- Maryo Bittar

- Barnett Q. Brooks

- Timothy M. Hartman

- Joyce Smithey

- Lisa L. Walker

- Reuben W. Wolfson

- Wage Issues

- Discrimination

- Sexual Harassment and Abuse

- Employee Contract and Severance Negotiations

- Equal Pay Act

- Mediation and Alternative Dispute Resolution

- In the Media

- Presentations and Publications

- Federal Government Agencies

- Maryland State Government Agencies

- Non-Profit Agencies

- Other Employment Related Organizations

Have you been retaliated against, wrongfully let go, or forced to work in unsafe conditions due to COVID-19? Find out if you qualify for a claim!

What to Do If Your Employer Won’t Reimburse Business Expenses

At Smithey Law Group LLC , our attorneys are frontrunners in the employment law community and have represented employees in thousands of disputes. We have the experience and knowledge to help you recoup your business expenses and damages from your employer.

Is a Business Expense Reimbursement Part of My Wages?

Plain and simple, your employer must pay you wages for your work. And how does the law define wages? Under Maryland law, wages include the following :

- Your standard rate of pay (which must comply with the minimum wage laws),

- Commissions,

- Fringe benefits,

- Overtime pay, and

- Any other promised compensation.

While business expenses are not listed above, federal law states that your employer must remit payment to you “free and clear” or unconditionally. Your employer’s payment to you is not free and clear if your work requires you to purchase materials or pay other costs for the benefit of your employer, and those costs bring your pay below minimum wage or infringe on your overtime entitlements. Those costs must be reimbursed.

Expenses that are for the benefit of an employer and subject to reimbursement can include the costs of :

- Purchasing materials requested explicitly by an employer;

- Depreciation in value of a personal vehicle that an employee is obligated to use during working hours;

- Mileage for trips an employer requires an employee to make during working hours;

- Purchasing tools requested explicitly by an employer;

- Buying gas used for trips an employer requires an employee to make during working hours; and

- Other travel expenses.

Please keep in mind that an employer’s obligation to compensate an employee for travel expenses does not include an employee’s travels to work before a shift starts or travels back home after a shift ends. Also, an employer doesn’t necessarily have to reimburse an employee for the exact amount of costs they incur. An employer has to pay for only a “reasonable approximation of expenses” its employee collects on its behalf.

In addition to its obligations under federal and state wage laws, your employer also has obligations to you under any employment agreement you have. If a business, agency, or organization promises to pay you a certain wage for your work and also requires you to make purchases that reduce your wages, a failure to reimburse you might be a breach of contract. Your employer’s refusal to cover your business expenses could subject it to a breach of contract lawsuit , regardless of whether the expenses reduce your pay to less than minimum wage or overtime entitlements.

Taking Legal Action Against an Employer that Won’t Reimburse Business Expenses

Unfortunately, some employers put their employees in a position where they have to fight for the compensation they earned. If an employer requires you to use your money or personal belongings to benefit the employer’s business without recompense, you are not receiving your full wages. Employees who do not receive their full wages can file wage complaints with the government or lawsuits in court.

The Employment Standards Service (ESS) of the Maryland Department of Labor and the Wage and Hour Division (WHD) of the U.S. Department of Labor handle wage complaints against employers that fail to reimburse their employees . The ESS and WHD investigate complaints, review evidence, and conduct interviews and conferences in an effort to resolve complaints. And if the WHD or ESS is unable to adjudicate a wage complaint, an employee still has the option of suing their employer in court.

If their complaint or lawsuit is successful, an employee can win remedies such as :

- Liquidated damages,

- Treble damages, and

- Attorney fees.

An employer that willfully fails to reimburse an employee could also be subject to civil and criminal penalties.

There are many steps to initiating and maintaining a legal complaint against your employer for improper payment of wages. As soon as a wage issue arises at your workplace, you should speak to an experienced wage and hour attorney to help ensure that you take the right course of action to get the compensation your employer owes you.

Deadline for Filing a Complaint or Lawsuit

Not only do you need to file your wage complaint or lawsuit in the right place, but you also need to file your legal action on time. You must file your complaint with the WHD within two years if your employer’s failure to reimburse you is not willful. And you must file with the WHD within three years if your employer’s actions are willful. Under Maryland law , you have two years to file a complaint with the ESS and three years to file a lawsuit in court.

Let Smithey Law Group Help You

You worked hard on your own to earn money at work; why should you have to fight alone to recover that money from your employer? The answer is simple: You don’t have to fight alone to recover your wages, nor should you. At Smithey Law Group , we focus exclusively on representing individuals in employment disputes. We are experienced and knowledgeable regarding how to resolve the employment law challenges Maryland residents face. We are also award-winning leaders in the employment law community.

If you are searching for an advocate who gets results and can successfully litigate, negotiate, and educate on matters regarding employment, speak to us. We are sought-after professionals who can maximize your recovery and protect your rights. You can call us at 410-881-8190 or contact us online whenever you need help.

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Understanding business travel deductions

More in news.

- Topics in the News

- News Releases

- Multimedia Center

- Tax Relief in Disaster Situations

- Inflation Reduction Act

- Taxpayer First Act

- Tax Scams/Consumer Alerts

- The Tax Gap

- Fact Sheets

- IRS Tax Tips

- e-News Subscriptions

- IRS Guidance

- Media Contacts

- IRS Statements and Announcements

IRS Tax Tip 2023-15, February 7, 2023

Whether someone travels for work once a year or once a month, figuring out travel expense tax write-offs might seem confusing. The IRS has information to help all business travelers properly claim these valuable deductions.

Here are some tax details all business travelers should know

Business travel deductions are available when employees must travel away from their tax home or main place of work for business reasons. A taxpayer is traveling away from home if they are away for longer than an ordinary day's work and they need to sleep to meet the demands of their work while away.

Travel expenses must be ordinary and necessary. They can't be lavish, extravagant or for personal purposes.

Employers can deduct travel expenses paid or incurred during a temporary work assignment if the assignment length does not exceed one year.

Travel expenses for conventions are deductible if attendance benefits the business. There are special rules for conventions held outside North America .

Deductible travel expenses include:

- Travel by airplane, train, bus or car between your home and your business destination.

- Fares for taxis or other types of transportation between an airport or train station and a hotel, or from a hotel to a work location.

- Shipping of baggage and sample or display material between regular and temporary work locations.

- Using a personally owned car for business.

- Lodging and meals .

- Dry cleaning and laundry.

- Business calls and communication.

- Tips paid for services related to any of these expenses.

- Other similar ordinary and necessary expenses related to the business travel.

Self-employed individuals or farmers with travel deductions

- Those who are self-employed can deduct travel expenses on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) .

- Farmers can use Schedule F (Form 1040), Profit or Loss From Farming .

Travel deductions for the National Guard or military reserves

National Guard or military reserve servicemembers can claim a deduction for unreimbursed travel expenses paid during the performance of their duty .

Recordkeeping

Well-organized records make it easier to prepare a tax return. Keep records such as receipts, canceled checks and other documents that support a deduction.

Subscribe to IRS Tax Tips

Everything You Need to Know About the Business Travel Tax Deduction

.jpeg)

Justin is an IRS Enrolled Agent, allowing him to represent taxpayers before the IRS. He loves helping freelancers and small business owners save on taxes. He is also an attorney and works part-time with the Keeper Tax team.

You don’t have to fly first class and stay at a fancy hotel to claim travel expense tax deductions. Conferences, worksite visits, and even a change of scenery can (sometimes) qualify as business travel.

What counts as business travel?

The IRS does have a few simple guidelines for determining what counts as business travel. Your trip has to be:

- Mostly business

- An “ordinary and necessary” expense

- Someplace far away from your “tax home”

What counts as "mostly business"?

The IRS will measure your time away in days. If you spend more days doing business activities than not, your trip is considered "mostly business". Your travel days are counted as work days.

Special rules for traveling abroad

If you are traveling abroad for business purposes, you trip counts as " entirely for business " as long as you spend less than 25% of your time on personal activities (like vacationing). Your travel days count as work days.

So say you you head off to Zurich for nine days. You've got a seven-day run of conference talks, client meetings, and the travel it takes to get you there. You then tack on two days skiing on the nearby slopes.

Good news: Your trip still counts as "entirely for business." That's because two out of nine days is less than 25%.

What is an “ordinary and necessary” expense?

“Ordinary and necessary” means that the trip:

- Makes sense given your industry, and

- Was taken for the purpose of carrying out business activities

If you have a choice between two conferences — one in your hometown, and one in London — the British one wouldn’t be an ordinary and necessary expense.

What is your tax home?

A taxpayer can deduct travel expenses anytime you are traveling away from home but depending on where you work the IRS definition of “home” can get complicated.

Your tax home is often — but not always — where you live with your family (what the IRS calls your "family home"). When it comes to defining it, there are two factors to consider:

- What's your main place of business, and

- How large is your tax home

What's your main place of business?

If your main place of business is somewhere other than your family home, your tax home will be the former — where you work, not where your family lives.

For example, say you:

- Live with your family in Chicago, but

- Work in Milwaukee during the week (where you stay in hotels and eat in restaurants)

Then your tax home is Milwaukee. That's your main place of business, even if you travel back to your family home every weekend.

How large is your tax home?

In most cases, your tax home is the entire city or general area where your main place of business is located.

The “entire city” is easy to define but “general area” gets a bit tricker. For example, if you live in a rural area, then your general area may span several counties during a regular work week.

Rules for business travel

Want to check if your trip is tax-deductible? Make sure it follows these rules set by the IRS.

1. Your trip should take you away from your home base

A good rule of thumb is 100 miles. That’s about a two hour drive, or any kind of plane ride. To be able to claim all the possible travel deductions, your trip should require you to sleep somewhere that isn’t your home.

2. You should be working regular hours

In general, that means eight hours a day of work-related activity.

It’s fine to take personal time in the evenings, and you can still take weekends off. But you can’t take a half-hour call from Disneyland and call it a business trip.

Here's an example. Let’s say you’re a real estate agent living in Chicago. You travel to an industry conference in Las Vegas. You go to the conference during the day, go out in the evenings, and then stay the weekend. That’s a business trip!

3. The trip should last less than a year

Once you’ve been somewhere for over a year, you’re essentially living there. However, traveling for six months at a time is fine!

For example, say you’re a freelancer on Upwork, living in Seattle. You go down to stay with your sister in San Diego for the winter to expand your client network, and you work regular hours while you’re there. That counts as business travel.

What about digital nomads?

With the rise of remote-first workplaces, many freelancers choose to take their work with them as they travel the globe. There are a couple of requirements these expats have to meet if they want to write off travel costs.

Requirement #1: A tax home

Digital nomads have to be able to claim a particular foreign city as a tax home if they want to write off any travel expenses. You don't have to be there all the time — but it should be your professional home base when you're abroad.

For example, say you've rent a room or a studio apartment in Prague for the year. You regularly call clients and finish projects from there. You still travel a lot, for both work and play. But Prague is your tax home, so you can write off travel expenses.

Requirement #2: Some work-related reason for traveling

As long as you've got a tax home and some work-related reason for traveling, these excursion count as business trips. Plausible reasons include meeting with local clients, or attending a local conference and then extending your stay.

However, if you’re a freelance software developer working from Thailand because you like the weather, that unfortunately doesn't count as business travel.

The travel expenses you can write off

As a rule of thumb, all travel-related expenses on a business trip are tax-deductible. You can also claim meals while traveling, but be careful with entertainment expenses (like going out for drinks!).

Here are some common travel-related write-offs you can take.

🛫 All transportation

Any transportation costs are a travel tax deduction. This includes traveling by airplane, train, bus, or car. Baggage fees are deductible, and so are Uber rides to and from the airport.

Just remember: if a client is comping your airfare, or if you booked your ticket with frequent flier miles, then it isn't deductible since your cost was $0.

If you rent a car to go on a business trip, that rental is tax-deductible. If you drive your own vehicle, you can either take actual costs or use the standard mileage deduction. There's more info on that in our guide to deducting car expenses .

Hotels, motels, Airbnb stays, sublets on Craigslist, even reimbursing a friend for crashing on their couch: all of these are tax-deductible lodging expenses.

🥡 Meals while traveling

If your trip has you staying overnight — or even crashing somewhere for a few hours before you can head back — you can write off food expenses. Grabbing a burger alone or a coffee at your airport terminal counts! Even groceries and takeout are tax-deductible.

One important thing to keep in mind: You can usually deduct 50% of your meal costs. For 2021 and 2022, meals you get at restaurants are 100% tax-deductible. Go to the grocery store, though, and you’re limited to the usual 50%.

{upsell_block}

🌐 Wi-Fi and communications

Wi-Fi — on a plane or at your hotel — is completely deductible when you’re traveling for work. This also goes for other communication expenses, like hotspots and international calls.

If you need to ship things as part of your trip — think conference booth materials or extra clothes — those expenses are also tax-deductible.

👔 Dry cleaning

Need to look your best on the trip? You can write off related expenses, like laundry charges.

{write_off_block}

Travel expenses you can't deduct

Some travel costs may seem like no-brainers, but they're not actually tax-deductible. Here are a couple of common ones to watch our for.

The cost of bringing your child or spouse

If you bring your child or spouse on a business trip, your travel expense deductions get a little trickier. In general, the cost of bring other people on a business trip is considered personal expense — which means it's not deductible.

You can only deduct travel expenses if your child or spouse:

- Is an employee,

- Has a bona fide business purpose for traveling with you, and

- Would otherwise be allowed to deduct the travel expense on their own

Some hotel bill charges

Staying in a hotel may be required for travel purposes. That's why the room charge and taxes are deductible.

Some additional charges, though, won't qualify. Here are some examples of fees that aren't tax-deductible:

- Gym or fitness center fees

- Movie rental fees

- Game rental fees

{email_capture}

Where to claim travel expenses when filing your taxes

If you are self-employed, you will claim all your income tax deduction on the Schedule C. This is part of the Form 1040 that self-employed people complete ever year.

What happens if your business deductions are disallowed?

If the IRS challenges your business deduction and they are disallowed, there are potential penalties. This can happen if:

- The deduction was not legitimate and shouldn't have been claimed in the first place, or

- The deduction was legitimate, but you don't have the documentation to support it

When does the penalty come into play?

The 20% penalty is not automatic. It only applies if it allowed you to pay substantially less taxes than you normally would. In most cases, the IRS considers “substantially less” to mean you paid at least 10% less.

In practice, you would only reach this 10% threshold if the IRS disqualified a significant number of your travel deductions.

How much is the penalty?

The penalty is normally 20% of the difference between what you should have paid and what you actually paid. You also have to make up the original difference.

In total, this means you will be paying 120% of your original tax obligation: your original obligation, plus 20% penalty.

.jpeg)

Justin W. Jones, EA, JD

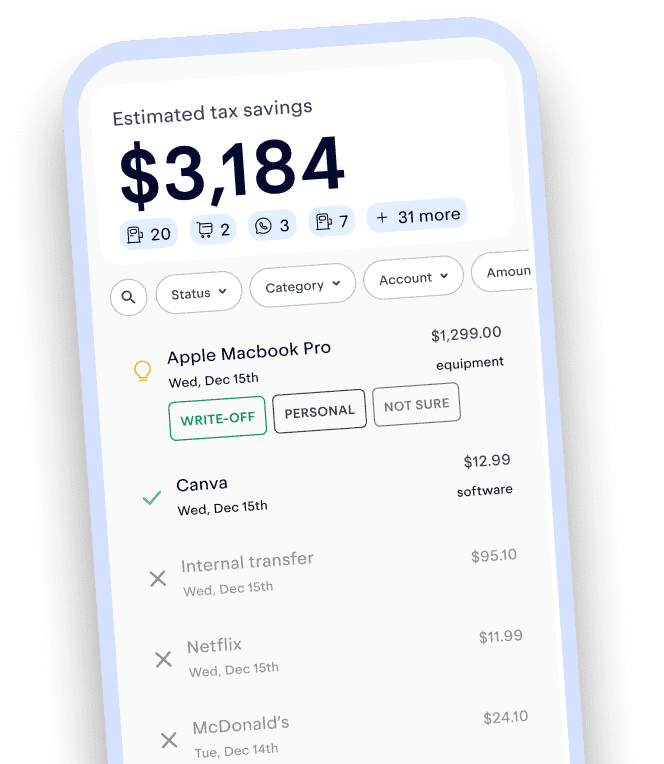

Over 1M freelancers trust Keeper with their taxes

Keeper is the top-rated all-in-one business expense tracker, tax filing service, and personal accountant.

Sign up for Tax University

Get the tax info they should have taught us in school

Expense tracking has never been easier

What tax write-offs can I claim?

At Keeper, we’re on a mission to help people overcome the complexity of taxes. We’ve provided this information for educational purposes, and it does not constitute tax, legal, or accounting advice. If you would like a tax expert to clarify it for you, feel free to sign up for Keeper. You may also email [email protected] with your questions.

Voted best tax app for freelancers

More Articles to Read

Free Tax Tools

1099 Tax Calculator

- Quarterly Tax Calculator

How Much Should I Set Aside for 1099 Taxes?

Keeper users have found write-offs worth

- Affiliate program

- Partnership program

- Tax bill calculator

- Tax rate calculator

- Tax deduction finder

- Quarterly tax calculator

- Ask an accountant

- Terms of Service

- Privacy Policy

- Affiliate Program

- Partnership Program

- Tax Bill Calculator

- Tax Rate Calculator

- Tax Deduction Finder

- Ask an Accountant

- Search Search Please fill out this field.

What Are Travel Expenses?

Understanding travel expenses, the bottom line.

- Deductions & Credits

- Tax Deductions

Travel Expenses Definition and Tax Deductible Categories

Michelle P. Scott is a New York attorney with extensive experience in tax, corporate, financial, and nonprofit law, and public policy. As General Counsel, private practitioner, and Congressional counsel, she has advised financial institutions, businesses, charities, individuals, and public officials, and written and lectured extensively.

:max_bytes(150000):strip_icc():format(webp)/MichellePScott-9-30-2020.resized-ef960b87116444b7b3cdf25267a4b230.jpg)

For tax purposes, travel expenses are costs associated with traveling to conduct business-related activities. Reasonable travel expenses can generally be deducted from taxable income by a company when its employees incur costs while traveling away from home specifically for business. That business can include conferences or meetings.

Key Takeaways

- Travel expenses are tax-deductible only if they were incurred to conduct business-related activities.

- Only ordinary and necessary travel expenses are deductible; expenses that are deemed unreasonable, lavish, or extravagant are not deductible.

- The IRS considers employees to be traveling if their business obligations require them to be away from their "tax home” substantially longer than an ordinary day's work.

- Examples of deductible travel expenses include airfare, lodging, transportation services, meals and tips, and the use of communications devices.

Travel expenses incurred while on an indefinite work assignment that lasts more than one year are not deductible for tax purposes.

The Internal Revenue Service (IRS) considers employees to be traveling if their business obligations require them to be away from their "tax home" (the area where their main place of business is located) for substantially longer than an ordinary workday, and they need to get sleep or rest to meet the demands of their work while away.

Well-organized records—such as receipts, canceled checks, and other documents that support a deduction—can help you get reimbursed by your employer and can help your employer prepare tax returns. Examples of travel expenses can include:

- Airfare and lodging for the express purpose of conducting business away from home

- Transportation services such as taxis, buses, or trains to the airport or to and around the travel destination

- The cost of meals and tips, dry cleaning service for clothes, and the cost of business calls during business travel

- The cost of computer rental and other communications devices while on the business trip

Travel expenses do not include regular commuting costs.

Individual wage earners can no longer deduct unreimbursed business expenses. That deduction was one of many eliminated by the Tax Cuts and Jobs Act of 2017.

While many travel expenses can be deducted by businesses, those that are deemed unreasonable, lavish, or extravagant, or expenditures for personal purposes, may be excluded.

Types of Travel Expenses

Types of travel expenses can include:

- Personal vehicle expenses

- Taxi or rideshare expenses

- Airfare, train fare, or ferry fees

- Laundry and dry cleaning

- Business meals

- Business calls

- Shipment costs for work-related materials

- Some equipment rentals, such as computers or trailers

The use of a personal vehicle in conjunction with a business trip, including actual mileage, tolls, and parking fees, can be included as a travel expense. The cost of using rental vehicles can also be counted as a travel expense, though only for the business-use portion of the trip. For instance, if in the course of a business trip, you visited a family member or acquaintance, the cost of driving from the hotel to visit them would not qualify for travel expense deductions .

The IRS allows other types of ordinary and necessary expenses to be treated as related to business travel for deduction purposes. Such expenses can include transport to and from a business meal, the hiring of a public stenographer, payment for computer rental fees related to the trip, and the shipment of luggage and display materials used for business presentations.

Travel expenses can also include operating and maintaining a house trailer as part of the business trip.

Can I Deduct My Business Travel Expenses?

Business travel expenses can no longer be deducted by individuals.

If you are self-employed or operate your own business, you can deduct those "ordinary and necessary" business expenses from your return.

If you work for a company and are reimbursed for the costs of your business travel , your employer will deduct those costs at tax time.

Do I Need Receipts for Travel Expenses?

Yes. Whether you're an employee claiming reimbursement from an employer or a business owner claiming a tax deduction, you need to prepare to prove your expenditures. Keep a running log of your expenses and file away the receipts as backup.

What Are Reasonable Travel Expenses?

Reasonable travel expenses, from the viewpoint of an employer or the IRS, would include transportation to and from the business destination, accommodation costs, and meal costs. Certainly, business supplies and equipment necessary to do the job away from home are reasonable. Taxis or Ubers taken during the business trip are reasonable.

Unreasonable is a judgment call. The boss or the IRS might well frown upon a bill for a hotel suite instead of a room, or a sports car rental instead of a sedan.

Individual taxpayers need no longer fret over recordkeeping for unreimbursed travel expenses. They're no longer tax deductible by individuals, at least until 2025 when the provisions in the latest tax reform package are due to expire or be extended.

If you are self-employed or own your own business, you should keep records of your business travel expenses so that you can deduct them properly.

Internal Revenue Service. " Topic No. 511, Business Travel Expenses ."

Internal Revenue Service. " Publication 463, Travel, Gift, and Car Expenses ," Page 13.

Internal Revenue Service. " Publication 5307, Tax Reform Basics for Individuals and Families ," Page 7.

Internal Revenue Service. " Publication 463, Travel, Gift, and Car Expenses ," Pages 6-7, 13-14.

Internal Revenue Service. " Publication 463, Travel, Gift, and Car Expenses ," Page 4.

Internal Revenue Service. " Publication 5307, Tax Reform Basics for Individuals and Families ," Pages 5, 7.

:max_bytes(150000):strip_icc():format(webp)/TaxHome-3b9f1ac36f6c4e28889c34943d991fc9.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Search Search Please fill out this field.

- Career Planning

- Succeeding at Work

- Pay & Getting a Raise

How Do Business Travel Expenses Work?

Employers Pay for Company Business Travel in Several Ways

:max_bytes(150000):strip_icc():format(webp)/Susan-LargeImage-5b771f8846e0fb002ca317db.jpg)

- Employees on Long-Term Assignments

- Employers Pay for Travel Expenses?

- Know Your Travel Expense Policies

- Using Travel As an Employee Incentive

Travel expenses are expenditures that an employee makes while traveling on company business. Company business can include conferences, exhibitions, business meetings, client and customer meetings, job fairs, training sessions, and sales calls, for example.

Expenses can include lodging, personal car mileage reimbursement , flights, ground transportation, tips to bellhops, meals, tips to waiters, room service, and other incidental expenses an employee might experience while on the road.

Expenditures that an organization will reimburse are found in the company’s business travel policy. Become familiar with your company’s policy because expenses, as varied as dry cleaning and gym membership, can be covered for employees on extended trips in addition to the expected travel costs, housing, and meals.

Travel Expenditures for Employees on Long-Term Assignments

When using long-term housing facilities for traveling employees, many employers also supply opportunities for the employee's family to visit when the employee is traveling extensively on business. When an employee is assigned to another company location on a temporary basis, employers will sometimes pay for the family of the employee to visit at prescribed time intervals. This keeps the burden of remote work from affecting family relationships adversely.

Employers seek to provide options of value for employees who are away from home and family for extended periods of time. You need to take advantage of any travel privileges that your employer offers to build employee morale and dedication.

Client entertainment at conferences, on sales calls, and on-site visits is another reimbursable expense, but know your company’s policies so you don’t exceed the limits that are placed on entertainment costs. For example, companies frequently place a cap on what you can spend on taking a client to dinner.

Know also your company's policy on the awarding of airline miles credit. It varies. Some companies allow employees to accrue airline travel miles that they then can use for personal family travel. Others accrue a bank of travel miles that they use to cover additional employee business travel. Again, knowing your company's policies is crucial.

How Do Employers Pay for Employee Travel Expenses?

Typically, organizations pay employee travel expenses in these three ways.

Company credit cards

Credit cards are issued to employees who must travel frequently for business. Employees may charge most of the expenses they incur on a business trip to the company credit card. For reimbursement of incidentals such as tips and fast food, employees will need to fill out an expense report when they return from their trip.

Charge cards are convenient for employees as they do not have to come up with the cash to pay for business expenses prior to reimbursement. Become knowledgeable about your company's policies, though; you may still need to turn in receipts and other supporting documentation even when you charge these expenses to a credit card.

Organizations without employee company credit cards require employees to fill out an expense reimbursement report for each expenditure while the employee is on the road. They generally require receipts and some level of justification for each expense.

Only rarely would an organization ask employees to pay for the big-ticket items such as airfare and seek reimbursement later. A company purchase order or company credit card will pay for large expenses upfront. But employees are often required to pay cash out-of-pocket for day-to-day travel expenses that are later reimbursed.

A per diem is a daily allowance of a certain amount of money that an employee is given to cover all expenses. The employee is responsible for making sound travel expense choices within the parameters of the amount of money that he or she is allotted daily.

Some companies pay directly for transportation and housing but give traveling employees a per diem for all other expenses including meals and ground transportation. Employees have been known to underspend on expenses to keep the extra cash from the per diem. Companies generally allow this.

Know Your Employer's Travel Expense Policies

Employees who travel for business are advised to stay up-to-date on company travel policies and costs covered for reimbursement. Expenses that fall outside of the policies are generally not reimbursed or covered.

Receipts are required by most companies except for those that pay a per diem. Your company also likely has a form that they expect employees to use for turning in travel expenses.

To stay on top of reimbursable expenses, employees are often given a deadline by which they need to file an expense report and turn in applicable receipts. The finance department will have guidelines that help it stay current.

If you have questions about what constitutes appropriate travel expenses in your organization, check with your manager and the Human Resources department. You don't want to spend the money and receive a surprise later.

Employers Are Using Travel As an Employee Incentive

Some employers have started to use travel as an employee incentive. When employees are rewarded with travel by their company for meeting a goal, the incentive travel will increase both employee loyalty and workplace engagement.

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

- EXPENSES & DEDUCTIONS

Proving employee business expense deductions

- Individual Income Taxation

Editor: Mark G. Cook, CPA, CGMA

Prior to the passage of the law known as the Tax Cuts and Jobs Act (TCJA), P.L. 115 - 97 , taxpayers were allowed to deduct unreimbursed employee business expenses as miscellaneous itemized deductions, subject to Sec. 67's 2% floor on miscellaneous itemized deductions and Sec. 68's overall limitation on itemized deductions, on Schedule A, Itemized Deductions , of Form 1040, U.S. Individual Income Tax Return . The deduction was disallowed for the years 2018 to 2025 by the enactment in the TCJA of Sec. 67(g), which suspends the allowance of miscellaneous itemized deductions. Nonetheless, because unreimbursed employee business expenses will be deductible again in 2026, and court cases involving disputes between the IRS and taxpayers over their deduction on tax returns for years before 2018 continue to make their way through the courts, knowledge of the details of the unreimbursed employee business expense deduction remains important.

Employee business expense deduction

To get started, what is a deductible unreimbursed employee business expense? Per Sec. 162(a), there shall be allowed as a deduction all the ordinary and necessary expenses paid or incurred during the tax year in carrying on any trade or business. Performing services as an employee constitutes a trade or business (see, e.g., Primuth , 54 T.C. 374 (1970)). Thus, with respect to employee business expenses, a deduction under Sec. 162(a) will be allowed for an unreimbursed expense that is:

- Paid or incurred during an employee's tax year;

- For carrying on his or her trade or business of being an employee; and

- Ordinary and necessary.

An expense is ordinary if it is common and accepted in the taxpayer's trade, business, or profession. An expense is necessary if it is appropriate and helpful to the taxpayer's business; it does not have to be required to be considered necessary.

Employer reimbursements

To prevent a taxpayer from obtaining a double benefit, only unreimbursed business expenses are deductible. Also, business expenses are not "necessary" if reimbursement is possible ( Podems , 24 T.C. 21 (1955)). Thus, if an employee incurs an expense that he or she has a right to reimbursement for under an expense reimbursement plan of his or her employer, but the employee fails to obtain reimbursement for the expense, the employee cannot take a Sec. 162(a) deduction for the expense.

This is true regardless of why an employee does not seek reimbursement for a business expense incurred on behalf of his or her employer. The Ninth Circuit held in Orvis , 788 F.2d 1406 (9th Cir. 1986), that a taxpayer's lack of knowledge that his employer had a policy of reimbursing such expenses was not relevant to whether he could take a deduction for the expenses on his personal return.

The burden of proof

Should the tax return be audited or a notice of deficiency be received, the taxpayer generally has the burden of proof. However, the burden of proof switches to the IRS if an individual taxpayer produces credible evidence in support of an expense, has complied with the substantiation requirements for the expense, has maintained all required records for the expense, and has cooperated with reasonable requests by the IRS for witnesses, information, documents, meetings, and interviews regarding the expense.

Credible evidence is evidence that, after critical analysis, the court would find sufficient upon which to base a decision on the issue if no contrary evidence were submitted (without regard to the judicial presumption of IRS correctness). The burden is not shifted if the taxpayer presents incredible or implausible evidence, even if that evidence is not controverted.

Substantiation requirements

An employee must be able to substantiate a deduction for an unreimbursed business expense by keeping (and producing for the IRS, if requested) adequate records. In general, the Code does not require the records to be in a specific form. However, under Sec. 274(d), specific proof is necessary to substantiate deductions for away - from - home travel and business gift expenses, and deductions related to listed property. A taxpayer must substantiate these expenses by adequate records or by sufficient evidence corroborating the taxpayer's own statement showing:

(A) the amount of such expense or other item, (B) the time and place of the travel or the date and description of the gift, (C) the business purpose of the expense or other item, and (D) the business relationship to the taxpayer of the person receiving the benefit.

Temp. Regs. Sec. 1. 274 - 5T (c)(2) in general defines "adequate records" as an account book, diary, log, statement of expense, trip sheets, or similar record, and documentary evidence that, in combination, are sufficient to establish each of the required elements of an expense.

Temp. Regs. Sec. 1. 274 - 5T (c)(3) defines "sufficient evidence corroborating the taxpayer's own statement" as the taxpayer's own statement, whether written or oral, containing specific information in detail about the required element of an expense and other corroborative evidence sufficient to establish that element. However, the Tax Court has routinely held that it is not required to accept a taxpayer's self - serving testimony without objective, corroborating evidence.

The taxpayer must substantiate the required elements for every Sec. 274(d) expense. Because Sec. 274(d) overrides the Cohan rule ( Cohan , 39 F.2d 540 (1930)), courts cannot estimate the amount of the taxpayer's expenses.

Temp. Regs. Sec. 1. 274 - 5T (c)(5) offers an exception to the adequate - records rule if the loss of records is due to circumstances beyond the taxpayer's control (e.g., a natural disaster). In this circumstance, the taxpayer has the right to substantiate his or her deductions through reasonable reconstruction of expenses.

If, as scheduled, unreimbursed employee business expenses again become deductible, employees should understand their employer's policy about business expense reimbursements to avoid denial for business expense deductions. If the employer's policy is unclear, the taxpayer should attempt to receive a reimbursement and document the results as evidence. It is important for taxpayers to keep a good record of the business expenses and make sure it is detailed enough to show that the expenses were incurred or paid during the tax year. For deductions for travel expenses, gifts, and deductions related to listed properties, taxpayers must ensure that they can substantiate the deductions under the strict standards in Sec. 274(d).

Editor Notes

Mark G. Cook , CPA, CGMA, MBA, is the lead tax partner with SingerLewak LLP in Irvine, Calif.

For additional information about these items, contact Mr. Cook at 949-623-0478 or [email protected] .

Contributors are members of SingerLewak LLP.

Recent developments in Sec. 355 spinoffs

The research credit: documenting qualified services, income tax treatment of loyalty point programs, tax court rules cancellation of debt is part of gain realization, listing of reportable transactions under the apa.

This article discusses the history of the deduction of business meal expenses and the new rules under the TCJA and the regulations and provides a framework for documenting and substantiating the deduction.

PRACTICE MANAGEMENT

CPAs assess how their return preparation products performed.

High Contrast

- Asia Pacific

- Latin America

- North America

- Afghanistan

- Bosnia and Herzegovina

- Cayman Islands

- Channel Islands

- Czech Republic

- Dominican Republic

- El Salvador

- Equatorial Guinea

- Hong Kong SAR, China

- Ireland (Republic of)

- Ivory Coast

- Macedonia (Republic of North)

- Netherlands

- New Zealand

- Philippines

- Puerto Rico

- Sao Tome & Principe

- Saudi Arabia

- South Africa

- Switzerland

- United Kingdom

- News releases

- RSM in the news

- AI, analytics and cloud services

- Audit and assurance

- Business operations and strategy

- Business tax

- Consulting services

- Family office services

- Financial management

- Global business services

- Managed services

- Mergers and acquisitions

- Private client

- Risk, fraud and cybersecurity

- See all services and capabilities

Strategic technology alliances

- Sage Intacct

- CorporateSight

- FamilySight

- PartnerSight

Featured topics

- 2024 economy and business opportunity

- Generative AI

- Middle market economics

- Environmental, social and governance

- Supply chain

Real Economy publications

- The Real Economy

- The Real Economy Industry Outlooks

- RSM US Middle Market Business Index

- The Real Economy Blog

- Construction

- Consumer goods

- Financial services

- Food and beverage

- Health care

- Life sciences

- Manufacturing

- Nonprofit and education

- Private equity

- Professional services

- Real estate

- Technology companies

- See all industry insights

- Business strategy and operations

- Family office

- Private client services

- Financial reporting resources

- Tax regulatory resources

Platform user insights and resources

- RSM Technology Blog

- Diversity and inclusion

- Middle market focus

- Our global approach

- Our strategy

- RSM alumni connection

- RSM Impact report

- RSM Classic experience

- RSM US Alliance

Experience RSM

- Your career at RSM

- Student opportunities

- Experienced professionals

- Executive careers

- Life at RSM

- Rewards and benefits

Spotlight on culture

Work with us.

- Careers in assurance

- Careers in consulting

- Careers in operations

- Careers in tax

- Our team in India

- Our team in El Salvador

- Apply for open roles

Popular Searches

Asset Management

Health Care

Partnersite

Your Recently Viewed Pages

Lorem ipsum

Dolor sit amet

Consectetur adipising

Tax issues arise when employers pay employee business travel expenses

Employers must determine proper tax treatment for employees.

Most employers pay or reimburse their employees’ expenses when traveling for business. Generally, expenses for transportation, meals, lodging and incidental expenses can be paid or reimbursed by the employer tax-free if the employee is on a short-term trip. However, the tax rules become more complex when the travel is of a longer duration. Sometimes the travel expenses paid or reimbursed by the employer must be treated as taxable compensation to the employee subject to Form W-2 reporting and payroll taxes.

The purpose of this article is to address some of the more common travel arrangements which can result in taxable income to employees for federal tax purposes. Although business travel can also raise state tax issues, those issues are beyond the scope of this article. This article is intended to be only a general overview as the tax consequences to an employee for a given travel arrangement depend on the facts and circumstances of that arrangement.

In the discussion below, it is assumed that all travel expenses are ordinary and necessary and incurred by an employee (or a partner in a partnership) while traveling away from home overnight for the employer’s business. In addition, it is assumed that the expenses are properly substantiated so that the employer knows (1) who incurred the expense; (2) where, when, why and for whom the expense was incurred, and (3) the dollar amount. Employers need to collect this information within a reasonable period of time after an expense is incurred, typically within 60 days.

Certain meal and lodging expenses can fall within a simplified substantiation process called the “per diem” rules (although even these expenses must still meet some of the substantiation requirements). The per diem rules are outside the scope of this article.

One of the key building blocks for the treatment of employee travel expenses is the location of the employee’s “tax home.” Under IRS and court holdings, an employee’s tax home is the employee’s regular place of work, not the employee’s personal residence or family home. Usually the tax home includes the entire city or area in which the regular workplace is located. Generally, only expenses paid or reimbursed by an employer for an employee’s travel away from an employee’s tax home are eligible for favorable tax treatment as business travel expenses.

Travel to a regular workplace

Usually expenses incurred for travel between the employee’s residence and the employee’s regular workplace (tax home) are personal commuting expenses, not business travel. If these expenses are paid or reimbursed by the employer, they are taxable compensation to the employee. This is the case even when an employee is traveling a long distance between the employee’s residence and workplace, such as when an employee takes a new job in a different city. According to the IRS, if it is the employee’s choice to live away from his or her regular workplace (tax home), then the travel expenses between the two locations which are paid or reimbursed by the employer are taxable income to the employee.

Example: Bob’s personal residence is in Chicago, but his regular workplace is in Atlanta. Bob’s employer reimburses him for an apartment in Atlanta plus his transportation expenses between the two cities. Since Atlanta is Bob’s tax home, these travel expenses are personal commuting expenses and the employer’s reimbursement of the expenses is taxable compensation to Bob.

Travel to two regular workplaces

Sometimes an employer requires an employee to consistently work in two business locations because of the needs of the employer’s business. Factors such as where the employee spends the most time, has the most business activity, and earns the highest income determine which is the primary location with the other being the secondary location. The employee’s residence may be in either the primary or the secondary location. In general, the IRS holds that transportation costs between the two locations can be paid or reimbursed by the employer tax-free. In addition, lodging and meals at the location which is away from the employee’s residence can generally be paid or reimbursed tax-free.

Example: Caroline lives in Location A and works at her company headquarters there. Her employer opens a new store in Location B and asks her to handle the day-to-day operations for two years while the store is getting up to speed. But Caroline is also needed at the headquarters so her employer asks her to spend two days a week at the headquarters in Location A and three days a week at the store in Location B. Because the work at each location is driven by a business need of Caroline’s employer, she is treated as having primary and secondary work locations and is not treated as commuting between the two locations. Caroline’s travel between the two locations and her meals and lodging at Location B can be reimbursed tax-free by her employer.

As a practical matter, the employer must carefully consider and be able to support the business need for the employee to routinely go back and forth between two business locations. In cases involving two business locations, the courts have looked at time spent, business conducted and income generated in each location. Merely having an employee “sign in” or “touch down” at a business location near his or her residence is unlikely to satisfy the requirements for having two regular workplaces. Instead, the IRS would likely consider the employee as having only one regular workplace with employer-paid travel between the employee’s residence and the regular workplace being taxable commuting expenses.

Travel when a residence is a regular workplace

In some cases an employer hires an employee to work generally, or only, from the employee’s home, as he or she is not physically needed at an employer location. If the employer requires the employee to work just from his or her residence on a regular basis, does not require or expect the employee to travel to another office on a regular basis, and does not provide office space for the employee elsewhere, then the residence can be the tax home since it is the regular workplace for the employee. When the employee does need to travel away from his or her residence (tax home), the temporary travel expenses can be paid or reimbursed by the employer on a tax-free basis.

Example: Jason is a computer programmer and works out of his home in Indianapolis for an employer in Seattle. He periodically travels to Seattle for meetings with his team. Since Jason has no assigned office space in Seattle and is expected by his employer to work from his home, Jason’s travel expenses to Seattle can be reimbursed by his employer on a tax-free basis.

Travel to a temporary workplace

Sometimes an employer temporarily assigns an employee to work in a location that is far from the employee’s regular workplace, with the expectation that the employee will return to his or her regular workplace at the end of the assignment. In this event, the key question is whether the employee’s tax home moves to the temporary workplace. If the tax home moves to the temporary workplace, the travel expenses between the employee’s residence and the temporary workplace that are paid or reimbursed by the employer are taxable compensation to the employee because they are personal commuting expenses rather than business travel expenses. Whether or not the employee’s tax home moves to the temporary workplace depends on the duration of the assignment and the expecations of the parties.

- One year or less . If the assignment is expected to last (and actually does last) one year or less, the employee’s tax home generally does not move to the temporary workplace. Therefore, travel expenses between the employee’s residence and temporary workplace that are paid or reimbursed by the employer are typically tax-free to the employee as business travel.

Example: Janet lives and works in Denver but is assigned by her employer to work in San Francisco for 10 months. She returns to Denver after the 10-month assignment. Janet’s travel expenses associated with her assignment in San Francisco that are reimbursed by her employer are not taxable income to her as they are considered temporary business travel and not personal commuting expenses.

- More than one year or indefinite . If the assignment is expected to last more than one year or is for an indefinite period of time, the employee’s tax home generally moves to the temporary workplace. This is the case even if the assignment ends early and actually lasts one year or less. Consequently, travel expenses between the employee’s residence and the temporary workplace that are paid or reimbursed by the employer are taxable compensation to the employee as personal commuting expenses.

Example: Chris lives and works in Dallas but is assigned by his employer to work in Oklahoma City for 15 months before returning to Dallas. Chris’s travel expenses associated with his assignment to Oklahoma City that are reimbursed by his employer are taxable income to him as personal commuting expenses.

- One year or less then extended to more than one year . Sometimes an assignment is intended to be for one year or less, but then is extended to more than one year. According to the IRS, the tax home moves from the regular workplace to the temporary workplace at the time of the extension. Therefore, travel expenses incurred between the employee’s residence and the temporary workplace that are paid or reimbursed by the employer are non-taxable business travel expenses until the time of the extension, but are taxable compensation as personal commuting expenses after the extension.

Example: Beth’s employer assigns her to a temporary workplace in January with a realistic expectation that she will return to her regular workplace in September. However, in August, it is clear that the project will take more time so Beth’s assignment is extended to the following March. Once Beth’s employer knows, or has a realistic expectation, that Beth’s work at the temporary location will be for more than one year, changes are needed to the tax treatment of Beth’s travel expenses. Only the travel expenses incurred prior to the extension in August can be reimbursed tax-free; travel expenses incurred and reimbursed after the extension are taxable compensation.

When an employee’s residence and regular workplace are in the same geographic location and the employee is away on a temporary assignment, the employee will often return to the residence for weekends, holidays, etc. Expenses associated with travel while enroute to and from the residence can be paid or reimbursed by an employer tax-free, but only up to the amount that the employee would have incurred if the employee had remained at the temporary workplace instead of traveling home.

Travel to a temporary workplace – Special situations

In order for an employer to treat its payment or reimbursement of travel expenses as tax-free rather than as taxable compensation, the employee’s ties to the regular workplace must be maintained. The employee must expect to return to the regular workplace after the assignment, and actually work in the regular workplace long enough or regularly enough that it remains the employee’s tax home. Special situations arise when an employee’s assignment includes recurring travel to a temporary workplace, continuous temporary workplaces, and breaks in assignments to temporary workplaces.

- Recurring travel to a temporary workplace . Although the IRS has not published formal guidance which can be relied on, it has addressed situations where an employee has a regular workplace and a temporary workplace to which the employee expects to travel over more than one year, but only on a sporadic and infrequent basis. Under the IRS guidance, if an employee’s travel to a temporary workplace is (1) sporadic and infrequent, and (2) does not exceed 35 business days for the year, the travel is temporary even though it occurs in more than one year. Consequently, the expenses can be paid or reimbursed by an employer on a tax-free basis as temporary business travel.

Example: Stephanie works in Location A but will travel on an as-needed basis to Location B over the next three years. If Stephanie’s travel to Location B is infrequent and sporadic and does not exceed 35 business days a year, her travel to Location B each year can be reimbursed by her employer on a tax-free basis as temporary business travel.

- Continuous temporary workplaces . Sometimes an employee does not have a regular workplace but instead has a series of temporary workplaces. If the employee’s residence cannot qualify as his or her tax home under a three-factor test developed by the IRS, the employee is considered to have no tax home and is “itinerant” for travel reimbursement purposes. In this case, travel expenses paid by the employer generally would be taxable income to the employee.

Example: Patrick originally worked in Location A, but his employer sends him to Location B for eleven months, then assigns Patrick to Location C for another eight months. Patrick will be sent to Location D after Location C with no expectation of returning to Location A. Patrick does not maintain a residence in Location A. Travel expenses paid to Patrick by his employer will likely be taxable income to him.

- Breaks between temporary workplaces . In an internal memorandum, the IRS addresses the outcome when an employee has a break in assignments to temporary workplaces. When applying the one-year rule, the IRS notes that a break of three weeks or less is not enough to prevent aggregation of the assignments, but a break of at least seven months would be. Some companies choose to not aggregate assignments when the breaks are shorter than seven months but are considerably longer than three weeks, given the lack of substantive guidance from the IRS on this issue.

Example: Don’s regular workplace is in Location A. Don’s employer sends him to Location B for ten months, back to Location A for eight months, and then to Location B again for four months. Although Don’s time in Location B totals 14 months, since the assignments there are separated by a break of at least seven months, they are not aggregated for purposes of applying the one-year rule. Consequently, the travel expenses associated with each separate assignment to Location B can be reimbursed by the employer on a tax-free basis as temporary business travel since each assignment lasted less than a year.

Conclusion

The tax rules regarding business travel are complex and the tax treatment can vary based on the facts of a situation. Employers must carefully analyze business travel arrangements to determine whether travel expenses that they pay or reimburse are taxable or nontaxable to employees.

RSM contributors

Subscribe to RSM tax newsletters

Tax news and insights that are important to you—delivered weekly to your inbox

THE POWER OF BEING UNDERSTOOD

ASSURANCE | TAX | CONSULTING

- Technologies

- RSM US client portals

- Cybersecurity

RSM US LLP is a limited liability partnership and the U.S. member firm of RSM International, a global network of independent assurance, tax and consulting firms. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other. Each member firm is responsible only for its own acts and omissions, and not those of any other party. Visit rsmus.com/about for more information regarding RSM US LLP and RSM International.

© 2024 RSM US LLP. All rights reserved.

- Terms of Use

- Do Not Sell or Share My Personal Information (California)

KPMG Personalization

- KPMG report: Taxation of paid or reimbursed travel expenses and determination of employee’s tax home

Issues relating to whether paid or reimbursed travel expenses may be taxable or nontaxable to employees

Issues relating to whether paid or reimbursed travel expenses may be taxable or nontaxable

- Home ›

- Insights ›

In response to the coronavirus (COVID-19) pandemic, organizations across the globe experienced a workplace transformation by expanding and enabling remote work practically overnight. The rise in flexible worksite arrangements presents a challenge to employers that provide them and pay or reimburse employees for business travel because the rules for when reimbursed expenses related to business travel can be excluded from an employee’s compensation are complex, often outdated, and derived from court decisions with very specific facts and circumstances.

Read a May 2023 report * [PDF 431 KB] prepared KPMG LLP tax professionals that discusses the issues relating to whether paid or reimbursed travel expenses may be taxable or nontaxable to employees, focusing in particular on the analysis of the location of an employee’s tax home, including whether a personal residence may be considered a tax home.

*This article originally appeared in Tax Notes Federal (May 1, 2023) and is provided with permission.

The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation. For more information, contact KPMG's Federal Tax Legislative and Regulatory Services Group at: + 1 202 533 3712, 1801 K Street NW, Washington, DC 20006.

Grow Your Skills

- Construction & Housing

- Human Resource

- Microsoft Office

- Payroll & Accounting

- Employee Retention

- Exempt vs Non-Exempt Employees

- Internal Investigation

- Social Media At Workplace

- Succession Planning

- April 14, 2024

- Compliance Prime Team

Do employers have to reimburse travel expenses?

Travel for business purposes is a common aspect of many jobs in the United States, whether it involves attending conferences, meeting clients, or collaborating with team members across different locations. However, the question of whether employers are required to give travel expense reimbursement to employees.

In this blog, we will explore the legal framework, employer policies, and best practices for travel expense reimbursement in the United States.

Legal Obligations For Travel Expense Reimbursement:

In the United States, there is no federal law that explicitly requires employers to reimburse employees for business-related travel expenses. The Fair Labor Standards Act (FLSA), which governs minimum wage, overtime pay, and other labor standards, does not specifically address travel expense reimbursement. However, some states may have specific regulations mandating reimbursement for certain expenses. For example, California requires employers to reimburse employees for all necessary expenses incurred in the course of their employment.

Employer Policies For Travel Expense Reimbursement:

While there may not be a legal requirement for travel pay or reimburse travel expenses, many employers choose to do so as part of their employee benefits package or as a matter of company policy. These policies typically outline what expenses are eligible for reimbursement, the documentation required, and the process for submitting expense reports. Employers should communicate these policies clearly to employees to avoid misunderstandings and ensure compliance.

Types of Travel Expenses:

There can be different types of travel pay for different travel expenses can include a variety of costs, such as transportation, lodging, meals, per diem , and incidentals. Employers may choose to reimburse these expenses in different ways, such as providing a per diem allowance based on the location and duration of the trip or reimbursing actual expenses incurred by the employee. It’s important for employers to establish consistent guidelines for reimbursement to ensure fairness and transparency.

Documentation and Reporting Of Travel Expense Reimbursement:

Proper documentation is essential when seeking reimbursement for travel expenses. Employees should keep detailed records of their expenditures, including receipts, invoices, and mileage logs. Employers may require employees to submit expense reports within a specified timeframe, along with supporting documentation. Failure to provide adequate documentation could result in delays or denial of reimbursement.

Negotiation and Agreements For Travel Expense Reimbursement:

Employers and employees may negotiate reimbursement arrangements as part of the employment contract or during salary negotiations. It’s crucial for both parties to clearly define expectations regarding travel pay upfront to avoid disputes later on. Employers should be transparent about their reimbursement policies, while employees should advocate for fair compensation for their business-related travel.

Tax Implications For Travel Expense Reimbursement:

Both employers and employees should consider the tax implications of travel expense reimbursement. In general, reimbursed expenses that are incurred for business purposes and properly documented are not considered taxable income for employees. However, employers should consult with tax professionals to ensure compliance with relevant tax laws and regulations.

Bottom Line:

While there may not be a federal legal requirement for employers to reimburse travel expenses in the United States, many choose to do so as a matter of policy or to attract and retain talent. Clear communication, consistent policies, and proper documentation are essential for ensuring fair and transparent reimbursement processes for both employers and employees. By understanding the legal framework, negotiating reimbursement arrangements, and adhering to best practices, employers and employees can navigate travel expenses with confidence and clarity.

Be the first one to get latest industry news

Disclaimer: We do not make any warranties about the completeness, reliability and accuracy of the information provided on this website. Any action you take upon the information on this website is strictly at your own risk, and Compliance Prime will not be liable for any losses and damages in connection with the use of our website.

- 304 S. Jones Blvd #1666, Las Vegas NV 89107 United States

- (888) 527-3477

- [email protected]

- Privacy Policy

- Terms & Conditions

- Refund Policy

NEWSLETTER SUBSCRIPTION

10 productivity hacks, get free e-book.

Thanks, your free e-Books is on its way

Check your email to download the ebook. if you don't see the email, check in your spam folder as well..

- Tax Pro Center | Intuit

- Blog Post Archive

- Tax Law and News

What is a Tax Home, and How Does it Impact Travel Expenses?

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

Written by Liz Farr, CPA

- Modified Aug 8, 2019

Today’s super-mobile workforce means that you may have clients who are splitting their time between multiple work locations. In these situations, understanding the concept of a tax home will help clarify the treatment of travel expenses.

What is a Tax Home?

The IRS defines a tax home as the city or general area where someone’s main place of business or work is located. If your client travels away from their tax home for work purposes, their travel expenses may be deductible.

“May be deductible” has taken on new meaning since the Tax Cuts and Jobs Act was passed in late 2017. Under prior law, employees could deduct unreimbursed work expenses, including travel expenses, as a miscellaneous itemized deduction. However, from 2018 though 2025, that deduction has been suspended, except for Armed Forces reservists, qualified performing artists, and fee-basis state or local government officials.

The best bet for employees who no longer qualify to deduct their travel expenses is to set up an accountable plan with their employer. Reimbursed travel expenses under an accountable plan are not taxable to the employee, while reimbursements under a non-accountable plan are included in the employee’s wages.

However, self-employed individuals can still deduct expenses for travel away from their tax home as business expenses.

A tax home may or may not be the same place as the family home, or a place that your client returns to regularly. For clients who work in more than one place, their tax home is their main place of business or work. This is determined by considering the following factors:

- The total time spent in each place.

- The level of business or work activity in each place.

- The relative amount of income earned in each place.

Expenses for work-related travel away from someone’s tax home are deductible or can be reimbursed tax-free under an accountable plan. Travel expenses include transportation, meals, lodging, laundry and dry cleaning, and incidentals.

For example, Ryan is a self-employed consultant living in Denver. He spends one week of every month working onsite for a client in Salt Lake City. Ryan spends the remaining three weeks of the month working with clients in the Denver area. Ryan’s tax home is Denver, so his travel, lodging and meal expenses for his monthly trips to Salt Lake City are deductible.

Over time, Ryan’s client in Salt Lake City becomes a bigger part of his work. Eventually, Ryan is spending all of his working time in Salt Lake City and flying home to Denver on the weekends. Now, his tax home is Salt Lake City, and neither his living expenses in Salt Lake City nor his plane fare between Denver and Salt Lake City are deductible.

What About Temporary Work Assignments?

It’s not unusual for an employee to be sent to work in a different location. If that assignment is temporary and the employee maintains a home in the original location, the tax home is still the original location. Travel expenses will be deductible for a contractor. Employee reimbursements under an accountable plan will be tax-free.

But, if the assignment is permanent or indefinite, then the person’s tax home is the new location, so travel expenses are not deductible. Accountable plan reimbursements are now taxable to the employee.

The IRS defines “temporary” as a work assignment that’s expected to last a year or less. If a work assignment that started out as a temporary posting is extended to more than a year, then it becomes an indefinite assignment when the anticipated duration changes.

For example, Kimberly has been working for a company in Boston and is sent to Los Angeles for an eight-month project. Kimberly’s tax home is still Boston. Her employer reimburses her for her travel, lodging and meals under an accountable plan, and those reimbursements are tax-free.

However, seven months into the project, Kimberly’s employer decides to extend her posting in Los Angeles for another eight months, to a total of 15 months. At that point, Kimberly’s assignment becomes indefinite, so her tax home changes to Los Angeles. If her employer continues to reimburse her for living expenses, even if it’s done under an accountable plan, those reimbursements are now taxable.

This only scratches the surface of the tangled web that results when people live and work in multiple locations. Depending on the states involved, your clients may also have state tax issues. IRS Publication 463 , Travel, Gift, and Car Expenses , is a good resource, so be sure to check it out if you have clients in this situation.

Editor’s note: This article was published on the Firm of the Future blog .

Previous Post

What to Tell Your Clients About Tax Return Privacy

Key Tax Developments for 2019

Liz spent 15 years working as an accountant with a focus on tax work as well as working on audits, business valuation, and litigation support. Since 2018, she’s been a full-time freelance writer, and has written blog posts, case studies, white papers, web content, and books for accountants and bookkeepers around the world. Her current specialty is ghostwriting for thought leaders in accounting. More from Liz Farr, CPA

Comments are closed.

Browse Related Articles

Last Crack at Lower Medical Expense Deduction Floor

What your clients need to know about business-related t…

Travel-Related Tax Tips for Your Self-Employed Clients

Tax Tips for Real Estate Professionals Who Are Self-Emp…

Tax Reform Makes Changes to the Meals and Entertainment…

Share These 11 Lesser-Known Tax Deductions With Your Cl…

Top 10 Surprising Tax Deductions

IRS Updates Per-Diem Guidance for Business Travelers an…

15 must-see tax breaks for small business owners in 202…

How to deduct business expenses while on vacation

Tax Resources for Accountants and Small Businesses (U.S.)

- Expense Reimbursements / IRS / Meals and Incidental Expenses / Mileage / Payroll / Per Diem Rates / Small business

- Complete Guide to Reimbursing Employees for Travel Expenses

Published September 2, 2020 · Updated April 21, 2021

When an employee travels away from the office and incurs expenses, the company should reimburse them. Whether travelling across the world or just driving their car to a client’s location, getting the reimbursement right isn’t hard.

Keep reading to learn how to make proper employee reimbursements.

Accountable Plans

You’ll first need to decide if you will implement an accountable or nonaccountable plan. This is just as it sounds; either you’ll have employees be accountable for business expense reimbursements or not.

All businesses should have an expense reimbursement plan in writing. This includes corporations, sole proprietors, the self-employed, and non-profits. Non-profits should be extremely careful when reimbursing disqualified persons because nonaccountable plan reimbursements not properly approved or recorded can cause significant tax exposure to the charitable organization.

An accountable plan must follow the IRS guidelines for expense reimbursement. To qualify, the following rules must be met:

- Expenses must be for business purposes.

- Expenses must be adequately reported to the company in reasonable time.

- Any excess reimbursement or allowance must be returned in a reasonable amount of time.

Any expense that doesn’t meet these three criteria is considered a reimbursement under a nonaccountable plan.

This distinction between these two types of plans is important because accountable plan reimbursements are not taxable to the employee, whereas nonaccountable plans are taxable.

Business Purpose

Expenses incurred as an employee while completing work for an employer have a business purpose. Examples include things like registration fees for a conference, taxi rides to the airport for a business trip, or meals while away on a business trip.

If however, an employer reimburses an employee for dinner when the employee works late, this does not qualify as a business purpose. This reimbursement would be taxable to the employee because it was made under a nonaccountable plan.

Reporting in a Reasonable Time

While what is considered a reasonable amount of time is subjective, the general rule is that all reimbursable expenses must be submitted within 60 days of when they were incurred.

Adequate reporting involves providing a record, like an expense report, of all expenses incurred and providing evidence, like receipts, to support the expenses.

Excess Reimbursement