Best Logbook & Mileage Tracking Apps in 2024

Mileage logbooks and mileage tracking apps have been around for years and have proven to be valuable tools when it comes to keeping track of your car’s maintenance and necessary repairs over time. There are some great features in these apps that make them much more versatile than their paper counterparts, especially when you’re trying to budget or plan major vehicle maintenance at the right time each year. Here’s a breakdown of the best mileage logbooks and mileage tracking apps in 2024, so you can make an informed decision regarding which app is right for you.

If you are a fleet owner and want a comprehensive solution, Zenroad can help. With options for asset tracking (through GPS or via barcode scanning), mileage logs, driver time recording, trip-management tools, and more. Zenroad offers a complete suite of solutions to keep your business running smoothly. The main draw is that Zenroad has both an iOS app and an Android app so drivers can record their trips while on the go. The basic version is free with some premium features available at a cost.

Zenroad lets you track driving metrics and even allows for safe driving competition between co-workers or teammates. You can compare your stats with other drivers , plan trips ahead of time, automatically record stops to keep track of fuel costs, and get notifications about key events such as speeding. With real-time features for traffic reports, roadside assistance, and car diagnostics, you will always be connecte d to safety support on your long commutes.

Try Zenroad 🚀

To have a logbook app is great, but it’s not enough to just have one. You also need to be sure you’re tracking your miles correctly. You can use an app like Motive (formerly known as Keep Trucking), to automatically and securely manage your mileage logs. These applications are designed specifically for professional drivers who want to increase their accountability and efficiency, as well as control their vehicle maintenance and fuel consumption. Better yet, there are options out there which allow you to track your miles with ease and convenience: at a glance, you can see how much time and money you’ve saved on every trip!

The Fleet Solution is a valuable tool for small businesses. Companies with several drivers and vehicles need to keep accurate records of usage, ensuring that all vehicles are being used effectively and efficiently. If a driver is using one car too much, then it’s costing their company more money than it needs to, especially if another car sits idly at home due to lack of availability. A logbook app like LogbookMe can make tracking mileage very simple. You can track mileage quickly by connecting your accounts with Google Drive or Dropbox. Once your data is transferred, you’ll be able to track your expenses as well as see which vehicles have been underutilized and which ones have been used most frequently over time. It also allows you to view vehicle history reports so you can compare miles driven between two different dates or locations. You’ll even be able to export data into Excel spreadsheets or CSV files!

Many companies are looking for options that give their drivers better real-time visibility into what’s happening in their fleet. For example, GOFAR is a cloud-based fleet solution and logbook app. It helps fleet managers create routes, manage and monitor driver locations, send alerts to drivers , and more. Using it with mobile devices—iOS or Android—helps drivers record work hours on-the-go. Drivers can clock time in at each location where they pick up or drop off passengers. On top of that, drivers can track miles driven during particular assignments to calculate taxes and have all their records available from one easy dashboard view.

Azuga FleetMobile

Azuga FleetMobile is a cloud-based fleet solution that helps you manage drivers , vehicles, and work orders through all of your locations. Azuga’s service works with most vehicles and any driver, meaning you don’t have to invest in new hardware or keep track of large amounts of paper records. The software provides comprehensive mileage logs, allowing you to gather data on vehicle maintenance, driver hours, fuel costs, and more. Azuga includes multiple advanced features that allow you to set up custom trip reports and analytics so you can optimize your routes and make informed decisions about how to improve your business based on real-time data . All of these options are neatly organized in one central dashboard where you can quickly assess performance across all aspects of your fleet’s activities.

Build your Own Mileage Tracking App Using Telematics SDKs

Instead of building your mileage tracking app , consider using a telematics solution . The telematics industry is growing and as a result, so are telematics SDKs (software development kits). Today, you can find an open-source library or boilerplate that handles everything from GPS and location tracking to OBD2 diagnostics—allowing you to easily add functionality like keyless entry, locking/unlocking, remote starting, speed alerts/limiting, text message alerts, and more.

Trip recording is a smart way to streamline your business; by integrating trip recording software into your existing mobile apps, you not only gain valuable insight into how customers use your product or service but also provide an additional feature that strengthens customer loyalty. Companies like UPS and Uber are already using trip recording tools, so it’s important to keep up with what other leaders in your industry are doing. There are many different ways to log trips via Damoov Mobile SDKs and and Telematics APIs . We encourage entrepreneurs to choose one that makes sense for their particular industry.

Useful links to build your own app

- Company website: https://damoov.com

- Open-source telematics app : https://damoov.com/telematics-app

- Telematics SDK : https://damoov.com/telematics-sdk

- Telematics API: https://damoov.co/api-services

- Developer portal: https://docs.damoov.com

- Datahub: https://app.damoov.comm

- Github: https://github.com/Mobile-Telematics

Telematics infrastructure for tracking and safe-driving mobile applications

- Documentation

- Quick start

- Telematics SDK

- API reference

- Open-source app

- Services status

- Data export

- Safe-driving

- Eco driving

- Fleet tracker

- In-Vehicle data

- Driver engagements

- Postman collection

- Shared mobility

- Gig economy

- Corporate safety

- Transportation

The 5 Best Mileage Tracker Apps in 2024

Reviewed by

April 21, 2023

This article is Tax Professional approved

When you track your miles during business travel, your tax savings increase in sync with your odometer.

But keeping records of that travel—consistent, accurate, and tidy ones, at that—is often a hassle. The admin work adds up quickly when you have to leaf through logbooks, gas receipts, toll booth slips, and credit card statements.

I am the text that will be copied.

Luckily, a host of car mileage tracker apps use GPS tracking to make it easy to keep tabs on your small business travels—and keep IRS-compliant reports. Some free mileage trackers let you take a limited number of trips before you have to break out the credit card to cover a premium package. Other mileage apps lack a free version but offer a wealth of entry-level features.

Here are the five best mileage tracker apps for businesses in 2024. But first—how do you deduct business mileage, anyway?

How to deduct business mileage

If you’re self-employed, you can deduct your mileage any time you leave your business location—even if that business location is your house. One condition: The trip has to be for work purposes.

Which miles count?

Meeting with clients, making a sales call, visiting the post office to send shipments to customers—these are all day-to-day examples of when your small business might apply the mileage tax deduction .

Keep in mind that the mileage has to be “ordinary and necessary” to be a write-off. If you drive 15 miles to pick up inventory from a vendor and 15 miles back to your place of work, for example, you can deduct 30 miles total.

But if you take a 10-mile detour on the way back so you can visit your favorite bubble tea shop, that extra mileage can’t be deducted. You can only deduct the 30 miles you traveled for business.

The self-employed standard mileage rate

You deduct mileage from your taxes using a standard per-mile rate . For the 2023 tax year, the rate was 65.5 cents per mile. For the 2024 tax year, it’s 67 cents.

For quick trips around town, this may not add up to much. But once you start tracking work trips like attending conferences, visiting far-flung clients or vendors, the standard mileage rate can take a significant chunk out of your tax obligation—so long as you have a clear mileage log.

On top of that, food, lodging, and other costs on the road are also deductible business expenses. To learn how your business trips can save you money on taxes, check out our article on deductible travel expenses .

As an added bonus, even the cost of a mileage tracker is a deductible business expense. That’s right, a deductible expense to track even more tax deductions.

The best mileage tracker apps

The best mileage tracker for your business will depend on your needs as a business owner. Are you a rideshare driver? Do you pay reimbursements to employees for travel? Do you use Apple iOS or Android? Different apps cater to different needs. Skip scrolling through an app store with the five best mileage tracker apps to make mileage logging stress a thing of the past.

Free version: Up to 40 trips per month

Full version: $5.99/month, or $59.99/year (paid annually)

- Automatic mileage tracking: Once you flag certain routes, MileIQ will automatically detect them when you drive, classifying them as expenses.

- Work hours : You can set work hours to determine MileIQ’s automatic mileage tracking.

- Integration with Freshbooks and Excel: If you use either of these apps to manage your expense tracking, MileIQ can export IRS-compliant reports to them.

- Only tracks miles: MileIQ doesn’t offer any accounting tools , like expense calculation. It just tracks how far you drive and lets you classify the trip.

As one of the most popular mileage tracking apps out there, MileIQ automates so much of the mileage tracking process. When you tag trips as “business,” the app remembers the route and assigns it the same tag in the future. This means tracking business miles doesn’t have to be a conscious thing—so long as you’re driving the same routes frequently. This feature may not be a good fit for rideshare drivers with routes that always vary.

MileIQ doesn’t offer any accounting capabilities beyond counting and classifying mileage; you won’t be able to calculate your tax deduction on the fly.

MileIQ is a solid choice if you drive for your business, but not for a ridesharing job. It’s also helpful if you have irregular hours since you can set work hours in the app.

Free version: Up to 30 automatic trips per month, plus unlimited manual trips and receipts

Self-employed premium version: $60/year (paid annually), or $8/month (paid monthly)

Business version: Starts at $120/user/year (paid annually) or $12/user/month (paid monthly)

- Simple, clean interface: Users report that Everlance is simpler, more intuitive, and easier to use than other mileage tracking apps.

- Automatic classification: Frequent places and trips are detected and automatically classified, and you can set rules for trip classification based on work hours and commutes.

- Multiple ways to track expenses: Employees can snap pictures of receipts and upload them to the cloud or sync with their bank or credit card for automatic expense tracking.

- Team reporting and analytics: As soon as a trip is classified as work-related, managers have access to trip details, including starting and ending locations, times, and complete route maps.

- IRS-compliant mileage logs: Everlance provides downloadable mileage logs, and their Tax Center calculates mileage totals and deductions.

- Limited free version: The free version only allows for 30 automatically tracked trips per month, though you can track additional trips manually.

- Automatic tracking troubles: Some reviewers have reported that Everlance sometimes fails to start automatically at the beginning of a trip. That could mean you have to keep an eye on the app to make sure it’s working.

Everlance is easy to use, offers multiple options for expense tracking, gives managers more visibility into their team’s trips, and ensures IRS compliance for self-employed users and businesses of all sizes. With more than 18,000 ratings, their 4.8-star rating (out of 5) speaks for itself—currently, they’re the number-one ranked mileage tracker on the App Store.

Whether you’re a rideshare driver, frequent business traveler, or manager of a growing business, Everlance will probably work for you. The app is user-friendly and feature-rich, and if you don’t make many trips, the free version is likely enough to suit your needs. Their downloadable mileage logs can save you work during tax season, too.

Keep in mind that Everlance has received some negative reviews about its automatic tracking capabilities. Before you start relying on it for your business, check out the newest reviews and developer updates, and take the free version for a spin.

SherpaShare

Basic version: $5.99/month or $59.99/year (paid annually). Users receive a two-week free trial.

Full version: “Super Premium” starts at $10/month

- Unlimited, automatic mileage tracking: As many trips as you can make per month, tracked automatically via GPS.

- SmartShare analytics for rideshare drivers: Track hourly revenue and profit, chat with other drivers, see a heatmap of where other drivers are active, and get recommendations on where to go based on past drives.

- No free version

SherpaShare stands out for features tailored to rideshare drivers. Its SmartDrive tools not only let you keep track of how much you’re earning, but collect information that can help you earn more. Its driver heatmap, for example, shows you where other drivers are operating, so you can plan your locations strategically.

However, there’s no free version of SherpaShare—so you’d better be sure you’re going to use it before signing up.

Free version: No automatic tracking, five vehicle limit, 40 trips per month

Full version: Premium plan is $5.99 a user/month or $60/year, teams are $10/user/month, and enterprise pricing is $15/user/month.

- Multiple vehicles and drivers on a single tracking system: Track company mileage easily for deductions and reimbursements.

- Many ways to track mileage: Both manual and automatic, BlueTooth connection with vehicle, and compatibility with mileage tracking devices.

- Photo capture for expenses: Employees can record receipts for expenses they incur on their trips.

- Integrations: TripLog is partnered with several industry-leading tools such as QuickBooks, ADP, Concur, Xero, and others.

- Free version doesn’t include automatic tracking: You have to enter mileage manually with TripLog’s free version. That more or less defeats the purpose of having a mileage tracking app—though new users can test out TripLog’s features with a 15-day free trial.

TripLog functions best when tracking all your employees’ mileage in one place. They even have the option of including extra expenses with photo capture, including gasoline or meals on the road. The app starts automatically when your vehicle starts moving, and you can activate an onscreen widget that counts your miles in real-time.

TripLog is your best mileage tracking option if you have multiple employees with multiple vehicles who need to track their mileage. The free version lacks automatic tracking, though—so if you don’t have employees, but you’d like to test-drive a mileage tracker, TripLog may not be the best bet.

Free version: Single user, no automatic tracking

Full version: $8.34/month for Premium, $16.67/month for Pro (when billed annually)

- Other expenses: Hurdlr is a full-fledged expense tracking app; mileage tracking is just one of its capabilities.

- App integration: Hurdlr can connect to your Uber, Lyft, Uber Eats, AirBnB, and other work accounts to track your income and calculate your taxes on the fly.

- Bank integration: Connect Hurdlr to your business checking account to track income and expenses.

- Slow starting: Some users have reported it takes up to one mile of travel before automatic tracking starts—meaning you can’t track that first mile and deduct it from your taxes.

Hurdlr stands out by integrating with rideshare and similar “gig economy” apps and calculating your taxes on the fly. If you have to pay estimated quarterly taxes , this can be a blessing; on-the-fly tax calculations make it much easier to estimate in advance how much you owe the IRS.

Since Hurdlr offers other expense tracking capabilities, it can be used to track expenses beyond travel for other tax deductions. If you’re just starting your business or dipping your toes into expense reporting apps in general, Hurdlr might be the one-stop-shop you’re looking for.

Note that some users have found Hurdlr delays a bit before it begins automatically tracking, so there is a chance your mileage reports may not be 100% complete. If that’s essential for your business, you may want to try a different app.

Rideshare drivers and other “gig economy” workers, solopreneurs, and freelancers. Hurdlr also explicitly targets their app at real estate agents.

Need help staying on top of your tax deductions?

Mileage is just one of the travel write-offs that can reduce your tax obligation. Lodging, food, airfare, and other travel costs can also cut you a break. Learn more with our guide to business travel deductions .

Further reading: The Best Apps for Managing Receipts

How Bench can help

Your mileage is just one of many potential tax deductions available to your business. If you’re looking for a solution to tracking the rest of your expenses so you don’t miss a single tax deduction, try Bench. We’re America’s biggest bookkeeping company, and our platform automates so much of the stress of staying on top of your monthly reporting. Just connect your accounts, and your personal bookkeeping team automatically imports all your transactions to categorize and generate reports. You also get access to our tax professionals who will help you optimize your income tax return, so you don’t leave a single cent of savings on the table. Learn more .

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

TripLog mobile app introduction for Drivers

If you need help with Getting Started Please Check out our First Time Setup Article

Mileage Tracking

Add a vehicle.

If you are not prompted to add a vehicle then a placeholder vehicle may have been added. You are able to manually add a vehicle on the app or the web. In the app you can click Main Menu>Vehicles>Add Vehicle.

App Settings

Required: Location Settings

Once you are logged in, the app will ask you to allow permissions including Notifications, Location and to Disable battery optimizations. It is necessary to allow all these permissions as need for the app to function.

In order to provide optimal tracking, it’s important to select “ Always Allow ” for TripLog access to location. If you need to find the permissions it is located under the main menu and system permissions.

Data Sync : How To Sync Data to the Web

If the app has not automatically synced your data when you log in you may need to manually sync your data from the cloud. In order to properly receive updates and settings in TripLog it’s important to “Merge Data” The other two options are generally only used in troubleshooting situations.

Add a Vehicle

To get started, it's important to add a vehicle. To do this, go to the Homepage → Menu → Vehicles → Add Vehicle → Save.

Auto Start Settings

By default Magic Trip is selected in the app for Automated Mileage Tracking. This may be different if determined by your administrator. If you are able to choose please refer to the Compare AutoStart Options to see what will work best for you. Please remember, even if you choose manual tracking that the location permission is still require to be set to Always Allow.

Additional AutoStart Settings

Trip Editing

When you drive, your trips will be displayed on the “Trips” page and will be automatically recorded. Take a moment to get familiar with the options on the screen below.

To submit trips, go to Menu → Submission. Here you can filter by Trips, Expenses, Time, Date Range, Activity, Not Submitted, and Submitted Trips.

Once you are ready to submit, simply press submit, and a message will be displayed to verify trip details.

Enter your search term

Search by title or post keyword

Triplog: How The App Works, Features, Pricing and More

Since 2012, Brett Helling has built expertise in the rideshare and delivery sectors, working with major platforms like Uber, Lyft, and DoorDash.

He acquired Ridester.com in 2014, the first ridesharing marketplace, leveraging his direct experience to enhance the site. His insights at Ridester are recognized by Forbes, Vice, and CNBC.

Expanding his reach, Brett founded Gigworker.com and authored “ Gigworker: Independent Work and the State of the Gig Economy “, demonstrating his comprehensive knowledge of the gig economy.

More about Brett | How we publish content

If you use your car to make money, you need to keep track of your mileage.

That can get complicated if you use your vehicle for work and personal travel.

That’s where the best mileage trackers come in.

And Triplog , an innovative and popular app with automatic mileage tracking, is making things even easier.

- What is Triplog?

- Triplog for Employees

- Triplog for Self-Employed Drivers

- 1. Integrate with Quickbooks

- 2. Automatic Mileage Tracking

- 3. Track Income and Spending

- 4. Track Team Members’ Schedules

- 5. Classify Trips

- 6. Route Planning

- 7. Tax Compliant Mileage Reports

- 8. Gas Tracking

- Triplog vs. MileIQ

- Triplog vs. Everlance

- Triplog vs. Stride

- Triplog vs. Hurdlr

- Premium Plan

- Enterprise Plan

- Time & Scheduling Add On

- Step by Step Instructions for App Users

- How to Use Triplog

- Pros for Employees

- Cons for Employees

- Pros for Self-Employed Drivers

- Cons for Self-Employed Drivers

- Triplog Bottom Line

Triplog is an app that does the work of mileage tracking for you.

This way, you don’t have to keep a manual log on paper.

But that’s not all.

If you take advantage of the whole suite of options, you can do almost all of your mileage tracking automatically, categorizing different types of trips as you go and even estimating your gas mileage and other expenses.

Let’s dive deeper into the Triplog mileage tracker and see how it works and what it can do for you.

How Does Triplog Work? Who Can Use Triplog?

To get started with Triplog’s basic version, all you need to do is install the app.

And it’s not just for one type of driver either.

A company can even use it to track mileage across a fleet of drivers.

It’s a modern and GPS-based solution for what’s always been a tedious process for tracking miles.

Here’s how it works.

In manual mode, Triplog software uses your GPS data to record your driving times and distances.

You can classify each trip on the fly, so you can keep track of rides for different companies and keep it all separate from your personal mileage.

You can even add or edit trips after they occur, so you don’t have to waste time in between trips.

So far, that’s all free.

There are more advanced features available by subscribing to Triplog.

But you don’t need to pay for advanced features or pay anything to keep a mileage expense log with the Triplog app.

Whether you’re a rideshare driver, working for a large company with multiple vehicles, or just keeping track of personal mileage, Triplog manages virtually every mileage situation.

If you work for a company as a driver, whether you drive their vehicle or your own, Triplog is an app you might use to track mileage.

If you’re using your own car, you might be eligible for mileage bonuses, tax write-offs, or more.

And the Triplog app can log all those miles without you having to do very much at all.

For self-employed drivers, Triplog is an asset that tracks mileage and allows you to record and itemize all your expenses so you can report them as part of your tax submission.

This way, you can deduct the cost of each expense and the mileage you accrue from your gross income, reducing your overall tax liability.

Triplog Features

Triplog is more than just a simple mileage log or automatic mileage tracker for rideshare drivers.

The Enterprise version of the Triplog app allows integration with QuickBooks , an Intuit product that’s used by many businesses for accounting and bookkeeping purposes.

This can simplify information sharing and help streamline things behind the scenes.

Triplog allows users to auto-start the mileage tracker by various methods.

In one setting, you can initiate tracking by plugging their phone in or just by traveling in the car.

When you unplug or stop for more than five minutes, the trip stops.

You can also upgrade your Triplog car mileage tracker by purchasing a Triplog Beacon, which plugs into your car’s USB port and instantly detects movement.

Or, if you don’t want to use your phone and your car has internet and bluetooth connectivity, you can install a Triplog Drive, which tracks trips and mileage but doesn’t deplete your phone’s battery or use up your data.

If you connect a bank, debit, or credit card account, you can automatically download transactions into the Triplog app.

This allows you to track both expenses and income, and you can also make adjustments and add transactions manually.

Triplog features scheduling software as well.

You and your team can easily schedule shifts and track trips in real-time.

With just a glance at Triplog, you can see who’s where, manage routes, and dispatch drivers as needed.

And since all of those functions utilize GPS data, you can be confident in the information you’re seeing.

Classify each trip recorded by the Triplog app or the ones you enter manually.

You can set up a list of types of trips and enter classifications manually, but the app will also try and fill in the classifications automatically.

You can also add new trip types as you go, and you can go back and edit inaccuracies.

For instance, if you drive for both Uber and Lyft, you can track those trips separately.

Since Triplog is GPS-based, you can predetermine the best routes for drives.

For instance, if you want to create a loop that takes your driver to ten stops in the morning and ends back at your headquarters, you can.

Thor mobile app will guide them along your predetermined route.

Track mileage accurately so that when it’s time to make a submission for income tax deductions, you’re not relying on scraps of paper or other unreliable mileage records.

Track each fill-up for accurate expense reporting.

You can enter expenses manually or link the app directly to your method of payment.

Triplog Comparisons

There are other apps on the market that promise to do as well as or better than Triplog.

Let’s see how other mileage tracking software measures up against Triplog.

Triplog and MileIQ both excel at tracking miles.

Where Triplog wins out is in the customer service arena.

MileIQ only provides online documents that show you how the service works.

Triplog blows that out of the water with free demos, online webinars, an extensive training library of videos , and live online chat support.

Plus, Triplog’s basic paid option only costs $4 per month and offers a free trial, whereas Mile IQ costs almost $6 and does not offer a free trial period.

Everlance and Triplog both offer a free service.

But, the next tier up at Everlance is much more expensive than the Premium service from Triplog.

Triplog costs can go up dramatically when you add features, but Everlance starts at more than $100 a month , making its business software a mileage app suited for larger companies, as opposed to a single user.

For your money, Everlance provides all of the same services as Triplog but doesn’t feature an employee time clock.

Triplog has fewer free features than Stride .

But, the availability of some advanced features, like the Triplog Drive and Beacon setups, are not available on Stride.

That said, they both offer accurate mileage tracking, so you can deduct mileage expenses at tax time.

Stride’s mileage tracker is part of a family of apps designed to recommend wallet-friendly health plans and save people money on their taxes.

They’re available across the United States.

Hurdlr and Triplog are essential apps for Uber drivers .

Both apps are very similar in terms of pricing, features, services, and integration.

They are pretty much in a dead heat against each other, but Triplog is a bit less expensive for users who select middle-of-the-road packages.

Hurdlr excels at reporting, as there are ways to automatically send your tax professional or accountant copies of your deduction report and mileage at tax time.

How Much Does Triplog Cost?

Triplog pricing varies, so for details, check out their comprehensive pricing guide .

For a quick snapshot, the plan details are below.

The Lite plan is free, but only a single user can take advantage of the app.

It’s limited to forty trips or logged expenses per reporting period.

Lite plans have manual trip tracking only, but you can record toll and parking expenses and even calculate an estimate of your fuel mileage.

The Premium Triplog plan costs $5.99 per month per user.

You can have up to ten users on one plan, and you can access Triplog on the app or their website.

You can save 16% over the monthly fee by paying once annually.

The Premium Triplog version offers all the features from the Lite plan, plus a few other features that appeal to small businesses .

You’ll have unlimited tracking of mileage automatically, expense tracking with automatic optical recognition capturing your receipts, and even integration with your bank and credit cards.

The Enterprise plan carries over all of the features from the Premium plan.

Since this version of the app is for companies with many employees, it allows for unlimited users.

But, since the number of total users can vary so widely, you’ll have to request pricing for your particular needs.

In addition to the items in the Premium version, Enterprise users will also have access to an administrative console online, where a company can adjust their policies for tracking mileage to suit their business needs.

It can also integrate with other business processing services, like QuickBooks or Paychex to streamline your back-office functions.

It can also flag accounts when users are potentially over-reporting mileage, potentially saving you money.

The optional Time and Scheduling add-on costs an additional $4 per user, per month.

But you can add it to any plan.

It offers some additional features that might appeal to businesses large and small:

- Timesheet submissions and management

- Paid Time Off (PTO) and leave tracking

- Clocking in and out for employees

How to Sign Up for Triplog

To use Triplog, you need to have the app installed on your device.

So to get started, choose a plan.

Then subscribe if necessary for an upgraded plan if needed.

Once you have the app installed, follow the instructions below to get started using it.

This process might look a little different depending on if you’re using Triplog for yourself or for a bigger business that uses the app for time tracking or sending additional information to employees via google calendar.

- Check your email for a welcoming message and an invite to install the app (skip this for personal users)

- Install the app on your mobile device

- Log in using the details from the welcome email (or set up a login for a personal account)

- Start tracking your miles!

It’s that easy to get started!

To use Triplog, make sure the app is on your phone.

Set your preferences, make sure you’ve enabled the app to use your GPS data, and head out on your first trip.

Make sure to set up the features you need, and then check on the data compiled.

You can tweak the settings to get the most out of the app.

Is Triplog Worth It?

Figuring out if Triplog is worth the expense starts with deciding how much you need a mileage tracking app and how much you’re willing to pay for other services and integrations.

But there are some specific pros and cons to keep in mind.

- Follow the boss’s predetermined routes easily.

- Protect yourself from accusations of improper reporting of mileage or expenses.

- Get what you deserve for your services, including mileage reimbursement and fuel costs.

- Big brother is always watching.

- May drain your phone’s battery.

- If you use your personal phone, using Triplog may deplete your data allowance.

- Accurately record expenses and mileage for tax purposes

- Easy to use and link with other services you might use like QuickBooks

- Easy to use and setup

- Track fuel costs and maintain a trip log with ease

- Upgrades are optional, and free trials are often available

- All features and costs are tax-deductible

- Uses up your phone’s data allowance and battery life

- Premium features can be expensive

- Auto-tracking might start during personal use

Triplog is very good at what it does.

When you step up to the more advanced plans and premium features, tracking mileage and expenses becomes even easier.

If you’re thinking about trying Triplog, you can sign up for a free trial today !

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Jump to section

Related posts.

How to Choose the Right Uber Eats Bag for Food Delivery

How DoorDash Storefront Works [& Is It Worth It To Try?]

How Rocket Carwash Works [& Video Walkthrough]

Browse our resources.

Whether you're a customer or a driver, we've made it easy to find information about how to make the most of rideshare, delivery, and transportation companies.

New to #ridesharing and #delivery? Start here!

Get all the best information about the Delivery Industry.

Explore Delivery Service companies and jobs.

Income & Payments

Find the best advice on using delivery services as a customer.

Gig Economy Knowledge from Experts

Travel Logs - Vehicle Logbook

Automated GPS Trip Logging

Travel Logs is the next generation digital vehicle logbook for Apple iPhone, iPad and Android devices. It is designed to help you keep track of your trips for each vehicle easily with automated features and real-time GPS tracking and recording. Also features the ability keep track of vehicle related expenses and credits, vehicle maintenance and service records. ATO FBT compliant. Supports Bluetooth devices, Places (Geo-Fencing) and NFC tags for automatic trip recording.

Features at a glance

Here are some of the great features available in Travel Logs…

ATO Compliant

Complies with the Australian Tax Office (ATO) logbook format. It will calculate the percentage of business use for each vehicle and total business distance in the exported log reports.

Real Time GPS Tracking

Uses your device’s GPS to track your location accurately. No additional devices are needed!

Determines your location automatically. It will auto-fill the location details for your logs and also estimate the distance traveled so you won’t have to fill in the end odometer values!

Vehicle Expense Tracking

Track the expense and credits for each of your vehicles. Also include a photo attachment.

Widget Support*

Easily start/stop trips from the handy widget available on the notification screen.

Route Recording

Record the route you took for a trip. Routes will be plotted on the map and can be exported as a GPX file.

Log Reports

Reports are in PDF and Comma Separated Value (CSV) format, so you can import and open in any of your spreadsheet applications. (Excel, Numbers, etc)

Contacts Integration

Select your origin/destination addresses from your contacts from right within the application.

iCloud Sync*

Sync with iCloud Drive to have all your trips with you on all your devices.

Calendar Integration*

Import calendar events to use as your trip purpose and desciption.

Places (Geo-Fencing)

Automatically start and end trips when you depart or arrive at a place.

Vehicle Maintenance and Service Logs

Keep track of each of your vehicles maintenance and service records.

Bluetooth Device Support

Automatically start and stop trips when connected to your vehicle's bluetooth hands-free device.

NFC Tag Support*

Create NFC tags to automatically start and stop trips.

* Feature only on iOS devices.

Feature Packed

Travel Logs is packed with features that will make logging your daily trips easy. Automated data entry and accurate GPS route logging will save you time.

Designed to be used on the go. Information such as address, time and date, odometer values can be automatically logged. A companion app is available on the Apple Watch to allow you to quickly and easily start and stop trips.

© Sockii Pty Ltd 2011-2021. All Rights Reserved. ABN 67 160 198 685

Apple, iPad, iPhone, iPod touch, and iTunes are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google Inc.

Best Logbook Apps for Aussies

Using your car for business travel and looking for a fair, detailed review of the best ATO approved logbook apps for Aussie drivers?

You can claim from $3,000 to $10,000 and more every year with a digital logbook app . All of the apps listed are ATO -compliant, tax-deductible, and vary in cost between free and $468 per year.

What is the Best ATO Logbook App?

- Rank #1: GOFAR Logbook App – cheapest with most features

- Runner-up #2: ATO myDeductions App – free from ATO, but unreliable

- 3rd Place: MileIQ – quality product, but not Aussie made

- 4th Place: Driver Direct – ATO compliant, but can sometimes lose data

- 5th Place: Driversnote – quality app, but GPS mode only

- Best price, full-featured, ATO-compliant app

- Logbook app with tax return and superannuation tools

- Affordable, American-made quality app with basic functions

- Robust fleet management app

- Simple, easy app but with highest cost

Logbook App Features Comparison

Next, I’ll share my explorations of each app and the detailed specifications and features for each one. My goal is to help you choose an app that ultimately helps you accurately and easily track your ATO work-related expenses .

#1: You need the best-priced, full-featured, ATO-compliant logbook app

App name: gofar (#1 logbook apps winner).

Created by : Australians Cost : $8/month, no hidden extras Download : Google Play , Apple Store Extras : Check your car compatibility

You can receive between $3,000 and $10,000 back at tax time simply by recording your trips correctly, and GOFAR makes it easier than the other apps in this comparison.

Plus, it’s fully tax-deductible!

Let’s break it down to the main features that Australian drivers need when considering the best logbook apps:

ATO cents per km or logbook method? GOFAR includes both methods.

When using the ATO cents per km method you can record your work mileage with just one swipe .

This is a major advantage for people, like me, who are short on time and patience with this type of business administration.

The GOFAR car logbook app will do the rest for you in terms of collating the data into a report compliant with your end-of-financial year July tax return .

GOFAR collates the driving data (locations and kilometres driven) into an easy-export CSV file.

Simply email the file to your accountant before tax time in July each year: all ATO compliant data is included. The file can be emailed directly out of the app to your accountant or your own email address. Your choice.

I need automated trip data collection, do you?

A feature that sets GOFAR apart from other logbook apps is that it automatically starts and stops tracking your trips, as you drive .

A small, matte black OBD2-compatible adapter is inserted into the port underneath your car dashboard (usually on the right hand side, under the steering column). ( Check if your car is compatible here .)

The adapter is about the size of a match-box and glides in easily. Take note that there is a ‘top’ and ‘bottom’ so you get a good fit with the diagnostics port.

The OBD2 adapter is a leave-in device .

This means that it can record and save data for up to a week of trips without being connected to your smartphone app.

This is in contrast to other logbook apps which are contained within your smartphone. Forget your phone and your trip will not be recorded. Or forget to record your trip, and you won’t be able to claim it as a work expense.

Being a leave-in device means you don’t have to manually update your app with trip data. GOFAR is essentially a set-and-forget logbook app. Super convenient!

GOFAR has automated claim rates, specifically for Australian drivers

And GOFAR automatically updates your business claim dollars so you can see exactly how much money you’re claiming each week.

This is my favourite featured because I’m currently recording data for my ATO 12 week timeframe . It takes a few seconds each week to record my trip data correctly. And I won’t have to worry for another 5 years. Woohoo!

In the screenshot you can see the settings in the GOFAR app. I’ve chosen to automatically tag business trips and to use the ATO Standard Rate as a preset. The ATO myDeductions app is also set up at the ATO Standard Rate. MileIQ and Driversnote need to be configured as they are not Australian-made.

The claim rate is currently set to 78 cents per kilometre for the 2022-2023 financial year , and will increase to 85 cents per kilometre next year, 2023-2024. That’s a 7 cent difference between the cents per km rate of 2022 and 2024.

I can record all work-related vehicle expenses, not just kilometres

GOFAR also records your fuel expenses.

Every time you fill up at the bowser you can input your fuel costs. This, in turn, enables GOFAR to give you a fuel efficiency report. (In recent tests, GOFAR recorded fuel savings of between 9.8% and 30% per driver ).

When I fill up my 4WD diesel it costs around $140 per tank. In my area of NSW, the cost for diesel is currently sitting at $2.11 per litre. So that’s a saving of $88 per tank, especially if I drive in eco mode. The Ray helps me control my speed and driving behaviour, which ultimately helps me save money at the pump.

You can toggle between monthly and yearly data in the fuel efficiency report.

GOFAR comes with the “bad traffic” tag pre-loaded . It’s interesting to see how my business trips are usually bad traffic! Aaaargh.

If you’re tagging business vs personal trips it will give you a comparison for those as well.

If you only want to record mileage for tax expense claims then you don’t necessarily need the Ray. But, if you’d like to save on fuel then simply get the Ray too . The Ray is optional. You’ll be able to record logbook expenses without it.

Ultimately, this means that with a GOFAR you’ll be around 10 cents in the pocket better off for every litre you buy at the petrol bowser.

Why I bought the GOFAR logbook app?

GOFAR won a prestigious Good Design Award . Everyone loves it, including me!

And in comparison with other mobile apps, it has an ATO tax calculator that can calculate ATO business percentage for you, help you learn how many litres of fuel you used, and accurately predict the cost of each trip.

Plus you can keep track of your CO2 emissions to contribute towards a healthier planet.

GOFAR will get you a lifetime of savings on your ongoing car costs . Start saving $1000s and hours on paperwork while receiving free lifelong updates !

GOFAR also works in any petrol, diesel or hybrid vehicle since 2007 (and many older). Check your car’s compatibility here .

#2: You need a free logbook app, with tax return and superannuation features

App name: mydeductions (runner-up).

Created by : Australian Taxation Office Cost : Free, no ongoing charges Download : Google Play , Apple Store

The Australian Taxation Office (ATO) offers a free myDeductions app that allows you to record and manage expenses and trips, relating to your work as an employee, your business as a sole trader and other general expenses.

It is a general purpose app, with a function included for logbook tracking and that’s why it’s in our list of the best logbook apps. This means that the developers haven’t focused solely on the logbook aspect, and so it’s a little rough around the edges.

I need to record business travel trips

Relating specifically to mileage tracking, in the app you can use a GPS point-to-point method to record your trips. Select the point of departure from a map, and then select the arrival location. myDeductions will calculate the shortest distance travelled, and record the trip.

Alternatively, you can manually record your odometer numbers . Add the number of kilometres displayed on your car dashboard at your starting point, and then when you arrive, record the final odometer number.

Both methods — GPS point-to-point and manual odometer count — require you to manually enter your kilometres into the myDeductions app.

The ATO does not offer an adapter that connects with your car’s onboard computer, to accurately and automatically log this data on your behalf, which is a major drawback.

So, whilst the ATO app is free, free comes at a price! Your time. This issue is the number one reason why Australians are not claiming all their eligible reimbursements from the tax office.

How popular is the ATO app compared to the other best logbook apps?

It’s a pretty basic free app but has more than 1,000,000 installs as of September 2023 and now allows you to upload your myDeductions records to the ATO for pre-fill into your tax return.

The app is popular, but also has 1,000s of negative reviews. This was my favourite quote from Tim Osmond, with 207 upvotes. I hope you have a chuckle too:

It’s a government app so basically it’s like a new Australian Prime Minister, seems like a great idea but then fails to deliver and becomes a huge disappointment when you need it the most.

What other useful features did I find in the ATO app?

The ATO app includes access to other non-driving related tools and resources. For example:

- myDeductions allows you to record all work expenses as an employee or sole traders.

- Tax withheld calculator helps you to work out the amount of tax that has been withheld from your salary and wage payments.

- ABN Lookup enables you to search for an Australian business number. (This seems to be an odd inclusion in a tax management app. How many times do we need to do this in our lifetimes?)

- Business performance check is a tool to compare your business with other similar businesses, and benchmark your own performance.

You can also use it to set important notifications and alerts when it comes to your quarterly or annual tax obligations.

This app also allows you to enrol your voiceprint with the ATO so you can access their services via the app using voice identification to verify your identity.

What are the known issues that might be a problem for me and you?

According to reviews in the Google Play and Apple Store ,

- “no search function , which means it’s difficult for you to find trips” Garry Wu

- “no ability to reset records, so data ends up ‘bloated'” Garry Wu

- “access to expense logging function is not easy to find” Liss Punch

- “restore from backup option doesn’t work” Clivey in Space

- “Server too clogged during tax time, which will be a long term issue” John Ferarri

- “Extremely unnecessarily complicated and frustrating to use” Sharmaine Leeke

- “Got a new phone and find that the app doesn’t auto backup ?!? Total data loss.” Keith Canfield

Being a government app it means that there are some quality issues, and perhaps people have a tendency to point out the negatives more than the positives. The app is designed for general-purpose expense keeping and tax management, and has one section for trip logging.

Why do some people like the ATO app?

- “very easy to use, has a well thought out layout and I have been able to easily check my tax info” Andrea Simpson

- “App is good when it works , which is thankfully most of the time” John Ferarri

Author’s Note: To be honest, I’ve read through 100s of reviews for this app in the Google Play and Apple Store. It was nearly impossible to find positive reviews that had any detail and that I thought would be useful for you to read. It seems that the app doesn’t always work, it loses data and constantly has installation bugs. Yikes!

However, it’s free and being made by the ATO it will always be compliant with the Australian tax system, no matter what, and that’s why it’s my 2nd choice.

#3: You need an affordable, quality app with basic functions

App name: mileiq (3rd place).

Created by : Americans Cost : AU$9.30/month (US $5.99) Download : Google Play , Apple Store

MileIQ was founded in 2012 by an American entrepreneur, Chuck Dietrich, and has been customised for American drivers . However, the app can still be used by Australians to record mileage and produce reports for tax deductions.

As with the other apps, it’s simply a matter of installing the software either on your Android or Apple phone, setting up your personal profile, and hitting the record button. I found the installation process very easy and quick.

MileIQ, whilst it’s not specifically created for Australians and the ATO, you can set a custom mileage rate . For the year 2022-2023 the custom rate is AU$0.78. Keep in mind that MileIQ is recording in US dollars, so be careful with any currency conversions.

Of all the apps, MileIQ has the cleanest interface design . The app is well laid out, without clutter, and without too many buttons. If you want a simple app that is reliable, but don’t need the extra features offered by GOFAR, then MileIQ is an excellent choice.

Is MileIQ reliable? Sometimes.

MileIQ is far more reliable than ATO myDeductions. The MileIQ team briefly worked with Microsoft, and as such, have an experienced, talented development team who regularly release app updates and improvements. The same can’t be said for the ATO myDeductions app with the 1,000s of negative reviews.

Recently the MileIQ team have received negative reviews that relate to the app either forgetting to record, or recording ‘mystery’ trips that never happened. Being a stand-alone app, without an OBD2 adapter, means that MileIQ will record trips if you have your phone on you and are in a friend’s car.

Whereas with GOFAR and Driversnote, you need the OBD2 adapter. With an OBD2 adapter trip recording is far more accurate than MileIQ without the adapter. GOFAR offers the adapter for free, whereas Driversnote charges $60 plus shipping fee.

Overall MileIQ is slightly more costly than GOFAR, and cheaper than Driversnote, but keep in mind that buying the app is a tax-deductible expense.

What other useful features are included in the MileIQ app?

One feature that I particularly like in MileIQ is the ability to set your daily working hours . It’s a clever use of technology and shows that the MileIQ team are thinking about real people with their real problems.

For example, if you always work on Tuesdays between 9am and 5pm, you can set these times in your user profile. MileIQ knows to classify any driving during those hours as business/deductible trips.

However, if you make a personal trip during this time, you need to delete it via the web interface. Slightly time consuming, but a better outcome than missing tax deductible trips.

What are the known issues that might be a problem?

The Apple Store only has a few older reviews, some of them as complaints. The reviews are not worth reading because the MileIQ developers will have fixed the issues in the intervening years. However, the Google Play store has several interesting comments — all from recent months in 2023 — from other users:

- “ Cannot change the date of a manually added entry . Can’t even delete it from the app, you have to use the web interface.” AaronLPC

- “Instead of letting you just mark a trip as ‘business’ or ‘personal’ it now makes you [select] from a list of options. It is extremely annoying and makes for about a 3-4 second selection per drive, instead of [being able to choose] 3-4 selections per second.” Benjamin Lubenow

- “ every time that you stop at a red light, it starts a new drive . Drive 15 miles on city streets and you may have to combine 15 drives, which is pretty annoying.” Phillip Greenberg

- “It doesn’t work. Your phone will say “automatically logging your drives” but it is not. I’ve had it now for over 2 years, but since around April or Jun (2023), it hasn’t been working . I have uninstalled and installed it back 2 different times, and it will work for the first or second drive, and then it stops. ” Rafael Camargo

- “Good app but often makes multiple trips out of one . Easier to join trips on laptop than app, could be an easier join function, click multiple trips and join at one time. They have not made it so it doesn’t make multiple trips. Stop at a stop light, you get a new trip.” Farren Flynn

The biggest issue I see is that MileIQ have recently updated the app (perhaps around April or June of 2023) but haven’t communicated the new changes with users. Many of the users are complaining about the app not working, but it appears to be an issue with logging out and resetting the app, so there are no split drives and user accounts.

In my mind, it doesn’t make sense to log multiple trips every time you stop at a set of red lights. Hopefully the MileIQ developers will fix this issue before the next financial year.

Why I think that people are frustrated with missing drive data?

One of the most frustrating issues that I encountered when using MileIQ was that I have to disable power-saving mode in my phone while MileIQ is installed .

MileIQ says “ the MileIQ app won’t be activated when you move significantly, which could cause missed drives ” and “ low battery mode can reduce the accuracy of location signals, leading to incorrect routes and mileage calculations .”

Perhaps this is why so many other users are having difficulty with missed drives? If I’m driving a few hours each day to attend pet grooming appointments, then I need to preserve the battery life of my phone. That’s why I use the low power mode; because I’m on the move all the time.

Not being able to use low power mode is a considerable inconvenience.

The MileIQ support team are quick to respond to issues, but being a large development team they need more time to fix the bugs. GOFAR has a small, agile development team and are able to fix bugs very quickly. ATO myDeductions are also very slow with bug fixes as the app isn’t a high priority project.

Why do other people like the MileIQ App?

Overall, the sentiment is that people love that it automatically classifies drives, even after regular business hours. The classification system is limited, but simple. GOFAR and Driversnote offer the same classification system, with GOFAR being easier to customise than other apps.

- “I love how the app automatically tracks mileage.” A Simple Homestead

- “Auto-detecting drives is brilliant, it’s tracked me already over $2000 in mileage write-offs , in just 2 months.” Alex

- “I’m a petsitter and use it to track mileage from job to job. For the most part it’s easy to use and works well. I like that I can add customised purposes.” Bonnie Keyes

Every one of the apps reviewed, except ATO myDeductions, will auto-detect and auto-track drives, and can literally give you 1,000s of dollars back in your pocket at tax time.

It’s simple: Use a logbook app and get money back at tax time. And that’s why MileIQ has made it into our list of the best logbook apps.

#4: You need a robust fleet management logbook app

App name: driver direct (4th place).

Created by : Japanese Cost : Free Download : Google Play , Apple Store

Developed by Toyota for its fleet customers, this app includes many of the same features as the other apps reviewed in this blog, including:

- capturing trip data via GPS,

- downloadable logbook data,

- multiple vehicle tracking,

- business/private use split, and

- expense recording and reporting.

This car logbook app also doubles as an ATO receipt app that boasts time-saving functionalities such as storing descriptions for future presets and photo-stocking your receipts .

Also included are a (Toyota) dealer locator for servicing and a fuel finder that lets you filter results for a particular brand – ideal for fuel card holders.

This is ideal for Australian conditions. Many 4Wd owners traverse Australia. Broken down? Need a new part? This app can pinpoint my closest Toyota dealer, even in remote areas.

In addition, Driver Direct includes Novated Lease tools, unlike all of the other apps in this review. I was able to work out how much I owed on my Novated Lease with the comprehensive calculator.

One thing I particularly like about Driver Direct, that none of the other logbook apps offer, is the ability to display the app on your Apple Watch .

This makes it incredibly easy to initiate a new trip, without reaching for your phone. In Australia, it’s illegal to touch your phone while driving. So, if you’ve just started a new business trip you can legally touch your Apple Watch on your arm, but not your iPhone.

This app doesn’t appear to have been updated since 2017 so that’s the main reason why it’s lower down on my list of choices for the best logbook apps. I also don’t love the interface design. Being old, it looks clunky and dark.

#5: You want a simple app and are prepared to pay more money

App name: driversnote (5th place).

Created by : Danish Cost : $16/month, plus $60 for plugin device Download : Amazon , Google Play , Apple Store

Driversnote is the most expensive subscription-based app — in our analysis of the top 5 logbook apps — that can track your ATO work-related expenses.

The app was originally developed for American drivers, and has only recently become available for Australians.

Why is Driversnote more expensive than the other best logbook apps?

Driversnote is twice the cost of GOFAR, and users must also pay an additional cost of $60 for the plug-in adapter. There is also a ‘ small fee ‘ for delivery to some countries, which would include Australia as this is a Danish company.

With the free version, you have to push start and stop buttons on your phone that will make sure trips are automatically registered via your phone’s GPS tracking (up to 15 trips per month).

The paid subscription includes a device for automatic tracking on unlimited trips , now recently compatible with Android.

It generates comprehensive mileage documentation, can track private or work-related trips and calculates reimbursement, distances and odometer readings.

You can add or edit trips in the logbook at any time if you forgot to use the mileage tracker and there is the possibility to track miles and keep a mileage log for multiple cars and workplaces.

Yes, everything is oriented towards miles and American classifications in the original app version. However, recently they’ve released an Australian version that is ATO compliant.

There’s an option to attach a comment on the trip recorded and to add odometer readings if you need them.

In a nutshell, this app allows you to:

- document and categorise your personal and business trips based on ATO requirements using your phone’s GPS,

- record and segment your trips so that you keep your mileage log for multiple vehicles or different employers,

- download your mileage report as a PDF or Excel file containing all the necessary details for tax deductions and reimbursement claims,

- a simple ATO tax calculator that automatically calculates reimbursements based on the current mileage rates from ATO.

The app itself is compatible with iOS and Android and has an automatic backup feature for your peace of mind in case you lose your phone. This is the case with most of the best logbook apps.

What is the iBeacon and how does it compare to the GOFAR Adapter?

Driversnote is the only other logbook app that needs an additional bit of hardware for tracking to be effective. In both the iBeacon and GOFAR adapter, the device will start and end tracking when you enter and exit the vehicle .

Being a somewhat forgetful person, rushing off to a new client meeting, I am always forgetting to trigger my logbook app to record. So, the device absolutely saves me every single time. It’s brilliant.

However, the biggest difference is that the GOFAR adapter will track trips within itself if I don’t remember to specifically record a trip on my phone, or I don’t have my phone with me. The iBeacon is not able to independently track trips and doesn’t have an inbuilt GPS .

So, when a work colleague borrows my car with the GOFAR all trips will be tracked. Whereas with the Driversnote iBeacon my colleague would need to take my phone with them, in order to track the trip for tax purposes.

This became a particular concern when I discovered that unlike the GOFAR, Driversnote won’t track trips or remind me if trips aren’t tracked for a week or more. This can be especially problematic for caravan drivers who need automatic starts and stops for their long, remote drives.

It’s a good app overall, but won’t notify you if trips are not tracked for at least a week or more. Dale Longenecker

The GOFAR Adapter plugs in — safe and secure — into my car’s OBD2 port, whereas the iBeacon can be left to float about in the glove box or centre console.

Yes, you can use Driversnote without the iBeacon, same as GOFAR.

What are the known issues in the Driversnote app?

- “Close to perfection.. I prefer manual entry w/ odometer reading and/or simply entering miles driven. Being forced to choose a route isn’t good when my route isn’t listed = inaccurate mileage .” Ryan S

- “My only complaint is that someone really dropped the ball with the pricing structure. Among all the cool bells and whistles that would make sense to charge for, they chose to charge for… spreadsheet space . Not a satisfying perk. And at $14/mo for the lowest tier, that potentially ends up costing nearly a dollar per ride for users who don’t surpass their free 15 rides by very much.” Elliot Davidson

- “ App uses well over 10% of my battery everyday you have to have physical activity turned on so they’re tracking you when you walk through your own home not just when you’re driving your vehicle for work purposes.” Anonymous

- “Love it in concept, but even after purchasing their “iBeacon” to make sure that no trips would somehow be missed, there are still huge periods of time with no trips logged even though I have not touched any settings and I drive multiple trips almost 365 days/year. If you decide to use this ATO mobile app , you must check daily to make sure it’s working properly. :-(” Diane Matcheck

Are there any hidden costs and charges with Driversnote?

I was very surprised to discover that I need to pay an additional US$12 per month to access reports. All of the other apps offer standard and custom reports for free.

This hidden charge ( it’s not listed on their pricing page ) blows the cost in the first year out to a whopping $468. Without the report module the cost in the first year is a more manageable $252.

Yes, Driversnote is tax deductible so your business is bearing the cost, but it’s a considerable difference when compared to the free ATO myDeductions app and GOFAR at $8/month, plus all the extra features offered by GOFAR .

What did other people like about Driversnote?

- “Nicely remembers common destinations, which is particularly helpful if you make the same runs over and over again. One can easily go back and manually add these by selecting a date, clicking the start location and stop location.” A Google User

- “It has a nice layout and could use a few minor features but overall I really enjoy this app.” Robert J. Kreckel

- “I deliver for DoorDash and UberEats, and this app has helped me track my miles so much more easily as well as keep track of my driving patterns for the day. There aren’t any ads that pop up, and I can easily start tracking since it’s got a very straightforward interface.” Kimberly

The reason why I’ve placed Driversnote last is mainly due to the hidden costs and the iBeacon tracking techology is problematic. The future promise is excellent and I hope that they continue to develop their technology so it becomes more reliable and affordable for Australian tax payers.

It could then move up a few places in our analysis of the best logbook apps in Australia, for Australian drivers.

How Do I Choose the Best Logbook Apps for Me?

Ultimately it comes down to your personal circumstances , business kilometres travelled and budget . Consider these points to reach your final decision:

- Do you want everything to be as automated as possible. Your time is most important? Choose GOFAR .

- Do you want a 100% free smartphone app that is suitable for Australians? Choose ATO Logbook .

- Do you want an app that automates reporting to your accountant ? Choose GOFAR .

- Do you own a fleet of cars and want to track your driver’s movements? Choose Driver Direct .

GOFAR’s app is the best ATO compliant logbook app in terms of value and functionality because it:

- is compatible with both iOS and Android

- installs easily via your car’s diagnostic OBD2 port

- can store a week of detailed driving logs on the Adapter if you forget your phone

- helps you save on fuel costs (buy the Ray too)

Either way, the bottom line is that once you try any of these smart car log book apps, you’ll be wondering how you survived without one.

Updated on Tuesday 19 September with new prices, new features, and replaced out-of-date logbook apps. Removed Vehicle Logger; discontinued. Updated Driver Direct; low usage and user ratings, and hasn’t been updated by Toyota since 2017. Updated with new reviews from Google Play, Apple Store and my own experience using the apps. Apps were paid for by the writer.

Danny Adams

Co-founder of GOFAR and with a Computer Science background from Harvard University, and a Bachelor of Aerospace, Aeronautical & Astronautical Engineering (Honours), UNSW. I want to transform data from cars into useful services so -> drivers save time & money -> emissions fall -> Australian roads are safer. So we built an ATO-compliant logbook app called GOFAR . I write to help you understand how to use GOFAR to maximise business travel . Reach out via [email protected] .

Related Posts

- Short message

- Name This field is for validation purposes and should be left unchanged.

You have 0 item in cart.

You just added:

- Cart items: 1

- Cart Subtotal: $ 0

Need an extension cable? Want to go green? Choose from these handy products:

- Tech Deals at Target Right Now!

- The Electric Grill You Need This Year

The 10 Best Road Trip Planner Apps for 2024

Save time, money, and energy with these apps so you can focus on the fun instead

:max_bytes(150000):strip_icc():format(webp)/EliseMoreau-0eca4760f970423a98ea884d9230df8c.jpg)

- University of Ontario

- George Brown College

- Payment Services

We love road trips! Planning them can be fun but, let's be honest, also stressful. The right road trip planner apps can take some of that stress away by helping you plan, organize, and manage travel before and during your trip. We've researched and tested these apps to help give you peace of mind so that you can spend more time enjoying your trip.

The Ultimate Map App for Planning Your Route: Roadtrippers

Access to free and convenient travel guides.

Share-ability so friends can join in on the planning process and suggest places to visit.

The app can use up the battery life of your device quickly. Take a car USB charger with you.

Built for travelers, Roadtrippers helps you create your route while allowing you to discover great places as you plan it out. Add a new place to your itinerary to work it into your trip.

The app features an easy-to-use interface. In addition to covering the U.S., it also covers Canada, Australia, and New Zealand.

Download For:

Automate Your Trip Planning and Organization: Google Travel

Automatic trip organization via Gmail integration.

Offline access so you can see your trip information even when you don't have an internet connection.

Limitations with customizing some day trips exactly the way you want.

You can count on Google to make your trip planning a breeze. Pre-constructed day plans are available for hundreds of the world's most popular destinations, which you can customize to your liking.

It's one of the most versatile travel planner apps out there, giving you one convenient place to see your hotel, rental car, and restaurant bookings.

Find and Book a Last-Minute Place to Stay: Hotels.com

A fast, easy-to-use booking feature.

For every 10 nights you book through Hotels.com, you get one night free, provided it's the average daily rate of those 10 nights.

No option to easily cancel if you change your mind.

Whether your road trip itinerary changed, or you haven't decided on a place to stay yet, Hotels.com can help you find a place and book it when you're on the go, even when it's super last-minute. You can sort and filter hotels, see the amenities they have to offer, compare prices, and catch a glimpse of how many rooms are available.

This is the app you'll want to have handy if you want to see in-depth hotel details at a glance and need to find a place to crash ASAP without breaking the bank.

Find Local Restaurants, Read Reviews, and Make Reservations: OpenTable

Lots of great filter options and suggestions.

Access to gorgeous, high-quality images of menu items and informative reviews from other users.

Reported problems and inconveniences with their built-in reward system.

Searching for specific restaurants is more difficult than simply looking at what's around in the area.

Deciding on a place to eat in a new area is quick and hassle-free with OpenTable. See what's nearby, filter restaurants by cuisine, see photos of what's on the menu, make reservations, and get personalized recommendations based on your preferences.

OpenTable is known to be one of the top location-based food apps available, so you know you can trust its information when you're dying for something to eat.

Navigate Like a Local: Waze

Hands-free navigation with voice commands.

Alerts-only mode for road hazards and police.

Share up-to-date ETA with friends.

Spotify and Apple Music widgets get in the way.

Cluttered maps can be confusing.

Higher battery usage than Google Maps.

Waze is a community-driven travel app that shows you the shortest possible route to your destination. Like Google Maps, Waze makes real-time adjustments for traffic jams and other obstacles—but Waze is often more accurate since it caters specifically to drivers.

The app syncs with your Google Calendar and can tell you when you should leave for appointments based on traffic. There's also a cool option to record your own voice and use it for directions .

Know Exactly When and Where to Make a Pit Stop: iExit Interstate Exit Guide

Access to detailed summaries of what's at the next exit (including gas prices at nearby gas stations).

Search for the next 100 exits from your location.

The app can only be used on major U.S. exit-based highways.

No offline access, so you'll use your data plan while you're on the road.

Making a pit stop for food, gas, or a bathroom break is easy when you have the iExit app. Using your device's GPS, the app offers helpful suggestions for when and where to stop based on your location along the highway.

Whether you're looking for well-known franchises like Starbucks and Walmart to convenient amenities like free Wi-Fi and truck or trailer parking, this app has you covered.

Find the Cheapest Fuel Nearby: GasBuddy

An in-app gas payment feature.

Opportunity to save 10 cents per gallon on your first fill-up and five cents per gallon on every fill-up after.

The app can take up a lot of data and battery life as it runs in the background.

GasBuddy is an app specifically designed to find nearby gas stations and save money on gas. Use it to find the cheapest gas in your area and filter gas stations by amenities like car washes, restaurants, and bathrooms.

It's the app you want to have if you're serious about finding the cheapest gas around. Information comes from users like you, so you have the most up-to-date prices.

Download For :

Never Forget an Item: PackPoint Premium Packing List

Access to a built-in library of items to pack with the ability to add or remove items as needed.

An elegant, intuitive app interface.

Can't input multiple destinations for a single trip.

Not a free app.

PackPoint helps you make sure you have everything you need based on where you're going and what you're doing. In addition, the app takes into consideration the length of your trip and the expected weather conditions. Perhaps best of all, this app turns a mundane chore into something that's actually quite fun.

Find Out Where to Park and How Much It Will Cost: Inrix ParkMe

ParkMe is the only app that also includes street parking and parking meter rates where available, in addition to parking lots.

Real-time updates on available parking spots.

Rates and hours may be inaccurate in some areas.

ParkMe claims to be the world's largest and most accurate parking database. It allows you to purchase your parking spot through the app and compare prices across parking providers to help you save more money.

If you're road tripping around major cities in the U.S., Canada, or Europe, this app can be a huge help. You can even compare parking options and prices so that you always get the best deal.

Automate Your Itinerary: TripIt

Automatically creates itineraries from your inbox.

Widget displays trip details on your home screen.

Annoying amount of alerts by default.

If you're planning a trip, you'll likely have a lot of confirmation emails for hotels, appointments, restaurants, and attractions. TripIt syncs with your inbox and uses that information to compile an itinerary so that you don't have to scramble for it.

The free version is fine for road trips, but if you ever fly, the premium version gives you the option to upgrade seats and track reward miles.

In addition to your phone, laptop, and tablet, other travel tech essentials include chargers, headphones, travel adapters, cameras, luggage trackers, and off-grid communications

Yes. You can use Google Maps as a trip planner through the “Places” and “My Maps” features. Both the Google Maps website and app let you save locations to lists and get directions.

Get the Latest Tech News Delivered Every Day

- The 9 Best Travel Planner Apps of 2024

- The 10 Best Road Trip Podcasts of 2024

- The 10 Best Car Apps of 2024

- The 9 Best Travel Apps for 2024

- The 5 Best Motorcycle Apps of 2024

- The 7 Best Emergency Alert Apps of 2024

- The 13 Best Android Auto Apps of 2024

- The 20 Best Free iPhone Apps of 2024

- The 7 Best Google Maps Alternatives of 2024

- The Best Halloween Apps of 2024

- The 9 Best Summer Apps of 2024

- The 6 Best Mileage Tracker Apps for 2024

- The 7 Best Traffic Apps of 2024

- The 10 Best Apartment Websites of 2024

- The 10 Best Alcohol Apps in 2024

- The 10 Best Productivity Apps of 2024

You'll never travel without our trip planner again

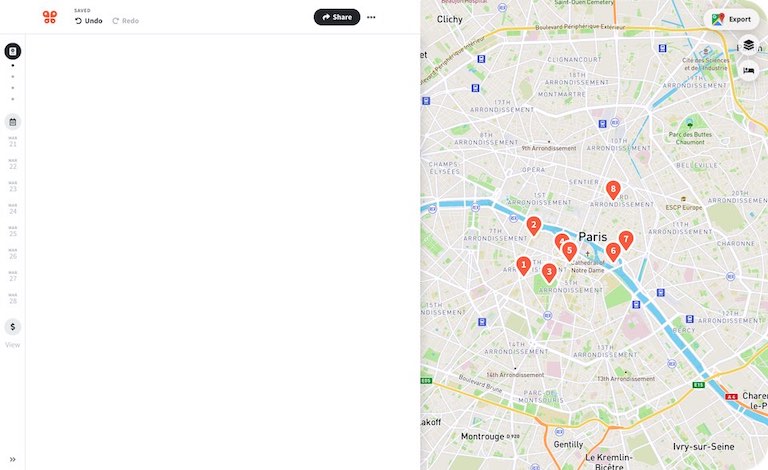

Travel planning at its best. build, organize, and map your custom itineraries in a free travel app designed for vacations & road trips, powered by our trip planner ai.

Your itinerary and your map in one view

No more switching between different apps, tabs, and tools to keep track of your travel plans.

What travelers are raving about