Effortless booking

Maximize online conversions with the most intuitive checkout online.

Expand revenue with our powerful Automated E-commerce tools.

Upgrade your website to industry’s best. Fresh websites. Fresh revenue.

Amplify visibility and expand earnings with integrated OTAs and local partners.

Streamline check-ins, limit risk, and amplify customer data with built-in digital waivers.

Transform data into insights. X-ray reporting gives you customer and business intelligence.

Manage high-volume walk-up customers effortlessly with POS, ticketing, and gated entry.

Automate management of staff schedules, assignments, and staff communications

Control your business precisely the way you want with endless yet easy configurability.

Allocate equipment used in various products. Prevent overbookings and maximize profits.

Grow with Xola in our constantly expanding universe of integrations and apps.

Harness customer data to drive marketing campaigns and generate repeat business.

Transform your guests into passionate brand advocates. Perfect your products & services.

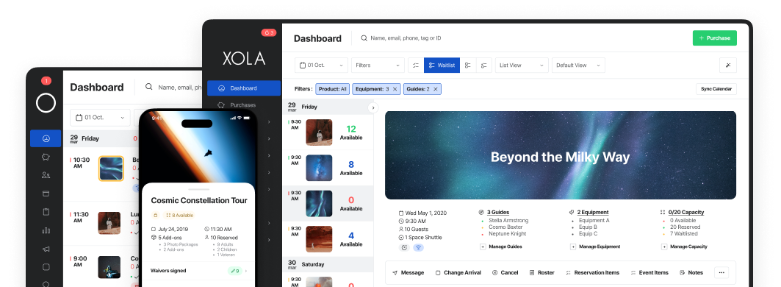

Manage your business with the most powerful mobile suite in the industry.

Perfect the guest experience by giving your staff the industry’s most intuitive software.

Efficiently manage guest flow, minimize wait times, and ensure maximum satisfaction.

Ticketing & Entry

Revolutionize your guest experience: Effortless check-ins, interactive displays, secure payments.

Boost revenue with automated rave reviews, actionable insights, and loyal customer engagement.

Efficient ticketing, digital waivers, and fast check-ins enhance on-site operations and guest satisfaction.

Explore Xola Universe: 80+ apps, limitless integrations, endless growth opportunities.

Simplify check-in and boost your marketing efforts with our integrated automated digital waivers.

With SOC 2 Type II and CCPA compliance Xola exceeds industry security standards and insures your data protection.

Access real-time insights for business growth with our powerful reporting.

Remarkable and hassle-free guest experiences with waitlist and virtual queuing.

An overview of the best distribution channels

- Xola University

- Business Operations

Tour operator insurance: 5 considerations to protect your business

When starting a new tour business, one of the most vital steps is protecting your assets. To do so, you will need liability insurance.

While liability insurance is essential, as a new tour operator you may be wondering what you need coverage for and how much it will cost.

In this post, we’ll dive into the ins and outs of liability insurance as well as what you should consider.

Disclaimer – Before we dive in, this post is designed to be a general primer into liability insurance for tour operators. For specific details and questions about different policies, we recommend reaching out to your insurance agent or lawyer.

- What is tour operator insurance?

What types of insurance do I need for my tour business?

How much does liability insurance cost, the 6 most popular types of liability insurance, how to vet tour operator insurance providers, additional best practices for protecting your business, what is tour operator insurance .

Tour operator insurance is a specialized type of insurance designed to protect tour operators as well as travel agents that organize and sell travel packages. It typically covers risks associated with travel planning and execution, such as trip cancellations, delays, supplier failures, and liability issues. This insurance is important because it protects tour operators from significant financial losses and legal liabilities that can arise from unforeseen events or accidents during the tours they organize, ensuring business continuity and customer trust.

If you are thinking about starting or have recently launched a tour business, you may be wondering what to insure and if have enough insurance to cover all of your assets. Let’s get the nitty gritty insurance details out of the way so can focus on the joy of sharing an adventure you love with your guests.

Every business has a unique set of liabilities, so deciding which liability insurance you need comes down to asking yourself this:

What could possibly go wrong and how can I mitigate damage?

While brainstorming “worst-case scenarios” isn’t fun, isn’t it better to have a plan in place if something does go awry?

Here are some examples of potential questions to think through:

- Who will replace the kayak that fell off your rig while transporting the fleet?

- Who covers the emergency medical costs if a customer breaks his leg on your zipline tour and later files a lawsuit to recoup the money he is out from medical bills?

- What happens if one of your tour guides gets COVID-19 after being exposed on a tour?

Deciding what type of coverage you require when you first launch your business will allow you to focus more time on providing a great guest experience.

Keep in mind that most policies are for an entire year, even if your business is seasonal. This is a benefit since your equipment will be covered in the event of loss or damage during the off-season.

In addition, your state may have specific insurance required for your type of tour. For example, Washington state requires workers’ compensation through the Department of Labor and Industries. Additionally, they require minimum coverage for business vehicles of $25,000 bodily injury liability per person, $50,000 bodily injury liability per accident, and $10,000 property damage liability per accident.

The importance of carrying adequate liability insurance

Between 2007-2013, the canoeing industry suffered more fatalities than kayaking, rafting, and paddleboarding combined. Canoeing may seem like a safe enough activity, but this statistic proves that accidents do happen — and why emergency medical coverage is essential.

While a fatality is definitely the worst-case scenario, even a minor customer injury could lead to a personal injury settlement that is not only costly but time-consuming . One case could take years to settle.

Starting and maintaining a business is expensive enough. If you have a fleet of 20 canoes and they are stolen or catch fire, you are looking at a minimum of $5,000 to replace them. Liability insurance helps you eliminate that financial risk.

Your local insurance agency might be able to provide a basic policy that covers all your needs through one plan or with add-on riders. Still, tour businesses might need to have an additional policy through an agency that specializes in tour operations such as Excursion Insurance , CNA International , or XInsurance .

In addition, you should consider how much your assets (equipment and/or property) are worth. It is often better to consider a higher coverage amount that your business can grow into over being underinsured and potentially on the hook in the event something goes wrong.

The level of danger inherent in your business is also a factor. Adventurous activities will require comprehensive policies that cover emergency care and so on. For example, a kayak rental business or walking tour will have lower premiums than a scuba diving business or an axe-throwing venue.

Pro Tip: The average annual plan cost for $1 million in coverage for a tour operator is $350-$700.

There’s a wide variety of liability insurance types offering different levels of coverage depending on the businesses they protect.

Ask your insurance agent to customize your insurance policy or policy package to your specific needs.

1. General/business liability insurance

General/business liability is imperative.

This covers legal fees for customer injury and property loss.

The kayak that fell off your rig? This covers the replacement cost.

This insurance will also cover legal fees to sue for less likely events such as copyright infringement or slander from a competitor.

Perhaps most interesting right now, as many small businesses navigate uncertain times due to the pandemic, is that general/business liability insurance includes legal and relocation fees if your business is wrongfully evicted from a rented building or property.

Here are a few things to consider when looking for the best liability insurance provider:

- Adequate coverage: Ensure that the insurance policy provides sufficient coverage for the risks and liabilities specific to your tour or attraction operations. Assess the nature of your business activities, the number of participants, and the associated risks to determine the appropriate coverage limits.

- Comprehensive policy: Look for a comprehensive insurance policy that covers a wide range of risks, including bodily injury, property damage, personal injury, and advertising injury.

- Certificate of insurance: Request and keep updated certificates of insurance from any subcontractors or vendors you work with. This verifies that they have adequate liability coverage, protecting both parties in case of any incidents or accidents.

2. Auto liability insurance

If you provide transportation for your customers, auto liability will cover both owned and rented vehicles beyond the scope of personal auto policies.

Whether you are transporting paddleboarders to your favorite cove at sunrise in Florida or sunset in California, auto liability covers what you are accustomed to with your personal auto policy, only with higher weight restrictions and limits of liability.

When your business vehicles are insured, any employee may drive. This will allow you to take multiple vehicles (i.e. more customers) on each excursion or have one employee shuttle customers while the other remains on location.

Consider the following before choosing an auto liability insurance policy:

- Commercial auto policy: Look for a commercial auto insurance policy specifically designed for business vehicles. This type of policy provides coverage for accidents, injuries, property damage, and other liabilities that may arise from the use of vehicles in your tour and attraction operations.

- Hired and non-owned auto Coverage: If your business involves renting or using vehicles that you do not own, consider adding hired and non-owned auto coverage to your policy. This coverage extends liability protection to vehicles you rent or borrow for business purposes.

- Driver qualifications: Establish clear driver qualification standards. Ensure that your drivers meet the requirements for your auto liability insurance. This may include age restrictions, valid driver’s licenses, clean driving records, and any specific training or certification requirements.

3. Watercraft liability insurance

Whether the watercraft has a motor or not, this insurance is mandatory in most states for watercraft operators, so ensure it is covered in your general/business liability policy or an add-on rider.

This will cover emergency medical costs for customer injury specific to the watercraft as well as the loss of or damage to personal belongings.

Here are a few considerations to keep in mind as you research watercraft liability insurance:

- Vessel types: First, you’ll need to determine the types of vessels your company will use. Then, verify that your insurance policy covers that specific type of vessel, which can range from motorized boats, sailboats, personal watercraft, or paddle craft.

- Passenger capacity: Assess the passenger capacity of each boat and confirm that the insurance covers the maximum number of passengers allowed on board. Compliance with safety regulations regarding passenger limits is crucial to mitigate risks and ensure proper coverage.

- Waterway restrictions: Understand any restrictions imposed by the insurance provider regarding the waterways in which you can operate. Some policies may have navigational limits or exclusions for certain high-risk areas.

4. Professional liability insurance

Here is another one that you’ll want to add if it is not included in your general/business liability policy.

This is for the mistakes you didn’t mean to make or changes you couldn’t help but make.

Nicknamed the “errors and omissions policy,” professional liability covers the accidents made through typos or data left out of a tour description. It covers legal fees for cases of misrepresentation (the artisan lunch promised is fried Spam sandwiches) or violation of good faith (a loyalty program was shut down or not allowed to be used as promised).

Keep this in mind as you’re choosing your professional liability insurance:

- Retroactive date: Pay attention to the retroactive date mentioned in the policy. This is the date from which the policy coverage starts and typically excludes claims arising from incidents that occurred before that date. Ensure that the retroactive date aligns with your business’s start date or the date you first purchased the insurance.

- Claims-made policy: Professional liability insurance is typically written on a claims-made basis. This means that coverage is triggered by claims made and reported during the policy period. Understand the reporting requirements and ensure that you report any potential claims or incidents to your insurance provider in a timely manner.

- Professional associations: Consider joining professional associations relevant to the travel and tourism industry. Some associations offer access to group insurance plans or negotiated rates for professional liability coverage.

5. Employer liability insurance

Many states require businesses to apply for workers’ compensation through the Department of Labor . If your state does not provide this service at the government level, adding employer liability will protect your business during lawsuits launched by employees as well as pay for employee medical care, disability, and even funeral in the case of a death on the job.

Here’s what to consider when researching employer liability insurance:

- Workers’ compensation laws: Each jurisdiction may have specific rules regarding workers’ compensation coverage limits, eligibility criteria, claim filing procedures, and benefit entitlements. Complying with these laws is crucial to protect both your employees and your business.

- Employee classification: Properly classify your employees based on their job roles and associated risks. Different job categories may have different insurance requirements and premium rates.

- Return-to-work programs: Establish return-to-work programs that facilitate the smooth transition of injured employees back to work after recovering from a workplace injury or illness.

6. Business interruption liability

Seattle, Houston, and Austin shut down due to snow for a week? Impossible.

But then, in February 2021, it happened and interrupted thousands of travel plans.

For tour operators with business interruption insurance, customer refunds due to business closures and trip cancellations were taken care of by their insurance companies.

A natural disaster is an extreme example, but unforeseen events happen all the time.

A rained-out performance or a lightning storm forecast during a water event is more common. While bad weather won’t cause weeks of cancellations, it is money lost.

Here are some practical tips and considerations to keep in mind when it comes to business interruption liability insurance:

- Assessing risks and vulnerabilities: Take the time to assess the potential risks and vulnerabilities that could interrupt your business operations. Consider factors such as natural disasters, fires, power outages, supply chain disruptions, or unforeseen circumstances that could affect your ability to serve customers.

- Waiting period: Keep in mind that most policies have a waiting period before coverage kicks in, so plan accordingly to manage your finances during that time.

- Business continuity planning: Develop a comprehensive business continuity plan that outlines steps to be taken during and after a disruption. Having a well-thought-out plan in place can expedite the recovery process and potentially reduce the duration of business interruption.

Use the following tips to ensure you’re partnering with the right insurance providers:

- Reputation matters: Do your homework and dig into the reputation of potential insurance providers. Look for reviews, testimonials, and feedback from other tour and attraction operators. Don’t settle for a company that leaves a trail of disappointed customers in its wake. You deserve an insurance provider that’s got your back.

- Tailored to your industry: Seek providers that specialize in serving the unique needs of tour and attraction operators. They understand the ins and outs of your industry, the risks you face, and the coverage you require.

- Transparency is key: Nobody likes being kept in the dark, especially when it comes to insurance. Look for providers that are transparent and clear in their communication. You want an insurance partner who explains the terms, conditions, and coverage in a way that makes sense to you. No jargon, no confusion — just straightforward and honest communication.

- Customizable coverage: Your business is unique, so your insurance coverage should be too. Avoid providers that offer rigid, off-the-shelf policies. Instead, opt for those that offer customizable coverage to meet your specific needs. Whether it’s liability, property, or equipment coverage, you should have the freedom to tailor your policy to fit your business like a glove.

- Responsive customer service: In times of crisis, you need a responsive insurance provider who doesn’t leave you hanging. Look for companies that prioritize customer service and have a reputation for being there when you need them the most.

- Easy claims process: The last thing you need when filing a claim is a complicated and frustrating process. Look for insurance providers that have a streamlined and efficient claims process. You deserve an easy-to-navigate system that minimizes paperwork, reduces headaches, and gets you back on your feet as quickly as possible.

- Competitive pricing: We can’t forget about the bottom line. While pricing shouldn’t be the sole deciding factor, it does play a role. Seek out insurance providers that offer competitive pricing without compromising on coverage and service.

- Recommendations and referrals: Don’t be afraid to tap into your network and ask for recommendations. Reach out to fellow tour and attraction operators, industry associations, or trusted colleagues for their input. Personal referrals can provide valuable insights and help you find hidden gems in the insurance provider landscape.

Liability waivers are a simple way to further protect your business. Our post on Liability Waiver Best Practices gives a clear path to how you can use digital waivers to simultaneously protect your business as well as ways you can use this information in your marketing.

In addition, you should also have a cancellation policy, which should be available on your website and in your digital waiver. You should clearly state your terms for how and when guests can cancel a booking as well as your refund policy.

Finally, what emergency medical plans do you have in place? While keeping your first aid kits stocked is probably first on your list, other items to keep near – such as emergency blankets, survival tents, etc. – will depend on your type of tour and customer demographic. For example, if your business is based in Florida, you might want to have an evacuation plan in place for how to board up and secure your venue in case you have to evacuate due to a hurricane.

In sum, taking everything into account, liability insurance is as important of an investment as your equipment. Shopping around for an insurance company that is the perfect fit for your business is as important as shopping around for a vehicle and kayaks.

Writer Carla Vianna

Related Articles

You’ve likely considered the pros and cons of listing your tours with a third-party website. While your own tour website

6 examples of how tour operators can use AI to automate tasks

We know there’s a lot of buzz around Artificial Intelligence (AI), and you may not think there’s anything in it

How to find the best tour booking software for your company

Thousands of businesses rely on a comprehensive booking management tool to streamline operations and enhance customer experience every day. With

Get the latest news and resources.

For tours and attractions delivered straight to your inbox each week.

Transform your business now.

5 types of tour guide insurance all tour operator businesses need

By Rezdy — 10 Nov 2018

costs legal operations tour operator

5 types of tour operator insurance and what to consider

Updated November 2021 – As a tour operator, you will be dealing with risks on a daily basis. On top of the typical risks that businesses face, you also face additional risks unique to the tour industry. Protecting your business with specific tour operator insurance will ensure you cover all your bases.

For example, what happens if you have to cancel your tours due to weather or insufficient numbers? or when a customer gets hurt while participating in your tour? These situations may vary in their rarity but the financial damages from these risks are always significant. Luckily, there are many types of insurance plans available to protect tour operators against risks.

With Bob’s Hypothetical Kayaking Tours as an example, we will cover the 5 most important insurance plans your tour needs.

1. Asset & revenue insurance

While the specifics will vary depending on the nature of your tour or activity, you’ll need to consider all areas. This refers to things like:

- Breakdown and damage of business assets (for example fires , burglary, general property, equipment breakdown). All Australian businesses have to ensure company vehicles for third-party injury liability. Your equipment and property investments are at great risk if you don’t insure them. TIP: Make sure to check your own federal or state laws to see what is legally required!

- Business interruption (any interruption to the business which stops the business from making money). This includes interruption through a key person’s illness or bad weather.

If Bob’s Kayaking office was to catch fire and nearly everything was destroyed, Bob would lose money on bookings that would have to be canceled, rent that still needed to be paid, wages that are still payable to his staff, and all of the other regular expenses. A claim on asset & revenue insurance will pay for the expenses of the business while they are unable to operate due to an insurable loss.

2. Public liability insurance

Let’s say Bob can’t catch a break and one of his tour participants loses their phone, laptop, jewelry, and glasses while having the time of their life on his exhilarating kayaking experiences. Public liability insurance will free Bob from any responsibility of paying back the stolen/lost items. Tip: Learn how to write a liability release form here!

While public liability insurance is a very costly form of tour operator insurance (the standard cover is $10M), most agents will refuse to resell your tour unless your tour has one. Remember that if you work with a third-party contractor, you need to make sure that they have public liability insurance in place as well.

3. Workers compensation insurance

Bob can’t manage his kayak operation all by himself! He needs accountants to manage his numbers, tour leaders to run the tours, and maintenance staff to take care of the kayaks. Many tours, such as Bob’s, involve a lot of physical activity on a daily basis. Even employees who work in Bob’s Kayaking office can trip on a cord and hurt themselves.

By having workers compensation insurance in place, you’re protecting your business against costly compensation claims as a result of a workplace accident or illness. Workers compensation has to be taken out for all employees of a Pty Ltd company, including company directors and business owners.

However, business owners aren’t covered by workers compensation if they are a sole trader or a partnership. In this case, you can opt for income protection in the case of accidents and illnesses so you don’t lose revenue while you recover.

4. Commercial Crime Insurance

As much as Bob values all his staff and employees, sometimes there’s going to be a bad egg. This may be shocking, but theft and misdeed by employees are actually more common than you may think it is. A report published by Embroker states that a shocking 75% of employees admit to stealing at least once from their employers. It is for this reason that Bob should have commercial crime insurance in place as one of his tour operator insurances .

In the event of theft or misdeeds actioned by one of Bob’s staff, commercial crime insurance will cover any losses. This can include missing assets or money misspent on non-work-related purchases

5. Errors and Omissions Insurance

Running a kayak business is very demanding and Bob deals with a variety of customers every day. Making mistakes is inevitable, however, certain hiccups can result in severe damages and ruin Bob’s business reputation. Not only that, but the time spent on recovering and fixing a mistake is time-consuming.

Errors & Omission Insurance (EOI) will protect Bob’s business from claims that may arise due to mistakes or failure to meet certain criteria of a signed contract. With an E&O Insurance in place, Bob will be covered for any financial losses from the result of errors and omissions. E&O Insurance also covers Bob from any settlement or additional costs related to the mistakes that may arise.

In most cases, EOI is often one of the required forms of business insurance many organizations will need to have in place. This tour operator insurance cost is highly recommended to protect your tour operator business from inevitable human errors.

Where to look for Tourism Insurance

With the 5 types of tour operator insurance covered above, it’s important to do your research prior to signing up with an insurance company. Without the right level of cover, you may be out of pocket after a claim. So it’s critical that you choose the correct tour operator insurance plan and an insurance company that fits well with your tour operator business.

You can begin your search by:

- Getting quotes from those specializing in tourism insurance

- Asking others in the industry for recommendations

- Contacting your local tourism organization and ask them for recommendations

Once you’ve gathered this information, pick your top three companies from the list and compare their offerings. It’s important to find a policy that’s right for your business, so make sure to do proper research and shop around instead of jumping signing up with the first tour operator insurance company you see.

If you enjoyed this article – 3 types of insurance all tour operators need – then follow the Rezdy blog . There are a lot of marketing tools and resources designed with businesses like yours in mind.

Curious to see if Rezdy is right for you? Start a FREE 21-day trial or request a demo from our friendly team today.

For more information or to get a quote contact us today

[dtblogpostsidebarauthor].

email: [dtBlogPostSidebarAuthorEmail] [dtBlogPostSidebarAuthorDesc]

Liability Insurance for Guided Tour Companies

Protecting guided tour companies on land, sea or air.

New York City has always been a center of attraction — last year was no exception. In 2017, the City welcomed a record 62.8 million visitors in 2017, an increase of 2.3 million tourists over 2016. Of those, 49.7 million were domestic and 13.1 million were international visitors . That’s great news for the Big Apple, and equally good news for guided tour companies that show these visitors a good time. Take the famous Circle Line Sightseeing Cruise around Manhattan Island, or the hop-on, hop-off, open-air bus tours, or walking tours — not to mention the new guided bike and Segway tours.

Of course, Washington, DC, Chicago, Las Vegas, and other major cities have their fair share of guided tours — whether by land, water or helicopter. After all, there’s a lot to see in this great country of ours. What do these guided tours have in common? The potential for great profits — and risk.

Guided Tour Risks

What are some of the most common risks associated with guided tours?

Baggage loss can be an inconvenience at best and dangerous at worst if your clients are carrying important information or medication in their luggage. Transportation malfunctions are also a risk to consider.

Consider the helicopter crash that killed four people on a Grand Canyon helicopter tour. In one case in 2018, five British tourists died during a helicopter tour after the pilot lost control of the aircraft thanks to a violent gust of wind. Or the city sightseeing, the open-air tour bus that careened out of control in San Francisco a few years ago and injured four.

You may also run into unexpected health issues or — depending on your location and the destination of your tour — a lack of proper accommodation, leaving you out in the cold. Finally, there is always the risk of stolen personal items. While no one will care about a t-shirt or a pair of shoes, if their money or passport goes missing, it can be a massive problem.

How to Decrease Guided Tour Risks

What can you do to decrease these risks on your guided tours?

Make sure you provide information about the area you’re traveling to in advance. We all love the idea of booking a trip or a tour on a whim, but it is essential that your clients know what they’re getting into before they pay for their tour. On your end, you also need to understand your travelers’ specific needs before they join the tour. You don’t need to be invasive with your questions but you do need to know anything that could potentially put them at risk during the tour.

Encourage your travelers to take health measures before they arrive. This could be as simple as taking Dramamine if they’re prone to motion sickness or as complex as necessary vaccinations before they arrive if they’re traveling from a different country.

Finally, you’ll need to obtain guided tour insurance to protect both you and your clients in the event of an incident.

If you’re offering guided tours, you should always be prepared for the unexpected. One of the best ways to do that is to obtain guided tour insurance. Danger is inherent in every tour, but it doesn’t have to put a damper on your business. Learn more about guided tour insurance options from XINSURANCE for your business and what insurance tour operators need.

XINSURANCE is powered by Evolution Insurance Brokers , an insurance brokerage. XINSURANCE provides customized specialty insurance solutions for ever-changing risks and liability issues, including property and casualty insurance — and Tour Operator Liability Insurance for Guided Tour Companies. We’ll even defend you in the event you are named in an incident, claim or lawsuit.

XINSURANCE provides an all-in-one approach that allows business owners to have broader coverage, up to $20 million limits with higher limits available through reinsurance partners, flexible underwriting, risk management expertise, extraordinary claims results, and a partnership approach.

With XINSURANCE, guided tour companies can rest assured they’ll be around to welcome millions of more visitors to their great city. Contact XINSURANCE today to see how we can help you protect your business as well as your clients moving forward.

Get A Quote Today!

You can start the quote process by filling out the form at the top of this page . Once you are finished, we will have an underwriter contact you about the quote request and discuss your insurance needs. Get started today!

Last updated on March 10, 2021.

Rick J. Lindsey hails from Salt Lake City, Utah. He began working in the mailroom of his father’s Salt Lake City insurance firm, getting his introduction to the business that became his lifelong career. Rick J. Lindsey quickly rose through the ranks while working in nearly every imaginable insurance industry job. As an entrepreneur, specialty lines underwriter, claims specialist, risk manager, and a licensed surplus lines broker, Rick J. Lindsey is highly skilled in all levels of leadership and execution. As he progressed on his career path, Rick J. Lindsey discovered an urgent need for insurers willing to write policies for high-risk individuals and businesses. He was frequently frustrated that he could not provide the liability protection these entities desperately needed to safeguard their assets. He also formed the belief that insurance companies acted too quickly to settle frivolous claims. Rick J. Lindsey decided to try a different approach. He started an insurance company and became the newly formed entity’s CEO. This opportunity has enabled Rick J. Lindsey to fill a void in the market and provide a valuable service to businesses, individuals, and insurance agents who write high-risk business. XINSURANCE also specializes in helping individuals and businesses who live a lifestyle or participate in activities that make them difficult for traditional carriers to insure. If you’ve been denied, non-renewed, or canceled coverage, don’t give up quite yet. Chances are XINSURANCE can help.

Privacy Overview

- Aerospace & Aviation Overview

- Aircraft Hull Deductible Insurance

- Airline Insurance & Risk Management

- Airshow Insurance

- Drone Insurance

- Glider Insurance

- Gyrocopter Insurance

- Helicopter Insurance

- One Up, One Down Aviation Insurance Policy

- Space & Satellite Insurance

- Vintage Aircraft Insurance

- Art, Jewellery & Specie Insurance Overview

- Art, Museums & Exhibitions Insurance

- Fine Art Insurance

- Jewellers Block & Specie Insurance

- Automotive Overview

- Classic Car Restoration Insurance

- Driving Instructor Insurance

- Limousine Insurance

- Self-Drive Car Hire Insurance

- Care Overview

- Care Home Insurance

- Care Insurance

- Children's Home Insurance

- Domiciliary Care Insurance

- Fostering & Adoption Agencies

- Supported Living Insurance

- Charities & Not For Profit Overview

- Buddhist Temple Insurance

- Charity Insurance

- Charity Shop Insurance

- Community Transport Insurance

- Minibus Insurance

- Social Housing Insurance

- Youth Club Insurance

- Construction Overview

- Construction Insurance

- Contractors Insurance

- CPA Members Insurance

- Roofing & Scaffolding Insurance

- Surety Bonds

- Tradesman Insurance

- Education Overview

- Education Insurance

- Schoolshare

- Energy Overview

- Renewable Energy Insurance

- Energy Insurance

- Farming Insurance

- Hospitality, Leisure & Tourism Overview

- Hospitality & Leisure Insurance

- Holiday & Home Parks Overview

- Holiday Home Owner Insurance

- Holiday Let Insurance

- Holiday & Home Parks Insurance

- Theme Park & Leisure Attractions

- Legal and Indemnity Overview

- Dispute Resolution

- Legal Indemnity

- Professional Indemnity

- Warranty & Indemnity

- Life Sciences Overview

- Clinical Trials Insurance

- Life Sciences Insurance

- Life Sciences Start-Up Insurance

- Manufacturing Overview

- Manufacturing & Heavy Engineering

- Food & Drink

- Marine Overview

- Commercial Craft Insurance

- Marine Trade Insurance

- Superyacht Insurance

- Yacht & Motorboat Insurance

- Media & Entertainment Overview

- Firework & Pyrotechnics Insurance

- Media, Entertainment & Events Insurance

- Motor Trades Overview

- Auto Electrician Insurance

- Body Shop Insurance

- Breakdown & Recovery Agents

- Car Dealership Insurance

- Car Valeting Insurance

- Combined Motor Trade Insurance

- Mobile Mechanic Insurance

- MOT & Service Stations Insurance

- Motor Trade Insurance

- Motorcycle Trader Insurance

- No-Claims Motor Trade Insurance

- Part-Time Motor Trade Insurance

- Road Risk Insurance for Motor Traders

- Service and Repair Garage Insurance

- Smart Repair Insurance

- Startup Motor Traders Insurance

- Tyre Fitter Insurance

- Vehicle Sales Insurance

- Young Motor Traders Insurance

- Public Sector

- Real Estate Overview

- Block of Flats Insurance

- Estates Insurance

- Freeholders Insurance

- Landlord Insurance

- Legal Indemnity Insurance

- Propertymark Members

- Real Estate Insurance

- Unoccupied Property Insurance

- Transportation Overview

- Courier Fleet Insurance

- Courier Van Insurance

- Goods in Transit Insurance

- Hanson Franchisee Insurance

- Haulage & Distribution Insurance

- Passenger Transport Insurance

- Railway Insurance

- Taxi Fleet Insurance

- Taxi Insurance

- Transportation Insurance

- Vehicle Transporters Insurance

- Technology & Telecommunications Overview

- Hardware & Electronics Insurance

- Media Insurance

- Software & IT Services Insurance

- Technology Insurance

- Telecommunications Insurance

- Travel Overview

- Airline Personnel Travel Insurance

- Group Business Travel Insurance

- Scheduled Airline Failure Insurance

- Travel Agents Insurance

- Travel Insurance

- Corporate Insurance Overview

- Casualty Insurance

- Claims Management

- Commercial Property Insurance

- Crisis Management Overview

- Crisis Resilience Insurance

- Kidnap & Ransom Insurance

- Terrorism Insurance

- Cyber Liability

- Delegated Authority

- Directors & Officers Liability

- Dispute Resolution Insurance

- Fleet & Commercial Vehicle Insurance

- General Liability Insurance

- Intellectual Property Insurance

- Latent Defects Insurance

- Mergers & Acquisitions

- Professional Indemnity Insurance

- Retail Insurance

- Structured Credit & Political Risk Overview

- Commodity Traders

- Credit & Political Risk Cover

- Non-Payment Insurance for Banks

- Private Equity

- Public Agency & Multilateral Organisations

- Trade Credit

- Warranty & Indemnity Insurance

- Personal & Household Overview

- Aviation Insurance Overview

- Landlord Overview

- HMO Landlord Insurance

- Multi-Property Landlord Insurance

- Student Landlord Insurance

- Golfers Insurance

- Home & Contents Overview

- Home Insurance

- High Net Worth Home Insurance

- Holiday Home Insurance

- Non-Standard Home Insurance

- Thatched Property Insurance

- Motor Overview

- Car Insurance

- Prestige & Classic Car Insurance

- Van Insurance

- Risk Management Overview

- Business Continuity Planning

- Cyber Risk Management

- Enterprise Risk Management

- Fleet Risk Management

- Health & Safety Risk Management

- Property Loss Control

- Small Business Insurance Overview

- Builders Insurance

- Professional Indemnity Overview

- Accountants Professional Indemnity Insurance

- Gardeners Insurance

- IT Consultant Insurance

- Public Liability Insurance

- Shop & General Retail Overview

- Restaurant Insurance

- Shop Insurance

- Specialist Solutions Overview

- Affinity Partnership Schemes

- Alternative Therapists Insurance

- Dance Teacher's Insurance

- Fitness Instructor Insurance

- Hairdresser & Barber Insurance

- Members and Visitors Insurance

- Office Insurance

- Personal Trainer Insurance

- Recruitment Agency Insurance

- Removals & Storage Insurance

- Rope Access Insurance

- Tanning Salon Insurance

- Travel Agents & Tour Operators

- Tradesman Overview

- Carpenter Insurance

- Electrician Insurance

- Handyman Insurance

- Plumber Insurance

- Self-employed Insurance

- Tree Surgeon Insurance

- Window Cleaner Insurance

- Culture Change Consulting

- Communication Consulting

- Financial Wellbeing Solutions

- Organisational Wellbeing Overview

- Organisational Wellbeing Consulting

- Diversity, Equity and Inclusion Consulting

- Employee Benefits Consulting Overview

- Asset Management

- Benefits Strategy

- Flexible Benefits & Technology

- Healthcare & Protection

- Multinational Benefits

- Workplace Pensions

- Reward Consulting Overview

- Bonus Plan Design

- Executive Remuneration

- Gender Pay Reporting

- HR and Reward Training

- International Reward Management

- Job Evaluation

- Long Term Incentive Plans

- Pay Benchmarking

- Reward & Recognition

- Salary Surveys

- Share Schemes & Sales Incentive Plans

- News & Insights

- Gallagher Better Works

- Media Centre

- The Gallagher Way

- UK Executive Team

- International Operations

- Premiership Rugby Partnership

- FATCA Forms

- Modern Slavery

- Bland Bankart Retirement Benefits Scheme

- COVID-19 Risk Assessment

- Gender Pay Gap Reports

- Office Locations

- Travel Agents & Tour Operators Insurance

Insurance solutions for tour operators and travel agents.

Start your journey with us today. call us on 0800 062 2028, start your journey today., travel agents & tour operators' liability insurance.

This can include tour operators’ liability insurance, including liabilities arising from The Package Travel, Package Holidays and Package Tours Regulations 1992.

With over 30 years’ experience as an independent insurance broker for travel agents and tour operators, we can arrange competitively priced insurance for any business, from small, single-proprietor firms to large UK companies.

We specialise in travel businesses

Because we specialise in insurance for travel companies, we know just how complex your risks can be. Over the years, we’ve developed a deep understanding of the challenges faced by tour companies and travel agencies , and can advise you about the types and you may need to protect your business.

Relationships with travel underwriters

Thanks to our long-standing experience arranging insurance for travel agents and tour operators, we’ve developed strong relationships with some of the leading travel underwriters. As a result, we can arrange wide-ranging and competitive insurance solutions for both travel agents and tour operators – suitable for your business.

Insurance for travel businesses can include travel agent’s and/or tour operator’s liability insurance, scheduled airline failure insurance (SAFI insurance), travel bonds (ATOL, ABTA, CPT, IATA, Airline), public liability & employer's liability insurance and product liability cover. It can also include cyber liability insurance, directors’ & officers’ liability cover, supplier failure credit insurance and office/shop/commercial combined insurance.

Travel Agents & Tour Operators Insurance

- 30+ years specialising in insurance for travel agencies & tour operators

- Helpful advice about the type & level of insurance you need

- Cover your liabilities under The Package Travel, Package Holidays and Package Tours Regulations 1992

- Long-standing relationships with travel underwriters

We can arrange insurance which covers liabilities to the public and employees, as well as cover for claims arising from errors/omissions in client bookings. And our insurance for tour operators covers legal liabilities arising from The Package Travel, Package Holidays and Package Tours Regulations 1992 (including liability for suppliers’ actions). For further information please contact us.

Related Products

More products.

- Kidnap and Ransom Insurance

- Risk Management

- Employee Benefits Consulting

- Financial Wellbeing

- Reward Consulting

Start your journey with Gallagher. Connect with an expert.

Travel Liability Insurance and Risk Management for Travel Agencies and Tour Operators

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Spotify | Android | Pandora | iHeartRadio | Blubrry | TuneIn | Deezer | RSS

Adventure Travel Liability Insurance Questions and Answers

Tourism Tim Warren Lives Adventure…

Are you are a tour operator, travel agent, hotelier, resort, lodge and have questions on travel liability insurance and risk management, especially in adventure travel, you need to listen to this important episode of Travel Business Success Podcast.

Click on player bar below to listen or download the MP3 audio for free.

Tourism Tim Warren interviews Rick McKinley with Alameda Associates who specializes helping travel providers and vendors get liability insurance and has lots of experience in the adventure travel and active sports.

Also read below for updated 2016 travel liability insurance coverage specifically for tour operators and travel agents, including adventure travel tour operators, lodges, etc.

Top travel liability insurance and hospitality risk management topics include:, 1 ) where can i find liability insurance for my travel agency \ tour operations, 2) what’s does it cover • levels of coverage: • cost, 3) what are the basics you need for travel liability insurance.

• General liability insurance • Non owned and hired auto -important • Physical and sexual abuse • Worldwide coverage • Bodily injury • Errors and omissions ( $ back from client) • Volunteer workers comp • Accidental death and dismemberment

4) TRAVEL LIABILITY INSURANCE SUPPLIERS:

- CNA international

- Travel Safe Insurance

- Lexington – AIrisk.com

5) WHAT’S DOES IT NOT COVER?

• Definitions in policy • Endorsements

6) WHAT SHOULD I DO TO FIND OUT WHAT MY CURRENT POLICY COVERS AND DOES NOT COVER?

7) what can i do proactively to reduce my chances of having a travel liability insurance claim.

Have in contracts:

- Hold harmless/ disclaimer statements

- Limit liability

- Medical release form for treatment

- Vendors insurance – naming suppliers as additional insured

- Vendor selection process

- Hold activity provider harmless – indemnity provision

6) CRISIS MANAGEMENT PLANS

- Risk management policies, procedures and STAFF TRAINING

Rick McKinley Contact:

Voice: (510) 522-2090 email: [email protected] www.alamedaassociatesins.com

Adventure Tour Operator & Travel Agent Insurance Program from Zurich Insurance Co.

Types of Risks

Adventure Tour Operators; Travel Agencies; Tour Operators; Student Tour Operators; Independent Contractors (Travel Agents); Corporate Meeting Planners, Destination Management Companies

Appetite: All sizes of risks; travel and tour arrangements can be worldwide no territory restrictions;

Ineligible risks: Outfitters & Guides; Spring Break Student Tour Operators; Party or Wedding Planners

Geography: Nationwide

Adventure Travel Liability Insurance Coverage Highlights

Coverage offered:

- General Liability

- Professional Liability (Including Bodily Injury, Property Damage, and E&O coverage)

Coverage limits: Up to $5,000,000/$5,000,000 for qualifying companies

Admitted or non-admitted paper: Admitted in all 50 states, except non-admitted for NY Tour Operators, and Student & Adventure Tour Operators

Additional Travel Liability Insurance Program Highlights

- Program Administrator has more than 30 years experience in this industry

- Worldwide territory

- Occurrence form

- In-house underwriting and claims handling

Click Here for More Information on Zurich Insurance Company for Liability Insurance for Adventure Tour Operators and Travel Agents

Click triangle below to listen to travel business success podcast on travel liability insurance, what are your top travel liability insurance and risk management questions please post them below and we will provide you guidance to help your travel business succeed., comments (16).

I work with a tour operations company. We have an upcoming tour for a high school choir group. For the school district, the tour falls under the category of a “field trip” and consequently they now require us to have a commercial liability insurance policy for $2Million and to be have the district’s name added as an insured. They also want us to be responsible for any medical expenses incurred as a result of injury to its employees, volunteers and/or representatives. We do not currently have any business insurance. It is my thinking that this type of commercial liability policy that is being requested does not apply to our industry. I am aware of general liability policies and errors and omissions. Is there any policy for our business that would better meet the requirements of the school district?

I am English, my wife is Indonesian. We are setting up a Tour Operator business in Indonesia.It will be licenced in Indonesia. We need Liability Insurance. We have Drafted Proposed Terms & Conditions which we can send you. Can you advise if you would cover us? Many thanks.

Like to help Tim, but I do not provide any sort of insurance for travel companies.

When you are ready to create awareness for your tour operation website, drive traffic and convert them into sales, then our articles, course and tele-seminars will help you succeed

This was a great podcast. It helped me sort out a lot of my questions — thanks!

I would like to check your services for my 2 web site: 1. http://www.itsvietnam.com as a B2B web 2. http://www.itsvietnam.com.vn as a B2C web Thanks a lot

Thanks Thuy Tran for your interest in improving both your Vietnamese travel websites.

I can help then you increase inquiries and sales. Not only on your websites, but on your trade show stand marketing too.

Both websites need help to improve the “credibility” / sales aspect and the search engine ranking info to improve traffic.

You need to start with by creating a “travel website that Sells”. Neither of the websites communicate your years of experience quickly or clearly. Neither of your websites quickly show guest or travel social media endorsements or reviews Your B2C site lacks critical Meta Data you must have to get ranking in the search engines. There is many more quick and easy improvements that will increase results fast…

I can provide consulting on how to improve both sites results and coach you in the implementation of the improvements. And the work we do on your websites, you can use on your trade show ( and all your) marketing too.

Both will radically improve your inquiries, sales while LOWERING your marketing costs.

And my services will cost you less then exhibiting at WTM and yield a higher return on investment. Please email me direct @ [email protected] to set discuss your needs and my services.

To your success, Tourism Tim Warren

Hey Rick !!

I loved your Talk show about the Travel agents Liability. I am a Travel agent in Ladakh, India. We are specialized in Adventure and culture tours in the Himalayas . I am planning to have it registered here in the United states (Outbound). I would like some additional information from you. I have been a Adventure tour guide in the Himalayas for almost 12 years and never had a single disaster or unsatisfied client. What i am concerned about, is the US laws that are a little more complicated. Most agents in India do not provide any Liabilities. We advice clients to have travel insurance for themselves. When its a hardcore adventure activities like an expedition, We make sure they are covered by their insurance and on the other hand make then sign a waiver about the risks involved and that they are aware there are no liabilities towards the company. However, that never seemed the right solution to me because we don’t want the Travelers to feel like ” we like saving our own a**) we do need to have them in the comfort zone and trust the Agent. Despite this I still feel there are many reasons they can still sue us for. I would like to is there a way we can insure each tour and are there any agents who cover our liabilities this way. I personally feel this might be more economical over the annual fees we pay the insurance company. I also feel this will help protect smaller Travel agents whose turnover are small compared to the ones who makes Half a million and more.

I have the terms and condition detailed on the website you can check it out. For the time being my website is off the server because of a Domain transfer dispute. it will be up in another week hopefully. Please check http://www.amazinghimalayas.com I am keen to hear you talk on the above topic or have your personal opinion. Looking forward to hear from you

Thank you in Advance. Sonam Amazing Himalayas – Rewarding Adventures

Thanks Sonam for your accolades on my tour operator /travel agent liability insurance interview. It is important. But getting US liability insurance for a foreign operator is near impossible – especially in the high adventure tours you provide.

What I think is more important to book more adventure tours – besides being totally committed to safety as reflected in your good safety record – is to communicate your safety and experience throughout your adventure tour website.

Adventure travel shoppers want to know you are safety conscious and experienced. And they need to know this super fast on your tour website. Or they are gone. Usually forever…

Testimonials are great, but do not bury them at the bottom of the page. And since you have been in business for almost 12 years, you have had many 100’s if not 1000’s of happy clients haven’t you?

This needs to be reflected on every page of your tour website. I call this a “Defining / Credibility Statement. It communicates in about 3 seconds that you are professional, experienced and can be trusted. Learn more about this super important, proven tour sales strategy here .

Let me know your thoughts.

I love adventure travel. it is my heritage and how I got into helping tour operators like you grow your business.

To your awesome success, Tourism Tim

I use your videos, website and info when I teach a travel marketing class! Excellent stuff!

Question: what is the best type of insurance to cover a tour broker business? Someone who sells eco-heritage tours on a local basis working with independent guides who take folks on river paddling trips, historical walking tours, nature walks, etc. (no overnights) Guides must have their own insurance to cover themselves and their own property.

Recommendations??

Thanks Cynthia for your kind words. So glad my travel marketing blog and videos is helpful to you and your class.

Where are you teaching travel marketing? What other topics would be helpful to you and your classes? Anything I can do to help, let me know.

I’ll do some more research, but Berkeley and http://www.stratumins.com/travelagentinsurance.htm both may have policies that work for you. Let me know what you find out. Looks like I need to update my interviews on this topic 🙂

what is a rough estimate for liability insurance for an adventure travel start up?

I am not an insurance agent so I don’t know current pricing or policies. But what I do know is that liability insurance for an adventure travel business can be hard and expensive to get. Key elements the insurance companies look at to determine if they will issue a policy and cost are: your business location, size, activities, how long in business, price point, domestic or international travel, etc.

One of the top adventure travel tour operator and travel agent liability insurance providers is Zurich Insurance Company I am not sure their current offerings worldwide, but this is a good place to start.

What type of adventure travel business are you starting Jacob and where?

Please keep me posted on what you discover on your adventure travel business liability insurance research.

TO your success, Tourism Tim PPS Thanks for using the “Social sharing” buttons to share and “Like” my site. 🙂

Great info ! I came across this article as i am looking for info about insuring our tour company .

Just found the article and contributions on it so helpful .

Thank you for your helpful information on this site! I’m a small business Tour Operator (small groups) in the State of NY (US to Mexico). Who might be my best provider and what policies should I make sure to include? Thank you for your guidance! Dr. Pascoe.

Thanks S Pascoe for your accolades on my podcast and website, and your good question on tour operator business & liability insurance. Let do some vendor updates and get back to you with more details

But here’s some tour operator type of insurance to get:

1. Assets & revenue: Specifics will vary depending on the nature of your tour or activity, you need to take all areas into consideration. Breakdown and damage of business assets: (fires, burglary, general property, equipment breakdown, through a key person’s illness or bad weather.) Business interruption (any interruption to the business which stops the business from making money, while you still have bills to pay).

2. Liability: frees you from responsibility if someone gets hurt or their belongings are stolen while on your tour.

3. People: You are legally required to take out workers compensation insurance for your employees. Independent contractors are a different story.

What have you found so far? Any feedback or insights you can share helps us all.

Best, Tourism Tim

6 Types of Insurance Every Tour Operator Needs

If you're in the business of providing tours, then you need to have insurance. It's that simple. But not all insurance is created equal, and there are a few specific types that are essential for tour operators.

In this blog post, we'll discuss the six most important types of insurance, and we'll explain why each one is important. So if you're looking to start a tour company or you're just curious about what type of insurance you should be carrying, read on!

What kind of insurance do tour operators need?

Thinking about starting a tour business? Well, you may have heard that insurance is essential, but what type of policy do you need? Let us unravel the mystery for you.

Every tour operator business has unique needs that should be taken into account when selecting an insurance policy. But there are some general types of coverage you'll want to make sure you have.

Deciding which one, however, is up to you and your provider. To help you, ask yourself:

What possible risks may arise and how can I best prepare to protect against them?

Anticipate potential risks that could emerge to be prepared for any possible outcomes. For example:

- Who covers the risk of property damage, liability, or other risks associated with taking people on tours?

- What if a customer breaks his leg on your zipline tours or gets food poisoning from your restaurant tour? Who will cover the emergency medical costs?

- What happens if one of your tour guides gets injured while leading the tour or gets COVID-19?

Knowing the answers to these questions is crucial for making sure your tour business is properly covered.

Furthermore, each country may have unique requirements depending on the tour activities you offer. So be sure to research your options and make an informed decision about the kind of coverage that best suits your needs, even small businesses.

Now that you know why insurance is important to protect your business, let's take a look at what type of policies you should consider.

6 Types of Insurance for Tour Operators

1. general/business liability insurance .

Without a doubt, tour businesses must acquire this type of insurance for their protection. It covers legal costs if someone sues your business for personal injury, bodily injury, property damage, slander and libel, copyright infringement, and more.

For example, your tour driver could get into an accident that damages property or injures someone. If that happens, then general liability insurance will help cover the costs associated with the damages.

Without this one, you're putting your business in a precarious position.

2. Professional liability insurance

Also known as Errors and Omissions (E&O) liability insurance, this type of policy protects you against the risk of being sued for negligence.

For instance, if a customer on your tour gets food poisoning from a restaurant you recommended, then your business can be held liable for not providing accurate information. This will help cover the costs like medical bills of any legal action.

3. Commercial property insurance

It doesn't matter where your business is located, property insurance should be considered a must-have. This third party property policy will help protect your physical assets from risks such as fire, theft, floods, and other natural disasters.

For example, if you operate by the beach, then you should probably invest in property insurance with coastal coverage.

4. Auto/transportation insurance

If your tour operator business involves transportation (for example, a bus tour), then you must have auto insurance. This will cover any expenses related to the vehicle in case of an accident of your employees and clients.

For instance, your paddle-boarding tours require a truck to transport the equipment. If the driver gets into an accident while on tour, then this will help cover the damages.

Also, when you have this type of insurance, any employee may drive. This will allow you to rest assured that your staff is covered in case of an emergency.

5. Cyber liability insurance

This type of liability insurance protects businesses from cyber attacks and other digital risks.

For example, if a hacker steals confidential customer data from your website or an employee accidentally sends sensitive payment information to the wrong person, then this will help cover the costs associated with recovering the data and restoring your reputation.

6. Business interruption insurance

This policy will help secure your business from any unforeseen circumstances that could lead to a risk of financial loss.

For example, if your tour company is forced to temporarily close due to the COVID-19 pandemic, then this insurance will help cover the expenses incurred while your business is closed.

Tour businesses with a business interruption policy were able to recoup their customer refunds due to pandemic-related closures and cancellations thanks to the protection provided by their companies.

Additional best practices for protecting your business

In addition to the six types of insurance discussed above, there are other steps you can take to protect your business.

- Make sure all employees have the proper training and certifications.

- Keep up with safety regulations, such as regular vehicle maintenance checks or pest control services.

- Understand the laws and regulations that apply to your industry.

- Create a crisis response plan and review it regularly.

- Stay ahead of the competition by monitoring their activities and trends in the industry.

Having a cancellation policy is also a must-have. This should even be readily available on your website so customers know what to expect in case they need to cancel their tour. Your terms should be clear and concise, leaving no room for misinterpretation.

Finally, ensure you have emergency medical plans in place. For instance, if your tours are based in places where hurricanes or tropical storms are common, have a plan in place to evacuate quickly and safely.

Frequently Asked Questions

How much does tour operator insurance cost.

The cost of insurance will vary depending on the type and amount of coverage needed. Generally, the more coverage you have, the higher your premium will be to protect your business.

How much is liability insurance for tour operator?

Liability insurance typically ranges from hundreds to thousands of dollars, depending on the type and amount of coverage needed.

Do tour guides and travel agents need insurance?

Yes, most travel agents and tour guides should have the appropriate insurance to protect themselves and their customers from liabilities and financial losses. Insurance can also provide peace of mind for both the tour guide and their customers.

Final Takeaways

Having the right insurance is an essential part of running a successful tour business.

With this comprehensive guide, you should now have a better understanding of the different types of insurance tour businesses need and how they can protect their business from liabilities and financial losses.

Get the latest news and stay in touch with the industry secrets.

By clicking "Subscribe", you agree to our Privacy Policy and the data we do collect.

Beyond the Basics: A Checklist Page for Your Tour Website

Tour Operator Guide: November 2023 Core Update for Tour Operators

Tour Operator Guide: How to Improve Customer Service

Unleashing the Power of User-Generated Content for Tourism Website

Keep Reading

Effective Strategies to Minimize No-Shows on Your Tour or Activity Business

Let's explore six essential tactics to minimize no-shows and cancellations on your tour and activity business.

Let's discuss the six most important types of insurance for tour operators, and we'll explain why each one is important.

- Excursion Insurance

- Testimonials

5 Commonly Asked Questions about Tour Operator Liability Insurance

1. Why is Tour Operator Liability Insurance Required?

Tour operators wishing to work with cruise lines are required by the cruise lines to have insurance, also called Excursion Insurance. This is a different type of insurance than the local insurance your business may need to comply with local insurance requirements, and is needed if you wish to contract your tours with, or be listed as a “recommend excursion” by cruise lines to their passengers.

Cruise lines will only accept tour operators demonstrating insurance coverage in the following areas: contingent general liability; vehicle general liability (when applicable); motorized and nonmotorized watercraft coverage (when applicable). Furthermore, this coverage must include World-Wide Jurisdiction in order to protect passengers from any country, and the insurance provider needs to have received A.M Best Rating of A- or better .

2. What Is the Difference between Tour Operator Liability Insurance and Excursion Insurance?

Tour Operator Liability Insurance, and Excursion Insurance are two terms describing the same type of insurance coverage and may be used interchangeably. There is no functional difference between Tour Operator Insurance and Excursion Insurance.

3. What Is Global Jurisdiction and Why Does It Matter?

Global Jurisdiction , or Worldwide Jurisdiction provides insurance coverage for personal injury and property damage liability claims filed from anywhere in the world.

Passengers of cruises come from a multitude of different countries throughout the world, each with different and complex liability laws. Cruise lines do not expect to be responsible for any injuries, property damage, or loss experienced by passengers while they are on a tour or excursion in port. Instead, this liability may fall to the tour operator.

Costs associated with a passenger injury that occurs during an in-port excursion can quickly become astronomical, and can include local medical expenses, food and lodging for the spouse or family members of the injured party, airlifting the injured person to a different hospital, and other transportation costs if a passenger is unable to return to the cruise.

In addition to global jurisdiction coverage being a prerequisite to a tour operator’s contracting with a cruise line, the minimum liability coverage required for the tour operator’s local laws may not provide adequate coverage for the costs associated with an injured passenger, who may file a claim upon returning home. A dependable insurance company will try to settle that claim out of court to avoid legal fees.

4. What Does Tour Operator Liability Insurance Cover?

There are three basic areas of coverage :

Contingent General Liability

Contingent General Liability, also called Third Party or Public Liability , covers bodily injury and property damage to tourists in your care, custody and control while participating in an excursion tour. This insurance is mandatory for mitigating exposure for any tour operator dealing directly with the public. This includes every service from ziplines or river rafting tours, cultural walking tours or museum tours to vehicle and watercraft rentals.

Contingent Auto Liability

This coverage is excess auto liability coverage over and above your local compulsory automobile insurance and includes coverage for owned, hired and non-owned vehicles.

Contingent Watercraft Liability

Similar to the Contingent Auto Liability, this covers owned, hired and non-owned watercraft having a motor that carries passengers for hire.

Auto and watercraft liability protects the policyholder in the event of damage to the vehicle or injury, loss, and property damage suffered by tour participants if there is an accident, and associated medical expenses.

Insurance policies are usually customized to cover potential accidents based on the types of vehicles and watercraft as well as their function.

5. Is Excursion Insurance Expensive?

No, the cost of insurance is easily offset by the increase in revenue derived from an increase in tour visitors.

Cruise lines are only willing to promote or contract with tour operators who meet their standards for minimum liability coverage, and cruise line passengers are unlikely to research on-shore activities not promoted by the cruise line. Thus, complying with cruise lines insurance policies is the best way to ensure your tour is promoted to passengers.

- Follow us on Facebook

- Follow us on Linkedin

- Follow us on Mail

- Follow us on Copy Copied to clipboard

Why You Need Tour Operator Liability Insurance For Your Excursion

Previous post, 3 easy steps to reducing your excursion insurance rates.

Tour Guide Insurance

Get an insurance policy by the hour, day, or month in 60 seconds.

4.4/5 stars from 1689 reviews on Trustpilot

Featured in

Why do I need Tour Guide Insurance?

As a professional tour operator, you’re tasked with knowing the ins and outs of your blank. We say “blank,” because you could be a tour company guiding people through a city’s downtown, elating taste buds on a wine tour, or growling and roaring with lions on a children’s jungle safari tour at a zoo. Knowing everything about your blank means being able to wax poetic about all the best facets of your blank. But it also means knowing all the worst parts about it too.

“Insurance” is our blank. We know the ins and outs of this industry and why tour guides absolutely need to protect themselves with general liability insurance and professional liability insurance .

Imagine, poor weather in the forecast threatens to cancel the tour. Without a cloud in the sky, and knowing how excited guests are for your tour, you decide to ignore the warning and continue without canceling. Near the end of the tour, a flash of rain douses the entire group. In an attempt to get to cover, two of your tour members collide and an ambulance needs to be called. Both parties conspire to hold you responsible for the medical bills and for negligence on continuing the tour despite the forecast.

It’s the simple factors, often outside of your control and done with the very best of intentions that can escalate to needing insurance. Our Tour Guide General Liability and Professional Liability Insurance was made with the worst-case scenario in mind.

Ensure you have Thimble’s Tour Guide Insurance and keep your business on the route to success.

Quick thinking insurance for small businesses.

What does Tour Guide Insurance cover?

Unforeseen circumstances or an accident shouldn’t spell the end of your business. Thimble’s Tour Guide Insurance is designed to protect tour guides from situations like the below:

Third-party, non-employee bodily injury

At the final stop on the wine tour, a particularly lively guest leans too far back in their chair. Unable to catch themself, they fall backward and catch the corner of the table directly behind them. The paramedic in the ambulance suspects it might be more than a concussion. The guest then expects you to cover any costs that arise from this.

Third-party property damage

Part of your city tour involves renting electric scooters. Though you’re an expert on two wheels, you’ve never dealt with a bee flying into your eye. Losing control, you steer right into a car, leaving a sizable dent. Unfortunately, this wasn’t “just a car;” it was a brand new Rolls Royce. The owner expects to be paid in full.

Defense costs

A family has booked your tour months in advance. They’re flying across the coast for a vacation and this tour has been the only thing their son has talked about. When an unexpected thunderstorm rolls through your city, you’re forced to cancel. The son is devastated, and the parents are especially litigious. Despite having no control of the weather, you need a lawyer, because they’re suing you for a breach of contract.

Errors & omissions

You’ve advertised a new tour for a while, with multiple tour guests waiting patiently for the expedition. Once you set out with your group, one of your clients decides that the excursion doesn’t live up to expectations. They then sue you for false advertising.

How much does Tour Guide Insurance cost?

Our Tour Guide Insurance policy rate reflects the risk factors that are related to your niche. Wine tour guides and museum tour guides, for example, need personalized coverages, and neither party wants to pay for anything they don’t need. That’s why we customize your policy rate to the location you work in, the size of your crew (if you have one), and the coverage limit required.

Thimble’s Tour Guide Insurance is on when you’re working and off when you’re not. Plus, you can add as many Additional Insureds as you’d like for free. That’s game-changing flexibility. That’s insurance done right. Get your free Tour Guide Insurance quote now.

Tour Guide Insurance FAQs

How quickly can I get a Certificate of Insurance?

Quicker than you can say “And if you’ll look to your left.” When you need Tour Guide Insurance, you can get a free insurance quote, and then purchase that policy all within 60 seconds. The COI (Certificate of Insurance) will be sent to your inbox immediately.

Did your friend ask you to cover for them while they’re on vacation? While you’ve never worked for their company before, you decide to accept the job. The manager in charge asks for your Certificate of Insurance. Thanks to Thimble, you can hop on the app and show them your COI within seconds.

With Thimble, you can schedule your coverage up to six months in advance, and if your friend’s plans end up changing, you can cancel your policy penalty-free up to an hour before the coverage was expected to begin. That’s fast and flexible insurance.

If any changes need to be made, consider them done. Add and modify your Additional Insureds at a moment’s notice, right through the Thimble app.

What are the Tour Guide Insurance policy limits?

There are two Tour Guide Insurance policy limits offered by Thimble: $1 million and $2 million. You can choose the one that protects your tour guide business best, depending on the risk factors you’re facing.

Are workplace injuries of my staff covered?

No. General Liability Insurance for tour guides only provides coverage when the injury happens to a third party. If you want to have three extra tour guides working for you, you may want to consider workers’ compensation coverage . In many states, you can only operate legally with workers’ comp in place.

Does Thimble’s Tour Guide Insurance cover damage to my equipment?

Also no. Thimble’s Tour Guide Insurance only provides this protection for third party damage. If you’ve purchased your own Segway to help maximize your efficiency, you may want to consider a commercial property policy to insure your gear.

How do I get Tour Guide Insurance with Thimble?

Getting Tour Guide Insurance has never been easier, thanks to Thimble. All you need is one minute and the Thimble app. Offer some details about your tour guide business, your ZIP code, and the length of your desired coverage (hourly, daily, or monthly), and we’ll send you a quote instantly. From there, click to purchase and you’ll receive your Certificate of Insurance instantly.

Quick-thinking insurance for fast-moving businesses.

Fewer questions. More options. Buy a policy online, in the app, or over the phone in minutes. Get to work before the other guys even call you back.

Any size. Every stage. Get coverage by the job, month, or year. Choose how you pay, then upgrade when business really takes off.

Total Control. Seamless edits. Modify, pause, or cancel instantly, whether work slows down or hiring picks up.

Get covered in minutes. (Then get to work!)

Tour Operators and Travel Agents Insurance

Get a Quote

Direct client.

We use a network of Insurance Brokers to deliver our products.

Click the button below to find a Broker near you.