MEDOC Travel Insurance through Johnson Inc.

Federal Retirees have the option to enhance their coverage with MEDOC ® , which picks up where PSHCP and PDSP leave off. Basic MEDOC ® coverage can be purchased by all members, regardless of their age or health status. The MEDOC ® base plan insures many expenses not covered by PSHCP and extends other coverages.

I have 40 days coverage with PSHCP, why should I buy MEDOC?

Here is why over 85,000 Federal Retirees' members know that MEDOC® Travel Insurance is the right plan for them.

- New: Members are now covered for an unlimited number of trips within Canada of any duration

- New: Up to $12,000 per insured in-province Trip Cancellation, Interruption & Delay Insurance benefit

- New: Up to $5,000 non-medical emergency evacuation coverage

- New: Up to $500 document replacement coverage for lost or stolen documents

- New: Involuntary Schedule Change expense for the lesser of the change fee charged by the airline or up to $1,000 for the extra cost of one-way economy air fare to your next destination (inbound and outbound).

- MEDOC offers up to $5,000,000 as its policy limit.

- Up to $12,000 per insured, per trip for Trip Cancellation, Interruption and Delay insurance; PSHCP does not offer this coverage.

- Up to $3,000 for Vehicle Return; PSHCP; does not offer this coverage.

- Up to $500 for Pet Return; PSHCP does not offer this coverage.

- Up to $1,500 per insured for Baggage and Personal Effects insurance (up to $3,000 per family); PSHCP does not cover this.

- Because PSHCP only provides coverage for trips of up to 40 days in duration, MEDOC offers a Supplemental Plan to provide coverage beyond the 40th day of your trip. Any claim incurred after the 40th day of your trip will be eligible for coverage from first dollar ($1) with no deductible.

- In Hospital Private Duty Nursing

- Up to $5,000 for Emergency Dental Expenses; PSHCP covers this benefit up to a maximum of $2,000 per emergency, so you can claim up to an additional $5,000 if you have MEDOC, and your emergency dental expenses are in excess of $2,000.

- Up to $600 for Emergency Relief of Dental Pain.

- Incidental hospital expenses (TV, telephone, etc.) MEDOC covers up to $50 per day, or up to a maximum of $2,000 per insured.

- PSHCP insures up to $3,000 for repatriation or burial. MEDOC covers any amount you incur in excess of this amount up to a maximum of $5,000.

- PSHCP insures up to $2,500 in total for all additional hotel and meals expenses. MEDOC covers up to $350 per day, or up to a maximum of $3,500 per insured. So if your emergency is within the first 40 days of your trip, and you incur this expense, you can claim $2,500 from the PSHCP plan and then a further $3,500 from MEDOC if you incur in excess of $2,500 for additional hotel and meal expenses.

- PSHCP covers 80% of emergency related medications prescribed while out of Canada and MEDOC will reimburse the other 20% of emergency related medications prescribed while out of Canada.

For more information on MEDOC® travel insurance, call toll-free at 1-855-772-6675 or visit www.johnson.ca/federalretirees .

MEDOC TRAVEL INSURANCE POLICY - EFFECTIVE - JANUARY 1, 2021 - Johnson Insurance

- Download HTML

- Download PDF

- Style & Fashion

- IT & Technique

- Cars & Machinery

- Government & Politics

- Uncategorized

- Home & Garden

- Hobbies & Interests

- Current Events

- Health & Fitness

Group Insurance

MEDOC Plan Design

Current underwriter (2019) – royal & sun alliance insurance company of canada.

The MEDOC Plan provides Emergency Medical and Non-Medical Insurance benefits as indicated below. Emergency Medical Insurance benefits are available for trips taken outside your province or territory of residence. Unless otherwise stated, all dollar amounts shown under this insurance are in Canadian currency. All benefits are subject to Exclusions & Limitations as outlined in Section IV.

A 17-DAY PLAN

If you purchased the 17-day Plan, your coverage includes:

Up to a maximum aggregate of $5,000,000 Emergency Medical Insurance benefits per insured person, per policy year for an unlimited number of trips, outside of Canada, not exceeding 17 consecutive days. Trips taken outside of your province or territory of residence, but within Canada, can be of any duration within the policy year. Proof of departure from your province or territory of residence is required if a claim occurs.

Non-Medical Insurance benefits includes up to a maximum of $8,000 Trip Cancellation, Interruption & Delay Insurance benefits per insured person, per trip. This applies only to trips booked prior to your day of departure.

B 35-DAY BASE PLAN

If you purchased the 35-day Base Plan, your coverage includes:

Up to a maximum aggregate of $5,000,000 Emergency Medical Insurance benefits per insured person, per policy year for an unlimited number of trips, outside of Canada, not exceeding 35 consecutive days. Trips taken outside of your province or territory of residence, but within Canada, can be of any duration within the policy year. Proof of departure from your province or territory of residence is required if a claim occurs.

C SUPPLEMENTAL PLAN

If you purchased the Supplemental Plan, your coverage includes:

The 35-day Base Plan and the additional coverage for a single trip in excess of 35 consecutive days outside Canada, as shown on your confirmation of coverage. The additional number of days must be purchased to cover the entire duration of your travel, starting from the time you leave Canada for a period of more than 35 consecutive days until you return to your province or territory of residence. Coverage is available up to the maximum number of days allowed under your Provincial or Territorial Health Insurance Plan in your province or territory of residence.

The entire duration of your Supplemental Plan single trip, as shown on your confirmation of coverage must occur between the day you leave Canada and the day you return to your province or territory of residence. Should your travel dates change prior to leaving Canada, you must contact the Administrator to ensure your coverage is valid for your trip.

The Supplemental Plan automatically includes the 35-day Base Plan coverage. The Supplemental Plan is not an add-on to the 35-day Base Plan and must be purchased separately.

When purchasing two or more Supplemental Plans, the full premium for all trips must be paid.

Up to a maximum of $8,000 Trip Cancellation, Interruption & Delay Insurance benefits per insured person, per trip. This applies only to trips booked prior to your day of departure.

Changing your Day of Departure or Day of Return

If there is a change in your day of departure or your day of return as indicated on your confirmation of coverage, you must contact the Administrator before your day of departure or if you have already left on a trip, before your current coverage expires. Evidence of your day of departure will be required at the time of claim. Unless specified otherwise, your coverage will begin and end as described in Section I. General Information, E. When does your coverage begin and end?

D DEDUCTIBLE OPTION

The deductible amount (if applicable) is based on the amount indicated in your confirmation of coverage. The deductible amount applies to each unrelated claim for any benefit paid under the Emergency Medical Insurance benefits only and not to Trip Cancellation, Interruption & Delay Insurance benefits.

If a deductible amount applies (as indicated on your confirmation of coverage), the expenses covered will be limited to the eligible expenses described in your policy, after the application of the deductible.

An optional deductible amount (if applicable) must be selected at the time of yourapplication for insurance or effective date. At the effective date of a new policy,the optional deductible amount may only be selected or changed within 60 daysfrom the first premium deduction for that policy year, provided no claim has beensubmitted or is pending.

E MEDOC Plan Health Options

The MEDOC Plan provides three Health Options: Optimum Health Option, Preferred Health Option and Standard Health Option.

The Health Option you qualify for is based on your answers to the Health Option Questionnaire and determines the Rate Schedule that applies to you at the time of your application for insurance or effective date. If your answers to the medical questions on the Health Option Questionnaire are not complete and accurate, the Insurer may void this insurance at its sole discretion.

Please note: at each effective date, coverage shall be issued at the Standard Health Option. If you wish to apply for the Optimum Health Option or the Preferred Health Option you must do so within 60 days of the first premium deduction date for that policy year.

All members automatically qualify for the Standard Health Option if they meet the eligibility requirements of this policy. To qualify for the Optimum Health Option or Preferred Health Option, the Health Option Questionnaire must be completed at each effective date. At each new effective date, coverage will be issued at the Standard Health Option rates applicable for the new policy year. An insured person has 60 days from the first premium deduction for that policy year to submit their completed Health Option Questionnaire and have their Health Option adjusted if they qualify for the Optimum Health Option or the Preferred Health Option. Confirmation of a change of Health Option shall be provided in writing by the Administrator and your premium rates shall be adjusted. Any insured person who had the option of submitting the Health Option Questionnaire and did not, automatically qualifies for the Standard Health Option.

Once you have accurately completed the Health Option Questionnaire and have qualified for either the Optimum or Preferred Health Option, you will continue to qualify for that option until the end of the policy year (August 31st), regardless of changes to your health during the current policy year.

NOTE: The Pre-existing Medical Condition Limitation applies to all insured’s under all Health Options. For Trip Cancellation, Interruption & Delay Insurance benefits, the Pre-Existing Medical Condition Limitation also applies to a family member, close business associate, caregiver, travelling companion or your travelling companion’s family member. Please refer to Exclusions & Limitations in Section IV.

The Supplemental Plan includes Base Plan coverage.

Trip Cancellation, Interruption, & Delay

Up to maximum $8,000 per Insured Person, per trip available if the insured, the insured’s immediate or extended family member, close business associate or travelling companion suffers a medical emergency before or during the scheduled trip. This only applies to trips booked prior to your day of departure from your province or territory of residence.

Emergency Medical Expenses

Eligible expenses are in Canadian currency and include but are not limited to the following:

- Emergency medical expenses for hospital, physician, surgical and medical treatment, drugs and medication, x-rays, and nursing services up to the amounts specified and a maximum aggregate of $5,000,000 per insured, per sickness or injury.

- Air emergency transportation or evacuation.

- Return of vehicle up to a maximum of $5,000.

- Additional expenses for meals and accommodation up to $350 per day, maximum $3,500, which includes return of dependent child with escort transportation of a family member to the bedside.

- Repatriation or Burial at place of death up to a maximum of $5,000.

- Pet return up to a maximum of $500.

- Emergency dental up to a maximum of $5,000.

- Emergency relief of dental pain up to a maximum of $600.

- Incidental hospital expenses up to a maximum of $250 provided hospitalized for 48 hours or more.

All expenses must be approved and arranged in advance by contacting Global Excel Management at the MEDOC Claims Assistance Centre.

- Our History

- Mission, Vision, and Values

- Achievements

- Strategic Objectives

- Board of Directors

- Representatives & PNA Staff

- Vancouver Island

- Southern Interior

- Saskatchewan

- Southwestern Ontario

- Golden Horseshoe

- North Central

- Durham-Trent

- National Capital & Nunavut

- Saguenay / Lac-Saint-Jean

- Fredericton-Saint John

- Prince Edward Island

- Cape Breton

- Western Newfoundland

- News Articles

- Newsletters

Medoc Insurance Travel Coverage

Dear medoc customer,.

Although the world continues to be challenged by the pandemic, we continue to see increasing signs of recovery, along with a renewed interest in people looking to travel beyond their own borders. With that in mind, we are pleased to share an update on MEDOC and your travel coverage.

Additional 4 months coverage

Given the exceptional travel circumstances, we’re extending the term of your MEDOC Base Plan for a total of 4 months at no additional charge. Your current MEDOC policy will now provide coverage until December 31, 2020. This extension is effective immediately. Should you be planning to travel this fall and require coverage for a trip that is longer than your base plan please call us to purchase the additional days needed.

Please carefully review the details of the modifications to your MEDOC Travel policy, which can be downloaded, printed, and saved by clicking here .

Medical Coverage for Travel NOW

We are also pleased to announce that although travel advisories may still be in place, your MEDOC policy will now provide coverage for travel outside Canada with the exception of claims directly or indirectly related to COVID-19 or any other specific local travel advisory that is issued by the Government of Canada and in effect at the time (for example, areas of conflict in the Philippines).Travel within Canada is also still covered as our provincial borders gradually begin to open for all Canadians.

Trip Cancellation and Interruption coverage remains in place, and is currently available for COVID-19 related cancellations if your trip was booked prior to the travel advisories being issued; however it is not likely to be available for existing or future travel bookings as of January 1, 2021.

MEDOC Reissue for 2021

Because of the coverage extension during 2020, your annual MEDOC reissue documentation will now be sent in November for a new policy term of January 1 to August 31, 2021. While we are finalizing our terms for the January 1, 2021 renewal, our plan remains to provide industry-leading coverage.

Our intention is to provide coverage for medical emergencies including COVID- 19 once travel advisories are lifted, as well as continue to provide non-COVID- 19 related coverage should advisories remain in place or be reinstated. At this point, Trip Cancellation and Trip Interruption coverage related to COVID-19 is not likely to be available for existing or future travel bookings as of January 1, 2021.

Our hope is that with more time we will have more certainty and stability within the Travel industry and we’ll all be able to benefit from our industry-leading MEDOC travel insurance in the future.

Johnson Insurance

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Faye Travel Insurance Review: Is It Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Travel insurance can be a worthwhile investment, especially if you’re worried about unexpected costs during your trip. There are a ton of different travel insurance companies out there, so finding one that suits your needs can be a struggle. That’s why we’ve done the work for you.

Let’s take a look at travel insurance provider Faye to see what type of plans the company offers, the coverage levels you can expect and whether Faye travel insurance is right for you.

About Faye travel insurance

Faye is the brand name for customizable travel protection plans offered by a company called Zenner Inc. Its website notes that it specializes in quick reimbursements, which can be a big draw for travelers. Policies issued by Faye are underwritten by the United States Fire Insurance Company.

» Learn more: How to pick between travel insurance providers

Faye insurance plans

Unlike many other travel insurance companies , Faye offers only one plan.

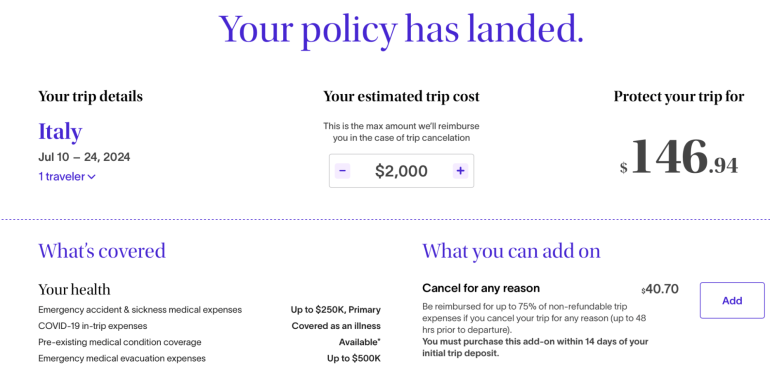

To find out what types of coverage Faye travel insurance plans include, we generated a quote for a 44-year-old woman from Arizona who was traveling to Italy for two weeks. Her total trip cost came in at $2,000.

Here’s what Faye provides:

This plan costs 7.03% of the overall trip cost, which is typical according to NerdWallet's analysis .

The plan is comprehensive and includes coverage you don’t typically see, such as reimbursement for lost credit cards and a payment for being inconvenienced.

Faye also offers a number of customizations; there are different add-ons from which to choose, all of which vary in price. More on your options in the next section.

» Learn more: How travel insurance for domestic vacations works

Plan add-ons

If you'd like to customize your Faye travel insurance plan to meet your needs more specifically, you can add on extra coverage for more money.

» Learn more: How does travel insurance work?

What isn’t covered by Faye

Even if you purchase a very comprehensive travel insurance policy, there are still situations where you’re not covered.

These include:

Bad weather, including hurricanes, if the policy was purchased after the storm was named.

Intentionally self-inflicted injuries or suicide.

Expenses incurred while under the influence of drugs or alcohol.

High-risk sports for which you are paid.

Psychological disorders, unless you’re hospitalized.

War and acts of war.

Illegal acts.

Piloting or learning to pilot or acting as crew of an aircraft.

To find the full list of exclusions for your specific policy, be sure to review your plan’s benefits schedule.

» Learn more: What to know before buying travel insurance

How to choose a Faye plan online

Purchasing a Faye travel insurance plan online is simple. You’ll first want to head to the company’s website to generate a quote.

You’ll need to input information like your age, where you live, where you’re going and how long you’re going to be away. Once you’ve got that all entered in, you’ll be taken to the results page.

Here, you’ll be able to see what plan options you have available, as well as what add-ons there are to pick.

After you’ve selected the coverage you’d like, you’ll need to go through the online checkout process.

» Learn more: Is travel insurance worth it?

Which Faye plan is best for me?

Although Faye has just one base plan available for purchase, it has plenty of different add-ons from which to choose. Faye sorts its bundles and add-ons according to the trip you’re taking, so you may see your bundled offer vary from time to time.

For tentative plans . Choosing to add on a Cancel For Any Reason (CFAR) policy can provide peace of mind if your travel plans aren’t solid. With the ability to get up to 75% of your money back, you’ll just want to make sure you’re canceling at least 48 hours in advance.

For pet owners . Not many travel insurance companies include coverage for your pets , especially not when it comes to vet bills. With a low overall cost, this add-on can make a huge difference if you end up delayed on your return.

For those wanting to customize everything . Faye’s base plan allows customers to create tons of different customizations according to their travel needs. Even though it’s costly, it makes up for it with wholly comprehensive coverage.

Faye’s travel insurance offerings may suit your needs, but before purchasing a plan, take a look in your wallet. Many different travel credit cards offer complimentary travel insurance , which can include benefits such as trip cancellation reimbursement, rental car insurance and more.

on Chase's website

on American Express' website

• Trip delay: Up to $500 per ticket for delays more than 12 hours.

• Trip cancellation: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Trip interruption: Up to $10,000 per person and $20,000 per trip. Maximum benefit of $40,000 per 12-month period.

• Baggage delay: Up to $100 per day for five days.

• Lost luggage: Up to $3,000 per passenger.

• Trip delay: Up to $500 per ticket for delays more than 6 hours.

• Trip delay: Up to $500 per trip for delays more than 6 hours.

• Trip cancellation: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

• Trip interruption: Up to $10,000 per trip. Maximum benefit of $20,000 per 12-month period.

Terms apply.

Insurance Benefit: Trip Delay Insurance

Up to $500 per Covered Trip that is delayed for more than 6 hours; and 2 claims per Eligible Card per 12 consecutive month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Insurance Benefit: Trip Cancellation and Interruption Insurance

The maximum benefit amount for Trip Cancellation and Interruption Insurance is $10,000 per Covered Trip and $20,000 per Eligible Card per 12 consecutive month period.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

1x-10x Earn 5x total points on flights and 10x total points on hotels and car rentals when you purchase travel through Chase Travel℠ immediately after the first $300 is spent on travel purchases annually. Earn 3x points on other travel and dining & 1 point per $1 spent on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $1,125 toward travel when you redeem through Chase Travel℠.

1x-5x 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases.

75,000 Earn 75,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's over $900 when you redeem through Chase Travel℠.

1x-2x Earn 2X points on Southwest® purchases. Earn 2X points on local transit and commuting, including rideshare. Earn 2X points on internet, cable, and phone services, and select streaming. Earn 1X points on all other purchases.

50,000 Earn 50,000 bonus points after spending $1,000 on purchases in the first 3 months from account opening.

For our latest information about the coronavirus disease (COVID-19) outbreak including news from Federal Retirees preferred partners, please visit our COVID-19 information hub .

MEDOC Travel Insurance through Johnson Inc. offers annual emergency medical travel insurance that coordinates with both the Public Service Health Care Plan (PSHCP) and your provincial government health insurance plan.

Federal Retirees members benefit from a specially designed plan that offers comprehensive coverage at an exceptional rate.

Please note that an active Federal Retirees membership in good standing is required to be eligible for MEDOC travel insurance. For members with partners who would like to take advantage of MEDOC as well, an active double membership is required. An exception is made if your subscription to MEDOC began in 2017, or earlier, and has remained in good standing since.

I have 40 days coverage with PSHCP, why should I buy MEDOC?

Here is why over 90,000 Federal Retirees' members know that MEDOC Travel Insurance is the right plan for them.

- New: Members are now covered for an unlimited number of trips within Canada of any duration

- New: Up to $15,000 per insured in-province trip cancellation, interruption & delay insurance benefit

- New: Up to $5,000 non-medical emergency evacuation coverage

- New: Up to $500 document replacement coverage for lost or stolen documents

- New: Involuntary schedule change expense for the lesser of the change fee charged by the airline or up to $1,000 for the extra cost of one-way economy air fare to your next destination (inbound and outbound).

- MEDOC offers up to $10,000,000 as its policy limit.

- Up to $15,000 per insured, per trip for trip cancellation, interruption and delay insurance; PSHCP does not offer this coverage.

- Up to $10,000 for vehicle return; PSHCP; does not offer this coverage.

- Up to $500 for pet return; PSHCP does not offer this coverage.

- Up to $1,500 per insured for baggage and personal effects insurance (up to $3,000 per family); PSHCP does not cover this.

- Up to $100,000 per insured for flight accident and accidental death & dismemberment insurance; PSHCP does not cover this.

- Because PSHCP only provides coverage for trips of up to 40 days in duration, MEDOC offers a supplemental plan to provide coverage beyond the 40th day of your trip. Any claim incurred after the 40th day of your trip will be eligible for coverage from first dollar ($1) with no deductible.

The MEDOC annual base plan provides emergency medical coverage for an unlimited number of trips per policy year up to 40 days each for out of country travel (includes unlimited number of trips within Canada of any duration), for claims that exceed $1, 000,000 (the coverage provided by your PSHCP). For claims exceeding $1,000,000, the following are examples of what is provided in addition to your PSHCP coverage:

- In hospital private duty nursing

- Up to $5,000 for emergency dental expenses; PSHCP covers this benefit up to a maximum of $2,000 per emergency, so you can claim up to an additional $5,000 if you have MEDOC, and your emergency dental expenses are in excess of $2,000.

- Up to $600 for emergency relief of dental pain.

- Incidental hospital expenses (TV, telephone, etc.) MEDOC covers up to $50 per day, or up to a maximum of $2,000 per insured.

- Return of Deceased provides coverage of up to $15,000 for preparation and transportation of the deceased.

- PSHCP insures up to $2,500 in total for all additional hotel and meals expenses. MEDOC covers up to $350 per day, or up to a maximum of $3,500 per insured. So if your emergency is within the first 40 days of your trip, and you incur this expense, you can claim $2,500 from the PSHCP plan and then a further $3,500 from MEDOC if you incur in excess of $2,500 for additional hotel and meal expenses.

- PSHCP covers 80% of emergency related medications prescribed while out of Canada and MEDOC will reimburse the other 20% of emergency related medications prescribed while out of Canada.

For more information on MEDOC travel insurance, call toll-free at 1-855-772-6675 or visit federalretirees.johnson.ca

Johnson Inc. ("Johnson") is a licensed insurance intermediary. MEDOC ® is a Registered Trademark of Johnson Inc., a licensed insurance intermediary (“Johnson”). MEDOC ® is underwritten by Royal & Sun Alliance Insurance Company of Canada (“RSA”) and administered by Johnson. Johnson and RSA share common ownership. Travel Assistance is provided by Global Excel Management Inc. *For a trip to be covered under Trip Cancellation, MEDOC ® coverage must be in effect on the day your trip was booked or purchased, a) within 5 business days of booking your trip, or b) prior to any cancellation penalties being charged for that trip. **A 90-day Health Stability Clause applies to pre-existing medical conditions for the Standard Health Option, Supplemental Plan only, and other restrictions may apply. The terms, conditions, limitations and exclusions which apply to the described coverage are as set out in the policy. Policy wordings prevail.

COMMENTS

See reverse for premium rates. MOD.A.RATES.2021.ENG Administration Information You and your spouse can select two Individual plans or one Family plan. If you are purchasing a Family plan, both ... MEDOC® TRAVEL INSURANCE Johnson Inc. 10 Factory Lane St. John's, NL A1C 6H5

MEDOC® coverage and we will be pleased to assist you. Toll free: 1.866.606.3362 Email: [email protected] Mailing Address: MEDOC® TRAVEL INSURANCE Johnson Inc. 10 Factory Lane St. John's, NL A1C 6H5 Administration Information *Family coverage is available to you, your spouse and dependent(s) when:

EFFECTIVE - JANUARY 1, 2021 MEDOC® TRAVEL INSURANCE POLICY. INDIVIDUAL C.MX 1 DETAILS ABOUT YOUR POLICY Travel insurance is designed to cover losses arising from sudden and unforeseeable ... the new policy terms and conditions and the new premium rates in effect for the new policy year. Along with your notification, you will also receive a ...

Here is why over 85,000 Federal Retirees' members know that MEDOC® Travel Insurance is the right plan for them. The Top 12. New: Members are now covered for an unlimited number of trips within Canada of any duration; New: Up to $12,000 per insured in-province Trip Cancellation, Interruption & Delay Insurance benefit;

MEDOC® Travel Insurance Policy QCC Active Plan Effective September 1, 2021 Wishing you safe travels This insurance is underwritten by SSQ Insurance Company Inc. MODEL A - QCC ACTIVE 1 DETAILS ABOUT YOUR POLICY ... coverage under the new policy terms and conditions and the new premium rates in effect for the new policy year.

Emergency medical coverage for multiple trips throughout the policy year. Return of vehicle - up to $3,000. Pet (s) return - up to $500. Emergency dental - up to $5,000. Convenient monthly premium payments or you can pay your premium in a lump sum. For further information call 1-866-606-3362.

• Coverage under your new 2021/2022 MEDOC Travel Insurance Policy begins on this date. • Requests for changes to your 2021/2022 policy received by this date will be reflected on your ... MEDOC RATES MEDOC rates are changing this year due to rising costs, largely driven by the global COVID-19 pandemic. You may see a change in your premium for

EFFECTIVE - JANUARY 1, 2021. This insurance is underwritten by. Royal & Sun Alliance Insurance Company of Canada INDIVIDUAL B. SA. M. PL. E. DETAILS ABOUT YOUR POLICY. Travel insurance is designed to cover losses arising from sudden and unforeseeable.

For often less than the cost of purchasing insurance for multiple trips separately1, you can enjoy an unlimited number of trips2 during the policy year. Travel insurance that's ready to go. 1.855.473.8029 Johnson.ca/MEDOC Contact Johnson for a quote and you'll be entered to win 1 of 5 travel gift certificates valued at $5,000 each ...

Your MEDOC Travel Insurance Includes: Coverage for an unlimited number of trips up to 40 consecutive days. Insurance that can be purchased no matter your age or health status. Trip cancellation, interruption and delay insurance for multiple trips throughout the policy year. Up to $10 million in emergency medical coverage per insured person, per ...

MEDOC® coverage and we will be pleased to assist you. Toll free: 1.866.606.3362 Email: [email protected] Mailing Address: MEDOC® TRAVEL INSURANCE Johnson Inc. 10 Factory Lane St. John's, NL A1C 6H5 Kanata Office: 471 Hazeldean Road, Suite 7 Kanata, Ontario K2L 4B8 Langley Office: 9440 202nd Street, Suite 110

Incidental hospital expenses (TV, telephone, etc.) MEDOC covers up to $50 per day, or up to a maximum of $2,000 per insured. PSHCP insures up to $3,000 for repatriation or burial. MEDOC covers any amount you incur in excess of this amount up to a maximum of $5,000. PSHCP insures up to $2,500 in total for all additional hotel and meals expenses.

Helplines) for the NSED Travel Insurance Out of Province / Canada Emergency Medical Plan and Trip Cancellation / Trip Interruption Plan (if applicable). These plans replaced the MEDOC® Travel Plans effective September 1, 2020. Please note, with your new travel ID card in hand, you can now dispose of your current card as it will no longer be valid.

MEDOC® coverage and we will be pleased to assist you. Toll free: 1.866.606.3362 Email: [email protected] Mailing Address: MEDOC® TRAVEL INSURANCE Johnson Inc. 10 Factory Lane St. John's, NL A1C 6H5 Administration Information *Family coverage is available to you, your spouse and dependent(s) when:

A 17-DAY PLAN. If you purchased the 17-day Plan, your coverage includes: Up to a maximum aggregate of $5,000,000 Emergency Medical Insurance benefits per insured person, per policy year for an unlimited number of trips, outside of Canada, not exceeding 17 consecutive days. Trips taken outside of your province or territory of residence, but ...

For more information or to get a quote: 1.866.606.3362 MEDOC® Travel Insurance Or visit:Johnson.ca/MEDOC. An unlimited number of 17-day or 35-day (or less) trips outside of Canada, depending on your plan selection, with coverage options for a longer trip. An unlimited number of trips within Canada of any duration.2.

The policy renewal period is being extended free of charge to Dec. 31, 2020, with the new policy year beginning on Jan. 1, 2021. Federal Retirees has enjoyed a trusted relationship with Johnson Insurance for nearly 30 years and MEDOC has consistently been a top-of-market travel insurance program for our members.

The NSTU Group Insurance Trustees have decided to rebrand the name of their travel insurance from MEDOC® to NSED Travel Insurance effective September 1, 2020. To help you understand ... We have paid an extremely large amount of claims since COVID-19 began and a rate hold is great news for the 2020-2021 year. Remember, in renewing your policy ...

MEDOC Reissue for 2021. ... more certainty and stability within the Travel industry and we'll all be able to benefit from our industry-leading MEDOC travel insurance in the future. Stay safe, Johnson Insurance . Search: Videos From newscanada. Popular Articles. November 22, 2023 .

commencement of the policy year, the premium rates will be pro-rated from your effective date until the end of the policy year. Please contact Johnson Inc. for information on pro-rated premium rates. ‡The Supplemental Plan provides coverage for a single trip that includes travel for more than 35 consecutive calendar days outside of Canada.

Shopping for travel insurance? Explore Faye's customizable plans and coverage details to see if they're the right fit for you and your upcoming travel needs.

6 MODEL C.MX For trips taken outside of Canada, your 17-day Plan or 35-day Base Plan coverage for Emergency Medical Insurance benefits ends on the earliest of: a) the day you return to your province or territory of residence; or b) the day you have been outside Canada for more than 17 consecutive days, including the day you left Canada, if you selected the 17-day Plan; or

PSHCP covers 80% of emergency related medications prescribed while out of Canada and MEDOC will reimburse the other 20% of emergency related medications prescribed while out of Canada. For more information on MEDOC travel insurance, call toll-free at 1-855-772-6675 or visit federalretirees.johnson.ca.