shopped, what they bought or how much they paid.

And with rampant breaches of credit card numbers — if you learned that a website you shopped at had been compromised, for example — you could generate a new card number anytime within the Wallet app. The old number would be invalidated.

What money insights will it offer?

Among the goals Apple talked about is offering customers information on their spending, so they can make wiser financial choices.

Categorizing spending — into food spending, shopping and entertainment — is useful information, but not a groundbreaking offering. It’s available through many card issuers, banks and third-parties like NerdWallet and Mint.

One feature the Apple Card offers that you don’t see everywhere is relabeling cryptic transactions with easy-to-understand descriptions helped by machine learning and Apple Maps. That potentially will also help to accurately categorize spending.

The Apple Card will also encourage you to pay a little more on your credit card to avoid interest charges, a healthy habit.

What if I need help?

Round-the-clock support will be available via text message, Apple said. You can also place a voice call from the Wallet app.

What’s the deal with the titanium card?

The physical card associated with the account lacks the identifying numerical details you would typically expect to find — there's no card number or security code on it, which Apple said makes it more secure. (Again, that information is in the Wallet app.)

If you choose to get it, though, you should probably just frame it and hang it on a wall at home. Its 1% cash back rate isn’t competitive among today’s cash-back cards .

The bottom line? Apple Card is a good choice for your digital wallet, but a poor choice for your real one.

On a similar note...

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.

Apple Card’s High-Yield Savings Account Review April 2024: attractive APYs, but little else

Best known for its line of high-end devices, such as MacBooks, iPhones, iPads, and other gadgets, Apple launched the Apple Card in August 2019. Twelve million Apple Card users earned over $1 billion cash back on daily purchases in 2023. Now, users have another great feature: a high-yield savings account.

All rates and fees are current as of April 23, 2024, and are subject to change.

Apple Savings

- Attractive 4.50% APY on savings accounts

- Earn up to 3% cash back on daily purchases

- Has no minimum balance and no fees

- Exclusive to Apple product users

- Must have an Apple Card to have an Apple savings account

- No joint Apple savings account options

Apple rates and products

Right now, your banking options with Apple are limited. However, its high-yield savings account offers an attractive rate of 4.5% APY.

Savings accounts

Apple’s new Savings account is gaining a lot of buzz—and for good reason. As a high-yield savings account , it offers an impressive APY of 4.50%, a rate that is significantly higher than that of standard savings accounts.

While 4.5% is a great rate, it isn’t the highest offered. Additionally, these rates aren’t available to Android users as you must have an Apple Card to have a Savings account. Check out our list of current high-yield savings accounts for alternative options.

Apple savings account features

Apple savings rates compared to current top rates*.

While Apple is a great option, there are some institutions that offer higher interest rates. Compare the rates above to this list of competitors:

How does Apple Card work?

To use an Apple Card, you must have an iPhone or iPad where the card can be added to your Apple Wallet. You also won’t get a physical card in the mail unless you specifically request a titanium one; otherwise, it lives in your digital wallet.

You'll earn cash back, called Daily Cash back, on every purchase you make; 3% with select retailers, such as Apple and T-Mobile, and 2% cash back when using the Apple Card with Apple Pay. If a merchant doesn’t accept Apple Pay, you’ll earn 1% cash back instead.

You can then deposit your Daily Cash into a Savings account or an Apple Cash card. If you have neither, you can also receive a statement credit instead.

Other services Apple offers

- Apple Pay: Using your Wallet, pay using any stored card at retailers in person, in an app, or online, provided they accept Apple Pay. It’s a contactless payment method that takes a few taps.

- Apple Cash: Send and receive cash using iMessage with funds stored in your Wallet app.

- Apple Pay Later: Similar to Klarna or Affirm, Apple Pay Later is a new pay-in-four option to split your purchases over time. You can use it on any iPhone or iPad transactions between $75 and $1,000 to pay for your purchase over six weeks.

- Online banking: Apple is a bit different than your standard online bank or credit union . All your Apple Card and Apple Savings transactions are handled via the Wallet app on your iPhone or iPad. Additionally, you can access your account details via a web browser.

The Apple platform and customer support

Apple’s platform is easy to use and understand thanks to its simple user interface (UI). To access support for Apple's financial services, contact them by phone or through Messages in your Wallet. Depending on your inquiry, you may be referred to Goldman Sachs, which is the issuing bank for Apple Card and Apple Savings accounts.

Is Apple secure?

Apple responds to any vulnerabilities relatively quickly, such as the patch updates released in August 2022 that addressed issues with its Apple smart watches which were making them vulnerable to hackers. While it doesn't have any security issues specific to its banking products in particular, its issuing bank, Goldman Sachs, has had some issues in the past. For example, in September 2023, the United States Securities and Exchange Commission (SEC) fined it $6 million for a breach of its communications policy that took place over a 10-year period.

Apple user reviews

Customers appreciate the ability to finance their Apple purchases over time without interest and enjoy earning up to 3% cash back on their purchases. However, users caution that it might not be as useful to someone who isn't enmeshed in everything Apple, and suggest there are better alternatives for those with different spending needs.

Compare Apple alternatives

Is apple right for you.

If you’re an Apple enthusiast, an Apple Savings account and Apple Card might be right for simple, everyday spending. However, if you’re looking to keep all your banking with one institution, you’re better off looking elsewhere for an institution that has checking, savings, credit cards, loans, and brokerage account options.

Frequently asked questions

Is apple card a hard card to get.

The score used by Apple Card is the FICO Score 9, ranging from 300 to 850. If your score is above 660, you're likely to get approved.

Is an Apple Card an actual credit card?

When approved for an Apple Card, your ‘card’ is digital and gets added to the Wallet that lives on your iPhone or iPad. You can request a physical titanium card, but this must be done manually.

What is the maximum limit on an Apple Card?

Apple doesn't disclose its credit limits, however, Reddit forum answers vary. Some say their limit is as high as $82,000—but take that with a grain of salt. Any interested customers should contact Apple directly for further details.

EDITORIAL DISCLOSURE : The advice, opinions, or rankings contained in this article are solely those of the Fortune Recommends ™ editorial team. This content has not been reviewed or endorsed by any of our affiliate partners or other third parties.

Apple Card’s new high-yield Savings account is now available, offering a 4.15 percent APY

Text of this article

April 17, 2023

Starting today, Apple Card users can choose to grow their Daily Cash rewards with a Savings account from Goldman Sachs, which offers a high-yield APY of 4.15 percent 1 — a rate that’s more than 10 times the national average. 2 With no fees, no minimum deposits, and no minimum balance requirements, users can easily set up and manage their Savings account directly from Apple Card in Wallet. 3

“Savings helps our users get even more value out of their favorite Apple Card benefit — Daily Cash — while providing them with an easy way to save money every day,” said Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet. “Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.”

Once a Savings account is set up, all future Daily Cash earned by the user will be automatically deposited into the account. The Daily Cash destination can also be changed at any time, and there’s no limit on how much Daily Cash users can earn. To build on their savings even further, users can deposit additional funds into their Savings account through a linked bank account, or from their Apple Cash balance.

Users will also have access to an easy-to-use Savings dashboard in Wallet, where they can conveniently track their account balance and interest earned over time. Users can also withdraw funds at any time through the Savings dashboard by transferring them to a linked bank account or to their Apple Cash card, with no fees. 4

The new Savings account from Goldman Sachs builds upon the financial health benefits that Apple Card already offers, with absolutely no fees, 5 Daily Cash on every purchase, and tools that encourage users to pay less Apple Card interest — all, while offering the privacy and security users expect from Apple.

- Annual Percentage Yield (APY) is 4.15 percent as of 4/14/2023. APY may change at any time. Maximum balance limits apply . Savings is available with iOS 16.4 and later.

- Accurate as of the time of publication. The national average rate referenced is from the FDIC’s published National Rates and Rate Caps for Savings deposit products, accurate as of 3/20/2023. See the FDIC website for more information.

- Savings accounts are provided by Goldman Sachs Bank USA, Salt Lake City Branch. Member FDIC. Savings is available to Apple Card Owners and Co-Owners, subject to eligibility requirements.

- Transfer limits apply to Savings transfers to and from Apple Cash. See the Deposit Account Agreement for more information regarding transfer limits.

- Variable APRs for Apple Card range from 15.74 percent to 26.74 percent based on creditworthiness. Rates are as of April 1, 2023. Apple Card is subject to credit approval, available only for qualifying applicants in the United States, and issued by Goldman Sachs Bank USA, Salt Lake City Branch.

Press Contacts

Apple Media Helpline

Find wireless network providers and worldwide service providers that offer eSIM service

An eSIM is a digital SIM that allows you to activate a mobile data plan from your network provider without having to use a physical nano-SIM. Find out which wireless network providers in your country or region offer mobile plans on an eSIM, either activated by eSIM Carrier Activation, eSIM Quick Transfer or other activation methods. Many network providers also support eSIM activation on pre-paid plans, if you want to use a local line while travelling internationally. Worldwide service providers also offer eSIM plans in over 190 countries and regions to use while at home or when you travel. If your iPhone is unlocked, you can also use eSIM plans offered by other network providers.

Find out more about eSIM on iPhone and how to Use eSIM while travelling internationally with your iPhone .

Wireless network providers that support eSIM Carrier Activation

With eSIM Carrier Activation, your network provider can assign an eSIM to your iPhone digitally at the time of purchase, or if you call your network provider for an eSIM after the setup process.

Lucky Mobile

Virgin Plus

Czech Republic

Magyar Telekom

Reliance Jio

Puerto Rico

T-Mobile USA

South Korea

Switzerland

Chunghwa Telecom

Taiwan Mobile

United Kingdom

United States

Boost Mobile

Boost Infinite

Caroline West Wireless

Credo Mobile

H2O Wireless

Nex-Tech Wireless

Spectrum Mobile

Straight Talk

Strata Networks

Verizon Wireless

Xfinity Mobile

Wireless network providers that support eSIM Quick Transfer

With eSIM Quick Transfer, you can transfer your phone number from your previous iPhone to your new iPhone without contacting your network provider. You can also convert your physical SIM to an eSIM.

Rakuten Mobile

SK T elecom

United Arab Emirates

Cellcom Wisconsin

Wireless network providers that support other eSIM activation methods

In addition to eSIM Carrier Activation and eSIM Quick Transfer, these network providers support other ways of activating eSIM on iPhone, such as scanning a QR code or using a network provider app.

Grameenphone

Bhutan Telecom

Burkina Faso

Hrvatski Telekom

Dominican Republic

Bouygues Telecom

French West Indies

Docomo Pacific

China Mobile Hong Kong

MTX Connect

Tango Mobile

Crnogorski Telekom

Maroc Telecom

Netherlands

New Zealand

North Macedonia

Makedonski Telekom

Philippines

Saudi Arabia

Cable & Wireless

Slovak Telekom

A1 Slovenija

South Africa

Taiwan Star

Türkiye

Turk Telekom

Virgin Mobile

Appalachian Wireless

Carolina West Wireless

Chat Mobility

Consumer Cellular

Copper Valley Telecom

Metro by T-Mobile

Mint Mobile

NorthwestCell

Optimum Mobile

Pioneer Wireless

Thumb Cellular

Union Wireless

United Wireless

West Central Wireless

Wireless network providers that support eSIM activation on pre-paid plans for international travellers

When travelling, you can stay connected through an international roaming plan from your existing network provider. Alternatively, these network providers offer pre-paid plans if you would like a local line while travelling internationally.

Cable and Wireless

Worldwide service providers

Worldwide service providers allow you to stay connected with pre-paid data plans that you can use at home or when you travel in over 190 countries and regions. You can also purchase a plan before travelling, making staying connected even easier.

CMLink eSIM

DENT Wireless

Redtea Mobile

Soracom Mobile

Information about products not manufactured by Apple, or independent websites not controlled or tested by Apple, is provided without recommendation or endorsement. Apple assumes no responsibility with regard to the selection, performance or use of third-party websites or products. Apple makes no representations regarding third-party website accuracy or reliability. Contact the vendor for additional information.

Related topics

COMMENTS

Apple Pay is a safer way to pay that helps you avoid touching buttons or exchanging cash. And with every purchase you make using your Apple Card with Apple Pay, you get 2% Daily Cash back. No points to calculate. No limits or deadlines. Just real cash you can spend, send, or save and grow over time.

Share the benefits of Apple Card with anyone in your Family Sharing group — whether it's a partner, a child, or someone else you trust. 10 It's a great way for everyone on the account to work toward healthy finances together. Add a Co-Owner 11 to build credit as equals 12 and manage the account together. You can also add kids and young adults as Participants. 13 And if a ...

On Wednesday, Apple announced it is rolling out a new limited-time deal for eligible Apple Card cardholders. Cardholders will get 5% Daily Cash back on up to $20,000 on travel spending and up to ...

Apple Card has seen a number of Daily Cash promotions in recent years, but this latest one may be the biggest yet. The new promotion offers 5% Daily Cash back on up to $26,000 of travel and dining ...

Mastercard Travel & Lifestyle Services. With Mastercard you can always feel like a VIP. Enjoy free nights at partner hotels, hundreds of staycation offers, amenities and upgrades at properties in our portfolio, savings and status upgrades on cars and RV rentals and personal airport concierge service for that extra peace of mind.

The offer is also available on all forms of the Apple Card, including the Apple Wallet version and physical card. If you are targeted, you're in for a real treat. Through September 20, 2023 , you can get 5% Daily Cash back on travel and dining purchases , up to $1,300 in Daily Cash — a generous amount that's not usually seen with most ...

As far as rewards rates go, what the Apple Card offers is pretty standard. ... The best credit cards of 2024 Best travel credit cards Best rewards credit cards Best cash back credit cards.

APR ranges may vary based on when you accepted an Apple Card. Cardholders who accept an Apple Card on and/or after February 1, 2024: Variable APRs for Apple Card, other than ACMI, range from 19.24% to 29.49% based on creditworthiness. Rates as of February 1, 2024. Existing cardholders: See your Customer Agreement for applicable rates and fee.

The Apple Card offers an APR between 10.99 percent and 23.99 percent based on your credit score. ... Other benefits include Mastercard's travel discounts and upgrades, Mastercard's exclusive ...

The Apple Card best suits beginners and offers a simple rewards rate across all purchases. It could fit you if you make many purchases with Apple Pay or the (limited) list of 3% bonus merchants. If not, you can probably do better with a cash-back card offering 2% on all purchases.

See how to pay with Apple Card using Apple Pay, or how to use your virtual card number or titanium card. Buy with Apple Card; Get unlimited Daily Cash with Apple Card. Learn how you can receive a percentage of every purchase you make with Apple Card back as Daily Cash.

Apply for Apple Card on your iPhone. Open the Wallet app and tap the Add button. Select Apple Card, then tap Continue. Complete your application. Review and agree to the Apple Card Terms & Conditions. Accept your offered credit limit and APR. 3. After you accept your offer, Apple Card is added to the Wallet app and you can request a titanium ...

Cash-back rewards. 1. Earn bonus cash back with Apple Pay. Apple Card holders earn 3% cash back on purchases with Apple and at select merchants including Nike, T-Mobile, Exxon, and Walgreens when ...

Apple Credit Card Quick Facts. $0 annual fee. Can pay off eligible Apple purchases, in monthly installments, with no interest. Earn 3% back on eligible purchases from Apple including the Apple ...

The Apple Card offers 3% back when you use Apple Pay at select merchants. The 3% list expanded frequently in the first year but hasn't changed since 2020. ... Sara is a NerdWallet travel and ...

Table of Contents. Apple is offering up to $200 in Apple Daily Cash to Apple Card * customers and new users who are added to their account by December 17. Apple Card owners can add one co-owner ...

Offer #2: Apple Card Family $125 Offer. Share your Apple Card with anyone you call family and each person will receive $25 Daily Cash when they spend $25 in their first 30 days. You can add anyone age 13 or over to your Apple Card as an authorized user (Apple calls them a "participant".

Rather than arriving after your statement closes, as the name implies, Daily Cash will arrive in the form of Apple Cash after a transaction posts. You'll earn 3% cash back on Apple purchases, 2% on all purchases made via Apple Pay and 1% cash back on physical card purchases. So assuming you're paying with Apple Pay, you're getting a return that ...

10% Daily Cash: Valid 4/25/24 through 5/2/24 ("Offer Period"). All Existing Apple Card holders will earn a total of 10% Daily Cash on up to $500 in total Qualifying Purchases made at Nike ...

With Nike's limited-time offer, Apple Card holders can earn a maximum of $50 in immediate cash back. The new promotional offer is valid from April 25 through May 2, 2024, and covers purchases made ...

From April 25 through May 2, Apple Card owners will get 10 percent Daily Cash back on Nike purchases made using Apple Pay. The deal is available on the Nike website , the Nike app, and ...

Get Daily Cash you can use right away. Everyone in the family gets 3% Daily Cash back 7 on their own purchases of Apple products — all up front. And each user can choose where it gets deposited. Have it go to the Apple Cash card in the Wallet app, and it's ready to use whenever and however they want. 8 Or, Apple Card Owners and Co‑Owners can set up a high-yield savings account, and the ...

Progress Towards Offers: Keep an eye out for limited-time promotions, like earning bonus Daily Cash for adding new users to your Apple Card Family. 5. Scroll to the bottom of this screen to find ...

1% cash back. All purchases made with the physical Apple Card. If you use Apple Pay, cash-back rewards are good: 2% back on all purchases is above average and 3% is competitive for purchases from ...

Fortunately, many travel credit cards offer benefits for no annual fee. ... Apple TV+, Spotify and others. Hilton Honors American Express Card [ jump to details ] The Hilton ...

Savings accounts. Apple's new Savings account is gaining a lot of buzz—and for good reason. As a high-yield savings account, it offers an impressive APY of 4.50%, a rate that is significantly ...

Most travel cards have welcome offers that you can earn as a new cardholder. A card may offer 60,000 bonus points if you spend $4,000 on purchases in the first three months.

Starting today, Apple Card users can choose to grow their Daily Cash rewards with a Savings account from Goldman Sachs, which offers a high-yield APY of 4.15 percent 1 — a rate that's more than 10 times the national average. 2 With no fees, no minimum deposits, and no minimum balance requirements, users can easily set up and manage their Savings account directly from Apple Card in Wallet. 3

Many network providers also support eSIM activation on pre-paid plans, if you want to use a local line while travelling internationally. Worldwide service providers also offer eSIM plans in over 190 countries and regions to use while at home or when you travel.