The best travel insurance policies and providers

It's easy to dismiss the value of travel insurance until you need it.

Many travelers have strong opinions about whether you should buy travel insurance . However, the purpose of this post isn't to determine whether it's worth investing in. Instead, it compares some of the top travel insurance providers and policies so you can determine which travel insurance option is best for you.

Of course, as the coronavirus remains an ongoing concern, it's important to understand whether travel insurance covers pandemics. Some policies will cover you if you're diagnosed with COVID-19 and have proof of illness from a doctor. Others will take coverage a step further, covering additional types of pandemic-related expenses and cancellations.

Know, though, that every policy will have exclusions and restrictions that may limit coverage. For example, fear of travel is generally not a covered reason for invoking trip cancellation or interruption coverage, while specific stipulations may apply to elevated travel warnings from the Centers for Disease Control and Prevention.

Interested in travel insurance? Visit InsureMyTrip.com to shop for plans that may fit your travel needs.

So, before buying a specific policy, you must understand the full terms and any special notices the insurer has about COVID-19. You may even want to buy the optional cancel for any reason add-on that's available for some comprehensive policies. While you'll pay more for that protection, it allows you to cancel your trip for any reason and still get some of your costs back. Note that this benefit is time-sensitive and has other eligibility requirements, so not all travelers will qualify.

In this guide, we'll review several policies from top travel insurance providers so you have a better understanding of your options before picking the policy and provider that best address your wants and needs.

The best travel insurance providers

To put together this list of the best travel insurance providers, a number of details were considered: favorable ratings from TPG Lounge members, the availability of details about policies and the claims process online, positive online ratings and the ability to purchase policies in most U.S. states. You can also search for options from these (and other) providers through an insurance comparison site like InsureMyTrip .

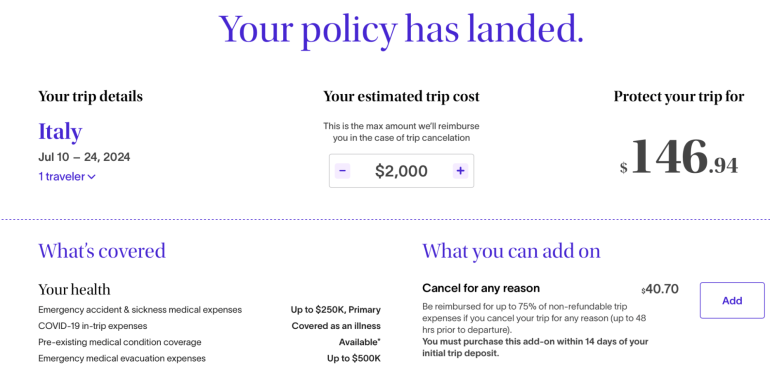

When comparing insurance providers, I priced out a single-trip policy for each provider for a $2,000, one-week vacation to Istanbul . I used my actual age and state of residence when obtaining quotes. As a result, you may see a different price — or even additional policies due to regulations for travel insurance varying from state to state — when getting a quote.

AIG Travel Guard

AIG Travel Guard receives many positive reviews from readers in the TPG Lounge who have filed claims with the company. AIG offers three plans online, which you can compare side by side, and the ability to examine sample policies. Here are three plans for my sample trip to Turkey.

AIG Travel Guard also offers an annual travel plan. This plan is priced at $259 per year for one Florida resident.

Additionally, AIG Travel Guard offers several other policies, including a single-trip policy without trip cancellation protection . See AIG Travel Guard's COVID-19 notification and COVID-19 advisory for current details regarding COVID-19 coverage.

Preexisting conditions

Typically, AIG Travel Guard wouldn't cover you for any loss or expense due to a preexisting medical condition that existed within 180 days of the coverage effective date. However, AIG Travel Guard may waive the preexisting medical condition exclusion on some plans if you meet the following conditions:

- You purchase the plan within 15 days of your initial trip payment.

- The amount of coverage you purchase equals all trip costs at the time of purchase. You must update your coverage to insure the costs of any subsequent arrangements that you add to your trip within 15 days of paying the travel supplier for these additional arrangements.

- You must be medically able to travel when you purchase your plan.

Standout features

- The Deluxe and Preferred plans allow you to purchase an upgrade that lets you cancel your trip for any reason. However, reimbursement under this coverage will not exceed 50% or 75% of your covered trip cost.

- You can include one child (age 17 and younger) with each paying adult for no additional cost on most single-trip plans.

- Other optional upgrades, including an adventure sports bundle, a baggage bundle, an inconvenience bundle, a pet bundle, a security bundle and a wedding bundle, are available on some policies. So, an AIG Travel Guard plan may be a good choice if you know you want extra coverage in specific areas.

Purchase your policy here: AIG Travel Guard .

Allianz Travel Insurance

Allianz is one of the most highly regarded providers in the TPG Lounge, and many readers found the claim process reasonable. Allianz offers many plans, including the following single-trip plans for my sample trip to Turkey.

If you travel frequently, it may make sense to purchase an annual multi-trip policy. For this plan, all of the maximum coverage amounts in the table below are per trip (except for the trip cancellation and trip interruption amounts, which are an aggregate limit per policy). Trips typically must last no more than 45 days, although some plans may cover trips of up to 90 days.

See Allianz's coverage alert for current information on COVID-19 coverage.

Most Allianz travel insurance plans may cover preexisting medical conditions if you meet particular requirements. For the OneTrip Premier, Prime and Basic plans, the requirements are as follows:

- You purchased the policy within 14 days of the date of the first trip payment or deposit.

- You were a U.S. resident when you purchased the policy.

- You were medically able to travel when you purchased the policy.

- On the policy purchase date, you insured the total, nonrefundable cost of your trip (including arrangements that will become nonrefundable or subject to cancellation penalties before your departure date). If you incur additional nonrefundable trip expenses after purchasing this policy, you must insure them within 14 days of their purchase.

- Allianz offers reasonably priced annual policies for independent travelers and families who take multiple trips lasting up to 45 days (or 90 days for select plans) per year.

- Some Allianz plans provide the option of receiving a flat reimbursement amount without receipts for trip delay and baggage delay claims. Of course, you can also submit receipts to get up to the maximum refund.

- For emergency transportation coverage, you or someone on your behalf must contact Allianz, and Allianz must then make all transportation arrangements in advance. However, most Allianz policies provide an option if you cannot contact the company: Allianz will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Allianz Travel Insurance .

American Express Travel Insurance

American Express Travel Insurance offers four different package plans and a build-your-own coverage option. You don't have to be an American Express cardholder to purchase this insurance. Here are the four package options for my sample weeklong trip to Turkey. Unlike some other providers, Amex won't ask for your travel destination on the initial quote (but will when you purchase the plan).

Amex's build-your-own coverage plan is unique because you can purchase just the coverage you need. For most types of protection, you can even select the coverage amount that works best for you.

The prices for the packages and the build-your-own plan don't increase for longer trips — as long as the trip cost remains constant. However, the emergency medical and dental benefit is only available for your first 60 days of travel.

Typically, Amex won't cover any loss you incur because of a preexisting medical condition that existed within 90 days of the coverage effective date. However, Amex may waive its preexisting-condition exclusion if you meet both of the following requirements:

- You must be medically able to travel at the time you pay the policy premium.

- You pay the policy premium within 14 days of making the first covered trip deposit.

- Amex's build-your-own coverage option allows you to only purchase — and pay for — the coverage you need.

- Coverage on long trips doesn't cost more than coverage for short trips, making this policy ideal for extended getaways. However, the emergency medical and dental benefit only covers your first 60 days of travel.

- American Express Travel Insurance can protect travel expenses you purchase with Amex Membership Rewards points in the Pay with Points program (as well as travel expenses bought with cash, debit or credit). However, travel expenses bought with other types of points and miles aren't covered.

Purchase your policy here: American Express Travel Insurance .

GeoBlue is different from most other providers described in this piece because it only provides medical coverage while you're traveling internationally and does not offer benefits to protect the cost of your trip. There are many different policies. Some require you to have primary health insurance in the U.S. (although it doesn't need to be provided by Blue Cross Blue Shield), but all of them only offer coverage while traveling outside the U.S.

Two single-trip plans are available if you're traveling for six months or less. The Voyager Choice policy provides coverage (including medical services and medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger and already have a U.S. health insurance policy.

The Voyager Essential policy provides coverage (including medical evacuation for a sudden recurrence of a preexisting condition) for trips outside the U.S. to travelers who are 95 or younger, regardless of whether they have primary health insurance.

In addition to these options, two multi-trip plans cover trips of up to 70 days each for one year. Both policies provide coverage (including medical services and medical evacuation for preexisting conditions) to travelers with primary health insurance.

Be sure to check out GeoBlue's COVID-19 notices before buying a plan.

Most GeoBlue policies explicitly cover sudden recurrences of preexisting conditions for medical services and medical evacuation.

- GeoBlue can be an excellent option if you're mainly concerned about the medical side of travel insurance.

- GeoBlue provides single-trip, multi-trip and long-term medical travel insurance policies for many different types of travel.

Purchase your policy here: GeoBlue .

IMG offers various travel medical insurance policies for travelers, as well as comprehensive travel insurance policies. For a single trip of 90 days or less, there are five policy types available for vacation or holiday travelers. Although you must enter your gender, males and females received the same quote for my one-week search.

You can purchase an annual multi-trip travel medical insurance plan. Some only cover trips lasting up to 30 or 45 days, but others provide coverage for longer trips.

See IMG's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Most plans may cover preexisting conditions under set parameters or up to specific amounts. For example, the iTravelInsured Travel LX travel insurance plan shown above may cover preexisting conditions if you purchase the insurance within 24 hours of making the final payment for your trip.

For the travel medical insurance plans shown above, preexisting conditions are covered for travelers younger than 70. However, coverage is capped based on your age and whether you have a primary health insurance policy.

- Some annual multi-trip plans are modestly priced.

- iTravelInsured Travel LX may offer optional cancel for any reason and interruption for any reason coverage, if eligible.

Purchase your policy here: IMG .

Travelex Insurance

Travelex offers three single-trip plans: Travel Basic, Travel Select and Travel America. However, only the Travel Basic and Travel Select plans would be applicable for my trip to Turkey.

See Travelex's COVID-19 coverage statement for coronavirus-specific information.

Typically, Travelex won't cover losses incurred because of a preexisting medical condition that existed within 60 days of the coverage effective date. However, the Travel Select plan may offer a preexisting condition exclusion waiver. To be eligible for this waiver, the insured traveler must meet all the following conditions:

- You purchase the plan within 15 days of the initial trip payment.

- The amount of coverage purchased equals all prepaid, nonrefundable payments or deposits applicable to the trip at the time of purchase. Additionally, you must insure the costs of any subsequent arrangements added to the same trip within 15 days of payment or deposit.

- All insured individuals are medically able to travel when they pay the plan cost.

- The trip cost does not exceed the maximum trip cost limit under trip cancellation as shown in the schedule per person (only applicable to trip cancellation, interruption and delay).

- Travelex's Travel Select policy can cover trips lasting up to 364 days, which is longer than many single-trip policies.

- Neither Travelex policy requires receipts for trip and baggage delay expenses less than $25.

- For emergency evacuation coverage, you or someone on your behalf must contact Travelex and have Travelex make all transportation arrangements in advance. However, both Travelex policies provide an option if you cannot contact Travelex: Travelex will pay up to what it would have paid if it had made the arrangements.

Purchase your policy here: Travelex Insurance .

Seven Corners

Seven Corners offers a wide variety of policies. Here are the policies that are most applicable to travelers on a single international trip.

Seven Corners also offers many other types of travel insurance, including an annual multi-trip plan. You can choose coverage for trips of up to 30, 45 or 60 days when purchasing an annual multi-trip plan.

See Seven Corner's page on COVID-19 for additional policy information as it relates to coronavirus-related claims.

Typically, Seven Corners won't cover losses incurred because of a preexisting medical condition. However, the RoundTrip Choice plan offers a preexisting condition exclusion waiver. To be eligible for this waiver, you must meet all of the following conditions:

- You buy this plan within 20 days of making your initial trip payment or deposit.

- You or your travel companion are medically able and not disabled from travel when you pay for this plan or upgrade your plan.

- You update the coverage to include the additional cost of subsequent travel arrangements within 15 days of paying your travel supplier for them.

- Seven Corners offers the ability to purchase optional sports and golf equipment coverage. If purchased, this extra insurance will reimburse you for the cost of renting sports or golf equipment if yours is lost, stolen, damaged or delayed by a common carrier for six or more hours. However, Seven Corners must authorize the expenses in advance.

- You can add cancel for any reason coverage or trip interruption for any reason coverage to RoundTrip plans. Although some other providers offer cancel for any reason coverage, trip interruption for any reason coverage is less common.

- Seven Corners' RoundTrip Choice policy offers a political or security evacuation benefit that will transport you to the nearest safe place or your residence under specific conditions. You can also add optional event ticket registration fee protection to the RoundTrip Choice policy.

Purchase your policy here: Seven Corners .

World Nomads

World Nomads is popular with younger, active travelers because of its flexibility and adventure-activities coverage on the Explorer plan. Unlike many policies offered by other providers, you don't need to estimate prepaid costs when purchasing the insurance to have access to trip interruption and cancellation insurance.

World Nomads offers two single-trip plans.

World Nomads has a page dedicated to coronavirus coverage , so be sure to view it before buying a policy.

World Nomads won't cover losses incurred because of a preexisting medical condition (except emergency evacuation and repatriation of remains) that existed within 90 days of the coverage effective date. Unlike many other providers, World Nomads doesn't offer a waiver.

- World Nomads' policies cover more adventure sports than most providers, so activities such as bungee jumping are included. The Explorer policy covers almost any adventure sport, including skydiving, stunt flying and caving. So, if you partake in adventure sports while traveling, the Explorer policy may be a good fit.

- World Nomads' policies provide nonmedical evacuation coverage for transportation expenses if there is civil or political unrest in the country you are visiting. The coverage may also transport you home if there is an eligible natural disaster or a government expels you.

Purchase your policy here: World Nomads .

Other options for buying travel insurance

This guide details the policies of eight providers with the information available at the time of publication. There are many options when it comes to travel insurance, though. To compare different policies quickly, you can use a travel insurance aggregator like InsureMyTrip to search. Just note that these search engines won't show every policy and every provider, and you should still research the provided policies to ensure the coverage fits your trip and needs.

You can also purchase a plan through various membership associations, such as USAA, AAA or Costco. Typically, these organizations partner with a specific provider, so if you are a member of any of these associations, you may want to compare the policies offered through the organization with other policies to get the best coverage for your trip.

Related: Should you get travel insurance if you have credit card protection?

Is travel insurance worth getting?

Whether you should purchase travel insurance is a personal decision. Suppose you use a credit card that provides travel insurance for most of your expenses and have medical insurance that provides adequate coverage abroad. In that case, you may be covered enough on most trips to forgo purchasing travel insurance.

However, suppose your medical insurance won't cover you at your destination and you can't comfortably cover a sizable medical evacuation bill or last-minute flight home . In that case, you should consider purchasing travel insurance. If you travel frequently, buying an annual multi-trip policy may be worth it.

What is the best COVID-19 travel insurance?

There are various aspects to keep in mind in the age of COVID-19. Consider booking travel plans that are fully refundable or have modest change or cancellation fees so you don't need to worry about whether your policy will cover trip cancellation. This is important since many standard comprehensive insurance policies won't reimburse your insured expenses in the event of cancellation if it's related to the fear of traveling due to COVID-19.

However, if you book a nonrefundable trip and want to maintain the ability to get reimbursed (up to 75% of your insured costs) if you choose to cancel, you should consider buying a comprehensive travel insurance policy and then adding optional cancel for any reason protection. Just note that this benefit is time-sensitive and has eligibility requirements, so not all travelers will qualify.

Providers will often require CFAR purchasers insure the entire dollar amount of their travels to receive the coverage. Also, many CFAR policies mandate that you must cancel your plans and notify all travel suppliers at least 48 hours before your scheduled departure.

Likewise, if your primary health insurance won't cover you while on your trip, it's essential to consider whether medical expenses related to COVID-19 treatment are covered. You may also want to consider a MedJet medical transport membership if your trip is to a covered destination for coronavirus-related evacuation.

Ultimately, the best pandemic travel insurance policy will depend on your trip details, travel concerns and your willingness to self-insure. Just be sure to thoroughly read and understand any terms or exclusions before purchasing.

What are the different types of travel insurance?

Whether you purchase a comprehensive travel insurance policy or rely on the protections offered by select credit cards, you may have access to the following types of coverage:

- Baggage delay protection may reimburse for essential items and clothing when a common carrier (such as an airline) fails to deliver your checked bag within a set time of your arrival at a destination. Typically, you may be reimbursed up to a particular amount per incident or per day.

- Lost/damaged baggage protection may provide reimbursement to replace lost or damaged luggage and items inside that luggage. However, valuables and electronics usually have a relatively low maximum benefit.

- Trip delay reimbursement may provide reimbursement for necessary items, food, lodging and sometimes transportation when you're delayed for a substantial time while traveling on a common carrier such as an airline. This insurance may be beneficial if weather issues (or other covered reasons for which the airline usually won't provide compensation) delay you.

- Trip cancellation and interruption protection may provide reimbursement if you need to cancel or interrupt your trip for a covered reason, such as a death in your family or jury duty.

- Medical evacuation insurance can arrange and pay for medical evacuation if deemed necessary by the insurance provider and a medical professional. This coverage can be particularly valuable if you're traveling to a region with subpar medical facilities.

- Travel accident insurance may provide a payment to you or your beneficiary in the case of your death or dismemberment.

- Emergency medical insurance may provide payment or reimburse you if you must seek medical care while traveling. Some plans only cover emergency medical care, but some also cover other types of medical care. You may need to pay a deductible or copay.

- Rental car coverage may provide a collision damage waiver when renting a car. This waiver may reimburse for collision damage or theft up to a set amount. Some policies also cover loss-of-use charges assessed by the rental company and towing charges to take the vehicle to the nearest qualified repair facility. You generally need to decline the rental company's collision damage waiver or similar provision to be covered.

Should I buy travel health insurance?

If you purchase travel with credit cards that provide various trip protections, you may not see much need for additional travel insurance. However, you may still wonder whether you should buy travel medical insurance.

If your primary health insurance covers you on your trip, you may not need travel health insurance. Your domestic policy may not cover you outside the U.S., though, so it's worth calling the number on your health insurance card if you have coverage questions. If your primary health insurance wouldn't cover you, it's likely worth purchasing travel medical insurance. After all, as you can see above, travel medical insurance is often very modestly priced.

How much does travel insurance cost?

Travel insurance costs depend on various factors, including the provider, the type of coverage, your trip cost, your destination, your age, your residency and how many travelers you want to insure. That said, a standard travel insurance plan will generally set you back somewhere between 4% and 10% of your total trip cost. However, this can get lower for more basic protections or become even higher if you include add-ons like cancel for any reason protection.

The best way to determine how much travel insurance will cost is to price out your trip with a few providers discussed in the guide. Or, visit an insurance aggregator like InsureMyTrip to quickly compare options across multiple providers.

When and how to get travel insurance

For the most robust selection of available travel insurance benefits — including time-sensitive add-ons like CFAR protection and waivers of preexisting conditions for eligible travelers — you should ideally purchase travel insurance on the same day you make your first payment toward your trip.

However, many plans may still offer a preexisting conditions waiver for those who qualify if you buy your travel insurance within 14 to 21 days of your first trip expense or deposit (this time frame may vary by provider). If you don't need a preexisting conditions waiver or aren't interested in CFAR coverage, you can purchase travel insurance once your departure date nears.

You must purchase coverage before it's needed. Some travel medical plans are available for purchase after you have departed, but comprehensive plans that include medical coverage must be purchased before departing.

Additionally, you can't buy any medical coverage once you require medical attention. The same applies to all travel insurance coverage. Once you recognize the need, it's too late to protect your trip.

Once you've shopped around and decided upon the best travel insurance plan for your trip, you should be able to complete your purchase online. You'll usually be able to download your insurance card and the complete policy shortly after the transaction is complete.

Related: 7 times your credit card's travel insurance might not cover you

Bottom line

Not all travel insurance policies and providers are equal. Before buying a plan, read and understand the policy documents. By doing so, you can choose a plan that's appropriate for you and your trip — including the features that matter most to you.

For example, if you plan to go skiing or rock climbing, make sure the policy you buy doesn't contain exclusions for these activities. Likewise, if you're making two back-to-back trips during which you'll be returning home for a short time in between, be sure the plan doesn't terminate coverage at the end of your first trip.

If you're looking to cover a sudden recurrence of a preexisting condition, select a policy with a preexisting condition waiver and fulfill the requirements for the waiver. After all, buying insurance won't help if your policy doesn't cover your losses.

Disclaimer : This information is provided by IMT Services, LLC ( InsureMyTrip.com ), a licensed insurance producer (NPN: 5119217) and a member of the Tokio Marine HCC group of companies. IMT's services are only available in states where it is licensed to do business and the products provided through InsureMyTrip.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not create or modify any insurance policy terms in any way. For more information, please visit www.insuremytrip.com .

Find the Best Travel Insurance & Avoid Costly Surprises

- 21 Top-Rated Providers

- Side-by-Side Comparison

- 3 Million+ Travelers Insured

Standard Single Trip Policies

- The most popular and comprehensive travel insurance plan

- Covers cancellations, medical emergencies, delays, and luggage

- Protection from the time you purchase to the date you return

Annual / Multi Trip Policies

- Cost-effective option for travelers taking multiple trips a year

- Includes common medical, delay, and luggage benefits

- May require add-ons from trip cancellation or interruption

Cruise Insurance Policies

- Offers comprehensive trip protection on land and at sea

- Includes high travel medical insurance coverage limits

- Protects against hurricanes, inclement weather, and more

Adventure & Sports Policies

- Essential for travelers partaking in high-risk activities

- Provides protection for lost or delayed sports equipment

- Strong coverage for cancellations and medical emergencies

Compare and Save in Minutes

Whether you’re heading abroad or staying local, we make it easy to find the best travel insurance plan for your next adventure. No bias. No hidden fees. Just the best trip protection quotes from the country’s leading providers.

Tell us some basic information about your next trip. We’ll use these details to help narrow your search and show the plans that best fit your needs.

Easily see how plans from the best travel insurance providers compete on cost and coverage. Use filters and sort results to uncover the right plan for you.

Get peace of mind at the lowest possible price. We partner with leading providers to offer you the best policies at the best value, guaranteed.

Why Trust Squaremouth?

When selecting a travel insurance provider, it's crucial to compare options. Obtain quotes from three to five insurers to ensure the best coverage and value. While it may seem time-consuming, this process can result in significant savings.

That's why we're here – over the past two decades, our industry-leading comparison engine has helped millions of travelers find highly-rated insurance plans and protect their trip expenses.

Our industry-leading comparison platform , enriched by customer reviews, displays unbiased results based on your specific trip details. If you run into any trouble, our multi-award-winning customer service team is just a phone call away.

- Helped more than 3 million travelers

- 20+ years serving the travel community

- Intuitive & user-friendly comparison engine

- More plans and top-rated providers than the competition

- Prices are regulated by law; you won't find a lower price anywhere else

- Multi award-winning customer service team

- 140,000+ customer reviews

Save With Squaremouth

Squaremouth has helped more than 3 million travelers find the best policy for their trip.

Key Travel Insurance Benefits

Most trip insurance policies are comprehensive, including coverage for cancellations, medical emergencies, travel delays, and lost luggage, among other benefits.

What Coverage is the Most Important?

Squaremouth customer reviews.

More than 99% of customers would recommend Squaremouth to others. Read what a few of them had to say about their recent experience buying travel insurance.

Great Experience!

"The Squaremouth website is fantastic! It was very easy to select coverage and find and compare policies. Will recommend it to others."

Savannah from NC 03/26/2024

Great Coverage and Price

"Getting a travel insurance quote online was easy. We have used Squaremouth before and have been pleased each time. It's peace of mind for our travel needs."

Rhonda from IN 03/20/2024

Easy to Use!

"I always use Squaremouth simply because it is so easy to use and offers plans that are affordable to me."

Emily from AZ 03/08/2024

Very pleased!

"They give great service, and the website is so easy to navigate to find just the right insurance plan. I always appreciate working with them."

Don from UT 03/07/2024

The Squaremouth website is fantastic! It was very easy to select coverage and find and compare policies. Will recommend it to others.

Featured Articles

Our topic experts keep a constant pulse on the travel industry so we can provide the most current information and recommendations based on today's traveler needs.

What Type of Insurance Do I Need?

Plans can range in terms of cost and coverage, so it’s important to identify your specific needs before comparing options. Discover the different types of travel insurance policies you should consider for your upcoming trip.

How to Buy Travel Insurance on Squaremouth

If you’re new to Squaremouth, this quick guide can help you identify your needs, start your first quote, and compare your results. If you need additional help, our customer service team is just a phone call away.

Travel Insurance FAQs

Here are some of the most frequently asked questions from travelers like you.

Is Travel Insurance Mandatory for International Travel?

While rare, some countries or organized tours may require proof of travel insurance that lasts for the duration of your trip. Our Destination Center is a good starting point to learn about entry requirements and travel insurance recommendations.

While it is typically not mandatory, travelers should consider buying insurance if they want to protect themselves financially from unforeseen events that may impact their travel plans. Many Americans and U.S. residents purchase travel insurance when planning international or high cost trips. View our list of the top international travel insurance providers .

What Does Travel Insurance Cover?

Comprehensive travel insurance is designed to cover common disruptions that may impact a trip. Most policies will provide coverage for trip cancellations , medical emergencies , travel delays , missed connections , accidental death and dismemberment , and lost luggage . Travelers that experience financial loss as a result of a covered disruption may be eligible for reimbursement through their insurance policy.

How Much Does Travel Insurance Cost?

In general, a comprehensive policy with Trip Cancellation typically costs between 5% and 10% of the total trip cost. The cost of a policy depends on four primary factors: trip cost, traveler age, trip length, and coverage amounts. A policy without an insured trip cost will be significantly less expensive. We recommend comparing plans from multiple providers to find the best priced plan for your trip.

What Should I Look for When Comparing Travel Insurance?

There’s no one-size-fits-all policy when it comes to travel insurance. When comparing plans, you should consider the following:

- Benefits: Travel insurance benefits outline what situations are covered under each plan. Make sure each plan you’re considering includes coverage for what’s important to you.

- Coverage Limits: Plans will set limits to how much reimbursement you’re eligible for, and can vary significantly. Higher coverage limits can result in less out of pocket expenses in the event of a claim.

- Exclusions: Travel insurance companies will list specific activities, equipment, and scenarios that are not covered by their plans in the event of a claim.

- Premium: Higher priced insurance products do not always equate to better coverage. We recommend choosing the most affordable plan that offers the travel protection you need.

- Provider Reputation: All providers on Squaremouth have been carefully vetted and offer 24-Hour Assistance services. Customers are also encouraged to share honest reviews about their experience before, during, and after their trips.

Does Travel Medical Insurance Cover International Trips?

In many cases, primary health care plans, such as Medicare or a policy you have through your employer, are not accepted overseas. If you’re not covered, you may be responsible for unforeseen medical expenses if you get sick or injured while traveling.

To avoid out-of-pocket expenses if you need medical care in the event of an emergency, many travelers opt for travel medical insurance. These plans can cover the cost of treating unexpected medical conditions incurred during your international trip.

Are Pre-Existing Conditions Covered by Travel Insurance?

Coverage for pre-existing conditions varies among travel insurance policies. While many plans won’t offer coverage for existing injuries or illnesses, some plans may offer Pre-Existing Condition waivers if certain conditions are met, such as purchasing the policy within a specified time frame from booking the trip.

Will My Policy Cover Trip Cancellations?

Yes, many comprehensive travel insurance policies cover trip cancellations under specified circumstances, such as sudden illness, injury, or death of the insured or a family member, natural disasters, or unexpected work obligations. Most policies that include the Trip Cancellation benefit offer 100% reimbursement for all prepaid, non-refundable trip costs.

What’s the Difference Between Single-Trip and Annual Travel Insurance?

Single-trip travel insurance covers a specific journey for a set duration, offering protection for that trip only. This is the most popular type of travel insurance among Squaremouth users. In contrast, Annual Travel Insurance provides coverage for multiple trips within a year. Annual plans can be cost-effective for frequent travelers and less of a hassle than purchasing multiple single-trip plans.

What's the Process for Filing a Travel Insurance Claim?

To file a trip insurance claim, follow these steps:

- Contact your insurer: Notify them as soon as possible about the incident.

- Gather documentation: Collect relevant documents, such as police reports, medical records, or receipts for expenses incurred.

- Complete the claim form: Fill out the insurer's claim form with accurate details.

- Submit supporting documents: Attach all required documents to substantiate your claim.

- Keep records: Maintain copies of all submissions and correspondence for your records.

- Follow up: Stay in touch with the insurer for updates on your claim status.

- Be honest and thorough: Provide clear and truthful information to expedite the process.

Remember, the process may vary by insurer, so review your policy or contact your insurance provider for specific instructions. Learn more about what can be covered and how to file a travel insurance claim .

Where Can I Buy Travel Insurance?

Travelers can purchase travel insurance directly from providers, through a comparison site like Squaremouth, or directly through a travel supplier when booking. Credit cards and travel agents are other sources to consider. Travel insurance prices are regulated by law, meaning the price of one specific policy must be the same regardless of where it is sold, whether it’s purchased from Squaremouth or directly from the provider.

12 Best Travel Insurance Policies and Why You Need Them

By Suzanne Rowan Kelleher

Condé Nast Traveler has partnered with CardRatings for our coverage of credit card products. Condé Nast Traveler and CardRatings may receive a commission from card issuers. We don't review or include all companies, or all available products. Moreover, the editorial content on this page was not provided by any of the companies mentioned, and has not been reviewed, approved or otherwise endorsed by any of these entities. Opinions expressed here are entirely those of Condé Nast Traveler's editorial team.

You’ve purchased your flights and booked your hotel. Now, what about travel insurance? These days, it’s easy to add coverage to your trip, but what's the best travel insurance policy to buy? And is the extra cost always necessary?

When planning a trip, nobody loves imagining worst-case scenarios and everyone has a different risk tolerance. For a weekend road trip , you may be willing to cross your fingers and suck up your losses should something go awry. But what if you’re shelling out for a longer, more complex and more expensive trip? You’ll likely want peace of mind when your risk and financial investment are greater.

When do you need travel insurance?

There’s nothing like bad luck to turn you into an insurance evangelist. For travel writer Katherine Fan, the epiphany came after a thunderstorm disrupted her flight in Chicago . “My bags didn't make it to Italy for more than five days, and my travel insurance covered all the costs for replacement items as well as the alternative transportation I had to rebook because of the delay,” she says. “I'll never live without it now.”

In general, the older you are and the more remote your destination, the more crucial it is to buy travel insurance. Lou Desiderio, a communications executive from Long Island, New York, recalls the time his octogenarian father became ill during a European cruise , and doctors recommended that his parents return home immediately. His parents’ travel insurance covered the lion’s share of the $9,500 they subsequently racked up in medical costs, ground transportation, flights, hotel, and meals. “You always wonder if the cost of insurance is worth it,” says Desiderio. “In this instance, it was absolutely worth it.”

“Not all domestic health and medical insurance plans will follow you outside your home country,” says Justin Tysdal, CEO of Seven Corners , a travel insurance provider. “Something as simple as twisting your ankle in a foreign country may not be covered and could result in expensive medical bills.”

Simply having travel insurance can have side benefits, too. “One of the best hidden perks is the 24/7 global travel assistance provided by the plan,” says Stan Sandberg, CEO of TravelInsurance.com . The hotline can be helpful in dealing with a multitude of unexpected issues, from currency conversion or cash transfers to replacing passports or IDs to finding a local physician.

Where can you find a good policy?

Travel agencies, airlines, cruise lines, and tour operators often offer an optional insurance add-on, but these plans tend to have been run through the company’s legal team and contain more exclusions. Travel rewards credit cards also offer some built-in insurance benefits to their cardholders, like trip cancellation coverage, delayed baggage coverage, and trip interruption and delay coverage. But you’ll often be better served by a plan from a third-party insurer, which tend to offer more holistic plans.

The good news is that it has never been easier to buy exactly the type of travel insurance you need at a reasonable price. Most people buy comprehensive insurance for a single trip, but annual travel insurance plans that cover multiple trips in a one-year period are becoming more popular.

You can find some of the best travel insurance policies by visiting an insurance comparison site like TravelInsurance.com, InsureMyTrip.com or SquareMouth.com . Plug in your trip details and you’ll get instant quotes for multiple insurance plans that you can compare on price, coverage limitations, and other parameters. Be sure to read the policy details, as inclusions can vary from plan to plan but will end up making all the difference to your particular needs.

What’s it going to cost?

The cost of travel insurance depends on a variety of factors, including the price and length of the trip, your age, destination, and any optional add-ons. For your average domestic or international trip with flights and hotels , expect to pay anywhere from 3 to 7 percent of your trip’s cost, depending on inclusions.

So for a $2,000 trip, you might expect a typical comprehensive plan with trip cancellation, interruption, and delay, along with baggage loss and delay, and emergency medical coverage and evacuation to cost in the $100 ballpark. Some upgrades, like a “cancel for any reason” provision, will cost more.

When should you buy travel insurance?

Don’t procrastinate. “Some benefits and coverages are available only if you’ve purchased your policy within a short window, typically seven to 21 days from when you make the first payment towards your trip,” says Sandberg. Buy early and you may qualify for a pre-existing condition waiver or a ‘cancel for any reason’ upgrade.

It’s especially important not to delay buying travel insurance if you’re traveling to, say, the Caribbean during hurricane season. Once a major storm has been named, the window of opportunity slams shut, and you can no longer buy insurance for that hurricane. “If you purchase a policy after a storm is named, trip cancellation and trip interruption are excluded from coverage,” says Sandberg.

What’s not covered?

“Some people believe that a travel insurance plan is designed to give you the flexibility to cancel your trip for any reason whatsoever,” says Sandberg. “But the standard plan is not going to provide cancellation coverage for a change of heart or a relationship break-up or an outbreak of Zika in your destination.” If you need that flexibility, opt for the ‘cancel for any reason’ upgrade.

“As far as medical coverage, people often believe a travel insurance plan will cover preventative services such as immunizations and annual check-ups,” says Tysdal. “But travel insurance is intended to cover illnesses and injuries that originate during a trip, and that’s why it’s relatively inexpensive.” Be careful about overindulging, too. “If you injure yourself as a result of being intoxicated beyond a legal limit, your travel insurance policy will not likely cover you,” says Sandberg. Ditto for drug use.

How easy is it to file a claim?

“Documentation is key,” says Meghan Walch, product manager for InsureMyTrip. If luggage is lost or items are stolen, file a report with the airline or police. You may need to provide original receipts for the stolen items in order to receive reimbursement up to the policy limits.“ Also, be aware that baggage coverage only offers coverage up to a set amount,” says Walch. “So, if you are carrying, say, a fancy $3,000 Nikon or Canon camera , you’ll likely need to buy additional insurance elsewhere or cover it under a homeowner's policy.” Note, also, that many plans specifically exclude computers and electronics.

What about car rental insurance?

It’s often possible to add car rental insurance, also known as the Collision Damage Waiver (CDW), to a comprehensive travel insurance plan, which can save you from a serious headache should you get into an accident while driving. “But the biggest mistake people make when renting a car is to waste money on duplicate coverage,” says Jonathan Weinberg, CEO of AutoSlash , the car rental deal-finding site. “The reality is that if you own your own vehicle and have car insurance, you are likely already covered when renting in the U.S.”

Jessica Puckett

Lee Marshall

Meaghan Kenny

And if you don’t own a car? “Your credit card may also cover you when renting,” says Weinberg. “It's always important to check to be sure, but why pay again for coverage you already have?” Indeed, paying for your rental with the right travel rewards credit card might cover your collision insurance, with some policies covering damage up to the value of the car. Travel outside the U.S. and Canada , though, and it’s a different story. “Most personal auto insurance policies will not cover a claim for damage to a rental outside the U.S. or Canada,” says Weinberg. “Likewise, different credit cards have different exclusions when it comes to covering damage to a rental car in a foreign country.”

Types of travel insurance

Most travelers opt for a comprehensive plan, but you should know what each type of coverage does, so you’ll know if a package truly fits your needs. Here’s a brief rundown of the main types of coverage.

Trip protection

Often known simply as “travel insurance,” this type of comprehensive package is the most common purchase.

Commonly covers: Reimbursement for money spent on your trip due to cancellations, interruptions, and delays; medical expenses if you become sick or injured and, if necessary, emergency medical evacuation and repatriation; and coverage for your belongings if lost, stolen, damaged, or delayed.

How to get it: Compare plans at Square Mouth , Seven Corners , InsureMyTrip.com , and TravelInsurance.com

Trip cancellation

This benefit can reimburse 100 percent of your trip cost—flights, hotels, cruises, and pre-paid activities—if you need to cancel for a covered reason.

Commonly covers: Unforeseen illness or injury; the death of you, a family member, or a traveling companion; terrorism; inclement weather; natural disasters.

Fine print: Some policies also include other covered reasons, such as jury duty or an employment layoff.

Trip interruption

You’ll be reimbursed for your costs if your trip is interrupted for a covered reason. The payout may exceed the total trip cost if you need to incur additional expenses to return home, but some policies limit coverage to a return flight home.

How to get it: Signing up for travel rewards cards like the Chase Sapphire Reserve can automatically give you this coverage for all trips booked on the card.

Learn more about signing up for the Chase Sapphire Reserve here .

Cancel for any reason

This upgrade provides reimbursement for 50 to 75 percent of prepaid and non-refundable trip payments if you cancel a trip for any reason not otherwise covered by your policy.

Watch out: You’ll be required to insure your trip’s entire cost, which will typically increase your premium by roughly 40 percent.

Fine print: Typically available for purchase up to seven to 21 days from the date you make your initial trip deposit. You must cancel the entire trip at least two to three days before your departure date.

Travel delay

If your trip is unexpectedly delayed by a designated amount of time (typically three to 12 hours, depending on the policy), this benefit provides a per-diem dollar amount (typically $150 to $200) that can be used for meals, hotels, and other necessary expenses during the delay.

Commonly covers: Inclement weather and mechanical breakdowns of “common carriers,” meaning public transportation such as planes, trains, or buses.

How to get it: Signing up for travel rewards cards like the Chase Sapphire Reserve can automatically give you this coverage for all trips booked on the card that meet the requirements.

Missed connection

You’ll be reimbursed for additional costs for you to catch up to your trip if you miss your departure due to a common carrier delay of a specified amount of time. It's usually an added feature of larger insurance packages.

Commonly covers: Inclement weather and mechanical breakdowns of common carriers.

Watch out: Some policies only reimburse if you need to catch up to a cruise or tour. Since the wording typically specifies public transportation delays, you would be out of luck if you’re driving and miss your connection because you got caught in traffic.

Baggage and personal items loss

You’ll be covered for lost, stolen, or damaged luggage. Expect limits in both overall coverage and per-item coverage. It's included with many travel rewards credit card benefits.

Watch out: While most policies cover your personal belongings throughout the entire trip, some will only cover luggage while it is checked with an airline or transportation carrier.

Baggage delay

If your luggage is delayed for a specified period of time—typically 12 or 24 hours—this coverage will reimburse you for any clothing, toiletries, and other essential items you need to purchase. Expect a maximum coverage amount per person, as well as a daily limit. It's also included as a cardholder benefit with many travel credit cards.

Emergency medical coverage

This covers the costs to treat a medical emergency, including treatment, hospitalization, and medication. This type of coverage is highly recommended for international trips and cruises.

Watch out: You would pay for medical care out-of-pocket, and then file a claim for reimbursement when you return home. In certain situations, an insurer might pre-authorize payment of medical bills, but it is not guaranteed.

How to get it: Browse medical coverage plans at Seven Corners .

Emergency evacuation coverage

This coverage is for transportation to the nearest medical facility in the event of a medical emergency during your trip. It's usually an add-on to larger medical coverage.

Commonly covers: If the treating physician recommends that you should return home for further medical attention, this benefit can also cover those transportation expenses. In the case of a death, repatriation can transport a traveler’s remains back home. It's usually an add-on to a larger travel insurance policy.

Pre-existing medical conditions waiver

Most policies have built-in exclusions for pre-existing conditions. So if you’ve been seriously ill in the past or need ongoing treatment, consider looking for a plan that offers a pre-existing condition exclusion waiver.

Fine print: You’ll need to purchase the plan within a few weeks from the date you make your initial trip payment.

Hazardous/adventure sports coverage

Are you an adrenaline junkie? Adventure activities such as heli-skiing, off-trail snowboarding, bungee jumping, wakeboarding, Jet Skiing, spelunking, rock climbing, and scuba diving are almost always excluded from coverage in most travel insurance plans.

Fine print: You can buy coverage as an optional upgrade, which is an especially smart bet if you’re planning an adventure trip outside the United States.

Condé Nast Traveler has partnered with CardRatings for our coverage of credit card products. Condé Nast Traveler and CardRatings may receive a commission from card issuers.

By signing up you agree to our User Agreement (including the class action waiver and arbitration provisions ), our Privacy Policy & Cookie Statement and to receive marketing and account-related emails from Traveller. You can unsubscribe at any time. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

You are about to leave geico.com

When you click "Continue" you will be taken to a site owned by , not GEICO. GEICO has no control over their privacy practices and assumes no responsibility in connection with your use of their website. Any information that you provide directly to them is subject to the privacy policy posted on their website.

Travel Insurance

Get a travel insurance quote and protect your next trip

For flight insurance protection:

Aircare Flight Quote

For all-in-one trip insurance protection:

ExactCare Travel Quote

Manage Your Travel And Flight Insurance

Manage your policy online

Need a travel insurance quote?

Existing policyholder?

Take the worry out of your travels with affordable flight or trip insurance.

Looking to plan the vacation of a lifetime or flying home for the holidays? Trip insurance and flight insurance can provide the peace of mind you need for your next journey. The GEICO Insurance Agency, with Berkshire Hathaway Travel Protection (BHTP), offers comprehensive travel insurance coverage, with prompt service and global assistance. Get an online travel insurance quote today and confidently protect your next adventure.

AirCare Flight Insurance

If you only need to protect your travel costs for a flight, AirCare may be what you need. With affordable coverage for both domestic and international flights, AirCare flight insurance helps you plan with peace of mind.

ExactCare Travel Insurance

If you want to cover your flight and other trip arrangement's ExtraCare can help. An ExactCare Travel Insurance policy can help with the unexpected like:

- Trip Cancellations/Interruptions/Delays

- Lost/Stolen travel documents

- Unexpected medical expenses

What's the difference between flight insurance and travel insurance?

The main difference is that a flight insurance policy only covers your airfare. On the other hand, a travel insurance policy helps protect your flight as well as other parts of your trip. While you're planning your next trip, think about where you're going and what you'll be doing. Once you have that, it'll be easier to choose which policy works best for your trip.

What does a flight insurance policy cover?

AirCare Flight Insurance has a variety of benefits including emergency travel assistance, 24/7/365. Some common flight coverages are:

- Airfare incase flights are cancelled or you miss a connection

- Personal items like lost or delayed luggage

- Flight delays in your departure (at the gate or on the tarmac)

AirCare Quote

What does a travel insurance policy cover?

ExactCare Travel Insurance provides all-in-one travel protection, with family friendly pricing and worldwide emergency travel assistance 24/7/365. Common things covered by travel insurance are:

- Trip cancellation or interruption

- Personal items like passports and luggage

- Medical costs like hospital and doctor expenses, medical evacuations, and more

ExactCare quote

What is not covered by travel insurance?

Your coverage is based on the plan you choose. However, in general some things that aren't normally covered by travel insurance are:

- Action and team sports, for example auto racing, pro sports travel, or other extreme sport activities

- Travel to get medical care

- Trip Cancellation because you changed your mind

For more information, please check your policy.

Is travel or trip insurance worth the cost?

Travel insurance can help protect your vacation or trips from unexpected things happening. You can travel without trip insurance but doing so brings greater risk if something goes wrong or you encounter unexpected delays. Flight insurance or trip insurance coverage can include things like flight cancellation, lost luggage, trip cancellation, emergency medical transportation, and more. Learn more about travel insurance and why you should get a travel insurance quote today!

How much does travel insurance cost?

Travel insurance typically costs 5 to 10 percent of your total trip cost, though that can be influenced by several things.

- The cost of the trip

- The length of your trip and destination

- The amount of coverage selected

- The number of travelers covered under the policy

Worldwide service and claims information.

It's easy to manage your travel insurance..

Berkshire Hathaway Travel Protection (BHTP) has made it easy to manage your travel insurance. You can:

- Visit Berkshire Hathaway Travel Protection's website

- Email [email protected]

Is travel insurance worth it?

Yes. Things happen that are out of your control. Whether it's your flight being cancelled or delayed to a family emergency. Life happens and that's how travel insurance can help. Plan for the unexpected with a travel insurance policy so you can rest easy knowing you're covered.

Travel Insurance: Get the answers you're looking for.

- What travel insurance plans are available? BHTB offers AirCare (flight only) and 3 main plans: ExactCare Value, ExactCare, and ExactCare Extra. ExactCare Value provides great traveling insurance coverage for budget minded travelers. You can rest easy knowing you're covered for things like trip cancellation, trip interruption, and medical expenses. The main difference is the maximum amount that will be covered. ExactCare and ExactCare Extra's insurance cover the same things as ExactCare Value and add coverage for missed connections and accidental death & dismemberment. The overall amount covered is also increased for each plan respectively.

- Can I get trip insurance for an extended overseas stay? Yes. We can help you with getting insurance for overseas. Please visit our overseas insurance page for information about all the options we have for you!

- Is there travel insurance that can cover my vehicle while traveling to Mexico? Your US auto insurance policy won't cover your vehicle when you drive into Mexico. We're here to help you find the Mexico car insurance you need to insure your car.

- Tips for saving money on your next vacation. No one wants to overpay things. We're here to help. Check out our 5 ways to save your money on your next family vacation.

- Where you're going

- Number of days you're traveling

- Cost of your overall trip

- Coverage you pick

- Number of people covered under your policy

If you choose to get a rate quote or service your policy online, you will be taken to the Berkshire Hathaway Travel Protection website which is owned by Berkshire Hathaway Specialty Insurance Company, not GEICO. Any information that you provide directly to Berkshire Hathaway Specialty Insurance Company on its website is subject to the privacy policy posted on their website, which you should read before proceeding. GEICO assumes no responsibility for their privacy practices or your use of their website.

ExactCare is provided through Berkshire Hathaway Global Insurance Services, LLC. ExactCare and AirCare are underwritten by Berkshire Hathaway Specialty Insurance Company. Both coverages are secured through the GEICO Insurance Agency, LLC.

Benefits may vary by jurisdiction. Please contact a representative to confirm availability.

Please note:

The above is meant as general information and as general policy descriptions to help you understand the different types of coverages. These descriptions do not refer to any specific contract of insurance and they do not modify any definitions, exclusions or any other provision expressly stated in any contracts of insurance. We encourage you to speak to your insurance representative and to read your policy contract to fully understand your coverages.

Colorado Language Preference

Are you a resident of or looking for insurance in the State of Colorado?

We are temporarily unable to provide services in Spanish for Colorado residents. You will now be directed to an English experience.

Estamos encantados de ofrecer nuestra nueva version del sitio web en Español. Apreciamos su paciencia mientras seguimos mejorando su experiencia.

Starting Medical Screening ....

Regulatory Policy | Privacy Policy | Cookies Policy | Complaints | Terms and Conditions | Modern Slavery Statement

Click here to find other travel insurance providers for people who have serious medical conditions .

Millstream Underwriting Ltd is authorised and regulated by the Financial Conduct Authority, FRN: 308584. Registered in England and Wales. Registered no: 3896220, Registered office: 52-56 Leadenhall St, London EC3A 2EB. Further details are available from the FCA website www.fca.org.uk

Millstream is part of the Nexus Group. © 2019 Millstream Underwriting Limited. All rights reserved.

Travel insurance policies available on this website are underwritten by Millstream Underwriting Limited on behalf of AWP P&C SA.

Suggested companies

Big cat travel insurance, true traveller.

It's So Easy Travel Insurance Reviews

In the Travel Insurance Company category

Visit this website

Company activity See all

Write a review

Reviews 4.0.

Most relevant

I’m having the same problem that I…

I’m having the same problem that I reported last year. Can’t get through by phone which I need to do. Left my number 3 hours ago as suggested but no response. WFH maybe?

Date of experience : April 22, 2024

Infuriating useless Site

I was recommended this company from good friends who are frequent flyers and insure with It's so Difficult er, easy! I have several health conditions but only wanted three days' cover for Belgium - I got as far as the quote on two several times - had spent some time getting that far and got as far also as giving my details and faced two buttons - Save Quote/Continue which when clicked - the wretched site crashed with the illuminating message that session terminated as an exception occurred while timed out whilst dealing with a previous exception(!). My mind refuses to remember the exact Dalek speak. Hopeless! Perhaps 1 to 2 AM is a particularly busy time for this site in London? Bad vibes about this company and I have found hints like this terrible waste of time to be best observed. Going elsewhere and friends are getting an earful! I could have spent this hour or so researching my trip!

Date of experience : June 09, 2023

Reply from It's So Easy Travel Insurance

Good morning Mike, Thank you for leaving us feedback and I apologise if you had trouble saving your quote. However, I have located two saved quotes matching your details, both of which are on OK To Travel's pre-existing medical condition product. These were saved and emailed to you and can be retrieved online by following the instructions in the emai we've sent. Kind regards, Reece

I took out Travel Insurance on 5th…

I took out Travel Insurance on 5th October to travel to Spain for three months on 6th. Yesterday I phoned to ask if it would be worth my while claiming for 42.75euros it had cost me for drinks after a hole in one and I was told that my policy was void because the FCO was advising against going there. That was the advise when I bought the insurance. Why did you not tell me? I am now in Spain with no travel insurance and as far as I know I have to be in the UK to buy such insurance. Are you surprised at the rating I give you?

Date of experience : November 06, 2020

Good morning, I am sorry to hear your dissatisfaction at the service received. I can see that since speaking with you on 5th November, we have provided a full refund of the policy premium as the cover was not valid. Unfortunately, like many travel insurance providers, we are not able to provide insurance cover for travel to an area where the Foreign, Commonwealth and Development Office have advised against all or all but essential travel. If we had discussed your quote over the phone prior to purchase, one of our advisers would have emphasised this. We have signposted this throughout our website, which is displayed prior to receiving a quote. ‘Our policies will not provide any cover if you travel when there is Foreign, Commonwealth and Development Office (FCDO) advice against travel to the country you are visiting.’ If you would like to discuss this further or have any queries, please get in touch. Kind regards, Reece

Thankfully I didn’t need to take…

Thankfully I didn’t need to take advantage of the insurance so unable to to validate effectiveness of the cover purchased. The cost however was prohibitive, probably due to disclosure of health issues.

Date of experience : October 11, 2021

Good morning, Sorry to hear you were not happy with the policy premium; if you would like to email us with a policy number ([email protected]), I'll be more than happy to give you a further break down of the cost. As so many factors come together to generate the premium, we would always recommend that customers shop around to find the best quote for their specific requirements. Best wishes

Overall was a great travel insurance…

Overall was a great travel insurance but my last yearly price was over £600 for one year’s insurance which have Not been able to travel due to covid so I’m hoping they will extend my insurance for another year as a courtesy but I doubt it . Plus they really difficult to contact as they never answer phone with the usual we are really busy answer message but how come as nobody can travel

Date of experience : May 27, 2021

Good afternoon Brett. Thank you for sharing your feedback! As you can imagine, a lot of our customers were in the same position with their annual travel insurance last year, we'd certainly like to resolve this for you. Our call centre is working on reduced numbers/hours due to COVID-19 restrictions, however, we are open weekdays from 9am until 2pm. If you call us on 0330 606 1434 and leave a voicemail if we're unavailable, we'll be sure to call you back. Alternatively, email us [email protected] with your policy details and I'll see what we can do for you. Kind regards, Reece

Happy so far

I was happy with the ease with which I was able to navigate the site and how it catered for one way travel needs. The main test will come if I have to make a claim on the policy

Date of experience : May 31, 2022

Proactive and knowledgeable

Great service with a friendly cando attitude. Renewal sorted ASAP.

Date of experience : October 03, 2021

Quick issue resolution

Quickly resolved issue with policy that did not auto issue

Date of experience : September 09, 2021

Dear Mr Howe, Thank you for bringing this to our attention. Unfortunately, it appears that our automated system failed to email your documents for this particular policy, however, I have sent these this morning. Having looked over our inbox, we don’t appear to have received any email correspondence from yourself. I apologise for any inconvenience this has caused. If you require any further assistance, please get in touch on 0330 606 1434. Kind regards, It’s So Easy

Easy online service

Easy online service , not cheap but great Covid coverage.

Date of experience : December 03, 2020

I scoured the internet for hours…

I scoured the internet for hours looking for someone to insure my wife and I for our one way trip to Australia. Most companies only offer 'single trip' insurance. A real relief to find ISETI. Not only did they have the cover I was looking for but when I telephoned to query a few items they were so knowledgable, polite and helpful. Hopefully I won't need to use the insurance to find out how good they are when dealing with claims, but if my experience so far is anything to go by they will be excellent.

Date of experience : March 04, 2022

Thank you for leaving such a fantastic review of our services. We strive to offer travel insurance cover where others don't so it's great to hear we were able to help you find appropriate cover for your one way trip!

Exceptional service and value for money.

I spoke with both Carl and Len about my travel insurance. Both were exceptional as they guided me through the policy. As a 71 year old, I needed assistance and reassurance that I was getting the right cover for my preexisting conditions. I was delighted with the cost of cover annd felt confident I had made the right choice. Jeff

Date of experience : October 30, 2020

Good morning, Thank you for taking the time to leave us a review. We always strive to achieve the highest level of customer service so that's great to hear! I have passed your comments to both of my colleagues. Kind regards, Reece

Great company to deal with Having been in contact with many…

Having been in contact with many different travel insurance companies and not being able to secure insurance. From when I first contacted It's So Easy to Travel, they were so helpful and me feel reassured that they could help. They were very reasonable rates. I am very happy with the service I received.

Date of experience : February 18, 2022

No problems so far

I've never had to claim, so this review is related to buying the policy, and how the policy seems on paper. The purchase process is easy and the company provide what seems like very good cover. Their approach to preexisting conditions is refreshingly sensible.

Date of experience : March 16, 2021

Good afternoon David. Thank you for responding to our feedback invitation and for leaving such a good review of our service. We appreciate that travel insurance isn't always the most exciting thing to arrange, so aim to make the process as painless as possible! We hope to speak with you again in the future. Kind regards, Reece

Pre-existing Medical Condition Travel Insurance

We needed travel insurance for pre-existing medical conditions and couldn’t complete on line so had to ring. Everyone we spoke to was very helpful and we were able to purchase an annual policy at a very reasonable price. Hope we never need to use the insurance but would never travel without it.

Date of experience : June 01, 2021

I have always used Freedom but was unable to this year as they are changing underwriters. I used their sister company’ it’s so easy’ and I have to say they were amazing and competitively priced. I am travelling with my family and two of us have complex conditions. They referred us to their underwriter as a precautionary measure to ensure we had appropriate cover. Their Chief Medical Officer called me back personally twice to talk through the queries and was very reassuring. I was then passed back to the It’s so Easy team and their offices had closed for the day but their Manager called me back and completed my policy. Obviously I can’t comment on claims experiences but cannot ask for more with policy issuing. Thankyou

Date of experience : February 01, 2022

It really is easy: 15+ years of being a customer and they always impress me

I've used this business for at least 15 years. They have been able to insure me with a pre-existing medical condition at very good rates. The team are very friendly always offering clear helpful advice. I recently asked a question regarding my COVID cover, they checked with the underwriter and emailed a response the next day. Some years ago my partner claimed on joint policy I had with It's So Easy Travel Insurance and the policy paid out, again the cover was excellent. If you want a insurer that understands all sort of medical conditions and can provide the right cover I would highly recommend them. As the name say it really is easy with It's So Easy Travel Insurance.

Date of experience : April 23, 2021

I have not had to claim against the…

I have not had to claim against the policy (and hopefully I won’t have to) so I cannot comment on the claiming process. However the service I was provided to put the policy in place was very good. I was looking for something a bit unusual and the staff (Reece) was very helpful and very responsive. So definitely 5 stars for quality of service provided so far.

Date of experience : October 13, 2021

Easy on-line process

We have just completed the online form for our annual travel insurance. During the process we had a couple of questions which we required clarity/confirmation on. We used the on-line chat and Reece responded immediately, he answered our questions allowing us to complete the form. All documents now received with a clear email giving us the relevant information to access 'our wallet' for our comprehensive documentation. Great service so far.

Date of experience : October 13, 2023

i needed travel insurance for a…

i needed travel insurance for a specific health issue and found them to be very helpful and the price was very good for an annual policy, added on covid cover for this year too, sadly no holidays as yet though! would recommend.

Date of experience : November 01, 2020

Happy with them

U.S. News takes an unbiased approach to our recommendations. When you use our links to buy products, we may earn a commission but that in no way affects our editorial independence.

8 Cheapest Travel Insurance Companies Worth the Cost

Trawick International »

World Nomads Travel Insurance »

AXA Assistance USA »

Generali Global Assistance »

Seven Corners »

Allianz Travel Insurance »

IMG Travel Insurance »

WorldTrips »

Why Trust Us

U.S. News evaluates ratings, data and scores of more than 50 travel insurance companies from comparison websites like TravelInsurance.com, Squaremouth and InsureMyTrip, plus renowned credit rating agency AM Best, in addition to reviews and recommendations from top travel industry sources and consumers to determine the Cheapest Travel Insurance Companies.

Table of Contents

- Trawick International

- World Nomads Travel Insurance

- AXA Assistance USA

There are plenty of smart ways to save money on your travel plans, but refusing to buy travel insurance isn't necessarily one of them. Not having travel insurance can mean being on the hook for exorbitant medical bills or costs for emergency transportation if you become sick or injured during your trip. You could also face significant financial losses if your trip is delayed or your bags are lost or stolen, and without travel insurance you won't have a third party to rely on for assistance.

Buying affordable travel insurance makes more sense than skipping this coverage altogether, so read on to find out which companies offer the cheapest plans and all the protections you can get for a low cost.

How We Chose the Cheapest Travel Insurance Companies

To determine the cheapest travel insurance companies, U.S. News created sample traveler profiles for three separate eight-day trips to different destinations (the Cayman Islands, Spain and California) at a range of price points ($6,500, $10,500 and $8,500, respectively). We used that information to get quotes for the cheapest option for 100% trip cancellation coverage for each trip. We then calculated the average cost of the trips.

The travel insurance companies that made our ranking have a high credit rating and offer the lowest average cost, outlined below. (Note: The sample average costs are not price quotes from U.S. News. To find a travel insurance price quote, use the "View plans" link to enter your trip details and find more information.)

- Generali Global Assistance

- Seven Corners

- Allianz Travel Insurance

- IMG Travel Insurance

- Trip cancellation coverage (up to $30,000) for 100% of the insured vacation

- Trip interruption coverage (up to $30,000) for 100% of the insured vacation

- Trip delay coverage worth up to $1,000 ($150 per day for delays of 12 hours or more)

- $750 in coverage for lost and damaged luggage; $200 for baggage delays

- Up to $500 in coverage for missed connections of three hours or more

- Up to $50,000 in emergency medical coverage ($750 sublimit for emergency dental)

- Up to $200,000 in coverage for emergency medical evacuation

- Up to $2,500 of trip protection for cancellation or interruption

- Up to $1,000 in coverage of lost, stolen or damaged baggage; up to $750 for baggage delays on your outward journey

- Up to $100,000 in emergency medical insurance; $750 dental sublimit