- Single Trips

- Multi Trips

- Visitors to Canada

Frequently asked questions (FAQ)

Questions about all our plans, questions about our plans for canadians.

Yes, by default our plans have a $0 deductible, but clients can save with higher deductibles on single-trip and multi-trip emergency medical plans:

Note: Deductible options are not available for all-inclusive (single-trip or multi-trip) plans.

Questions about our plans for visitors to Canada

Yes, by default our plans have a $75 deductible, but your client can pay a little more for a $0 deductible or save with higher deductibles on emergency medical plans:

Note: Deductible options are not available for trip interruption insurance.

Yes, with Plan A, whether or not your client adds trip interruption insurance. Family coverage is not available with Plan B.

Family coverage covers the applicant, the appliant's spouse and dependent children, and all family members must be under age 60. The cost for Plan A emergency medical benefits (including travel accident insurance) is twice the premium for the oldest traveller under age 60. The cost for Plan A trip interruption insurance is three times the premium for the oldest traveller under age 60.

Questions about our plans for students

Your client can call the Assistance Centre to request an extension as long as the plan has not expired and:

- The period of coverage does not extend beyond 365 days

- The client remains eligible for insurance under this plan

- The plan is not changing from single to family coverage

If your client has a medical condition or pending claim, the Assistance Centre must evaluate and approve the extension.

- Travel Insurance

- Manulife Financial CoverMe Travel Insurance Review

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First , we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second , we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

Manulife Financial CoverMe Travel Insurance Review 2024

Updated: Feb 28, 2024, 7:30am

Manulife Financial’s CoverMe Travel Insurance offers a generous $10 million in emergency medical coverage, and mature travellers will benefit from the emergency medical coverage for pre-existing conditions. But if you’re looking for high levels of trip insurance, you might want to consider other options.

- Generous emergency medical coverage

- Coverage for pre-existing conditions

- COVID-19 Pandemic Travel Plan

- Lengthy medical questionnaire

- No CFAR coverage

- Lower trip benefits than other plans

Table of Contents

About manulife financial coverme travel insurance, what travel insurance does manulife financial offer, manulife financial coverme travel insurance plans, summary: plan comparison, manulife financial travel insurance cost, comparing manulife financial travel insurance with other insurers, optional add-ons for manulife financial travel insurance, does manulife financial travel insurance offer any discounts, does manulife financial travel insurance offer annual multi-trip plans, manulife financial travel insurance 24/7 travel assistance, does manulife financial travel insurance have cancel for any reason (cfar), does manulife financial travel insurance have interruption for any reason (ifar), manulife financial travel insurance and pre-existing medical conditions, manulife financial travel insurance exclusions, manulife financial travel insurance eligibility, how to file a claim with manulife financial travel insurance.

Manulife Financial Corporation is a multinational financial services company offering financial advice, insurance and wealth management services.

Headquartered in Toronto with offices in Canada, Asia and Europe, as well as in the U.S. under the name John Hancock, Manulife started selling insurance in 1887. Today the company offers a bevy of insurance products, including health, life, mortgage protection and travel insurance.

Manulife Travel Insurance is underwritten by The Manufacturers Life Insurance Company (Manulife) and First North American Insurance Company (FNAIC), a wholly-owned subsidiary of Manulife.

Here are the key types of travel insurance coverage offered in Manulife travel insurance plans:

- Emergency medical insurance: If you get ill or are injured on your trip, travel medical insurance can pay for emergency medical expenses, up to the coverage limits in your plan. These expenses can include doctor and hospital bills, medication and lab work.

- Trip cancellation insurance: If you cancel a trip for a reason listed in your travel policy, such as you or your travelling companion becoming ill, weather conditions causing a massive delay or you losing your job, trip cancellation insurance can reimburse you for prepaid, non-refundable costs.

- Travel interruption or delay insurance: Trip interruption insurance can pay for a last-minute flight home in an emergency and money that you lose by cutting a trip short, such as non-refundable activities and hotel stays. If your flight is delayed , your insurance can cover the cost of incidentals, such as meals or accommodations, after a specified period of time, like 10 or 12 hours.

- Baggage insurance: Baggage travel insurance can compensate you up to your policy limits if your luggage is lost or stolen. It will reimburse the depreciated value of your suitcases and what you packed. If your bags are delayed, it can reimburse you for the cost of the necessities you’ll have to buy to tide you over. It also extends to your personal belongings, if lost, damaged or stolen.

- Travel accident insurance. This coverage offers compensation in the event of accidental death or catastrophic injury from an accident during your trip. Flight Accident Insurance covers injury while you’re on a commercial plane, during a connection or in an airport. Travel Accident Insurance covers death or dismemberment, including the loss of limbs or eyesight, while on your trip.

Manulife Financial Travel Insurance offers four plans:

All Inclusive: This is the most comprehensive plan offered by Manulife Financial that includes coverage for unforeseen medical emergencies, trip cancellation and interruption, travel accident, and baggage loss, damage and delay.

According to Manulife Financial, emergency medical treatment includes:

- Hospital accommodation up to a semi-private room

- Private duty nursing

- Rental or purchase of a hospital bed, wheelchair, brace, crutch or any other medical appliance

- Diagnostic tests

- Prescription drugs and medication

- Paramedical services, such as care from a chiropractor, osteopath, physiotherapist, chiropodist or podiatrist, up to $70 per visit for a maximum of $700 per covered injury

- Ambulance transportation

- Emergency dental due to a blow to the face (up to $3,000: $1,500 on your trip and $1,500 once you return home) or,

- Emergency dental due to pain, up to $300

Medical benefits also include coverage to bring someone to your bedside, expenses for meals, hotel accommodations and associated expenses if a medical delay prevents you from returning home, repatriation expenses, return of your remains if you die and a hospital allowance, for expenses such as parking and TV rental.

Manulife Insurance is secondary insurance, which means that coverage kicks in once any other benefit plan is exhausted.

Emergency Medical: If you’re only worried about medical emergencies while travelling, this plan offers all of the emergency medical coverage options of the all inclusive plan and includes hospital accommodations, physician fees, lab tests, private nurses and ambulance services.

Trip Cancellation/Interruption: If you have medical coverage elsewhere, such as a travel credit card , this will cover trip cancellation and trip interruption. It does not offer any baggage coverage or flight and travel accident coverage.

COVID-19 Pandemic Travel Plan: This plan provides emergency medical insurance for COVID-19 and related complications, as well as trip interruption insurance benefits if you need to quarantine. The maximum payable amount is $5 million for a medical emergency related COVID-19 if you are vaccinated and $1 million if you are not vaccinated. The $5 million in coverage can also be used in the event of a non-COVID related medical emergency.

Family coverage for up to four adults (parents and grandparents) and their unmarried dependent children or grandchildren may also be available for any of these plans. (If purchasing the COVID-19 Pandemic Plan, family coverage is available for up to two adults.)

In order to be eligible for coverage, the following must be true:

- All travellers are between 30 days old and 59 years old at the time of the application

- Adults are either a parent or grandparent of the dependent children or grandchildren

- Dependent children or grandchildren are unmarried and under age 21, a full-time student under age 26 or mentally or physically disabled

We’ve highlighted key benefits of Manulife CoverMe Travel Insurance for the single trip plan to help you identify which coverage is the best fit for you.

The price of a Manulife Financial CoverMe travel insurance plan depends on factors such as the cost of your trip, your age and the amount of coverage you choose.

Here are some examples of the cost for Manulife Financial CoverMe Travel Insurance single trip plans for healthy travellers based in Ontario. Each traveller is quoted individually.

With your emergency medical coverage, you can also add an optional deductible, or the amount you will pay out of pocket before your coverage kicks in, of $500, $1,000, $5,000 or $10,000.

Emergency medical: $5 million Cancel For Any Reason: Yes, 50% to 75% Baggage insurance (maximum): $1,500

Related: CAA Travel Insurance Review

TD Insurance

Emergency medical: $5 million Cancel For Any Reason: No Baggage insurance (maximum): $1,000

Related: TD Insurance Travel Insurance Review

Emergency medical: $5 million Cancel For Any Reason: No Baggage insurance (maximum): $1,500

Related: Blue Cross Travel Insurance Review

Manulife Financial does not offer any insurance riders or add-ons.

Costco Executive members can save up to 5% on most Manulife insurance plan premiums.

Yes. You can buy multi-trip annual insurance if you travel more than once a year for multiple individual trips. Manulife Financial offers medical only coverage for four, 10, 18, 30 and 60 days and all inclusive coverage for four, 10, 18 or 30 days per trip. If you stay longer than the number of days you purchased, you can purchase a top-up. It’s important to note that the Multi-Trip All Inclusive plan is only available for purchase within 60 days of departure.

Here’s how the prices between single trip and multi-trip insurance for 18 days compare:

The Manulife Assistance Centre is available 24/7 and 365 days of the year and can help you when you’re faced with an emergency. Depending on the coverage provided by your insurance policy, support includes:

- Verifying and explaining coverage

- Referral to a physician, hospital or other health care provider

- Monitoring your medical emergency and keeping your family informed

- Arranging for return transportation home when medically necessary

- Arranging direct billing of covered expenses, wherever possible

- Assistance with lost, stolen or delayed baggage

- Assistance in obtaining emergency cash

- Translations and interpreter services in a medical emergency

- Help to replace lost or stolen airline tickets

- Assistance with obtaining prescription drugs

- Assistance in obtaining legal help or bail bond

For policyholders with emergency medical coverage, Manulife Financial Travel Insurance also offers StandbyMD, a medical concierge service. StandbyMD offers the following services 24/7:

- Teleconsultations with a physician who can assess your symptoms and provide treatment options

- A network of visiting physicians in 141 countries and over 4,500 cities

- In-network clinics close to the patient

- In-network ERs close to the patient

If you (or someone calling on your behalf) do not contact the Manulife Assistance Centre before receiving medical treatment, you may be limited to reimbursement of 80% of eligible medical expenses. It’s important to remember that certain services, such as MRIs, CAT scans, ultrasounds, biopsies and cardiovascular surgeries must be approved in advance of receiving treatment.

Manulife Financial will not pay any medical expenses related to a medical condition that is not stable for a set period of time before your coverage takes effect, either three months or six months depending on the rate category you qualify for when purchasing your policy based on your health status.

A medical condition is considered stable when all of the following are true:

- There has been no new treatment prescribed or recommended or change in existing treatment, including a stoppage in treatment.

- There has not been any change in medication, or any recommendation or starting of a new prescription drug.

- The medical condition has not become worse.

- There has not been any new, more frequent or more severe symptoms.

- There has been no hospitalization or referral to a specialist.

- There have not been any tests, investigation or treatment recommended but not yet complete, nor any outstanding test results.

- There is no planned or pending treatment.

In addition, Manulife will not cover any heart condition for which you’ve had to take nitroglycerin for angina pain in the three or six months before your effective date (the date your coverage starts), or any lung condition that required treatment with oxygen in the three or six months before your effective date.

However, Manulife Financial offers TravelEase insurance coverage for fully disclosed pre-existing medical conditions with up to $5 million in emergency benefits. Travellers interested in this coverage can call Manulife Financial for a quote.

There are a number of scenarios not covered by travel insurance and it’s critical to know what not to do before you make a claim only to be told you’re on the hook for all associated costs. The following are some of the most common issues not covered by travel insurance:

- A claim against an unstable pre-existing medical condition

- Self-inflicted injuries, unless medical evidence shows the injuries are related to a mental health illness

- Any claim resulting from a criminal offence or illegal act

- Any medical condition resulting from you not following prescribed treatment

- Any medical condition due to use or withdrawal from alcohol, drugs or other intoxicants, before or during your trip

- Routine pre-natal or post-natal care, or your pregnancy, delivery or complications of either nine weeks before or after your expected due date

- A child born on the trip

- Any non-emergency, experimental or elective treatment, such as cosmetic surgery, chronic care or rehabilitation

- A travel visa not issued in time due to a late application

- Failure of any travel agency, agent or broker

- Any loss suffered during an “Avoid all travel” or “Avoid all non-essential travel” advisories

- Any medical condition for which it was reasonable to believe you’d require treatment for during your trip or would produce symptoms before your trip

- Any act of terrorism or war

To be eligible for emergency medical insurance coverage, the following must apply:

- You are a resident of Canada and are covered under a government health insurance plan

- You are at least 30 days old

- You have not been advised by a physician not to travel

- You have not been diagnosed with a terminal illness or metastatic cancer

- You do not require kidney dialysis

- You have not been prescribed or used home oxygen in the last 12 months

- You have never had a bone marrow, stem cell or organ transplant, except for corneal transplant

There are additional eligibility criteria for travellers aged 60 and older based on their answers to a health questionnaire.

You can file a claim online 24/7 by visiting the Manulife online claims portal where you can start a new claim, submit your required documentation and follow the progress of your claim.

If you are making an emergency medical claim, documentation may include:

- Original itemized receipts for all bills and invoices

- Proof of payment by you and any other benefit plan (as Manulife is a secondary plan, meaning it pays out the balance not covered by any other insurance coverage)

- Medical records, including complete diagnosis by the attending physician or the hospital verifying that the treatment was medically necessary

- Proof of the accident if you are submitting a claim for emergency dental

- Proof of travel, including departure date and return date

- Your historical medical records, if required

- Police reports

For a trip cancellation and trip interruption claim, you may be asked to provide:

- A medical certificate stating why travel was not possible

- A police (or other responsible authority) report documenting the reason for the delay if your claim is due to a missed connection

- Original receipts for any travel accommodations made in advance and/or receipts for extra hotels, meals, telephone and taxi expenses

If you are making a baggage loss, damage and delay insurance claim, you will need to provide:

- Copies of reports from the authorities (police, hotel manager, tour operator, etc.) as proof of loss, damage or delay

- Proof that you owned the items and receipts for their replacement

To make submitting a claim easier, Manulife Financial also offers a TravelAid mobile app that gives policyholders immediate digital access to the Assistance Centre.

You must report a claim within 30 days of the occurrence, and you must submit proof of your claim within 90 days that a claim occurred or a service was provided. Money will be paid out within 60 days after all required documentation has been received and the claim is approved.

Manulife Financial CoverMe Travel Insurance FAQs

Does manulife financial pay for medical costs upfront.

According to the company, its Assistance Centre has existing relationships with medical providers in many vacation destinations to ensure emergency situations are handled “as smoothly as possible.” There is the caveat that some medical providers will require a deposit or assurance that they will be paid. However, the insurer adds that, “once the Assistance Centre is contacted and actively managing the case, the providers will directly bill Manulife and, in almost all cases, you will not see a bill.” Should you have to pay direct, Manulife will reimburse expenses once the claim documentation has been received and verified.

However, if you pay out of pocket for medical expenses without prior approval by Manulife’s Assistance Centre, eligible expenses will be reimbursed to you based on “reasonable and customary charges,” which may be less than what you paid.

Does Manulife Financial cover COVID-19?

Yes. If you have been fully vaccinated against COVID-19 at least 14 days before the start of your trip and your policy includes emergency medical benefits, Manulife will provide coverage for any unforeseen medical emergency related to COVID-19. If you’re required to quarantine, your emergency medical coverage will reimburse you for extra expense for meals, accommodation, telephone calls and taxi fares and/or the expense to bring you home. For policyholders with Trip Cancellation and Trip Interruption, COVID-19 is considered a “known event” and therefore will not be covered except for as part of one of the three scenarios below:

1) You become ill with COVID-19 and you’re unable to travel 2) You test positive for COVID-19 within 72 hours before you leave home 3) You lose your job as a result of the pandemic

Does Manulife Financial offer coverage extensions?

Yes. Your coverage is automatically extended for 72 hours starting on the final day of your trip due to a transportation delay. If you or your travelling companion are hospitalized, your coverage is extended for the period of hospitalization (to a maximum of 365 days), plus up to five days after discharge. If you or your travelling companion is unfit to travel due to a medical emergency that does not require hospitalization, your coverage is automatically extended for up to five days.

You can also request an extension if you want to stay longer on your trip, provided you apply before the expiry date of your policy and you haven’t made any claims or you’re not currently seeking treatment.

Does Manulife Financial require a medical questionnaire?

Yes. Travellers age 60 and over must complete a comprehensive medical questionnaire that asks questions about your eligibility for insurance. For example, if in the last 12 months you’ve had a new heart condition or an existing heart condition that required a change in medication or hospitalization, or if in the last four months you’ve been prescribed or taken six or more prescription medications (with some exclusions), you are not eligible for insurance. You may, however, be eligible for the TraveEase plan for pre-existing conditions. Additional questions are used to assign you to a certain rate category, which affects your premiums as well as your stability period. For example, if in the last five years you’ve been diagnosed with or treated for diabetes, a stroke or a lung condition, you’ll be assigned rate category C. Meanwhile, if in the last two years, you’ve been diagnosed with or treated for chronic bowel disease or kidney disorders, or been to the ER more than twice in six months, you’ll be assigned rate category B.

Also, if it’s discovered that you did not answer the questions truthfully or there are any errors in your claim, this may void your plan and/or your claim may be denied.

Does Manulife Financial have any age restrictions?

Yes. Travellers must be at least 30 days old. There is no maximum age limit, though family coverage is only available up to age 59.

When does my coverage with Manulife Financial begin?

If you purchase cancellation coverage, it begins the day you buy your policy and ends the day when you make a claim or leave on your trip. Your interruption coverage, if purchased, begins when you leave home. Your delay coverage begins once an insured risk prevents you from returning home as scheduled.

Can I get a refund with Manulife Financial?

You can cancel an emergency medical plan, both single trip and multi-trip, before the effective date of coverage. Refunds and cancellations are not available for any all inclusive plan.

Does Manulife Financial offer a free look period?

Yes. Manulife Financial offers a 10-day “Free Look” period where you can review and cancel your policy within 10 days of purchase if you have not already left for your trip and there is no claim in progress.

Fiona Campbell is a Staff Writer for Forbes Advisor Canada. She started her career on Bay Street, but followed her love for research, writing and a good story into journalism. She is the former editor of Bankrate Canada, and has over 20 years of experience writing for various publications, including the Globe and Mail, Financial Post Business, Advisor’s Edge, Mydoh.ca and more.

- Goose Travel Insurance Review

- CAA Travel Insurance Review 2023

- TuGo Travel Insurance Review

- Blue Cross Travel Insurance

- World Nomads Travel Insurance Review

- Medipac Travel Insurance Review

- RBC Insurance Travel Insurance

- TD Insurance Travel Insurance Review

- Johnson MEDOC Travel Insurance

- Allianz Global Assistance Travel Insurance

- TD Bank Travel Insurance

- CUMIS Travel Insurance Review

- AMA Travel Insurance

- GMS Travel Insurance Review

- CIBC Travel Insurance Review

- BMO Travel Insurance Review

- Desjardins Travel Insurance Review

- Travelance Travel Insurance

- Scotia Travel Insurance Review

- How To Get Pre-Existing Conditions Covered By Travel Insurance

- Should You Buy Travel Insurance And Is It Worth It?

- Why Travel Medical Insurance Is Essential

Do I Need Travel Insurance When Travelling Within Canada?

- Trip Cancellation Travel Insurance

- How To Get Reimbursement For A Travel Insurance Claim

- Do Canadian Travellers Need Schengen Visa Insurance?

- How Travel Insurance Works For Baggage

- How To Travel To The U.S. From Canada

- Do You Need Annual Multi-Trip Travel Insurance?

- Travel Insurance For Trips To Europe

- What Travel Insurance Does Not Cover

- Top 10 Travel Insurance Tips For 2023

- Travel Insurance For A Mexico Vacation

- How To Read The Fine Print Of Your Travel Insurance Policy

- 5 Top Tips For Handling Flight Cancellations Like A Pro

- What Does Travel Delay Insurance Cover?

- Advantages Of Buying Travel Insurance Early

- Travel Insurance For U.K. Trips

- Travel Insurance For Trips To Italy

More from

$10 etias travel pass for europe visits pushed to 2025, what’s the purpose of an etias travel authorization, bcaa travel insurance review 2024, pacific blue cross travel insurance review 2024, cumis travel insurance review 2024.

Group benefits support

On this page.

Instruction: Change of selection promptly shifts the focus to a matching heading further down, on the same page.

Popular support topics

Manulife ID for Group Benefits

Submit your group benefits claims

Getting started: FAQ

People like you

Group Benefits FAQ for plan members

Group Benefits video resources

Coordination of Benefits

Do you have insurance coverage under more than one benefits plan? With Coordination of Benefits (or COB), you and your family members may qualify for reimbursement of up to 100% of your insurance claim. But how do you get that done?

Support topics

Let’s get started with your Group Benefits account. Here’s a few FAQ about registering, signing in, passwords, and personal verification questions.

Remember to download your benefits card to your phone – you never know when you might need quick access to your benefits information.

Need help? Check out this video for step-by-step instructions .

The way you sign in is changing. We’ve introduced Manulife ID to make it easier for you to sign in by setting up your own custom username. Manulife ID also makes it easier to reset your password and to retrieve your username if you forget them.

Click to get started , then "Continue"

If you’re using the mobile app to access your group benefits account, a Manulife ID is required.

First time signing in?

To set up your Manulife ID and connect it to your new Group Benefits plan:

- Click the “Set up a Manulife ID” button

- Follow the steps to set up your Manulife ID

- If you’re an existing user, connect your Group Benefits plan to your Manulife ID

- If you’re new to group benefits we just need a bit more information to connect you

You can also set up your Manulife ID and connect it to your new Group Benefits plan on the app. Open the app and follow the steps.

Watch this video on how to setup your Manulife ID .

Returning visit?

If you already have a Manulife ID, click the “Sign in” button and enter your Manulife ID username and password. Then click “Go” under the plan that you want to access.

These numbers are found on your benefits card, which you can find on the plan member site under “My Benefits” or on the Manulife Mobile App. You can also download a benefit card onto your digital wallet from the app. Your plan contract and member certificate are also provided on Claims statements.

To find your benefit card on the website:

- Sign in to your plan on the website

- Click on the Group Benefits tile, then click “Go” under the plan you want to access

- Under the “My benefits” tab, click “My benefits card”

- Click the picture of the card and print or download it

To find your benefit card on the app:

- Sign in to your plan on the app

- Click “Benefits card”

- To add it to your digital wallet, click “Add to WalletPasses” or “Add to Apple wallet” on the bottom right.

Note: If you need your number for other medical or dental benefits, you can access additional info by pressing the three dots in the top right of the wallet app once the Manulife benefit card has been selected.

Check out our Managing your Group Benefits account page for guidelines on operating your account, including the following (and more):

- sign-in issues

- password instructions

- personal verification questions (PVQ)

Need a little more information? Here’s a resource that talks about enrolment and selecting benefits . Or, check out our Group Benefits FAQ from the link below.

A large part of managing your account is about keeping your information – including beneficiary(ies) designation(s) – up-to-date. Here’s a few step-by-step guides about how to do just that:

To update your personal information, including your email, phone number and address:

- Under “My Profile,” click “Personal Information—Edit Personal Information”

- Update your information

The instructions below do not apply to all plans. If you are unable to update your information using the instructions below, talk to your HR representative. (Please note: you cannot set up direct deposit on the app, you have to use the website to do so.)

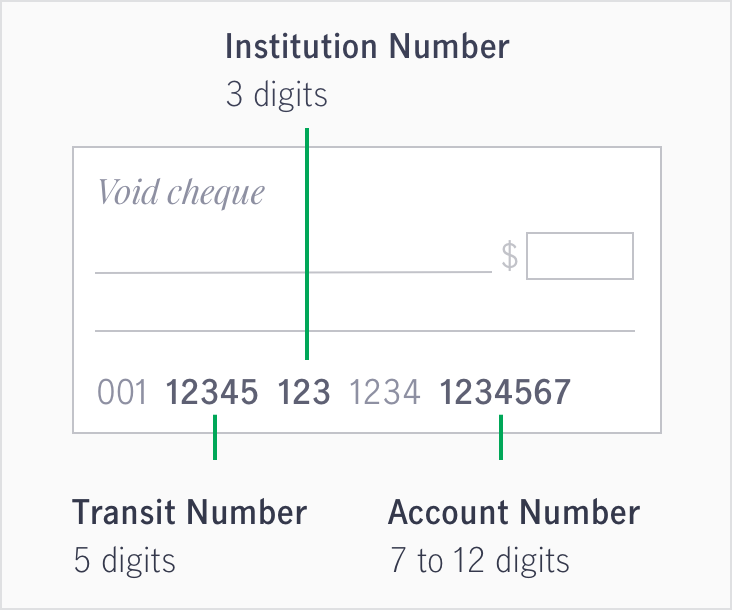

Direct deposits are easier and faster than cheques. To set up direct deposit:

- Under the “My profile” tab, click “Edit my banking Information”

- Enter your transit number, institution number and account number

You can find your banking information on a personal cheque, direct deposit form, or you can ask your bank for assistance.

If you have a void cheque handy, follow the diagram below to find your banking information:

For more, visit our Change your bank information page .

The instructions below do not apply to all plans. If you are unable to update your information using the instructions below, talk to your HR representative.

To update your beneficiary information, if your life insurance is with Manulife:

- Under “Forms,” click “Administration Forms—Find a Form—Change of Beneficiary”

- Complete the form and submit it as per the instructions on the form

Click to get started , then “Continue”

- Click the button “Set up a Manulife ID”

Watch this video on how to set-up your Manulife ID.

Returning visit

Video: plan member site overview.

Learn more about our Plan member site with this guided video tour .

Your coverage

Find out what your plan covers – and what it doesn’t cover:

Health Care Spending Accounts (HCSA)

To see what services your plan covers:

- Under the “My Benefits” tab, click “View Benefits Booklet”

If your plan does not include an online Benefits Booklet, your plan administrator at work may be able to supply you with information about services your plan covers. You may also contact our Customer Service Centre to inquire about coverage for a specific type of expense.

Find out what your drug coverage includes as follows:

- Sign in to your plan on the website.

- Go to the My Benefits menu and select My drug plan.

- Search for a drug name to find out your coverage details.

Video: Pharmacy search tool

Watch this video to find ways you may reduce prescription drug costs.

- File a Group Benefits insurance claim through the Manulife mobile app or online for quick response times.

- Register for Direct Deposit to get covered expense balances into your bank account faster.

- Group Benefits customers seeking travel information – for before, during and after a trip – may find this helpful: What you should know and expect when travelling outside Canada .

How to submit a Group Benefits claim

Disability claims FAQ

Yes, once you are registered on the site or app, you can submit your claims online. To do so:

- Click “Submit a claim”

- Follow the steps to submit your claim.

Learn more about how to submit your group benefits claims .

You can submit your claim online if:

- You incurred the expense in Canada

- You have already paid for and received the service

- The payment should be made to you

- The claim is for you

- The claim is for your spouse and they aren’t covered by another plan

- The claim is for your dependant(s) if your spouse is not covered by another plan OR your spouse is covered by another plan, but you are the parent whose birthday (month and day) falls earlier in the year

- The service provider type is listed in the Online Claim Submission tool

- Your plan includes the Online Claim Submission feature

Please submit all other claims on paper.

Learn more about how to submit your group benefits claims .

You can find copies of your claims statements online, after you sign in to your plan on the website . Once signed in, your Claims history presents itself on the screen. Click on the “Statement” icon (on the right beside a specific claim) to find the statement for that claim.

You can download the Manulife Mobile App from the app store on both android-enabled and apple phones. Search for Manulife Group Benefits and look for the app called Manulife Mobile.

Learn more about the app

Video: Submit a claim

Learn more about how to submit claims online .

If you have Group Benefits insurance under more than one plan, with Coordination of Benefits you may be able to get back the full amount of your claim. This resource shows you how:

Submit a claim to more than one plan

- First send the claim in to your own plan.

- If your plan doesn’t pay out the full amount of the claim, then you would send the claim in to your spouse’s plan to recover any amounts their plan may cover.

Your spouse will need to:

- First send the claim in to their own plan.

- If their plan doesn't pay out the full amount of the claim, then they may send the claim in to your plan to recover any amounts your plan may cover.

Consider the birth dates of both your spouse and yourself. Is your birthday closer to January 1 st than is your spouse’s birthday? If it is, then your plan will pay the claim first, followed by your spouse’s plan. If it’s not, your spouse’s plan will pay first, followed by your plan.

Whoever has the birthday closer to January 1 st is the one whose plan will be applied to first.

Send the claim in as follows:

- to your full-time job’s plan first

- if there are outstanding amounts not paid, submit the claim to your part-time job’s plan second

- and if there are still amounts outstanding, and you have a spouse who has benefits, submit your claim to your spouse’s plan third

Find answers to questions about downloading forms (and completing them) on our Find a form page .

Looking for a form for Group Retirement or Individual insurance?

Manulife mobile app

Learn more about how to download the app for Group Benefits and Group Retirement plans.

Provider eClaims

These health care providers bill Manulife directly for service costs you incur with them.

Mental Wellness Solutions

Employers: Review this comprehensive listing of resources, videos, stories and more.

Chat with us

Chat with us and get your questions answered in real time. We can help with coverage details, claims, and more.

Agents are available when the ‘Let’s chat’ option appears in the lower right-hand corner of your screen. Just click on it to start a chat. Be sure to have your Group Benefits plan details handy.

We’re online from 9 a.m. to 7 p.m. EST, Monday to Friday.

You’ll find the appropriate mailing address for your claim included right on the claim form.

Learn more at our How to submit your Group Benefits claims page. And for answers to questions about submitting by mail, check out our Group Benefits FAQ and select ‘Paper claim’.

For general questions about Group Benefits coverage, claims and more, call:

1-800-268-6195 (8 a.m. to 8 p.m. EST, Mon. to Fri.)

For questions about short- and long-term disability claims and applications, please call:

1-877-481-9169 (8 a.m. to 8 p.m. EST, Mon. to Fri.)

* In response to COVID-19 , making sure loved ones have access to their benefits is essential to their safety. We want to make it easier for you to get the information you need to care for them.

If you have Power of Attorney (POA)

If you call our call centre, to make claims on behalf of someone, ask questions about eligibility or make administrative changes, you’ll need to provide us with the following:

- verification that you are Power of Attorney (POA)

- the account holder’s full name and date of birth

- the account holder’s member number and certificate number

For more information about Powers of Attorney, visit our Group Benefits Power of Attorney FAQ page.

If you don't have Power of Attorney (POA)

If you aren’t the POA but can provide us the account holder’s full name, date of birth, member number, and certificate number, then we can provide you the account holder’s coverage information. Or you can assist your loved one in navigating our plan member site, or our Manulife mobile app.

- Health Insurance

Drug, Dental and Health Coverage

- Guaranteed Issue Enhanced

- FollowMe Health

Serious Illness Coverage

- Critical Illness Insurance

- Life Insurance

Term Life Coverage

- Easy Issue Life

- FollowMe Life

Permanent Life Coverage

- Guaranteed Issue Life

- Travel Insurance

- Travelling Canadians

- Visitors to Canada

- Health & Dental Insurance

- Manulife Vitality

Select your region

This value is required.

CoverMe Health and Life Insurance plans are only available in Canada. If you're travelling to Canada, why not explore our Travel Insurance plan?

- Give feedback

Resolve a complaint

1-877-cover me ® (1-877-268-3763), 1-800-cover me ® (1-800-268-3763), 1-888-626-8843.

We usually reply within one business day.

Please complete all fields.

Share your feedback

The Vitality Group Inc., in association with The Manufacturers Life Insurance Company, provides the Manulife Vitality program. Vitality is a trademark of Vitality Group International, Inc., and is used by The Manufacturers Life Insurance Company and its affiliates under license. Manulife, Manulife & Stylized M Design, and Stylized M Design are trademarks of The Manufacturers Life Insurance Company, and are used by it, The Vitality Group and its affiliates under license. PO Box 670, Stn Waterloo, Waterloo, ON N2J 4B8.

Eligibility and availability of rewards are not guaranteed and may change over time. Insurance provided by The Manufacturers Life Insurance Company.

- Online Claims open in new window

- Health and Dental Insurance

QUICK LINKS

- Single Trips 1 of 2

- Top-Ups 2 of 2

Why is Travel Insurance important?

Travel insurance is important to help protect you, your family or visitors to Canada from costs that can occur due to an unforeseen medical emergency during a trip or an unexpected reason to cancel or interrupt a trip. Without it, travellers may be left to pay significant out of pocket expenses.

If you are looking for Single Trip Emergency Medical coverage, we have recently introduced a new plan that provides up to $5 Million for COVID-19 emergencies while travelling outside of Canada. See the COVID-19 Pandemic Travel Plan for more details.

Learn More About Our Plans

You are no longer on Costco's site and are subject to the Privacy Policy of the company hosting this site.

Submit a claim

Health and dental, claim eligible health expenses.

Submit a Health & Dental claim online using our secure process.

Make a Life Insurance claim (PDF) using this form.

Travel Insurance

To make a claim, call 1-855-841-4796 toll-free from the USA and Canada, or +1-519-988-7008 collect to Canada from anywhere else in the world.

You can also start a claim on the TravelAid™ App .

Manulife uses cookies to personalize your experience, analyze site traffic and serve targeted ads. Learn more about your privacy options .

- Manulife Manuvie

Please select your location and the product you wish to sign into. All links are to external sites.

Canada Client Sites

Manulife Bank

Online banking

Visa credit card

Insurance

My Manulife Vitality

SecureServe® Claims

Formerly with Standard Life

Group Plans

My Group Benefits

My Group Retirement or VIP Room

Retirement Redefined

Plan Sponsors & Administrators

Group Benefits

Group Retirement

VIP Room

Advisor Portal

Online banking Visa credit card

My Manulife Vitality SecureServe® Claims Formerly with Standard Life

My Group Benefits My Group Retirement or VIP Room

Group Benefits Group Retirement VIP Room

Advisor Portal Group Retirement VIP Room

US Client Sites

Retirement Plans

Annuities

College Savings

Life Insurance

Long-term Care

Safe Access Account

Investments

Retirement Plans Annuities College Savings

Life Insurance Long-term Care Safe Access Account

Asia Client Sites

For All

China mainland

Hong Kong

Indonesia

Cambodia

Japan

Malaysia

Philippines

Singapore

Taiwan

Vietnam

China mainland Hong Kong Indonesia

Cambodia Japan Macau

Malaysia Philippines Singapore

Taiwan Vietnam

Are you looking for:

United states.

We help Americans protect their loved ones, grow their wealth, improve their health – and build their futures. And our goal is to make it fast and easy to do all those things, so you can spend time on the people and things that really matter.

It’s not what we have in life, but who we have that matters. Protect the people you care about most with easy-to-understand insurance options that offer peace of mind and put precious time back where it belongs – in your hands.

Investments

Whether you’re investing for the first time, saving for the future or embarking on retirement, we can help you enjoy today while you prepare for tomorrow.

Group retirement

Make the most of your retirement - track and manage your savings here.

Let us support you as you grow your business and protect your assets with innovative, customized insurance solutions. Whether you’re a small startup with big dreams or a large company looking to support its people with financial and wellness options, we’ve got you covered.

Your employees want to make the most of their retirement savings. Help them plan ahead and support them with solutions that can help them achieve their goals.

Take advantage of our 70+ years of experience as an active investor, owner, developer and asset manager of commercial real estate.

Our global reinsurance business serves all our property and casualty clients through Manulife Re, located in Barbados.

Our experts are here to help

Quick links.

- Results and reports

Shareholder Services

Career Opportunities

Past Presentations

- Shareholder services

- Career opportunities

- Past events

Privacy policy

Real Estate

Global High-Net-Worth

Accessibility

Manulife Re

Fraud Prevention Centre

Supplier Diversity

© The Manufacturers Life Insurance Company

How to File a Travel Insurance Claim

W hen it comes to travel, there are generally two types of people: people who cannot travel as it is too expensive and those who budget $4,000 per year for vacations, according to Forbes. Travel is costly, so people often purchase travel insurance to safeguard their financial investment from unforeseen events like illnesses, luggage delays, personal emergencies, and more.

When policyholders pay honest money for an insurance policy to offer protection, they want to be able to reap the benefits of the travel insurance claim. If your travel insurance company has denied payment, our tips on how to properly file a travel insurance claim may be helpful.

Why Buy Travelers Insurance?

Travel is generally less stressful with vacation insurance — it is packaged as a wise investment that can protect you against financial losses due to unexpected events. For instance, the U.S. State Department highly recommends international travel trip insurance as Medicare and Medicaid often do not cover overseas medical costs.

The travel insurance premium is relatively small compared to the non-refundable trip costs you could lose in a bad situation. It is particularly worth it if your trip involves non-refundable costs, international travel, or travel to a remote area with limited healthcare facilities or regions prone to natural disasters.

Some of the primary reasons people buy trip insurance are to help offset:

- Emergency medical services and treatment

- Cancellations due to a sudden illness or serious health condition

- Emergency evacuation

- Loss of a friend or family member

- Compromised destinations

- Delayed or lost luggage

- Trip interruption or cancellation

What Is Not Covered By Travel Insurance?

The best insurance policies cover basic and common travel risks and bundle different coverage types related to trip cancellation, medical issues, luggage or trip delays, and more. Travel insurance is not meant to cover all foreseeable events, and every policy will address exclusions differently. Examples of potential limitations are:

- Tropical storms, hurricanes, and other dangerous weather conditions

- Certain medical issues

- Acts of war

- High-risk behavior involving drugs, unlawful acts, or riots

- Government-imposed restrictions

Travel insurance claims submitted without proper documentation or cancellation for reasons not covered by your travel policy are surefire ways to prevent coverage and reimbursement. This is why it is helpful to understand travel insurance coverage properly and take appropriate actions before assuming foul play.

Can You Cancel Travel Insurance and Get a Refund?

Most travel insurance carriers allow refunds, depending on when a policy is canceled and if there is a money-back guarantee. Most insurers ask that the policy be revoked during the review period outlined in the contract terms to qualify for a complete travel insurance refund. If the review period has passed, then policyholders might be eligible for a partial refund or not qualify for one at all.

What To Do if a Travel Insurance Claim Is Denied

If your travel insurance claim submitted for medical reasons, delays, cancellations, or any other reason was denied by your insurer, then remember that you have options. Both denials and rejections may happen for valid as well as unethical reasons. An insurance claim denial is not the end of the road; you can dig deeper to figure out whether you can still be reimbursed under your insurance.

Travel insurance claims are routinely denied when policyholders make common mistakes in their claim forms, or they mistakenly assume their policy covers their specific situation. Good faith denials happen when policyholders do not fill out their travel insurance claim form correctly, do not submit the right documents, or do not include info like contact details for follow-up questions.

In some cases, travel insurance companies may wrongly deny claims and stall the claims process. For instance, they might fail to investigate the claim or conduct proper due diligence. In such scenarios, it is advisable that policyholders adjust and resubmit their insurance claim, appeal the denial, or pursue legal action if insurers continue to illegally hold their payout.

How To Appeal a Travel Insurance Claim: 4 Steps

The travel insurance claim appeal process allows policyholders to ask the insurer to reconsider its decision. When appealing their travel insurance claim, policyholders must:

- Carefully Review the Denial Letter: Review the specific reasons for the denial to determine your next steps. Cross-check the reasons stated with your policy documents, additional emails, and other papers.

- Review Your Policy: Review the terms of your travel insurance policy and pay attention to disclaimers, damage limits, filing time limits, and submission requirements.

- Reach Out for Assistance: After carefully reviewing your policy, if you find the denial letter and policy terms do not line up, contact an insurance legal expert with experience in handling travel insurance claims for help.

- Gather Documentation and Keep Careful Records: Maintain communication records with your insurer, copies of denial letters, and other documentation regarding your claim.

How To Write a Travel Insurance Claim Letter

Sometimes, travelers have to file a trip insurance claim when their vacation does not go according to the plan. A travel insurance claim letter is a formal piece of communication between you and your insurance agency. Its purpose is to ask for reimbursement for covered damages or losses under the travel insurance policy. Therefore, it is important to craft a professional and detailed claim letter to increase your chances of a favorable resolution.

A claim letter should include the following information:

- Introduce Yourself. Include all relevant information of the person appealing (such as the policy number and contact information).

- Address the Denial. Summarize the date you received the letter and why the denial was made. Do not leave out any important details.

- Point Out the Error. Explain why you do not agree with the claims denial, based on your policy and pertinent information.

- Attach Extra Documents. Include all other documents supporting your trip insurance claim, such as photos, additional correspondence, transcripts of phone calls, etc.

How Long Does It Take To Get Reimbursed From Insurance?

Travel insurance companies generally process most claims within a few weeks. Sometimes, the insurance claims process office might have follow-up questions, thereby increasing the time you can expect to hear back. However, if you feel that your insurance claim is taking months to resolve without a proper reason, you should speak to an experienced insurance dispute lawyer. While every situation is different, policyholders should always keep careful and consistent notes as it will help them take informed legal action if necessary.

Travel Insurance Claims Advice on Documentation

You must be thorough with your documentation to enhance your chance of successful recovery. When you file a trip claim, your insurer will more likely refund travel insurance when you include the following information in your claim submission:

- Lost Luggage: Make a list of what was lost, along with the details and cost of each lost item.

- Job Loss: Request that your previous employer send you a notarized letter on company letterhead in the case of a trip cancellation due to job loss.

- Medical Emergency: Include detailed medical records in your claim if a health emergency kept you from traveling.

- Canceled/Delayed Flight: If you could not attend your trip because the flight was canceled or delayed, provide proof such as an email that relays the reasons (mechanical issues, weather, etc.).

- Receipts for Delayed Flights: You might want to keep receipts for necessary expenses incurred due to delays, like hotel stays, transportation costs, meals, and personal necessities.

- Police Reports: These reports can help substantiate claims made for stolen items or car troubles.

- Other Reports: You may include tickets for unused flights or excursions in your insurance claim.

Has a Formal Complaint Been Filed Against the Travel Supplier?

Formal complaints against travel suppliers are helpful in legal cases dealing with similar situations. The Van Rossem v. Penney Travel Service (April 15, 1985) case exemplifies travel insurance gone wrong.

In this case, a newlywed couple arranged a honeymoon trip with travel agent Penney Travel. The agent used a wholesaler, Lotus Tours, to book the reservation without the couple's knowledge. Lotus Tours abruptly went bankrupt before booking the client's reservation with SANDLES, which remained unpaid. When the case came before the court, the judge noted that "an agent who makes the contract in his own name for an undisclosed principal is liable as a principal." Here, the defendant had failed to disclose the identity of Lotus Tours, and so, it was responsible as the principal. The couple had paid $2,059 in advance. The judge awarded them reimbursement of $1,312, plus costs and disbursements.

In another lawsuit, Touhey v. Trans National Travel , a travel agent did not check to see if the hotel a client had booked was duly constructed. The plaintiff-client was awarded $25,000 in special damages because of the mistake.

What Are Bad Faith Insurance Practices?

Bad faith insurance refers to unethical insurance practices used by an insurer to delay, deny, or lowball policyholders. Examples of bad faith insurance practices include:

- Misrepresenting contract language to prevent a payout

- Failing to disclose policy limitations and exclusions to policyholders

- Making unreasonable demands, like excessive paperwork requests to prove a covered loss

Sometimes, only a seasoned insurance dispute lawyer who regularly deals with contract breaches and bad faith claims can identify honest errors from serious red flags and help a policyholder get paid their due.

How to File a Travel Insurance Claim: A Summary

Travelers usually plan their vacations down to the last detail. Travel insurance is a buffer for unplanned curveballs that can derail even the most meticulous plans, such as medical emergencies or misplaced luggage.

Insurance companies are explicit about what travel mishaps or unexpected events they will or will not cover, which is why it is crucial to understand policy limitations and how to properly file a travel insurance claim.

As a final snapshot, the key steps to filing a travel insurance claim include:

- Reviewing policy terms and exclusions.

- Gathering necessary documentation based on submission requirements.

- Submitting your claim according to the insurer's timing and filing guidelines.

- Filing an appeal if an insurance claim is wrongly denied.

- Consulting an experienced insurance dispute lawyer to assist with an intentionally stalled, denied, or undervalued claim.

Travel insurance claims can become challenging, depending on the situation and response from your insurer. When small bumps in the road become permanent roadblocks, it is helpful to know that qualified travel insurance claims attorneys are available to help frustrated policyholders recover their losses.

COMMENTS

Start your travel claim. Online claim Email and paper claims App claims Give us a call Timeline. Follow these steps to register online, and start a claim: Step 1: Create and register an account at our ACM travel portal. Go to the Manulife ACM travel portal. Click Register at the top right corner of the page. Fill in the required information.

Do you need to file a travel insurance claim with Manulife? Visit the claims centre on www.manulifetravelinsurance.ca and find out how to submit your claim online or ...

Contact method. Contact details. Telephone. For all travel insurance inquries, please contact the SISIP insurance program at Manulife and speak with an agent at 1-855-887-7809. Open between 8 a.m. and 8 p.m. EST Monday to Friday. Mail. Manulife. 200 Bloor Street East. Toronto, ON M4W 1E5.

To cancel a trip before your scheduled departure date, you must cancel your trip with the travel supplier and notify us at 1 888 881-8010 or +1 519 945-8346 on the day the cause of cancellation occurs or on the next business day at the latest.

Manulife Travel Insurance offers comprehensive coverage for your trips abroad, including emergency medical, trip cancellation, baggage loss and more. Find out how to file a claim online or by mail, and get the support you need.

Whether you need to cancel your trip, seek medical assistance, or deal with any unexpected situation, Manulife Travel Insurance has you covered. Visit our claims centre to access helpful resources, check your policy details, and submit your claim online easily and securely.

Want to submit your travel insurance claims online? Submit claims through our online travel claims portal. ... Complete your trip cancellation and interruption form and send it to us via the email or address provided. ... The Manufacturers Life Insurance Company (Manulife) Manulife, Manulife & Stylized M Design, Stylized M Design and Cover-Me ...

Up to sum purchased per insured per trip for the Trip Cancellation & Interruption Plan when purchased separately. Up to $3,500 per insured per trip for the Single-Trip All-Inclusive plan. Up to $3,500 per insured per trip and up to $6,000 per policy for Multi-Trip All-Inclusive Plans. Reimbursement of prepaid portion of the trip that is non ...

Can just one parent or grandparent and his/her children/grandchildren get family coverage? Can clients save with higher deductibles? Premium savings. Deductible per claim (CAD$) 10%. $ 500. 15%. $ 1,000. 30%.

Travel insurance is important to help protect you, your family or visitors to Canada from costs that can occur due to an unforeseen medical emergency during a trip or an unexpected reason to cancel or interrupt a trip. Without it, travellers may be left to pay significant out of pocket expenses. If you are looking for Single Trip Emergency ...

We've highlighted key benefits of Manulife CoverMe Travel Insurance for the single trip plan to help you identify which coverage is the best fit for you. Coverage Type. All Inclusive. Emergency ...

Manulife Travel Insurance

File a Group Benefits insurance claim through the Manulife mobile app or online for quick response times. Register for Direct Deposit to get covered expense balances into your bank account faster. Group Benefits customers seeking travel information - for before, during and after a trip - may find this helpful: What you should know and ...

1-800-COVER ME ®(1-800-268-3763) To learn more about Manulife Vitality. We're available Monday to Friday 8 a.m. to 8 p.m. Eastern Time.

Travel insurance is important to help protect you, your family or visitors to Canada from costs that can occur due to an unforeseen medical emergency during a trip or an unexpected reason to cancel or interrupt a trip. Without it, travellers may be left to pay significant out of pocket expenses. If you are looking for Single Trip Emergency ...

If you need to file a travel insurance claim, please contact your provider as soon as possible. If you need to spend money out-of-pocket, speak to your provider first and save your receipts or proof of expenses to have accurate documentation for your loss. ... Mailing Address Manulife Global Travel Insurance c/o Active Care Management P.O. Box ...

Travel Insurance. To make a claim, call 1-855-841-4796 toll-free from the USA and Canada, or +1-519-988-7008 collect to Canada from anywhere else in the world. You can also start a claim on the TravelAid™ App.

Group retirement. Make the most of your retirement - track and manage your savings here. 401 (k) Send us a message. Give us a call. We offer financial solutions for individuals and businesses. Our products and services include insurance, investments, retirement, real estate and reinsurance.

A travel insurance claim letter is a formal piece of communication between you and your insurance agency. Its purpose is to ask for reimbursement for covered damages or losses under the travel ...