One Way Travel Insurance

Expatriate Group’s One Way Travel Insurance covers all outward-bound trips from any global destination.

Plan Options

Worldwide Travel Insurance

Bought a one way ticket to a destination? Require travel insurance? Our One Way Travel Insurance will put your mind at ease whilst travelling overseas.

With our one trip travel insurance, we have individuals seeking an insurance policy covered. Our standard travel insurance policy can be tailored to cover just one way travel for expats and travellers alike.

What is one way travel insurance?

One way trip insurance is designed specifically for people who are heading overseas for a long period of time, do not have a return ticket or do not have a return date in mind. The one way insurance policy covers individuals on the journey from their departure country to their destination.

How does one way travel insurance work?

Once a policy holder departs their starting country on the date specified (when taking out the travel insurance) it will be active and they will be covered. Expatriate Group’s one-way travel insurance policy cannot be extended and is ideal for travellers, or expats moving permanently to a destination country. For one trip travel insurance policy holders the maximum duration may not exceed 180 days.

Policy Benefits

Key Benefits of our One Trip Travel Insurance

With Expatriate Group’s one way travel insurance you can add different policy options to suit your needs. Having served expats and travellers since 1997, we understand that flexibility is key and all customers to tailor their policies. Just choose whether you want a single or annual trip and select the additional benefits you require.

Emergency Medical Evacuation

There are some locations around the world where medical care is poor or non-existent. In these circumstances, should you fall ill or become injured, it’s important that you have the correct cover. One trip travel insurance covers medical evacuations, ensuring you ate transported to a suitable hospital or medical facility to receive the care you need.

Emergency & Accidental Medical Treatment

Whilst one trip travel insurance only protects you from departure to arrival (and a short while thereafter) in your destination, cover is important. Should you fall ill on a layover, or obtain an injury boarding a flight, Expatriate Group will ensure you receive the medical treatment you need at an appropriate hospital or clinic. No matter where you are you will receive medical treatment.

Enhanced Benefits & Protection

One trip travel insurance can be tailored to your needs. Our core insurance policy offers the flexibility for you to add different benefits that suit your needs. Optional protection covers you against the likes of loss of passport, personal liability, baggage delays and theft, missed departures, and legal expenses. Evacuations for non-medical reasons can also be added to your policy.

Cancellation and Curtailment Cover

Sometimes your trip abroad can go wrong before you’ve even left for the airport. Cancellation and curtailment cover safeguards you against the likes of strikes, industrial action, redundancy, or your travel operator collapsing. You’re also protected should you need to come back early due to medical issues, injuries, or illness.

The Benefit Schedule

The benefit schedule below is applicable to Expatriate Group’s One Way Travel Insurance. It is a summary of travel cover and must be read in conjunction with the policy wording . All coverages and plan costs listed in this schedule of benefits are in Euros, dollars, and pounds. All benefits will be reimbursed at Usual, Customary and Reasonable (UCR) charges where applicable. Amounts shown are the maximum per policy and period of cover, except where otherwise stated.

Our Partners

One Way Travel Insurance FAQs

Is one way travel insurance the same as single trip.

One way travel insurance covers individuals on the journey from departure to their destination. Alternative cover will need to be purchased shortly after arrival. Single Trip Travel Insurance is designed for those heading overseas and covers the entire period abroad, such as a holiday.

Can I extend my one way travel insurance?

One way travel insurance policies are not able to be extended. Why not take a look at our other International Travel Insurance products for a policy that will suit you better? Or do you need something more permanent? International Health Insurance may be the answer. Don’t forget, you can always contact Expatriate Group for expert advice or take a look at all our expat insurance products.

Can I get one way travel insurance from the UK to Australia?

Yes, our one way travel insurance policies cover you for single journeys to countries in Europe and Worldwide. To find out how much your policy to Australia would be get a one way travel insurance quote today.

Will I be covered if I have a pre-existing condition?

There are specific exclusions for pre-existing conditions and limitations of coverage. You will need to check the coverage and policy wording to fully determine benefits covered by the policy you choose.

Get your one way travel insurance quote online now.

Latest Worldwide Expat News

Whether you’re planning on being overseas for a short, long, or indefinite amount of time check out our guides and blogs. We give you the latest news, as well as advice, tips, and inspiration for your time abroad.

Featured In

Quick Quote

Retrieve Quote

Privacy Overview

- 1300 409 322 Australian Based Call Centre

One Way Travel Insurance

One way travel insurance .

If you're heading overseas on a one-way ticket, it can be hard to find a one-way travel insurance policy to match!

With Fast Cover if you are an Australian Citizen or Permanent Resident , there’s no need to have a return flight booked or even a set return date in mind to buy travel insurance. Our policies can easily be extended online while you're travelling!

Whatever type of traveller you are or whatever budget you have, Fast Cover may be able to help with your travel insurance. Just choose the level of cover that best suits you and focus on enjoying your adventure!

So before you start packing your backpack, make sure you buy a one-way travel insurance policy!

Who should buy a one-way travel insurance policy?

Does the freedom and flexibility of a one-way trip appeal to you? Ready to pack your bags and book a one-way flight with a vague itinerary and no set return date? Or heading overseas on a working holiday and not sure when you'll come home? Or, perhaps you're embarking on an epic backpacking adventure with no plan at all that will see you travelling the globe or even living in a new country for a while?

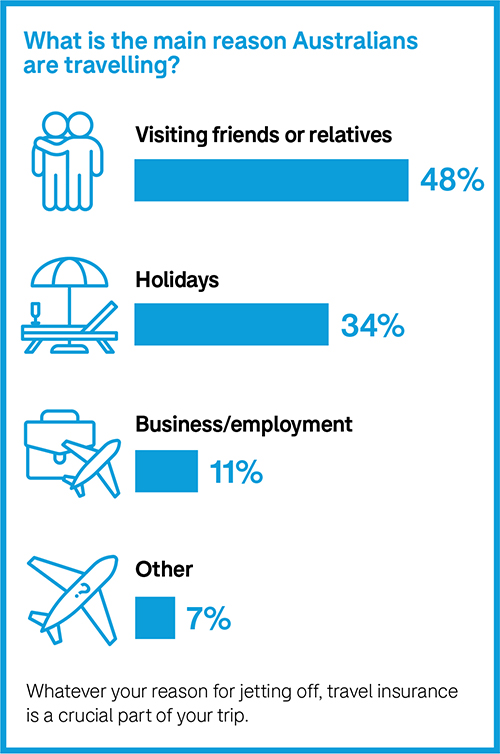

You're not alone! Thousands of travellers head overseas every year without a return ticket, not knowing exactly when they'll be returning.

Wherever you're going and whatever your plan is when you get there, whether you’re relocating, working or starting the adventure of a lifetime, we’ll help tailor your insurance to best suit you.

A one-way travel insurance policy may be worth considering if you are:

Moving overseas temporarily:.

If you’re moving overseas temporarily for your job, to be with a partner, or just to experience life in a new city for a while, a Fast Cover policy can provide protection for both you and your belongings while you're in transit and once you arrive. You can also use our insurance as a bridge until you get set up and secure insurance in your new home.

Working overseas:

We can cover your working holiday whether you're planning to work your way around the world, or travelling specifically to one destination for the entire time. You might be working the snow season at a ski resort in Canada, or taking up an international business internship in China, or just picking up any odd jobs you can find along the way to sustain your travels.

Travelling to different destinations:

To include cover under your policy for your travel destinations, you should specify all the countries that you plan on visiting. You can add other countries after you've bought your policy and during your trip too - let us know, and if that country is not excluded from cover under our policies , we’ll be able to add it to your policy for you. Sometimes an additional charge may apply.

If you're headed overseas without any set itinerary, just select the region that includes all the countries you may want to visit.

Note: We may not be able to provide you with cover for some countries or areas within a country, even if you have selected the country or the region to which the country belongs, due to various reasons included in the policy terms, conditions and exclusions.

Our Which country or travel insurance region do I choose page can give you more information on which region your destination country belongs to, and when we cannot provide cover for some countries.

Possibility of extending:

If you're having too much fun travelling, or another great work opportunity comes up and you want to stay overseas a bit longer, you can easily extend your policy online up to a maximum of two years. If you want to keep travelling even longer, just contact us to take out a new policy after that.

What are the advantages of one-way travel insurance?

The importance of travel insurance can’t be overstated for a one-way trip.

Your health and safety are always a number one priority and if you’re relocating, you may also have more belongings and higher value items with you than if you were taking a short trip.

Our insurance can come in handy if you experience a medical emergency by covering the cost of treatment, hospital costs and medicines.

We also cover your belongings and personal items. If they’re lost or stolen, insurance can cover the cost of their replacement.

You can also receive emergency funds for essential items if the arrival of your belongings has been delayed by the airline.

See the benefit tables below to compare the different levels of cover we can provide one-way travellers:

Please note: This is only a summary of benefits. Policy terms, conditions, limits, sub limits and exclusions apply to each cover type. Benefit limits shown are for Single and Duo (per person) policies. Pooled Benefits mean that Family policy benefit limits apply for the whole family and are double the corresponding benefit limit under a Single policy, except for certain benefits - please refer to the Product Disclosure Statement for full details. ^Cover under these Benefits are excluded while travelling within Australia.

Why choose Fast Cover for your one-way trip?

Fast Cover has provided specialist insurance packages to Australians for many years.

Not only do you get great cover at an affordable price, but all of our travellers have access to a 24 hour Emergency Assistance team in case you run into trouble and need help or advice on your travels.

Get a free quote online now or talk to us to help tailor an insurance policy that meets your requirements.

^ Price as at 20/03/2024 compared to the price calculated today for this policy.

* See Product Disclosure Statement for full terms and conditions and exclusions and limits that apply.

† Fast Cover has a referral arrangement with this company.

The entity that referred you does not act for Fast Cover and may receive remuneration from us. You can ask them or us for more details. Make sure any information listed in any quote provided remains accurate and if not, please change it on our website.

- United States

- United Kingdom

One-way travel insurance

Booked a flight with no return date one-way travel insurance is ideal for you, but not all insurers offer it – we'll show you who..

In this guide

What is one-way travel insurance?

Who offers one-way travel insurance, the benefits of one-way travel insurance, what does a one-way policy cover, anything else i need to know, ready to compare policies, questions you still might have.

Destinations

What you need to know

- Some insurers need you to have a return date but a large number of travel insurance brands cover one-way trips.

- One-way travel insurance can cover you for up to 24 months – after which it will expire.

- It can cover flight cancellations, rearrangements, lost and delayed luggage, and more.

One-way travel insurance, as the name implies, cover you for trips where you don't have a return flight booked. It can usually cover you for 12-24 months or you can have it expire once you reach your destination and you've organised local health insurance.

It works similar to regular travel insurance , except you don't need to provide the exact end date of your trip.

Who needs one-way travel insurance?

If you've booked a flight overseas with no return date in mind, you probably want to get one-way travel insurance – for example, if you're moving to a different country and want covered for flight cancellations and medical expenses when you first get there.

Note: This information was last updated August 2023

- You get the same benefits as a normal travel insurance policy.

- Suitable for different travellers, whether you're immigrating to another country or just not sure when you'll return home.

- The flexibility of being able to extend your expiration date if you give enough notice to your insurer. This way, you only pay for the cover you need.

- Being covered while you sort out local health insurance at your final destination.

There are no major differences between one-way travel insurance and standard travel insurance in terms of what's typically covered. You should get:

- Cancellation and amendment fees. If unforeseen circumstances force you to cancel your trip, you’ll be reimbursed for any cancellation fees or lost deposits on prepaid travel arrangements such as flights, meals, accommodation and activities.

- Medical expenses. A medical complication overseas can be expensive, so your one-way travel insurance will cover things like medical costs, hospital costs and emergency dental costs.

- Repatriation. The expense of your medical repatriation back to Australia is also covered but you may have to reimburse your insurer for the price of an economy ticket (if you had already purchased a return flight, the insurer might have been able to obtain a refund for it. But since you don’t have a return ticket, you might be responsible for their inability to recoup those funds).

- Additional accommodation and travel expenses. If your trip is disrupted or you have to return to Australia sooner than expected due to unforeseen circumstances, your one-way travel insurance will cover the additional accommodation and travel expenses you incurred.

- Lost, stolen or damaged personal items and luggage. If your luggage and/or personal belongings are lost , stolen or damaged, your one-way travel insurance will cover the cost of their repair or replacement.

- Misplaced luggage. If a travel provider misplaces your luggage, you’ll receive the funds you need to buy emergency clothing and toiletries.

- Lost, stolen or damaged documents, credit cards and travellers’ cheques. If your important travel documents (including your passport) are lost, stolen or damaged, your one-way travel insurance will cover their replacement.

- Theft of cash. You’ll be covered up to a certain limit for the theft of cash from your person.

- Travel delays. If your prepaid transport is delayed, cancelled or rescheduled due to unforeseen circumstances you’ll be reimbursed for the cost of things like extra accommodation, meals and transfers.

- Personal liability. Your policy will cover you if you cause bodily injury or property damage to a third party.

- Rental vehicle excess. If your rental car is stolen, damaged or crashed, your one-way travel insurance will cover the cost of the rental company’s insurance excess.

- Accidental death. Your family will receive a benefit if you die as a result of an accident while overseas.

- Disability. You’ll receive a benefit if you become disabled as a result of an accident while travelling.

- Loss of Income. If you are injured while travelling and unable to work when you return to Australia, your one-way travel insurance will cover your lost income for a certain period of time.

- Resumption of Journey. If your trip was cut short due to an unforeseen circumstance, you will be covered for the return flight to the nearest international airport where your trip unexpectedly ended.

What else can I get cover for?

- Winter sports or adventure activities. If you partake in more risky and/or expensive winter sports activities , adding this to your policy will cover you for accidents and equipment.

- Pre-existing conditions. Not all pre-existing conditions are covered under a typical one-way travel insurance policy, but some of these can be added for an extra fee if you undertake a medical assessment. Even if your pre-existing medical condition does not qualify, you may still be able to get coverage for everything not related to that condition.

- Pregnancy. Depending on how far along you are in the pregnancy and whether or not you are having complications, you may not need any extra insurance. But in some cases you will need to be assessed and may have to pay additional cover or forfeit any pregnancy-related claims.

- Valuable items. If you plan to take items that are more valuable than your policy will cover you for, you may be able to upgrade this portion of your policy to the level you need.

- Cruise. This offers additional cover for specific things that could go wrong on a cruise . Some providers automatically cover cruises under their travel insurance policies, while others charge an additional fee. So if you’re planning a one-way cruise to New Zealand , then make sure your plan covers it.

- Do I need to tell my insurer I'm going on a one-way trip? You’ll need to tell your insurer that you’re travelling on a one-way ticket when you apply for cover. If you fail to do so, your policy could be void. It’s always important to be upfront and honest with your insurance provider and disclose any relevant information about your travels.

- How long am I covered? Terms and conditions differ between policies. Some policies let you nominate an end date of your choosing up to a year from the date your policy starts. Others only cover you during transport and the policy will cease anywhere from 24 hours to 7 days after you arrive at your final destination. It is important to read the PDS of each policy and understand the specific terms and conditions.

- Can I extend my cover from overseas? Some policies will allow you to extend your coverage from overseas for up to a maximum of one-year total coverage from the start of your journey.

- How old can I be when taking out one-way travel insurance? Every travel insurance policy comes with a maximum age limit. This may be 75 years on some policies, or 100 or more on others. You’ll need to be aware of this when applying for cover.

- I have a pre-existing condition. Does it matter? You need to inform your insurer of any pre-existing medical conditions you have. Whether or not you’ll be able to take out cover for those conditions will depend on your insurer and the nature of your illnesses or injuries. In some cases you may be denied coverage. In other cases you will be able to take out cover, but will be unable to make claims related to the pre-existing condition.

- Do I need to come home to make a claim? No. You can make the claim from anywhere in the world. The point of travel insurance is to make you life easier while travelling, not harder.

- In the event I need to be repatriated, can I choose where I am repatriated to? Some policies allow you to nominate a final destination that is different than Australia. If you need to be repatriated, you can choose to be repatriated to that destination. Be sure to check the PDS and/or talk to a consultant to find how each insurer handles this option.

Use a comma or space to separate ages. Add kids under the age of 1 by typing a “0” 0 traveller(s)

Include travel deals and helpful personal finance content from Finder

By submitting this form, you agree to our Privacy & Cookies Policy and Terms of Service

Why you can trust Finder's travel insurance experts

We're experts

We're independent

We're here to help

Can i get travel insurance for a one-way trip.

Yes. Some providers offer one-way travel insurance, ideal if you're leaving Australia and are not sure exactly when you'll be heading back home. It can cover you for up to 24 months.

How to get travel insurance with no return date?

If you're going overseas and haven't booked a return flight, some but not all insurers will allow you to take out travel insurance.

When do I need one-way cover?

It makes sense to get one-way travel insurance if:

- You're going overseas and you're not sure when you're coming back home. For example, if you've decided to backpack around Asia and haven't decided when you will return home, you need one-way cover to safeguard against any risks you encounter while travelling.

- You're moving overseas and need to be covered until you organise insurance in your new country. For example, if you're moving to the USA for a new job, you'll want to make sure that you're covered for cancellations, luggage and medical expenses before you land.

- You already have insurance organised in your new country and you only need cover for the flight over. For example, if you're a UK citizen who is returning to the UK from Australia, this cover can act as a bridge to make sure that you and your possessions arrive home in one piece

What if I'm moving to a country indefinitely?

If you're moving to another country, some insurers will end your cover between 24 hours to 7 days from leaving immigration control at the airport. This is for those who don't have a return date to Australia at all. This is because if you're relocating to another country, you're no longer "travelling" as such, so it's expected that some form of local health insurance will kick in.

Am I covered for one-way trips back to Australia?

You’ll need insurance for Australians that are already overseas . Most insurers offering this will need you to already have a return ticket booked to Australia.

What's not covered by one-way travel insurance?

There are certain circumstances under which travel insurance claims will not be paid. These are similar to those you'll find with standard travel insurance and include:

- If your claim is a result of you acting unlawfully or recklessly

- If your claim results from you being under the influence of drugs, except for those prescribed by a medical practitioner

- If your claim results from you being excessively under the influence of alcohol

- If you ride a motorcycle on your trip (unless you are wearing a helmet and are licensed to ride a motorcycle in Australia)

- If your claim results from you leaving your belongings unattended in a public place and they are lost or stolen

- If you participate in high-risk adventure sports and activities like skydiving (unless you have added this to your policy)

- If you are more than 26 weeks pregnant and you suffer any pregnancy-related complications.

How do I cancel my travel insurance after I arrive?

Your travel insurance will automatically cancel after the expiry date. You can't cancel the remaining unused portion of a policy for a refund after the cooling-off period.

Gary Ross Hunter

Gary Ross Hunter is an editor at Finder, specialising in insurance. He’s been writing about life, travel, home, car, pet and health insurance for over 6 years and regularly appears as an insurance expert in publications including The Sydney Morning Herald, The Guardian and news.com.au. Gary holds a Kaplan Tier 2 General Advice General Insurance certification which meets the requirements of ASIC Regulatory Guide 146 (RG146).

More guides on Finder

The best travel insurance policies are different for each individual traveller.

We take a look to see if you are fully protected by insurance if your Airbnb trip goes wrong.

South Korea has become a tourist hotspot in recent years, and is usually a very safe choice if you travel smart.

Everything you need to know about taking your pet overseas including rules for flying with pets and how to prepare for your trip.

Find out how travel insurance for trip disruption actually works and policies from Australian brands.

Find out how travel insurance covers accidental death and what will be paid from in the event of a claim.

Beware when swimming at Byron, Ballina, Bondi and Bells.

Learn more about travel insurance brokers, how they are paid and the way they can help you find comprehensive travel cover.

Is travel insurance a worthy investment? Find out why travel insurance is an invaluable travel item.

Guide to high-risk travel insurance: What is and isn't covered.

How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

Important information about this website

Advertiser disclosure.

finder.com.au is one of Australia's leading comparison websites. We are committed to our readers and stands by our editorial principles

We try to take an open and transparent approach and provide a broad-based comparison service. However, you should be aware that while we are an independently owned service, our comparison service does not include all providers or all products available in the market.

Some product issuers may provide products or offer services through multiple brands, associated companies or different labeling arrangements. This can make it difficult for consumers to compare alternatives or identify the companies behind the products. However, we aim to provide information to enable consumers to understand these issues.

How we make money

We make money by featuring products on our site. Compensation received from the providers featured on our site can influence which products we write about as well as where and how products appear on our page, but the order or placement of these products does not influence our assessment or opinions of them, nor is it an endorsement or recommendation for them.

Products marked as 'Top Pick', 'Promoted' or 'Advertisement' are prominently displayed either as a result of a commercial advertising arrangement or to highlight a particular product, provider or feature. Finder may receive remuneration from the Provider if you click on the related link, purchase or enquire about the product. Finder's decision to show a 'promoted' product is neither a recommendation that the product is appropriate for you nor an indication that the product is the best in its category. We encourage you to use the tools and information we provide to compare your options.

Where our site links to particular products or displays 'Go to site' buttons, we may receive a commission, referral fee or payment when you click on those buttons or apply for a product. You can learn more about how we make money .

Sorting and Ranking Products

When products are grouped in a table or list, the order in which they are initially sorted may be influenced by a range of factors including price, fees and discounts; commercial partnerships; product features; and brand popularity. We provide tools so you can sort and filter these lists to highlight features that matter to you.

Terms of Service and Privacy Policy

Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

- Car Finance

- Hire Purchase

- Novated Leasing

- Bad Credit Car Loans

- Car Loan Refinance

- Business Car Loans

- Australian Car Statistics

- Car Loan Repayments Calculator

- Compare Car Loans

- Average Car Loan Interest Rates

- How Much Can I Borrow?

- How to Get a Car Loan?

- Caravan Loans

- Motorbike Loans

- Jet Ski Loans

- Camper Trailer Loans

- Loans for Harley-Davidson

- Boat Loan Calculator

- Caravan Buying Checklist

- How to Choose a Motorbike?

- Top Tips to Choose a Right Boat

- Equipment Finance

- Chattel Mortgage

- Truck Finance

- Aircraft Finance

- Technology Finance

- Agriculture Finance

- Plant & Machinery Finance

- Operating Lease

- Unsecured Personal Loans

- Low-interest Personal Loans

- Debt Consolidation Loans

- Travel Loans

- Wedding Loans

- Bad Credit Loans

- Compare Personal Loans

- Personal Loan Calculator

- Personal Loans Eligibility

- Unsecured Business Loans

- Small Business Loans

- Invoice Financing

- Business Overdrafts

- Cashflow Lending

- Small Business Start-up Loans

- Compare Business Loans

- Business Loan Interest Rates

- First Home Buyers

- Buy Next Home

- Investment Home Loans

- Home Loan Refinance

- Bad Credit Home Loans

- Self Employed

- Construction Home Loans

- Compare Home Loans

- How to Choose a Home Loan?

- Home Loan Repayments Calculator

- Borrowing Power Calculator

- Balance Transfer

- Frequent Flyer

- No Annual Fee

- Master Card vs Visa Card

- Maximise Credit Reward Points

- Perks of Using a Credit Card

- Manage Your Debt with a Balance Transfer Card

- Small Personal Loan

- Quick Cash Loan

- Rental Bond Loan

- Car Repair Loan

- Furniture Loan

- Emergency Loan

- Rent Arrears Loan

- Bank Accounts

- Savings Accounts

- Term Deposits

- Business Bank Accounts

- Debit Cards

- Kids Savings Accounts

- Margin Loans

- Travel Money Cards

- Best International Money Transfers

- Send Money to India

- Send Money to USA

- Send Money to New Zealand

- Send Money to UK

- Send Money to Canada

- Superannuation

- Compare Super Funds

- Cryptocurrency

- Share Trading

- Forex Trading

- CFD Trading

- Comprehensive Car Insurance

- Third Party Fire and Theft Car Insurance

- Third Party Property Damage Car Insurance

- CTP Insurance

- Classic Car Insurance

- Car Insurance for Young Drivers

- Seniors Car Insurance

- How Do I Compare Car Insurance?

- How Much is Car Insurance?

- Types of Car Insurance in Australia

- Market Value Vs Agreed Value

- Car Insurance with Choice of Repairer

- Landlord Insurance

- Building Insurance

- Flood Insurance

- Contents Insurance

- Best Home Insurance

- Cheapest Home Insurance

- Professional Indemnity Insurance

- Public Liability Insurance

- Product Liability Insurance

- Domestic Travel Insurance

- Cruise Travel Insurance

- Single Trip Travel Insurance

- Seniors Travel Insurance

- Best Travel Insurance

- Cheap Travel Insurance

- Travel Insurance for Pre-Existing Conditions

- What Does Travel Insurance Cover?

Why Do I Need Travel Insurance?

- Travel Insurance COVID-19

- Seniors Funeral Insurance

- Hospital Cover

- Extras Only Cover

- Singles Cover

- Couples Cover

- Family Health Insurance Cover

- Overseas Visitors Health Insurance Cover

- Health Insurance for Seniors

- Cheap Health Insurance

- Income Protection

- Personal Accident Insurance

- Trauma Insurance

- TPD Insurance

- Funeral Insurance

- Seniors Pet Insurance

- Cheap Pet Insurance

- Best Pet Insurance

- Electricity Plans

- Compare Electricity Plans

- Compare Gas Plans

- Solar Electricity Plans

- Green Energy Plans

- ADSL Broadband Plans

- Mobile Broadband

- Home Wireless Broadband Plans

- Internet Providers

- Best Broadband Deals

- Prepaid Plans

- iPhone Plans

- Unlimited Data Plans

- SIM-Only Plans

- Unlimited Data for Mobile Phones

- Travel Insurance for Mobile Phone

- Customer Reviews

One-Way Travel Insurance

Compare a range of one-way insurance offers with Savvy today.

Fact checked

Compare Travel Insurance Quotes in 30 Seconds

- 100% free to use. No obligation.

Not all holidays and overseas trips have to have clear structures to them; you might simply want to travel abroad and see where the wind takes you. If you’re booking a one-way trip and are looking for travel insurance to align with your journey, you can compare your options right here with Savvy.

We’re partnered with trusted travel insurance providers to give you high-quality options to compare before you buy your policy. Compare different insurers side-by-side by getting a free, no-obligation quote online with Savvy today.

What is one-way travel insurance and how does it work?

One-way travel insurance is a type of insurance which can cover those travelling overseas without a set end date or any concrete plans to return to Australia. This makes it different from standard travel insurance policies, which require your covered trip to begin and end in Australia. There are insurers which may be able to offer you cover for up to 12 months away from home under this type of insurance, though this will depend on meeting your insurer's eligibility criteria (for example, those over 65 may be limited to 90 days' worth of coverage).

As part of your policy, you’ll be required to outline to your insurer the destination or destinations you’re planning to travel to whilst overseas. Missing out any locations could leave you without cover if you need to make a claim. You may also have the option to extend your policy up to a maximum of two years with some insurers if you're extending your overseas stay, with any further coverage requiring a new policy to be bought.

What can I be covered for under a one-way travel insurance policy?

The coverage offered by one-way travel insurance is, in most cases, the same as what you’d receive under any other standard international travel insurance policy. However, this will depend on whether you elect to take out a comprehensive or basic policy, as well as other factors relating to meeting your insurer's qualification requirements. What your travel insurance policy covers can include:

- Emergency medical attention

- General medical treatment

- Transportation to a hospital (such as in an ambulance or helicopter)

- Medical evacuation and repatriation in Australia

- You or a family member falling ill (or if a relative passes away)

- A natural disaster striking, such as a flood or fire

- Unexpectedly being made redundant without any knowledge that this would take place

- If you, a travel companion or family member is posted overseas or required to stay in the country due to being a member of the defence or police force, nursing or ambulance services or a firefighter

- Loss of an item under a covered event

- Damage to an item under a covered event

- Theft of an item under a covered event

- Hire car excess: if you’re renting a car overseas and it’s damaged in your possession, your insurance policy may be able to offer cover for the cost of its excess . This is provisional on factors such as you not breaking any road rules or driving on unsealed roads at the time of the accident.

- Personal liability: if you’re found to be liable for causing damage to someone’s property or causing harm to them, you may be able to be covered for up to $5 million depending on your insurer, the coverage you buy and whether you qualify for that coverage as an individual.

It's important to bear in mind that all coverage will be subject to your insurer's qualification requirements and the terms and conditions of your policy agreement, so comparing different policies and insurers can help you gain a greater understanding of what is and isn't covered under your one-way travel insurance.

How do I compare one-way travel insurance policies?

There are many key areas to consider when comparing different travel insurance policies. Fortunately, you can do just that with Savvy. Consider the following factors when taking out one-way travel insurance:

Inclusions and exclusions

Not all policies will offer the same covered events, so it's crucial to determine what the inclusions and exclusions are before you buy. For instance, some policies won't include things like motorcycle cover or other, more risky activities like winter sports automatically, which would instead be available for purchase as an optional extra or not covered at all. Many policies will omit medical expenses as a result of a pre-existing health condition from their coverage, so if you find yourself in that boat, it’s crucial to compare your options.

Cost of premiums

Of course, you shouldn’t be forced to pay more than necessary for your insurance policy. Although the cheapest policies may not always offer the cover you need, it’s worth comparing your options thoroughly among insurers who can offer you suitable cover.

Excess requirements

When it comes to the excess on your travel insurance policy, the amount you can choose to set it at may vary depending on your profile and the insurer you choose to purchase with. With some insurers, you may not have to pay an excess at all in certain situations. However, it's worth noting that higher excesses will generally result in lower premiums, and vice versa.

Countries serviced

Insurance providers also don’t always offer coverage for all countries around the world, so it’s important to look for a policy which allows you to make a claim in any country or city you visit over your time away from home (if available).

Finally, it’s worth making sure you can actually receive the cover you need based on your age. As mentioned, not all providers offer one-way policies for senior travellers beyond the age of 65, but this may not be the case across the board. As such, if you're a senior, it's worth comparing insurers based on their age limits and terms and conditions surrounding older travellers.

Types of travel insurance

International.

International travel insurance can offer cover for a range of events, including medical expenses, lost luggage or items, cancellation fees and more when you're overseas and a long way from home.

If you're journeying within Australia, domestic policies are designed to offer many of the same protections as international travel insurance (with the exception of medical expenses).

Single trip

The most standard and common type of travel insurance, this policy can cover you for one trip starting and ending in Australia (and is available for both international and domestic travel).

Annual multi-trip

As the name suggests, this type of travel insurance covers multiple trips over a 12-month period. Depending on your insurer, you may be able to take an unlimited number of trips up to 90 days each.

You don't have to have a return ticket booked to take out cover while you're overseas. One-way travel insurance enables you to access cover without a set end date, such as if you're moving temporarily.

You may need to take out specialist coverage if you're setting sail on a cruise. Fortunately, cruise insurance can cover emergency evacuation, cabin confinement and more.

Just because you're older doesn't mean travel insurance isn't still important. If you qualify for cover, seniors' travel insurance can offer greater peace of mind for included events while you're travelling.

Adding winter sports or ski cover to your policy can add protection against damage to your equipment, piste closure due to bad weather and activities such as back-country skiing, heliskiing and more.

Adventure sports

Looking to enjoy some adventure sports on holiday? An adventure sports pack can grant you cover for a range of activities, such as hiking, scuba diving and motorcycle or scooter riding.

Jetsetting with the whole clan in tow? Some insurers offer family travel insurance, which enables you to include yourself, your partner and your dependent children under one policy to help you save.

If you're travelling interstate or overseas with your partner (or simply another friend or family member), you may be able to access a discount by taking out a joint or duo travel insurance policy.

Why compare travel insurance with Savvy?

Reputable insurance partners, fast and convenient online process.

You can complete the quote, comparison and purchase process online through Savvy quickly and easily.

Competitive quote costs

Regardless of the type of insurance you’re looking for, we can help you compare between competitive quotes.

The pros and cons of one-way travel insurance

Designed for more flexible holidays.

If you want to travel freely around the world without a set end date, a one-way policy can help you do so without worrying about not being covered.

Same coverage as other policy types

Just because it’s travel insurance for a one-way trip doesn’t mean it offers different coverage than you might receive on a standard round-trip policy.

Suitable for temporary relocations

If you're moving overseas as part of your job or to live with your partner without a set end date, a one-way policy may be worth considering.

Ability to extend your coverage

Once you're overseas, you may be able to extend your coverage up to a maximum of two years (depending on your insurer and their terms and conditions).

Doesn’t cover all ages

If you’re an older traveller, not all insurers will be able to offer the coverage you might need if you want to travel the globe without an end date.

Less suitable for short-term trips

If you’re looking for cover for a short trip to New Zealand with a return date in mind, it may be less cost-effective to buy a standard policy than two one-way policies.

More one-way travel insurance questions answered

While returning home early from your overseas trip won’t incur any fees or added costs, you won’t be able to receive a refund for the part of your holiday which didn’t end up going ahead. Also, even if you're returning within your coverage window, you're unlikely to be covered for your return to Australia, so you may need to purchase a different policy designed for travellers who are already overseas if you wish to have a travel insurance policy in place.

Some insurers can offer cover for COVID-19-related costs, such as those which may stem from medical treatment or cancellations after contracting the virus. However, not all such costs can be covered, such as those occurring in the 72 hours after purchasing your policy or resulting from lockdowns. As such, it's important to familiarise yourself with different PDS documents to determine what you can and can't be covered for.

Whether you can be covered for pregnancy-related expenses under your travel insurance will come down to a variety of factors, such as how far along you are at the time of your travel and whether there are any recommendations from your doctor regarding travelling. While there are some insurers who can offer cover for related claims up to 32 weeks, others cap this at a shorter period of 18 to 24 weeks (though any coverage will be subject to meeting your insurer's criteria relating to your pregnancy). As such, childbirth or any further complications falling outside the window outlined in your agreement won't be covered.

Some insurers allow you to purchase one-way family policies if you're travelling overseas with your partner and/or dependent children without an end date booked. Different insurers have different definitions of dependent when it comes to children on a policy, with some defining this as being under 20, not working full-time and still being financially dependent on you. Therefore, if you need cover for a trip to the Middle East for work with no set end date, you may be able to take out a policy which offers cover for your whole family for a variety of claimable events.

There may be insurers who offer policies which cover you if you’re cruising abroad with no immediate plans to return to Australia. It's important to check with different companies to determine which products they offer and the terms and conditions to see how long you can be covered at sea.

Helpful travel insurance guides

Travel Insurance That Covers Border Closures

Find out if travel insurance policies cover border closures by comparing with Savvy. Compare Travel Insurance Quotes in 30 Seconds...

What is a Travel Insurance Excess?

Find out what a travel insurance excess is and how you should compare them here. Compare Travel Insurance Quotes in...

Asking yourself why you need travel insurance for your holiday? Compare with Savvy and understand the benefits. Compare Travel Insurance...

Compare Cruise Travel Insurance

Setting sail on your next holiday? Compare cruise travel insurance with Savvy. Compare Travel Insurance Quotes in 30 Seconds Get...

Travel Insurance for Heart Conditions

Looking for travel insurance that covers heart conditions? Compare with Savvy to help you get the cover you need today....

Compare Domestic Travel Insurance

Exploring your own backyard? Compare and find the best domestic travel insurance with Savvy. Compare Travel Insurance Quotes in 30...

Cheap Domestic Travel Insurance

Compare with Savvy and find a cheap travel insurance deal for your next domestic holiday. Compare Travel Insurance Quotes in...

Cheap Travel Insurance For Seniors

Compare travel insurance for seniors with Savvy to help you find the cheapest. Compare Travel Insurance Quotes in 30 Seconds...

Best Multi-Trip Travel Insurance Australia

Compare your multi-trip travel insurance options with Savvy to help you find the best. Compare Travel Insurance Quotes in 30...

How Late Can You Buy Travel Insurance?

Find out how close to your departure you can purchase your policy with Savvy. Compare Travel Insurance Quotes in 30...

Explore your travel insurance options for your next destination

Travel Insurance for Brazil

Travel Insurance for Abu Dhabi

Travel Insurance for Fiji

Travel Insurance for America

Travel Insurance for Oman

Travel Insurance for Portugal

Travel Insurance for Belgium

Travel Insurance for Switzerland

Travel Insurance for Antarctica

Travel Insurance for the Seychelles

Travel Insurance for Africa

Travel Insurance for Hong Kong

Travel Insurance for Saudi Arabia

Travel Insurance for Tunisia

Travel Insurance for Lebanon

Travel Insurance for Europe

Travel Insurance for Denmark

Travel Insurance for Norway

Travel Insurance for France

Travel Insurance for Prague

Travel Insurance for Iceland

Travel Insurance for the Bahamas

Travel Insurance for the Philippines

Travel Insurance for Italy

Travel Insurance for Bangladesh

Travel Insurance for Vietnam

Travel Insurance for Bermuda

Travel Insurance for the Himalayas

Travel Insurance for Greece

Travel Insurance for Malta

Disclaimer: We do not compare all travel insurance brands currently operating in the market. Any advice presented above or on other pages is general in nature and does not consider your personal or business objectives, needs or finances. It’s always important to consider whether advice is suitable for you before purchasing an insurance policy.

Savvy earns a commission from our partners each time a customer buys a travel insurance policy via our website. We don’t arrange for products to be purchased from these brands directly, as all purchases are conducted via their websites.

Before purchasing your policy, we recommend you refer to the provider’s PDS for any further information on the terms, inclusions and exclusions.

- Giving Back

- Partner with us

- Privacy Policy

- Terms of Use

- Credit Guide

- How We Handle Complaints

- Scam and Fraud Warning

- Comparison Rate Warning

1300 974 066

Sign up to our newsletter.

Quantum Savvy Pty Ltd (ABN 78 660 493 194) trades as Savvy and operates as an Authorised Credit Representative 541339 of Australian Credit Licence 414426 (AFAS Group Pty Ltd, ABN 12 134 138 686). We are one of Australia’s leading financial comparison sites and have been helping Australians make savvy decisions when it comes to their money for over a decade.

We’re partnered with lenders, insurers and other financial institutions who compensate us for business initiated through our website. We earn a commission each time a customer chooses or buys a product advertised on our site, which you can find out more about here , as well as in our credit guide for asset finance. It’s also crucial to read the terms and conditions, Product Disclosure Statement (PDS) or credit guide of our partners before signing up for your chosen product. However, the compensation we receive doesn’t impact the content written and published on our website, as our writing team exercises full editorial independence.

For more information about us and how we conduct our business, you can read our privacy policy and terms of use .

© Copyright 2024 Quantum Savvy Pty Ltd T/as Savvy. All Rights Reserved.

Thanks for your enquiry!

Our consultant will get in touch with you shortly to discuss your finance options.

We'd love to chat, how can we help?

Where do you live

All persons to be insured must reside at a permanent address within the EEC ( Excluding Switzerland, Russia, Belarus, Montenegro and the Ukraine) to be eligible for cover.

Can I take out this insurance if I am already travelling?

When cover is purchased after an Insured Person has departed their home to commence their journey, there is a fixed period of 48 hours prior to cover commencing. Any illness arising during this initial 48 hour period will be an excluded Pre-existing Medical Condition. In the event of serious injury in connection with an accident, you will be covered from the date you take out cover subject to the accident being independently witnessed and also verified by a Medical Practitioner.

There is no 14 Day Cooling off Period and no premium refund will be made if the insured Person has already travelled.

family family

Definition of a couple

A couple is defined as 2 adults who have been permanently living together at the same address for more than six months, who intend to travel together.

If you do not qualify as a couple, please select individual(s)

Annual Multi-Trip Durations

Annual Multi Trip policies are designed for multiple short holidays leaving from and returning to your home country.

Annual Multi Trip trip limits:

Standard policy - 30 days

Premier policy - 70 days

If you need continuous cover for a year (home visits allowed on policies over 4 months long) select Single Trip or One Way. You can travel around as much as you like, to as many different countries as you like, with a Single Trip or One Way policy.

One Way Trip

Please note a Single Trip policy can cover travels with no return ticket booked, a One Way policy is intended for:

Emigrating to new country where you intend to permanently live

Returning to your home country permanently

All cover ceases upon arrival at final destination

Select the type of policy most suitable for your needs.

Single Trip: A flexible policy with no limits on how many countries you visit or how long you’re away for. Suitable for all types of travel whether it be short term/long stay or backpacking. No return ticket required and unlimited home visits offered on policies over 4 months long.

One Way Trip: Means you are Emigrating to a new country where you intend to live permanently or, returning to your home country permanently. Cover will end upon arrival at your final destination. Please note: There is no cover for emergency return travel expenses if you do not have an original return ticket.

Annual Multi-Trip: This policy covers an unlimited number of trips throughout the 12 month Period of Insurance. Each trip has a maximum stay validity depending on the type of policy chosen. For example, for Standard Policies, the maximum duration of any trip shall not exceed 30 days and for Premier policies, the maximum duration of any trip must not exceed 70 days.

If you are already travelling it is not possible to purchase the annual multi-trip policy.

Geographical Areas

Europe: Europe means the continent of Europe West of the Ural Mountains, and includes the Isle of Man, the Channel Islands, Iceland, Jordan, Madeira, the Canary Islands, the Azores and Mediterranean Islands as well as all countries bordering the Mediterranean. Australia & New Zealand: a) For any period of cover purchased, a 48 hour stop-over anywhere in the World for both outward and return travel will be included. b) If the period of cover purchased is two months or more, a stop-over of 7 days/nights anywhere in the World will be included. Worldwide excluding North America & Mexico: (North America means the USA, Canada & Mexico.) a) For any period of cover purchased, a 48 hour stop-over anywhere in the World for both outward and return travel will be included. b) If the period of cover purchased is two months or more, a stop-over of 7 days/nights anywhere in the World will be included. Worldwide including North America & Mexico: Worldwide means anywhere in the World including the USA, Canada & Mexico.

Automatic Trip Extension If the Insured Person is prevented from completing their travel before the expiration of this Insurance as stated under the Period of Insurance on the Booking Invoice or Validation Certificate (as applicable) for reasons which are beyond their control, including ill health or failure of public transport, this Insurance will remain in force until completion but not exceeding a further 31 days on a day by day basis, without additional premium. In the event of an Insured Person being hijacked, cover shall continue whilst the Insured Person is subject to the control of the person(s) or their associates making the hijack during the Period of Insurance of a period not exceeding twelve months from the date of the hijack. Please ensure you arrange cover for the entire duration of your travel

Where you normally reside

Where do you normally reside? Where do you normally reside? Please use the drop down box to choose your country of residence. Note we can only insure residents of the UK & EEA Countries. Can I take out this Insurance if I’m already abroad? If you are normally a resident of the UK or EEA Countries and your insurance has run out, you may take out cover online with us. This is on the understanding that nothing has occurred at the time of taking out the cover which has led to a claim or may lead to a potential claim. Note you cannot take out our Multi-Trip Insurance if you are already abroad. Do you have minimum residency requirements? No. If you are, for example, a British Passport holder and have right of abode in the UK, we are not concerned as to how many months in the past year you have been in the UK provided at the time of arranging this insurance you have a UK residential address.

Age Restriction Error

We are unable to quote, Please ring our Offices on 0333 0033 161 for further assistance.

Get a Quote

No return ticket required

You don't need to know when you'll be returning home to get cover. So if you're on an open ended trip, or emigrating, we can cover you. We specialise in providing travel insurance without the need of a return ticket.

Are you Emigrating?

You can insure your travels to your place of a new residence, even if you're not taking a direct route. So if you're flying straight there, taking a short - or long - detour, we've got you covered.

Cover for 156+ Activities

Whether you'll be scuba diving, jet-skiing, bungee jumping, sky diving, trekking above 2,500m or kayaking. Our Activity Packs can cover various levels of adventurous sports.

Cancellation & Baggage Cover

24 hour emergency helpline, up to £10m medical cover, claim while you're travelling, travel insurance for one way travel.

It’s common not to have a return ticket booked for your trip, but not doing so can be quite tricky trying to find cover. Most insurers require you to have a return ticket in order to purchase travel insurance cover, but don’t fret, we specialise in providing travel insurance without the need of a return ticket.

Some FAQ's:

Riding a motorbike or scooter up to 125cc is automatically covered with all our policies. Riding a motorbike over 125cc can be covered with our Activity Pack Add-on.

If you are a pillion passenger on a motorcycle tour, such as the Ha Giang Loop, this is covered automatically and does not require any Activity Packs or any relevant licences.

When riding, you must always ensure you:

- Wear an appropriate crash helmet.

- Obey the Local road rules and laws

- Have the relevant licence(s) required to ride a motorcycle in the country or countries you will be riding in. If the country you’re in requires you to obtain a specific in-country licence to legally ride a motorcycle, then to be covered, you must obtain this licence.

- If all that’s required is an International Driving Permit (IDP), and you hold an IDP, then there’s no need to go about getting any more licences.

- Be aware that an IDP will only allow you to ride the same class of vehicle as your home licence allows. So, if you’re not licensed to ride a motorbike at home, you’re not licensed to ride a motorbike abroad under your IDP. It's up to you to make sure you are licensed for the type of motorcycle you hire.

- You should always ensure the bike is fully insured (motor insurance arranged by the company that owns the bike) as there is no Personal Lability cover whilst riding a bike. We cannot cover any participation in competitions or racing or any kind.

If you get sick while travelling or you're seriously injured you are covered for emergency medical treatment including:

- Hospitalisation

- Ambulance costs

- Surgery and follow up treatment

- Visits to the Doctor

- Repatriation

- Prescribed Medicine

- Emergency dental treatment to relieve pain and suffering (limited to £350)

24hrs Medical Emergency Assistance.

Decide Canada’s not for you, and want to return earlier than your full period of insurance?

Other insurers will tell you to wave goodbye to your money, but Big Cat lets you claim a partial premium refund for the unused time you didn’t stay in Canada.

How does the EARLY RETURN REFUND work?

Let’s say you buy a 24-month policy to cover your time in Canada. But after nine months, you decide that Canada’s not for you, and you want to return home. You may have invested a substantial amount for your 24 months Big Cat policy, most of which you’ll now no longer need. Unlike most insurers, Big Cat is happy to offer you a partial refund on the redundant portion of your insurance as a fair’s fair consolation. Please note that travel insurance premiums are not calculated on a pro-rata basis, as such, no refund is calculated in this manner either.

How does Big Cat calculate the amount of EARLY RETURN REFUND?

We take the length of time of the original policy and subtract the actual amount of time you have used, and payout the difference, deducting a £50 Cancellation Charge.

Are there other conditions that apply to my EARLY RETURN REFUND?

- Only applicable to 24 month IEC policies.

- We are not able to offer refunds to cover the first 6 months of the policy.

- No refund can be given on a policy where a claim has been made or is likely to be made prior to the cancellation of your Big Cat policy.

- You must be back in your home country and notify us by email of your wish to cancel the policy within 14 days of your arrival, please also provide us with proof of your return to the UK (flight ticket / e-ticket / boarding pass).

- All refund calculations are based on the base premium paid only. Add-ons are non-refundable.

Can you give an example of how much I could receive back in my EARLY RETURN REFUND?

Say you took out a 24-month budget IEC policy costing £525.24, then you wish to cancel the policy after 9 months. Our 9-month budget IEC policy costs £312.55. So we deduct £312.55 from £525.24 = £212.99

Then we apply the £50 Cancellation Charge, refunding you a total of £162.99.

Temporary return to home country (Single trip policies only) Where cover has been purchased for a total duration of 4 months or more, and you want to return to your home country during the period of insurance for any reason that is not directly or indirectly caused by arising or resulting from, or in connection with a claim under this insurance all cover under this policy will be suspended from the time that you clear customs in your home country and restarts after the baggage check in at the international departure point for the return flights, international train or ferry to the overseas destination. Any illness, disease, injuries, accidents which existed, showed symptoms or were diagnosed in the previous trip(s) during this period of insurance will not be covered in the restarted period of insurance.

To add any of our Activity Packs, just follow the Quote form - to stage 3 - there you will find all of the optional extras.

Means WWOOFing, fruit picking, casual farm work. Other Manual Work can be covered as long as it does not involve the use of plant/trade/industrial/agricultural machinery (other than tractors) or non-domestic power tools.

Please get in touch if you'd like to find out if we can provide cover for any light manual work you will be doing.

WWOOfing is classed as Permitted Manual Work, so with the Activity Pack, you’re covered.

(see above)

Yes, bar work or working in a chalet is automatically covered with all of our policies.

Non-manual/clerical work is covered automatically with a Big Cat policy. So, there’s nothing you need to add to be covered for things like teaching, caring or nursing.

With the Activity Pack, we can also cover work of a more manual nature. This can include things like WWOOFing, partaking in community or wildlife based conservation work, charity based supervised building / renovation projects or other permitted manual work (defined below).

Cover is excluded for any activity that involves the use of industrial machinery (other than tractors) or non-domestic power tools.

Key Features of One Way Travel Insurance:

- Cover for over 156 sports & activities.

- Worldwide cover for trips up to 24 months.

- Emergency Medical and Repatriation Expenses up to £10 million.

- Personal Liability up to £2 million.

- Baggage & Personal Effects up to £2,000.

- Gadgets & valuables up to £1,000 (If optional extra selected).

- Legal Expenses up to £15,000.

- Personal Money up to £500.

- Tickets up to £1,000.

- Passport and Visa up to £300.

- Unrestricted return trips home (subject to terms and conditions)

- Cover if you wish to undertake light-manual or volunteer work.

- Facility to arrange or extend Insurance when already travelling.

- Money-back 14-day cooling off period if you decide to cancel prior to departure.

*Please note that there are certain optional extras which can be added to the one-way policy that are not included automatically, these can be found on page 3 of the quotation process.

Big Cat Travel Insurance Services, a trading name of Flynow.com Ltd (registration No.FRN 745388) is an Appointed Representative of Campbell Irvine Ltd (registration No.306242) who are authorised and regulated by the Financial Conduct Authority. You may check this on the Financial Services register www.fca.org.uk or by contacting them on (0) 800 111 6768. © 2023 Big Cat Travel Insurance Services. All rights reserved.

A fantastic plugin that allows you to display age restriction message to the visitors while visiting site

List of automatically covered medical conditions that do not need to be declared

Acne, ADHD, Allergic reaction (Anaphylaxis) provided that you have not needed hospital treatment for this in the last 2 years, Allergic rhinitis, Arthritis (the affected person must be able to walk independently at home without using mobility aids), Asthma (the diagnosis must have been made when the affected person was under the age of 50, and the asthma be controlled by no more than 2 inhalers and no other medication), Blindness or partial sightedness, Carpal tunnel syndrome, Cataracts, Chicken pox - if completely resolved, Common cold or flu, Cuts and abrasions that are not self-inflicted and require no further treatment, Cystitis - provided there is no on-going treatment, Deafness, Diabetes (which is controlled by diet or tablets only), Diarrhoea and vomiting - if completely resolved, Eczema, Enlarged prostate - benign only, Essential tremor, Glaucoma, Gout, Haemorrhoids, Hay fever, Ligament or tendon injury - provided you are not currently being treated, Macular degeneration, Menopause, Migraine - provided there are no on-going investigations, Nasal polyps, PMT, RSI, Sinusitis - provided there is no on-going treatment, Skin or wound infections that have completely resolved with no current treatment, Tinnitus, Underactive Thyroid (Hypothyroidism), Urticaria, Varicose veins in the legs.

Important information

If you have a medical condition in addition to any of the automatically covered medical conditions, all conditions will be excluded from cover unless declared to the medical screening helpline.

What is classed as a medical condition?

a Any respiratory condition (relating to the lungs or breathing), heart condition, stroke, Crohn’s disease, epilepsy, allergy, or cancer for which you have ever received treatment (including surgery, tests or investigations by your doctor or a consultant/ specialist or prescribed medication).

b Any psychiatric or psychological condition (including anxiety, stress and depression) for which you have suffered which you have received medical advice or treatment or been prescribed medication for in the last five years.

c Any medical condition for which you have received surgery, in-patient treatment or investigations in a hospital or clinic within the last 12 months, or for which you are prescribed medication.

Any premium for medical screening quoted can be paid directly. This can be done either before or after taking out a policy with us. The policy and medical extension connect automatically, no reference numbers need to be exchanged.

Choosing not to declare a medical condition will not invalidate cover, but any costs incurred in relation to an undeclared condition will not be covered.

If making a declaration all medical conditions must be declared, you can't choose to only declare certain conditions.

Medical conditions can only be declared for up to 12 months at a time. A second declaration will have to be made after 12 months if necessary.

You are about to leave the site, this text will be refined later.

World Cover Tips

Backpacker Travel Insurance Made Simple

- UK Residents

- Australian Residents

- Other Residents

- Cheap + Good

- Disclosure + Privacy

One-Way Travel Insurance

+ 8 options that work.

Leaving on a jet-plane with a one-way ticket is stuff dreams are made of.

But getting one-way travel insurance? Not so much.

Especially when most travel insurance companies require a return ticket to your place of residence while processing your request.

So what do you do ?

When you’re planning a year-long backpacking adventure or emigrating to a new country?

Is one-way travel insurance your only option?

You need one-way travel insurance when you’re making an outbound journey from your country of residence (that is, somewhere you have been staying for over a year and may be different from your country of origin).

For example, one-way travel (wikipedia) insurance covers you when you’re emigrating to a new country , with a few stops along the way, or if you’re planning a year-long backpacking trip before you finally arrive at your destination.

A one-way travel insurance policy can cover you for a few days to several months.

However, these policies generally expire soon after you arrive at your destination (within a day, and in some rare cases, within a week). One-way travel insurance issuers also expect you to arrive at your final destination within a stipulated time-limit. So it’s important to factor in potential delays or itinerary changes to stay financially protected during your trip.

What does one-way travel insurance cover?

It’s difficult to anticipate bottlenecks when your trip hasn’t even started.

But imagine this: You’re out for dinner with friends, and your purse (with your passport!) gets snatched. Or worse – you arrive on a remote island and learn that a flood warning has been issued.

Needless to say, it’s always smart to stay covered no matter the duration of your one-way journey.

Most one-way travel insurance policies will cover you for the following:

Medical emergencies (including repatriation to home country in extreme cases), emergency evacuation, accidental injury or death, baggage hold ups or loss, personal liability cover, legal fees, and loss of travel documents. These policies also offer cover for a number of exciting (and potentially high risk) holidays activities.

Which one-way travel insurance is right for your trip?

The terms of your one-way travel insurance will depend on your country of residence, duration of travel, the places you’ll be visiting in between, planned activities, as well as your final destination.

Wondering which one-way travel insurance is right for you if you’re outbound from the UK, USA, Canada, or Australia?

You have come to the right place!

Please Note: Whilst we have taken a lot of care in producing this helpful information, you are responsible for checking if a particular insuracne is right your your needs.

If you need one-way travel insurance from the UK , here are your options.

True Traveller

True Traveller offers 3 tiers of one-way travel insurance to UK residents: True Value, Traveller and Traveller Plus.

Max duration of coverage: 24 months (can vary according to the destination)

What does it cover: Emergency medical expenses, legal fees, hijacking, personal accident, personal liability (for claims brought against you during your journey), repatriation, baggage cover (optional), travel disruption, airline failure, etc.

· Longest cover duration

· You’re also covered during home visits (unlimited) for any duration of insurance

· Huge variety of activity add-ons if you’re feeling extra adventurous (you’re covered for 92 activities by default).

Go Walkabout

Go Walkabout offers a flat quote based on travel details.

Max duration of coverage: 186 days (includes 31 days maximum cover after arriving at your destination)

What does it cover: Medical emergency, loss of personal effects (including eyewear, fine jewelry and laptop), legal advice, personal harm (hijacking, kidnapping, or detention), personal belongings lost in transit, repatriation, missing departure, accidental death or loss of limb, etc. You’re also covered in case of injuries from various fun activities (winter sports, outdoor adventures, etc.).

- Coverage continues for 31 days after you arrive at your final destination

- Offers Pet Migration Insurance

If you’re looking for one-way travel insurance as an EU resident (not just UK), Globelink International and Big Cat Travel Insurance (economic pricing and long coverage) are also good options.

USA and Canada

If you’re outbound from the USA or Canada, opt for a one-way travel insurance from World Nomads (review) whether you’re in the country or already travelling.

World Nomads (USA)

World Nomads offers 2 tiers of one-way travel insurance for US residents: Standard and Explorer

Max duration of coverage: up to 180 days (5 months)

What does it cover: Medical emergencies, emergency evacuation, trip cancellation, repatriation, baggage loss, accidental death, adventure activities, etc.

World Nomads (Canada)

World Nomads offers 2 tiers of one-way travel insurance for Canadian residents as well: Standard and Explorer. However, the coverage terms differ from that of US residents.

Max duration of coverage: 12 months

What does it cover: Medical emergency, emergency evacuation, trip cancellation, repatriation, baggage loss, baggage theft, travel documents theft, sports equipment loss or theft, adventure activities, etc.

- Super easy to opt for cover if you’re already travelling (pretty much anywhere in the world).

Outbound from Australia? The following service providers can help you with the right travel insurance for your one-way trip.

1Cover offers 2 specialised one-way travel insurance plans for Australian residents: Medical Only and Comprehensive.

Max duration of coverage: 12 months (6 months for individuals over 80 years)

Medical Only:

This plan is focused on overseas medical emergencies, including surgery and hospitalisation fees, as well as personal liability claims against an insurer.

Comprehensive Plan:

This plan includes full medical emergency benefits as well as the following: loss of personal effects (including cash and credit card theft), cancellation costs, alternative travel arrangement costs, accidental death or injury (including permanent disability), domestic costs incurred due to travel disruptions (housekeeping fees, additional kennel and cattery costs, etc.).

Different add-ons are also available, including cover for high-value items as well as outdoor activities.

- Dedicated medical plan for one-way travel

- Covers permanent disability costs (indefinitely)

- Covers domestic costs incurred in case of disruptions during travel

Fast cover offers 3 tiers of one-way travel insurance for Australian residents: Comprehensive, Standard and Basic.

What does it cover: All three plans cover unlimited overseas medical expenses. You’re also covered in case of travel delays, cancellation, loss of luggage and personal effects, etc. (although these do vary according to your selected plan).

- Unlimited medical expenses overseas

- Covers 43 pre-existing medical conditions (the most extensive we’ve seen so far)

Quick Recap: Consider the following to choose the right one-way travel insurance for your trip

- Cover your trip as soon as you book your ticket. While most travel insurance providers will allow you to purchase coverage if you’re already travelling, don’t wait for adversity to hit before opting for insurance as you’ll not be able to claim these expenses.

- One-way coverage for your trip depends on your country of residence, trip duration, places you’ll visit in between, as well as your final destination. Choose a provider and plan that offers optimum coverage based on your itinerary. Needless to say, the most economical option isn’t always the best.

- Do you plan to work during your backpacking trip ? Choose the appropriate add-on that covers the type of work you’d like to engage in (for example, volunteering vs. manual work)

- If you’re an adventurous soul, opt for a plan (or add-ons) that offers maximum coverage from high risk holiday activities.

- Don’t forget to read the fine print: Do you have a pre-existing medical condition? You won’t be able to claim expenses if this condition isn’t covered by your insurance provider. Are you traveling to a region of unrest? Your provider may not cover you for emergency evacuations and damages in such cases.

Safe travels!

Return to top of page

Copyright © 2024 · Generate Child Theme on Genesis Framework · WordPress · Log in

Search Smartraveller

Choice travel insurance buying guide.

Do you need travel insurance? How do you choose the right cover? What are you covered for?

CHOICE answers all the questions you need to know before leaving the country.

Download the CHOICE travel insurance buying guide [PDF 3.52MB] Download the CHOICE travel insurance cheat sheet [PDF 587KB] Who is CHOICE? Set up by consumers for consumers, CHOICE is the independent consumer advocate that provides Australians with information and advice, free from commercial bias. Visit choice.com.au .

Why travel insurance?

- Does travel insurance cover COVID-19?

How to get travel insurance

Before you buy, how to save money on travel insurance.

- How to read the product disclosure statement

What are you covered for?

- Credit card insurance

How to make a complaint

If you’re leaving Australia, travel insurance is just as essential as a passport.

Holidays don’t always go as planned.

If you’re leaving Australia, travel insurance is just as essential as a passport. Medical expenses are the number one reason to get insurance, but sometimes other things can go wrong, such as trip cancellations, delays, lost luggage or even the big stuff like natural disasters and pandemics. If you end up out of pocket because of these things, insurance can make up for that.

The Australian Government won’t pay your medical bills.

In an emergency, the Australian Government can only help so much. The Consular Services Charter describes what the government can and can’t do to help Australians overseas.